The disappearance of Token Fund and the rise of crypto VC

1. The Dismal Past of Token Funds

Starting from the end of 2017, as the wealth effect of cryptocurrencies like Bitcoin rapidly emerged, "Token Funds" became particularly popular in the domestic blockchain investment industry. Many institutions and individuals began to raise funds externally to establish Funds specifically for investing in Tokens issued by blockchain projects, attempting to replicate the success of the internet venture capital field over the past decade. To highlight the characteristics of Tokens, the industry commonly refers to funds investing in blockchain (including Tokens and equity) as "Token Funds."

By 2018, the cryptocurrency market saw the emergence of nearly a hundred different Token Funds, such as Node Capital, Coin Capital, Genesis Capital, Bawei Capital, Liaode Capital, PreAngel, and others. Multiples of investment returns were not uncommon, and the investment dynamics of leading Token Funds once became a market barometer, attracting the attention of many investors and researchers.

However, after experiencing a prosperous half-year, the industry situation took a sharp turn, and the myth of Token Funds began to crumble. In a report released by Chain Catcher in September 2018, due to severe price inversion between the primary and secondary markets, many Token Funds faced the dilemma of "investment leading to being trapped" and "investment leading to losses." Since June and July of that year, the investment pace of most Token Funds had significantly slowed down, and many Funds had already suspended investments and planned to pivot, with several well-known Funds even entering a state of hiatus.

As the anticipated bull market failed to materialize, the situation for Token Funds became even more severe. According to a December 2018 interview with a well-known figure in the cryptocurrency circle, Diao Fu Da Tou, founder of Qianfang Capital, the fund had invested in about 30 to 40 projects and had already lost 800 million yuan compared to its highest net value. "It was mainly due to the sharp decline of Ethereum; we didn't have time to sell. The liquidation losses were minimal, about 20 Bitcoins," Diao Fu Da Tou stated. Subsequently, under immense pressure from investors for rights protection, the Qianfang Capital team disbanded, and Diao Fu Da Tou moved abroad and rarely spoke out.

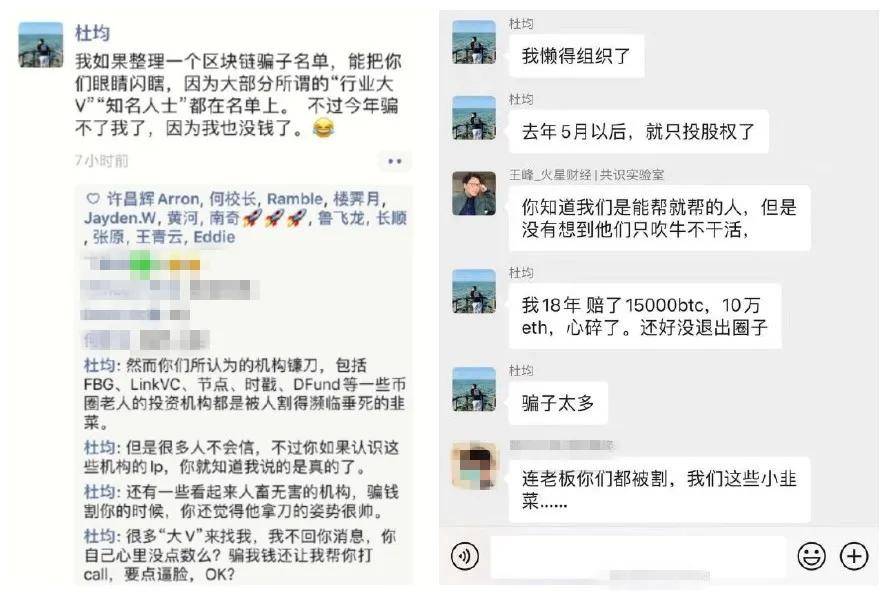

Du Jun, founder of Node Capital, also stated at the end of 2018 that the fifth report of Node showed a floating loss of 65% in currency terms. He later indicated that he had stopped Token investments and was only engaging in equity investments. "The institutions you consider to be the 'scissors' in the industry, including FBG, LinkVC, Node Capital, Timestamp Capital, DFund, and other veteran investment institutions in the cryptocurrency circle, are all on the verge of being cut down," Du Jun further exposed the industry's bleakness in a WeChat post in June of this year.

The downfall of Token Funds can be attributed not only to the prolonged external market downturn but also largely to their rough investment style and mechanisms. "Most Token Funds in the market were established after the Spring Festival of 2018, and their entry time was relatively short, lacking independent investment views and core capabilities." Yang Linyuan said. Other investors indicated that many Fund management teams are composed of agents without risk management awareness and have not experienced market cycles, leading to serious problems in investment strategies.

Another reason lies in the poor performance of projects. On one hand, the implementation of public chain applications has been slow, and on the other hand, the quality of entrepreneurs varies widely. "In 2017 and 2018, many people were doing projects just to raise money, with a strong speculative mentality, and they actually had no understanding of the industry and technology," said Howard, a partner at Fundemental Lab. Many traditional VCs that entered the market at that time also left in disappointment.

Jiang Tao, a partner at Shata Fund, further stated, "In many past situations, investors and founding teams were in a game of chess, with conflicting interests, leading to many projects setting up complex unlocking terms and price systems, resulting in mutual cutting between teams and investors."

According to Chain Catcher, due to the long-term dismal market conditions and investment performance, most Token Funds had ceased operations or pivoted to other businesses, such as mining, Staking, and lending, by the end of 2019, with very few continuing investment activities.

At the same time, the term "Token Fund" itself has become a symbol of confusion and immaturity, gradually fading in the cryptocurrency industry, but this does not mean that the cryptocurrency investment market is heading towards decline.

The more brutal the market conditions, the more they can validate the reliability of investment strategies. Navigating market cycles is the greatest test for investment institutions. After experiencing the bleak market conditions of the past few years, a group of crypto VCs, with outstanding investment results in the DeFi sector, began to emerge in the cryptocurrency industry with a more advanced appearance and posture.

2. The Rise of Crypto VCs

Although the essential functions of crypto VC institutions and Token Funds are similar, as representatives of two different periods in the industry, they still exhibit different characteristics in terms of investment strategies, with the most significant difference being the shift in investment strategies.

The first is the shift in investment type preference, from primarily infrastructure to primarily vertical applications, from covering all tracks to prioritizing the DeFi track. In the past, many Token Funds would prioritize investing in public chains and other industry infrastructures while covering tracks like gaming, exchanges, media, mining, and DeFi. However, due to the saturation of competition in the public chain track and the poor implementation of most applications, many Token Funds' past investment strategies were based on misjudgments.

"We originally thought that the prospects for landing applications in gaming and social directions were good, but over time, their landing pace has shown a significant gap compared to expectations." Jiang Tao said.

Therefore, in the recent wave of investment layouts by leading crypto VC institutions, a clear strategy of vertical track layout can be seen, with widespread investments in DeFi projects starting in 2019, playing an important role in the development of the DeFi ecosystem and establishing their current industry position.

The second is the shift in regional preference, from primarily domestic investments to primarily foreign investments. Nowadays, most projects that perform well in the market are led by foreign communities, while domestic projects often experience volatile rises and falls, even being disparagingly labeled as "local dog" projects. The decline of many Token Funds in the past was partly due to heavily investing in domestic projects, while those crypto VC institutions that first turned their investment focus to foreign projects enjoyed more developmental dividends.

In addition to cognitive aspects, this differentiation can also be attributed to the institutions' own capabilities in expanding overseas channels. Due to the severe information divide and high communication barriers between domestic and foreign markets, this poses a significant challenge to the professionalism and team capabilities of institutions. Crypto VC institutions like Hashkey and Distributed Capital have established offices in important overseas markets like the United States, focusing on discovering quality projects in local markets. "Domestic project investments often appear to be short and quick, similar to a game of who runs faster." Howard told Chain Catcher, "We have always invested more in foreign projects, and the investment return rates are relatively higher."

Thirdly, research-driven investments are becoming increasingly common, with many crypto VC institutions establishing dedicated research institutions to assist investment teams in making investment decisions. A recent example is Qianfeng Capital, which has produced several industry research reports that have gained widespread circulation in the industry, backed by the institution's long-accumulated research methodology.

The trend towards research-driven investment represents the professionalization of VC institutions. "In the past, many Token Funds were just a few people coming together without a legal entity, developing in a rough manner, but VCs are showing characteristics of institutionalization, professionalization, and scaling, with the 80/20 phenomenon becoming increasingly prominent," Howard said.

The professionalization of crypto VC institutions is also reflected in their fundraising sources. During the Token Fund era, most funds had relatively singular fundraising sources, primarily from cryptocurrency circles, but now the fundraising sources for crypto VC institutions are more diversified, with family offices and high-net-worth individuals from traditional industries being important sources.

Under the influence of various factors, many leading crypto VC institutions have emerged and become barometers in the cryptocurrency investment industry. The Block released a research report on December 15, analyzing a total of 873 blockchain-related investment transactions in 2020, identifying the ten most active crypto investment institutions of 2020: Alameda Research, Coinbase Ventures, CoinFund, ConsenSys Labs, Digital Currency Group, Dragonfly Capital, Hashkey Capital, NGC Ventures, Pantera Capital, and Polychain Capital.

"Crypto VCs are playing an increasingly significant role in promoting ecological innovation and rational resource allocation," Jiang Tao said, "but compared to traditional VC institutions, there is still a significant gap in terms of fund management scale, social recognition, and transformative power over society."

Of course, this awkward situation cannot be resolved unilaterally by crypto VC institutions; it also depends on the development status of the blockchain industry. With the good performance of the cryptocurrency market this year, the mainstreaming of crypto VC institutions may further accelerate.