The Underrated DeFi Aggregation Layer: How do InstaDApp, Zerion, and others enhance the usability of DeFi products?

This article is an original piece by Chain Catcher, authored by Gong Quanyu.

When it comes to the DeFi aggregation layer, one might first think of yield aggregators like YFI and YFII, which aggregate high-yield liquidity pools for investors and automatically optimize portfolios to achieve optimal returns. Additionally, there are trading aggregators such as 1inch, Metamask Swap, and Paraswap. As a large number of tokens' liquidity is dispersed across different DEX products, trading aggregators can help users obtain the best trading depth and have gained widespread recognition in the market.

Most of the aforementioned aggregators focus primarily on vertical product directions and do not venture into other DeFi vertical products. However, they collectively reflect a trend where the value of the DeFi aggregation layer is accelerating its expansion.

1. What is the DeFi Aggregation Layer?

Since the beginning of this year, the DeFi market has continued to develop rapidly, with total locked funds exceeding $44 billion, covering multiple verticals such as trading, lending, asset management, and insurance. However, due to the lack of usability and friendliness in many DeFi products, the complex product logic and operational processes have restricted DeFi products from reaching a broader audience.

In the current DeFi aggregation track, only vertical trading and yield aggregation projects are receiving market attention, with leading players like 1inch emerging. However, comprehensive aggregation projects that integrate asset management, trading, lending, and other types of products are rarely seen in the public eye, such as InstaDApp, Zapper.fi, DeFi Saver, and Zerion.

These applications mostly have good investment backgrounds and locking data, with two of them having received investments from Coinbase. InstaDApp and DeFi Saver have locked amounts reaching $1.04 billion and $600 million, respectively, ranking 11th and 15th on the data site DeFiPulse. This data does not match their level of recognition.

To some extent, crypto wallets also belong to aggregation-type applications, providing users with a rich variety of DApp products and DeFi functions. However, their role in lowering the specific product usage threshold and enhancing user product experience is limited.

For the sake of convenience, the DeFi aggregation layer applications referred to in this article specifically denote vertical aggregation applications that have visual asset tracking and management functions and integrate at least two types of DApps, such as yield, trading, and lending.

For example, applications like InstaDApp mentioned earlier. These applications can intuitively present the distribution of user assets across different DeFi applications, including debt situations and liquidity pool LP situations, while displaying the yield rates of different lending applications and LP liquidity pools, as well as the products with the highest yields, providing users with direct participation entry points.

In short, DeFi aggregation layer applications integrate the commonly used DApps and functions in the DeFi market for users, saving them time in comparing yield situations across different DApps and providing a better DeFi user experience. So why has this track received little attention from users in the past? There may be three reasons.

First, most DeFi users' product needs were relatively singular in the past, mainly focusing on the best trading depth or optimal staking yield, and the current aggregation products can effectively address these issues;

Second, most DeFi users' assets were concentrated on the Ethereum mainnet, and current wallets like MateMask and Imtoken can fully meet users' asset management needs;

Third, mainstream DeFi aggregation layer applications have not formally issued tokens, and the value capture mechanisms are unclear, leading to insufficient exposure in the absence of wealth effects.

However, as the DeFi market environment changes, these reasons are likely to gradually dissipate and drive DeFi aggregation layer applications to become important infrastructure for connecting different blockchain network DeFi applications and pushing DeFi into a broader market.

First, as the logic of DeFi derivatives products matures, investor education progresses, and more traditional financial investors enter the DeFi market.

Many DeFi users' usage needs will not be limited to simple trading and yields but will involve complex operations such as savings/loans, contract trading, and providing liquidity, resulting in user assets being distributed across different applications, making it difficult for users to intuitively grasp the distribution of their assets.

This also means that users' DeFi experience will decline, thus highlighting the value of DeFi aggregation layer applications, providing users with a one-stop DeFi management platform, which may to some extent become an infrastructure similar to "Alipay."

Second, several Layer 2 solutions have recently begun to materialize, with many user assets starting to transfer to Layer 2 networks like Polygon. At the same time, public chains like BSC are rising, and DeFi users, originally concentrated on Ethereum assets, will further disperse across different blockchain networks, complicating the asset management process for users.

Currently, multiple DeFi aggregation layer applications like Zapper.fi already support or will soon support users in viewing their asset distribution status on networks like BSC and Polygon, and directly conducting related transactions.

Third, the DeFi aggregation layer application with the highest locked amount, InstaDApp, announced in February that it would issue tokens in March and start liquidity mining, which may further stimulate capital inflow into DeFi aggregation layer applications. Considering the current prevalence of airdrops in the DeFi market, these applications that have not yet issued tokens may also stimulate market attention through airdrops.

Next, Chain Catcher will briefly introduce the functions and characteristics of the main DeFi aggregation layer applications currently, including InstaDApp, Zapper.fi, DeFi Saver, and Zerion.

2. Four Major Applications

1) InstaDApp

InstaDApp was launched in December 2018 and received $2.4 million in funding from institutions like Coinbase Ventures and Pantera Capital in December 2019. Its goal is to eliminate the complexity of DeFi products by aggregating assets and liquidity into a single layer, making DeFi more accessible to everyone.

Compared to other applications, InstaDApp's main feature is the use of smart wallets and bridging protocols to integrate major DeFi protocols. Users need to first activate a smart wallet using MateMask on the site and transfer funds to use it. All user wallets are uniformly controlled by InstaDApp's smart contracts, and users do not own private keys or mnemonic phrases.

Currently, the site has approximately 20,000 smart wallet users.

InstaDApp integrates DeFi protocols including Maker, Aave, Compound, and Uniswap, allowing users to trade their crypto assets on the platform and manage their trading pairs' LP on Uniswap, while also using LP as collateral for leveraged financing in supported lending protocols.

For the aforementioned lending protocols, InstaDApp not only supports users in regular deposit and withdrawal operations, but also provides rich features such as one-click withdrawal of all collateral, collateral swaps, debt swaps, and automatic debt refinancing, while also allowing users to migrate collateral between protocols.

In February of this year, InstaDApp also announced the DeFi Smart Layer (DSL) plan, allowing front-end developers to use DSL as middleware to meet all their DeFi needs and enabling most users to use DSL in these applications while supporting users in migrating assets to Layer 2.

InstaDApp is also expected to issue tokens in March and launch liquidity mining features, ultimately achieving decentralized governance.

2) Zerion

Zerion was launched in 2018 and is positioned as a one-stop platform for building and managing DeFi portfolios, having received $2 million in funding from Placeholder, Blockchain Ventures, and Gnosis in December 2019.

Currently, users can connect to the Zerion website using their MateMask wallet, and its main functional modules include views, investments, savings, loans, and transaction history.

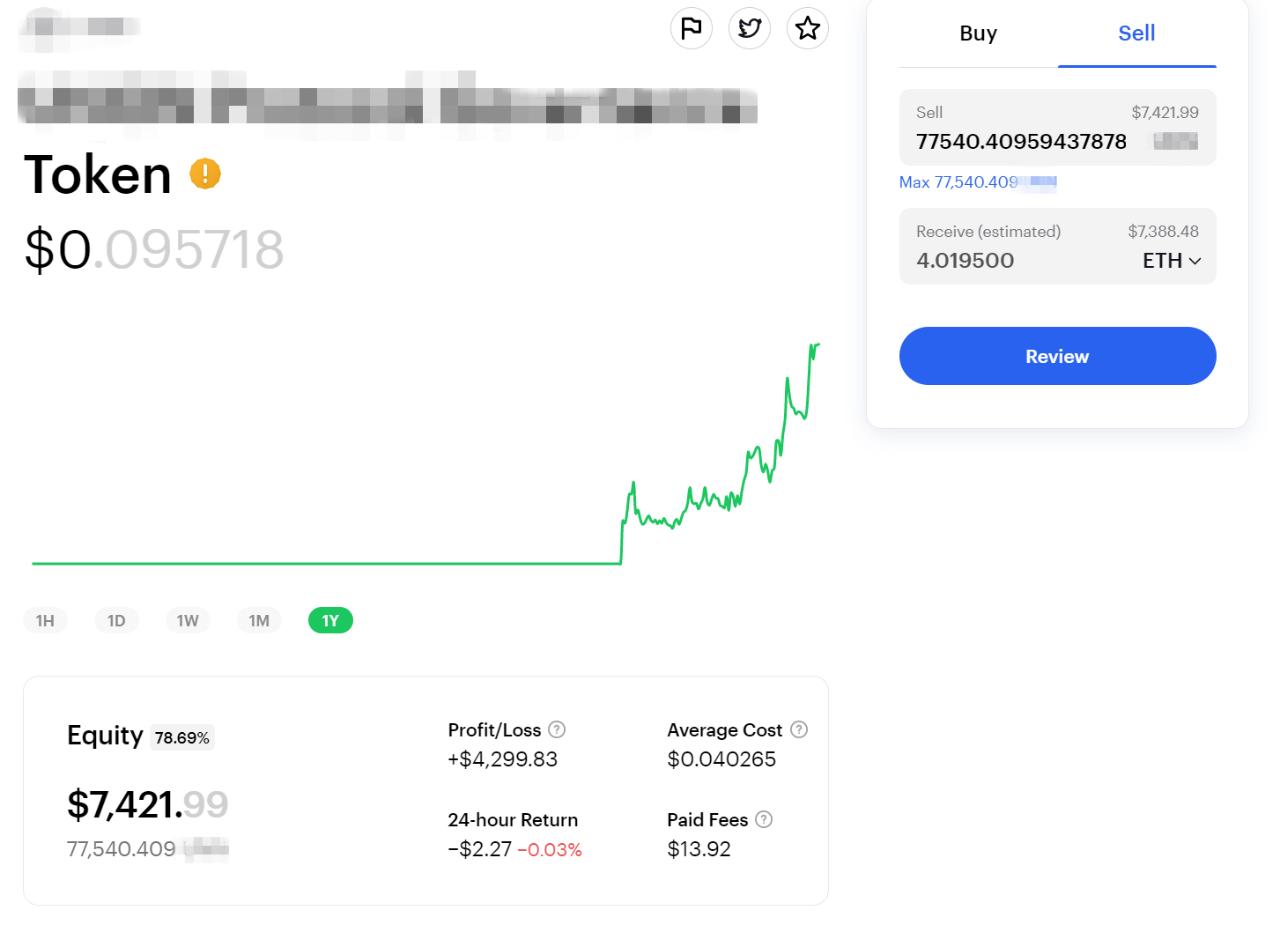

On the view page, the application can present the trend of the user's wallet asset value and specific asset distribution in the form of chart candlesticks. When users click on held tokens, they can also view the token value candlestick and realized profit value on that page.

Additionally, users can directly purchase crypto assets for their wallet addresses through credit cards and other channels on that page.

On the investment page, the application recommends DeFi index tokens such as DefiPulse Index and Synth sDEFI, while also recommending some well-known tokens categorized by social tokens, layer 2, etc. Users can click to see the token's price candlestick and a brief introduction, with a direct purchase option on the right side of the page.

Users can also view the DeFi tokens with the highest gains, the largest declines, and the liquidity pools with the highest yields on that page.

The aggregation trading page of Zerion is not significantly different from that of InstaDApp.

On the savings page, Zerion primarily collaborates with Compound, allowing users to earn interest income by collateralizing their assets. On the loans page, Zerion allows users to choose Maker or Compound to collateralize their assets and borrow funds.

Zerion has also developed an app product, with over 16,000 active mobile users as reported in Zerion's quarterly report released in January this year.

3) Zapper.fi

Zapper.fi was formed by the merger of DeFiZap and DeFiSnap in May 2020, positioning itself as the ultimate hub for decentralized finance, making DeFi easier to use and access. It received $1.5 million in funding from Framework Ventures, Coinfund, The LAO, CoinGecko, and others in August 2020, and a few months later secured seed expansion funding from Coinbase Ventures and Delphi Ventures.

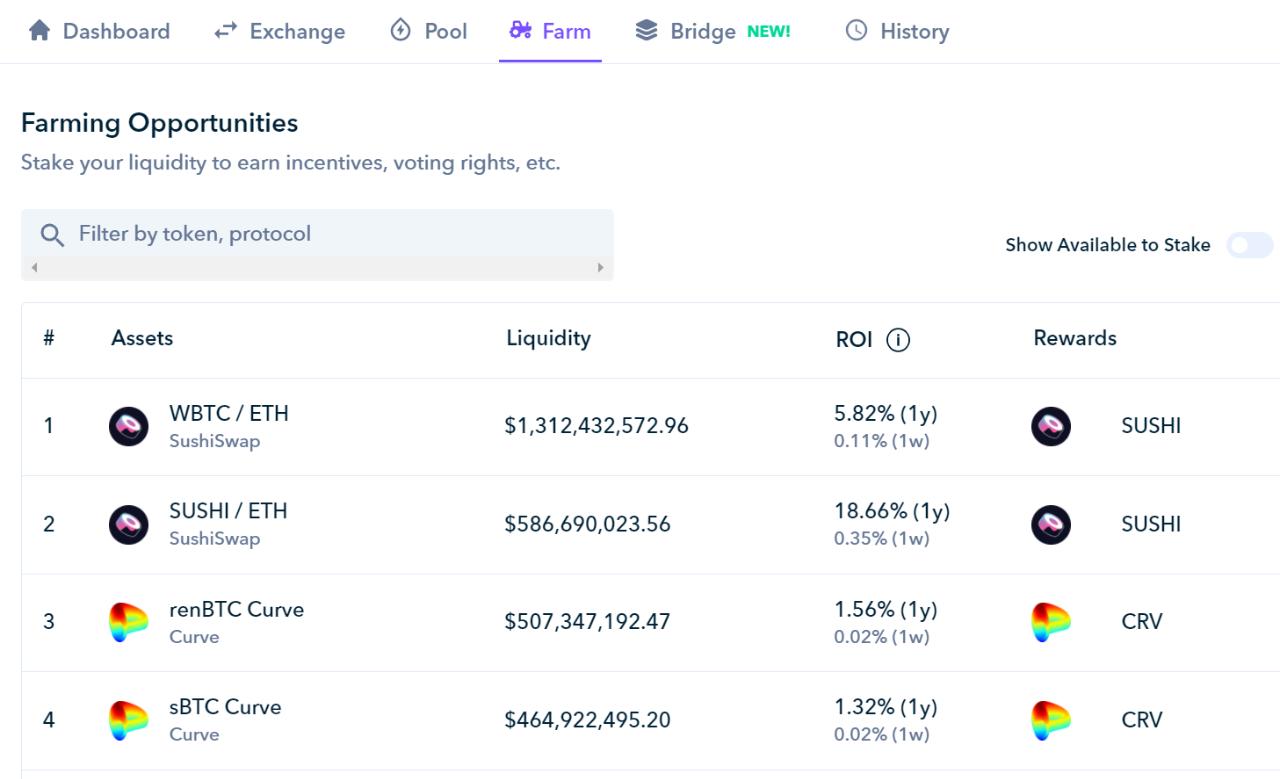

Currently, users can use the application by connecting their MateMask wallet to the website, with main functions including asset data dashboards, aggregated trading, adding liquidity to trading pairs, yield farming, Layer 2 transfers, and viewing transaction history.

The main feature of Zapper.fi is the development of cross-protocol smart contracts called Zaps, aimed at reducing friction between different protocols, essentially saving time and money, thus allowing users to operate across protocols more efficiently and access a wide variety of investment products.

Specifically, the platform can bundle the operations required for users' transactions into a single on-chain transaction, eliminating the waiting time for each operation to complete. Since the transactions are bundled, some gas fees do not need to be paid, achieving a reduction in gas cost.

For example, when users provide liquidity for a certain liquidity pool, Zapper.fi can help users provide liquidity for that specific pool using just one supported token, without needing to exchange it for the two tokens required by the pool, thereby reducing operational steps and gas fees.

The official site also provides a specific case: if a user only has ETH and wants to invest in Curve's sUSD pool, they must first manually exchange ETH for DAI and USDC before entering the sUSD pool. With Zaps, users can directly buy into the sUSD CRV liquidity pool using ETH without manually swapping ETH for DAI and USDC. "This reduces transaction fees and the number of transactions, ensuring 100% capital utilization."

On March 8, Zapper.fi announced that it has become a multi-chain platform, supporting Layer 1, Layer 2, and sidechains. It currently supports tracking token portfolios on Polygon and QuickSwap; supports Optimism and tracks the Synthetix protocol; and tracks token portfolios on BSC. Additionally, Zapper will integrate with Optimism, Arbitrum, XDai Stake, and Fantom Finance.

Zapper.fi also stated last year that it would support lending protocols like Aave, but it currently does not, making it the only platform in this article that does not support lending protocols.

4) DeFi Saver

DeFi Saver was launched in April 2019, initially aimed at helping DeFi users avoid liquidation of collateralized assets. It provides smart savings and automatic liquidation protection features based on the integration of Aave, Compound, and Maker, and is currently positioned as a one-stop DeFi management solution.

Similar to InstaDApp, the functions involving lending protocols in DeFi Saver require users to first activate their MateMask wallet to register a CDB account and transfer funds to use. Its unique feature is that it can help users automatically manage their debt positions and maintain them at a certain ratio. If the ratio exceeds 230%, it automatically raises it to 200%, and if it falls below 170%, it repays to 200% to prevent liquidation.

At the same time, DeFi Saver can help users transfer their debt positions between different lending protocols and convert collateral.

DeFi Saver has also launched an aggregated trading feature, integrating liquidity from DEXs like Uniswap, 0x, and Kyber Network, charging a fee of 0.0125% for each transaction. Earlier this month, DeFi Saver integrated the stable asset protocol Reflexer.

Currently, DeFi Saver's official website shows that it has over 770 smart wallet users, with total locked funds reaching $570 million.

3. Conclusion

In summary, DeFi aggregation layer applications allow users to perform all operations and track asset portfolio yields from a single interface, eliminating the need to access multiple interfaces and execute a series of transactions. They can also achieve functions such as debt position transfers, reducing trading slippage and costs, which are difficult for a single application to accomplish.

These advantages will inevitably lead to greater adoption of DeFi aggregation layer applications in the future, laying an important foundation for DeFi applications to reach a larger market alongside products like crypto wallets.

(Feel free to add WeChat ID gnu0101 to join the Chain Catcher group chat.)