Understanding Decentralized Yield Aggregators in One Article

Source: 《How to DeFi: Advanced》 Part III Chapter 12

Authors: Lucius Fang, Benjamin Hor, Erina Azmi, Khor Win Win

Compiled by: 8btc

Cryptocurrencies have spawned the activity of yield farming, where users can earn returns simply by allocating capital in DeFi protocols. Many cryptocurrency natives have since become yield farmers, seeking out the most attractive yield farms.

With a large number of new yield farms being launched every day, no one can seize every opportunity. Under the sky-high returns, the opportunity cost of missing out on new yield farms is increasing.

The birth of yield aggregators is to meet the need for users to automate their investment strategies, saving them the trouble of monitoring the market for the best yield farms. Below, we will explore several decentralized yield aggregator protocols.

I. Yield Aggregator Protocols

1. Yearn Finance

Yearn Finance was initially a creative project initiated by Andre Cronje, aimed at automatically switching funds between lending platforms to seek the best yields offered by different DeFi lending platforms. This is quite necessary for users, as most DeFi lending platforms offer floating rates rather than fixed rates. As the interest rates between dYdX, Aave, and Compound fluctuate, funds are switched between different platforms.

The service includes major dollar stablecoins such as DAI, USDT, USDC, and TUSD. For example, if a user deposits DAI into Yearn Finance, they will receive a yDAI token in return, which is a yield-bearing DAI token.

Subsequently, Yearn Finance partnered with Curve Finance to launch a yield-bearing dollar token pool called yUSD. Curve Finance is a decentralized exchange focused on trading between assets of roughly similar value, such as dollar stablecoins. yUSD is a liquidity pool that includes four y tokens: yDAI, yUSDT, yUSDC, and yTUSD.

Users holding yUSD can benefit from five sources of yield:

- DAI lending yield

- USDT lending yield

- USDC lending yield

- TUSD lending yield

- Trading fees earned by providing liquidity to Curve Finance

Thus, holding yUSD is a better way compared to merely holding stablecoins.

2. Vaults

Yearn Finance first launched its Vault feature after its token issuance, igniting a frenzy of automated yield farming and is considered the initiator of the yield farming aggregator category. Vaults help users earn liquidity mining rewards and sell the protocol's native tokens in exchange for related assets.

Vaults benefit users by socializing gas costs, automatically claiming yields, rebalancing assets, and automatically transferring assets when opportunities arise. Users also do not need to possess in-depth knowledge of the underlying protocols. Therefore, Vaults represent a passive investment strategy for users. It is akin to a cryptocurrency hedge fund, aimed at increasing the amount of assets deposited by users.

In addition to simple yield farming, Yearn Finance has integrated various innovative strategies to help enhance the yields of the Vaults. For example, it can use any asset as collateral to borrow stablecoins and deposit the stablecoins back into the stablecoin Vault. Any yields can then be used to buy back Vault assets.

Yearn v2 was launched on January 18, 2021, allowing multiple strategies (up to 20 strategies simultaneously) to be adopted in each Vault, unlike the first version where each Vault could only adopt one strategy.

3. Strategies

As a yield aggregator, Yearn Finance maximizes the composability features of Ethereum. Below, we will explore how Curve Finance's liquidity mining program plays a role in Yearn Finance's Vault strategy.

Curve Finance is a decentralized exchange focused on stablecoin pair trading. It utilizes a rather complex governance system. Users can lock CRV tokens to receive veCRV, thereby gaining governance voting rights in the protocol.

- 1 locked CRV for 4 years = 1 veCRV

- 1 locked CRV for 3 years = 0.75 veCRV

- 1 locked CRV for 2 years = 0.50 veCRV

- 1 locked CRV for 1 year = 0.25 veCRV

veCRV can be used to vote on launching new trading pairs and to decide how much CRV mining rewards each trading pair receives. More importantly, veCRV is used to determine the multiplier for the mining rewards that liquidity providers can receive.

As shown in the image above, yUSD is a yield-bearing stablecoin pool. Users can deposit yUSD into Yearn Finance to receive yCRV, and the CRV rewards will be harvested by the Vault and sold for more yUSD.

The Base APY refers to the trading fees earned as a liquidity provider in the Curve pool. The Reward APY refers to the liquidity mining program rewards in the form of CRV tokens. With the use of veCRV, the 8.68% base reward can be expanded to 21.69%, which is a 2.5 times increase from the base. Overall, the expected return rate is approximately 31.59% to 44.60%.

By depositing dollar stablecoins into Yearn Finance, you will benefit from a yield farming acceleration of up to 2.5 times, rather than having to participate in Curve mining by locking CRV yourself.

4. Yearn's Partnerships

From November 24, 2020, to December 3, 2020, Yearn Finance announced a series of partnerships (referred to as mergers), essentially forming an alliance around YFI.

- SushiSwap joined as its automated market maker (AMM) department

- Cover joined as its insurance department

- CREAM joined as its lending department

- Akropolis joined as its institutional service provider, offering Vaults and upcoming lending products

- Pickle joined as its yield strategy department

Additionally, Yearn Finance ended its partnership with Cover Protocol on March 5, 2021.

Yearn Finance v2 also incentivizes community contributions by sharing a portion of profits with community strategists. Yearn Finance has also established an alliance program with other protocols willing to form synergies, which can yield up to 50%. In other words, Yearn Finance has become a large ecosystem offering a range of yield farming products and services.

Alpha Finance

Alpha Finance introduced leveraged yield farming through their first product, Alpha Homora, allowing users to use borrowed capital to increase their risk in yield farming activities. Essentially, it is both a lending protocol and a yield aggregation protocol.

Alpha Finance introduced the concept of leveraged yield farming through their first product, Alpha Homora. It allows users to borrow assets to increase their positions in liquidity mining activities. Essentially, it is both a lending protocol and a yield aggregator protocol.

In Alpha Homora v2, users can lend out (earning interest on the lent assets) and borrow many assets (increasing leverage for yield farming positions), including ETH, DAI, USDT, USDC, YFI, SNX, sUSD, DPI, UNI, SUSHI, LINK, and WBTC.

Example:

Using the example mentioned in Chapter 2 regarding SUSHI/ETH, it is not just about mining with $1000 worth of assets. By using Alpha Homora, you can choose to borrow $1000 worth of ETH to leverage $2000 worth of assets.

By borrowing $1000, you can now participate in liquidity mining by providing $1000 worth of ETH and $1000 worth of SUSHI, totaling $2000. This strategy will only be profitable if the trading fees and liquidity mining rewards exceed the borrowing costs of Alpha Homora.

Additionally, it is important to note that since both ETH and SUSHI can be borrowed assets, you can leverage borrowing ETH and SUSHI to earn yields to reduce trading costs.

The borrowing costs of Alpha Homora are calculated at a variable interest rate, influenced by supply and demand. If borrowing costs suddenly spike due to increased borrowing, leveraged positions may incur losses. Another risk is when the price of the borrowed asset increases compared to the yield farming position. In the above example, if the price of ETH rises rapidly while the price of SUSHI falls, the leveraged position may face liquidation.

In addition to earning higher returns, having leveraged positions in yield farms will also expose users to higher impermanent loss. The profits earned are significantly affected by the volatility of the borrowed assets. For example, borrowing ETH against dollar stablecoins will lead to a completely different return scenario. For more details on impermanent loss, please refer to Chapter 5 of this book.

Alpha Homora V2 also supports liquidity provider (LP) tokens as collateral. For example, users who have liquidity positions in the ETH/SUSHI pool on Sushiswap can deposit ETH/SUSHI LP tokens as collateral on Alpha Homora V2 and borrow more ETH and SUSHI tokens to leverage higher.

Badger Finance

Badger DAO aims to create a DeFi product ecosystem that brings Bitcoin to Ethereum. It is the first DeFi project to choose Bitcoin as its primary reserve asset instead of using Ethereum.

Sett is a yield aggregator focused on tokenized BTC. Sett can be divided into three main categories.

1. Tokenized BTC Vaults

Inspired by Yearn Finance's Vaults, the initial products include Bitcoin Vaults that earn CRV rewards, such as SBTCCURVE, RENBTCCURVE, and TBTC/SBTCCURVE metapool.

They also partnered with Harvest Protocol to utilize RENBTCCURVE deposited on Harvest to earn CRV and FARM tokens.

2. LP Vaults

To attract more users, there is a WBTC/WETH Sett that can earn SUSHI rewards.

In addition, four Sett have been created to guide the liquidity of BADGER and DIGG, namely:

- WBTC/BADGER UNI LP

- WBTC/DIG UNI LP

- WBTC/Badger sushi LP

- WBTC/Digg sushi LP

3. Protocol Vaults

Users can choose to avoid impermanent loss and the risks of tokenized BTC by simply depositing native BADGER and DIGG tokens into bBADGER and bDIGG Vaults, earning protocol fees and yield farming rewards.

Trivia: The choice of the word Sett is because it refers to a badger's home.

Harvest Finance

Starting as a fork of Yearn Finance, Harvest Finance has adopted a rapid launch strategy. It releases new strategies faster than other yield aggregation protocols, even those considered high-risk protocols.

As of April 2021, it supported 63 different farms on Ethereum alone, covering categories such as stablecoins, SushiSwap, ETH2.0, BTC, NFTs, 1inch, algorithmic stablecoins, and mirror protocol's mAssets.

It has recently expanded to Binance Smart Chain (BSC), offering farms on Ellipsis, Venus, Popsicle Finance, PancakeSwap, Goose Finance, and bDollar.

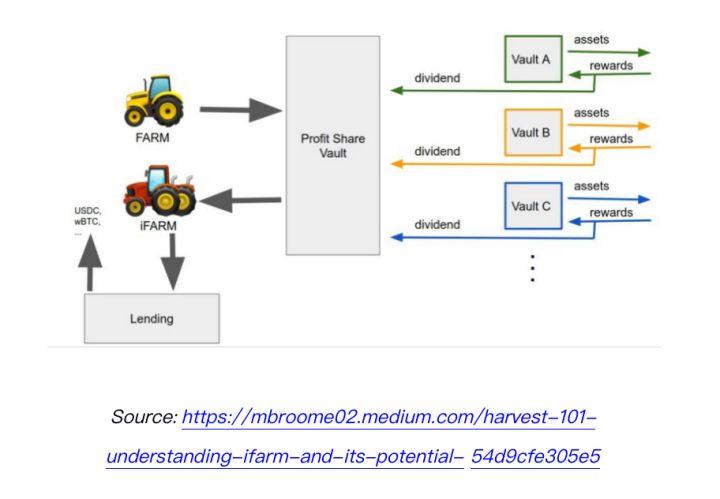

The Harvest team released an interest-bearing FARM (iFARM) token, which users can stake with FARM to earn protocol fees.

II. Comparison of Yield Aggregators

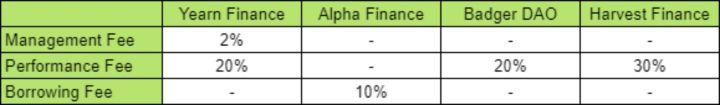

An important factor to consider when deciding which yield aggregator to use is the fees charged. Yearn Finance follows the standard hedge fund model, charging a 2% management fee and a 20% performance fee. Badger DAO and Harvest Finance charge only 20% and 30% performance fees, respectively. Alpha Finance charges 10% interest based on the borrowed leverage amount on Alpha Homora v1 on Ethereum and 20% on Alpha Homora V2.

In terms of fee structure, users investing in Yearn Finance may pay the highest fees, as they take 2% of the invested amount annually, regardless of whether the deployed strategy generates returns.

Charging performance fees can be considered fairer, as it simply means lower returns for users. Yearn Finance can charge a premium because it is an industry leader, and many of its Vaults are integrated with other protocols, such as Alchemix, Powerpool, and Inverse Finance.

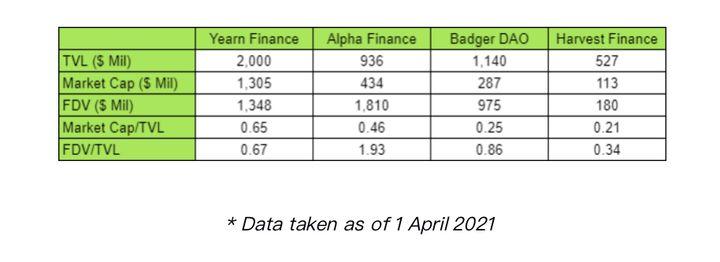

Yearn Finance still leads in Total Value Locked (TVL), while Harvest Finance seems to be the most undervalued among yield aggregators. Meanwhile, based on the ratio of fully diluted valuation to total value locked (FDV/TVL), Alpha Finance has the highest valuation.

Related Risks

Yield aggregators face a high risk of being hacked due to their nature of seeking high yields from higher-risk protocols. Among the four protocols, only Badger DAO has not been hacked (as of April 2021).

Integration with insurance protocols remains lacking, which may be the biggest bottleneck for further growth in the industry's total value locked (TVL). As more insurance protocols are launched, we may see the introduction of insured yield aggregator products in the future.

III. Other Noteworthy Protocols

Pancake Bunny is the largest yield aggregator in the Binance Smart Chain (BSC) ecosystem. It only offers farms based on PancakeSwap. The low gas fees on BSC allow for more frequent compounding strategies, resulting in higher APY. The farms offered consistently have yields above 100%.

AutoFarm is a cross-chain yield aggregator supporting Binance Smart Chain (BSC) and Huobi Eco Chain (HECO). Similar to Pancake Bunny, AutoFarm offers a higher compounding frequency, resulting in high APY for its farms. It is the second-largest yield aggregator in the BSC ecosystem.

Conclusion

The role of yield aggregators is similar to that of actively managed funds or hedge funds. Their job is to seek out the best investment opportunities and earn returns from them.

In DeFi, liquidity mining projects have given rise to a specialized way of earning yields. As the composability of DeFi is utilized in increasingly creative ways, we predict that the strategies adopted by yield aggregators will become more complex.

Most yield farming projects have a lifespan of about three to four months and can be changed at any time through governance. Yield aggregators help users find high-yield farms, but new farms often carry the risk of being hacked. Balancing the search for high yields and risks is quite challenging.

There are also concerns that the high yields offered by yield aggregators may not be sustainable. As of April 2021, high yields are supported by a speculative market environment. For example, higher CRV token prices translate into high yield rewards. No one knows exactly how yields might perform in a bear market, but there is a significant possibility they could compress to zero. This would not be a good phenomenon for yield aggregators.

Recommended Reading

- Yearn Improvement Proposal (YIP) 56 - Buyback and Build

https://gov.yearn.finance/t/yip-56-buyback-and-build/8929

- Yearn Improvement Proposal (YIP) 61: Governance 2.0

https://gov.yearn.finance/t/yip-61-governance-2-0/10460

- Upcoming Alpha Homora V2 Relaunch! What Is Included?

https://blog.alphafinance.io/upcoming-alpha-homora-v2-relaunch-what-is-included/