Airdrop Feast: A Carnival for the Whales, an Embarrassment for the Project Team

Author: Richard Lee, Gu Yu

In the current situation where the "wool party" is growing stronger, airdrops mean that a large amount of rewards are "sheared" away by external users, while not conducting airdrops makes it difficult to incentivize and reward early loyal users.

How to deal with the disruption caused by the "wool party" will increasingly test the wisdom and vision of project teams. Recently, the airdrop craze has reignited, becoming synonymous with "getting rich" in the eyes of many crypto users.

At 11 PM on September 8, the decentralized derivatives trading platform dYdX lifted the transfer restrictions on governance tokens, allowing 30,290 users to claim 50.3 million DYDX tokens for trading. In no time, various myths about airdrop whales spread in WeChat groups. One screenshot about "miner Lao Ma creating 800 accounts" attracted a lot of attention and shares.

Lao Ma, the person involved in the screenshot, told Chain Catcher that he indeed interacted with accounts in the "hundreds," but not as many as the rumored 800.

The rumors about airdrop whales also reflect the phenomenon of users registering multiple addresses to participate in airdrops, which is becoming more common and shows signs of further intensification. Along with the wealth myths created by speculators, there are also doubts about the fairness of token distribution.

1. Cost per single address reaches $200-300, mostly manual operations

At the beginning of this year, Qian Xin interacted with the dYdX platform using 43 accounts. In September, he received a total of 45,000 DYDX tokens from airdrops, worth nearly $510,000 at today’s price of $11.3. In addition to the rewards obtained from trading mining, he holds a total of 140,000 DYDX tokens.

Qian Xin is a "professional" in airdrop interactions. At the end of 2020, after Uniswap pioneered airdrops, the aggregation trading protocol 1inch also launched a large-scale token airdrop. Qian Xin felt it was "a trend" and developed a habit of regularly reviewing projects and selecting a few for bulk interactions each month. Every month, he looks at 20 to 30 projects and ultimately filters down to two or three projects for volume brushing.

Qian Xin prepared about 5-8 ETH (valued at approximately $7,500-12,000 at the early February price of around $1,500) as capital for dYdX interactions. The specific operations included: depositing, opening and closing contract orders, and withdrawing.

"At that time, one account would transfer 1 ETH, and after completing the transaction, I would spend some fees, for example, leaving 0.6 ETH, then transfer the 0.6 ETH to the next account, and operate like this, rolling it over," Qian Xin said. At the beginning of the year, the cost of interacting with dYdX was as high as $200-300 per account.

Qian Xin stated that his airdrop brushing was all done manually. "It's like operating one account, then operating all these accounts, there’s no shortcut," he said.

He usually partners with a friend to brush different projects separately. Besides dYdX, they also interacted in bulk with the DEX aggregator Matcha and the swap function of the Metamask wallet, with the former involving over 100 accounts and the latter over 400 accounts. As of now, neither of these projects has announced an airdrop. By the time they operated on dYdX, Qian Xin said he had already "gotten the hang of it," completing all interactions in half a day.

There are many people like Qian Xin who regularly brush volume, most of whom operate manually. Shuai Shuai had already developed a habit of interacting with new projects in 2020, but multi-account operations started this year. For the dYdX interaction, he brushed 27 accounts and ultimately received about 31,000 DYDX.

As a leader in the derivatives sector, dYdX has always been favored by airdrop enthusiasts, making the scale of this airdrop quite considerable. According to dYdX's official statistics, over 60,000 users were eligible to claim this airdrop, with the actual number of recipients exceeding 30,000. Based on previous statistics from Chain Catcher, its nominal airdrop scale ranks fifth in history, only behind ShapeShift, Uniswap, Ampleforth, and 1inch.

2. Damaging token distribution fairness, or respecting the interests of "cyber people"?

In the earliest Uniswap airdrop, since almost all users were unaware of future airdrops and used Uniswap due to their actual trading needs, the project’s airdrop was essentially distributed to precise users. However, as more users began to use projects purely for the purpose of "shearing" airdrops rather than actual usage needs, this has sparked many controversies regarding the fairness of airdrops.

"The market is always fair." When asked whether he thinks his airdrop brushing behavior affects the fairness of token distribution, Qian Xin replied this way. He believes that bulk registering accounts for project interactions is essentially no different from investing in the primary market. "The initial cost of brushing airdrops of 200,000 may go to zero, and the market will eliminate some people who are afraid to do this," he said.

Da Shuo, co-founder of DAO Square, told Chain Catcher: "Whether it's a single account used normally or multiple accounts brushing interactions, I believe both are legitimate." He stated that allowing permissionless accounts to participate in airdrop activities aligns with the spirit of Web 3.0, where both real people and bots are treated equally in cyberspace.

However, the volume brushing interactions have led to a large concentration of project tokens in the hands of a few "whales," and this unfair distribution has raised doubts among many users. For project teams, once the token transfer restrictions are lifted, these users may engage in large-scale selling, thus affecting the token price trend in the short term.

At the same time, the original intention of project airdrops is to reward early users, enhance community activity and loyalty, and distribute airdrops to multiple accounts of a single user, but most of these accounts are unlikely to remain active in the future, limiting the actual incentive effect of distributing a large number of tokens.

As of the time of writing, several dYdX volume brushing users interviewed by Chain Catcher have sold off to varying degrees. Qian Xin expects a psychological price of $20 for DYDX. On the evening of September 9, he sold 40,000 DYDX at a price of $15-16 to cover the costs of trading mining, while he plans to wait until the price rises above $20 to sell the remaining 100,000 tokens; Shuai Shuai "sold a portion" of his tokens and stated he plans to hold the remaining DYDX long-term.

Player Song Wuwei brushed 14 accounts, with 9 successfully obtaining a total of over 10,000 DYDX from the airdrop. Currently, he has sold half of his tokens, planning to hold the remaining portion long-term, and also expressed his intention to participate in DYDX governance.

3. Airdrop "risk control"? Project preventive measures may be increasing

For those users attempting to brush volume to gain airdrop eligibility, the dYdX Foundation has also clearly stated that it will take action, stating that "any accounts that appear to be clearly related to speculative future airdrop activities will be excluded from retroactive rewards."

Shuai Shuai mentioned that one of his accounts was once cleaned out; he accidentally clicked "withdraw" after depositing cash into a new account without trading. That address was later judged to be a "bot" and did not qualify for the airdrop.

Lei Kang also brushed dYdX. He entrusted a friend with 100,000 yuan to help him operate, and the friend used an automated script to run 200 accounts, but due to similar behavioral habits, this batch of accounts ultimately faced "risk control." However, a few accounts that Lei Kang manually interacted with "survived," collectively obtaining about 5,000 DYDX tokens.

But for "professional" airdrop shears, they often pay more attention to IP addresses and operational methods, making it difficult for project teams to detect them. Qian Xin also paid attention to IP issues during bulk interactions; after interacting with 1-3 accounts, he would switch IPs upon completing a transaction. Lao Ma stated that when brushing volume, he would choose IPs from regions with more lenient policies towards the crypto market, such as Singapore.

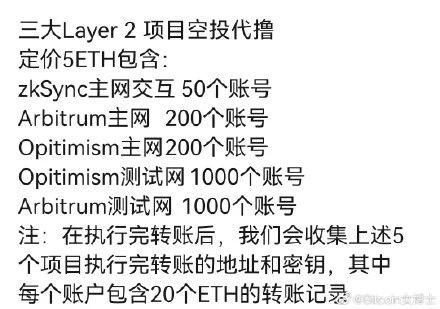

As the wealth effect of the dYdX airdrop becomes increasingly evident, more and more speculators are turning their attention to unlaunched projects like Zksync, Arbitrum, and Opyn, preparing to use a large number of Ethereum addresses to interact and gain potential airdrop opportunities.

Some communities have even derived activities to shear airdrops

But this further exacerbates the awkwardness for project teams, leading to increasing vigilance among more project teams. Members of the Synthetix ecosystem project and the on-chain options protocol Lyra recently stated in Discord that due to lower interaction costs with Optimism, they have discovered many bot accounts conducting small transactions, "Airdrops like Uniswap are too risky for us; we won't consider them."

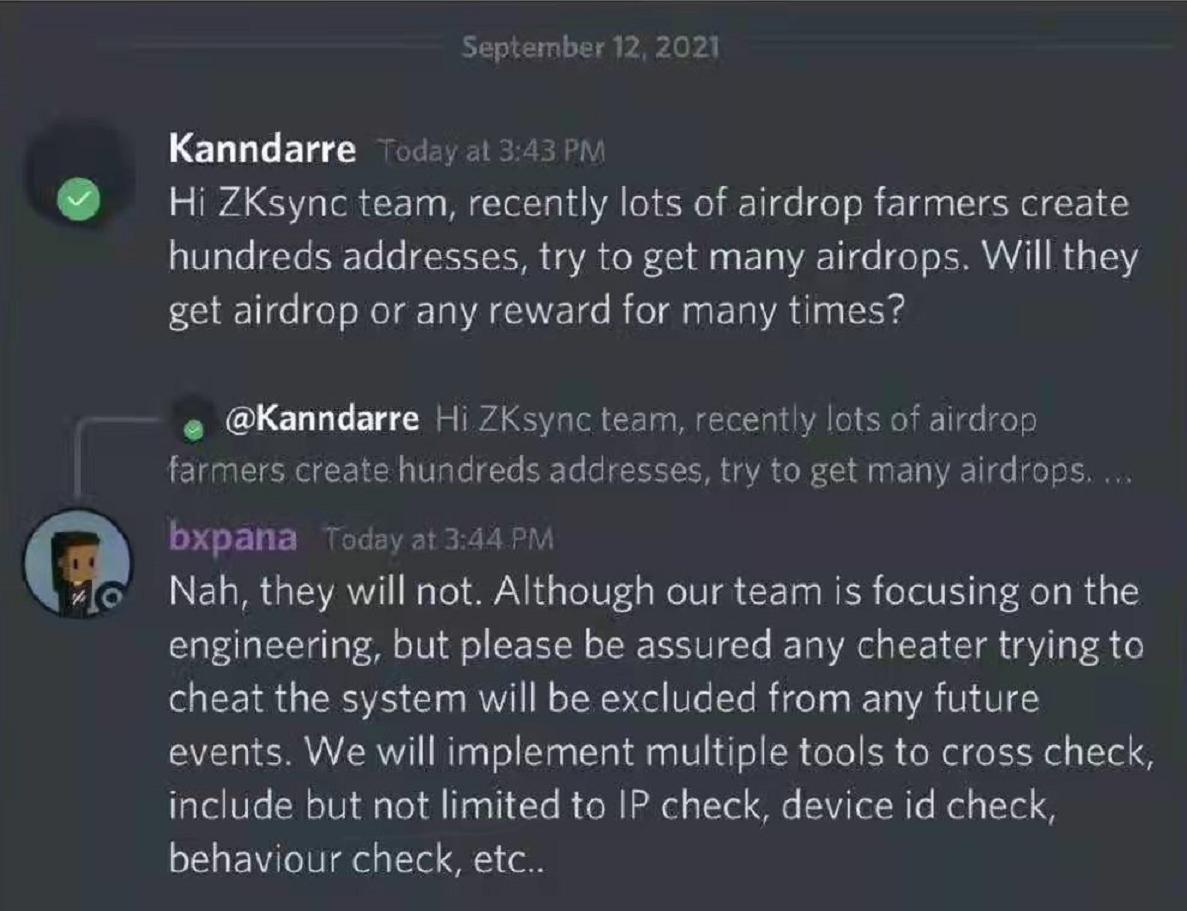

In response to some users' volume brushing behavior, zkSync developers recently replied in the Discord community that any cheating users will lose their eligibility to participate in future activities, and the team will use various tools for cross-checking, including IP checks, device ID checks, account behavior checks, and more.

At the same time, some project teams have begun to try decentralized identity solutions or impose requirements on the types and frequencies of address interactions to ensure that users with higher authenticity receive greater rewards. In May of this year, when Gitcoin distributed GTC airdrops, it increased the airdrop weight for users who completed Brightid real-name authentication, while users with more login times, more bound social accounts, and more diverse behavior types could also receive higher airdrop weights.

"Most resources on-chain are scarce. To solve the problem of shearing airdrops, we must first realize on-chain identity, but this cannot be solved by any single on-chain identity project; on-chain identity can only be resolved through gamification mechanisms. In games, we can only keep resources invested in the same character to stay ahead, and these resources include time and capital. The key to solving fair distribution is accumulation; time multiplied by capital equals extractable value." Da Shuo told Chain Catcher.

"There are also application-layer solutions like DAOSquare's DKP system, which, like Rarity, encourages users to accumulate points or experience, using different types of DKP points as filtering criteria to help project teams complete multidimensional filtering. Application interactions, locked tokens, Twitter retweets, Discord activity, holding a certain NFT, these are all just different DKP points. When we combine these conditions, it becomes easy to find real unique users." Da Shuo said.

As the airdrop game deepens further, how to deal with the disruption caused by the "wool party" will increasingly test the wisdom and vision of project teams.

(At the request of the interviewees, Qian Xin, Shuai Shuai, and Song Wuwei are all pseudonyms)