DAO Startup Guide: Complete these 5 steps to start your own DAO venture

Source: Bankless

Compiled by: Rhythm

Thousands of DAO experiments have emerged in the crypto space.

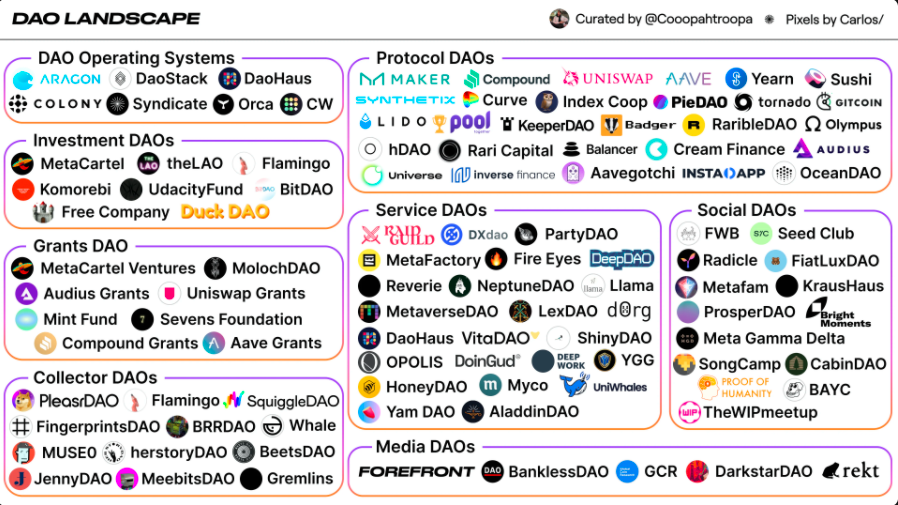

They are everywhere. Protocol DAOs, creator DAOs, media DAOs, social DAOs, and various DAOs doing crazy things, like bidding on priceless artworks with billionaires.

These new organizational forms represent a once-in-a-lifetime opportunity. We call them the future of work. We are very confident about this.

DAOs are the coordination layer of crypto. They allow people to collectively decide how to allocate resources globally, thereby forming new digital communities.

As you can imagine from the above, you can launch a DAO for just about anything.

You only need two things: a mission, a way to communicate, community finances, and a financial management framework. The rest is entirely open to imagination.

In the following text, Lucas explains what you need to know if you want to launch one of these new digital organizations.

How to Launch a DAO

Author: Lucas Campbell

The largest organizations in the world will eventually become DAOs.

Decentralized Autonomous Organizations (DAOs) are digital communities with a shared mission, a shared bank account, and a cap table. In recent months, as people have realized their potential to coordinate people and money globally, we have seen these new digital organizations rise to the forefront of the cryptocurrency narrative.

Public blockchains allow people to coordinate value democratically over the internet— all they need is a common mission.

With such a broad definition, you can almost launch a DAO for anything. We have seen DAOs bid over $40 million for a copy of the U.S. Constitution, raise $4 million for Doge memes, tackle climate change, buy golf courses, fund public goods, and more. The infinite design space of DAOs has just begun to be discovered.

If you are interested in launching a new organization like this, you need to consider the following aspects:

Mission

Community

Treasury

Governance

Ownership

1. Mission

Establishing a mission is the first step in creating a DAO and arguably the most important step.

What are you creating the DAO for? What is the goal of the DAO?

By solidifying this, you provide DAO members with a clear objective to strive for. If you are still trying to figure out the purpose of your DAO, here are some ideas to help you get started:

GitcoinDAO: Fund public goods (Impact DAO)

PleasrDAO: Collect artifacts (Collector/Curation DAO)

FreeRossDAO: Free Ross Ulbricht from prison (Impact DAO)

BanklessDAO: Bring 1 billion people into cryptocurrency (Social DAO)

Friends With Benefits (FWB): Create the ultimate social club (Social DAO)

Uniswap: Build an open value exchange protocol (Protocol DAO)

Constitution DAO: Purchase a copy of the U.S. Constitution (Collector DAO)

DAO Map

Given the above, the mission of a DAO can be almost anything. As an interesting example, I helped launch a small DAO (The Gnar Collective) aimed at building a crypto travel community, organizing trips around the world, and ultimately purchasing a vacation villa for DAO members. This is the direction of the DAO, but obviously, achieving these goals will take time.

The mission is just the first step. But once you have set your goals, what you need next is people. This leads us to the next aspect: community.

2. Community

The second step in launching a DAO is arguably the hardest: building a community.

First, you need to determine whether your DAO should be large or small; exclusive or open. Do you want a large community of thousands of people or a small group of selected individuals?

This is an important distinction that largely depends on your mission. If your goal is to help 1 billion people enter cryptocurrency, then you will need some scale. If you want to create an exclusive social club, you will want to limit it to specific individuals.

Utilizing platforms like Discord and Telegram is a great way to bring these like-minded individuals into the same room to start discussions. You can pair these two communication platforms with Collab Land to create more web3 experiences.

The communication venue is crucial for the success of a DAO. That said, one aspect to consider when guiding a DAO is building a community repository of on-chain addresses to eventually allocate ownership and governance rights.

We will discuss this further in later sections, but there are several ways to accomplish this. Distributing POAPs and other NFTs, collecting ENS domain names, etc., are all viable routes. Having an on-chain community makes it easier to execute the ownership and governance aspects of the DAO when the time is right.

If you want to learn more about how to build a web3 community, I would take some tips from my colleague Coopah.

Community Tools

Discord (Communication Hub)

Telegram Group (Communication Hub)

Collab Land (Token-controlled access)

3. Treasury

The community treasury—shared ownership—is a key unlock of web3 that makes DAOs so valuable. The treasury is about how the community coordinates and deploys funds to achieve its mission. While every DAO is different, determining how you will guide the treasury is an important step.

It all depends on the type of DAO you are launching. If you are building a protocol DAO that requires fees, this step can be relatively straightforward:

For DAOs that sell membership access through NFTs, the process is similar. Ultimately, your goal should be to deposit as much money into the treasury as possible, as this can provide operational funding for the community.

If you are launching a social DAO using ERC20s, this part can get a bit tricky. Bankless DAO has been working to create on-chain revenue through unique projects and initiatives, a portion of which will go to the DAO's treasury.

As a result, the community has released some of the best-selling crypto merchandise, launched unique NFT projects, collaborated with other DAOs to create new indices, and generated some high-signal content in crypto. All these initiatives not only increased revenue for the DAO treasury to guide operational funding but also provided income for contributors who helped launch these projects!

Another route is what DAOs like Friends With Benefits and Forefront have done, securing investments from large funds in exchange for a portion of ownership in the DAO. This, in turn, provides operational funding for the DAO, which can deploy these funds to achieve its mission—whether that’s paying core contributors or funding new projects, etc.

Once you have funds in the community treasury, the next step is figuring out how to manage it.

Treasury Tools:

Gnosis Multisig (Community Treasury)

Parcel (Treasury Management Tool)

SafeSnap (Governance + Treasury Tool)

JuiceBox (Crowdfunding)

4. Governance

While governance is not something everyone enjoys, in a DAO, it is your civic duty as a member. Participating in discussions, proposals, and submitting votes is a crucial task that needs to be completed to move the DAO forward.

There are various ways to handle governance currently, but it typically falls into one of two categories: on-chain and off-chain.

On-chain governance primarily revolves around token voting, while off-chain governance involves discussions and forum posts that ultimately lead to formal on-chain governance votes.

That said, the general governance process I see in DAOs looks like this:

High-level community discussions via chat and calls

Forum proposals to gain soft consensus

Token voting for hard consensus

If passed and quorum is met, execute the proposal

Complete, open community governance is just one aspect. We are also seeing delegated governance start to take shape, where the community grants a group of individuals/workgroups specific rights. This is particularly prominent in grant committees, which can gather input from the broader community but are ultimately granted the power to make management decisions on how to allocate grants.

Determining when, where, and how these delegated governance groups will operate is a key aspect of a DAO, as formal governance over every action and decision can slow things down. You don’t want to be making a decision through a governance process that takes weeks.

Having established power workgroups allows the DAO to act quickly and smoothly while maintaining a degree of community voice.

But use delegated voting sparingly—there are centralization risks involved.

Governance Tools:

Snapshot (Token Voting)

Tally (Token Voting and Governance Aggregator)

Discourse (Forum Discussions)

Boardroom (Governance Aggregator)

Messari Governor (Governance Aggregator)

5. Ownership

Once you have a governance framework, you can allocate ownership. This is how you access membership and vote on governance decisions.

As mentioned in this article, there are two main ways to allocate ownership: fungible tokens (ERC20) and non-fungible tokens (NFT).

Some projects utilize NFTs from their community (like Lootbags for Loot) as governance weight to vote on Snapshot, while communities like FWB use their native ERC20 tokens. Both have their pros and cons.

As mentioned in the treasury section, the biggest advantage of NFT member ownership is that it makes it easier to sell membership rights through NFT airdrops (not legal advice, please consult a lawyer), thereby facilitating capital flow into community finances.

For ERC20s, especially those involving the U.S., selling memberships can become more complex. Here, having a legal team to review the process is more necessary, and the SEC Chair Gary Gensler always has the opportunity to knock on your door (again, this is not legal advice, please consult a lawyer).

The main advantage of using fungible tokens is that it is a better mechanism for guiding internal economics. The fungibility of ERC20 tokens opens the door for easier incentives for contributors compared to NFTs. Additionally, by allocating a significant portion of the supply to the treasury, if the DAO is successful, it creates a higher leverage mechanism for guiding capital in the long run.

Considering all of this, future DAOs will certainly be able to utilize both NFTs and ERC20 tokens in their ownership structure and governance framework; however, it is still too early in this space.

Ownership Tools:

Coinvise (ERC20s)

Mirror (NFT Crowdfunding)

DAOs Will Eat the World

As stated in the opening line of this article, the largest organizations in the world will eventually become a DAO. I firmly believe this.

DAOs provide humanity with a new way for people to coordinate with each other over the internet and have collective ownership within it. This dynamic is incredibly powerful, and crypto natives are just beginning to realize it.

Ultimately, the rest of the world will come to the same realization, and the year of the DAO will arrive.

If you want to launch a DAO, whether for fun with friends or to initiate a serious plan aimed at changing the world, there are plenty of opportunities and design space available for you.

In summary, you can take the following 5 steps to launch a minimum viable DAO:

Establish the mission of the DAO (this part is open!)

Pair with Collab Land to build a community on Discord or Telegram

Create a shared treasury using Gnosis Multisig

Build a governance framework using Snapshot

Allocate ownership using Mirror or Coinvise

The rest is up to you and the community.

Good luck :)