Detailed Explanation of the Cosmos EVM Project Evmos Token Economic Model: Launching in a Few Weeks, 40% Allocated for Airdrop

Source: Evmos Blog

Original Title: 《The Evmos Token Model》

Compiled by: Hu Tao, Chain Catcher

EVM is coming to Cosmos, bringing with it battle-tested smart contracts, a new native token, and a vision for how future L1 networks can evolve to distribute value more equitably in the stack rather than trying to capture it.

The introduction of Rektdrop expresses the extent to which DeFi and NFT dApps have changed the rules of the game on Ethereum. Gas fees are painful and prevent value from accumulating to the parties that deserve it. But if dApps drive excitement among people, why don’t developers and users own more network tokens? Can developers do something about it?

The EVMOS incentive system and token distribution model outlined in this article is the first step in building an L1 that aligns stakeholders rather than alienating them. Our vision for the network begins with token economics and developers doing something.

1. EVMOS Token

Ethereum's token is described in the white paper as: "Ether" is the primary internal gas fee for Ethereum, used to pay transaction fees.

From the perspective of handling the scarcity of block space, the idea of this gas fee is compelling. But we believe it can be expanded through Evmo, especially in terms of driving more participation through balanced economics.

Wait, is this unbalanced?

L1 typically includes three participants: developers, users, and block maintainers (validators or miners). Each can play a significant role in driving and maintaining the value of any network, although many L1s have historically failed to accumulate sustainable value equally among these participants. Typically, block proposers accumulate the most network share, while users and developers—the most active participants—receive less.

Evmos aims to correct this imbalance and provide an alternative to the rent-seeking behavior of the past in fat protocols. Its network-level incentives will reward active users and fairly redistribute transaction gas fees between deployers of important applications and providers of key network infrastructure.

We have seen other chains in the Cosmos ecosystem demonstrate how protocols can do more to create a more balanced, self-sustaining economic machine.

EVMOS is not just a fee and staking token. It will be the first token on EVM that drives EVM governance outcomes. But it can also serve as a tool to determine the future economic outcomes for the three main participants (developers, users, and validators).

Token holders are responsible for guiding the DAO and deciding the fate of all on-chain assets entering Cosmos through Evmos. The goal of the network is for the vast majority of tokens to be owned and controlled by people outside the team. Here’s what we expect it to be used for:

- Paying service fees to developers and network operators through a built-in shared fee revenue model (dApp Store)

- Voting on protocol upgrades

- Registering tokens on the ERC20 module for EVM-IBC integration with ERC20

- Allocating usage rewards for applications on Evmo

- Enabling precompiles for useful high-priority features

Pre-mined Evmos tokens will not be sold.

2. Token Distribution Timeline

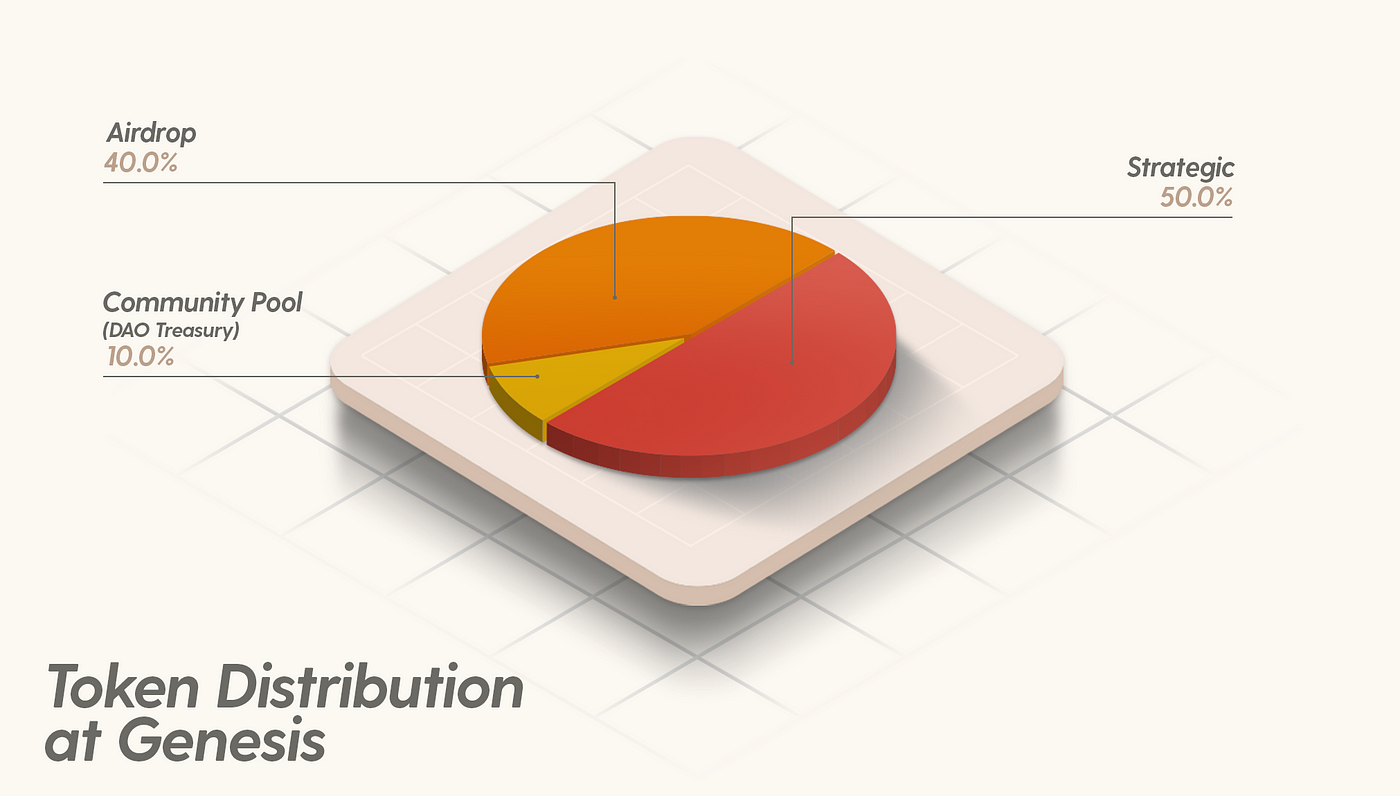

Evmos will have an initial supply of 200 million tokens at genesis, allocated to Rektdrop participants, community pools, and strategic reserves.

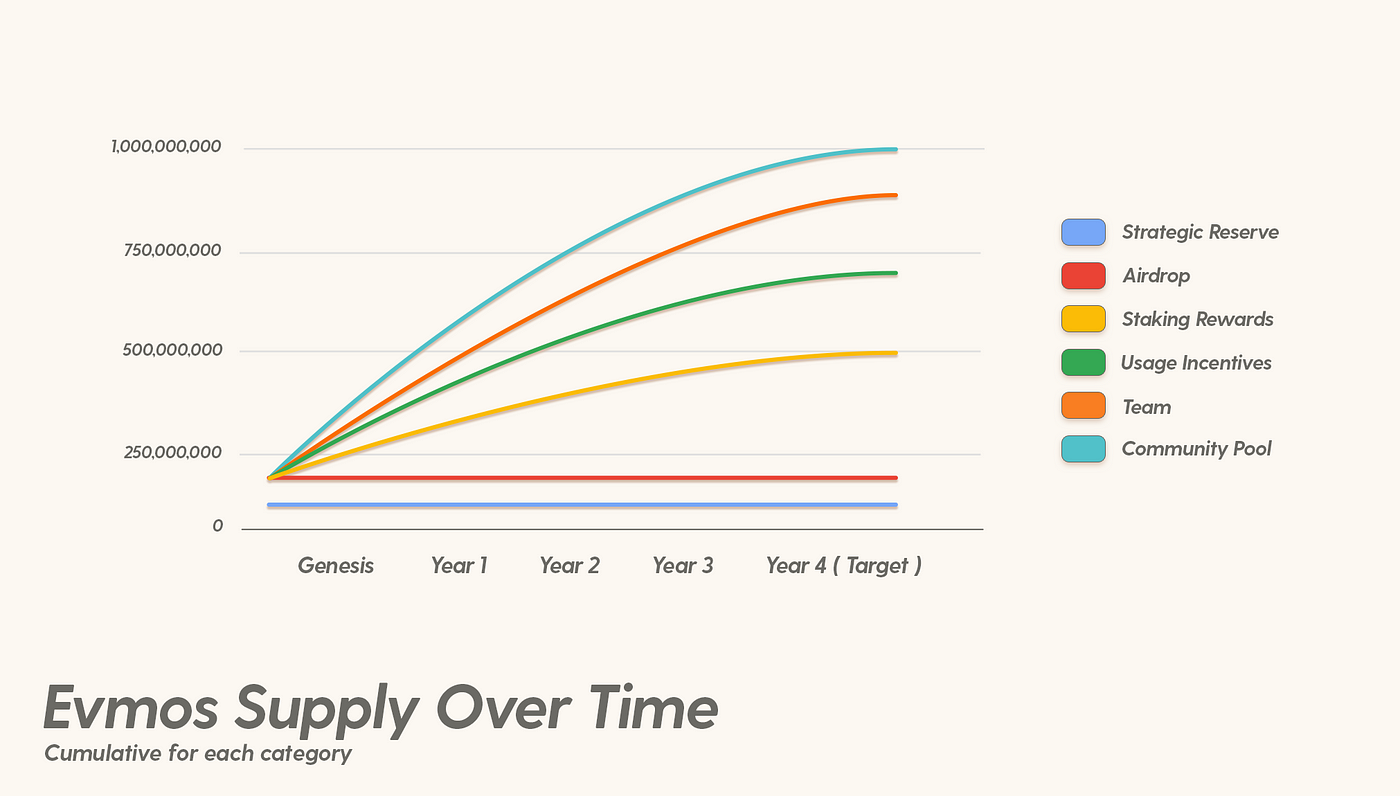

Evmos will initially be highly inflationary, issuing over 300 million tokens in the first year. Under the initial token model, new tokens will be issued according to an exponential decay schedule, where the inflation rate decreases each year (daily over 365 days). The goal is to issue 1 billion Evmos tokens over 4 years.

This results in a long-term deflationary appearance for the network, but we view Evmos as a token with no upper limit on supply. We encourage the community to choose alternative inflation models after the fourth year. For example, if rewards are deemed too low, the community can propose a linear or constant model.

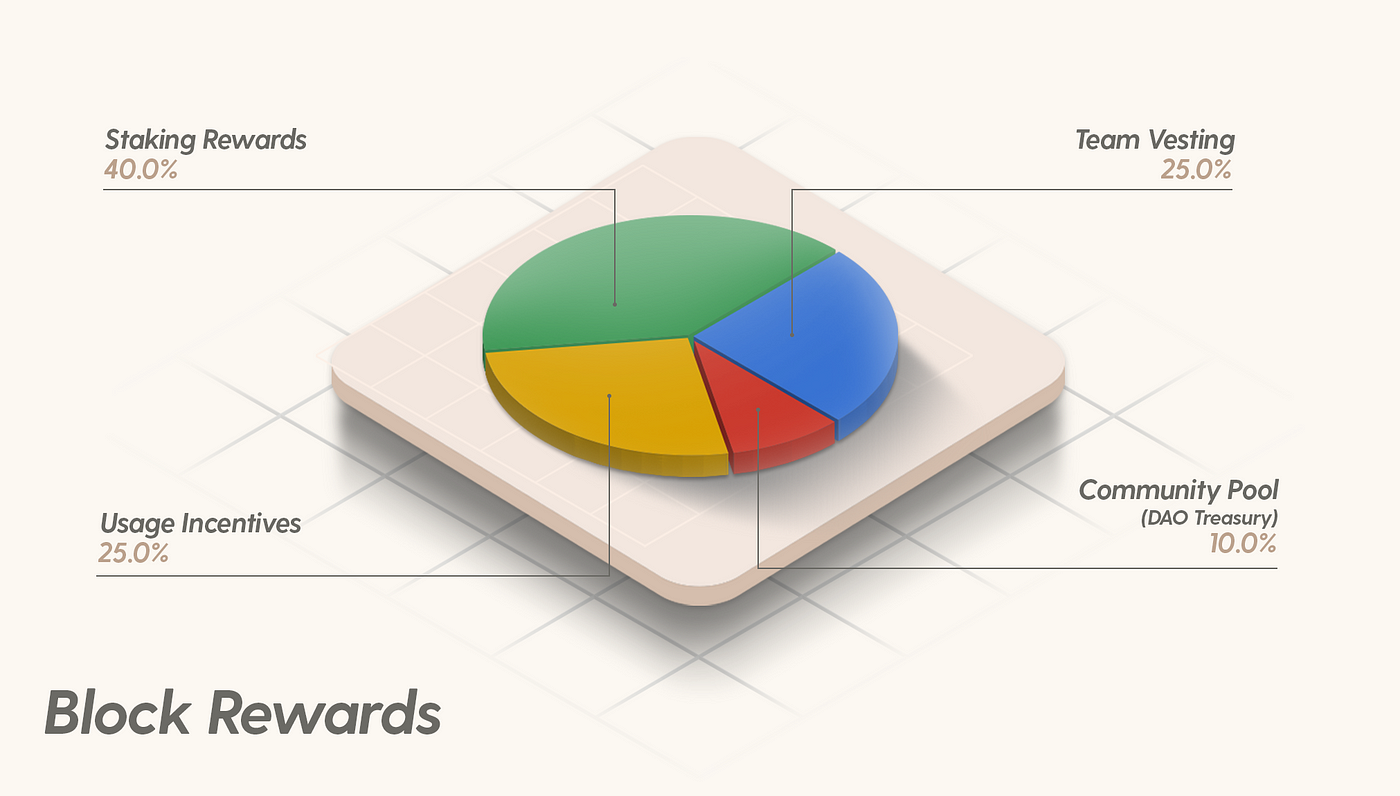

Newly issued tokens will be distributed as follows:

- Staking rewards: 40%

- Team allocation: 25%

- Usage rewards: 25%

- Community pool: 10%

3. Usage Rewards

25% of the block-released tokens will flow into a dedicated pool for incentivizing users.

Deferred gas fee rebates

Initially, the usage incentive pool on Evmos will sponsor gas payments for end users. The only limitation is that these incentives must be less than the fees.

To incentivize the use of smart contracts on Evmos, the community will be able to register incentives for a given smart contract through governance to utilize part of the usage incentive pool for a certain period. The allocation of these rewards will occur at each epoch (defaulting to 1 week), making them a cumulative, deferred rebate of paid fees. The purpose of this is to allocate rewards to contract users, acting as a gas fee subsidy.

This is essentially a way for the network to decide which dApps earn gas subsidies for their users, and token holders are best positioned to drive network usage of these dApps. Think of it as a quality of service (QoS) protocol, but a variant of governance control over block space rather than internet service guarantees.

Liquidity Mining

In the near future, the program will focus on driving usage incentives for TVL (Total Value Locked), as it is a means to incentivize residual behavior in multiple places.

The idea is to allocate Evmos tokens from the usage incentive pool to a contract where you can lock your DEX LP positions, currency market IOUs, or other liquidity IOUs (i.e., UNIv2 LP positions, AAVE aTokens/Compound cTokens, or Connext liquidity). These are typically represented as ERC20 tokens.

The contract will be governed so that token holders can decide which applications on the Evmos chain are eligible for usage reward farming.

This is essentially a liquidity mining program associated with the base layer but governed.

Over 4 years, this will total the issuance of 200 million Evmos tokens. The scale of this pool is significant because users are the backbone of any crypto project. For example, if governance decides that the network would benefit from more user growth, we could see larger usage incentives.

4. Fees

Evmos fees are priced based on network usage. Gas pricing is based on EIP1559. However, we do not burn the base fee; instead, we redistribute and reinvest it.

dApp Store

In Evmos, fees are no longer just burned; they only increase the network ownership share of network operators. Evmos now distributes fees between developers and network operators through a built-in shared fee revenue model as a reward for their services. We refer to this revenue model/fee distribution as the dApp Store.

It is essentially an app store model, where a portion of the revenue from app sales typically goes to the app store operator, while most of the revenue goes to the developers. The difference here is that the network is a continuous, active service, and network operators rent out most of the infrastructure needed to run decentralized applications.

It rewards developers based on the value and impact of their dApps, rather than their ability to launch new governance tokens and leverage connections with capital. Those building on Evmos gain real benefits in the development and governance of the protocol itself.

This fee distribution will be implemented at genesis in a 50/50 ratio between contract deployers and validators and can be adjusted through governance. To prevent spam, eligible contracts must go through governance. Note that this works in conjunction with usage incentives for gas subsidies.

Transaction fees on Cosmos chains are typically aggregated and distributed to validators and block maintainers. Fees are not included in block allocations as they vary based on activity in the network and the gas price market.

IBC Relayer Fee Discounts

Relayers are a thankless job as they are merely a loss on the validator's balance sheet. In Evmos, IBC transactions, especially UpdateClient and IBC transfers, will receive at least a 50% discount.

Note that this is parallel to the work on ICS-29 regarding relayer incentives. The purpose of this is not to serve as a direct substitute for the standard but as a way to thank relayers for their continued service, as they are the only reason IBC can move from one chain to another. This altruistic behavior of relayers is precisely why the Cosmos ecosystem builds the most decentralized and well-functioning chain sets.

5. Staking Rewards

Validators and delegators are crucial for ensuring the security of the Evmos blockchain and assisting in block proposing and validation. These roles can extend to providing oracles, secure cross-chain bridges, and offering aggregation services to Celestia or other Evmos sub-chains, making them key participants.

In the initial phase, the Evmos blockchain will have 150 active validators, depending on the amount delegated to each validator. The possible number of validators can be adjusted through governance.

40% of newly issued tokens will be used to proportionally reward active validators and their delegators based on the amount of staked Evmos tokens. Validators charge a commission to delegators based on the rewards earned. Each validator can choose their own commission rate, but the minimum commission rate set across the network is 5%.

6. Rektdrop

In 2021, many fortunes turned rapidly, but many faced various issues in the process. We created Rektdrop to reward active users in the Cosmos and Ethereum communities and stimulate the ecosystem.

By rewarding multiple categories of users rather than a single limited group, we believe this distribution will maximize fairness, avoid witch attacks, and select an initial group of token holders that will contribute to the network's prosperity.

Rektdrop will include an initial 80 million EVMO. All snapshots for the RektDROP standard will be taken on November 25, 2021, at 19:00 UTC.

We will introduce a web portal for users to see how many Evmos tokens they are eligible for. Once the Evmos mainnet goes live in the coming weeks, the portal will also allow users to claim rewards by completing a series of actions. The Rektdrop claiming process will be published separately, explaining what we have done regarding data extraction, parameter adjustments, segmentation, and how to claim Rektdrop.

7. Strategic Reserves

At genesis, 100 million Evmo will be allocated to strategic reserves. This strategic reserve will be controlled by a multi-signature DAO owned by the foundation, initially composed of the development team and members of the Cosmos community. It will expand in the future and maintain transparency in its decision-making.

It will be used to fund programs through grants and support highly active validators in the network through delegation, not just running a node with institutional backing. This may include providing relayer services, building explorers, maintaining open-source tools, and deploying dashboards that show overall market growth for the network. Evmos contributors value providing more services to active participants in the network to promote growth for all, including passive token holders. It will also be used to coordinate strategic partnerships for Evmos projects through fundraising. Any fundraising conducted through the DAO will be subject to a vesting period.

The DAO will ensure that the network's decentralization is not overly maintained. The strategic reserves will not be used for market sales or to control the network. The community will ultimately own more tokens, as the reserves will be used for the public good. We hope the token release schedule will lead to more active participants on the network beyond the foundation.

8. Community Pool

The dream of Evmos is realized through the Cosmos community pool. We hope to ensure an active Evmos community pool so that others can also drive their dreams.

The community pool will initially use 40 million Evmos tokens as seed funding and will continue to be funded by 10% of newly issued tokens.

Pool funds will be governed and should be used early. It is expected to be used to guide important tools, infrastructure, educational content, and other resources. We also believe the community pool can be used to back public goods funding. Our software is also built on other tools such as Go-Ethereum, Cosmos SDK, and Osmosis, so we strongly encourage requests from other builders!

9. Team Allocation

To build a world-class team, 25% of tokens will be allocated to developers of the Evmos protocol every period. These 200 million Evmo tokens are subject to a vesting period and are currently being allocated. They will be non-transferable or stakable before release.

Token holders can decide whether they want the current development team to participate in the network and choose to reclaim any unissued tokens from the development team through governance and redirect them. We genuinely want to work with the community to achieve decentralization and commit to its long-term success.

10. Conclusion

Genesis is the first step toward a more balanced L1 ecosystem. Evmos is expected to evolve with the needs of its community; the iterations released on day one may look different from Evmo six months, a year, or ten years later.

The token model is no different. As the first batch of deployed applications begins to take root, new features will be considered to meet their needs and promote value creation. Incentives will be refined over time to ensure that all participants can benefit in the long term. The community will be able to shift the token model to alternatives while the network is active.

Evmos plans to launch in a few weeks. The airdrop will be open for claiming soon. Please stay tuned for the latest details before the launch.