What are the new "smart money" DeFi DAOs buying?

Original Author: Ben Giove, Banklesshq

Compiled by: Katie Gu, Planet Daily

In the crypto space, "smart money" isn't necessarily hedge funds or asset management companies; it can also be DAOs.

These crypto-native entities with substantial funds employ some of the smartest crypto talents in the world to manage their wealth. We are also beginning to notice that they are the earliest sources of capital rushing in to "scoop up" potential tokens.

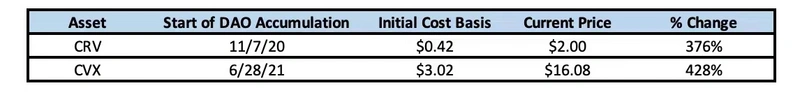

They started buying CRV at $0.42. Now it's over $2. (+376%)

They bought CVX at $3. Now it's over $16. (+426%)

What's cooler is that anyone can "peek" at the DAO's good token recommendations by checking governance forums or diving into on-chain data.

So what will DAOs scoop up next?

This article will guide you to dig deep into the treasure trove of "smart money"~

What are DAOs busy buying?

There is a new type of market participant within DeFi.

This does not refer to the heavily promoted TradFi institutions. Instead, these increasingly influential entities are crypto-native, fully active on-chain, and possess operational experience and insights into DeFi.

This emerging force is the DAO.

DaoFi refers to the DaoFi that appears as DeFi users and investors, a class of DeFi investors and the earliest sources of capital for certain tokens.

It makes sense to view DAOs as "smart money." They are non-native entities managed by some of the smartest people in the world, possessing substantial funds and high-level expertise.

A classic example of DAOs as "smart money" is the CRV and CVX War.

Starting in Q2 2021, protocols like Yearn Finance, StakeDAO, and Convex Finance were competing to accumulate and lock CRV tokens. These locked tokens exist in the form of veCRV, which grants holders higher rewards when providing liquidity on Curve and the right to vote on the direction of CRV emissions.

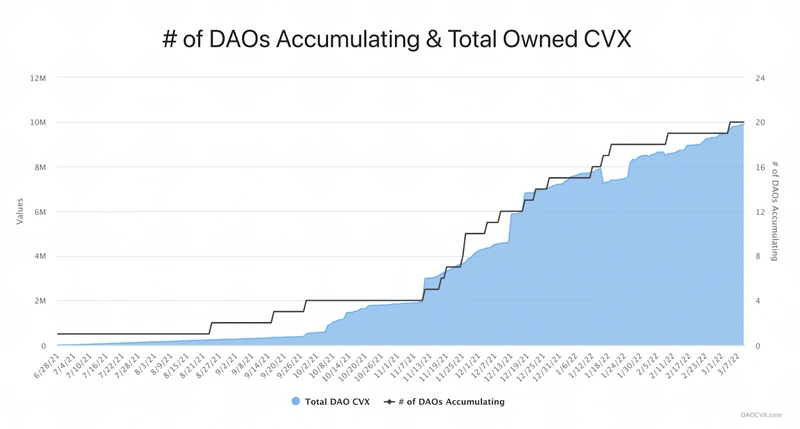

Source: DAOCVX.com

Convex quickly won this "moat or Trojan horse" battle, hoarding a large amount of CRV. The focus then shifted to CVX, as holders had the right to micro-govern the CRV held by Convex.

CVX is now held by 20 DAO token vaults.

It is well known that these wars are initiated by DAOs, but few discuss their cost basis.

From the table above, we can see that DAOs began hoarding CRV and CVX at prices far below the current trading prices. Despite both assets having fallen over 50% from their peak levels in January 2022, the aforementioned gains have still occurred. Interestingly, these actions were conducted "in broad daylight," where anyone could see them in governance forums, Twitter, and of course, on-chain in real-time.

The operations of these DAOs are easily replicable.

Although the sample size is small, we can conclude that DAO purchases serve as buy signals for investors.

This raises some questions:

Besides CRV and CVX, what other tokens are DAOs "scooping up"?

What are their reasons for doing so?

Will more DAOs follow in the footsteps of early adopters?

Let's search for answers in the holdings of DAOs.

Overview of DAO Holdings

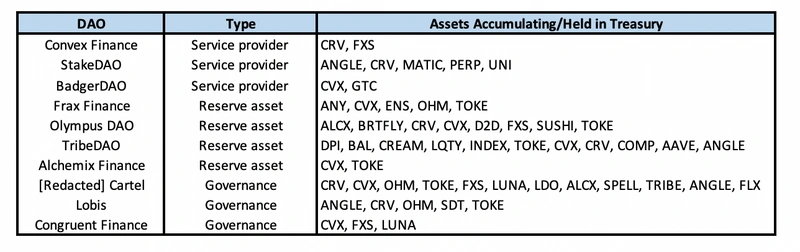

We will analyze 10 different token vaults of DeFi DAOs.

This list cannot encompass all DAOs, as there are hundreds of very smart and talented contributors on Ethereum. These 10 represent different combinations, and we will "unwrap" them based on their scale, their ultimate interest in acquiring various governance tokens, and their motivations for doing so.

The assets listed in the table do not include mainstream token assets such as ETH, BTC, stablecoins, liquidity tokens, and native tokens (assets over $20,000). These assets were acquired through various means, whether through public market purchases, mining rewards, token swaps, or seed round allocations.

These ten DAOs are divided into three main categories:

Service Providers: These DAOs are accumulating governance tokens to enhance the quality of their products for users, such as increasing yields. DAOs that fit this description include Convex Finance, StakeDAO, and BadgerDAO.

Reserve Asset Issuers: These protocols are issuing some form of reserve asset, whether pegged to fiat or floating exchange rates. These DAOs are hoarding various tokens to use as collateral, micro-governance rights, and/or to provide liquidity directly for their issued tokens. Selected DAOs in this category include Frax Finance, Olympus DAO, Tribe DAO, and Alchemix Finance.

Governance DAOs: These DAOs are hoarding tokens with the aim of accumulating governance power and influence in various strategically important protocols. These include [Redacted] Cartel, Lobis, and Congruent Finance.

As we can see, among the 10 DAOs on our list, there are 26 unique assets, with each DAO holding at least two non-native governance tokens in their vaults.

The average number of tokens held by each DAO is 5.5, with a median of 4. The two DAOs holding the most tokens are [Redacted] Cartel and Tribe DAO, holding 12 and 11, respectively.

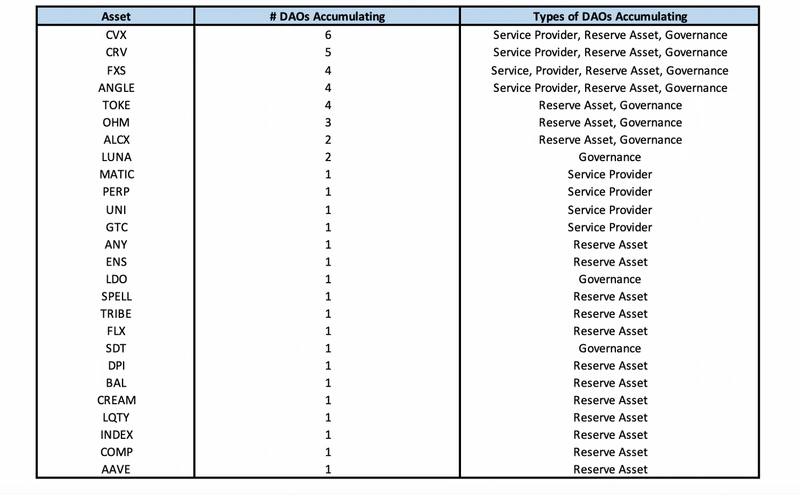

Breaking down the data by asset, it is no surprise to see that the most common asset is CVX, held by 6 DAOs, while 5 DAOs hold CRV. The three categories of DAOs hold only four assets, two of which are among them.

Looking further down, the fourth to sixth positions are FXS, TOKE, and ANGLE. The tokens are held by reserve asset and governance DAOs, while FXS and ANGLE are held by reserve asset, governance DAOs, and service providers.

The Three Most Common Held Assets

Now that we know the most commonly held tokens in the DAO sample group, let's take a closer look at some of these tokens to understand why they have become "scoop-up" targets for DAOs and their strategic importance.

We will focus on the three most widely held assets besides CRV and CVX: FXS, ANGLE, and TOKE.

- Frax Finance (FXS)

Number of DAOs holding this asset: 4

DAOs holding this asset: Convex Finance, Olympus DAO, [Redacted] Cartel, Congruent Finance

Types of DAOs holding this asset: Service Providers, Reserve Assets, Governance

Frax Finance is a stablecoin issuer, with its FXS token serving as a minting tax, generating fees, providing enhanced rewards for holders, and managing the protocol. Like CRV and CVX, FXS can be locked as veFXS, granting holders the right to vote on emissions for different FRAX pairs on any decentralized exchange.

DAO "scoop-up" motivation prediction:

The utility of the FXS token likely drives accumulation among the three types of DAOs. Service providers like Convex may want to lock FXS to offer the highest possible yields to depositors, while reserve asset issuers may be interested in locking FXS to drive liquidity for FRAX-based trading pairs, and governance DAOs can utilize the token to generate cash flow for their token holders through voting sales.

- Angle Protocol (ANGLE)

Number of DAOs holding this asset: 4

DAOs holding this asset: Stake DAO, Tribe DAO, Redacted Cartel, Lobis

Types of DAOs holding this asset: Service Providers, Reserve Assets, Governance

Angle is a stablecoin protocol currently issuing agEUR, which is pegged to the Euro. The ANGLE token plays a key role in the protocol, and acquiring these tokens through liquidity mining rewards may encourage DAOs to purchase or hold the tokens.

Like FXS, when ANGLE is locked as veANGLE, it accrues protocol fees, granting holders the right to increase emissions and vote on weightings. Similar to Frax, any agEUR pair on any exchange can be priced.

DAO "scoop-up" motivation prediction:

Although the appeal of agEUR has not yet reached the level of FRAX, its market cap of $129 million is only 4.4% of FRAX. If the adoption of ANGLE increases, the demand for ANGLE among these three types of DAOs is likely to rise.

- Tokemak (TOKE)

Number of DAOs holding this asset: 4

DAOs holding this asset: Olympus DAO, Tribe DAO, Redacted Cartel, Lobis

Types of DAOs holding this asset: Reserve Assets, Governance

Tokemak is a decentralized market-making protocol. The protocol's native token (TOKE) is used within the protocol as a means to allocate and directly provide liquidity to different tokens and exchanges.

TOKE holders invest their assets into a specific token reactor to earn yields in the form of TOKE emissions, while also acting as a backstop for the protocol in case the token reactor becomes under-collateralized due to significant short-term loss events.

DAO "scoop-up" motivation prediction:

Like FXS and ANGLE, TOKE is likely to be in demand from both reserve asset and governance DAOs, as it has the ability to control the flow of liquidity. Reserve asset DAOs may wish to hoard the token to increase liquidity for their issued tokens, while governance DAOs can sell their holding rights to bidders interested in establishing token reactors or directing more liquidity for their tokens.

Potential Future Target Assets for DAOs

Having discussed the most widely held assets, let's revisit some assets on the list that may become targets for an increasing number of DAOs in the future.

- Redacted Cartel (BRTFLY)

Number of DAOs holding this asset: 1

DAO holding this asset: Redacted Cartel

Type of DAO holding this asset: Reserve Asset

A potential target asset for DAOs is BRTFLY, the governance token of Redacted Cartel. As a fork of Olympus DAO, Redacted aims to accumulate governance power across various strategically important protocols. Redacted holds assets worth over $46 million, with their largest holdings being CRV, CVX, OHM, FXS, and TOKE at current market prices.

BRTFLY currently uses a rebase model similar to its parent DAO but will soon transition to a dual-token model. The new tokens, rlBRTFLY (locked yield BRTFLY) and glBRTFLY (locked governance BRTFLY), will split the cash flow obtained from bribes and the micro-governance rights of the token vault assets.

DAO "scoop-up" motivation prediction:

The primary reason DAOs are starting to accumulate BRTFLY is to gain the micro-governance rights held by glBRTFLY. As they hold increasingly larger shares of many strategically important assets mentioned in this article, glBRTFLY may become a popular micro-governance token among DAOs seeking to obtain the benefits of holding these tokens.

We have already begun to see DAOs showing interest in BRTFLY, with Olympus recently proposing to add BRTFLY to its strategic asset whitelist.

- Index Coop (INDEX)

Number of DAOs holding this asset: 1

DAO holding this asset: Tribe DAO

Type of DAO holding this asset: Reserve Asset

Index Coop is a decentralized asset management company responsible for creating thematic indices like GMI, DPI, MVI, and leveraged products like ETH 2x-FLI. While INDEX is used for governance within the INDEX Coop DAO itself, similar to glBRTFLY, token holders are granted micro-governance rights over the assets held in INDEX Coop products.

Although this function currently only applies to DPI, it could theoretically be applied to all categories under Coop permissions.

DAO "scoop-up" motivation prediction:

Like glBRTFLY, the primary reason DAOs may be interested in hoarding INDEX is the broad micro-governance rights currently and in the future within the token's permissions.

We have seen Tribe DAO leverage the micro-governance capabilities of INDEX. The DAO holds 100,000 INDEX (approximately $463,000 at current prices), which they used to help their stablecoin FEI launch on Aave. Given the utility and value brought by listing FEI on the largest currency market in DeFi by TVL, it is not impossible for other DAOs to follow suit.

- Balancer (BAL)

Number of DAOs holding this asset: 1

DAO holding this asset: Tribe DAO

Type of DAO holding this asset: Reserve Asset

Balancer is a decentralized exchange that allows for the creation of highly customizable AMM (automated market maker) pools, managed by the BAL token. The protocol plans to undergo a comprehensive reform of the BAL token economy to implement a ve model. Like Curve, BAL holders will be able to lock their tokens for up to a year, earning a portion of the trading fees generated by the DEX and gaining the right to vote on emissions for different pools.

DAO "scoop-up" motivation prediction:

Like Curve, the driving force behind the potential large-scale accumulation of BAL is the right to control future emissions, i.e., the liquidity of a given pool. This could drive demand for the token among service providers, reserve asset issuers, and governance DAOs.

Conclusion

DAOs are the smart money of DeFi, and they are very active in the market. As we have seen, these DeFi-native entities hold and hoard far more than just CRV; they are also turning their attention to other strategically important assets.

A common feature of the most widely held tokens is that they possess valuable governance rights, which can be obtained through direct token ownership, such as FXS and ANGLE; or through micro-governance, such as CVX, glBRTFLY, and INDEX. Additionally, in many cases, the coveted rights associated with these assets are the ability to guide liquidity flows through token emissions, and liquidity is the most valuable resource in DeFi.

We always say to follow the smart money; is there any smarter money than DeFi DAOs?