Consensus game among GameFi players

Author: Research DAO

Translator: Dinzz, H.Forest Ventures

Introduction

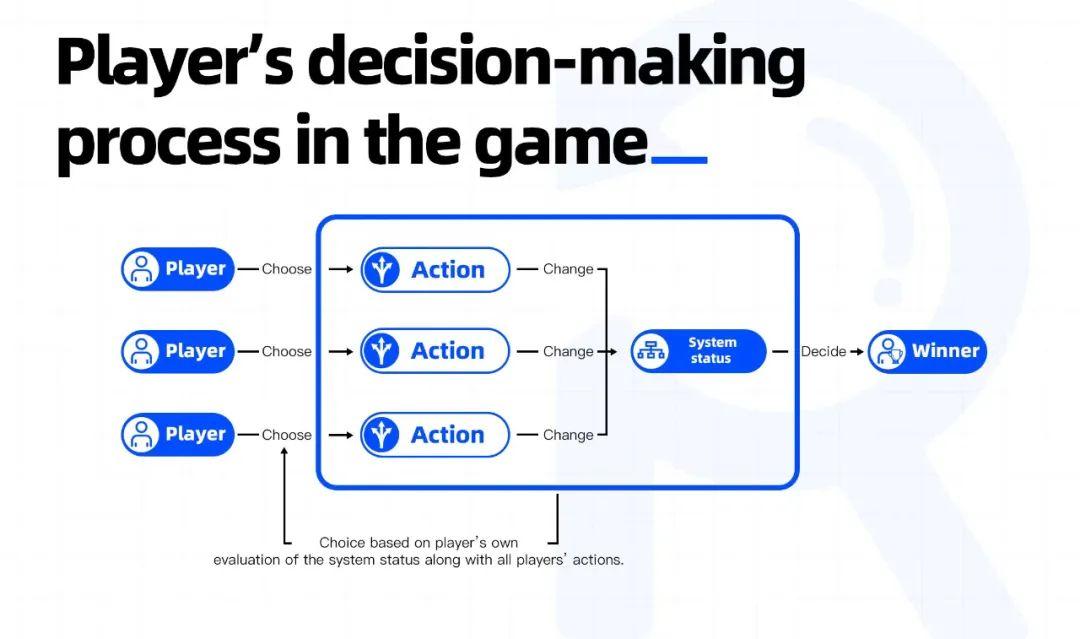

Behind the financial attributes of DeFi and GameFi, participants adjust their gaming strategies by assessing the average action consensus of other participants (i.e., the actions that most participants are likely to adopt).

Why is it not just a simple decision, but a dynamic game?

Because Player A's decision affects Player B's decision, which in turn affects Player A's own decision. Therefore, players will experience the complexity of the game, as their decisions (or sometimes anticipated decisions) occur simultaneously among all players. The development of the game will be multidimensional and happen in real-time, especially in markets with sufficient depth and liquidity.

Participating in the market means participating in the game. After evaluating the average consensus of all participants in the market, one must choose an action below the average consensus to win. If a participant's behavior is above the average consensus, they will fail.

This article discusses the unique features of GameFi and its inherent system properties, which are utilized by multiple parties within the gaming system to facilitate consensus. Taking various stakeholders in GameFi as examples, including developers, guilds, and ordinary players. In the game, there are players who can see a panoramic view of the entire market, and they can act by anticipating the actions that other players might take, choosing action routes with higher winning probabilities to gain an advantage in the game.

In this article, we will analyze the most typical GameFi game Axie Infinity and the most important guild in the GameFi field, YGG. We hope that through our efforts, we can provide you with an in-depth understanding of the main features and internal logic of GameFi.

Content Summary

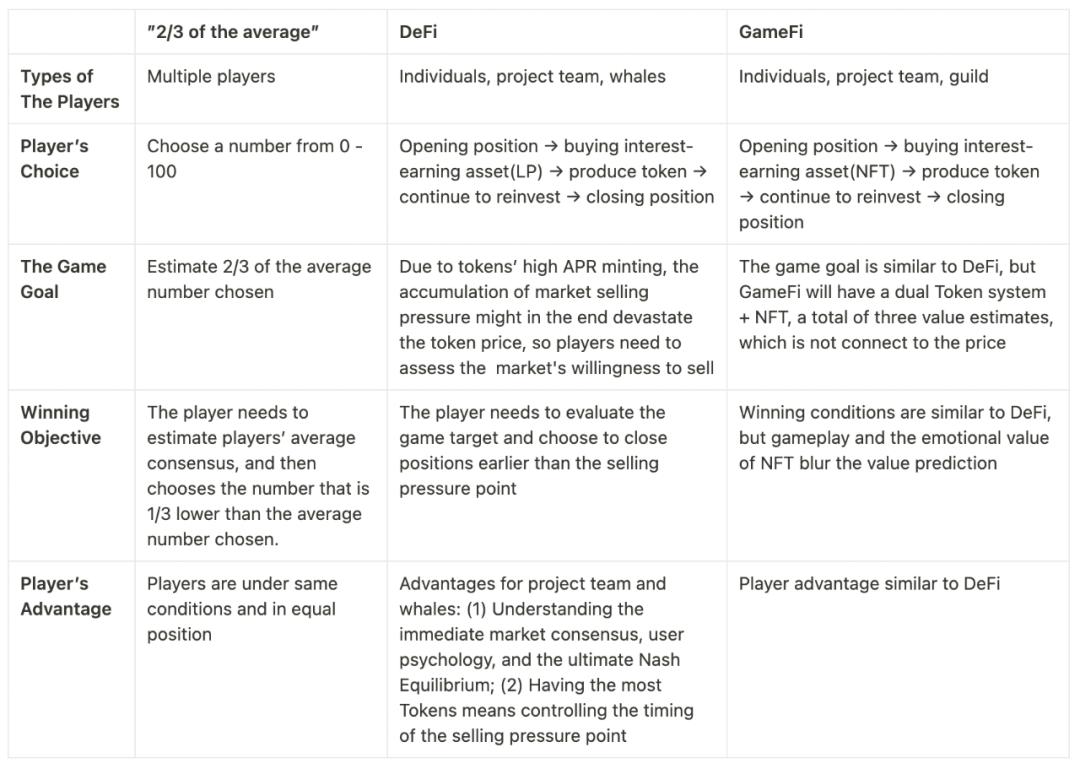

1. "Guess the Average of 2/3" Game

1.1 Two-player "Guess the Average of 2/3" Game: The minimum "strictly dominant strategy" is "0".

1.2 Multiplayer "Guess the Average" Game: After evaluating the average of all players' chosen numbers, the winner can win by providing a number that is 1/3 lower than the average.

2. Consensus Game of DeFi + GameFi

2.1 DeFi: After evaluating the average consensus of all participants on a project, the winner may win through actions below the average consensus.

2.2 GameFi: The emotional value of NFTs combined with the gaming functionality of GameFi makes it easy for various interest groups to manage player consensus in the market. Unlike DeFi's single-token system, the value of GameFi is not solely reflected in its token price. The complexity of player interaction patterns and consensus games is also increasing.

3. Axie Infinity

3.1 Economic Model of Axie: Player consensus is divided into three categories of assets, and the consensus game focuses on maintaining the price of SLP.

3.2 Axie Team and YGG: YGG has more capability and motivation to manage player consensus, but still requires Axie to introduce adjustments to its economic model.

4. The Consensus Game Never Stops

1. Average of 2/3 Game: Assessing Consensus and Winning with Weakly Dominant Strategies

Richard Thaler, in his Nobel Prize-winning work "Misbehaving," proposed an interesting game: guessing 2/3 of the average.

Participants are asked to choose an integer from 0 to 100. The participant whose number is closest to 2/3 of the average of all chosen numbers wins the game. For example, suppose there are three participants guessing 20, 30, and 40, the average is 30. Then the person who chose 20 is the winner.

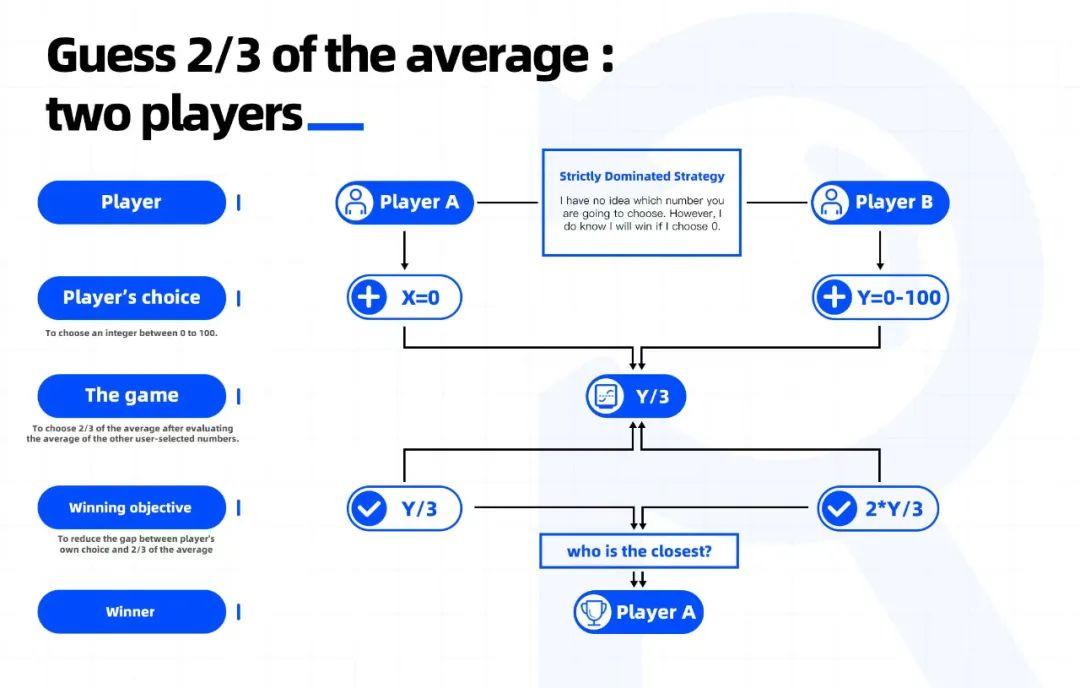

1.1 Two-player "Average of 2/3" Game

In this game, if there are only two players, there exists a "strictly dominant strategy" (which means that regardless of what the other player chooses, each player has a best strategy to win the game). Choosing 0 has a higher chance of winning than choosing any number greater than 0.

For example, if the two players provide numbers 0 and 100, then 2/3 of the average will be (0+100)/2*(2/3) = 33.3. The number 0 is closer to 33.3, so the player who chose 0 wins.

Simplified to its most essential form, the two-player game is essentially a scenario where "the one who chooses the smaller number wins." Due to the low degree of freedom in the game, players only need to choose a number smaller than the other player to win the game. Therefore, for all players, the "strictly dominant strategy" is to choose 0.

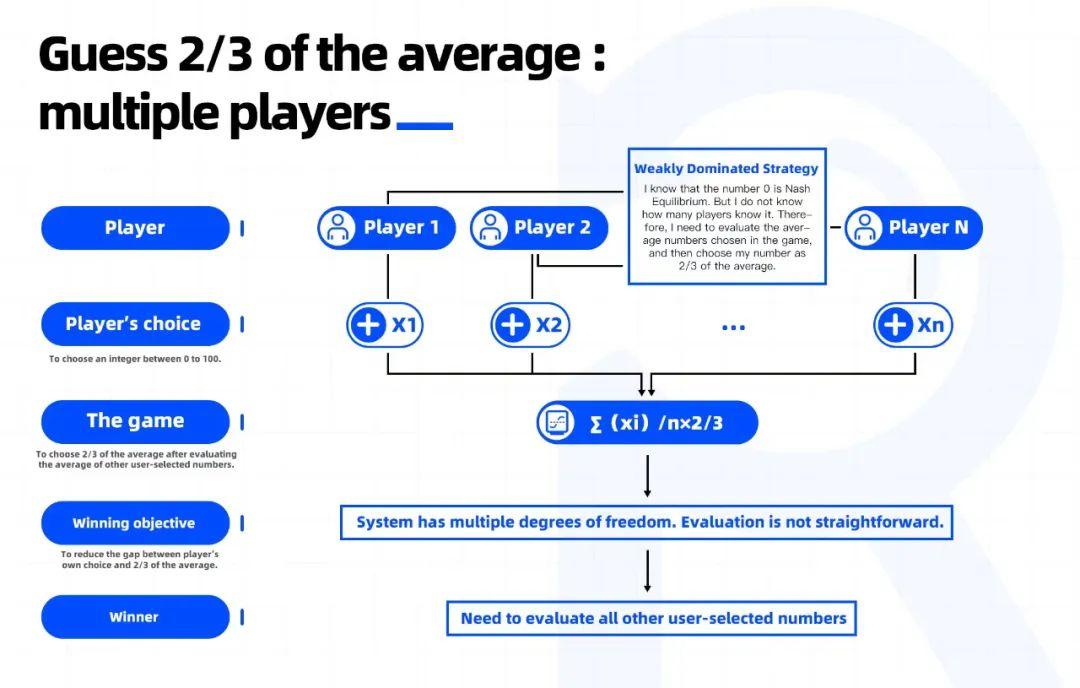

1.2 Multiplayer "Average of 2/3" Game

When the game has more than two players, we face a more complex situation, as the presence of new players forces all players to rethink the behavioral motivations of others. The winning strategy shifts from "strictly dominant strategy" to "weakly dominant strategy."

A rational player would reason as follows:

At first, I can make a reasonable assumption: Assume players choosing from 0-100 will follow a normal distribution with a mean of 50. 2/3 of 50 will be 33.3. Therefore, to win, I would choose 33 as my answer.

Based on the previous reasoning, I can dig a little deeper: If some players reason like I do, they will provide the number 33 as their answer, which means the actual average will be slightly below 50. Of course, if every player makes the same reasoning as above, the actual average becomes 33. To win, I would choose 22 as my answer (i.e., 33 * 2/3 = 22).

Through an elimination process, the answers will gradually approach 0. Ultimately, the integer 0 becomes the final answer, and the game reaches "Nash equilibrium."

In multiplayer games compared to two-player games, the degree of freedom is higher. Its basic mechanism is to predict the average number of all players. Simply choosing the smallest number 0 will not win the game.

Moreover, for multiplayer games, the key is not whether the game will ultimately reach Nash equilibrium.

The focus is on how far the current system is from reaching Nash equilibrium, considering all players in the game. The answer depends on the degree of information asymmetry within the system and the speed of information transmission among all participants.

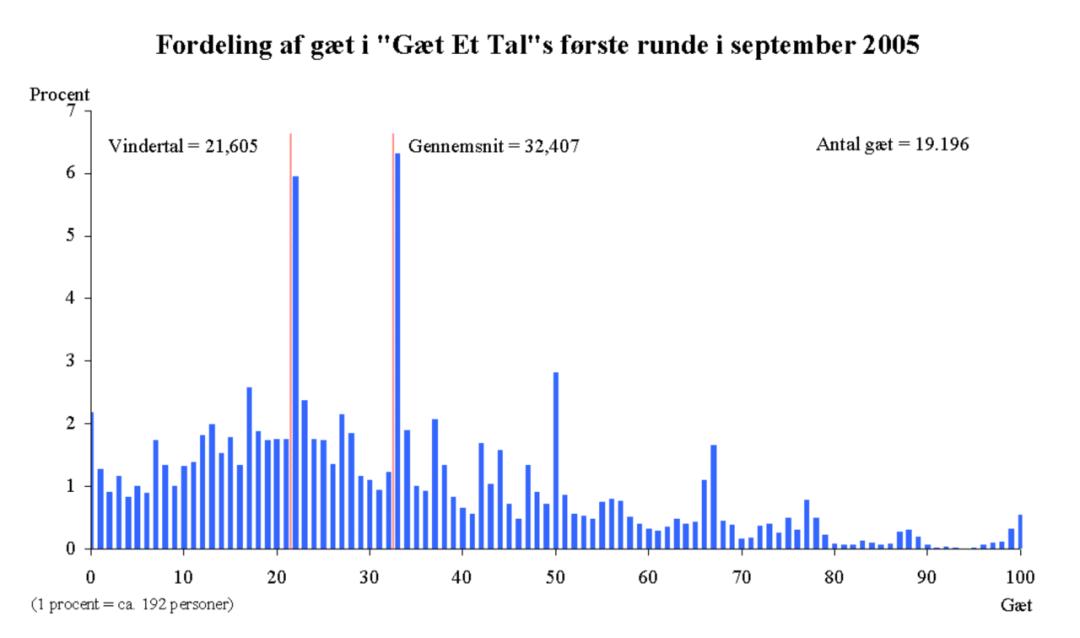

For example, in the first game, players follow the distribution shown in the above figure: more than 6% of players choose 33, and less than 6% choose 22, with the winning number being 19. Imagine if these players play the game a second time, the winning number will be closer to 0. When all participants realize that 0 is the ultimate winning answer, no player will be a loser. Ironically, the game will end simultaneously, with no winners.

Therefore, for players who want to win, there are a few points to consider:

How to assess the consensus of all players;

How to win through actions below the overall consensus;

How to interact with other players or influence the choices of the entire community.

As a classic game in the financial field, the "Guess the Average of 2/3" game paradigm is reflected in the blockchain players' cognition of project information, token price expectations, and the game of future business operations. In the subsequent chapters of this article, we will explain in detail how various players, including ordinary users, project parties, whales, and gaming guilds, play the consensus game in the DeFi and GameFi fields.

02. Consensus Game in DeFi & GameFi

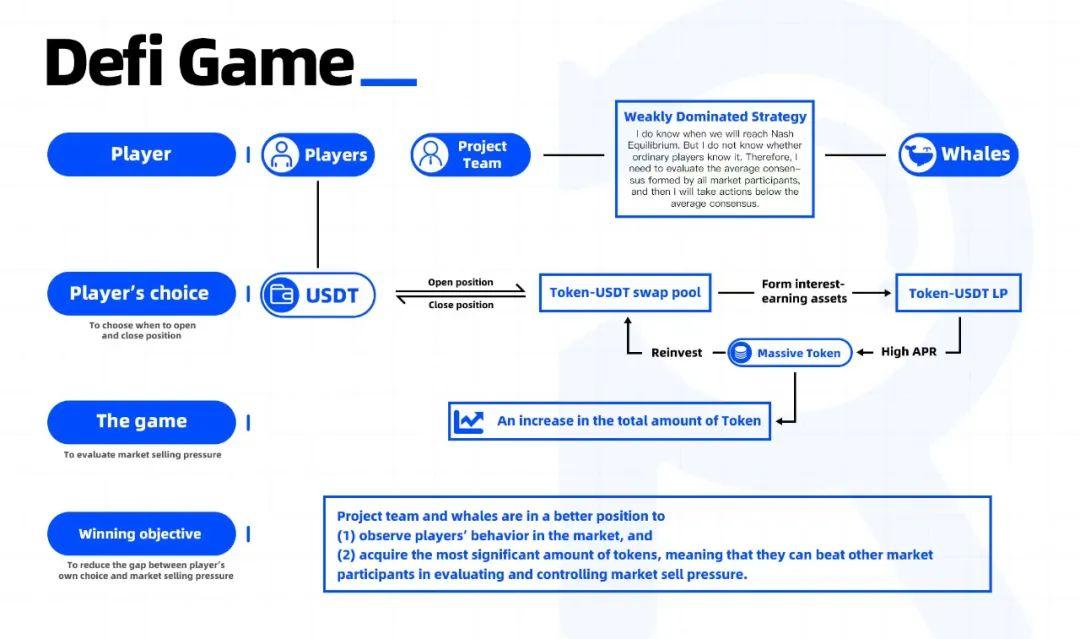

In the first part, we discussed the "strictly dominant strategy" of two players guessing 2/3 of the average. However, the actual dynamic game occurs in multiplayer games. Players need to assess the consensus of all players, which is the average number in the market, and the final winner only needs to provide a number that is 1/3 lower than everyone's consensus. The consensus game in DeFi is also of a similar form.

2.1 DeFi

DeFi participants need to evaluate the overall consensus on DeFi projects and all the information to be gathered in the market. Consensus can be reflected through many factors, including the average market behavior or the current trend of token prices.

When the DeFi swap forms that integrate DEX and AMM emerge, market liquidity is greatly improved. Therefore, market behavior can be directly reflected by users' opinions, and token prices directly reflect the quantified market consensus.

However, token prices do not fully represent the average consensus of all participants on the project. The concepts involved in DeFi are much more complex than the "Guess the Average of 2/3" game. DeFi project parties can directly participate in the design of the gaming system, continuously introducing new ideas, values, forms of cooperation, and financing during the operational cycle, including but not limited to:

Designing sustainable token economic models;

Implementing effective business operations;

Maintaining community building;

Increasing project value;

Improving the prediction of the project's future value;

Grasping macro market trends, etc.

DeFi project teams are good at leveraging unique DeFi mechanisms to enhance players' evaluations and expectations of the project, increasing the average consensus among market participants, ultimately extending the project lifecycle (i.e., delaying Nash equilibrium).

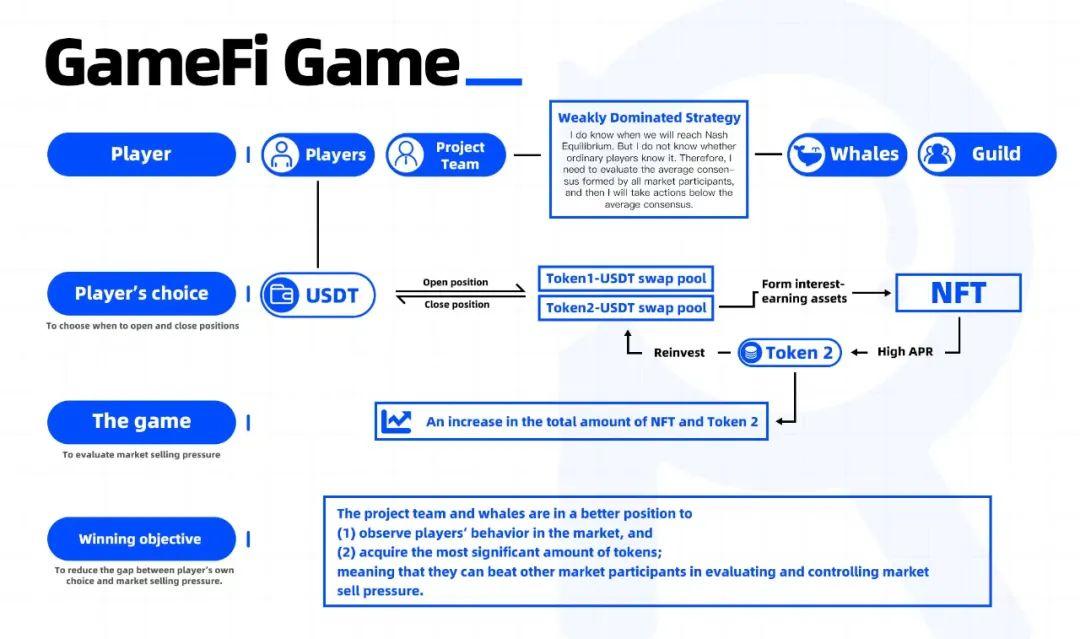

2.2 GameFi

GameFi also has similar gaming mechanisms. However, unlike DeFi's single-token system, GameFi adds the following two key features:

Introduction of multiple token systems + multiple liquidity pools + NFT markets

NFTs as a yield-generating asset also bring additional emotional value to players (i.e., non-financial products). Moreover, the rarity grading and functionality of NFTs introduce new methods for managing market consensus.

The ability to continuously inject value is the most significant advantage of GameFi: players' evaluations of GameFi projects are greatly influenced by emotional factors and inherent gaming value. Furthermore, project valuation is not necessarily directly related to its token price.

When playing DeFi and GameFi games, project parties, whales, and institutions often have clearer visions, better channels, and higher risk tolerance than ordinary players, giving them a more proactive and advantageous position in the game. With rich market information and funds that can influence market behavior, these players can quickly accumulate in-game assets, influence the average expectations and consensus of all players, and ultimately determine their winning goals.

For ordinary players, due to insufficient understanding of market information, they often cannot make optimal decisions. In terms of game outcomes, careless decisions are the norm, and most players cannot maximize their benefits. Sometimes, ordinary players are even forced to get caught up in the vicious competition between project parties and whales.

03. Axie Infinity

Taking Axie Infinity as an example. When GameFi projects assign yield-generating asset value to their NFTs, the rise of gaming guilds becomes inevitable. The tripartite consensus game among guilds, project parties, and ordinary players becomes more complex. Due to the dual-token and NFT economic model of Axie Infinity itself, the consensus goals of market participants are relatively dispersed, providing more operability for project teams and guilds, injecting project value into the community.

3.1 Axie Economic Model: Dual Tokens + NFTs

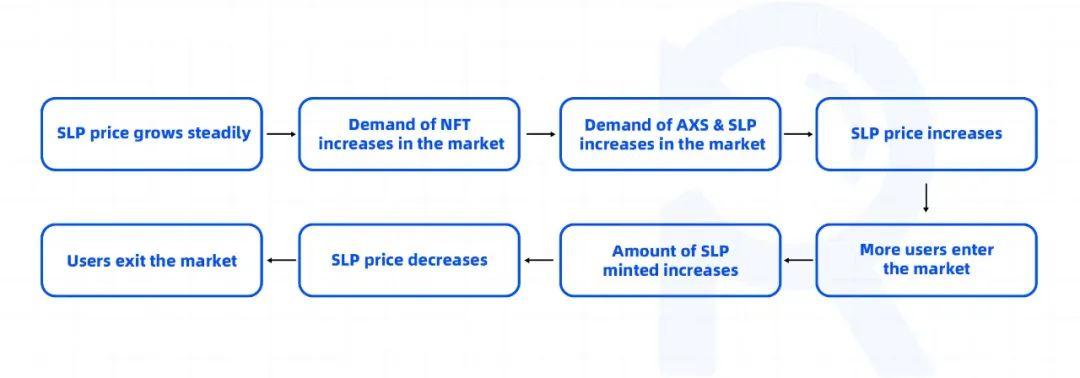

By establishing a sustainable economic model and a manageable consensus system, AXS can continuously create project value and help expand the SLP usage scenarios of Axie NFTs. Ultimately, market consensus will mainly focus on the price of SLP.

Assets in Axie Infinity are divided into three categories:

AXS: The total supply of the governance token is 270 million, with 100% circulation of AXS tokens by 2026.

SLP: The consumption token required for activities in the Axie Infinity game. It has no supply limit and is the main source of income for players. Players can earn SLP through daily tasks, battles, PVE-adventure modes, PVP-arena modes, daily rewards, etc.

Axie NFT: The primary method of game content. Within Axie Infinity, it is a yield-generating asset that can produce SLP and is also a way to burn AXS and SLP tokens.

As a card battle game, Axie Infinity requires players to form a team of three Axie NFTs through PVP/PVE battle modes to earn SLP. SLP can be used for upgrading and breeding NFTs. Excess SLP can be sold on the secondary market, which is the main source of income for most players on the secondary market.

In the economic model of Axie Infinity, AXS and Axie NFTs are more valuable than the infinitely supplied SLP (in the long run).

AXS: A large amount of AXS is controlled by the Axie team.

Axie NFT: YGG holds a large number of NFTs. NFTs are similar to means of production. YGG rents Axie NFTs to ordinary players who use NFTs to earn money. In return, YGG takes a certain percentage from the tokens earned.

As long as the output of AXS and SLP does not meet the consumption, the prices of both tokens will continue to rise. In fact, players burn AXS and SLP to generate Axie NFTs, which are then used to generate SLP. However, SLP does not have many methods to reduce inflation, leading to SLP bearing the full selling pressure of all three assets.

Given the high inflation economic model of SLP, it will inevitably continue to decline. When the number of new players starts to decrease, the demand for Axie NFTs will also decrease. If there are no more consumption methods, the price of SLP will drop, which will further reduce the productivity of NFTs. The growth rate of Axie NFTs will become 0.

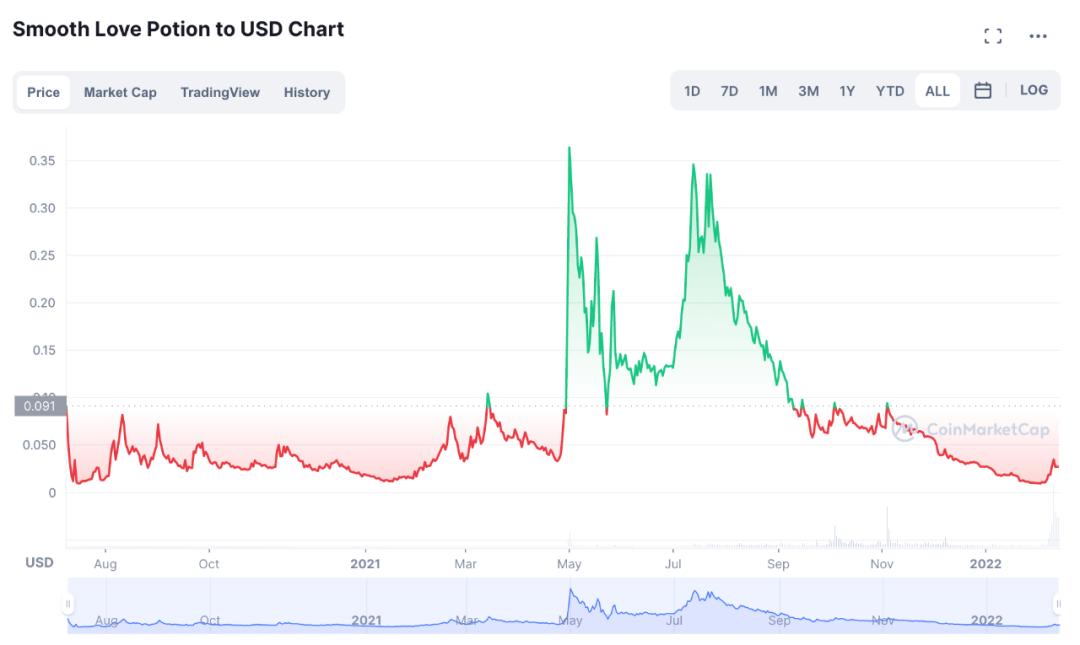

Although the price of SLP continued to rise during the summer of DeFi in 2021, it only lasted for 4 months. After peaking in July, SLP never returned to its peak.

In fact, the decline in SLP prices is an inevitable trend. But as mentioned earlier, Nash equilibrium is not the most important issue for us. As direct participants in the market, we are more concerned with the following questions:

How to assess the consensus of all players.

How to take actions below the average consensus to win;

How to influence the project consensus of other players or even the entire community.

Due to the limited length of this article, we will temporarily only discuss YGG. We will discuss other related topics in subsequent articles.

3.2 Axie Team and YGG

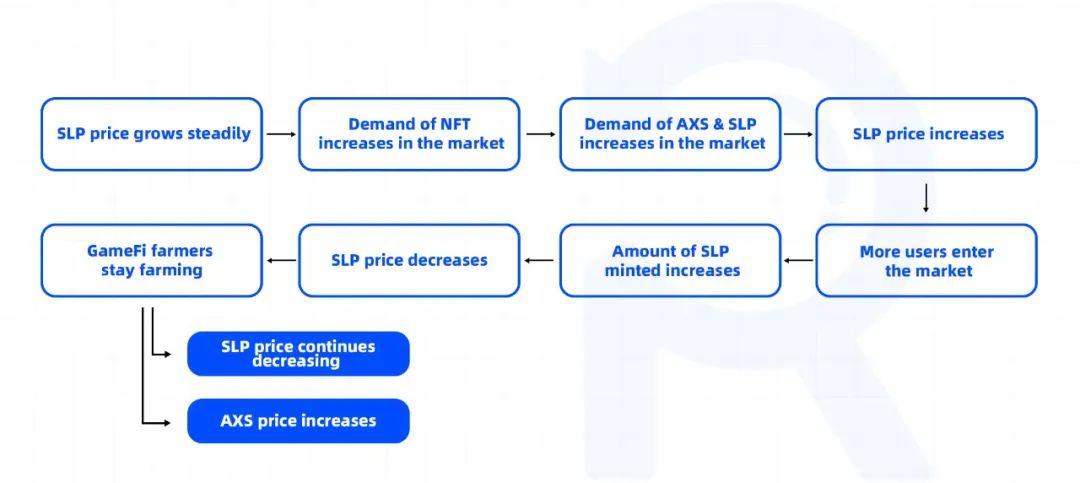

The explosive popularity of Axie Infinity cannot overlook the role of YGG. YGG is responsible for operating the community, onboarding and educating new players, cultivating player demand, and exploring the potential of NFT games. When YGG holds a massive amount of Axie NFTs and SLP, the primary responsibility for operating user consensus shifts from the Axie team to the YGG guild.

From a risk management perspective, the Axie team holds a large amount of AXS tokens. Compared to SLP tokens, the economic model and distribution of AXS make its price less likely to drop significantly. That said, to extend the project's lifecycle, the Axie team does not want SLP to decline. However, for YGG, this demand is more urgent, as it even holds more Axie NFTs and SLP tokens.

From the perspective of consensus management, maintaining the price of SLP is also one of YGG's important tasks in community governance. YGG members are primarily low- to middle-income individuals from Southeast Asian countries. The close interpersonal relationships in Asian culture make optimizing consensus management possible. Through offline development and governance of the community, the guild can effectively manage the expectations of money-making users, gradually transforming them from producers of SLP to end users and recipients of NFTs.

YGG holds high-quality NFTs in the market. Axie NFTs are not only yield-generating assets but also represent the gaming experience. YGG has, to some extent, improved the average consensus of players by controlling the NFT market and provided additional usage scenarios for Axie NFTs and SLP tokens.

However, as the project reaches a stalemate, YGG's control over SLP gradually weakens. Until recently, the Axie team announced the following adjustments to SLP:

Adjusting the breeding formula for Axie NFTs: SLP costs increase by 3 times, AXS costs decrease by 50%.

Eliminating SLP rewards for players ranked below 800 in daily tasks.

Removing SLP rewards from adventure modes; reducing SLP rewards in PvP modes; the higher the MMR, the higher the SLP rewards.

Increasing more SLP usage scenarios.

Gradually reducing or even eliminating SLP rewards in daily tasks and PvE modes.

Although the above methods increased the amount of SLP burned and reduced market circulation, leading to an increase in SLP prices.

However, reducing SLP output to increase its token price will not last long and may backfire. Ordinary players know this, the Axie team knows this, and YGG knows this. When token demand and price can only rise through production cuts, the average consensus of players on the project will decline.

We know that a decline will only lead to more declines, just as players know they are in the "Guess the Average of 2/3" game and must find a way out below the market consensus of 1/3.

04. The Consensus Game Never Stops

In Richard Thaler's words, participants provide numbers under conditions of information asymmetry and limited information dissemination speed, and the final winning conditions depend on the participants' degree of information acquisition and judgment based on the information obtained.

With each round of elimination, information will further spread within the system. Until the end, when all participants are "omniscient," and when all participants realize that the integer "0" is the final answer, the game ends. Until a new game begins, with new players coming in.

For the Axie development team and other participants with more complex identities within the community, they have a better understanding and estimation of the project's direction and final outcome when competing with ordinary participants. At the same time, they have a panoramic view of the consensus among all participants, achieving optimized consensus management. They can continue to bring in external funds, create new gaming methods, transform speculators into value investors, and find new applications for tokens and in-game assets.

Moreover, Axie Infinity is actively exploring new identities. The launch of the Ronin sidechain and its native infrastructure, along with the development of multiple new projects, has transformed Sky Mavis (the parent company of Axie Infinity) from an application developer into an infrastructure provider. That is to say, current "game" players can seamlessly participate in the next round of new consensus games.

Every consensus game will have an ending, but at the same time, new consensus games will continue to emerge.

Everything may come to an end, but the lessons learned along the way are valuable. Whether in DeFi or GameFi, it is inevitable that there will be short-lived projects during the development process.

But the consensus game always exists. As game participants, we will persist, hoping that the next round of Dapps can break through.

Please stay tuned for our follow-up reports. GameFi projects will become increasingly complex and diverse, but we are committed to describing gaming behavior in a simple and quantifiable manner.

Translator's Note:

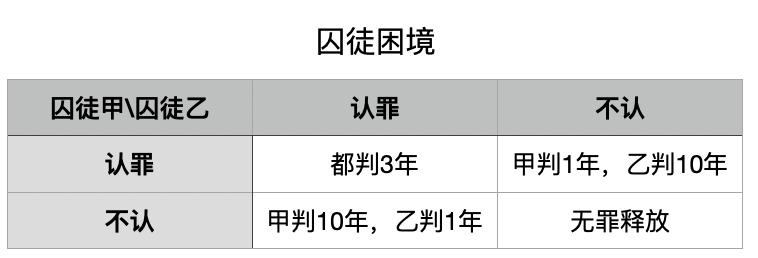

In game theory, there is a classic case known as the "Prisoner's Dilemma," which is also the origin of the DeFi 2.0 concept Olympus (3,3) theory. The Prisoner's Dilemma describes a scenario where A and B commit a crime together and are separately taken to an interrogation room for questioning. A and B are told: ① If both confess, both will be sentenced to 3 years; ② If one confesses and the other does not, the confessor will be sentenced to 1 year, while the non-confessor will be sentenced to 10 years; ③ If both do not confess, they will be released without charges.

At this point, A will analyze: If I confess, my outcome is either 1 year or 3 years. If I do not confess, the outcome is either released without charges or 10 years. From the results, A is likely to choose to confess. Similarly, B will analyze this way, so the result is likely that both A and B choose to confess. Although the outcome of both not confessing is the best for their community, in order to protect their own interests, confessing is the best choice for themselves.

Therefore, in this market, the interest game between individuals means that the best outcome for individuals does not represent the best outcome for the overall community, and sometimes even conflicts. We can use this thinking to view the actions of others and choose our own course of action.