Valuation for OP: See how much your OP airdrop is worth

Author: olimpio.eth

Compilation: Rhythm BlockBeats

This article summarizes the views of crypto KOL olimpio.eth from his personal social media platform, organized as follows:

On April 27, Optimism announced the launch of its ecosystem token OP, along with the token economics and airdrop plan. This article will attempt to value OP.

To estimate the price and airdrop value of OP, we need to:

Analyze the token economics of OP;

Compare it with other protocols and related metrics;

Analyze based on three valuation expectations: optimistic, moderate, and pessimistic.

Token Economics

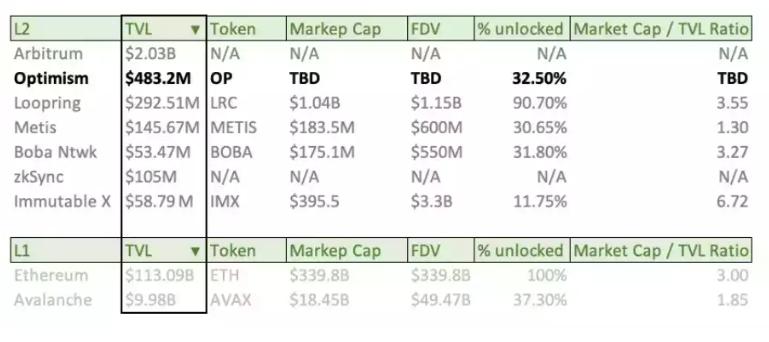

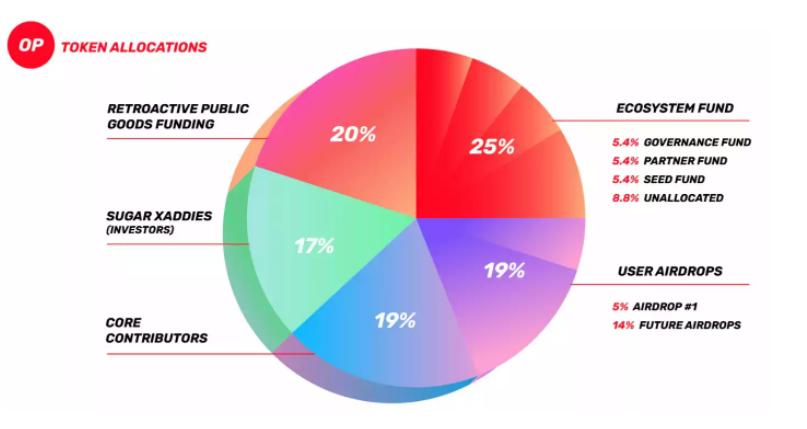

Airdrop accounts for 19% of the total supply: In the first phase of the airdrop plan, 5% is directly unlocked, while the remaining 14% will be allocated at the discretion of the DAO.

Check the quantity of the first phase airdrop

Core contributors (project team) account for 19% of the total supply.

Seed investors account for 17% of the total supply.

Ecosystem fund accounts for 25% of the total supply: The goal is to develop the Optimism ecosystem through grants, partnerships, and incubating new protocols. Essentially, it is a guarantee for the future development of its ecosystem.

Retroactive public goods funding accounts for 20% of the total supply:

V God once said: "The core principle is simple: things that have been useful in the past are easier to agree on than things that will be useful in the future."

So basically, retroactive rewards are for projects that have already contributed to the ecosystem. For example, SNX?

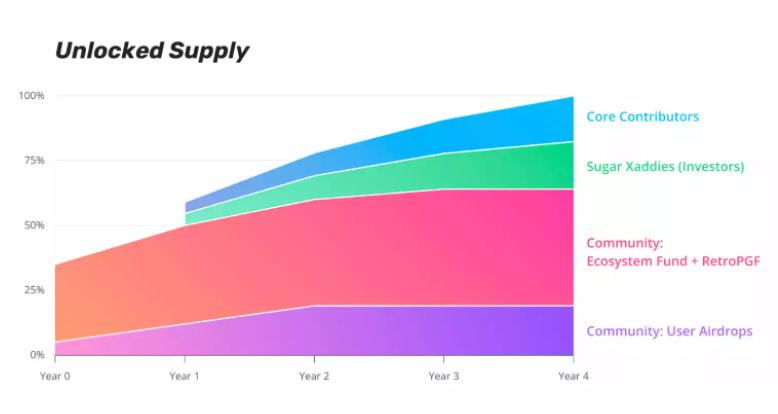

Circulating Supply

Total OP supply: 4.29 billion

Initial circulating supply: approximately 32.5% (highlighted)

Token contract address: https://optimistic.etherscan.io/token/0x4200000000000000000000000000000000000042

OP Valuation

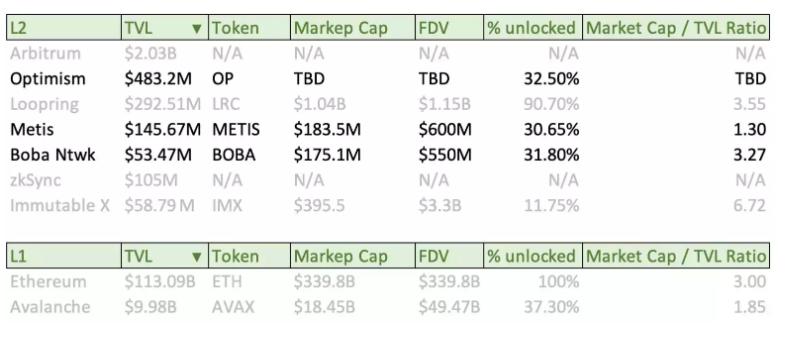

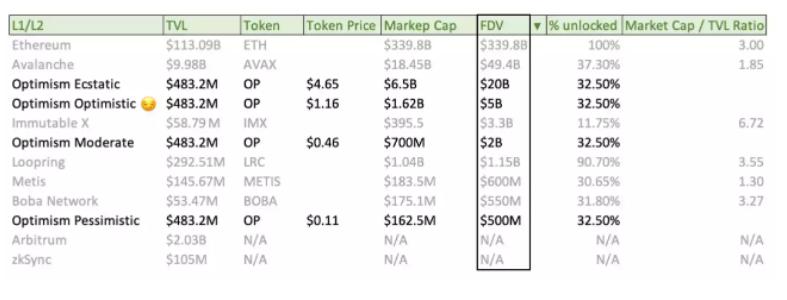

Currently, Optimism's TVL is $483 million. After the token launch, yield mining activities may emerge, so it is expected that TVL will significantly increase by then. We should look forward to this.

Metis and Boba networks have strong similarities with Optimism; both have released tokens, with circulating supply accounting for about 30% of the total.

Metis has a market cap to TVL ratio of 1.3, while Boba's is 3.27.

This means that relative to their symbolic valuations, Metis has significantly more "managed assets" than Boba.

If we value Optimism based on Metis's market cap to TVL ratio of 1.3, the market cap of Optimism would be $628 million, which implies a fully diluted valuation (FDV) of $1.93 billion. At the same time, the price of OP would be $0.45.

If we calculate based on Boba's market cap to TVL ratio of 3.27, the market cap of Optimism would be $1.58 billion, which implies an FDV of $4.86 billion. At the same time, the price of OP would be $1.13.

Immutable X has a market cap to TVL ratio of 6.72. By this calculation, the market cap of Optimism would be $3.25 billion, which implies an FDV of $10 billion. At the same time, the price of OP would be $2.32.

When comparing with Avalanche's AVAX, we need to use FDV/TVL instead of market cap/TVL due to the significant difference in their circulating supply ratios. AVAX's FDV/TVL ratio is 4.94, so by this estimate: the market cap of Optimism would be $780 million, which implies an FDV of $2.4 billion. At the same time, the price of OP would be $0.55.

Valuation Under Different Expectations

Pessimistic Expectation:

FDV = $500 million, OP price $0.11.

Neutral Expectation:

FDV = $2 billion, OP price $0.46.

Optimistic Expectation:

FDV = $5 billion, OP price $1.16.

Super Expectation:

FDV = $20 billion, OP price $4.65.

Note: The current FDV of AVAX is $40 billion; even under super expectation estimates, OP is only half of AVAX's valuation.

Additionally, after the token circulates, if yield mining leads to a rapid increase in TVL, OP will also be influenced by market speculation. This article does not discuss that, but it will certainly happen. This article primarily values OP based on the FDV to TVL ratio; different valuation methods will yield different results. This is just one perspective and is for reference only.