NFTs on ETH or NFTs on Solana: The Chicken or the Egg Problem

Original Title: "Meets Okay Bears"

Original Author: Mr.Fox

Compiled by: 0x21, Rhythm BlockBeats

After a period of continuous fluctuations in the NFT market over the past two weeks, it has returned to calm. NFT projects on the ETH chain have entered a winter throughout the week, while Opensea, as the largest NFT trading platform, has supported the trading of NFTs on the Solana chain, bringing more unique projects into the spotlight. The long-standing leader YugaLabs has also seen a decline in trading volume over the past week, with SolanaNFTs led by Okay Bears beginning to rise. Even the clones of Okay Bears have started to frequently top the charts, and major social media platforms have shown mixed reactions to this phenomenon. Mr.Fox, an NFT columnist for Real Vision, summarized the dynamics of the NFT market over the past week and conducted an in-depth analysis and reflection on the "new trend" brought by Okay Bears. Rhythm BlockBeats translates the original text as follows:

Review

In simple terms, over the past 7 days, the NFT market has begun to gradually rebuild from the chaos experienced last week. It seems that although progress is slow, this does not mean that everything has come to a standstill. Looking back at the various signs from the past week, we can break down this information for analysis.

In the past week, we have seen the overall NFT market in a sideways trend, but there are still some NFTs whose floor prices have risen. Let's take a look at the screenshots below.

However, some NFTs this week have fared worse, particularly with notable declines in the floor prices of projects like Fidenzas, Ringers, and Azukis.

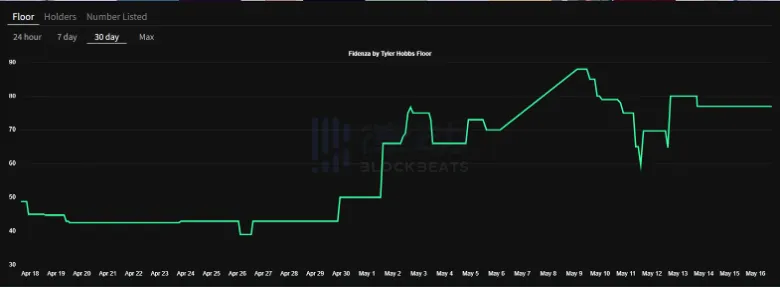

For Fidenzas and Ringers, these losses are a correction following the large-scale increases these two projects experienced last week, as well as due to the declines in other NFTs. Many believe that as concerns about the NFT market bear market intensify, investors are shifting their ETH from speculative avatar NFTs to more long-term NFTs like digital art; thus, the upward trends of Fidenzas and Ringers are shown in the following charts:

(30-day floor price chart for Fidenza, chart sourced from flips.finance)

(30-day floor price chart for Ringers, chart sourced from flips.finance)

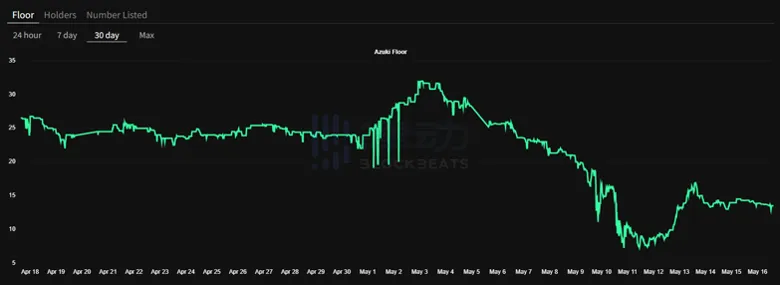

As for Azuki, despite their floor price rising nearly to 8 ETH, they are still experiencing the aftershocks of the "Rug Pull" incident involving one of the project's founders, Zagabond. Here is their floor price over the past 30 days:

(30-day floor price chart for Azuki, sourced from flips.finance)

After the negative news, there are still many positive signals. Additionally, Bored Ape Yacht Club, PROOF Collective, Moonbirds, Mutant Apes, CloneX, World of Women, and Meebits have all shown upward trends, while Doodles, VeeFriends, and Gutter Cats have seen relatively small declines. Many of these projects have also received positive news. For example, Yuga finally provided a clearer understanding of their metaverse, The Otherside, by releasing a short clip of the gameplay. Some details about the next steps for The Otherside have been announced, although this information is already well-known. The key point is that Kodas will be able to separate from the land in the future, and the land resources will be dynamically changeable, to be used for building, trading, and development over time.

Moonbirds tweeted a very mysterious GIF. Many believe this is a reward for their first nesting about a week later. In terms of project actions, these are the main developments in the ETH chain NFT market last week.

Okay Bears

Okay Bears is an avatar NFT project on Solana and one of the most eye-catching projects recently.

When we think of NFTs, we rarely consider which chain the NFT was issued on, for several reasons:

It has little to do with the NFT itself unless it is a utility that requires extensive transactions across many applications or games. However, the vast majority of NFTs that the market is accustomed to are avatar types, which do not require frequent transfers after purchase.

However, the main reason we rarely consider which chain our NFTs are on is that almost all NFTs we know today exist on ETH, leading most people to subconsciously feel that NFTs should be issued on ETH.

If the above explains why we only consider NFTs on Ethereum, the next question we must think about is why NFTs on Ethereum can remain the most popular, while projects built on public chains like Solana and Immutable X (Ethereum's Layer 2 network) without gas consumption struggle to gain the same level of attraction?

One thing is certain: this is not a decision based on utility, as Solana and Immutable X provide the same experience as Ethereum but at a much lower cost. Similarly, this is not entirely price-driven, as although the price of SOL is much more volatile than ETH, the savings in fees from the former would certainly reduce the impact of this volatility. On Immutable X, if users prefer to use ETH, they don’t even have to use the L2 token IMX for transactions.

Interestingly, we see very similar dynamics in other areas of NFTs, such as the disputes over secondary market platforms. Although LooksRare offers users a more cost-effective trading environment, the users it has accumulated still only account for a small portion of OpenSea's daily active users.

So why is this the case? When cheaper alternatives are readily available, why do NFT market participants consistently choose the more expensive method?

I believe there are mainly two reasons:

The Chicken and Egg Problem

Yes, Solana, Immutable X, and LooksRare save users more money than their competitors, but these platforms still lack products. For Solana and Immutable X, most new NFT projects are still based on ETH, making it difficult for these alternative chains to establish a first-mover advantage. Because people only buy NFTs on the ETH chain, it leads to no one issuing NFTs on other chains, and because no one is issuing on other chains, people can only buy NFTs on the ETH chain, and so on.

While this is somewhat beyond the scope of today's discussion, it is also true for LooksRare. In theory, if the same transaction is executed, it is more cost-effective for both buyers and sellers on LooksRare than on OpenSea, but many do not do so because OpenSea's competitors lack real and effective listings. If you want to sell an NFT, your top priority is liquidity (the ability to actually sell the NFT), so you will always choose OpenSea over LooksRare. Due to the lack of real and effective listings, buyers find it difficult to find more suitable trades. Because no one is listing, no one is buying, and because no one is buying, no one is listing, and so on.

Users' Subjective Experience

Even though many news articles have introduced that using other chains can be much cheaper than using the ETH chain, people still prefer the ETH chain, known for its high gas fees.

Another theory is that, ultimately, we are human, and at our core, we crave and enjoy rich experiences. It all goes back to the origin. Clearly, choosing ETH is the more expensive route to invest in NFTs, but it remains the top public chain. It seems that many would rather pay the extra gas to have their assets on the world’s largest public chain. This is why Rolex watches sell for much more than other watches. Yes, they all serve the same function of telling time, but when you check the time with a Rolex, there is a unique experience. ETH, like other brands, is currently the largest NFT brand in the world. This largely aligns with the examples outlined above.

We love to use the term "ETH network effect" in Real Vision's reporting because everyone is already on the chain, and everyone continues to build on it, which is why so many want their NFTs to exist on ETH. Gas fees are merely the cost many are willing to pay to join this network for a richer experience.

This does not mean that NFTs will not explode on other chains or Ethereum's Layer 2 networks in the future. Everything just needs a special project or product to bring enough traffic to solve the chicken and egg problem. And this network effect's flywheel has begun to appear on other platforms.

Is this why we are seeing the hottest NFT project now, Okay Bears?

In the past 7 days, Okay Bears has become incredibly popular. It has become the most successful avatar NFT project on Solana to date. Although other Solana avatar NFT projects have also achieved some success, such as DeGods and SMB, so far, whether in terms of trading volume success or in comparison to previous Solana projects, Okay Bears is the leader, attracting the attention of the entire NFT community.

What makes Okay Bears stand out? Why are they doing so well?

Sadly, the answer is nothing. Okay Bears is just another avatar NFT project. Their roadmap or what they describe as a "blueprint" is not even as detailed as most projects today. The IRL events, collaborations, future minting they promise—are all the same as other projects. Okay Bears has nothing particularly special.

I do not intend to criticize this project. Sometimes, not committing to anything and letting the art and atmosphere of the NFT guide the project's direction might be a better choice. To some extent, this seems to be what is happening with Okay Bears. Some projects are very lucky to find a magical way and eventually become popular.

Many critics of Okay Bears have noticed that holders on Twitter are working together to promote the project and claim that its growth is more or less inorganic. Now, I cannot comment on the authenticity of this project on Twitter, but what I can say is that Okay Bears seems to be the biggest winner in public opinion.

While ETH NFTs have suffered a huge blow, the entire crypto market is also showing a downward trend. Market participants are actively seeking other avenues for profit. Therefore, funds will only flow to projects with a stronger "narrative." In this context, Okay Bears will be the first top Solana avatar NFT project, so everyone should explore NFTs on different chains, and everyone needs to grab a bear before the price rises.

Of course, none of the 12-person team listed on their official website is verified. This is not a good sign for the future of a project.

In the past 24 hours, Okay Bears has achieved astonishing trading volume (more than any other NFT), but fundamentally, there are no signs that this project will succeed. It is worth noting that the rise of NFTs is often not very rational, so even though Okay Bears has not created stunning image quality, it does not mean it will not continue to rise. I am not saying Okay Bears is just a short-term growth, as they have now become a leading project, but it is undeniable that no one wants to miss any opportunity to make money during the ongoing sideways movement in the crypto market.