A Comprehensive Interpretation of the Current NFT Market: Who Will Be the Next OpenSea?

Original author: selinnawang, OKLink

Original editor: Xiao Ou

In recent years, NFTs, as a unique, scarce, and interesting asset class, have rapidly swept through various circles. No one expected that this initial technical trial in the art world would lead to the current phenomenon of "NFTs for everything."

As of June 1, according to the "On-chain Master NFT Special List Data" from OKLink, the total market value of the NFT market is $16.972 billion, an increase of 533 times compared to $31.7781 million on the same day two years ago.

The explosive popularity of NFTs has directly led to the emergence of numerous NFT trading platforms, whether in comprehensive markets or focused on niche segments such as art, music, photography, sports, and gaming, new competitors are entering the arena.

Due to the significant aggregation effect of top projects on Ethereum, its total NFT trading volume remains the highest. However, due to issues such as transaction fees, efficiency, and environmental concerns, public chains like Solana, Flow, and Tezos have entered a period of development, leading to a flourishing on-chain NFT market.

By 2022, with the increasing maturity of multi-chain ecosystems, supporting multiple mainstream public chains has become a development goal for many NFT platforms, such as OpenSea starting to introduce projects on the Solana chain.

Based on this, this article investigates, summarizes, and organizes six major blockchains—Ethereum, Solana, Flow, Tezos, Ronin, and Polygon—and 30 trading platforms, during which several noteworthy points were discovered:

What are the top 15 NFT platforms? What are their characteristics?

Changes in mainstream public chains and the degree of skew in NFT market trading volume.

Who will be the next OpenSea? (Reviewing the top NFT projects on various public chains)

Current Status of the NFT Market: One Dominant, Many Strong

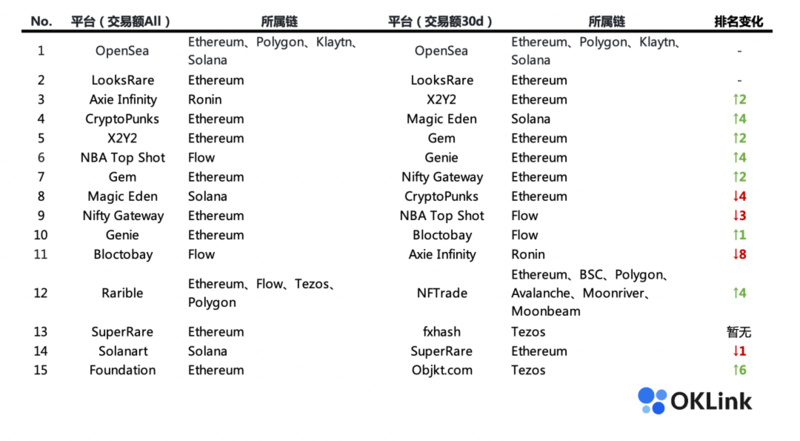

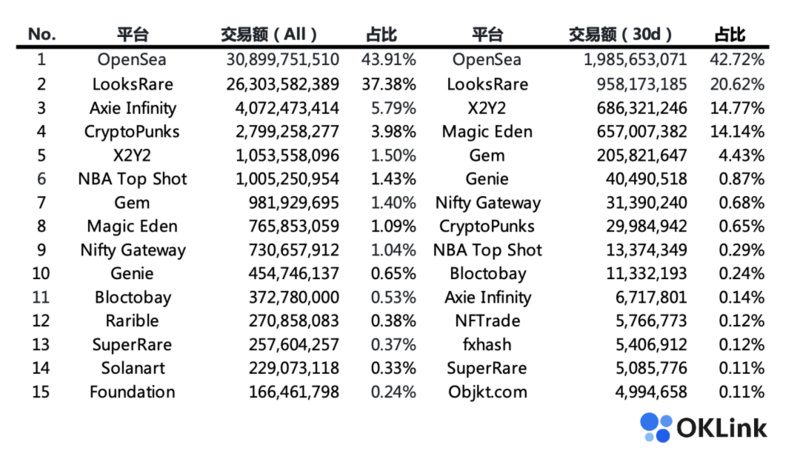

Considering the different launch times of various NFT platforms and to better reflect current trends, we ranked the major NFT trading platforms based on two data dimensions—total trading volume and trading volume over the past 30 days, resulting in the following two tables:

Ranking changes of Top 15 NFT platforms (trading volume, All, 30d), source: OKLink data

Ranking changes of Top 15 NFT platforms (trading volume, All, 30d), source: OKLink data

Proportion of Top 15 NFT trading platforms (trading volume, All, 30d), source: OKLink data

Proportion of Top 15 NFT trading platforms (trading volume, All, 30d), source: OKLink data

1. Among the Top 15 platforms, OpenSea still holds over 40% market share

When it comes to NFT trading platforms, OpenSea is undoubtedly the first name that comes to mind for most people. As a comprehensive NFT trading platform launched at the end of 2017, it had several contemporaries (within a year) such as MakersPlace, SuperRare, CryptoPunks, KnownOrigin, Axie Infinity, and Nifty Gateway, of which two are single NFT trading platforms and four are art and limited edition trading platforms, indicating that OpenSea has certain advantages in positioning and creation time.

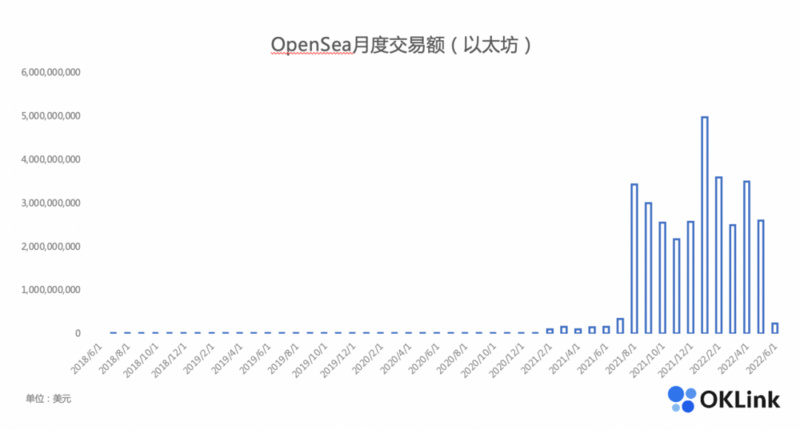

According to Dune Analytics, OpenSea's total trading volume exceeded $10 billion in November 2021 and surpassed $15 billion in January 2022, reaching $30 billion by mid to late May. As of now, OpenSea's total trading volume is $30.9 billion, meaning it has doubled its total trading volume in just six months.

OpenSea monthly trading volume, source: Dune data, chart by OKLink

In the past 30 days, OpenSea's trading volume reached $1.986 billion, accounting for 42.72% of the share among the top 15 platforms. The trading volume's share among the Top 15 is 43.91%.

It can be seen that for a long time, OpenSea has dominated the market. Although it has faced criticisms such as being overly centralized and operating Web3 with a Web2 mindset, and several platforms have challenged it through tactics like vampire attacks, OpenSea remains the undisputed leader, especially after it recently added support for Solana NFT projects, increasing the number of supported public chains to four, making another step forward in the multi-chain domain, along with another significant move—launching the Seaport protocol.

Let’s briefly explain the Seaport protocol.

Seaport is a new Web3 market protocol designed for the secure and efficient buying and selling of NFTs.

Users who have browsed the OKLink Hot Contract interface should have noticed that the "OpenSea Wyvern Exchange v2" tops the list of destroyed volume rankings. This Wyvern is the protocol currently used by OpenSea, primarily facilitating the trading of any crypto assets and NFTs, including ENS domain names, virtual land, and smart contracts themselves.

Source: OKLink Hot Contract interface

Since Wyvern can support such a large volume of operations for OpenSea, why launch Seaport? There are two reasons:

First, Seaport emphasizes efficiency and contains a large amount of low-level assembly code, which can significantly reduce users' gas fees. As mentioned in the article “Ethereum's 'Heart Surgery': Understanding the EVM Successor”, "Computer languages are divided into low-level and high-level languages. The programming we usually refer to is generally high-level language programming that is human-readable, while the low-level language, which is what computers can truly understand, is represented in binary numbers and is specifically used to control hardware."

This means that the closer a programming language is to 0 and 1, the faster the program runs and the less memory it consumes.

Second, Seaport provides more options for OpenSea's trading forms, such as bartering and combination trading, allowing users to make offers that include ERC 20, ERC 721, and ETH, rather than just ETH transactions. >

For example, if a BAYC is valued at 100 ETH, a user can use Seaport to create an offer that exchanges BAYC for a combination of CryptoPunks, Azuki, and UNI among other ERC20 assets.

Additionally, Seaport is an open-source protocol, meaning it is not only applicable to OpenSea but also to all NFT builders, creators, and collectors, aligning with the core spirit of Web3, marking a step towards decentralization for OpenSea.

2. Token Incentive-Driven Market: Decentralization is Not a Universal Key, Product is King

LooksRare and X2Y2 are comprehensive NFT trading platforms launched in January and February 2022, respectively. To capture the users accumulated by OpenSea, both platforms launched vampire attacks, airdropping assets to OpenSea users.

In the short term, both platforms have significantly impacted OpenSea by offering asset incentives (listing rewards, mining rewards) and lower transaction fees (OpenSea 2.5%, LooksRare 2%, X2Y2 official version 2%, adjusted to 0.5% in May), capturing a portion of OpenSea's market share since their launch.

However, starting in February, LooksRare fell into a series of controversies, mainly due to team cash-outs, halving of staking rewards, and a large number of wash trades resulting from its trading mining model.

X2Y2, which launched later, proposed staking NFT listing mining, which increased the listing volume but also attracted many opportunistic users making ineffective listings, forcing the project team to adjust the listing reward calculation. Additionally, prior to this, X2Y2 faced issues with airdrop claims and was questioned about contract security, leaving users with an impression of being "not reliable."

However, LooksRare has made product optimizations compared to OpenSea, such as one-click offers, NFT rarity ranking, integration with Gem, Ethereum chat rooms, providing a day mode, and displaying mobile browsing in a dual-column format. X2Y2 has also optimized its product, allowing users to add NFTs from different collections to a shopping cart for one-click purchases, and has engaged in a price war, with transaction fees as low as 0.5%, and offering permanent fee and royalty waivers for specified users at specified prices (similar to OTC, Private Sale).

In the past 30 days, LooksRare and X2Y2 ranked second and third among the Top 15 NFT platforms with total trading volumes of $958 million and $686 million, respectively.

Currently, OpenSea remains the first choice for most users. The initial user stickiness it has established is still hard to shake in the short term, but it faces regulatory issues, a lack of Web3 features, and the absence of a token, which have become shortcuts for challengers to OpenSea.

The core of Web3 is the shift from traffic thinking to community thinking. From LooksRare and X2Y2, it is clear that the community is an excellent entry point. Additionally, while token incentives can generate significant attention and hype in the short term, it is essential to clarify that decentralization is not a universal key; an excellent product experience is a necessary condition for enhancing user stickiness and project outcomes.

3. NFT Aggregation Platforms Attract Attention, OpenSea Acquires Gem

On April 25, 2022, OpenSea announced its acquisition of Gem, which many users viewed as a move by the NFT giant to consolidate and strengthen its position and power amid the emergence of new forces that have not yet posed a threat.

In traditional NFT trading platforms, users cannot purchase NFTs in bulk, and liquidity between different platforms is isolated. Based on this, the importance of NFT market aggregation platforms has become increasingly prominent.

Gem and Genie are regarded as pioneers of NFT aggregation platforms, having launched around the same time, in late December 2021 and mid to late November 2021, respectively. In the nearly six months of development, Gem and Genie achieved total trading volumes of $982 million and $455 million, respectively. According to the trading volume rankings over the past 30 days, they occupy the 5th and 6th positions among the Top 15 NFT trading platforms with $206 million and $40.49 million, respectively, indicating their rapid growth in just half a year.

In terms of transaction numbers and NFT sales volume, Gem has 318,200 transactions and 1,191,300 NFTs sold, while Genie has 113,000 transactions and 596,600 NFTs sold. In terms of new address counts, Gem and Genie have 75,200 and 40,800 new addresses, respectively.

It can be seen that although Gem launched slightly later than Genie, its product optimizations, such as supporting users to pay with various ERC20 assets they hold, adding a Web3 shopping cart feature, rarity ranking functionality, and creating a dedicated section for users to propose feature requests and suggestions, allowed Gem to overtake Genie in the early competition among NFT aggregation platforms. However, Genie quickly followed up with multiple feature releases, and its interface style has begun to align more closely with Gem, indicating that the competition between the two continues.

4. Single NFT Trading Platforms: Axie Infinity, CryptoPunks, NBA Top Shot…

Among the Top 15 NFT trading platforms, three are single NFT trading platforms in the past 30 days—CryptoPunks, NBA Top Shot, and Axie Infinity, which belong to the PFP, sports, and gaming sectors, respectively.

After being acquired by Yuga Labs, CryptoPunks is now part of Yuga Labs' portfolio, which includes BAYC, MAYC, BAKC, Otherdeed, CryptoPunks, and Meebits, making it a powerhouse with four of the top five projects on OpenSea's all-time leaderboard, highlighting its influence.

For Yuga Labs, from catching up and surpassing CryptoPunks with BAYC, to acquiring CryptoPunks, and then issuing land and games, as Web3 becomes more widespread and evolves, Yuga Labs' future moves are worth imagining.

NBA Top Shot is an officially licensed card collection application built on Flow, developed by Dapper Labs, the team behind CryptoKitties, which once congested Ethereum. Dapper Labs successfully transformed basketball star cards into a massive on-chain business, changing the previously fragmented and hard-to-verify basketball card market.

NBA Top Shot's historical total trading volume is $1.005 billion, with a trading volume of $13.3743 million in the past 30 days. Although its current trading volume is far less than when it was first launched, NBA Top Shot can still stand out among NFT trading platforms due to the sustained interest generated each year when the basketball season starts.

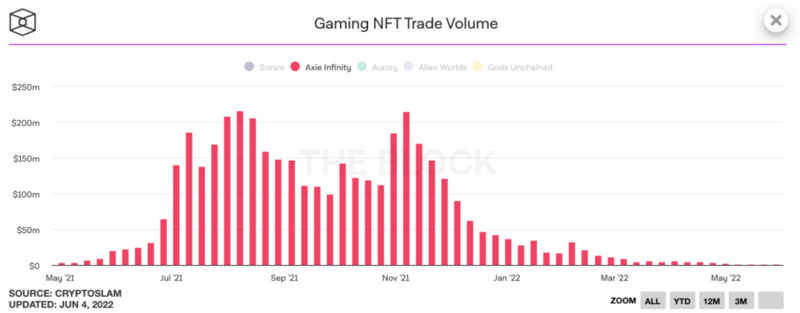

Axie Infinity previously sparked the GameFi craze, with its massive wealth creation effect causing its total trading volume to soar in a short time, dominating the NFT project rankings for months. As the pioneer of "X to Earn," Axie Infinity relies on continuous growth to sustain its operations, which means it faces long-term sustainability challenges.

Earlier this year, Axie Infinity showed signs of decline, compounded by the $625 million hack of Ronin. We can see that although Axie Infinity ranks third on the all-time leaderboard with $4.072 billion, it has dropped to 11th place in the past 30 days, with a trading volume of only $6.7178 million. This indicates that Axie Infinity will not see significant improvement until it resolves its economic model, playability, and sustainability issues.

Image: Axie Infinity

5. Prosperity of Multi-Chain Ecosystem: Emergence of New NFT Trading Platforms

The head effect of Ethereum remains evident, but the NFT boom has also brought opportunities for competing chains. For example, Solana has formed a market dominated by GameFi and PFP, Tezos focuses on the art sector, and Flow has excelled in collaborations with sports IP.

Previously, it was reported that Magic Eden's trading volume reached $45.71 million on May 25, surpassing OpenSea's $28.6 million in real-time trading volume. Along with the trading volume, user numbers also surpassed OpenSea, with approximately 50,600 users on Magic Eden in 24 hours compared to OpenSea's 36,900. This is not the first time Magic Eden has managed to outpace OpenSea.

Although Magic Eden still has a considerable gap from OpenSea in terms of total trading volume, transaction numbers, and user count, it is clear that it is on the rise, as evidenced by OpenSea's integration of the Solana chain.

Who will be the next OpenSea?

Whether from historical or recent data, the head effect of Ethereum remains evident in on-chain trading volume, but mainstream public chains like Solana, Flow, and Tezos have also found opportunities during the prolonged NFT boom.

OpenSea remains the leader in the NFT sector, holding over 40% of the share among the Top 15 NFT trading platforms. However, some new platforms, such as Magic Eden, are not choosing to compete directly with OpenSea on Ethereum but are leveraging the development opportunities of the competing Solana chain to surpass OpenSea in real-time trading volume, putting some pressure on OpenSea.

With the popularization and evolution of the Web3 concept, emerging players claiming to be the next-generation NFT trading platforms are also striving to catch up, and under the multi-chain backdrop, OpenSea and its competitors will also aim to integrate new chains. The market is ever-changing, and whether OpenSea can maintain its lead remains uncertain.