Dollarization of the crypto market

Written by: Solv Research Group, Meng Yan's Thoughts on Blockchain

This article is the second in-depth analysis by the Solv Research Group regarding the recent crash in the Crypto market, primarily discussing the basic facts of the dollarization of the Crypto market since 2018 and introducing the external impacts of this change on the Crypto market.

TL;DR

The crash of the Crypto market in 2022 has two significant differences from that of 2018:

First, due to the widespread financing of crypto projects through stablecoins, the impact on the entire industry's "production sector" is smaller than in 2018;

Second, this crisis mainly impacts centralized capital institutions involved in large-scale collateralized lending and credit lending, which are often supporters of the long-term value of digital assets like BTC/ETH, but are forced to liquidate collateral assets under short-term debt pressure, exacerbating the chain reaction of liquidity collapse.

The background of this situation is the dollarization and secularization of the Crypto industry. Since 2018, the Crypto industry has gradually accepted dollar stablecoins as its base currency, thus achieving basic dollarization. Due to the need for external input of dollar liquidity, the Crypto industry has regressed from a self-proclaimed "sovereign currency issuer" in a digital space to a "secular" industry within the dollar economy. This has profound and complex implications not only for the Crypto industry but may also have significant effects on the dollar in the near future.

Main Text

Those who have experienced the bear market from 2018 to 2020 will naturally compare the current market crash with the plunge from August to December 2018, but in reality, the Crypto market in 2022 is significantly different from that in 2018.

The biggest difference is the narrative. In 2018, the entire Crypto industry was focused on three narratives: public chains, exchanges, and industry blockchain applications, most of which were ultimately debunked. However, over the past two years, several new directions have rapidly emerged in the Crypto market, such as DeFi, NFT, GameFi, and Web3, which have clear, secular value creation logic and distinct competitive advantages, thus becoming popular topics in mainstream media. Even with the arrival of a bear market, people generally believe that the success of these fields is only a matter of time.

For an emerging industry, a novel and more persuasive narrative is undoubtedly the most important. However, at the same time, another less-known but potentially more profound change is occurring beneath the surface: the dollarization of the Crypto industry.

Dollar Stablecoins as the Base Currency of Crypto

In 2018, the Crypto industry was essentially "coin-based," with all financing conducted in BTC or ETH, and there were even instances of institutions settling trade in goods and services using BTC/ETH. After 2018, dollar stablecoins represented by USDT and USDC gradually took root and experienced rapid growth after 2020, with the entire Crypto financing and pricing switching to dollar stablecoins. The dollar has effectively become the trading intermediary, pricing unit, and value storage in the Crypto market, meaning that the Crypto industry has dollarized.

The direct evidence of Crypto dollarization is the explosive growth in the issuance of so-called "dollar stablecoins."

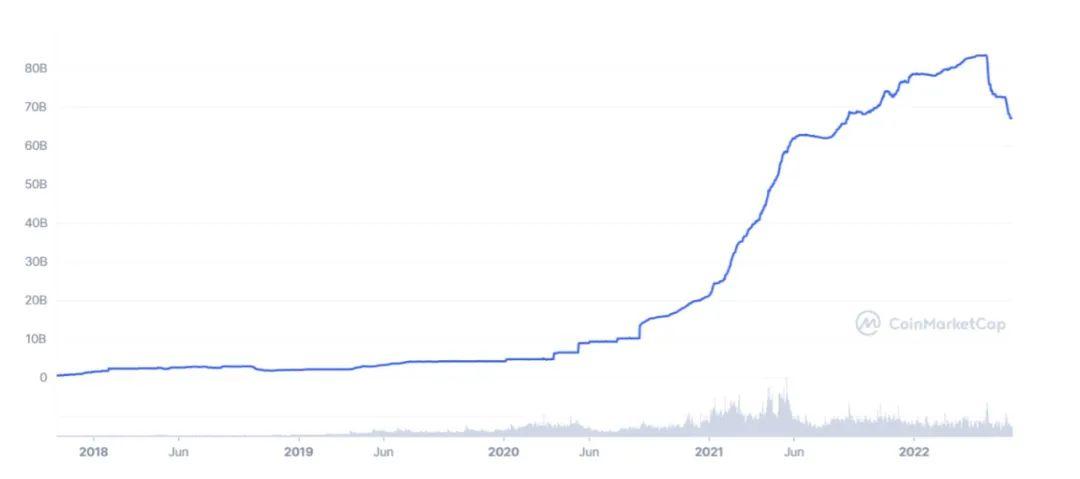

Figure 1. Growth of Tether (USDT) Issuance Since 2018

The issuance of Tether (USDT) has increased from $1.3 billion at the beginning of 2018 to $66.7 billion today, a growth of 50.3 times. Moreover, before the contraction of USDT issuance triggered by the Luna crash, the peak issuance of USDT was $83.2 billion.

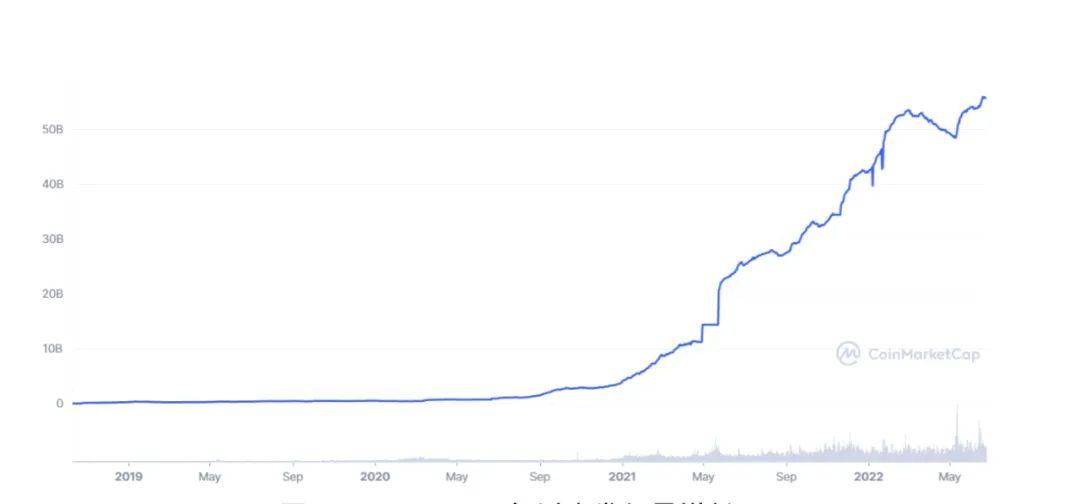

Figure 2. Growth of USDC Issuance Since 2018

In contrast, the issuance of another regulated dollar stablecoin, USDC, has continued to grow, increasing from $1.32 million in October 2018 to $55.8 billion now, showing signs of surpassing USDT.

The largest algorithmic stablecoin, DAI, had an issuance of just over $100 million in February 2020, but peaked at $10.3 billion in February 2022, and even after contraction, it still stands at $6.8 billion.

Overall, since 2018, the total scale of dollar stablecoins in the Crypto market has grown by more than 100 times, with only a 3-fold increase from 2018 to 2020, while it skyrocketed 31 times from 2020 to 2022.

Pros and Cons of Crypto Dollarization

The influx of a large amount of dollars into the Crypto market has profoundly changed the internal structure and operating rules of the industry, making this round of crash different from previous ones, with both advantages and disadvantages.

An obvious benefit is that due to the dollarization of Crypto, the industry's fundamentals have been temporarily stabilized during this round of crash.

Reflecting on the market crash in the second half of 2018, many projects had raised funds in BTC and ETH, and as the prices plummeted, development teams were unable to cover daily expenses and had to halt projects, leading to a severe "extinction" in the Crypto industry, with an estimated 99% of projects dying. It is important to note that in the early stages of any industry's development, projects are the only product. The mass death of projects caused the entire Crypto industry to nearly lose its fundamentals, making the bear market from 2018 to 2020 particularly long and suffocating.

The current situation is entirely different. This round of market crash mainly impacts centralized financial institutions within the industry, while Crypto projects have relatively suffered less. This is because the vast majority of Crypto innovation projects launched in the past two years have been financed in dollar stablecoins, and most projects are temporarily safe, which is crucial for stabilizing the industry's fundamentals. Of course, if liquidity shortages persist in the long term, more projects will inevitably die, but compared to 2018, the situation this time is much better. In fact, to some extent, this crisis may help the Crypto industry in the process of natural selection. Therefore, it can be reasonably optimistic that the recovery of the Crypto market and industry this time should be better than the last bear market.

However, the dollarization of the Crypto industry is a profound change, and the problems it brings are not fewer than the problems it solves.

The Crypto industry started with the vision of "private digital currency," which essentially aimed to create a virtual economic entity parallel to the real world with monetary sovereignty in the digital space. In the early stages of Crypto development, there was no need to beg established financial powers for the allocation of monetary resources; instead, financial resources were created through the aggregation of distributed consensus, thereby constructing a digital currency system parallel to fiat currency. This vision inspired a group of true idealists and led to the initial achievements in the Crypto field. Regardless of its feasibility, it was an extraordinary, exciting, and idealistic goal.

Of course, it is precisely because of this utopian goal that the Crypto industry has attracted much criticism. Many people still do not understand the value logic of Bitcoin. In reality, they do not fail to understand that consensus can become a basis for value, nor do they fail to comprehend the technological superiority of blockchain; their real issue lies elsewhere. They subconsciously sense that the goal of Bitcoin and cryptocurrencies is to establish a sovereign economic organization akin to a "quasi-state." It is precisely here that they experience great confusion and doubt: how can a virtual network composed of powerless decentralized individuals, lacking enforcement and violent capabilities, establish such a sovereign economic organization? How can real-world state organizations, which wield violence, tolerate such organizations competing with them?

This is the cleverness of the skeptics of the crypto economy, but it is also their blind spot. If the monetary system of the real world is consistent and stable, then cryptocurrencies indeed find it difficult to survive. However, after the 2008 global financial crisis, the Jamaica system based on credit dollars was not only greatly weakened but also showed serious cracks in its foundation. Bitcoin and cryptocurrencies emerged and developed precisely within these cracks. It is also because of these cracks that once the crypto digital economy reaches a certain scale, it becomes more advantageous for real-world sovereign economies to utilize and correct it rather than eliminate it. Attempting to jointly eradicate it lacks a foundation for realistic international political cooperation, while utilizing it only requires expressing tolerance and providing appropriate inducements to gradually integrate it into their monetary system.

It now appears that this revisionist path has achieved initial success. We do not believe there is a mastermind orchestrating this process, but the decision-making system of the dollar has indeed shown flexibility in addressing this issue. Allowing the issuance and circulation of private digital dollars on a scale of hundreds of billions has become the foundation for the dollarization of the Crypto industry. Other sovereign economies have had similar historical opportunities but have not chosen this path for various reasons, thus pushing this nascent and potentially enormous industry into the hands of the dollar.

Of course, after dollarization, Crypto has gradually distanced itself from the idealistic position of a "quasi-sovereign economy" and has been increasingly corrected to a secular industry within the dollar economy, with Web3 being a representative direction of the secularized Crypto industry. After this revisionist transformation, the Crypto industry can no longer create its own currency, and liquidity mainly relies on external provision. To obtain dollars, BTC, ETH, and other former "digital currencies" have been downgraded to "high liquidity digital assets," with their roles as trading mediums and accounting units abolished, either relying on their appreciation expectations to attract dollars or being treated as collateral assets, offering significant liquidity discounts to exchange for dollars.

Now, the Crypto industry is being tamed by the dollar into a traditional industry that needs to rely on the dollar financial system for survival and development. It is no wonder that classical internet VCs and Wall Street are becoming increasingly interested in Web3, nor is it surprising that U.S. regulators are showing more friendliness towards Crypto, as this Crypto industry is beginning to fall into their comfort zone. The entire Crypto industry needs to rely on dollar infusions for survival and development, using dollars as accounting tools to support daily financing and operations, and in the future, it will inevitably be strongly influenced by U.S. financial authorities.

Of course, Crypto still contains many fresh elements, such as DeFi, token incentives, DAOs, transparency, and permissionless systems, etc. However, as long as it continues to use the dollar as its base currency, it remains merely a chaotic, rapidly growing, and highly creative dollar colony with its own entrepreneurial board, and supporting its development aligns with the interests of the dollar.

Impact of Crypto Dollarization on the Dollar System

Many may question why current U.S. financial authorities cannot directly regulate the dollars in the Crypto market. If so, why support or at least tolerate the development of Crypto dollars? Why allow a dollar economy to emerge outside their control? Wouldn't this undermine the "face" of the dollar? Wouldn't it increase the difficulty of dollar regulation? Wouldn't it exacerbate illegal activities such as "money laundering," crime, terrorist financing, and "capital flight," as well as complicate the Federal Reserve's monetary control?

So far, we have not heard any public responses from U.S. financial authorities regarding these issues. However, some media reports suggest that experts in the digital economy and Crypto practitioners have discussed these issues with U.S. regulatory authorities. Some have pointed out that the dominance of dollar stablecoins in the Crypto market is beneficial for the dollar, while others have suggested that due to the success of compliant private dollar stablecoins (mainly USDC), the Federal Reserve no longer needs to consider issuing an official digital dollar. These reports at least provide us with a glimpse into one aspect of U.S. financial authorities' views on this significant issue.

While we cannot directly understand the U.S. government's attitude and strategy towards Crypto dollars, analyzing a similar issue may help us comprehend the underlying logic.

Here, we find it enlightening to compare "Crypto private dollars" with the widely circulated dollar banknotes around the world.

We know that the dollar primarily exists in two forms: dollar banknotes and account dollars.

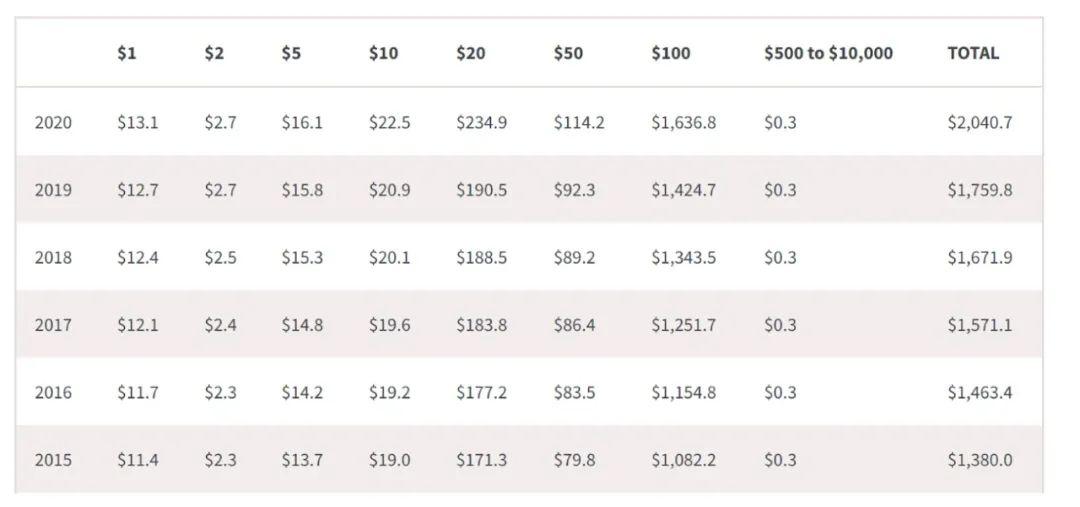

As of 2020, there were 50.3 billion dollar banknotes in circulation, valued at $2.04 trillion, with over 60% circulating outside the U.S. Among $100 bills, 80% circulate outside the U.S. This means there exists a massive dollar banknote economy outside the U.S.

Figure 3. Dollar Banknote Circulation from 2015 to 2020 (Source)

For this enormous overseas dollar banknote economy, U.S. financial authorities also cannot efficiently regulate it, leading to various troubles from illegal financial activities such as money laundering, crime, and terrorist financing. We all know that while many people unthinkingly accuse Bitcoin of being used for money laundering and other illegal financial activities, in that gray area, dollar banknotes are the true king, far surpassing Bitcoin in both scale and prevalence.

Given this, why doesn't the U.S. strictly control the outflow of banknotes? On the contrary, many dollar banknotes are actively released overseas alongside U.S. military and intelligence operations. What is the logic behind this?

The logic is quite simple.

There exists a significant demand for stable-value currencies abroad. Some of this demand is legitimate trading needs, while some falls into gray area transactions. This demand is objectively present; if the dollar does not occupy this market, people will use euros, yen, or other currencies. For the U.S., it is better for the dollar to occupy this vast market than to let other currencies take over.

Of course, this brings some challenges to dollar management, so the U.S. has taken several measures:

First, it has classified dollars. All dollar banknotes are issued by the U.S., and all account dollars (bank dollars) are also issued by the U.S., but the two types of dollars are different; the former is "gray," a lower-level dollar that may be associated with illegal financial activities, while the latter is "white," a higher-level dollar that is strictly tracked and regulated.

Second, it strictly distinguishes the applications of the two types of dollars. For large transactions within the country, international bulk trade, and financial transactions, account dollars must be used, and dollar banknotes are not accepted.

Third, it tightly controls the conversion from banknote dollars to account dollars. The process of converting illegal banknote dollars into higher-level account dollars is what is commonly referred to as "money laundering." This is a criminal activity that the U.S. has been striving to combat globally.

While such strategies create significant challenges for U.S. financial and law enforcement agencies and require complex and arduous long-arm jurisdiction, the overall benefits far outweigh the drawbacks. This not only helps the dollar solidify its global position but also provides the U.S. with a particularly important global governance tool.

Understanding this rationale, we can return to the dollarization of the Crypto market and comprehend the strategy currently adopted by the U.S.

Many people unthinkingly criticize the chaos of the Crypto market and the inevitable accompanying speculation and criminal behavior, but such criticism cannot halt the rapid growth of this market. If billions of people around the world start using this new technology called Crypto in a short period, and if Crypto and Web3 are destined to become a trillion-dollar market, then from the U.S. perspective, should it adopt a strict defensive stance to combat it, or should it stand by and point fingers, or actively integrate to seek a leadership position?

It now seems that the U.S. has continued its strategy in the realm of overseas dollar banknotes, adopting the third approach: encouraging or at least tolerating private digital dollar stablecoins to occupy this new domain.

A brief comparison reveals that Crypto dollars also share characteristics similar to dollar banknotes for the U.S.:

First, private Crypto dollars like USDC/USDT are created based on fiat dollars, thus named private dollars, but they are essentially just a third form of the dollar. Like dollar banknotes, they are a lower-level dollar;

Second, the use of Crypto dollars is limited and cannot be directly used for real-world payments;

Third, the conversion from Crypto dollars to account dollars is strictly regulated.

As long as these three points are ensured, U.S. financial authorities can effectively control Crypto dollars, and the mechanism is fundamentally consistent with the control of banknote dollars.

In November 2021, this emerging digital economy reached a scale of $3 trillion, ranking fifth globally, ahead of India. Of course, this economy has experienced significant fluctuations and is now around $1 trillion. However, as the development of Crypto and Web3 gradually stabilizes, this economy's growth may stabilize as well, potentially reaching a trillion-dollar scale, providing new support for the dollar's position. Especially as the dollar faces a series of issues and its dominance is challenged, the development of a dollarized, rapidly growing, global digital economy is nothing short of a boon for the dollar.

How has the dollar achieved such a position without bloodshed or hesitation? Is this an inevitability or a coincidence? Have other currencies in history ever had similar opportunities? These are topics worthy of study for historians of the digital economy. But for now, the dollarization of the Crypto market should be regarded as a basic fact.

Of course, this does not mean that this trend has strengthened to an irreversible extent. We see that the NFT market and Web3 gaming market still predominantly use native crypto assets like ETH and SOL for payments, granting these digital assets a "quasi-currency" status. Although their trading volume accounts for less than 1% of the entire market, it remains a noteworthy phenomenon. If the Web3 field widely adopts native digital assets as trading mediums, then with the growth and explosion of Web3, a "multi-currency standard" may emerge in the Crypto economy. Whether this is a transient historical phenomenon or a long-term trend remains to be seen.

Finally, with changes in the international situation, especially with significant historical events like the Russia-Ukraine war, whether other countries will participate in the competition for Crypto base currencies and whether multiple sovereign digital currencies will emerge in the global Crypto economy remains a topic worth关注. However, these topics are beyond the scope of this series of articles.