7 O’Clock Capital: A Casual Talk on the Past and Present of GameFi, Detailed Overview of the GameFi Ecosystem (Part 1)

Author: Luca, 7 O'Clock Capital

The concept of GameFi was first proposed by MixMarvel's Chief Strategy Officer Mary Ma during a speech at the Wuzhen Summit in the second half of 2019, referring to gamified finance and a new gamified business model. However, GameFi truly entered the sight of crypto market participants thanks to Andre Cronje (AC), the founder of Yearn.Finance.

In September 2020, Yearn.finance (YFI) founder Andre Cronje introduced the GameFi concept. In his view, the DeFi industry is still in the "TradeFi" (trade finance) stage and may enter the "GameFi" (game finance) stage in the future, where users' funds will become equipment used in DeFi games.

2021 is referred to as the first year of the metaverse, where the concept of the metaverse mapping reality into the virtual world and ultimately influencing the real world through activities in the virtual world has become a major direction for the future development of the internet. However, the internet's approach to mapping the real world into the virtual world is still in its infancy, with some metaverse projects remaining at partial reflections of reality, such as motion-sensing games and VR games.

The mapping of GameFi in terms of images and sounds is far inferior to internet technology. GameFi is also referred to as the "metaverse" due to the distributed structure of blockchain technology, which allows for a perfect mapping of the real world at a relatively abstract level through its distributed structure and the confirmation of asset ownership.

7 O'Clock Capital, as a full-cycle service venture capital fund in the Asian market, is also actively researching the GameFi field and ecosystem, continuously monitoring the development trends and directions of this sector. Established for less than two years, it has already participated in numerous investments in the GameFi field.

This article will elaborate on 7 O'Clock Capital's research and understanding of GameFi, sorting out its development context and ecological landscape.

1. Definition of GameFi

GameFi is the intersection of DeFi and Play-to-Earn (P2E) blockchain games in the metaverse, forming an ecosystem that transfers asset ownership to players and incentivizes higher loyalty, participation, and active management within these gaming communities.

Its keywords are: decentralization, gaming, finance.

1.1 Decentralization

Decentralized games refer to projects where the developers only act as "game developers" and "bug fixers," profiting by selling tokens and NFTs while more power is delegated to players. Players are given the decision-making power over game updates, directions, future items and characters, and profit distribution methods, governed in a DAO format.

1.2 Gaming

Games represent a highly digitalized world. In this digital world, to summarize in academic terms: a person's situation is an atomized one. The game itself, as a very basic structure, can carry rich content and can generate more creative outcomes. However, when we talk about games, we often overlook these aspects, which can be summarized in three points:

The first is the social nature of games, which has always been neglected;

The second is the spiritual aspect of games, which can nurture better and more significant impacts on society;

The third is that the future we head towards depends on how we perceive games.

Games should be a set of meaning systems guided by rules, played in specific times and spaces based on player initiative.

1.3 Finance

The financial aspect of GameFi merges DeFi and NFTs to form the concept of "gamified finance," presenting financial products in a gaming manner, gamifying DeFi rules, NFT-ifying game items and derivatives, and incorporating traditional gaming elements like competition and social interaction to enhance participants' entertainment, interactivity, and personal interest in the game.

2. Differentiation of GameFi from Traditional Games

2.1 Autonomy and Modifiable or Optimizable Games

Unlike traditional game companies that independently plan and design gameplay, scenes, and characters, every player in blockchain games can participate in improving and upgrading the entire game. Governance tokens exist in the game, allowing players to earn tokens while playing and vote to help upgrade and improve the game for a better future experience, leading to higher interactivity and stickiness between players and the game.

2.2 DAO Self-Management, No Unified Operating Center

Blockchain games are not owned by a single company but are jointly operated and maintained by developers and players. The popularity of the game is influenced by the market; the better the experience the game provides, the higher the user count will be. On-chain games are not controlled by companies, and companies cannot dictate the future development of the game; everything is related to the users themselves.

2.3 Wealth Creation Effect

Blockchain games allow players to earn money while playing. While relaxing in the game, players can earn tokens, items, etc., through leveling up and defeating monsters, which can be sold in on-chain markets.

3. Core Conditions Required for GameFi

3.1 Interactivity

Interactivity can also be understood as liquidity, which requires users to form. Therefore, having many users and high popularity is crucial and is a common demand for both players and the project itself.

Whether the initial popularity can be sustained will play a decisive role in the game's success or failure. More users mean more potential benefits, and players may perceive the game as fun, so it is essential to have a game with the potential to attract a large audience.

3.2 Playability

For a sustainably well-developed GameFi, the economic model and playability are significant prerequisites. Therefore, in 2022, more and more games began to focus on their gameplay and playability, leading to a surge in investments in blockchain AAA games.

3.3 Storyline

The storyline, as the name suggests, is the core concept and vision of the project. For a project to have a long and broad development space, its story concept is very helpful. For example, Sandbox promotes itself as the first open scene in the metaverse, the future "Ready Player One." Currently, Sandbox has attracted hundreds of brand merchants, and it may develop into a virtual world mall, akin to a commercial center connecting businesses and users. Therefore, a good GameFi also needs to form a storyline standard from vision-concept-product-economic model-business plan-value embodiment, etc.

3.4 Philosophical Discussion

While perfecting its overall gameplay and virtual space, offline scalability, social attributes, and physical space interconnectivity, it also needs to address psychological demands for spiritual value and the dual identity anxiety of virtual space. For instance, according to Maslow's hierarchy of needs, it can be observed that the majority of people's needs, when material conditions are sufficient, will continue to ascend the pyramid, from basic physiological needs like food and shelter to safety needs, then to belongingness, esteem needs, and finally to self-actualization. This enthusiasm for pursuing self-worth is essentially the absence of "I"—Gérard Genette described it as: "I have become a tourist in my own life, a visitor in the museum of my own existence," and the virtual world further reinforces this nature of disconnection: we sit in front of computers, continuously packaging our online self-image through joining online communities and expressing opinions, disciplining ourselves from an observer's perspective, yet we cannot provide users in the real world with any more essential, creative, long-term, and genuinely satisfying fulfillment.

4. Decentralized GameFi and DAO

Currently, all games, including some decentralized games promoted by on-chain GameFi, have developers holding absolute power over all matters within the game. Numerous issues arise, such as unoptimized game bugs, arbitrary changes to drop rates, and "one-size-fits-all" anti-cheat bans. True decentralization, where "the cultivators own the land," is the ultimate way to distinguish blockchain games from traditional games and even surpass them, which should be achieved in the form of a DAO. This can be realized through the following three points:

(1) The circulation of governance tokens is only distributed in the form of rewards. 10% of governance tokens belong to the project party, while 90% are earned by users/players through completing various tasks;

(2) Establish a dedicated management team with sub-departments for operations, development, marketing, compliance, etc. (Sub-DAO). Users who complete various bounty tasks can choose to enter a specific sub-department or management team, where each sub-department designs its governance model independently, but must center around governance tokens as the core rights credential;

(3) All rewards are settled on a project basis, paying with governance tokens. The technical layer is designed and maintained by the project party, with open-source code, allowing external users to jointly maintain it. Operations and promotions are incentivized through player voting, and game strategies and update directions are guided by token incentives through voting to attract advisors.

5. Ecological Market Segmentation of GameFi

To understand how GameFi significantly enhances players' incentive alignment, we must understand the roles of games, NFTs, gaming guilds, game studios, and data tools.

5.1 GameFi Games

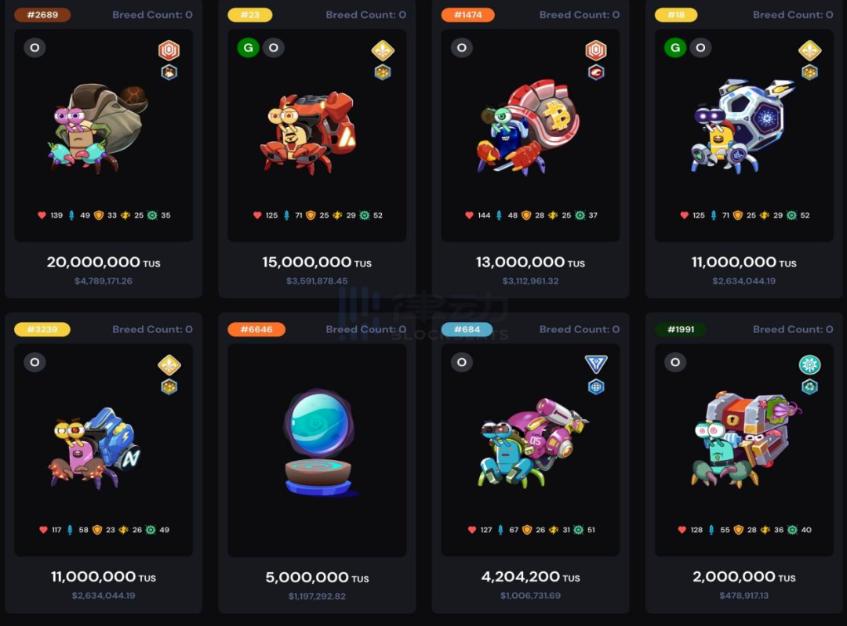

Taking Crabada as an example. When GameFi projects assign income-generating asset value to their NFTs, the rise of gaming guilds becomes inevitable. The tripartite consensus game between guilds, project parties, and ordinary players becomes more complex. Crabada is a P2E game similar to the Axie Infinity mechanism, initially launched in November 2021, and has now become a leading GameFi project on the Avalanche chain. Its current market cap is 6.5M, peaking at 130M, with NFT trading volume reaching 100 million USD. The trading volume in the Avalanche ecosystem continues to rise, primarily due to its Crabada contribution fee, which accounts for 50% of the entire Avalanche.

The game features include a mining mode (staking), game raiding (PVP), a rental system, and a breeding mode:

Mining Mode: Assemble 3 Crabada for idle mining, with a mining duration of 4 hours.

Game Raiding: Choose a team that is currently mining to raid; regardless of winning or losing, there will be corresponding rewards, such as a 65% profit reward from successful raids.

Price and rent idle Crabada; the rented Crabada will fight against raiders as mercenaries.

Breeding Mode: Two Crabada breed to produce a Crabada egg, with each Crabada able to breed up to 5 times. The egg requires a 5-day cooldown before becoming a Crabada.

The Crabada economic model consists of three assets: NFT, CRA, TUS (dual-token + NFT).

NFTs can be bred and used in the game, CRA is the governance token, and holding it can create project value and help expand TUS's use cases. The game currency TUS is primarily used for staking, game raiding, and renting NFTs, and can only be obtained through in-game production. Market consensus mainly focuses on the price of CRA.

CRA: Total supply of 1 billion governance tokens, 100% fully circulating by 2023. Current price: $0.049, historical high: $2.96, historical low: $0.049.

TUS: Game token, with no upper limit on supply, earned through mining and raiding rewards, breeding usage, and transaction fees for rentals and market trades.

In terms of market popularity, Twitter followers: 50K, Telegram: 8600, Discord: 13000, mainly focusing on official activities, game feature introductions, and interactive retweets. Overall, the number of followers on various platforms is not high, primarily due to short-term popularity.

In March of this year, Crabada launched a game-specific chain, Swimmer Network, with TUS as the transaction fee token.

A large number of tokens are controlled by the team, and until the production of CRA and TUS meets consumption, the prices of both tokens will continue to rise. In reality, players consume CRU and TUS to generate Crabada NFTs. Although there are methods to reduce inflation through rental and transaction fees, this approach still cannot bear the full selling pressure of all three assets.

Founding Team:

Oxtender is responsible for business operations, having held product management positions in digital exchange and cloud backup products, with 4 years of blockchain product experience. He previously ran a tech consulting company.

Jay is responsible for product design and has worked as a product designer at Binance.

Investors:

AVALANCHE, AVALAUNCH, SkyVision Capital, WANGARIAN (angel investor), Not3Lau Capital, ZEE Prime Capital, Devmons.

5.2 NFT (Mintable)

NFTs are issued in the form of smart contracts, where a single smart contract can issue one or more NFT assets, including physical collectibles, event tickets, and virtual assets like images, music, and game items. The NFT element is essential in GameFi, making all in-game assets, items, and characters unique and collectible. Combined with the attributes of blockchain games, players can fully own these assets in decentralized games.

Taking 7 O'Clock Capital's portfolio Mintable as an example, Mintable is a decentralized NFT trading platform that supports minting and trading NFTs, reflecting the combination of NFTs and DAOs.

- Social System

Provides a social trading section where users can deepen their understanding of products by consulting merchants via private messages, similar to an offline Taobao trading platform.

- Promotion System

Artists can pay to promote their listed NFTs to gain greater exposure.

- Rating System

Highly reputable products attract users more and are easier to trade. This system allows users and merchants to rate and evaluate each other, helping users improve their promotional effectiveness and standardize purchases while making inferior products more transparent.

- Duplication Check System

Verifies the originality of NFTs on the platform, conducting a comprehensive search for similar images across the internet to confirm the authenticity of NFTs.

- DAO Governance

Mintable uses NFTs for governance, which is not affected by price fluctuations. Only NFT holders have voting rights. When purchasing an NFT, in addition to the NFT itself, a voting-right NFT is also obtained, with each NFT representing a different number of votes. Subsequent purchases will add the newly acquired votes to the original NFT. Votes can also be obtained through Bonding Curve purchases.

Founding Team

Zach Burks: From Consensys Developer Research Institute, proficient in Solidity, business development, JavaScript, and blockchain technology. Former CTO of Harvest Network and a U.S. Army artillery battalion commander.

Mark Kamphuis: Former marketing director at Zilliqa and creative brand director at Woelgeest, graduated from Utrecht University.

Jiawen Ngeow: Graduated from the National University of Singapore, recognized by the Singapore Business Review as one of Singapore's top 15 cryptocurrency moguls, organizer of Block Live Asia, co-founder and CEO of Grounded, co-founder of MEGAX and The Cult.

Investors

CRC Capital, Time Ventures, Sound Ventures, Defiance Capital, DeFi Alliance, Lunex Ventures, Ripple, Animoca Brands, Metapurse, Expedia Group, Dallas Mavericks owner Mark Cuban, 7 O'Clock Capital.

5.3 Gaming Guilds (Cosmic Guild)

Gaming guilds also have a significant influence in the GameFi field, serving as the best link between project parties and players. On one hand, gaming guilds guide members to profit by discovering quality GameFi games; on the other hand, community governance also relies on guilds for coordination. Most importantly, gaming guilds are the initial capital gathering places for players, capable of exerting greater influence on the gaming market through unified actions.

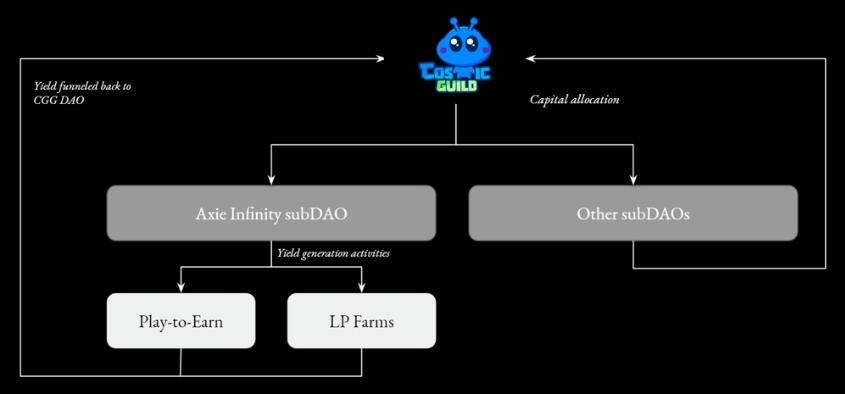

Cosmic Guild ($CG) is a decentralized gaming guild founded by gamers from around the world, with investment rounds led by Binance Labs. It rapidly expands through various forms such as creating subDAOs, NFT rental programs, and esports competitions.

The Cosmic Guild team believes that the P2E model will continue to grow exponentially and improve over time. More interesting iterations of the P2E economic model will emerge. For gamers, experiencing games like Axie Infinity may become very expensive. Therefore, gaming guilds need to rent out gaming NFT assets to novice players who wish to earn assets in the game. Play-to-Earn will also shift the incentive mechanisms into the hands of players to ensure ongoing development. For example, Sandbox and Ember Sword largely rely on the community to develop the metaverse into an exciting place for gamers to hang out. Developing these digital real estate assets is time-consuming, and the lack of expertise in managing these assets can lead to suboptimal returns.

Cosmic Guild was established in November 2021, with core team members from Coinbase, Gemini, Binance, and Bithumb. Cosmic manages multiple subDAOs, each managing NFTs in the portfolio and sharing revenue between Cosmic and scholars based on qualifications, performance, and loyalty. Revenue from each subDAO will be allocated from the parent CG DAO. In the future, subDAOs are prepared to expand into digital real estate development, such as virtual world rooms and event or game land management, generating additional revenue for Cosmic DAO. They will also scout talented gamers from scholars to participate in esports competitions. The guild leader is elected by vote, and the treasury is accessed through a multi-signature agreement. The guild structure is as follows.

Asset allocation decisions are made at the Cosmic DAO level through governance. After each subDAO receives funding allocations, revenue strategies will be formulated at the subDAO level by experts with in-depth knowledge of the game. A portion of the generated revenue will flow into the Cosmic DAO.

Currently, Cosmic Guild has nearly 20,000 community members, with major game projects including Axie Infinity, and upcoming projects like SipherXYZ, Aurory, Nyan Heroes, Ember Sword, and Star Atlas.

CG has a total issuance of 500 million tokens, primarily used to ensure that token holders are not affected by dilution, losing the ability to influence the DAO over time, and has not yet issued tokens.

Investors

$1.5 million seed round financing led by Binance Labs. DeFiance Capital, Alameda Research, Play Ventures participated, followed by a $3 million private placement round led by Crypto.com Capital, with strategic angel investors such as Fundamental Labs, Mirana Capital, and Istari Ventures participating.

5.4 Metaverse (Solice)

An eternal, vibrant digital universe that provides individuals with a sense of agency, social presence, and shared spatial awareness, as well as participation in a broad virtual economy with profound social impacts. It addresses issues of population, interests, economic collapse, and inflation that blockchain games must solve. The metaverse as a whole needs to provide directions and strategies for survival, but the games within it may rise and fall rapidly with the fading of fun or economic incentives.

Solice is a metaverse ecosystem built on Solana, established in September 2021, based on the Decentraland and The Sandbox model, offering cross-platform PC and virtual reality (VR) games. Users can play, build, own, socialize, and monetize their virtual experiences in an immersive way on the Solana blockchain through its constructed metaverse ecosystem. It enables interconnectivity with other users in the metaverse through VR devices and NFT assets.

- Solice ID

Any first-time user can obtain a Solice ID, which serves as the basis for the user's decentralized identity, and the user's assets will also be associated with the Solice ID. The Solice ID will be linked to the user's wallet address, allowing users to log into the platform without providing any information.

- Editor

Provides a standalone SDK editor, allowing any user to create their own assets and applications under certain conditions. Assets can be NFT-ified, traded, and creators can assign them scarcity, security, and authenticity, showcasing them within the metaverse ecosystem. Users can also generate revenue by constructing economic scenarios within the metaverse ecosystem.

- Business Forms

Users can build commercial venues such as art galleries, arcades, live music concerts, and personal NFT collections, where any user wishing to visit can pay to enter and experience realistic tours through wearable devices, further virtualizing and online commercial activities, driven by crypto assets. To construct commercial venues, users need to acquire components and materials within the metaverse system, and after completion, further turn NFTs into scarce assets. Users can earn incentives and NFT materials through tasks and games in a Play-to-Earn manner, promoting user stickiness.

- DeFi and P2E

In DeFi scenarios, for example, adding a DeFi program to a plot allows users to mortgage assets based on the DeFi program, earning additional APY rewards and opportunities to obtain rare materials. Lending, synthetic assets, DEX, insurance, etc., may all manifest as forms of DeFi. Additionally, users can obtain NFT pets in the Solice Metaverse, with varying rarity and scarcity, and can also acquire rare materials through pets, which support further incubation in a nurturing manner.

- Market Scenarios

The Solice Metaverse also supports conducting real-world business meetings in an online virtual format based on 3D VR, where both parties can engage in immersive discussions with the help of wearable devices.

The total number of LANDs is 60,000, and users can purchase LANDS, with each LAND plot measuring 15 meters by 15 meters. Public spaces, arenas, and roads are owned by the developers, and users cannot buy or sell them.

- Founding Team

Christian - CEO

Entered the crypto industry in 2016, with primary experience in institutional and retail investment, having worked at Fantom, LTO Network, and Solanium.

Serena - COO

An experienced business strategist with an entrepreneurial background. She has completed over $750 million in business contracts, is an advisor to an angel investment fund, founded a car resale group, and is an active podcaster.

Ray - CTO

Has worked in front-end, back-end, and embedded Linux systems and databases.

- Investors

Three Arrows Capital, Animoca Brands, and DeFiance Capital led the investment, with participation from Genblock Capital, Alameda Research, Solanium Ventures, SkyVision Capital, Jump Capital, KuCoin Labs, Solar Eco Fund, CMS Holdings, Maven Capital, Rhea Fund, a41 Ventures, ZBS Capital, Peech Capital, Icetea Labs, SkyNet Trading, Double Peak Group, Rarestone Capital, DAO Maker, Cropperbros Research, Mintable, DWeb3 Capital, and others.

5.5 Game Studios (Sky Mavis)

Taking Sky Mavis as an example, it was established in early 2018 as a technology-focused game studio, building the future virtual world and the infrastructure that makes it possible, also seen as an infrastructure builder. Headquartered in Vietnam, its team consists of 40 full-time employees.

This also reflects that its team has solid technical support and rich operational experience, along with a great passion for NFTs, blockchain games, and digital ownership. Axie Infinity is their flagship product. In addition to blockchain games, Sky Mavis also focuses on several areas:

Marketplace: A decentralized trading market for unique digital assets.

Hub: Infrastructure that allows products to reach millions of players worldwide.

Ronin Wallet: The official sidechain wallet for Axie Infinity, capable of storing digital items and currencies.

Ronin: A sidechain related to Ethereum specifically designed for Axie Infinity, which has sparked explosive growth in blockchain games and collectible projects.

On the other hand, they have popularized a concept called "Play To Earn," which means earning while playing.

- Founding Team

Trung Thanh Nguyen is the CEO of Sky Mavis, who founded the e-commerce startup Lozi.vn at the age of 19, which is still operational today. Trung has also represented Vietnam in the ACM-ICPC (International Collegiate Programming Contest) World Finals.

- Investors

In 2019, Sky Mavis raised $1.465 million in a funding round led by Animoca Brands. In 2021, Sky Mavis completed a $7.5 million Series A funding round led by Libertus Capital.

In 2022, Sky Mavis raised $150 million, led by Binance, with participation from Animoca Brands, a16z, Dialectic, Paradigm, and Accel.

5.6 On-Chain Data Analysis (Dune)

Dune Analytics is a blockchain data analysis company based in Oslo, Norway, founded in 2018. It is a powerful blockchain analysis platform that can be used to query, extract, and visualize vast amounts of data. It is a web-based platform that allows users to query Ethereum data from a pre-filled database using simple SQL queries, eliminating the need to write a dedicated script. Users can easily query the database to extract almost any information on the blockchain.

- How It Works

Users, creators, and suppliers operate in a self-circulating manner.

It can be understood as integrating unprocessed blockchain data into an SQL database, allowing users to query easily. If users need to create private charts, hide watermarks, and other features, they need to pay for a Pro level.

Currently, it supports blockchain data from Ethereum, Polygon, Optimism, Binance Smart Chain, and xDAI. Dune offers over 22,000 different dashboards to provide this information. Dune utilizes a "star rating" system, allowing users to "star" dashboards. The dashboards with the most stars stand out, incentivizing creators to write better query sets. Creators are the wealth of Dune, using SQL skills to create dashboards for users to view. Every graph or table on the platform is user-generated, and the motivation for creators comes from economic and social incentives.

- Economic Model

Users can access blockchain data, create dashboards, share charts, and fork existing queries without paying fees. When users need to run multiple queries at once, skip the query queue, export results, keep information private, or remove watermarks, they need to upgrade to "Dune Pro," with a monthly fee of $390. In addition to Dune Pro, enterprise API services are also offered, priced based on usage and priority.

Currently, no tokens have been issued. According to founder Olsen, "We do not oppose tokens, but if we do, we will make the most correct choice. We should build for the long term, not issue tokens for the short term."

- Founding Team

Haga is the founder and CEO of Dune, having worked as a blockchain analyst and project manager at Schibsted data brand media company, graduated from the University of California, Berkeley.

Olsen is the co-founder and CTO of Dune, having served as a senior data scientist at Schibsted data brand media company, graduated from the Norwegian University of Science and Technology.

- Investors

In 2019, Binance included Dune in their accelerator program, receiving $250,000. In 2020, during the seed round financing, Dragonfly Capital led the round, with participation from Multicoin Capital, Coinbase Ventures, Alameda Research, Coingecko, and angel investors such as AAVE founder Stani Kulechov and Uniswap's Matteo Leibowitz. In 2021, the Series A funding round was led by Union Square Ventures, with participation from Redpoint Ventures, Dragonfly Capital, and Multicoin Capital. In February 2022, Dune Analytics completed a $69.42 million Series B funding round, achieving a valuation of $1 billion, led by Coatue, with participation from Multicoin Capital and Dragonfly Capital.