Uniswap Governance Status: Minimizing Paradox

Authors: Laura Lotti, Aaron Z. Lewis, Joanna Pope, Other Internet

Translation: The SeeDAO

In the first quarter of 2022, Other Internet began listening to the voices of different stakeholders in Uniswap. Our goal was to identify the most pressing areas of concern within the Uniswap community and provide ideas for improving protocol governance. The "minimization paradox" ran through almost all of our conversations: how can governance participation be increased when the governance scope of Uniswap is intentionally limited? Few support changes to the protocol itself, and most of the community's energy has shifted to Web3 ecosystem issues, such as L2 scalability and multi-chain governance mechanisms. However, for projects in this area to succeed, Uniswap governance needs more off-chain organizational structures and processes to facilitate the coordination of complex relationships among stakeholders. We explored this issue from multiple angles and proposed potential paths for improvement.

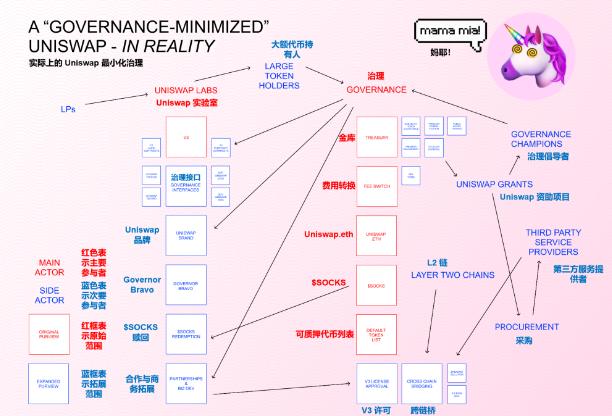

Theoretically, the governance scope of Uniswap may be very small. But in practice, protocol governance involves a much larger scope.

Uniswap adopts a "governance minimization" approach in its maintenance and development, which is also the source of its strength and security. For years, observers have praised the protocol's limitations. They view such limitations as elegant and consistent with Ethereum's ethos. However, for many governance participants we interviewed over the past three months, minimization sometimes makes the system feel too slow, too static, and difficult to navigate, leading to frustration.

These growing pains may be natural and inevitable. As the complexity of the Web3 public goods ecosystem continues to expand, and new chains surge at an unprecedented pace, it is clear that Uniswap governance requires more formal processes. To maintain minimized governance at the protocol level, mechanisms and processes are needed to facilitate off-chain coordination within the community and with external partners. At the same time, as the protocol matures, more opportunities for collaboration with service providers have emerged. Roles similar to "procurement teams" are needed to help evaluate these vendors and collaboration opportunities.

To gain a clearer understanding of the latest dynamics in Uniswap governance and how to most effectively support participants, we conducted a "listening tour" with Uniswap stakeholders in the first two months of 2022, representing different interests, concerns, and desires. Building on our previous ethnographic research within the crypto community and following up on topics raised in our last article, we aimed to understand:

1. Who are the political participants in the Uniswap community?

2. What governance issues do they care about?

But first, a brief explanation of our research methodology.

How to Study Social Organisms

DAO ethnography is an emerging field. As we delineate this new area, we are also forming a new research methodology. According to Vitalik's "e-theory-um blockchain," and its emphasis on wordcel theory over empiricism, protocols are not just about technology, economic mechanisms, and formal security guarantees. More importantly, they are living social organisms that evolve alongside their human participants and the environments they inhabit. Therefore, we chose a qualitative approach to delve into these subjective, meaning-making practices and motivations that shape protocols as social systems, with a particular focus on how this applies to human-led protocol governance in this emerging field.

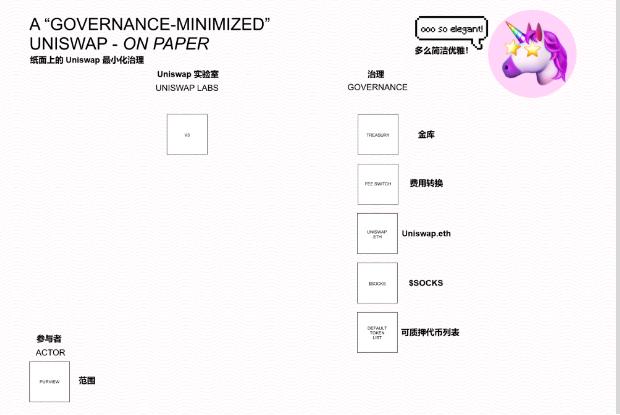

Drawing on the interpretive methods pioneered by Clifford Geertz (1973), which emphasize the cultural context of behavior and expression, we organized in-depth interviews with 20 stakeholders. We then coded these interviews using the analytical framework provided by Pelt et al. (2020). This framework enabled us to identify issues based on combinations of different categories.

Three Governance Layers:

Off-chain Community: In the case of Uniswap, social motivations and relationships occur within Uniswap's social environment (forums, Discord, Twitter, etc.) and inform the lower governance layers.

Off-chain Operations: Refers to governance matters conducted outside of formal on-chain voting, particularly regarding the development and maintenance of the protocol and ecosystem. UGP and The Stable fall into this category. As we will see, there are not many formal examples of off-chain operations in Uniswap.

On-chain Protocol: Refers to the interaction mechanisms and rules encoded in smart contracts, through which the governance process operates. In the case of Uniswap, this layer relates to the capabilities of Governor Bravo, which serves as the infrastructure for making decisions that affect protocol parameters.

The following are the five key dimensions in governance within open-source software and blockchain:

- Roles and Organizational Structure: The hierarchy of participants and accountability mechanisms;

- Information Flow: The media channels used for communication (within or outside the network);

- Financial and Non-financial Incentives: Monetized and non-monetized rewards for different participants;

- Rules, Thresholds, and Information Accessibility: Standards for participation and membership;

- Decision-making, Conflicts, and Power: The processes and mechanisms for decision formation;

Through analysis, we gained a multifaceted and detailed understanding of some key issues in Uniswap governance.

Framework for ethnographic research on decentralized protocols

Complex Participant Divisions and Multi-layered Perspectives

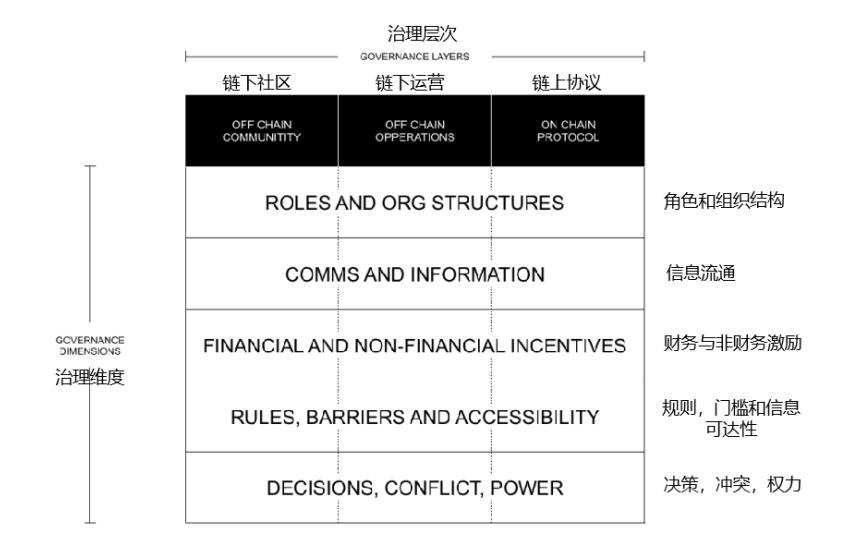

When we began our research, we anticipated discovering a relatively clear role distinction based on the scale of token holdings among stakeholders. This was derived from the governance narrative of Uniswap, which suggests that a small number of "whales" dominate the decision-making process, while on the opposite side, a large number of disempowered small holders exist.

However, we found that such distinctions were misleading. Their identities are often entangled, with several interviewees fitting into more than one category and shifting into different roles depending on their specific interactions with Uniswap.

Among the interviewed users, about a quarter actively participated in Uniswap governance, either as contributors engaging in discussions on forums and Discord or by proposing initiatives, or possibly both. We refer to these participants as "protocol diplomats."

In our analysis, large or professional LPs were noticeably absent from governance. Given that LPs do not deeply engage in the project, they are to some extent completely excluded from the governance process. This is not surprising.

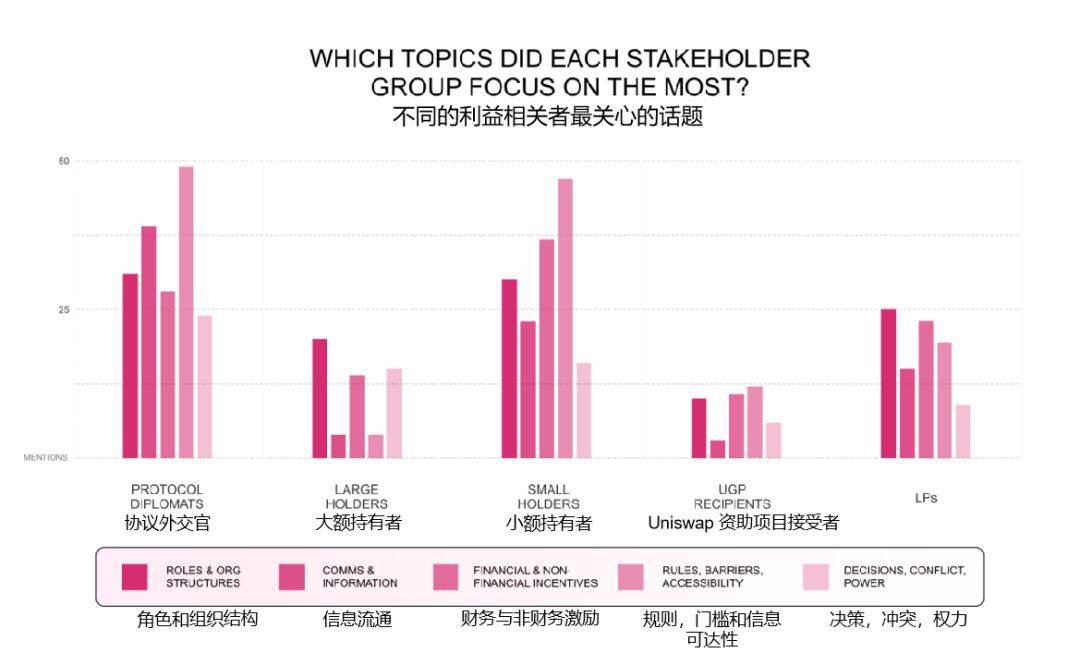

The above image shows the statistics of stakeholder perspectives during our interviews. Some respondents identified with more than one category.

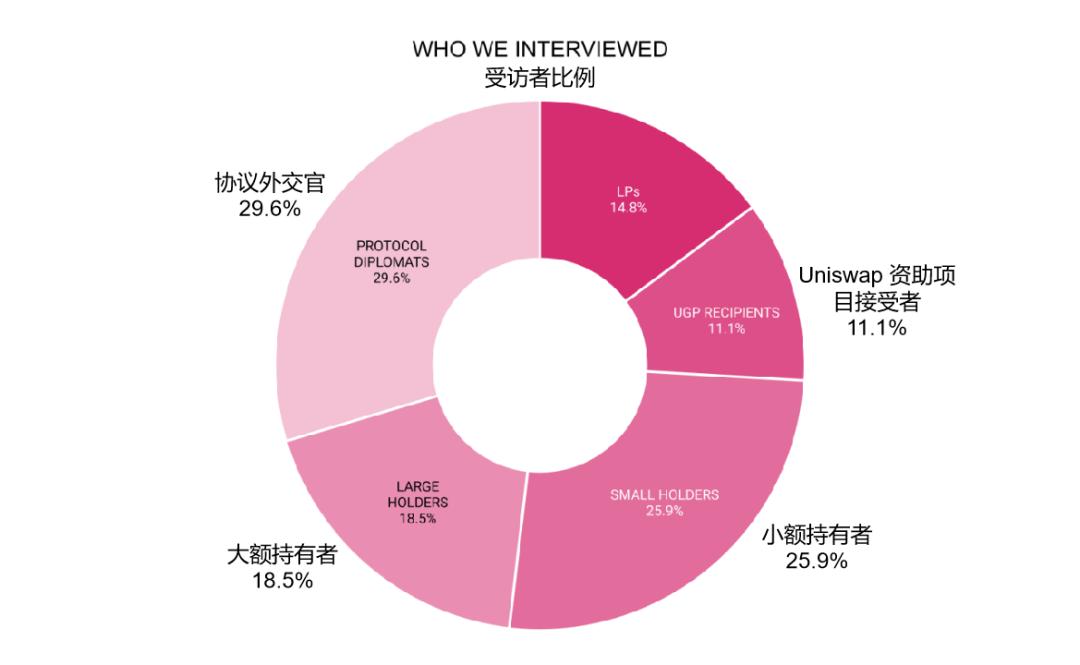

Different types of stakeholders have different perspectives on governance. Protocol diplomats and small holders focus more on issues related to rules and accessibility of barriers, while large holders and LPs primarily concern themselves with roles and organizational structure.

Interestingly, for all categories of stakeholders we interviewed, both financial and non-financial incentives for participation were of considerable importance. Perhaps protocol diplomats spoke less about this issue because their motivations were clearer from the outset.

Different stakeholder groups focus on different issues.

Attention to Different Dimensions

By listening to the voices of the community, we studied the role of the community in protocol governance and the rise of interest representation/lobbying around Web3 public goods. We observed that although the number of governance activities was limited, L2 scaling solutions sparked some healthy activity on forums, suggesting that these Web3 ecosystem issues might be catalysts for community engagement.

Recently, the surge in additional usage funding applications on forums validated our initial hypothesis. However, we found that the main concerns of stakeholders still revolved around the governance process itself, especially when it came to on-chain issues. Other frequently discussed topics included compensation for contributors (including representatives) and issues of power asymmetry, indicating that these significant obstacles need to be addressed before tackling other Web3 ecosystem issues. It can be argued that the lack of legal guidance regarding regulatory risks remains one of the primary reasons for decision paralysis. This hinders the community from advancing proposals that might attract regulatory scrutiny. Below, we will discuss the current obstacles and emerging issues in more detail and provide recommendations based on our analysis. Ironically, due to the protocol operating in a decentralized environment, there is often no single entity to address these proposals—this is another issue we will discuss below.

Current Obstacles

The Governance Process Itself is an Obstacle

While ecosystem-level issues are certainly a concern (especially for protocol diplomats), the governance process and compensation for contributors (especially representatives) are the main obstacles preventing these issues from being resolved. This is particularly evident in the licensing process. To support the community in handling additional usage authorization requests, Uniswap Labs has open-sourced deployment scripts and documentation outlining how to deploy V3 on other chains; they have also recently proposed a template to expedite the licensing process. While these efforts are commendable, achieving the vision of a "multi-chain Uniswap" requires first addressing the slow governance process and power imbalances.

"The governance work is progressing so slowly. There is just too much coordination work to be done."

"We ultimately decided to stop applying for authorizations because we didn't want to expend so much effort just to complete the voting process."

Technically, Uniswap's governance scope is minimal. However, achieving governance within this limited scope remains a daunting task. Due to the project's vast scale and the lack of structure within it, Uniswap can be said to be one of the protocols with the highest levels of informal governance or political activity. We can view this as a minimization of governance breadth while maximizing depth.

Selene vomer, also known as Lookdown, is a fish with an extremely narrow body. From the front perspective, it appears to be a very small fish. But from the side, it looks much larger.

Another typical example of this paradox in Uniswap governance is the issue of fee conversion, which has been endlessly discussed but has yet to see action taken to resolve it. Fee conversion is often viewed as a single issue with just one switch. In reality, as some respondents pointed out, each individual liquidity pool could theoretically spin off its own DAO and make its own governance decisions regarding the associated fee structure. Fee conversion is not a singular issue.

"I can see that Uniswap is taking a slow approach, but I am indeed frustrated by the lack of a simple framework for governance (Uniswap excels at simplifying transaction UI/UX, but why not governance UI/UX?). For example, each pool could vote on the conversion of V3 fees, such as the USDC/ETH pool, while each pool could also vote on the percentage of the base trading fee, just like proposals from stablecoin pools. Both of these matters would require a significant amount of voting through the traditional forum proposal voting process."

There are many different interest groups within "governance," making it difficult to act if we view the community as a single unit. For instance, Uniswap could try different experiments on different L2s. The scale and scope of the Uniswap governance portal make it challenging to experiment and act quickly.

"We explored governance for each pool to determine fee levels. One issue is that when the liquidity of a trading pool is more concentrated, the problems become more complex. This could affect how much power/fees are allocated, causing distortions… Each pool having its own DAO is a cool idea."

Uniswap Labs proposed suggestions to simplify the governance process, which Other Internet agreed with after suggesting some modifications. These changes may help simplify the "interface" of governance but do not necessarily address the underlying issue: even the smallest proposals must go through a laborious political process requiring 40 million votes to pass. Such governance mechanisms are indeed safer but make it difficult to act quickly and effectively.

Hesitation in the Face of Regulatory Pressure

It's time to address the elephant in the room: SEC regulation. Some are concerned that Uniswap may face fines or shutdowns from the SEC. Since reports from outlets like The Wall Street Journal in September 2021 indicated that Uniswap was under strict scrutiny from the SEC, governance participants have been cautious. Opponents argue that the protocol is an unregistered securities exchange. Supporters contend that Uniswap cannot be shut down technically because there is no single entity responsible for its ongoing operation. As Coin Center stated: "Labeling these tools as 'a DEX' and treating 'DEX' as a class of things that exist in the world (rather than actions) is harmful to the entire tech industry: it incorrectly portrays software tools as individuals or companies with agency and legal obligations. Companies and individuals—whether corporate or natural persons—have clear agency and obligations; software tools do not. Companies and individuals can be held accountable for their actions, while software tools cannot." Nonetheless, no one knows what will happen in the coming months and years, and that is part of the problem. Being the largest and most successful DEX means policymakers can target you as a scapegoat. Protocol diplomats feel particularly acutely the threat of regulatory scrutiny, making them reluctant to propose initiatives. As one observer noted:

"Due to regulatory reasons, Uniswap's risk aversion is very high. Other projects can do more to diversify and accumulate meta-governance power."

Our investigation also found that some workflows and projects have been stalled due to regulatory risks. One respondent said:

"There are many proposals I wish could be put forward. There are one or two we have actually written, revised repeatedly, but have not published. The main reason is legal issues. This is something everyone is well aware of—I don't know how to resolve it. Over time, it will become easier."

While we do not know the content of these proposals, we can clearly sense that looming regulatory risks are causing Uniswap to slow down.

"Frankly, Uniswap is one of the projects we've participated in that has performed the worst. Because the project lacks agility, and part of this is due to regulatory reasons. We want to do some cutting-edge innovations in directions that the DAO is interested in. But doing such things for Uniswap comes with much higher demands, and I have to think carefully about whether it's worth it."

Perhaps a formal procedure could be established where a DeFi education fund provides legal guidance and consultation to governance participants who successfully push proposals to on-chain voting. DAOs lack legal structures, which should be a feature rather than a problem. But this means that proposers need to handle legal risks and liabilities themselves—requiring significant money and expertise. Uniswap could also separate some specific target organizations from the DAO to assume legal roles in executing contract terms. However, the feasibility of this solution needs further exploration.

Power Asymmetry: Indifferent Voters and Exhausted Delegators

The severe inequality in the distribution of voting power has led many small token holders to become passive. They feel there is no reason to participate in governance because their votes do not matter. They are not wrong. Whale holders can appear at the last minute and change the voting landscape. Smaller token holders find it difficult to push proposals through.

"I feel like just a helpless little fish, with no influence at all. It's really hard to quantify. I feel exhausted from participating in governance because […] [a large venture capital firm] has everything and can control the vote to get any result they want. Whatever they want to do will happen. Any organization has the problem of concentrated control, and public companies are no different. I don't vote on the stocks I own."

Some believe that Uniswap is a brand new superstructure—a free, unstoppable, permissionless protocol—full of infinite possibilities and innovative potential. It is a new organizational design that does not apply any old rules. Others see shadows of the old order and believe that Uniswap's governance is leaning towards past corporate governance models.

"I always want to see where the power lies—power is in the hands of a very few; about 10 whale participants hold a large amount of governance tokens, while others have virtually none compared to them."

However, some community members feel that this power asymmetry is not a major issue. They believe that participating in governance decisions involves dealing with too many risk issues, and if ordinary people do not have enough information or expertise to make good decisions, there is no reason to try to maximize participation in governance.

"I don't think the number of voters is a metric that needs to be increased. Many people are asking: how do we get more people to vote? I don't know why this is something to look forward to. Governance is a highly specialized matter. In reality, is it worth pursuing to get more people to vote? Most people will make decisions without information. More importantly, it's about getting the tokens into the hands of those who care about it, who have higher credibility in knowledge and experience… For many, forming their own opinions and voting is unrealistic. Therefore, the best solution is to let them delegate or vote according to the opinions of their preferred representatives."

More complex delegation processes could help alleviate some of the power asymmetry issues in the Uniswap governance ecosystem. But for now, delegation seems to be an underutilized governance tool that has not fully integrated into Uniswap's culture. The "delegation proposals" topic on the governance forum is relatively inactive, with only 10 posts last year. a16z's token delegation plan may be the right direction, as it opens a formal channel for more actively participating community members to gain more voting power through it. More delegation opportunities and processes could make contributors interested in playing a more significant role more active. However, with more voting delegation comes greater responsibility. Participating in governance requires a significant amount of time, expertise, and social capital. Currently, there are not enough organizational structures or tools to make this process straightforward. This work is largely unpaid and lacks funding support. Some governance contributors pointed out the lack of incentives regarding delegation:

"I can be an LP; why should I delegate to others? I hold these governance tokens because I like Uniswap, and I believe this protocol has future value; they will do some great things. But none of this convinces me to delegate my governance tokens to others."

"If you could provide enough financial rewards to representatives, maybe that would make it feasible. This is also why people like me do not participate more—there are no incentives. I have a lot of voting power; so what? It's the important, controversial issues that would motivate me. I don't know if anything has happened in the past few months that felt super controversial or important. If there were enough incentives to make me spend 15 minutes writing an article, I might just go do it."

One respondent suggested introducing "meta-representatives" similar to political parties to incentivize representatives to participate and introduce a more inclusive governance approach.

"I propose encouraging organizations that comply with meta-governance to appoint themselves as representatives and start actively participating in governance. To some extent, this could be seen as a DeFi political party—I agree with this view. By supporting meta-representatives (meta-governance), the overall Uniswap governance model is further strengthened through a dual-factor governance process. Instead of allowing individual representatives to vote unilaterally on proposals, advocating for the participation of meta-representatives would provide a more nuanced and inclusive approach that truly reflects the community's demands."

Emerging Reasons for Obstacles

Slow Operational Decentralization

In the initial announcement of the UNI token, the governance layer was granted "direct ownership" of the community treasury. In early 2021, the Uniswap Grants Program (UGP) was established to promote funding for proposals related to ecosystem development. While the community can still vote on treasury-related matters, UGP essentially monopolizes the disbursement of funds. This six-person committee decides how millions of dollars are allocated. Of course, controversial proposals still need to be decided through governance mechanisms. But in an ideal world, the UGP committee would merely be one of many funding bodies within the Uniswap ecosystem. Other Internet and The Stable (a grant committee aimed at rewarding community contributors) are two early examples of this decentralized process, as they are both working groups under Uniswap's governance structure with the ability to allocate grants. It is not hard to imagine many other funding bodies, each with its own themes or focus areas. They might even compete with each other, stimulating more innovation within the ecosystem. As observed by two large token holders participating in governance:

"Better decentralization would require funding for more truly independent entities to achieve this. These entities could do different things or even similar things, as that is the true source of resilience in the system. I hope to see 5 UGPs funding different things, rather than just Uniswap Labs doing development and funding work. Funding is still a pretty good way to achieve goals."

"Beyond scaling, you could consider the funding program as an example of satellite teams. You could compare it to MKR, which spun off its core operational team into smaller units. IMO, it does the best job of governing a complex protocol."

The centralization of the funding program has been very helpful in the early stages of helping projects get off the ground. But now that it has gone through several waves, our investigation suggests that it may be time to consider breaking its monopoly on treasury expenditures and forming multiple funding programs focused on different areas. It is time for a major shift in funding.

Expansion of Governance Scope and Security Risks

Although Uniswap's governance was initially designed to be minimal, its governance scope has gradually expanded with the emergence of multi-chain deployment issues. As we observed in our previous report, governance mechanisms are being asked to make an increasing number of decisions that could threaten the network's security. For example, in a January 2022 blog post about multi-chain Uniswap, the Uniswap Labs team wrote: "When evaluating Uniswap v3 deployments, we encourage the community to closely monitor the security and trust assumptions of the cross-chain bridges used to convey governance to that chain." This expansion of governance scope brings new risks and contradicts the minimization spirit originally emphasized by Hayden Adams and Vitalik's proposal last year for a "non-governance" model (i.e., over time, governance has control over fewer and fewer functions).

In addition to the aforementioned governance "depth maximization" (seemingly simple governance proposals involve demands for governance structures and processes that require additional governance decisions), Uniswap governance is also easily affected by scope expansion because its functions are so unclear. The scope of governance is ever-expanding.

Since the expansion of governance scope is inevitable, clear processes are needed to handle these expanding responsibilities and mitigate risks. Any governance system, whether its purpose is minimization or maximization, requires auditing, proactive maintenance, and ongoing, targeted interventions to keep the governance system functioning properly. Minimizing governance at the protocol level does not necessarily mean minimizing approaches at the community and ecosystem levels. The scope of governance, including both on-chain and off-chain, is a process that must be continuously negotiated as the world surrounding Uniswap changes.

We should not forget that minimization is a means—not an end. It should not be pursued for the sake of minimization. The ultimate goal is not necessarily speed and efficiency, but safety. In Hayden Adams' words, this is precisely threatened by "new risks and trust assumptions that do not exist in immutable automated systems." The protocol currently uses a minimum threshold of voters passed by voting as a safety measure. The logic of this design is that if the threshold is high enough, no controversial proposals will be able to pass through the governance process. However, this "aristocratic security" is not an ideal way to safeguard the protocol. The design of governance power should make it practically operable and accepted by representatives and contributors. If the risk of a parameter is so high that a high voting threshold and whale veto power become necessary countermeasures, perhaps it should not be within the scope of governance in the first place. Illusory governance power, which can be overturned by whales in reality, often undermines the credibility and legitimacy of the entire governance system.

Lack of Accountability in Partnerships

In addition to security risks, facilitating interactions between Uniswap and other protocols through governance means that transactions negotiated through collaboration currently lack the possibility of enforcement.

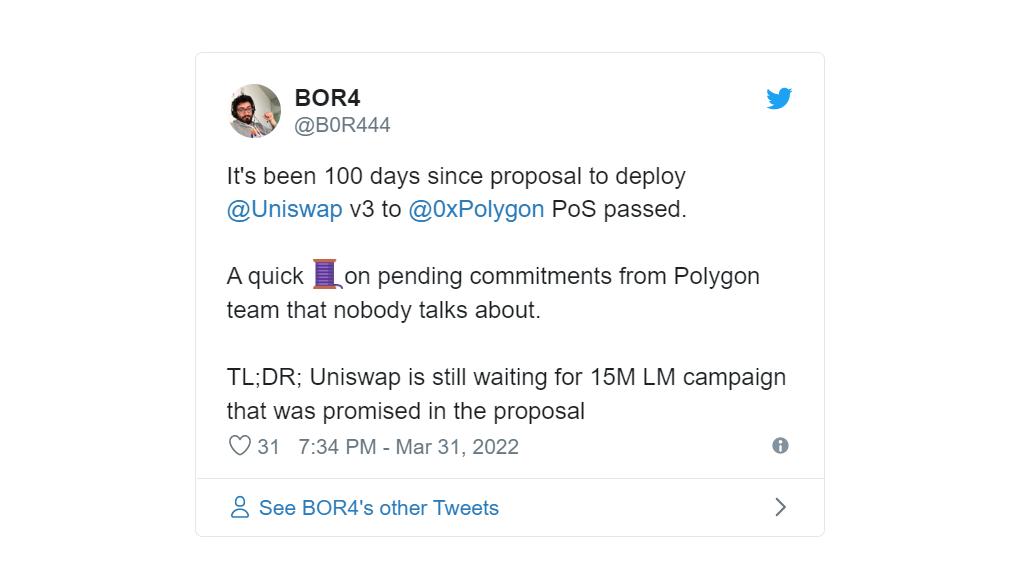

Uniswap's governance process, despite its technically minimal on-chain governance, remains very time-consuming. Because Governor Bravo—and the legitimate nature of the DAO—does not provide formal accountability or enforcement mechanisms for these proposals. This means that in Uniswap governance, proposals passed on-chain seem to create "binding" effects but cannot be enforced on-chain, let alone off-chain. The slowness of governance is frustrating because it involves social pressures, negotiations, and communication strategies, as we saw in the long-delayed liquidity mining incentive issue with Polygon:

Link: https://twitter.com/B0R444/status/1509494376606666752

Twitter: The proposal to deploy @Uniswap v3 to @0xPolygon has been pending for 100 days. Why is no one discussing the Polygon team's unfulfilled promise to resolve this issue quickly? TL;DR: Uniswap is still waiting for the $15M liquidity mining promised in the proposal.

The v3 authorization exemption process generated through governance also has issues of abnormal functioning and blind spots. While granting exemptions under commercial source licenses includes adding project names to a text record stored in v3-core-license-grants.uniswap.eth, there is no on-chain or legal avenue to enforce the financial and non-financial commitments promised when applying for additional usage funding through governance proposals.

A key question to consider is: does the lack of automated accountability mechanisms mean that on-chain collaborations are poorly designed—or that off-chain accountability solutions are inevitable? To what extent can these transaction mechanisms be fully automated?

DAO2DAO collaboration agreements offer a way to address some of these issues through on-chain escrow mechanisms. However, a degree of off-chain coordination is necessary to form cross-protocol partnerships and should be facilitated with appropriate processes and frameworks.

Conclusion: Developing Protocols Like a Gardener Cultivates Plants

The Uniswap protocol has been praised by many respondents for its elegance and governance minimization. But we see that human coordination issues cannot be eliminated. Because there were no processes in place at the start of Uniswap's gradual decentralization, governance work has become unsustainable in the eyes of many. It seems that the airdrop has transformed all the value generated by Uniswap for users into new costs for coordinating operational functions, which were managed by Uniswap Labs before the issuance of UNI.

Our interviews indicate that new redistribution mechanisms need to be established to balance the additional efforts required by the community, and some stakeholders have proposed ideas in this regard. One large holder suggested establishing incentive mechanisms for high-quality proposals, "as a different type of work from proposal/protocol update maintenance." A small holder and community contributor suggested setting up a "delegator bonus" as some form of LP token related to individual delegation amounts. Another forum contributor proposed the idea of "small-scale giveaways to all participants in governance." A protocol diplomat suggested that token design needs to be "more like gardening than architecture," and accordingly proposed ideas about token distribution:

"There is a view that community building is more like gardening than architecture, and I think token design could be the same. Some ideas around token distribution might involve rewarding governance proposals or voters in some way based on the success of proposals, with a budget of 1 million every six months to distribute UNI tokens to the final voters and proposers, encouraging more people to put forward proposals."

For a garden to thrive and bear fruit, it needs the right climate, soil composition, and cultivation techniques. Similarly, for a community to grow organically, appropriate processes and roles are needed to facilitate decentralized contributions and decision-making around these big issues. Based on our investigation, there are several core infrastructure areas that are crucial for the flourishing of the ecosystem surrounding Uniswap.

1. Formalizing off-chain processes and mechanisms in governance processes that cannot be fully automated. In cases where a proposal does not involve protocol changes or token transfers, consensus can be reached through off-chain means. The Uniswap Labs team has proposed simplifying governance processes, but this suggestion has yet to be implemented, which is a great irony regarding the current governance deadlock. While this is an important first step toward making the decision-making process more flexible and less burdensome, more effort is needed to create credible neutral processes to handle key areas such as partnerships and off-chain operations (i.e., establishing working groups or sub-DAOs) rather than addressing them on a case-by-case basis. To address these design issues in processes, as well as some of the urgent problems, we have established working groups in areas such as licensing and partnerships, as well as financial diversification.

2. Establishing multiple power centers independent of the core team. The delegation representative system is a governance tool that is currently underutilized but can be very helpful in bringing representatives of different interests into discussions for decision-making. Becoming a representative involves not only the quantity of governance tokens held by that person but also their analytical and interpersonal skills. If they do not inherently possess these skills, they need to learn them through practice. This is a time-consuming and energy-intensive task that should be appropriately rewarded. Only a few representatives actively participate in discussions on the forum, and those who respond actively are, in some cases, precisely the protocol diplomats. This is not a coincidence. They have the skills, internal motivation, and ecosystem interests to make informed decisions for the benefit of the protocol. However, for a truly thriving Web3 ecosystem that has positive externalities in the real world, there needs to be a greater diversity of multi-layered interest representation, including protocol contributors, DAO workers, LPs, and perhaps even local communities connected to Uniswap. Other Internet is collaborating with Orca Protocol to organize a governance summit, where emerging protocol politicians will pair with real-world governance experts to learn from each other and exchange ideas to tackle these challenging organizational issues. Another core part of the decentralization dilemma may be establishing a "procurement team" to articulate the needs of the Uniswap DAO to the Web3 community. As the possibilities for collaboration and the scope of governance expand, having a dedicated team to secure resources for the maintenance and development of the protocol may be useful, especially in these initial stages of Uniswap's decentralized operations. Other Internet is fully capable of helping to fill this role.

For more information about our ongoing interventions and our approach to Uniswap governance, the decentralized environment benefits from redundancy and parallel experimentation, and our analysis indicates that there are many areas in the Uniswap ecosystem that still require support.

For this reason, we are also sharing our own improvement ideas for adoption by the Uniswap community. After completing these interviews, we generated a series of suggestions that we believe would benefit Uniswap. If you are interested in implementing any of these, please contact us. We will provide support and sponsorship throughout the proposal process.

Read our governance intervention form:

https://otherinternet.notion.site/b4420c8c4c32448292a894bd91b2c3b0?v=223784034b194db8aceede5b262b6934