How does Paradigm's newly proposed GOO (Gradual Ownership Optimization) work?

Original Title: “GOO (Gradual Ownership Optimization)”

Authors: Dave White & Frankie, Paradigm

Compiled by: Biscuit, Chain Catcher

Today, Paradigm research partner Dave White and research assistant Frankie proposed the Gradual Ownership Optimization model (GOO) to address the challenges of distributing fungible tokens for NFT projects. Below is a compilation and organization of parts of the article by Chain Catcher.

Currently, there are two main ways NFT projects issue fungible tokens:

- Airdrop. At a specific point in time, all NFT holders receive fungible tokens proportional to the number of NFTs they hold.

- Constant Release. Over time, each NFT holder receives a constant number of tokens.

One method of constant release is staking, where NFT holders lock their NFTs in a smart contract and receive a certain number of tokens daily.

Another similar method to constant release is Play to Earn, where users who own or have access to designated NFTs can play games and earn a certain number of tokens daily.

In both cases, the number of people holding NFTs may differ significantly from the number of people holding fungible tokens over time.

In the case of airdrops, some users may choose to sell only their NFTs while others may choose to sell only their tokens, leading to a mismatch in the ownership of tokens and NFTs for the entire project, with no force to restore consistency.

In the case of constant release, since fungible tokens are issued at a constant rate, the proportion of newly issued tokens in the total supply becomes smaller over time, making it impossible for the ownership represented by NFTs and fungible tokens to restore consistency. Additionally, regardless of how many fungible tokens a user holds, there is no incentive to match them with a corresponding number of NFTs, and vice versa. Once a divergence occurs between the groups of NFT and token holders, there is nothing to realign their relationship.

GOO Solution Use Case

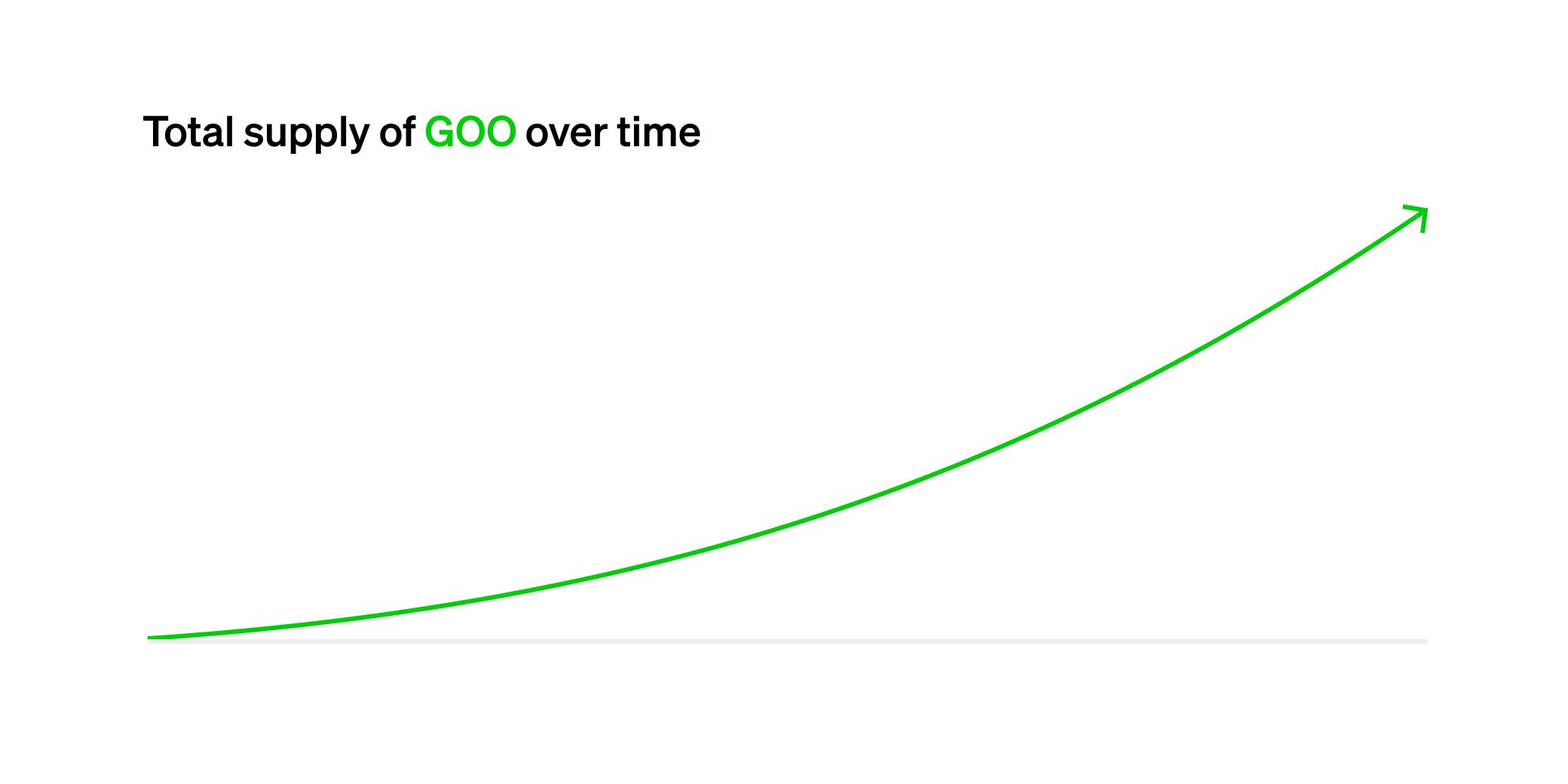

The upcoming NFT project Art Gobblers will issue an ERC-20 token called Goo. The more Goo a Gobbler NFT holder owns, the faster they generate Goo. This means the total supply of Goo is increasing daily, from thousands to millions or more.

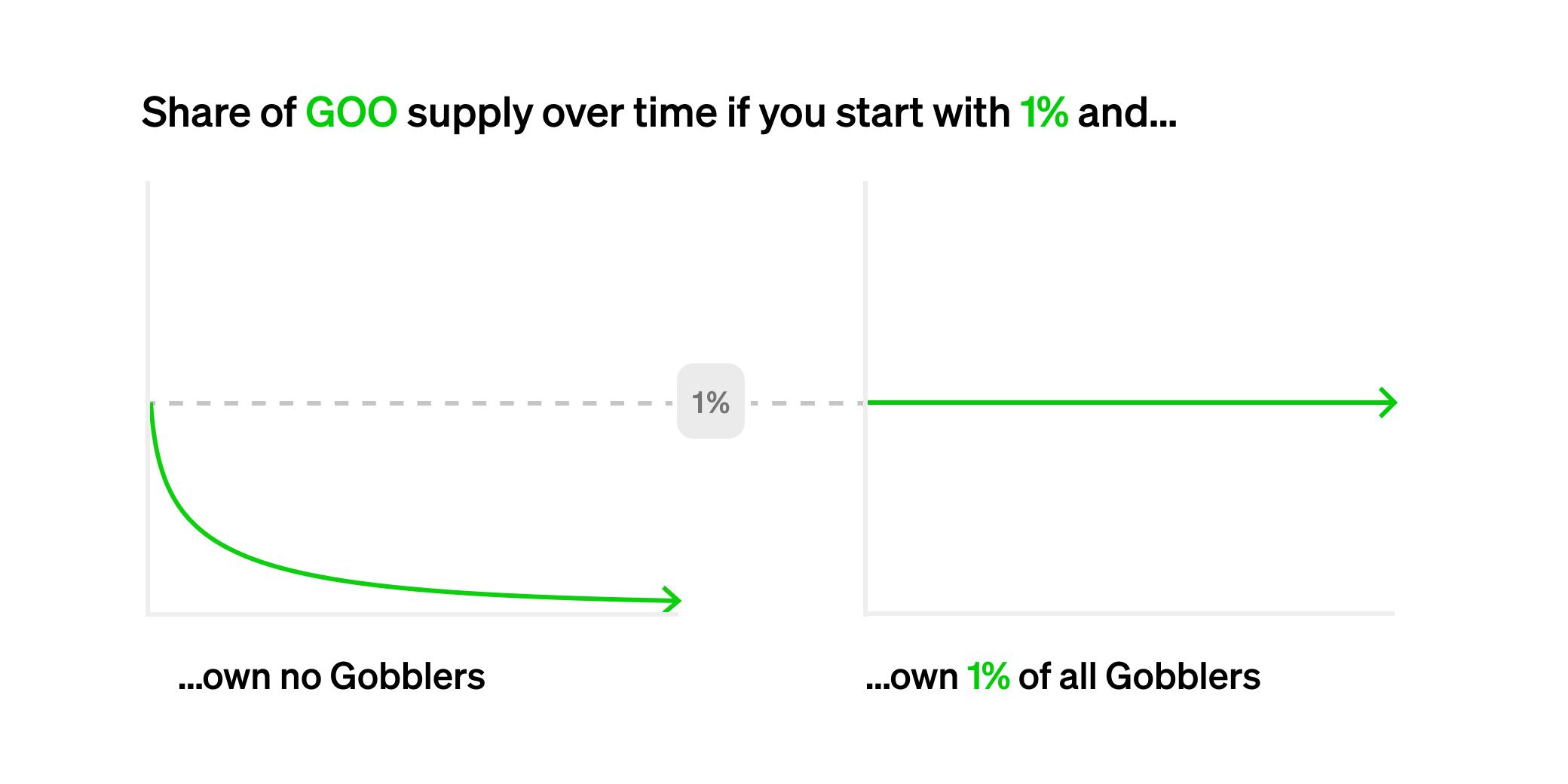

For users who do not hold any Gobbler NFTs, hoarding Goo is a very poor strategy, as others will acquire Goo much faster, and the non-holders' share of the total supply of Goo will quickly diminish to zero. On the other hand, if a user holds multiple Gobblers NFTs but only has a small amount of Goo, their Goo production will lag behind other players.

Assuming a user holds a Gobbler NFT and their total Goo production capacity accounts for 1% of the total, as long as that user never removes their NFT and Goo, they will always receive at least 1% of the total supply of Goo. This ensures that NFT holders can maintain control over their share of Goo in the long term.

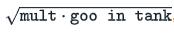

Mathematically, the initial issuance of Goo is equal to:

A single Gobbler NFT has a mult multiplier representing the base acquisition rate of Goo. We use differential equations to automatically combine the issuance of Goo over time, and if a user holds multiple Gobblers, it will also automatically balance the issuance of Goo among them.

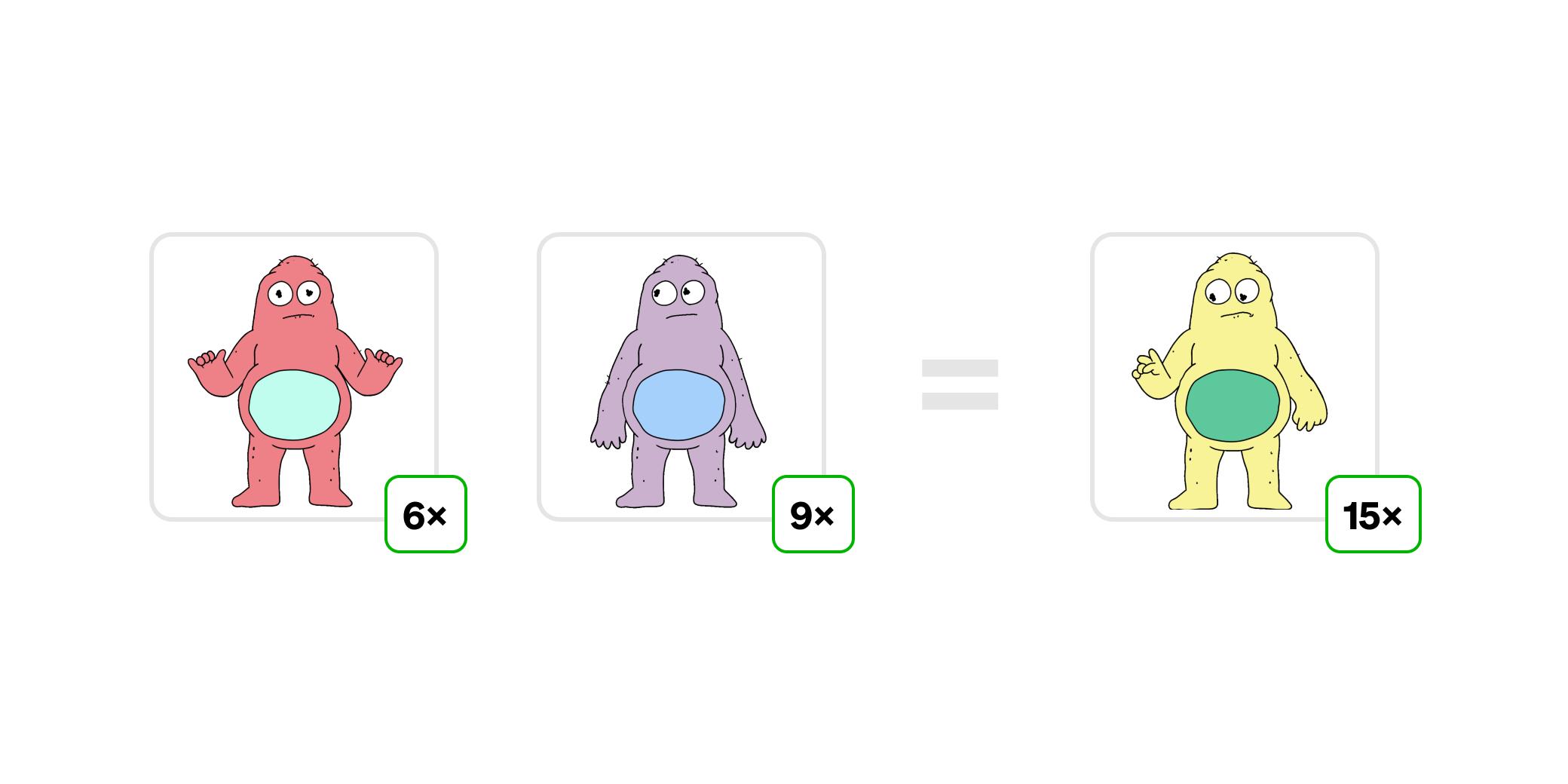

There are some very interesting mathematical operations in this system, which show that if multiple Gobbler NFTs have a total mult multiplier equal to that of a single Gobbler NFT, then they acquire Goo at the same rate. This means players can enhance their competitiveness by acquiring more Gobblers, keeping the game fair.

Although designed for Art Gobblers, this mechanism is applicable to any NFT ecosystem with fungible tokens. It keeps NFT and token holders aligned while ensuring the priority importance of the NFTs themselves.

GOO Mechanism Overview

All Art Gobbler NFT addresses will map Goo to a Goo container associated with that account. The owner of that address can add or remove Goo from the container at any time.

The rate at which Art Gobblers acquire Goo is proportional to the square root of the Goo in their container. Each Gobbler has its own mult multiplier that describes the base acquisition rate of Goo.

We use differential equations to automatically compound this token issuance model, finding that the issuance of Goo expands quadratically over time, but still much slower than the exponential growth common in most token staking schemes.

Because when a user's Gobbler is held in proportion to Goo, Goo is in an optimal issuance state, which is a good incentive for users to hold Goo and Gobblers in proportion. Since the total emission of Goo is continuously increasing, these incentives remain strong regardless of the current issuance of Goo.

Final Thoughts

We have open-sourced the GOO scheme on GitHub (transmissions11/goo-issuance), and we welcome developers to adopt the highly optimized, production-ready, and permissive (MIT) GOO scheme.

GOO is designed for Art Gobblers, but we believe it is applicable to various NFT projects and on-chain games. If you want to issue fungible tokens from NFTs while ensuring that users hold NFTs and tokens in roughly proportional amounts, GOO may be suitable for you.