Annual Review: 2022 Ethereum Highlights

Author: Stephanie/Franci, ECN

As 2022 comes to a close, looking back over the past year, the Ethereum community has experienced both hardships and joys. We may have felt anger and frustration in the face of repeated black swan events; perhaps we watched merge parties with like-minded friends; maybe we attended Devcon VI in Bogotá to experience this long-awaited event in person, or followed every exciting speech online; we might have been amazed by the technological innovations birthed by the community; or we may have been inspired by the revolutionary ideas of DeSoc…

There were simply too many unforgettable moments in 2022, leading us to make some selections during our material gathering. In this 2022 Ethereum annual review article, we have chosen 9 events and topics that are most worth recording, summarizing them in hopes of providing some memorable points for everyone as they reflect on 2022. Besides the events summarized by ECN, what unforgettable memories do our readers have? We welcome you to share with us~

Ethereum Merge

At 14:42 Beijing time on September 15, the Ethereum merge was successful. After 8 years of exploration, research, and testing, Ethereum finally transitioned from a PoW consensus mechanism to PoS. It is hard to argue against the statement that the Ethereum merge was the most significant event for Ethereum in 2022.

The Ethereum merge is epoch-making.

From the perspective of implementation difficulty, it was the most complex upgrade in Ethereum's history, resulting from the collaboration of 9 independent client teams across the consensus layer (Prysm, Lighthouse, Teku, Nimbus, and Lodestar) and the execution layer (Geth, Nethermind, Besu, and Erigon). It was achieved through "hot swapping" while Ethereum continued to operate.

In terms of its significance for Ethereum itself, the merge made Ethereum more secure, more sustainable, and laid the groundwork for future scalability. Although there is no consensus in the cryptocurrency world on whether PoW or PoS is more secure, based on the research and understanding of these systems by the Ethereum Foundation's research team, as well as their knowledge of various attacks, they believe PoS is more secure. What is largely undisputed is that the shift to PoS reduced Ethereum's energy consumption by over 99.95%, removing a significant obstacle to Ethereum's entry into the mainstream world, making applications like NFTs, DAOs, and DeFi more accessible to the general public. Additionally, adopting PoS architecturally lays the necessary foundation for future sharding scalability on Layer 1.

After the Ethereum merge, the next major upgrade for Ethereum will focus on improving its scalability.

Sharding Solutions Mature

Sharding is seen as the future of Ethereum's scalability. According to Vitalik, sharding is key to enabling the Ethereum ecosystem to achieve thousands of transactions per second. The Ethereum community has been discussing sharding since 2013, and the sharding proposal has undergone multiple revisions. In 2022, with the introduction of the Danksharding proposal, the path to sharding for Ethereum became clear and feasible.

The most well-known version of Ethereum's sharding proposal was presented at a seminar in Taipei in 2018, where researchers and core developers from the Ethereum Foundation unified their research on proof of stake and sharding into a three-phase "Ethereum 2.0" roadmap:

- Phase 0 brings the Beacon Chain

- Phase 1 adds data sharding

- In Phase 2, virtual machines are added to each shard to enable computation within the system.

The number of shards initially set at 100 was later increased to 1024, and then reduced to 64 in this version of the roadmap.

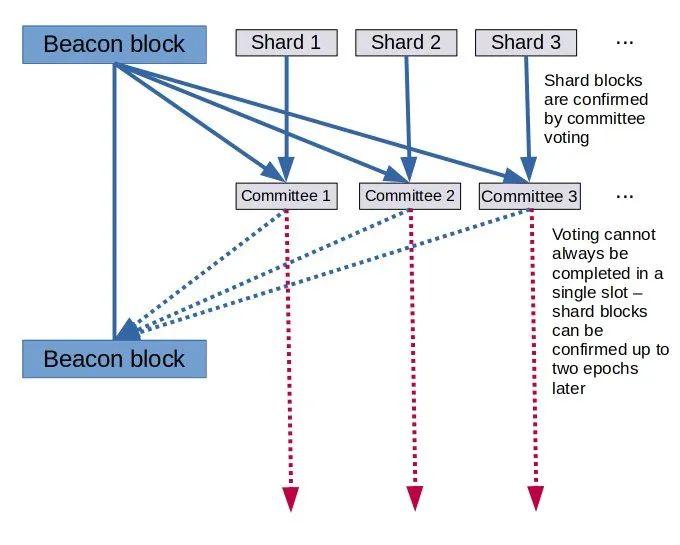

The sharding mechanism in this version of the roadmap refers to horizontal partitioning of the database, meaning each shard chain has a subset of nodes working on that chain. Each of the 64 shard blocks has its own proposer and a committee composed of randomly assigned validators from the validator pool, who independently verify the available shard data. In this design, all shards cannot achieve complete verification, and each proposer has the ability to disrupt the entire process. Additionally, shuffling validators between shards is quite complicated. Moreover, unless very strict synchronization assumptions are introduced, it is difficult to ensure that voting can be completed within a single slot.

Clearly, there are still many unresolved issues to achieve execution sharding in "Ethereum 2.0" Phase 2. At the end of 2020, Vitalik published an article titled "What Would a Rollup-Centric Ethereum Roadmap Look Like?", which mentioned that in the long term, under a rollup-centric Ethereum roadmap, when everyone moves to rollups, Ethereum's TPS could reach about 3000, and when rollups transition to shard chains for data storage, Ethereum's theoretical maximum TPS could reach 100,000. This means that the path to eth2 could end at Phase 1.5, allowing the Ethereum base layer to focus on two things—consensus and data availability. Furthermore, sharding data availability is much safer than sharding EVM computation.

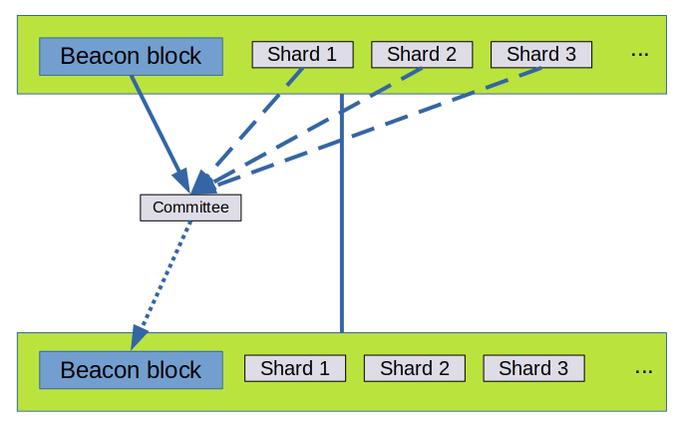

In this context, after a year of exploration, Ethereum Foundation researcher Dankrad Feist proposed a new sharding scheme at the end of 2021. This proposal gained attention and recognition from the community in 2022, and to distinguish it from the old sharding scheme, the new sharding proposal was named Danksharding. Danksharding is based on two new research advancements—PBS and crList, which aim to address MEV and censorship issues. Unlike previous sharding proposals, the Danksharding scheme has only one proposer selecting all transactions and data entering that slot, making the integration of Layer 1 and rollups tighter and significantly simplifying the original sharding proposal.

In 2022, the Ethereum community made significant progress in the research and development of Danksharding. Vitalik and other researchers proposed proto-danksharding (i.e., EIP-4844), which is a proposal that introduces most of the logic and scaffolding needed to implement the complete Danksharding specification, primarily introducing a new transaction type—transactions carrying blobs.

In addition to the work of implementing the merge, client developers in 2022 also focused on implementing proto-danksharding in the second half of the year. Currently, EIP-4844 has specifications for both the execution layer and consensus layer, and two developer testnets have been launched. The KZG ceremony required for the implementation of EIP-4844 has launched a public contribution test site, with the official version set to go live in the new year of 2023.

According to the last AllCoreDevs meeting of 2022, EIP-4844 will be included in the next Cancun upgrade of the Shanghai upgrade.

Related Reading:

《Revealing the Advantages of "Sharding" from a Technical Perspective》

《Rollup-Centric Ethereum Roadmap》

《A Significantly Simplified New Sharding Design》

《Vitalik: Proto-Danksharding FAQ》

The Collapse of FTX, the Second Largest Centralized Exchange in the World: What Happens to User Asset Security?

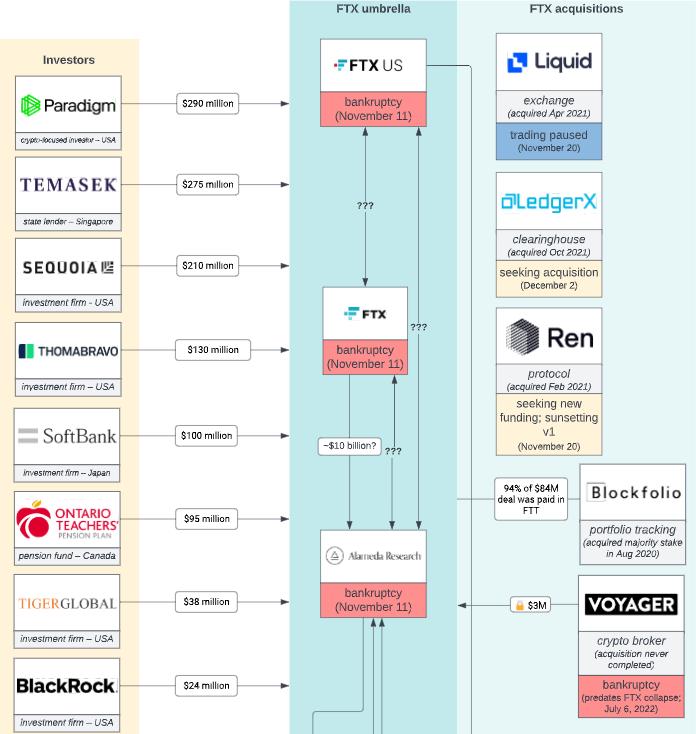

On November 11, the world's second-largest centralized cryptocurrency exchange, FTX, announced bankruptcy, plunging the entire blockchain ecosystem into a complex mix of shock, anger, and sadness. With an asset shortfall of up to $8 billion, countless users and some associated institutions lost everything. The rapid and dramatic evolution from the exposure of the event to the final announcement of bankruptcy left many affected users unable to digest the successive revelations and respond before FTX suddenly restricted user withdrawals.

What was the sequence of events? Initially, on November 2, CoinDesk revealed in a news report that Alameda Research, a cryptocurrency quantitative trading company co-founded by SBF, had a balance sheet showing that a large portion of its $14.6 billion in assets consisted of FTX's issued platform token FTT or assets borrowed against FTT as collateral. The community's discussion of this revelation intensified, and the involvement of Binance founder CZ made the situation appear more like a confrontation between two forces. Subsequently, FTX was unable to withstand user withdrawal pressure, fell into a liquidity crisis, halted user withdrawals, and announced bankruptcy… On December 13, SBF was officially arrested in the Bahamas and later extradited to the United States to await trial, temporarily bringing this farce to a close.

Here, we have only recounted the FTX incident itself, but the domino effect triggered by this black swan event is even more tragic and still has many undisclosed aspects. Crypto researcher Molly White created a diffusion relationship chart for FTX, showing the financial relationships between FTX and various institutions.

cr: mollywhite.net (excerpted some)

Asset security is an ever-present topic in the blockchain field, and 2022 was a year of numerous disasters for on-chain and off-chain users: frequent cross-chain attack incidents, the collapse of Luna-UST, the failures of Three Arrows Capital and Celsius… The collapse of FTX is undoubtedly the most unbelievable black swan event of the year. Clearly, the fundamental reason for FTX's failure was the misappropriation of user assets, leading to insolvency. Before this incident was disclosed, it is likely that few would have believed such a thing could happen to the world's second-largest exchange, FTX. This has sounded an alarm for the entire crypto circle: how to ensure the security of user assets?

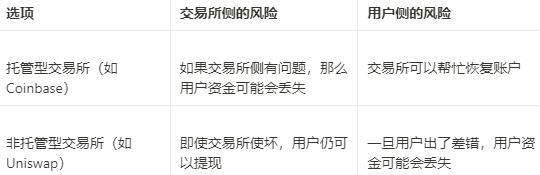

If we consider the degree of asset custody as a spectrum, the two ends of the spectrum are fully custodial CEX and non-custodial DEX. Both custody methods have their own advantages and disadvantages:

cr: vitalik.ca

Of course, we can do much more than simply choosing between CEX and DEX; there are still a series of options in the middle of the spectrum waiting for us to explore and develop.

Vitalik wrote an analysis on how to make centralized exchanges safer. In this article, we can see more possibilities for exploring centralized exchanges: proof of solvency realized using cryptographic techniques like Merkle trees or even ZK-SNARK, research directions for non-custodial centralized exchanges…

By introducing account abstraction (Account Abstraction) and multi-party computation (MPC) technologies, we can achieve wallet social recovery, Web2 social media account logins, and other functions, further improving the user experience of decentralized asset custody solutions.

For a long time to come, centralized exchanges and decentralized exchanges will continue to coexist, and the technology and research of both solutions should progress in parallel, filling the middle of this asset custody spectrum with more possibilities.

Related Reading:

《Building a Secure Centralized Exchange ------ Proof of Solvency and More》

Emerging DeSoc

People in the Ethereum community in 2022 have certainly heard of SBT (Soulbound Token), which appeared in various hackathon projects, fundraising news, and analyses related to Web3 digital credentials and identity systems…

This wave of enthusiasm originated in mid-May 2022 when Vitalik, along with lawyer Puja Ohlhaver and economist E. Glen Weyl, published the paper "Decentralized Society: Finding Web3's Soul." This paper pointed out various problems existing in the current Web3 world, where witch attacks and collusion are rampant in the virtual world, and only transferable assets prevent the DeFi ecosystem from supporting even the most mundane activities in the real economy. The Web3 world faces issues such as hyper-financialization, wealth concentration, and governance being susceptible to financial attacks.

The authors of the paper believe that the lack of a Web3 native identity is key to these problems, thus proposing two Web3 primitives: SBT and Soul (the account or wallet for "soulbound tokens"). SBT refers to tokens stored in Soul that are publicly visible, non-transferable (but may be revoked by the issuer), representing commitments, credentials, and affiliations, while Soul is the account or wallet that holds SBTs. They hope that under the identity paradigm formed by SBT and Soul, Web3 can move towards a decentralized society (DeSoc) characterized by co-decision-making, soul, and community-driven collaboration.

Once the paper was released, it became a hot topic in the community, leading to numerous explorations of SBT and Soul implementations. Currently, several SBT standards have been proposed in EIPs, some in Draft, Review, or Final stages. As of November 2022, two ERCs are in the Final stage—ERC-5192 "Minimal Soulbound NFTs" and ERC-5484 "Consensual Soulbound NFTs." Both ERCs have non-transferability as their core feature, differing in that ERC-5192 adds additional technical parameters to detect the state of transferability, while ERC-5484 focuses on mutual consent between the issuer and the recipient. Other EIPs include:

- EIP-4671: Non-Tradable Tokens Standard (Draft)

- EIP-4973: Account-bound Tokens (Review)

- EIP-5114: Soul Badge (Draft)

- EIP-5727: Semi-Fungible Soulbound Token (Draft)

- EIP-5516: Soulbound Multi-owner Token (Review)

- EIP-5633: Composable Soulbound NFT, EIP-1155 Extension (Draft)

In addition, projects, platforms, and protocols related to Web3 digital credentials, identity systems, and reputation systems have also attracted attention and investment from the community.

In 2022, various teams and enterprises in the Ethereum community participated in building the DeSoc ecosystem. Although we cannot yet say we see the prototype of DeSoc, this ecosystem is vibrant and is expected to achieve breakthrough progress in 2023!

Related Reading:

《Decentralized Society: Finding Web3's Soul》

Zero-Knowledge Proofs Gain Attention, ZK-EVM Competition Heats Up

When discussing the strongest cryptographic technologies that have emerged over the past decade, one cannot avoid mentioning zero-knowledge proofs (ZKPs). In the blockchain field, they have two major application scenarios: scalability and privacy.

At the opening ceremony of Devcon VI on October 11, a panel titled "What You Should Know About Zero-Knowledge" was held. Vitalik, one of the guests, stated, "I believe ZK is a natural complement to blockchain. The reason I say this is that I feel the censorship resistance provided by blockchain comes at the cost of sacrificing two very important properties: scalability and privacy. ZK-SNARKs are tailor-made technologies for these two properties."

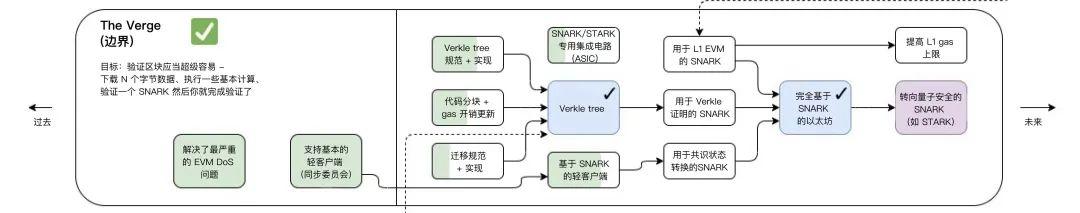

The importance of ZK-SNARK/STARK to the Ethereum protocol layer was reflected in the roadmap updated in November this year.

cr: @VitalikButerin (Chinese translation version)

In this part of the work (The Verge), the ultimate goal is to introduce a trustless or minimally trusted node solution (making light clients feasible), making block verification a super simple task. All of this is based on zero-knowledge proof technology. In the roadmap, achieving a fully SNARK-based Ethereum requires the following three milestones:

- SNARK for Verkle proofs;

- SNARK for consensus state transitions;

- SNARK for L1 EVM.

Additionally, since the beginning of this year, there has been fierce competition in the ZK-EVM solutions for Ethereum scalability, which can be roughly divided into four types of ZK-EVM.

- Type 1: Fully Ethereum-equivalent ZK-EVM (Privacy and Scaling Explorations team, Taiko)

- Type 2: Fully EVM-equivalent ZK-EVM (Scroll, Polygon Hermez)

- Type 3: Nearly EVM-equivalent

- Type 4: High-level language equivalent (ZKSync, StarkNet)

Notably, the zk proof outsourcing and decentralized proof network proposed by Scroll will bring a new research direction and hardware market for "proof generation" hardware acceleration. It is believed that general-purpose ZK-EVM solutions will shine brightly next year.

Related Reading:

2022 Updated Ethereum Roadmap

Compliance and Decentralization of MEV-Boost

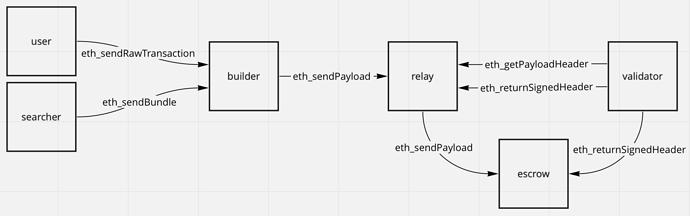

In 2021, Vitalik and researchers from the Ethereum Foundation proposed a specific design for the proposer/builder separation scheme (PBS) to address the MEV issue. In November of the same year, the Flashbots team proposed MEV-Boost based on the PBS design for the post-merge Flashbots architecture, which can be seen as a prototype of PBS. The Flashbots auction architecture allows validators to outsource block construction to a third-party block builder network, but places the mev-boost relay in a trusted position—both block builders and proposers need to trust the relay.

In early September 2022, the Flashbots MEV-Boost relay went live, connecting validators post-merge, allowing them to earn MEV profits in addition to validator rewards.

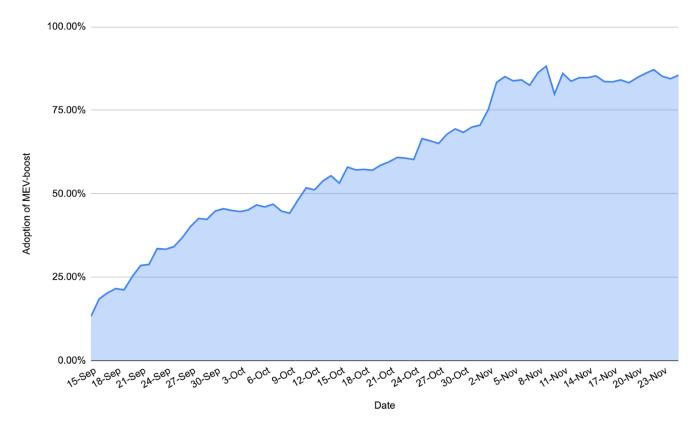

Adoption rate of mev-boost, source: https://dune.com/queries/1279670/2192739

As seen in the above chart, after the merge, the adoption rate of mev-boost by validators climbed to nearly 90%. Worryingly, in August of this year, OFAC (Office of Foreign Assets Control of the U.S. Treasury) sanctioned Tornado Cash, which undoubtedly brought a chilling effect on crypto industry enterprises. Even before the launch of mev-boost, Flashbots stated that "Flashbots' relays and builders currently and will continue to comply with OFAC regulations." This means that validators using Flashbots' mev-boost relay on Ethereum are engaging in censorship.

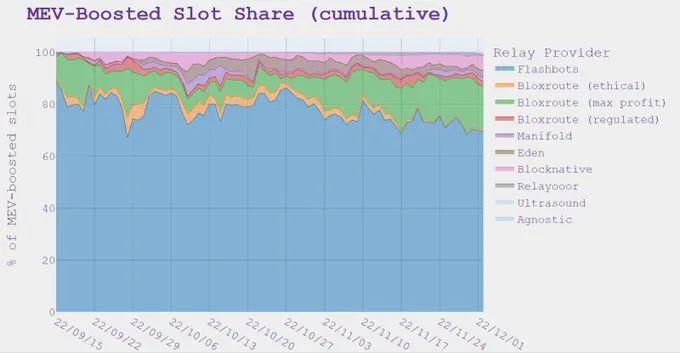

After the September merge, the proportion of Flashbots relays reached 84%, introducing a critical centralization crisis to Ethereum's infrastructure. Fortunately, to promote the Ethereum network's development in a healthier direction, the Flashbots team has open-sourced MEV-Boost, sync-proxy, and the block builder API. As more teams join the competition in the MEV ecosystem, including relays that explicitly state they will not engage in censorship, the proportion of Flashbots relays decreased to below 80% by December.

Additionally, the Flashbots team announced the SUAVE (Single Unified Auction for Value Expression) plan in late November to promote the decentralization of MEV. SUAVE decouples the roles of transaction pools and block builders from the existing blockchain, providing a highly specialized and decentralized plug-and-play option, allowing block builders to share the same ordering layer.

Although the centralization crisis and censorship issues brought by the Flashbots MEV-Boost relay still loom over the Ethereum community, the diversification of the MEV ecosystem is gradually improving. The Flashbots team has launched plans to promote MEV decentralization, and the protocol-level PBS that better addresses MEV issues will continue to be advanced next year.

Related Reading:

《Flashbots Architecture for the Merge: MEV-Boost and Its Implementation Plan》

《Fee Market Design Friendly to Proposer/Builder Separation》

《Vitalik: Two Slot Proposer/Builder Separation Scheme》

Optimistic Rollup Solutions Open the Era of L222 Ecological Applications

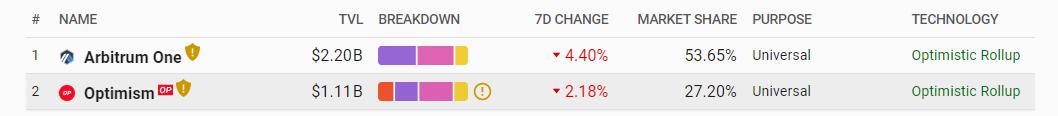

Although many L2 solutions launched their mainnets in 2021 or even earlier, 2022 marked the year of the explosive growth of the general-purpose L2 technology ecosystem and applications. As of December 31 this year, the total locked value in L2 has exceeded $4 billion.

cr: l2beat.com/scaling/tvl

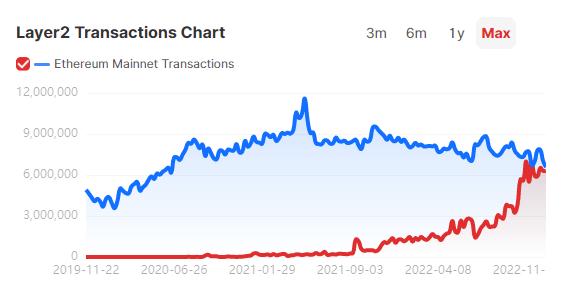

User interaction activity on L2 is gradually leveling with that of the Ethereum mainnet. The following chart is from Orbiter Finance L2 Data: the blue line represents the number of transactions on the Ethereum mainnet, while the red line represents the number of transactions on L2.

cr: orbiter.finance/data

Among the L2 solutions that make up these data, the two mainstream solutions using Optimistic Rollup technology, Arbitrum and Optimism, account for approximately 80% of the total share.

cr: l2beat.com/scaling/tvl

Arbitrum opened its public mainnet beta version and lifted the whitelist on September 1 last year. This year, Arbitrum underwent two major updates:

- Launched the iterative version Nitro of Arbitrum One, further improving the original version in various aspects, including providing higher efficiency, lower latency, stronger liveness guarantees, and better compatibility.

- Launched the off-chain data availability solution Arbitrum Nova based on AnyTrust technology to meet the scalability needs of certain applications (such as the gaming industry), but this also introduces additional minimal trust assumptions.

Optimism officially removed whitelist restrictions on December 17 last year, allowing permissionless deployment. In terms of protocol development, this year Optimism mainly focused on cost optimization upgrades, reducing transaction fees by at least 40% to improve user experience; launched the testnet for the next iterative version Bedrock, which will introduce the next-generation fraud proof system Cannon. In governance, Optimism has also made some innovations: it released the OP token, introduced the Optimism Collective, and established the Optimism Foundation. Optimism is governed jointly by the Optimism Foundation (an organization registered in the Cayman Islands) and members of the Optimism Collective. The Optimism Collective is governed by two houses: the Citizens' House and the Token House.

- The Token House was established through a token airdrop, creating the first batch of community members. OP token holders will be able to vote on protocol upgrades, project incentives, governance funds, and more.

- The Citizens' House will advance and govern the allocation process of retrospective public goods fundraising, with the funds raised collected from the network's profits. Citizenship will be granted through "soulbinding" (distributing NFTs), and as the Optimism community grows, the citizen group will continue to expand. The Citizens' House is a mechanism that shifts power from any centralized organization to a more individual-centered, non-corporate group.

Next year, in addition to updates and iterations of the protocol's performance itself, Optimistic Rollup and the entire Rollup ecosystem solutions will explore and practice more in the direction of Rollup decentralization. Ethereum co-founder Vitalik Buterin first proposed strengthening the Rollup system using multi-prover mechanisms at the Rollup Day event hosted by Scroll on October 11, and later posted on the Ethereum Magicians forum proposing "removing the three phases of rollup auxiliary wheels." These basic principles provide important ideas for the decentralized innovation and practical exploration of rollups.

Related Reading:

《Strengthening the Rollup System Using Multi-Prover Mechanisms》

《Removing the Three Phases of Rollup Auxiliary Wheels》

Tornado Cash Sanction Incident and Regulatory Storm

On August 8, the U.S. Treasury's Office of Foreign Assets Control (OFAC) sanctioned the virtual currency mixing platform Tornado Cash. The sanctions stipulate that any U.S. citizen, resident, or company engaging in trade, economic transactions, or "other transactions" with individuals, companies, and countries on the sanctions list (including Tornado Cash) will be considered illegal under U.S. federal law and may face hefty fines and imprisonment.

In an instant, discussions in the community about "what the OFAC sanctions mean" emerged one after another. Especially as Ethereum was about to transition from PoW to PoS consensus, the impact of the Tornado Cash sanctions on the post-merge Ethereum PoS mechanism sparked widespread discussion in the community: for Ethereum's U.S. miners and validators, if they generate (or validate) Ethereum blocks containing one of the Ethereum addresses on the SDN list, would that violate OFAC sanctions?

At that time, it was pointed out that it seemed that over 66% of Beacon Chain validators would comply with OFAC sanctions. (Validators from Lido, Coinbase, Kraken, Staked, and Bitcoin Suisse accounted for over 60%) This could lead to censorship behavior at the base/protocol layer.

Subsequently, in an All Core Devs meeting on August 18, Ethereum core developers discussed "how to respond to censorship attacks on the network." Developer @tkstanczak expressed that ideally, he would prefer to see responses to these issues occur at the social level rather than the protocol level. Marius emphasized that although it is difficult to get teams/organizations to commit, individual voices are also important. He stated that resisting censorship is a hill he personally stands on, and if Ethereum cannot achieve censorship resistance, he would leave Ethereum.

Previously, in a vote initiated by @ercwl targeting the Ethereum community: if most stakers choose option A in the vote, what would you do:

X) View censorship as an attack on Ethereum and expel these nodes from the network through Ethereum community consensus

Y) Allow censorship

Vitalik stated that he supports option X.

Censorship resistance is undoubtedly a long-term issue that the Ethereum community needs to think about and solve. Fortunately, in the face of different levels and types of censorship, the Ethereum community already has response plans at least in the research stage, such as PBS, MEV-Smoothing, and encrypted transaction pools written into the protocol layer. In addition to Ethereum's core developers, the work of resisting censorship also requires active participation from various teams in the Ethereum ecosystem.

Bogotá Devcon

After Devcon V held in Osaka, Japan in 2019, Devcon VI was finally held again in Bogotá, Colombia, South America, on October 11, 2022, after being affected by the pandemic.

Devcon is the only annual conference hosted by the Ethereum Foundation and is the largest event in the Ethereum community. This long-awaited Devcon VI welcomed unprecedented grandeur, receiving over 1200 speaker applications. During the four days of Devcon, 60,000 people worldwide watched the live stream, with over 20,000 viewers on the first day alone. This year's Devcon theme was no longer limited to technology; new themes such as "Opportunities & Global Impact" and "Governance & Collaboration" were added, with "Opportunities & Global Impact" becoming the most popular theme category. Representatives from UNICEF (United Nations Children's Fund) and the Internet Archive also spoke at Devcon VI, showcasing Ethereum's increasingly evident influence in helping the "real world" overcome "cross-cultural, ethnic, and economic disparities."

The 2022 Bogotá Devcon was undoubtedly a carnival for the global Ethereum community, where everyone gathered to collaborate and share knowledge, communicate and generate new ideas, strengthen the Ethereum community, and have fun, leaving a deep impression on every participant present.

So, where will Devcon VII be held in 2023? Let's take a look at the candidate list: https://forum.devcon.org/c/devcon-7-location-suggestions/14