Fantom founder AC: "DeFi is dead" is not the truth, "no new narrative" may be a good thing

Author: Andre Cronje

Compiled by: Katie Gu, Odaily Planet Daily

A journalist asked me the following question:

"High yields are long gone, and DeFi has seen almost zero growth since Terra. We want to know what the next step for DeFi will be? Much of the discussion has focused on bringing real-world assets (RWA) onto the blockchain, such as investing in U.S. Treasury bonds and securities through DeFi and on-chain credit. But I'm not sure about its sustainability; the topic of RWA has been around for a long time, and it's clear that there were reasons it didn't work in the past."

This article is my response to that question.

Is DeFi Dead?

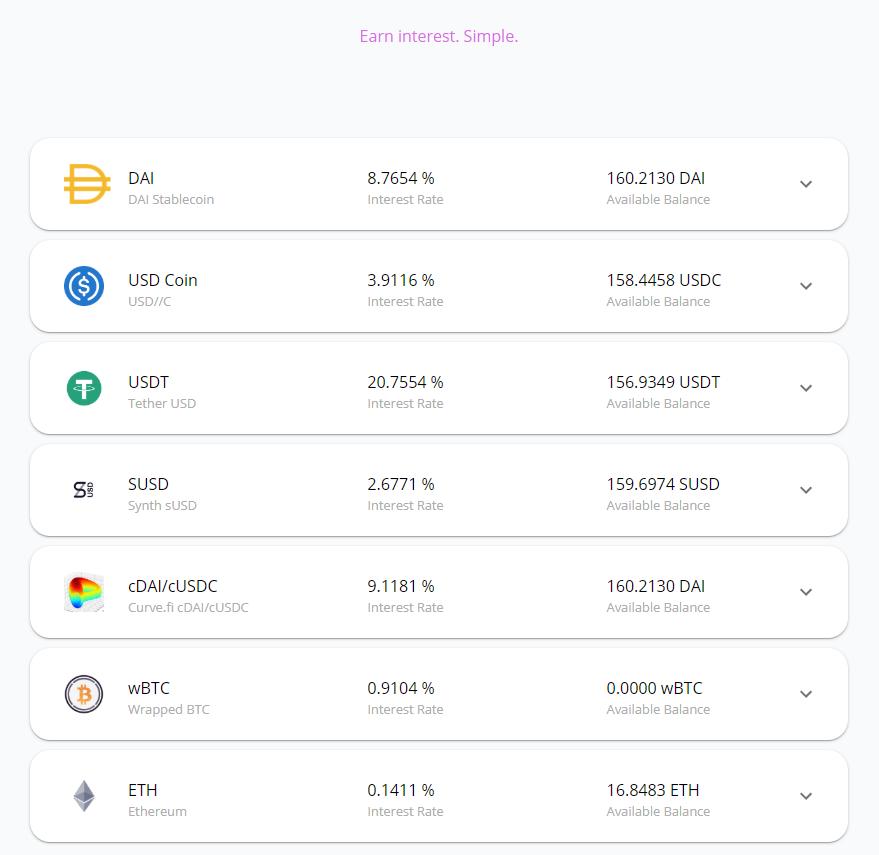

Yearn dashboard data as of February 5, 2020.

Above is the original dashboard data from Yearn. At that time, DAI had a DAI Savings Rate (DSR), providing about 7% in subsidies through high rates, while the actual DAI yield was between 1% - 2%. USDC was around 4%. USDT was at its peak of FUD, with many shorting it, but typically USDT would hover around 2% - 4%. SUSD was at 2%. BTC was at 0.9%, and ETH was at 0.14%.

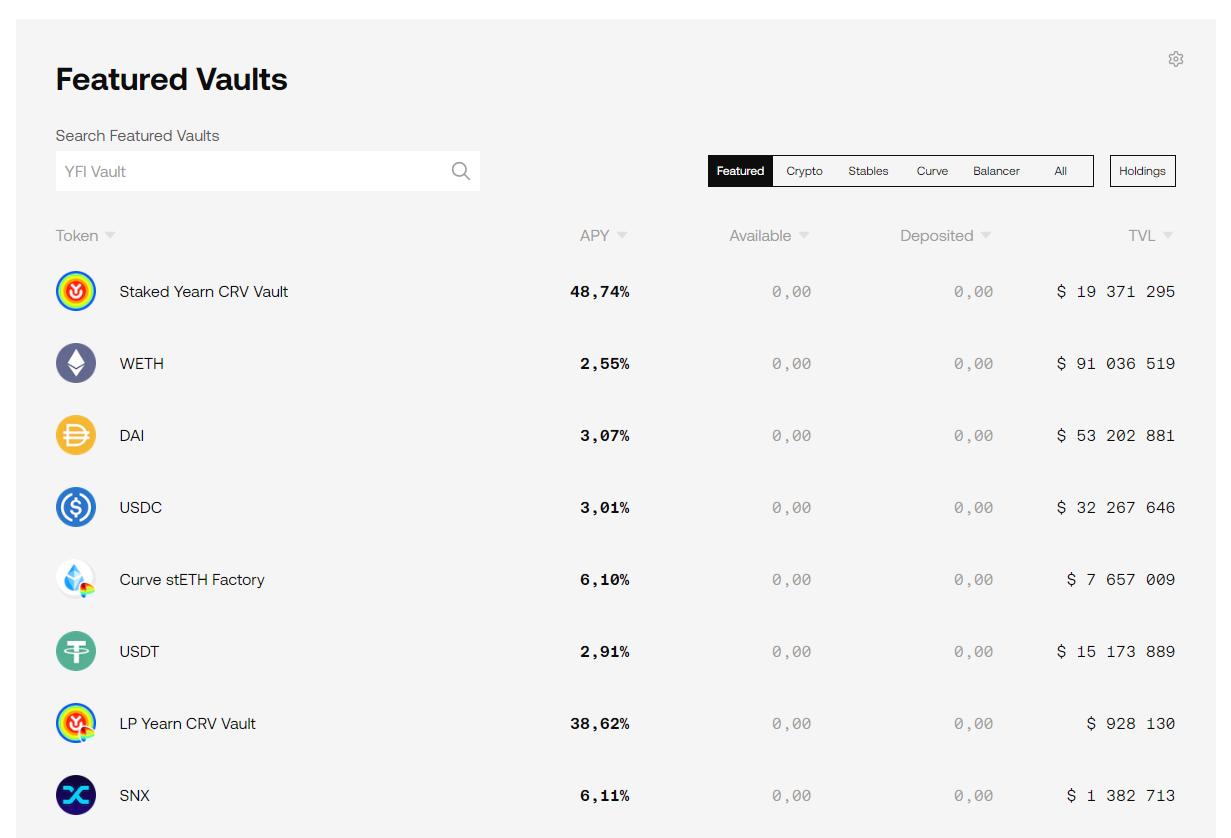

Now let's take another look at the Yearn dashboard data, as shown in the figure below.

ETH is at 2.5%, DAI is at 3%, USDC is at 3%, and USDT is at 3%.

And all of this is happening in an inactive market. All actual yields come from lending markets and trading fees. The lending market is driven by long/short activities.

In a bear market, people enter short positions, using stablecoins to collateralize their positions (increasing the supply of stablecoins, lowering the actual yield of stablecoins), borrowing cryptocurrencies and selling them (increasing the yield of cryptocurrencies, which can be clearly seen from the increase in the actual yield of ETH/BTC), and using the stablecoins obtained from the sales as further collateral (further lowering the actual yield of stablecoins).

In a bull market, people enter long positions, using their cryptocurrencies to collateralize their positions (lowering the actual yield of cryptocurrencies), borrowing stablecoins to buy more cryptocurrencies from the market (increasing the actual yield of stablecoins), and using the purchased cryptocurrencies as further collateral (further lowering the actual yield of cryptocurrencies).

Currently, we are in a deep bear phase with low volatility. At this point (based on the last two bull markets), we see very little trading activity, and every attempt to short has been made, but they lack enough confidence to close their positions (leading to buybacks and longs). Therefore, this is a "low point of actual yield." Considering this, the actual yield is still higher than the levels when Yearn was first created.

Therefore, I disagree with the statement that "high yields have long disappeared, and DeFi has seen almost zero growth." This statement is based on comparing the current market to an unsustainable, highly delusional market peak, rather than comparing its developmental process.

If you plotted a growth chart of TVL, yields, and trading volume and flattened the curves to avoid oscillations, it would be a clear linear growth chart. On every feasible metric, actual yields and DeFi have significantly increased.

The internet bubble did not destroy the internet, nor does it need a next narrative; it is those projects born in the crazy times that have become the anchor products we use today.

DeFi is Unstoppable

In response to the question "What might the next narrative for DeFi be?" my answer is "DeFi is the next narrative for DeFi. It does not need a 'new narrative' or 'new eye-catching tools'; DeFi is simply effective."

Real-World Assets (RWA)

Now let's discuss real-world assets (RWA). The three most important innovations in crypto are:

Zero Trust Finance (0 Trust Finance: no need for trust or assumptions of trust), examples include Bitcoin, Ethereum, Fantom, Uniswap, or Yearn V1;

Verifiable Finance (Verifiable Finance: there is assumed trust, but you can verify), examples include Aave, Compound, Yearn V2, where you can verify time-locked executions through multisig;

Trusted Finance (Trusted Finance: requires absolute trust), centralized exchanges and institutional brokers, such as Binance, Wintermute, etc.

The next focus will be regulation. Issuers of regulated cryptocurrencies must be fully legal, compliant, and regulated entities. Crypto regulation attempts to add regulation to decentralized protocols. The latter is unfeasible and will only create friction for all parties involved.

RWA needs to exist within "Trusted Finance" or "Verifiable Finance" and requires regulated cryptocurrencies. As the journalist's question pointed out, discussions about RWA have been ongoing for a long time. Back in 2018, I first spoke with traditional custodians, regulators, and governments about this topic. At that time, regulated cryptocurrencies did not exist, but they are starting to emerge now, and the success of any RWA project depends on this. Notable examples of regulated crypto legislation include the South Korean Financial Services Commission allowing the issuance of security tokens and the Swiss Parliament passing a federal law on DLT.

Regulation is part of it, and the second part is enabling traditional auditors to verify and understand on-chain RWA and provide these reports; without these reports, it will fail again. Therefore, as technology continues to evolve, we will see more real-world assets tokenized on-chain.

However, it should be noted that none of these are new narratives, nor will they bring any revolutionary changes to DeFi. DeFi remains just DeFi; it is merely another tokenized asset added as collateral or trading pairs.

So I do not believe DeFi needs the next trend; I believe DeFi is a trend. The focus of the Fantom Foundation is:

Regulatory frameworks;

Audit tools;

Layer 1 transaction volume and scalability;

Layer 1 account user experience and social recovery.

DeFi and other blockchain verticals (social media, gaming, art, news, etc.) still exist, but they are limited by the current state and access to underlying technology (just as the early Web was limited by underlying technology and access). There is no "new narrative" or "new trend"; just "business as usual," which is a good thing.