Winners Behind the LSD War: Is Pendle's Revival on the Horizon?

Written by: CryptoTrissy

Compiled by: aididiaojp.eth, Foresight News

Yield has volatility similar to token prices, rising in bull markets and falling in bear markets. Pendle Finance aims to provide users with attractive yields by increasing yield exposure during bull markets and hedging against yield decline risks during bear markets.

In simple terms, Pendle is a permissionless DeFi yield protocol where users can execute various yield management strategies.

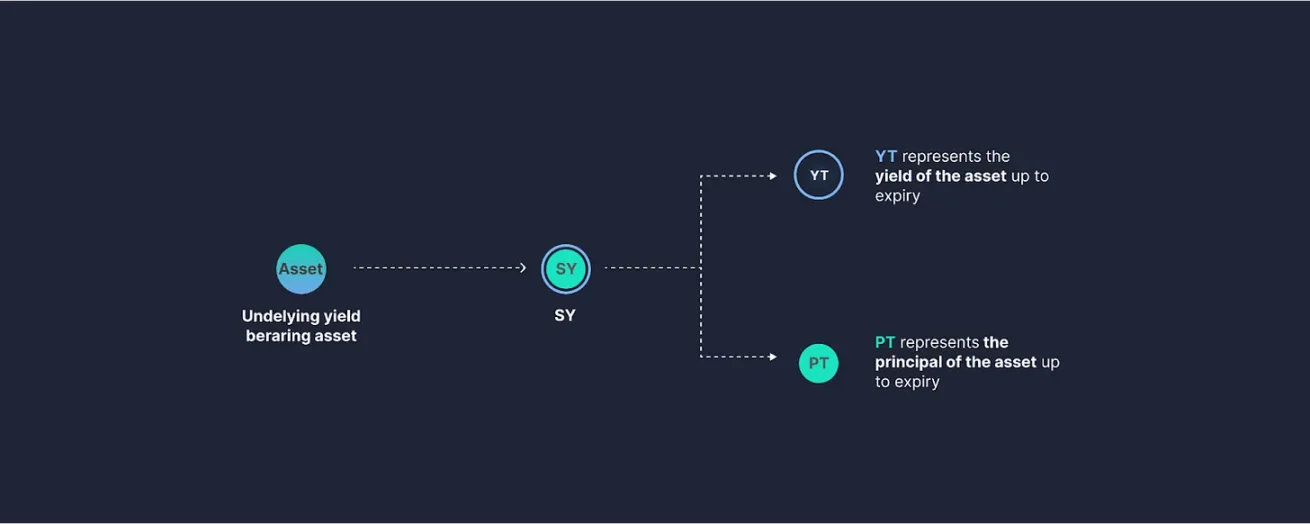

First, Pendle packages yield-generating tokens into SY (Standardized Yield Tokens), which are then split into two parts: principal tokens (PT) and yield tokens (YT), both of which can be traded through a customized V2 AMM.

In traditional finance, institutional participants rely on various hedging strategies to protect their positions, such as futures yield contracts. Pendle aims to bring the massive derivatives market (with a notional value exceeding $400 trillion) into the DeFi space.

By creating a yield market in DeFi, Pendle will unlock the potential of yields. Pendle enables users to execute advanced yield strategies, such as:

Forward asset discounting

Providing low-risk fixed yields for stable growth

Exposing to future yield streams without collateral

Any combination of the above strategies

How It Works

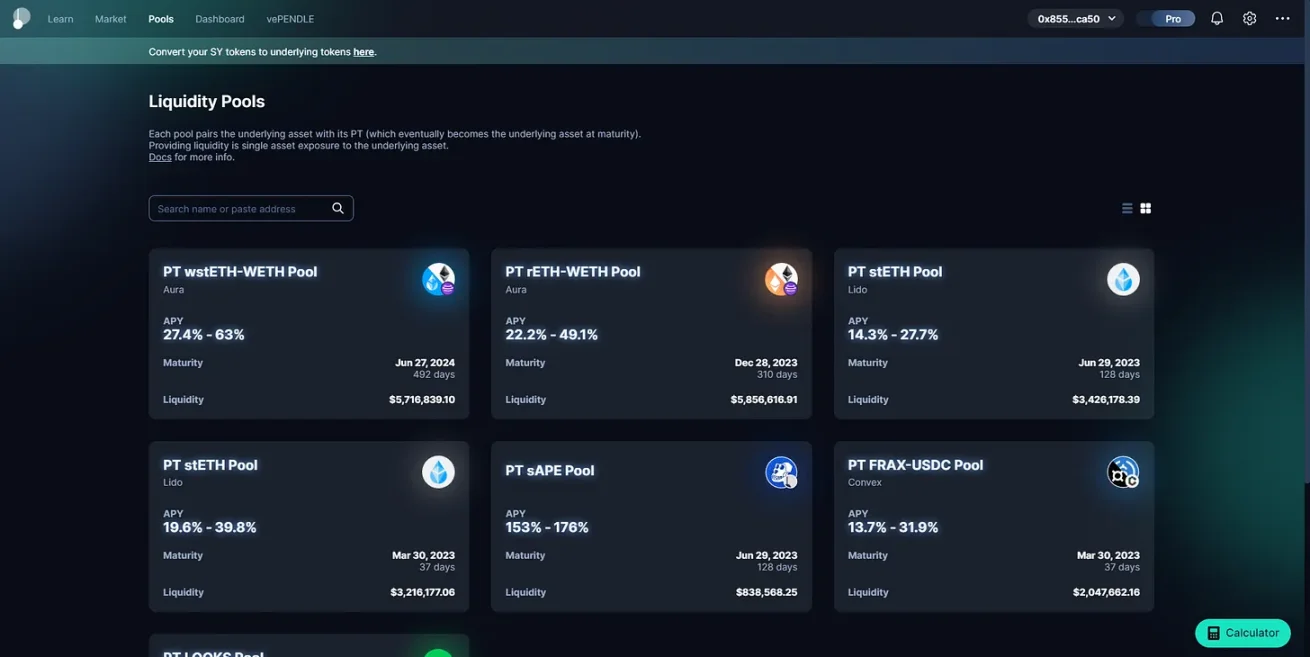

Pendle liquidity providers (LPs) can hold their positions until maturity to achieve zero impermanent loss (IL). All Pendle liquidity pools will pair PT with their underlying assets; for example, the stETH pool will pair PT-stETH with stETH.

What is PT-stETH?

PT is the principal token, and all PT can be redeemed for the underlying asset at a 1:1 ratio upon maturity. This means that all PT-stETH in the liquidity pool can ultimately be used to redeem stETH. The same applies to other liquidity pools; given enough time, the value of all PT equals the underlying asset.

Knowing this, it doesn't matter whether the liquidity pool contains:

50 PT-stETH + 50 stETH or 90 PT-stETH + 10 stETH; both contain 100 stETH at maturity.

Impermanent Loss IL

Before maturity, the price ratio of the PT underlying may fluctuate, which could lead to slight, temporary IL.

However, as long as you hold until maturity, providing liquidity on Pendle can be a viable way to stack yields on top of a bullish position or an effective method to accumulate assets like LSD.

Strategies

Buying PT:

If you believe the yield of an asset will decline and need to hedge against yield, you can achieve this by purchasing PT. Since the underlying asset is guaranteed upon maturity, buying PT effectively locks in the APY at the current implied yield. Another way to understand this is that it fixes the yield at the current implied rate.

For example, if you buy a PT-aUSDC with a 5% implied yield for a maturity of 1 year, this means that for every 1 USDC spent on PT, you will receive 1.05 USDC at maturity and redemption.

Buying YT:

On the other hand, if you believe the yield of an asset will rise and want to bet on the yield, you can do so by purchasing YT, thereby increasing your exposure to the asset's yield solely through the yield portion, with returns determined by the fluctuations of the underlying APY.

Additionally, buying YT is more capital efficient than purchasing the underlying asset, meaning you can buy more YT for the same amount of capital, thus increasing your yield exposure.

For example, if the price of YT is 5% of the underlying asset price, any increase in the underlying yield will result in your returns increasing 20 times, as you can purchase 20 times the YT.

Providing Liquidity:

If you believe the yield of an asset is unlikely to fluctuate significantly, you can choose to provide liquidity to earn some extra yield from swap fees and incentives.

Since the prices of PT and YT are tied to the price of the underlying asset, i.e., PT + YT equals the underlying price, the price fluctuations of the underlying asset do not carry the IL risks that most other yield protocols have. The only IL risk comes from the fluctuations in demand for PT and YT, which is inherent to all liquidity pools.

If you provide liquidity until maturity, IL will be limited and minimized, as the two assets provided will have exactly the same value at maturity. This way, providing liquidity can also serve as a hedge for any PT or YT position.

For example:

Suppose you have 100 aUSDC with an APY of 5%; after one year, you will have 105 aUSDC in your wallet.

Now, instead of waiting a year, you can directly use Pendle to split your aUSDC into 100 aUSDC-PT and 5 aUSDC-YT.

If you believe the yield will decline:

You can immediately profit by selling your aUSDC-YT on the market for $5. To redeem your principal, you will need to buy back 5 aUSDC-YT later.

If you just want to lock in the yield without speculating, you can sell YT for $5 and use that money.

A year later, the principal will be unlocked, meaning you can use future yields immediately.

Token Economics

Team tokens are locked until April 2023. Beyond that, any increase in circulating supply will be determined by contributions from incentives and ecosystem builders.

As of October 2022, the weekly unlock amount is 667,705, decreasing by 1.1% each week until April 2026. The current token economics allow for 2% inflation for incentives.

vePENDLE

Pendle's governance token is the custodial PENDLE or vePENDLE.

vePENDLE further decentralizes Pendle while unlocking new features for PENDLE holders, enhancing the token's utility.

vePENDLE also creates another avenue for PENDLE tokens, providing more stability for the token's price and the protocol.

How to Obtain vePENDLE

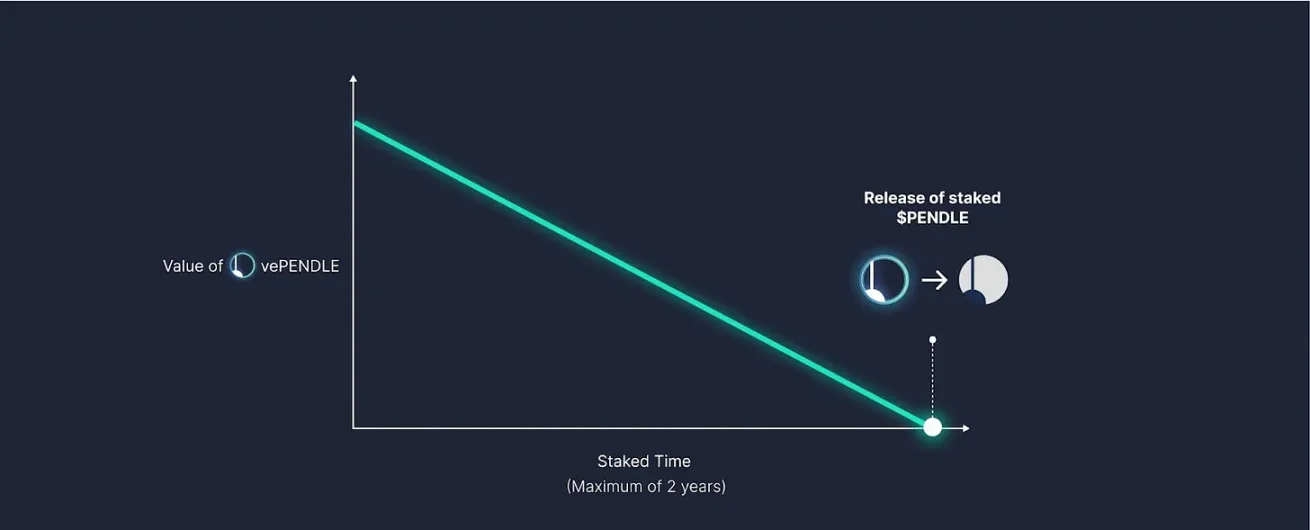

Staking PENDLE earns you vePENDLE, with the amount of vePENDLE proportional to the amount and duration of the stake, with a maximum staking period of 2 years.

vePENDLE will decrease over time and reach zero after the lock duration ends, at which point the staked PENDLE will be unlocked.

If you want to increase the value of vePENDLE, you can choose to extend the staking period or increase the staking amount.

Income Stream Flywheel

Pendle charges a 3% fee on all earnings accumulated from YT. Currently, this fee is fully distributed to vePENDLE holders, and the team does not take any revenue, although this may change in the future.

A portion of the earnings from PT that are not redeemed by maturity will also be proportionally distributed to vePENDLE holders.

For example, matured PT-aUSDC is equivalent to the value of aUSDC. If not redeemed, all its earnings will convert to stablecoins and be distributed as protocol revenue to vePENDLE holders.

All these rewards will be converted to USDC, and vePENDLE holders can receive regular profits by paying the contract.

Incentive Channels

vePENDLE powers Pendle's incentive mechanisms. vePENDLE holders can vote to direct rewards to different liquidity pools, thus achieving effective incentives.

In simple terms, the higher the value of vePENDLE, the more incentives you receive.

Every Thursday at midnight, a snapshot of all votes will be taken, and the reward rates for each liquidity pool will be adjusted accordingly. The voting pool also grants vePENDLE holders the right to receive 80% of the swap fees charged by the liquidity pools.

LP Reward Boost

If you act as an LP while holding vePENDLE, the PENDLE rewards and vePENDLE rewards for LPs will be further increased, with vePENDLE value potentially increasing by up to 250%.

While the value of vePENDLE will decrease over time, the boost rate for LPs will be calculable at the time of initial application. The boost rate will remain unchanged until the LP position is updated, at which point the rate will vary based on the current value of vePENDLE.

To receive enhanced rewards, you should lock PENDLE into vePENDLE before LPing.

If you are already acting as an LP and wish to use vePENDLE to boost your rewards, you must manually operate after voting.

Narrative

Bigger Blueprint

In DeFi, we all love to compare ourselves to traditional finance and say things like, "The nominal derivatives market is $400 trillion; if we capture just 1% of that, the DeFi ecosystem will expand 50 times."

While this is true, it is important to remain rational. We will eventually start to take market share from traditional markets, but to become their focal point may take at least five to ten years. dYdX founder Antonio Juliano shares the same view that we have not truly begun to see large-scale adoption of DeFi within the same timeframe.

One of the biggest reasons for this is the issues of legitimization and regional regulatory policies. We have seen recent news about Kraken being targeted for staking services and being viewed as a security. While most of us would agree this is quite absurd, due to the collapse of FTX, we may see the SEC take a strong stance in the foreseeable future, which is not what we want.

So far, let's talk about how infrastructure will play a crucial role in mass adoption. We will see the continuous creation of tools that will benefit mass adoption before the public is aware, as the current user experience lags far behind traditional industries.

Let's look at how traditional bonds circulate. Ordinary people wanting to invest in bonds can purchase and hold bonds through brokers and online brokers, who will handle the custody and management accounts on behalf of the investors. This means physical bonds will be held by brokers, and investors will receive regular statements showing their ownership and investment details.

When investors buy bonds through brokers, the bonds are stored in the investor's account with the broker, and interest payments are credited to the account. Brokers typically also handle the maturity of the bonds, including repaying the face value of the bonds at maturity.

We see users primarily delegating to brokers without worrying about custody issues. While this is seen as a negative in our decentralized world, the accumulated wealth is sufficient to thrive from this incentive.

Pendle Finance can provide the same service, but users can act as their own brokers without having to trust third parties. Users can not only freely self-custody but also fully enhance their yields or reduce risks based on financial forecasts.

Providing users with customized yield strategy diversification services will be a continuing trend in DeFi. Market makers or LPs can hedge positions more effectively through Pendle's liquidity terms, allowing larger participants to enter the market due to smaller volatility. Battle-tested smart contracts and ample liquidity are prerequisites for bringing larger institutions into the fold.

Under What Conditions the Project Can Excel

Pendle launched in the last bull market, and until recently, activity was quite low last year. The team has been continuously innovating and achieving rapid growth through new partnerships and adapting to new ecosystem designs.

Pendle Finance has been an innovator in yield strategies and will benefit from the upcoming EIP-4844 upgrade, as this will significantly reduce Rollup cost fees. The Arbitrum ecosystem will soon become a focal point as economic conditions will greatly favor products and applications. DeFi development has been hampered by high fees and unscalable technology, and now that barrier no longer exists, we will see a rapid increase in user activity.

Additionally, the ability of vePENDLE to generate income across multiple ecosystems is also noteworthy. As mentioned earlier, if you act as an LP while holding vePENDLE, all LP's PENDLE incentives and rewards will also be further increased, potentially increasing by up to 250% based on the value of vePENDLE.

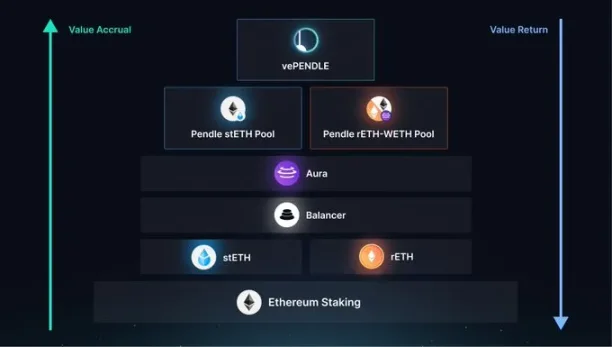

The recent surge in liquid staking derivatives (LSD) will accelerate Pendle's development as they evolve. In turn, value will flow back to Aura, Balancer, Lido, RocketPool, etc. Because users can reduce risks through Pendle Pro's yield strategies, they can elevate single-digit APYs of assets like stETH to double digits with almost no security risk.

As DeFi matures, we will see more institutional participants flock in due to attractive yields and the ability to enhance secure assets like ETH. Now that DeFi has learned from the collapse of Terra, what changes need to be made to provide stable liquidity and peg for yields?

Liquidity providers can choose to reduce risk, as providing liquidity until maturity will limit and minimize IL. The only IL risk comes from fluctuations in demand for PT and YT, which is inherent to all liquidity pools. This is possible because the two assets provided will have exactly the same value at maturity. Thus, providing liquidity can also serve as a hedge for any PT or YT position.

This is a step forward in the struggle to minimize impermanent loss and increase liquidity, which is crucial for Pendle's success.

With the Shanghai update approaching, I believe most people will be looking for alternatives to maximize ETH yields.

Existing Risks

Let's set aside the boring topic of legitimization; if the SEC continues to view staking mechanisms as securities, it will stifle innovation and liquidity in the short term, but founders will ultimately shift to more crypto-native countries. We have begun to see this to some extent; it is just a matter of when the SEC will provide clear guidelines on what is allowed.

The risks of smart contracts are significant, as the TVL has achieved great success in market value, so any flaws will become prime targets for hackers. The team is aware of this and maintains absolute transparency in audits.

Another consideration is that centralized competitors can offer better yields and custody. Ordinary people fear the complexity of cryptocurrencies, so they are more inclined to retreat to the safe havens created by centralized participants doing the hard work for them. Perhaps we will see people learn from recent collapses (FTX, Celsius, etc.), but as adoption increases, unless the user experience improves significantly, uneducated users will flock to centralized entities.

As the industry is still in its early stages, competition will be fierce, and it is easy to imagine that most companies are looking for ways to get ahead in the market. Aave has a significant lead in lending and borrowing, and with Aave, it wouldn't be difficult to dominate market share again by adding some customizable yield strategies as in the past few years. Ultimately, liquidity is everything; without reliable suppliers' true guidance, user activity can never achieve a qualitative leap.

The development of ecosystems has never been an easy task. As a startup, your existence is not well-known, and it can be challenging to collaborate with those who would benefit you the most. Unless the Pendle team continues to establish new partnerships for liquidity pools and incentives on other DEXs and platforms, PENDLE will not see the exposure it deserves. They have refined the infrastructure, and now it is up to the team to prove they have the marketing talent needed to direct users to the product.

Opinion Zone

From a fundamental and price perspective:

One of the best proofs of DeFi's ability to attract new participants is TVL. The success of Lido largely comes from its super high TVL, which builds trust in its mechanisms, leading to more participation. Due to Pendle's locking mechanism, if price action remains stable, we will see their TVL consistently exceed the market cap with incentive structures. This looks good for valuation and can demonstrate to investors that they have product-market fit.

To me, Pendle feels like a more refined Aave, allowing for greater customization and internal hedging options, meaning users do not have to go elsewhere. As mentioned earlier, liquidity plays a decisive role; if the team can continuously introduce new ecosystems and create impact, as they did with Camelot, then I believe it has some potential to become a dark horse.

With LSD becoming a market hotspot, unstaked ETH and better Rollup scaling will spark new activity in DeFi. Pendle will be perfectly positioned for users looking to profit in a hot ecosystem.

With the recent growth of wsETH and rETH, the Pendle team clearly understands the scale of this unlocking and the potential it creates for their ecosystem. You can now provide liquidity and earn an APY of 28-63%, which is incredibly crazy for one of the safest investments in cryptocurrency.

Even if Pendle grows 10 times and reaches a market cap of $170 million, it still needs to double to catch up with some leading projects. Based on recent marketing and upcoming events, I believe it will see a nice price increase.

Currently, 27.5 million PENDLE are locked, accounting for 18.3% of the circulating supply.

Charts and Liquidity Overview

Liquidity: Currently, liquidity is about $1.9 million across four listed DEXs (Sushiswap, Camelot, Kyberswap, and TraderJoe).

The only CEX it is listed on is Gate.io, so liquidity is limited, with a 2% spread of only $500.

TVL is $27 million and continues to grow, with a previous ATH of $37 million when the token was around $0.8-$1, so the current price does not reflect the TVL.

Price levels to watch: $0.24, $0.33, $0.5, and $0.8-$1, until the previous ATH of $2.

Conditions for reaching close to $2 in the coming months include a stable continuation of the ETH uptrend, and of course, it will also be influenced by the explosion of the Arbitrum and Optimism ecosystems. We hope to see more LSD pools and new partnerships to promote more liquidity.