Outlier Ventures: How to Manage DAO Governance Tokens with Joint Curves?

Author: Karim Halabi, Outlier Ventures

Compiled by: aididiaojp.eth, Foresight News

Token governance committees can distribute tokens to the community and stakeholders in many different ways, including airdrops, liquidity mining, auctions, or various combinations of the above methods. This article will introduce a new approach to enhance the effectiveness of various distribution strategies to strengthen consistency among stakeholders as much as possible.

Currently, DAOs face many issues, the most prominent of which is the pervasive voter participation problem, which anyone who actively contributes to a DAO can deeply relate to. Of course, this does not mean that every address holding a specific governance token must participate in and discuss every intricate detail, and not everyone has the same motivations when participating in community activities.

Another common issue is a frequently used distribution method, namely liquidity mining, which puts tokens into the hands of individuals who may not necessarily be interested in product governance. If those participating in liquidity mining are not interested in governance, they may attempt to sell their tokens to others. In the ruthless world of DeFi battles, it seems there are only two choices: either cash out or buy high.

Providing liquidity for tokens and the buying and selling behavior itself is not necessarily a bad thing; it is normal and sometimes even worth encouraging. However, the downside is that the profits of stakers come at the expense of the community and the DAO treasury. As pointed out in this article, we can observe this phenomenon of token sell-offs after yield farms are launched.

There are some methods to quantify contributions and distribute tokens more fairly to those who invest time and effort, but these loyal holders often lack a competitive advantage compared to speculators and liquidity mining participants. An intuitive solution is to create a vesting schedule for stakers and early buyers who are not DAO members, although the downside of this approach is that contributors do not truly profit from selling their tokens, as the liquidity provided by staking is lower, reducing demand for the tokens. Furthermore, a vesting schedule does not necessarily reduce sell-off pressure; it merely spreads it out over different time points.

There is no perfect way to manage governance tokens, but there are indeed methods that can mitigate certain risks, depending on the exact goals and requirements of the token release.

One often-overlooked token distribution method is using bonding curves to mint and burn governance tokens. For those unfamiliar with bonding curves, here is a brief introduction.

Bonding Curves: The Relationship Between Fixed Token Price and Supply

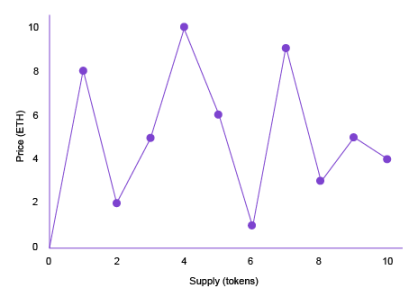

A bonding curve is essentially a simplified way to represent the relationship between price and supply. A simpler way to say it is: when the token supply changes by X, the price changes by Y, where Y can be a fixed value or a percentage.

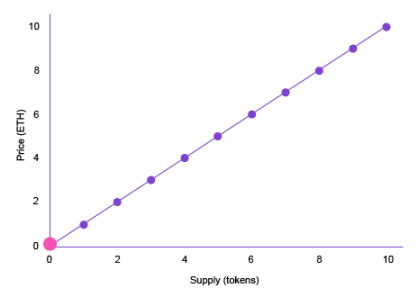

This works similarly to how AMMs operate, except that liquidity pools are not needed, as ETH or stablecoins can be deposited into the curve to mint tokens on demand, rather than requiring liquidity in the pool to facilitate trading. For example, we have a bonding curve where no tokens have been created yet, and the price increases and decreases by "1 ETH" with each minting or burning. The starting price for minting the first token is 1 ETH.

Now, after the first person deposits 1 ETH into the bonding curve, they will receive one token in return. The curve then begins to move, with X changing from 0 to 1, and Y becoming the y-coordinate when X equals 1; now the price to mint the next token is 2 ETH.

At this point, another person wants to participate. After minting one token at a price of 2 ETH, she mints another one, priced at 3 ETH. In total, Alice has deposited 5 ETH into the curve and received 2 tokens in return.

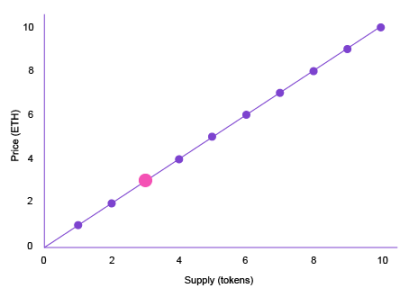

The first person sees the price rise and decides to cash out his tokens for profit. Since the price is now 3 ETH, Bob can deposit his governance tokens back into the curve and redeem 3 ETH, thus moving the point back one unit along the curve, and the price drops to 2 ETH.

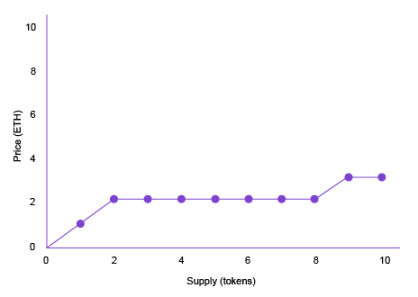

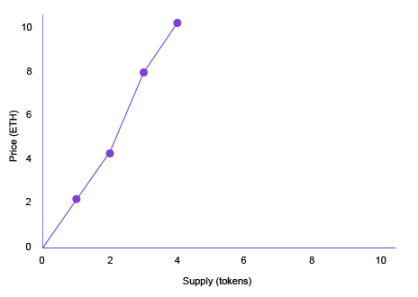

This is the essence of a simple bonding curve; once we start experimenting with the shape of the curve itself, it becomes even more interesting. What if the price increases by 10%? What if it changes by 0.5 ETH until reaching a supply of 100 tokens, at which point the curve flattens and each minting and burning only moves by 1%? What if the curve is of a certain shape but changes once certain product milestones are confirmed by some oracles? Such curves can be used to reward early believers who mint tokens during high-risk times, and as the product matures, the curve may become steeper.

The possibilities are endless, and bonding curves can take countless shapes. It looks like this:

Another option is to use different curves for buying (minting) and selling (burning), where the selling cost is higher than the buying cost when X is consistent, and the increments can be retained and sent to the treasury, or retained by the chart to grant a higher redemption rate for each token sold back to the curve.

Other Types of Bonding Curves

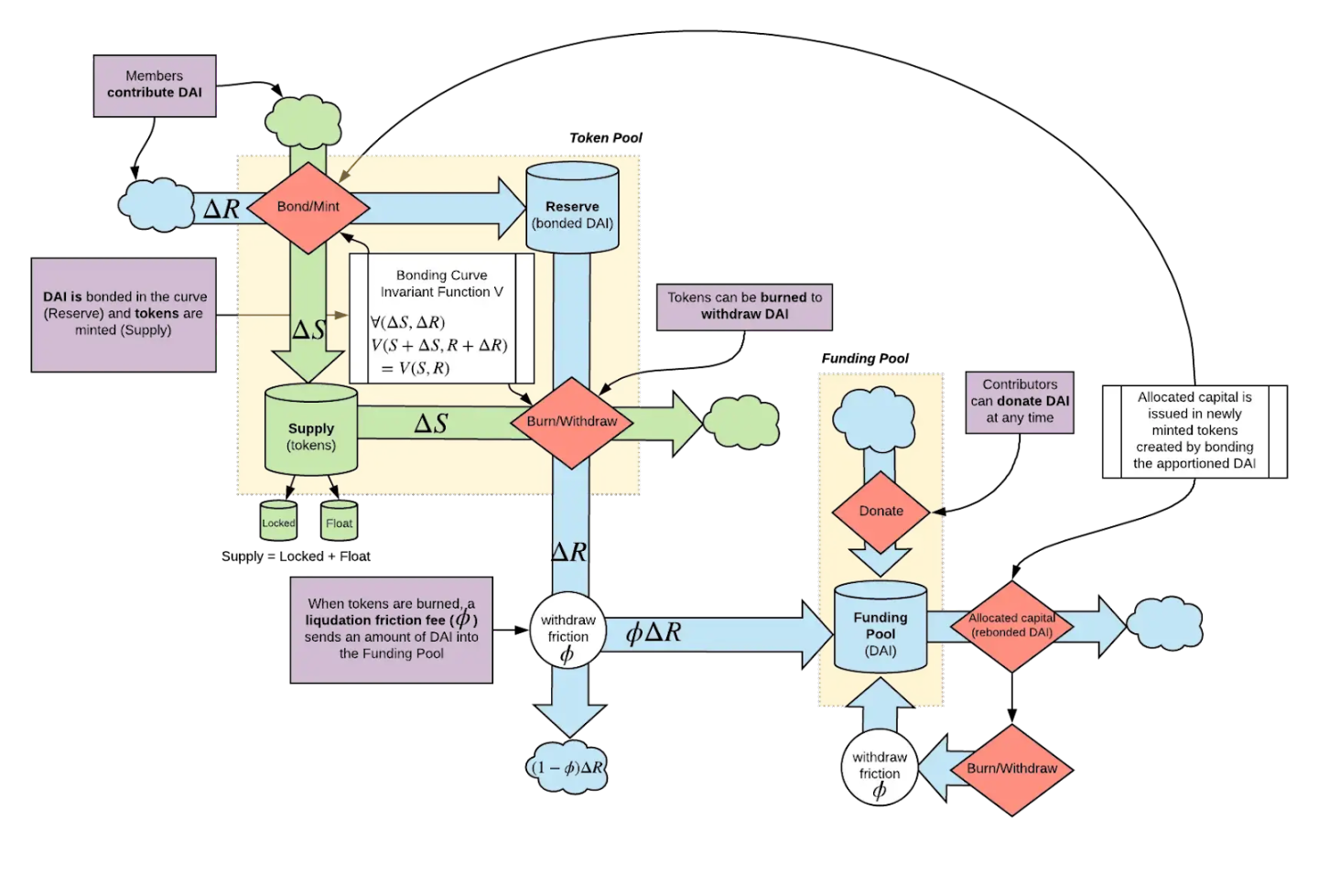

Of course, there are also other more complex types of bonding curves, with two notable ones, one of which is the augmented bonding curve introduced by Commons Stack.

The above image shows an augmented bonding curve with some interesting additions. The additions include a "incubation period," which is the early stage of minting where early investors can deposit funds to receive tokens and make early contributions. Some funds flow directly into the curve itself, while some funds go to the treasury, which can be used for capital allocation outside the bonding curve to promote product development.

In addition, there is a vesting schedule that grants "incubator" tokens in the initial phase, along with a small exit tax paid by sellers, which is redirected into the curve. Commons Stack even provides a simulator that can be used on their website, which is considered an effective way to fund public goods.

Another variant is the Variable Rate Gradual Dutch Auction (VRGDA) created by Paradigm. Essentially, it is a bonding curve that considers the time factor simultaneously. For example, we have a bonding curve where we want to allocate 10 tokens over the first two days.

If the amount minted during this period is less than 10, the price (Y) decreases according to a preset formula to incentivize accelerated minting. This also works the other way around; if the actual minted amount exceeds the target minting amount, the price may increase. A more complete explanation with examples can be found in this article.

In summary, bonding curves are an effective way to maintain consistency among DAO stakeholders. Understanding the different types of bonding curves and how they work helps lay the groundwork for a broader discussion on "SuperPowered Tokens" and how they can incentivize closer collaboration among DAO stakeholders.