Overview of the Bitcoin NFT (Ordinals NFT) Ecosystem

Author: Elaine Yang

1. Introduction to the Bitcoin NFT Protocol Ordinals

NFTs, as cryptographic tokens that can represent unique digital or physical assets, possess uniqueness and non-fungibility on the blockchain. NFTs have developed over the years on smart contract platforms like Ethereum, giving rise to many famous projects and applications. However, on Bitcoin, the earliest and most secure blockchain, NFTs have not seen widespread development and application due to the lack of native smart contract functionality and high transaction fees.

To address this issue, a protocol called Ordinals was officially launched on December 14, 2022. It leverages the technical features of Segregated Witness (SegWit) and Taproot 3 on the Bitcoin network (which reduce transaction data size, thereby speeding up transactions, improving scalability, and lowering fees) to enable the direct minting, transferring, and burning of NFTs on the Bitcoin chain. The Ordinals protocol assigns a unique identifier to each smallest unit of Bitcoin (Satoshi) and links it to metadata, forming a unique and traceable NFT. The Ordinals protocol does not require any centralized or trusted parties to participate, nor does it rely on any Layer 2 or sidechain solutions; it fully adheres to the rules and security of the Bitcoin network itself.

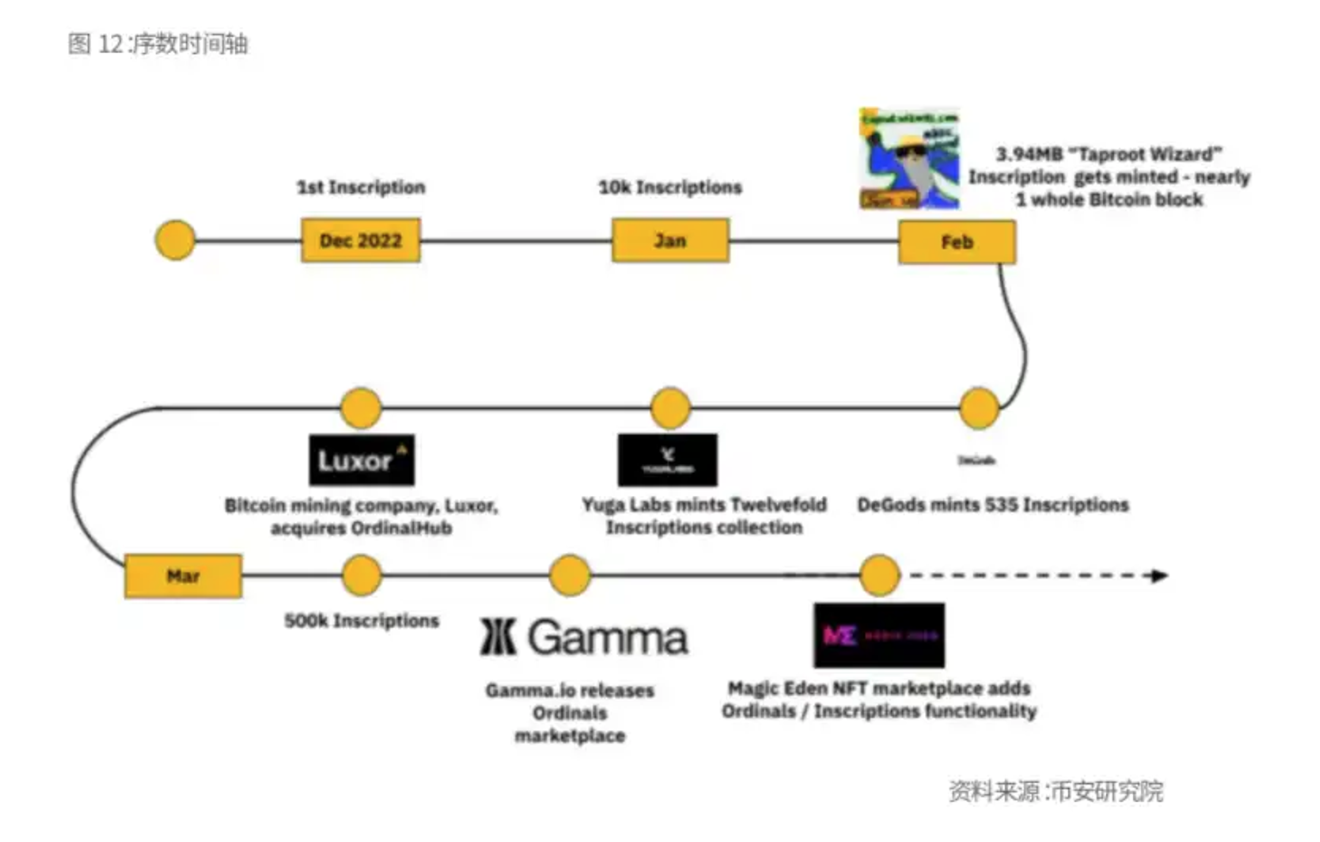

The next significant milestone for Bitcoin NFTs occurred in December 2022 when the first ordinal inscription was minted.

As of May 10, the inscription minting volume of the Bitcoin NFT protocol Ordinals reached over 5 million, with total fees incurred amounting to approximately 213.1 BTC.

How do Ordinals and Inscriptions Work?

ORD is an open-source software that can run on any Bitcoin full node and tracks individual Satoshis based on the "ordinal theory" proposed by its founder, Casey Rodarmor. Satoshis ("sats") are the smallest unit of the Bitcoin network, where 1 Bitcoin = 100,000,000 sats. The ordinal theory assigns a unique identifier to each individual satoshi. Furthermore, these individual sats can be "inscribed" with arbitrary content, such as text, images, or videos, to create "inscriptions," which are Bitcoin-native digital artifacts that can also be referred to as NFTs. Individual sats can be "inscribed" with arbitrary content, such as text, images, or videos, to create an "inscription," which is a Bitcoin-native digital artifact, or can also be referred to as an NFT.

Current data on the number of inscriptions on some ordinals protocols can be found at https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

2. Current Development Status of BTC NFTs

1. Blue-chip Projects on ETH and Solana Issued on the Bitcoin Network

High-profile NFT Projects

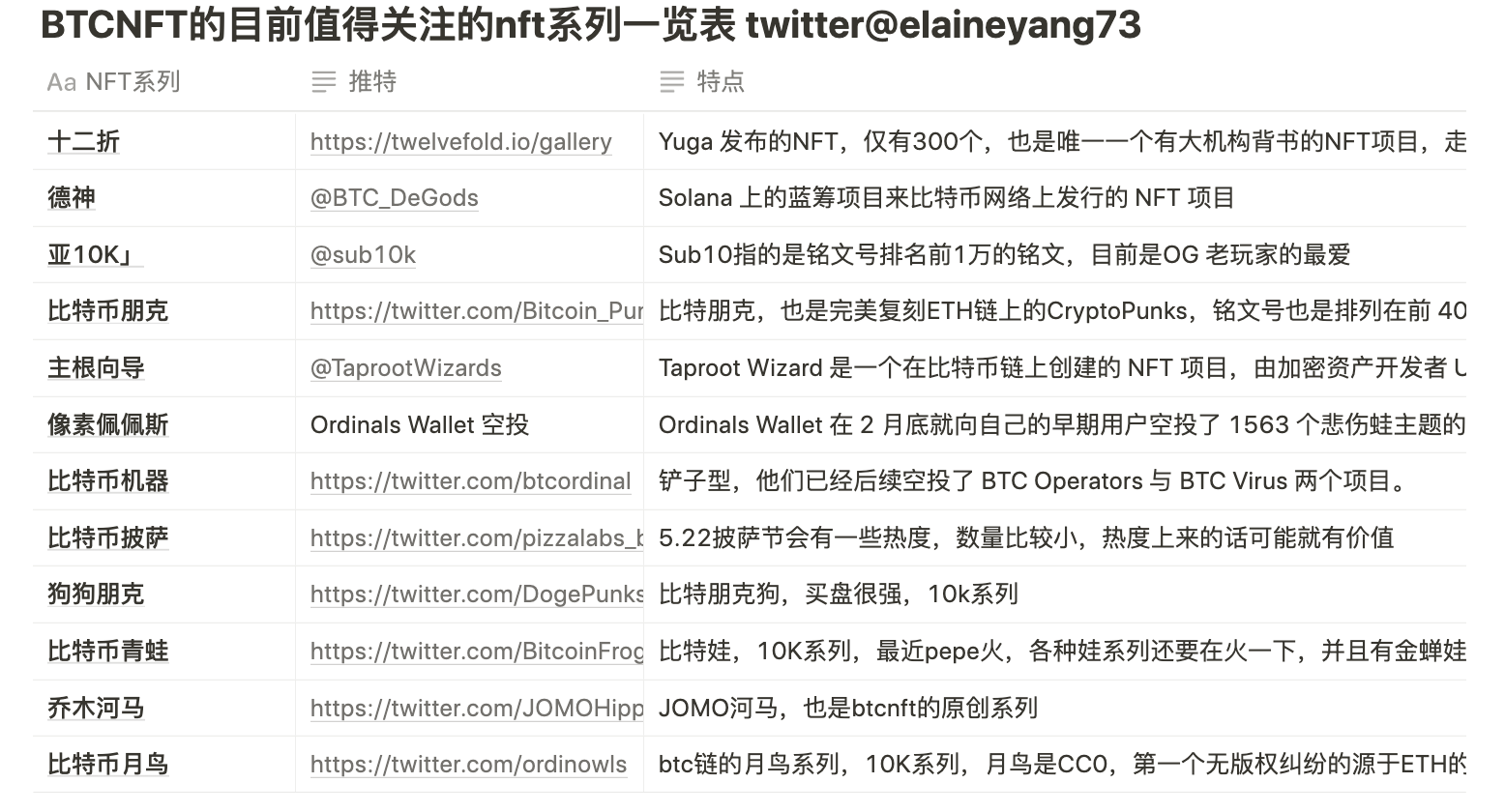

Refers to blue-chip projects on ETH and Solana that have issued NFT projects on the Bitcoin network, such as Yuga Labs' "TwelveFold" and the Bitcoin version of DeGods. TwelveFold is an NFT released by Yuga, with only 300 pieces, and is the only NFT project backed by major institutions, taking the art route, where the ceiling for art far exceeds that of PFP avatars. If successful in the future, it could become a top luxury item!

These types of projects already have significant influence, and thus their sale prices are quite high. Yuga Labs' "TwelveFold" sold 288 NFTs through an auction, with the highest bid at 7.1159 BTC and the lowest at 2.2501 BTC, generating auction revenue of approximately 16.5 million USD. Currently, on ordinals.market, the floor price of "TwelveFold" exceeds 30 ETH, with a total transaction volume of 108.49 ETH. DeGods sold 500 Bitcoin version DeGods at a price of 0.333 BTC in just 2 minutes.

- "Sub 10K"

Each inscription (Bitcoin NFT) has an inscription number; the earlier the minting time, the smaller the number. Therefore, NFTs with numbers below 10,000 and 100,000 are given a layer of "antique" meaning. Although these early inscriptions often lack thematic content, they are valued for their "time" significance.

Currently, the 2nd and 8th minted Bitcoin NFTs—Inscription #2 and Inscription #8—are listed on the Ordinals Wallet market.

The highest transaction price for a "Sub 10K" Bitcoin NFT is Ordinals Punk #87 (Inscription #613), which sold for 2.77 BTC. On March 17, the Bitcoin logo image Inscription #3384 was sold for 0.31 BTC. Notable "Sub 10K" series include Ordinals Punks, Bitcoin Shrooms, and Planetary Ordinal, while the well-known Bitcoin Punks belong to the "Sub 100K" category.

3. Bitcoin-native Crypto Color

Bitcoin Punks, which perfectly replicate CryptoPunks on the ETH chain, have inscription numbers within the top 40K, and are mostly held by OG players, with backing from OKX. Currently, like the Bitcoin Monkeys, they belong to the NFTs with the largest consensus.

The official Taproot Wizard shared the founder Udi Wertheimer's journey on social media: "On the day Silicon Valley Bank announced its collapse and the USDC panic, I decided to launch the Taproot Wizard NFT project today and let people record videos of themselves bathing in wizard costumes." It is reported that Taproot Wizard is an NFT project created on the Bitcoin chain, initiated by crypto asset developer Udi Wertheimer, aimed at commemorating Bitcoin's Taproot upgrade and a classic image of the Bitcoin community—the Bitcoin wizard.

4. Shovel Empowerment

Refers to NFT series that continuously provide valuable airdrops after holding. Currently, a well-known "shovel" is BTC Machine, which has subsequently airdropped two projects: BTC Operators and BTC Virus. Currently, the floor price of BTC Machine on the Ordinals Wallet market is 0.088 BTC, while the floor prices for BTC Operators and BTC Virus are 0.018 BTC and 0.0012 BTC, respectively. It is worth noting that using various Bitcoin NFT-related tools may likely lead to airdrops of "shovels." Ordinals Wallet airdropped 1,563 pixel PFPs themed around Sad Frogs to its early users at the end of February—"Pixel Pepes," and the current floor price for this series is 0.066 BTC. As one of the top three Bitcoin NFT trading markets by transaction volume, the value of Pixel Pepes largely stems from the expectation of "shovels." Given that current Bitcoin NFT-related tools offer overlapping functionalities, it is very likely that attracting traffic through NFT airdrops will become a common practice. Therefore, from now on, everyone should pay attention to interacting more with Bitcoin NFT-related tools.

3. BTC NFT Trading Markets

1. Exchange NFT MARKET PLACE

OKX: https://www.okx.com/cn/web3/nft/collection/eth/bitcoin-punks

Xu Mingxing: OKX Web3 Wallet Will Soon Support Market Trading of Ordinals and BRC-20 Tokens

2. Native Ethereum Trading Market Supporting Ordinals Protocol

Magic Eden Launchpad for Bitcoin Ordinals NFT Creators

3. Bitcoin Native Trading Market

Gamma.io

The NFT market on Stacks, originally named STXNFT, announced its rebranding to Gamma on April 27, 2022. The platform aims to gather collectors, creators, and investors to explore, trade, and showcase NFTs within the Bitcoin ecosystem. The Gamma platform consists of three core products: an NFT market, a launchpad, and a social platform. Gamma.io supports both primary and secondary markets for Bitcoin NFTs.

Gamma.io offers a minting method called Gamma bot. Users can mint their unique digital works using Gamma bot, which allows them to collect or sell. Users can mint NFTs through simple commands without coding or technical knowledge: just add Gamma bot on Discord and enter commands like create \<image_url> to create an NFT. Gamma.io also launched a .btc domain name market, allowing users to have their decentralized identity and website. Users can register, purchase, sell, and transfer .btc domain names on Gamma.io and link them to their NFTs.

4. Comprehensive Platforms for Inscription Minting and BRC20 Trading Markets

Unisats:

Currently a platform for issuing and minting BRC20 tokens, as well as an inscription minting platform, and domain registration can also be done on this platform. It supports peer-to-peer trading of BRC20 tokens, with the highest daily active and trading users, but currently does not support trading in the Bitcoin NFT market. Due to its large user base, it often faces lag and crashes, and we look forward to more iterations of the product in the future. Currently, the Chinese team has the fastest product development speed here.

IDclub:

A domain and minting platform, but it does not support peer-to-peer trading of BRC20 tokens, nor does it support trading in the Bitcoin NFT market.

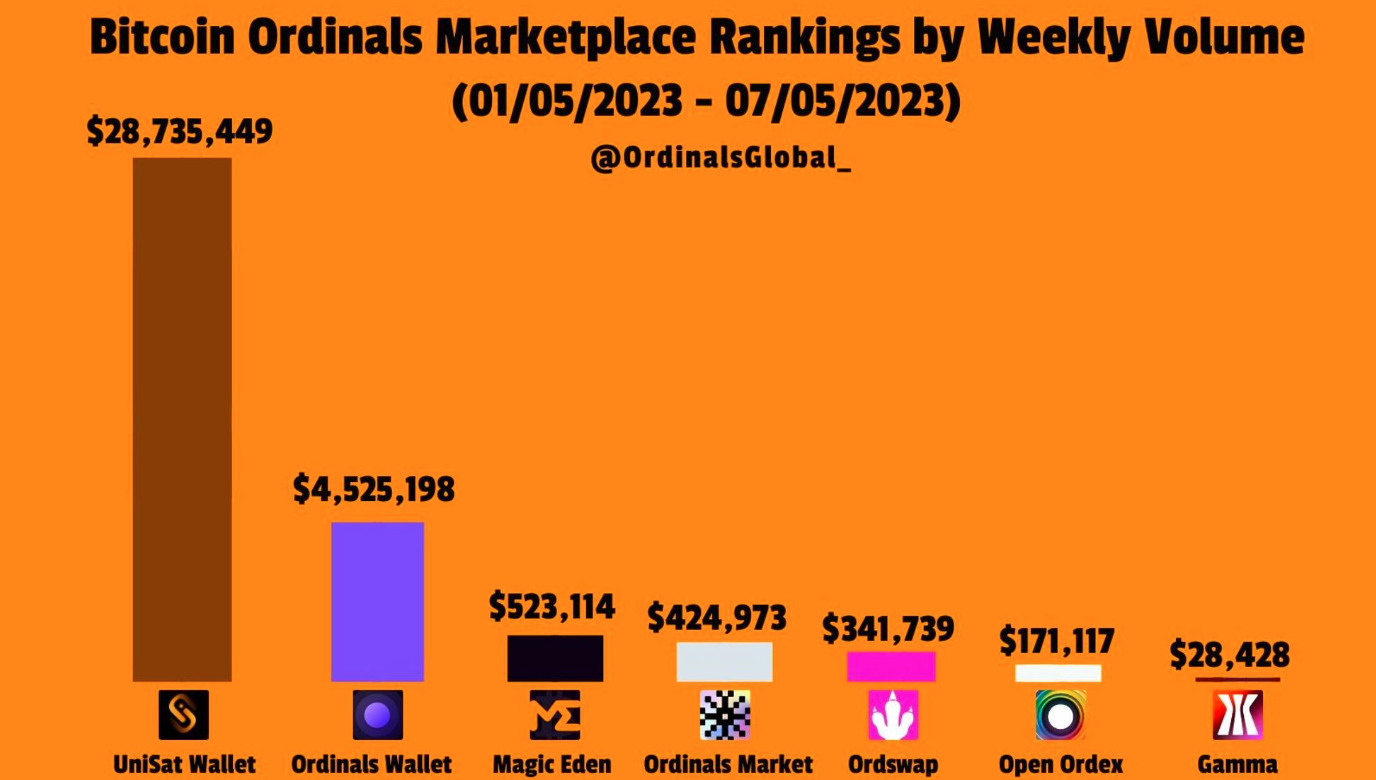

Current Trading Market Volume Rankings

4. The Value of BTC NFTs

A BRC20 token contains at least 546 Satoshis, making it impossible to go to zero. From this perspective, it is at least more valuable than air tokens on ERC20. Therefore, everyone should hold an inclusive attitude towards BRC20 tokens; do not completely deny them, nor fully accept them, but observe as you go.

It grants everyone the right to freely explore the diverse value of Bitcoin. You can certainly create an "NFT series," and you can also treat the Bitcoin network as your "diary," recording your written words, your drawn pictures, your sung songs… Throughout history, people have recorded their information on cave walls, bamboo slips, paper, computers, and now on the Bitcoin network. As long as you believe the Bitcoin network is eternal, the information recorded on it is also eternal, and the carrier of that information is Bitcoin itself—nothing could be cooler than that.

If you had to describe the difference between Bitcoin NFTs and Ethereum NFTs in one word, what would you choose?

Some say, Bitcoin NFTs are "eternal." As long as you believe the Bitcoin network is eternal, all data "inscribed" on Bitcoin will exist forever. No off-chain, only on-chain.

Some say, this is a banknote with a serial number; does it matter what you write on it? I don't know about Hong Kong dollars, but Bitcoin does! 1 Satoshi = Whatever you inscribed, this is the biggest underlying value logic difference between Bitcoin NFTs and Ethereum NFTs.

Some say Bitcoin NFTs are "historically valuable." Because the order of "inscription" for Bitcoin NFTs leads to differences in their serial numbers, the earlier a Bitcoin is "inscribed," the more valuable it may become in the future, just like Jurassic dinosaur fossils, Shang dynasty bronzes, and modern steel bars.

Some say, Bitcoin NFTs are "free." From Silk Road to some online malls, and then to Amazon and eBay, Bitcoin has been developing along the path of "being more widely accepted as currency." The emergence of the Ordinals protocol has made Bitcoin even freer. Who knows what additional value an "inscribed" Satoshi might have? The free flow of the market will assign new value to these "inscribed" Bitcoins. One day, we will have the answer to this question. These answers all showcase the unique charm of Bitcoin NFTs compared to Ethereum NFTs. (The above understanding is quoted from Cookie's article This Might Be the First Gathering of the Bitcoin Ordinals Community)

5. Challenges Bitcoin NFTs May Face

- Lack of Scalability Due to the cost factors of Bitcoin NFTs (fully on-chain), large-scale application and popularization may currently be unachievable.

- Lack of Infrastructure The Bitcoin NFT ecosystem is still not well-developed, lacking relevant infrastructure and application scenarios, mostly relying on over-the-counter trading.

- High Operational Threshold As mentioned above, since most Bitcoin NFT transactions need to be conducted over-the-counter, the operations are relatively complex. For ordinary users, understanding and using them may be more difficult.

- Increased Bitcoin Network Transaction Fees The rise in Bitcoin network transaction fees is a side effect of adding NFTs to the Bitcoin blockchain, causing the most severe Bitcoin transaction block congestion since the FTX bankruptcy.

- Violation of Bitcoin's Fundamental Doctrine Bitcoin maximalists believe that Bitcoin NFTs violate Satoshi's original intention of creating "peer-to-peer electronic cash," and writing NFT-related data into Bitcoin undoubtedly wastes block capacity.

6. Market Outlook

Currently, the blue-chip projects of BTC NFTs have not yet established a clear pattern, but Bitcoin Baby seems to have the potential for this 10k series blue-chip. For the 10k series, a 1 BTC floor price is a significant threshold, but it can be pursued. As exchanges come in to support BTC NFTs.

The BTC NFTs that can emerge in the future will definitely be original series from the BTC ecosystem, rather than copy-paste series from the Ethereum chain, while still continuing the PFP gameplay of NFTs. Only BTC NFTs that can create PFP avatar series have the potential to become blue-chip.

If the floor price of BTC NFTs starts at 0.001, the pump effect is best because such odds have the potential to increase by 20 times. The current floor price of 0.01 BTC is a threshold, and 0.02 BTC is another threshold; 0.1 BTC can elevate to a blue-chip series.

Currently, there are no new narrative gameplay on the ETH chain, and it can be observed that many NFT project parties have started migrating to BTC NFT entrepreneurship in the past half month. NFT artists should explore BTC elements more in their creations.