The SEC sues Binance and Zhao Changpeng for violating securities laws, a quick read of the lawsuit summary

Original source: SEC

Compiled by: Odialy Planet Daily

According to Bloomberg, the U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Binance and its CEO Changpeng Zhao (CZ), as well as two other subsidiaries, BAM Trading Services ("BAM Trading") and BAM Management US Holdings Inc. ("BAM Management"), accusing the defendants of violating U.S. securities regulations. Odialy Planet Daily has specially summarized the key points of the 136-page complaint:

The SEC believes the defendants ignored federal securities laws, thereby amassing billions of dollars in wealth for themselves.

The defendants required U.S. users to buy, sell, and trade crypto asset securities on the unregistered trading platform Binance.com and Binance US, which essentially does not exist. BAM Trading and BAM Management's claims of monitoring Binance.US are merely a facade. For a considerable period after the launch of Binance.US, Binance held and controlled BAM Trading's offshore data, and BAM Trading employees could not access certain real-time trading data from the Binance.US platform without personal approval from Zhao. (Note: Binance US was established in cooperation with BAM Trading).

Binance and BAM Trading illegally provided three fundamental securities market functions—exchange, broker-dealer, and clearing agency—without registering with the SEC. Furthermore, they engaged in the unregistered issuance and sale of crypto asset securities, including "BNB," "BUSD," "BNB Vault," "Simple Earn," and "Staking" services. Additionally, BAM Trading and BAM Management falsely claimed to have control over Binance.US, raising $200 million.

To evade the registration requirements of federal securities laws, in 2018, Binance hired several consultants to provide legal risk advice regarding the U.S. market. The consultants proposed a "Tai Chi" plan, which involved creating a U.S. entity (later Binance.US) to become a target of regulatory enforcement to ease tensions, "shielding Binance from historical and future liabilities." Under this plan, Binance would not only be a technology provider but also provide liquidity and market access for the platform. This move would not only retain the U.S. market but also allow for licensing fees and service fees paid by the U.S. entity; additionally, it would enable fiat currency inflow and outflow functions through the entity's OTC services, allowing Binance to access fiat currency without needing to establish separate bank accounts; more importantly, Binance personnel could continue operating in non-U.S. locations to avoid enforcement risks (asset seizure).

The first step of the plan was to create BAM Management and BAM Trading, publicly claiming independent operations, while in reality, CZ and Binance remotely directed BAM Trading's operations in the U.S.; the second step was to publicly state that the Binance.com platform did not serve Americans, while in fact, CZ instructed Binance staff to assist certain high-net-worth U.S. clients in evading controls—by changing IP addresses through VPNs or by setting up offshore companies for KYC; additionally, CZ actively solicited U.S. investors to trade on the Binance platform through his social media and other internet posts to retain U.S. investors.

While providing securities-related services to U.S. clients, the defendants placed billions of dollars of U.S. investors' funds at risk, allowing Binance and CZ to manipulate them. For example, billions of dollars of customer funds on the Binance platform were transferred to an account held by an entity controlled by CZ (named Merit Peak Limited), and these funds were later transferred to third-party accounts.

BAM Trading and BAM Management did not have adequate monitoring and control measures to prevent manipulative trading. In fact, "wash trading" was very common on Binance.US; from September 2019 to June 2022, CZ-controlled trading company Sigma Chain was heavily involved in false trading, artificially inflating Binance.US trading volume.

The SEC made a final ruling: (a) permanently prohibiting the defendants from further violating federal securities laws; (b) ordering the defendants to surrender their illegal gains and pre-judgment interest; (c) imposing civil penalties on the defendants and ordering appropriate or necessary equitable relief for the benefit of investors; (d) permanently prohibiting the defendants and any entities they control from directly or indirectly using means or instruments of interstate commerce to engage in the issuance, purchase, offer, or sale of securities (including crypto asset securities) and other financial services.

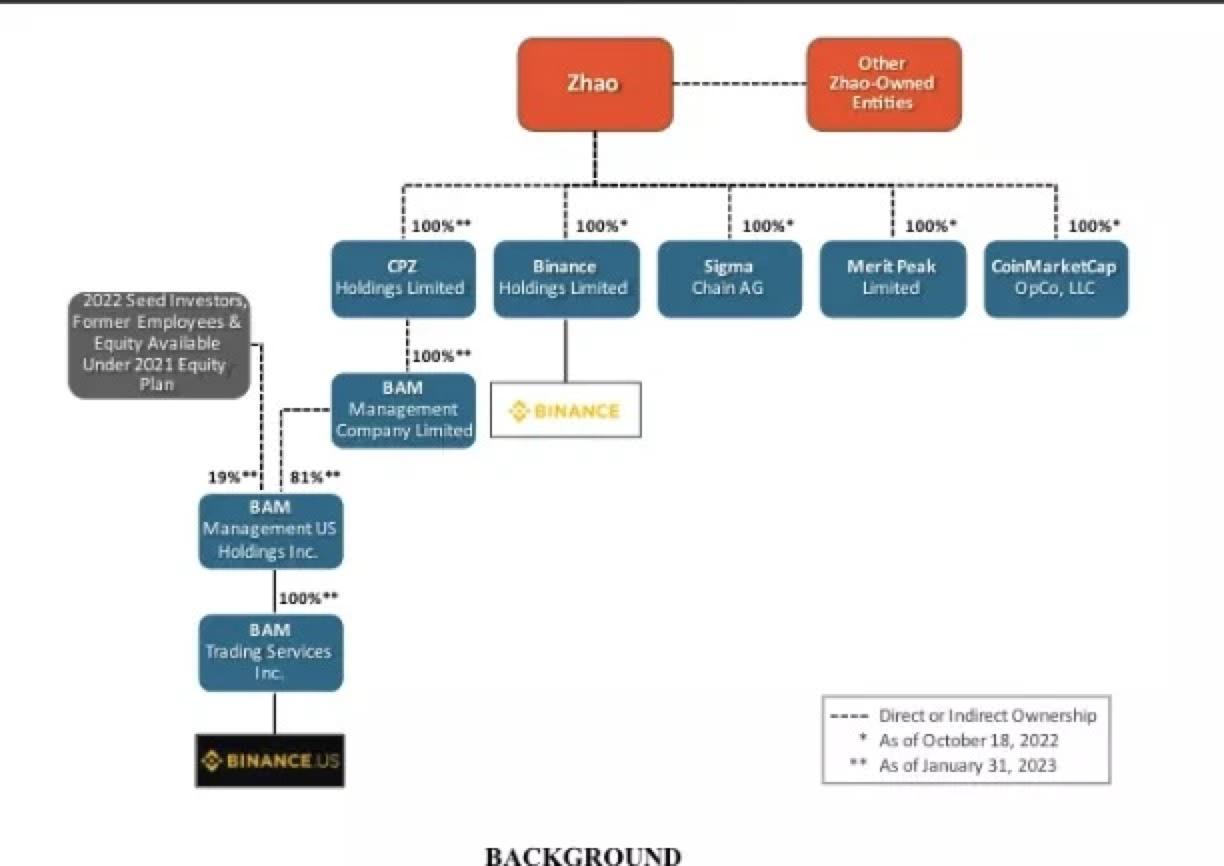

The Binance network consists of multiple entities and lacks transparency: CZ is the CEO of Binance and also the chairman of the boards of BAM Trading and BAM Management (at least until March 2022); BAM Trading is the operating company of Binance.US, holding money transfer licenses in 43 U.S. jurisdictions (including this district); BAM Management is the parent company of BAM Trading, which is wholly owned by BAM Management Company Limited in the Cayman Islands—this company is wholly owned by CPZ Holdings Limited in the British Virgin Islands, of which CZ owns 81%.

Sigma Chain is a cryptocurrency asset trading company registered in Switzerland, with CZ as its controlling person and several Binance employees responsible for its operations. Among them, Binance's back-end manager is also the president of Sigma Chain and has signing authority for BAM Trading's bank accounts. Sigma Chain is an active trader on both Binance platforms and refers to itself as "the primary market maker for Binance.com." After the launch of the Binance.US platform, Zhao instructed Sigma Chain to become one of its first market makers. Furthermore, since Binance.US began offering OTC and OCBS services, Sigma Chain has been one of the trading parties on the Binance.US platform.

Merit Peak Limited ("Merit Peak") is a cryptocurrency asset trading company registered in the British Virgin Islands, with CZ as its controlling person and several Binance employees responsible for its operations. Merit Peak is an OTC operator on Binance.com and one of the earliest market makers on the Binance.US platform. Through Merit Peak, CZ also provided over $16 million in funding to BAM Management to support the operations of the Binance.US platform.

(CZ and affiliated companies relationship chart)

Before 2021, accounts under Binance entities sent billions of dollars of customer assets to U.S. bank accounts under Merit Peak, which transferred all these funds to Trust Company A, and these funds appeared to be related to the issuance of Binance stablecoins (BUSD). Using Merit Peak as an intermediary to transfer platform customer funds to purchase BUSD exposed investors to undisclosed counterparty risks.

Merit Peak and Sigma Chain accounts were used for hundreds of billions of dollars in transfers between BAM Trading, Binance, and related entities. For example, by 2021, at least $145 million was transferred from BAM Trading to a Sigma Chain account, and another $45 million was transferred from BAM Trading's Trust Company B account to the Sigma Chain account. From this account, Sigma Chain spent $11 million to purchase a yacht.

Between October 2022 and January 2023, CZ personally received $62.5 million from a bank account of Binance.

From June 2018 to July 2021, Binance generated at least $11.6 billion in revenue, most of which came from trading fees.

CZ and Binance regularly tracked customer activity on the Binance.com platform, so they knew that U.S. customers constituted a significant portion of their business. In an internal report from August 2019, Binance estimated that its platform had over 1.47 million customers in the U.S.; by 2019, Binance had over 3,500 U.S. institutional traders (VIPs). According to an internal report from Binance in March 2020, the Binance.com platform still had about 159 U.S. VIP customers, accounting for nearly 70% of all global VIP trading volume; two years after the launch of the Binance.US platform (May 2021), U.S. VIP customers still accounted for over 63% of the VIP trading volume on the Binance.com platform. From January to September 2021, over 47,000 U.S. investors traded BNB on the Binance.com platform.

Before the launch of the Binance.US platform, the CEO of BAM advised against listing BNB trading on Binance.US, but CZ strongly insisted on the launch, knowing that this could lead to SEC enforcement actions, but believed that the profit opportunity outweighed the risks—they quantified the legal risk of listing BNB as: a 20% increase in BNB price vs. $10 million in legal fees and fines.

CZ and Binance controlled BAM Trading's bank accounts. Before December 2020, BAM Trading personnel could not control the company's bank accounts, including the accounts used for customer deposits on the Binance.US platform; only CZ or Binance back-end managers had signing authority for these accounts. Later, to avoid regulatory scrutiny, the CFO of BAM Trading was made one of the signatories for customer accounts, as these accounts were a focus of regulatory attention. As of May 2023, CZ still had signing authority over the accounts holding customer funds for BAM Trading on the Binance.US platform.

CZ controlled BAM Trading's daily business expenditures and decisions. Before January 30, 2020, all expenditures over $30,000 for BAM Trading required approval from CZ and Binance, including payments for rent, franchise taxes, legal fees, Amazon Web Services ("AWS") fees, and even $11,000 for purchasing Binance-branded hoodies. Binance's finance team in Shanghai managed BAM Trading's payments, including transferring funds between bank accounts and depositing cash during BAM Trading's operations; when BAM Trading lacked operating funds, Merit Peak would inject capital.

Without BAM Trading's knowledge, the Binance finance team was also able to conduct significant fund transfers. In June 2020, Trust Company B reminded the CEO of BAM that internal transfers for BAM Trading had increased from about $10 million per day to $1.5 billion, but the CEO was unaware of these transfers and could not verify them, as she did not have account access, ultimately having to seek confirmation from Binance.