Synthetix's Path to Advancement: Why Transition from a Synthetic Asset Protocol to DeFi Infrastructure?

Author: Grapefruit, ChainCatcher

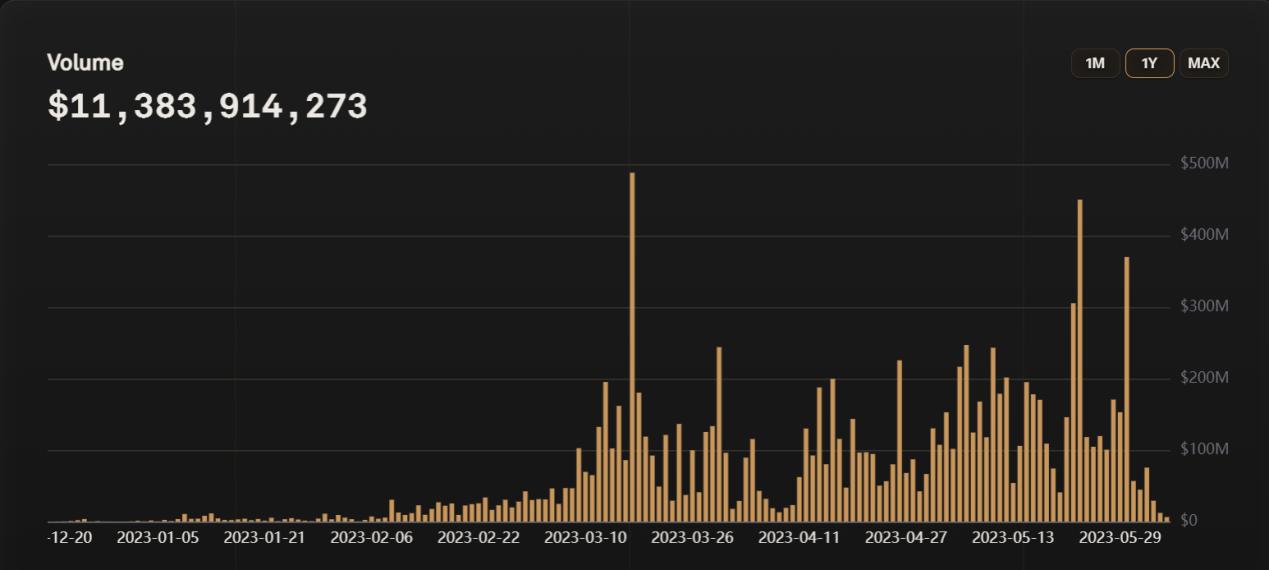

On May 25, the total trading volume of Synthetix Perps (perpetual contracts) officially surpassed $10 billion, marking a new milestone. According to DUNE data, from the release of Perps V2 in December 2022 to June 7, the total trading volume of Synthetix's perpetual contracts reached $11.278 billion, with captured trading fees nearing $8.897 million.

In addition, in the past month, the average daily trading volume of Synthetix Perps has exceeded GMX, ranking second in the decentralized derivatives space (with dYdX in first place).

In the six months since the launch of Perps V2, the revenue generated has approached $9 million. Such outstanding performance has brought the veteran DeFi application Synthetix back into the spotlight. Synthetix is no longer just a synthetic asset platform as initially positioned; its main business has shifted from the front stage to the backstage.

Moreover, Synthetix's perpetual contract products are not aimed at end-users but are presented in the form of backend products, supporting developers or DeFi derivatives to integrate this functionality. Users can interact with Synthetix Perps contracts through integrated DeFi products rather than using or interacting directly.

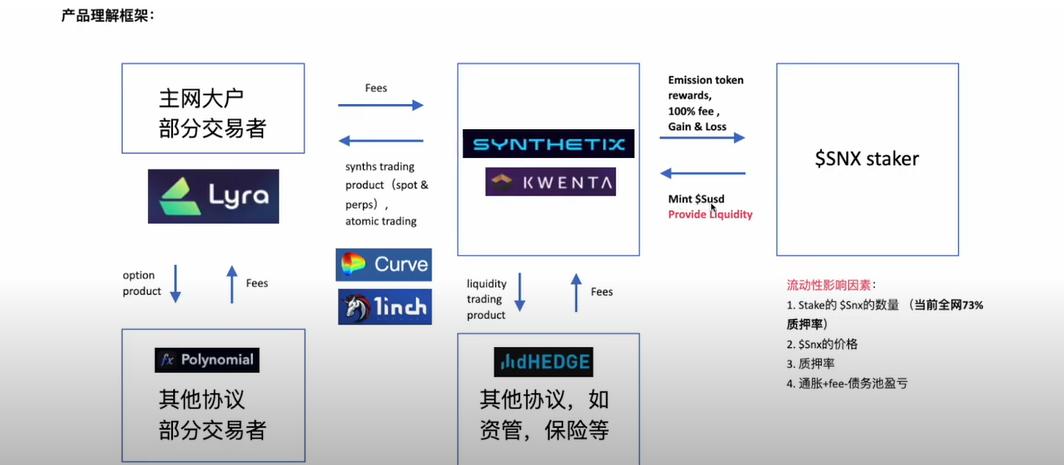

Currently, the trading volume of Synthetix perpetual contracts is mainly contributed by the spot and derivatives trading platform Kwenta, which is a decentralized contract product built on the Synthetix Perps component, aimed at trading users. In addition to Kwenta, other DeFi derivative applications that have integrated Synthetix include options platforms like Lyra, Polynomial, Decentrex, and dHEDGE.

From a front-end product to becoming a liquidity infrastructure for DeFi products, supporting the integration of any derivatives and trading products, Synthetix has completed its strategic transformation. So, how has Synthetix gradually approached its goal of becoming the infrastructure for DeFi liquidity? What has it gone through along the way?

Kwenta's trading volume has surpassed GMX

Kwenta, as the first front-end product built on Synthetix Perps, supports users in trading cryptocurrencies, spot, futures, etc., contributing over 98% of the trading volume to Synthetix Perps. Since May, Kwenta's contract trading volume has performed exceptionally well, with a single-day peak trading volume of $450 million on May 24.

In terms of contract trading volume and market share, Kwenta's recent data performance has far surpassed GMX, becoming the second-largest platform in the decentralized contract space.

According to DUNE data, in the past month, the total trading volume on the Kwenta platform was $4.46 billion, while GMX's total trading volume during the same period was only $3.67 billion. On May 23, Kwenta's daily trading volume reached $450 million, while GMX's trading volume that day was only $110 million.

Kwenta trading data changes

In fact, from the official backend data, Kwenta's trading data began to show an upward trend starting in February this year, reaching a historical high of $480 million on March 17. What has driven the growth of Kwenta's trading data? This is mainly due to the announcement on February 11 that Kwenta had launched the Synthetix Perps V2 version, allowing users to open new positions in the V2 version.

Thus, the growth of Kwenta's trading data is closely tied to the support of Synthetix Perps V2. What exactly is Synthetix Perps V2? What new changes has it brought to Kwenta?

Synthetix Perps V2 is an upgraded version of the contracts launched by Synthetix. By implementing a new off-chain oracle system and an adjusted funding rate mechanism, it has reduced trading costs and improved capital efficiency.

In simple terms, Perp V2 ensures the balance of long and short positions through a dynamic funding rate mechanism. For instance, when the number of short positions exceeds long positions, shorts must pay funding fees to longs at regular intervals to maintain balance, similar to CEX exchanges. However, Perp V2 adjusts dynamically over time, changing every hour.

Additionally, Perps V2 introduces an off-chain oracle system provided by Pyth Network, reducing trading delays, lowering the risks of front-running and arbitrage, and lowering trading fees to 0.05% to 0.1%.

Currently, Kwenta's trading fees are only 0.02% to 0.06% (GMX's trading fees are about 0.1%). Furthermore, when Kwenta launched the V2 version in February, it added 22 new cryptocurrency trading pairs, leading to a significant increase in trading volume.

Besides improvements in product experience and performance, Synthetix has also provided additional OP token rewards for trades integrated on the Perps V2 platform, which serves as an incentive beyond Kwenta's own KWENTA tokens. Starting from April 19, Synthetix will distribute a total of 5.31 million OP rewards to traders on platforms integrating Synthetix Perps over 20 weeks, with a maximum of 300,000 OP rewards distributed weekly.

At the same time, Synthetix has partnered with Kwenta, which will additionally provide 600,000 OP tokens as rewards for its platform traders, with all traders receiving rewards based on the trading fees paid.

Synthetix and Kwenta rewards

In summary, the increase in Kwenta's trading volume is closely linked to Synthetix's support, primarily benefiting from the release of Synthetix Perps V2, which reduced trading costs and increased the number of tradable assets. Secondly, the additional OP incentive measures provided by Synthetix have further stimulated the increase in trading volume.

With the support of Synthetix's resources, Kwenta has firmly established itself in the derivatives space, and its current recognition has fed back into the Synthetix platform.

Synthetix provides liquidity to DeFi applications by modularizing the debt pool

The success of the Kwenta platform also indicates that the Synthetix platform has successfully transitioned from an early synthetic asset platform aimed at end-users to a backend product providing liquidity for DeFi applications.

From the current product positioning, Synthetix is attempting to integrate liquidity into a broader range of DeFi applications' backends and build a set of products for users to interact with their synthetic assets.

Image source: Youtube

Currently, products built on Synthetix include not only Kwenta but also options platforms like Lyra, the options liquidity aggregation protocol Polynomial, and contract platform Decentrex. These platforms share the commonality of utilizing Synthetix's sUSD asset, with liquidity provided by it.

In fact, Synthetix supports not only the integration of liquidity for DeFi derivatives but also for spot trading products. The atomic swaps launched by Synthetix last year fall under spot trading, and platforms like Curve and 1inch have already integrated this feature.

Atomic swaps allow users to execute multiple trades across different DApps in a single transaction through packaging. The key feature of using Synthetix for spot trading is that it allows users to mint and trade various synthetic assets without slippage. The trading of synthetic assets does not have specific trading counterparts but is executed through smart contracts that destroy one token and mint another. For example, exchanging USDC for DAI and then DAI for ETH may yield better results.

If Xiao Ming wants to use 100,000 USDT to buy ETH, the usual method would be to use a DEX platform to directly purchase ETH with 100,000 USDT, which involves trading steps like USDT-DAI and DAI-ETH, leading to slippage. However, through the integrated Synthetix DEX platform, the trading process might change to first exchange USDT for sUSD, then sUSD for sBTC, and finally sBTC for BTC. Since sUSD/sBTC is a synthetic asset exchange with no slippage, and USDT/sUSD and sBTC/BTC are exchanges of similar assets, there is also no slippage.

The liquidity for all Synthetix-integrated products ultimately comes from its uniquely designed debt pool.

The dynamic debt pool is an innovation of the Synthetix platform and the mechanism for issuing synthetic assets (Synths). Users collateralize SNX to mint sUSD, a stablecoin pegged 1:1 to the US dollar. The value of sUSD is considered the system's liability, and when sUSD is traded for sTokens, the debt will increase or decrease with the price fluctuations of sTokens to maintain the stability of sUSD and other sToken prices, as well as to ensure no slippage during the trading process.

For instance, if the original debt pool has 100 sUSD and Xiao Ming buys sBTC with that 100 sUSD, when Bitcoin rises by 20%, the total debt of the debt pool will increase to 120 sUSD; when exchanging sBTC back to sUSD, he can receive 120 sUSD. Conversely, if Bitcoin drops by 20%, the total debt of the debt pool will decrease to 80 sUSD, and when exchanging sBTC back to sUSD, he can only receive 80 sUSD.

In Synthetix Perps, the debt pool acts as the counterparty for trades, providing liquidity for contract trading. In atomic spot trading, the assets in the debt pool provide liquidity for executing asset trades.

In other words, Synthetix has modularized the debt pool of synthetic assets, transforming it into a separate liquidity layer infrastructure that supports integration for DeFi applications. With Synthetix, newly launched DeFi applications can complete asset trades even without liquidity pools on their platforms, alleviating concerns about liquidity issues.

Synthetix V3 has achieved the evolution from synthetic assets to liquidity infrastructure

Synthetix originated as the stablecoin protocol Havven, which issued the stablecoin nUSD by collateralizing the native on-chain token HAV. In 2018, it was renamed Synthetix and later positioned itself as a synthetic asset platform, allowing users to mint synthetic assets (sUSD) Synths by staking SNX, supporting not only synthetic stablecoins but also tracking prices of foreign exchange, stocks, commodities, etc. with synthetic assets.

In 2021, the Synthetix Perp contract feature was launched, supporting DeFi derivatives developers to integrate the application and deploy products like Kwenta and Lyra.

In 2022, the atomic swaps feature was introduced, supporting liquidity integration for spot DEX.

However, throughout this process, the team did not publicly state that Synthetix's positioning had shifted from a synthetic asset platform aimed at end-users to a liquidity infrastructure for DeFi applications and developers. It wasn't until March of this year, with the deployment of Synthetix V3 on Ethereum and Optimism, that users truly realized Synthetix had completed its transformation.

The V3 version primarily focuses on four areas: the liquidity layer for DeFi derivatives, supporting new protocols built on Synthetix; increasing the types of collateral assets; compatibility with EVM, supporting cross-chain deployment; and providing more user-friendly tool components for developers.

- Liquidity layer for DeFi derivatives, Synthetix's clear goal is to become a protocol focused on liquidity as a service (Liquidity as a Service), transforming the protocol into a permissionless derivatives liquidity platform that provides the driving force for the next generation of DeFi products.

- Increasing the types of collateral assets to enhance the market scale of Synths and increase liquidity depth. Currently, since Synths can only be minted by SNX stakers, the overall scale limit of Synths depends on the value of SNX. With a circulating supply of about 300 million SNX and a price of $2.3, the market cap of SNX is around $700 million. Based on a 400% collateralization rate, the market scale of Synths is limited to $170 million. Therefore, V3 has created a universal treasury unrelated to collateral types, with each treasury supporting a single collateral asset. These treasuries will be combined and connected to one or more liquidity pools in the market, with different treasuries having different incentive structures to guide liquidity.

- Compatibility with EVM and support for cross-chain deployment, Synthetix V3 will be able to deploy on any EVM-compatible chain to support synthetic assets on any chain.

- Developer tools, Synthetix will provide more components to support developers, making it easier to build applications based on Synthetix.

Synthetix V3 fundamentally improves the operational efficiency of the Synthetix system, clarifying its future positioning, primarily aimed at B-end developer users. The V3 version will be released in phases over the coming months, with features gradually becoming available.

In fact, Synthetix's positioning as a liquidity infrastructure for DeFi can be traced back to the founder Kain's views on the future development direction of DeFi in 2021—"DeFi is not truly user-facing; we mistakenly thought it was because we have only been interacting with crypto enthusiasts since 2018. However, ordinary users are more likely to interact with DeFi infrastructure through mobile wallets rather than directly."

Through this gradual product iteration and functional optimization, identifying its strengths and characteristics, and continuously deepening them, Synthetix's products have upgraded from B2C to B2B, seeking its own uniqueness and differentiation in the saturated DeFi space.

In fact, it is not just Synthetix; many veteran DeFi applications are also trying to find new growth points and differentiated narratives, such as Curve launching the native stablecoin crvUSD, Frax Finance launching frxETH, and Aave introducing the stablecoin GHO, all attempting to delve into products and extend new narratives in today's stagnant capital market to build their own exclusive moats.