RootData's latest report: A review of the investment and financing characteristics and new trends in the eight major sectors of the Q2 cryptocurrency market

Author: Gu Yu & Biscuit, RootData

The second quarter of 2023 has just passed, and the crypto space may have entered the depths of a bear market. Since the collapses of Terra, FTX, and the bank run crises faced by several crypto-friendly banks in 2022, the liquidity of cryptocurrencies has plummeted sharply. Additionally, the ongoing crackdown by regulators on centralized exchanges has shaken market confidence, with the battle between centralized crypto giants like Binance and Coinbase against the U.S. SEC still ongoing. The few pieces of good news are that several asset management giants, including BlackRock, have once again filed for spot Bitcoin ETFs.

So, how did the crypto investment and financing market perform in the second quarter of 2023? What are the hottest trends in the current market? Rootdata has conducted a comprehensive analysis based on platform statistics. This report consists of two parts: Overview of the Crypto Investment and Financing Market in 2023Q2 and Analysis of Investment and Financing Market Trends.

I. Overview of the Crypto Investment and Financing Market in 2023Q2

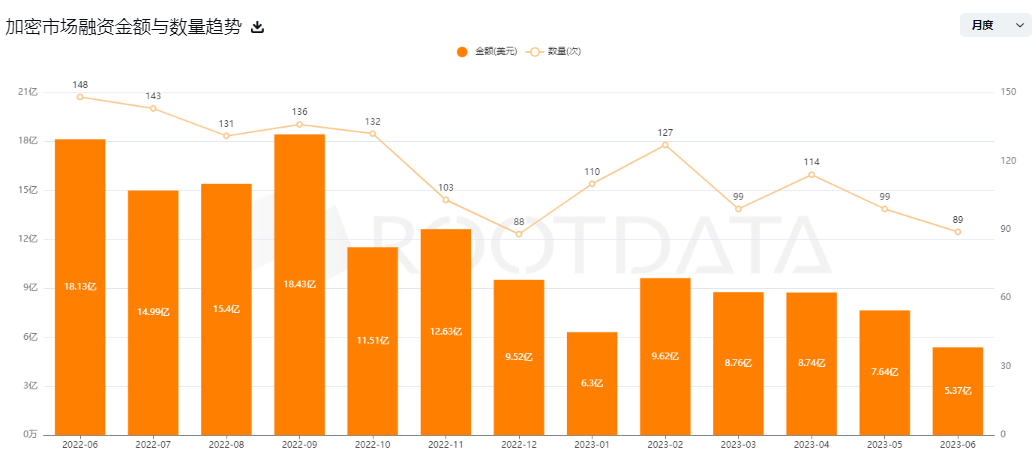

RootData data shows that from April to June 2023, the crypto industry disclosed a total of 301 project financing events, with a total financing amount reaching $2.177 billion, far lower than the $7.802 billion in the same period of 2022, a year-on-year decrease of about 72.1%. Compared to the previous quarter's $2.47 billion, there was also a slight decline, with a quarter-on-quarter decrease of about 11.8%. In summary, both the number of financing events and the amount of financing in this quarter hit new lows since 2021.

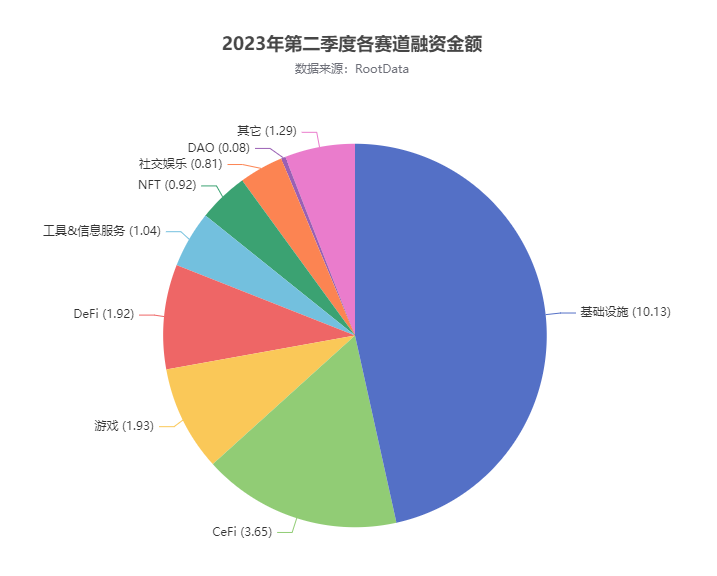

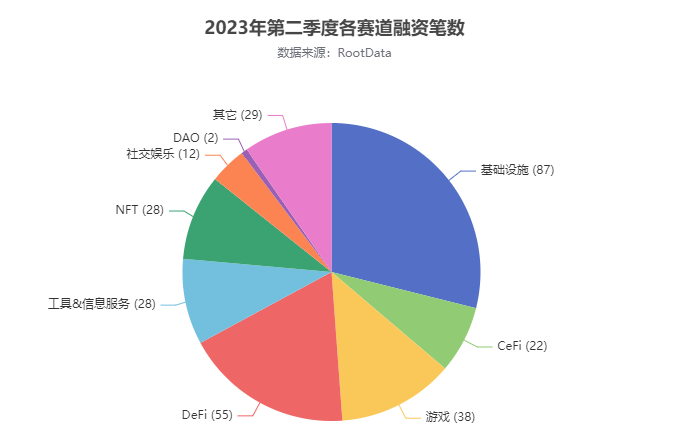

From the distribution of financing across various sectors, the following chart shows the number of financing events and the amount of financing (in hundreds of millions of dollars) for each sector from April to June 2023:

Among them, the infrastructure sector had the highest number and amount of financing among the nine major sectors, with an average single financing amount exceeding $10 million. Popular financing projects in this sector include modular blockchains, zk concepts, etc.;

The DeFi sector ranked second in terms of the number of financing events and fourth in terms of financing amount, with popular subfields being DEX, derivatives, etc.;

The gaming and social entertainment sectors ranked third and fourth in terms of financing events, with subfields like gaming platforms and creator economy receiving significant capital attention in Q2 2023.

In terms of investor participation frequency, RootData recorded 16 investors participating in more than 8 rounds, including NGC Ventures, HashKey Capital, DWF Labs, Binance Labs, Polygon Ventures, Coinbase Ventures, Alchemy Ventures, OKX Ventures, GSR, and other institutions, all exceeding 10 rounds.

II. Analysis of Crypto Investment and Financing Market Trends in 2023Q2

1) Layer1

In the second quarter of 2023, a total of 17 Layer1 projects completed $236 million in financing, an increase of 91.4% compared to the first quarter of 2023. The Layer1 projects that received financing can be roughly divided into two directions:

- Based on Cosmos technology: Nibiru, Syntropy, Sei Network, Berachain…

- Established public chains: EOS, TomoChain, Conflux, IOST, Ton…

From a trend perspective, as networks like Ethereum and Bitcoin shift more attention to Layer 2 scaling, the Layer1 sector is primarily driven by Cosmos ecosystems, and the concept of modular public chains is being realized. In the second quarter, Layer1 was still able to achieve impressive valuations: Sei Network ($800 million), Nibiru ($100 million), Berachain ($420 million).

However, financing for established public chains seems to be more influenced by speculative price movements, with Conflux having received $10 million in financing from DWF Labs in the first quarter, and DWF Labs following up with an additional $18 million in the second quarter.

This quarter saw two notable Layer1 projects launch their mainnets, but their subsequent performance seems less than satisfactory. On April 20, the privacy chain Iron Fish launched its mainnet (financing $33 million, valuation $190 million), and on May 3, the Move-based chain Sui (financing $336 million, valuation $2 billion) launched its mainnet. Iron Fish has seen little interest since the airdrop hunters left, and Sui has even fallen into debates over alliance chains.

Despite this, the Layer1 sector, with its vast imaginative potential and narrative capability, will remain one of the most attractive sectors for investors for a considerable time.

2) CEX

Since the collapse of FTX in the fourth quarter of 2022, various forces have sought to fill the void, and more financing events have been disclosed in this quarter. In the second quarter of 2023, a total of 12 CEX projects completed $152.25 million in financing, an increase of 851.5% compared to the previous quarter.

Among them, the non-custodial exchange EDX Markets, supported by Wall Street forces, completed a new round of financing and officially launched trading services. This exchange adopts a non-custodial model, not holding customers' digital assets during trading, thereby reducing custody risks, similar to the roles of traditional exchanges like Nasdaq or the New York Stock Exchange. EDX Markets offers products for trading including BTC, ETH, LTC, and BCH, and plans to launch EDX Clearing later this year to settle trades matched on EDX Markets.

According to RootData statistics, EDX Markets has attracted a series of top investment institutions, including Paradigm, Sequoia Capital, Virtu Financial, Fidelity Digital Assets, Citadel Securities, Charles Schwab, Miami International Holdings, and more.

Additionally, ABCDE Capital invested in the crypto derivatives trading platform CoinCatch, which focuses on social trading for KOLs, allowing KOLs to share trading strategies with their fans. Other projects in the CEX sector that received financing include Bitcoin financial service provider River Financial, institutional-grade digital asset exchange One Trading, and crypto exchange Bitget.

3) DeFi Derivatives

As DeFi foundational products and Ethereum staking become increasingly mature, DeFi derivatives protocols have become one of the few innovation hotspots in the crypto space. According to RootData, in the second quarter of 2023, a total of 14 DeFi derivatives completed $39.45 million in financing, an increase of 194.4% compared to the previous quarter.

Most of the financed derivatives protocols involve functions such as options, perpetual contracts, and spread trading, or amplify trading positions through lending or margin use, aiming to improve capital efficiency. For example, the multi-chain structured product protocol Thetanuts Finance offers automated options strategies, while the decentralized volatility product Smilee allows users to short LP tokens to mitigate their impermanent loss risks.

Moreover, some derivatives protocols exhibit varying degrees of innovation. The yield trading protocol Pendle Finance allows users to tokenize and trade future yields by leveraging top yield-generating protocols like Aave and Compound, then dividing yield assets into tokenized ownership (zero-coupon bonds) and yield components (coupons), thus providing innovative yield trading opportunities. The time-locked token trading market Hourglass tokenizes users' staked assets in DeFi protocols over specified time periods.

4) Artificial Intelligence

With the AI sector ignited by ChatGPT, how Web3 and cryptocurrencies can integrate with AI has also attracted much attention and practice. In the second quarter, AI-concept crypto projects such as Gensyn, WorldCoin, and Kaito all received financing.

Specifically, AI-concept Web3 projects can be divided into two categories: one focuses on infrastructure, optimizing the operational logic of the AI ecosystem, while the other focuses on applications, utilizing AI technology to optimize work in the Web3 field.

In the infrastructure direction, typical projects include Gensyn and WorldCoin, where Gensyn is a distributed computing network for training AI models that uses blockchain to verify whether deep learning tasks have been executed correctly and triggers payments via commands. Although WorldCoin is not directly related to AI technically, as a project founded by the creator of ChatGPT, it aims to become a digital identity system for the AI era, reducing or even avoiding the impact of AI on users' economic and social rights.

In the application direction, typical projects include Kaito, NFPrompt, and Mazzuma, where Kaito primarily optimizes the digital asset research process for crypto users through AI, NFPrompt helps artists generate NFT artworks using AI, and Mazzuma assists developers in generating smart contract code through AI. These scenarios can effectively enhance the work efficiency of target users.

In the AI era, the integration of Web3 and crypto technology will become increasingly close, and the number of AI-concept projects recently included by RootData has also significantly increased, suggesting that more innovative scenarios may emerge in the future.

5) Wallets

As one of the main entry points in the crypto space, the competition for crypto wallets involves user experience, security, multi-chain support, additional features, community and support, and business models. With the rise of the account abstraction concept, in the second quarter of 2023, projects like Safeheron, Fedi, and Openfort all received financing.

Specifically, the financed projects mainly focus on wallet infrastructure platforms. The self-custody digital asset platform Safeheron provides institutional-grade wallet solutions for small and medium enterprises based on its self-developed MPC and TEE technologies. The account abstraction wallet Openfort allows users to register using various popular authentication methods (such as Google, Gmail, and Twitter). The wallet-as-a-service platform Universal Ledger provides developers and engineers with APIs and event-driven architecture while maintaining global compliance standards similar to FATF 40 and local jurisdiction regulatory requirements.

Additionally, other financed projects include the Bitcoin ecosystem wallet Fedi, the privacy wallet Leo Wallet from the Aleo ecosystem, the hardware wallet Tangem, and the smart wallet Giddy, among others.

Account abstraction enables wallets to better handle and manage users' account information, providing more convenient, secure, and privacy-protecting digital asset management features. In the future, the usage threshold for wallets may be significantly lowered, potentially becoming the default configuration for users.

6) Decentralized Social

Decentralized social aims to allow users to better manage their social relationships and content while achieving monetization. Some projects also attempt to connect different applications and users to realize collaborative gaming and joint governance. Well-known crypto projects like Lens Protocol, CyberConnect, and Story Protocol received financing in the second quarter.

Overall, the decentralized social sector can be divided into three main directions: social graphs, social metaverses, and social media platforms. Social graphs enable users to control and own their social data by recording their social relationships and interaction data on the blockchain. Social metaverses are digital social spaces based on virtual reality or augmented reality technologies, where users can create their digital identities and interact with other users. Decentralized social media platforms allow users to create, share, and communicate content without the control of centralized entities.

In the social graph direction, Lens Protocol and CyberConnect both provide decentralized authentication solutions, protecting users' personal information and interaction data through blockchain technology, allowing users to communicate, share content, and build social relationships with others. In contrast, CyberConnect focuses on simplifying the user interface and operation process, with features like social relationship management, encrypted chat, and distributed storage aimed at facilitating secure and private social interactions. Lens emphasizes content display and creator experience, aiming to enable creators to derive value directly from their content.

In the social metaverse direction, Orbofi, PoPP, AnotherBall, and May.Social allow users to create and manage their digital identities, showcasing personalized characters, appearances, and assets in the virtual world, while encouraging user participation and contribution to the social metaverse ecosystem through internal economic models and incentive mechanisms. Users can earn economic rewards through content creation, asset trading, and other means.

Additionally, Story Protocol, led by a16z Crypto, is a platform focused on decentralized content creation, social interaction, and creator incentives. It provides a transparent and tamper-proof way to publish and share content, promoting user participation and economic returns for creators through incentive mechanisms and community governance. At the same time, the platform emphasizes users' control over their data and privacy protection, allowing users to participate in content creation and social interaction in a safer and more autonomous manner.

7) NFT Market

In the NFT market sector, OpenSea remains the unshakable leader, prompting more project parties to turn their attention to niche areas, allowing digital art, music, and gaming items to become valuable assets. These vertical NFT markets also received financing in the second quarter.

Specifically, the projects that received financing in this sector can be divided into comprehensive NFT markets, music NFT markets, and social NFT markets.

In the comprehensive NFT market direction, Tegro, Collectibles, and Treasureland Market support various types of NFT display and trading, with minor differences possibly in filtering functions, trading processes, and supported blockchain networks.

In the music NFT market direction, platforms like Spinamp, MetaZ, and AlienSwap focus on NFTs in the music and entertainment fields, including music works, virtual concert tickets, etc., with differences in music partners and artist communities. Additionally, special services are also one of the factors attracting users. For example, Dew Drops provides selected digital collectibles to collectors via SMS, Meta[Z] offers services for issuing NFTs for sneakers, and AlienSwap returns all its revenue to the community.

In the social NFT market direction, platforms like Oxalus, Colecti, and The Hug focus on NFTs in the social and creative fields, such as social greeting cards, virtual gifts, and creative artworks.

Overall, these NFT markets have made some differentiated innovations in positioning, functional focus, user interface, and community aspects. Users can choose suitable markets based on their needs and interests to obtain a better NFT purchasing, displaying, and interaction experience.

8) Developer Platforms

In the second quarter of 2023, Web3 developer platforms raised approximately $89 million in financing, with these 16 platforms categorized into four aspects based on positioning, functional focus, tools, and services provided:

- Authentication and wallet service platforms: Magic and Ramper focus on providing authentication and wallet services, aiming to lower the user entry experience into Web3. In terms of methods, Magic supports registration via email or social login, while Ramper achieves this through its self-developed key management architecture, called the Restorative Multi-Encryption System (RPMS).

- Blockchain development tools and service platforms: Platforms like Tableland, Mirror World, Ironforge, and Sort provide developer-friendly interfaces, documentation, and tools to simplify the blockchain development process. Notably, Tableland focuses on structuring relational data, Ironforge aims to improve the developer experience on Solana and simplify integration with existing systems, and Sort allows developers to create rich applications using Ethereum data.

- NFT development and API platforms: Platforms like Mazzuma, BlockSpan, and SPYCE5 focus on NFT development and APIs, providing tools and services to simplify the development and integration of NFT applications. They offer features such as real-time data and metadata retrieval, NFT price queries, and ownership verification.

- Others: Airstack and Cookbook provide developers with tools and services for quick and easy access to on-chain data across projects and blockchains.

The importance of developer platforms for a blockchain network lies in providing infrastructure, tools, resources, and support to facilitate ecosystem building and application development. As more applications and developers emerge with clear business models, developer platforms are receiving increasing attention from capital.

Summary

Overall, due to difficulties in fundraising for crypto funds, lack of market confidence, and poor exit channels, crypto investment institutions have slowed down their investment frequency, waiting for clearer signals from the market before adjusting their investment strategies.

In this context, the vast majority of crypto companies need to reassess their income and cash flow situations and develop strategies to cope with the worst-case scenarios. Many projects lacking cash flow and application scenarios will inevitably be eliminated by the market in this bear market, while new market hotspots will give rise to a new wave of competitive projects, entering a new round of infinite games crafted by venture capital institutions.