Market value nearly halved, Coinbase invests, the stablecoin landscape reshaped behind the USDC crisis response

Written by: flowie, ChainCatcher

Circle CEO Jeremy Allaire's sense of crisis seems to be palpable. Recently, Jeremy Allaire responded in an interview with Bloomberg, stating that in the face of competition from non-cryptocurrency companies like PayPal, Circle has over $1 billion in cash to buffer the pressure. Moreover, yesterday, Circle officially announced that Coinbase is about to invest, and USDC will launch on six new chains with Coinbase's support.

For Circle, the sense of crisis likely comes not only from the invasion of Web2 giants like PayPal but also from the continuous pressure exerted by old competitors such as USDT and DAI.

A fact facing Circle is that the market capitalization of USDC has dropped from $45 billion at the beginning of the year to about $26 billion, almost halving, setting a nearly two-year low. Meanwhile, the market shares of competitors like USDT and DAI have significantly increased or rebounded. Compared to the beginning of the year when USDT's market cap was $66 billion, it has risen by 25.7% to $83 billion; while DAI, after experiencing the USDC de-pegging crisis, saw its market cap increase by over 20% in the past two months thanks to RWA.

Amid the crisis of USDC's declining market cap, we can also see the reshaping of the stablecoin market landscape this year. On one hand, after the regulatory crackdown on BUSD and the de-pegging crisis of USDC, there have been significant changes among the top five stablecoins; on the other hand, established DeFi projects like Curve and Aave are actively launching native stablecoins, and new forces in interest-bearing stablecoins leveraging LSD and RWA are also on the rise. Additionally, with Web2 payment giant PayPal launching the stablecoin PYUSD, another important factor has been added to the stablecoin market.

Beyond the changing landscape of stablecoin projects, core crypto regions like the U.S., Singapore, and Hong Kong are also experiencing undercurrents in stablecoin regulation. Currently, the Monetary Authority of Singapore has taken the lead in releasing the "MAS Finalized Stablecoin Regulatory Framework," providing a reference for promoting compliant stablecoins.

Market Cap Nearly Halved: USDC's Anxiety and Response

Regarding the decline in USDC's market cap, although Circle CEO Jeremy Allaire attributed part of it in an interview with Bloomberg to Binance's decision a year ago to reduce USDC adoption in favor of promoting its own stablecoin BUSD.

In fact, aside from Binance reducing USDC adoption, USDC has remained shrouded in the shadow of this crisis since the de-pegging incident triggered by the Silicon Valley Bank run at the beginning of the year.

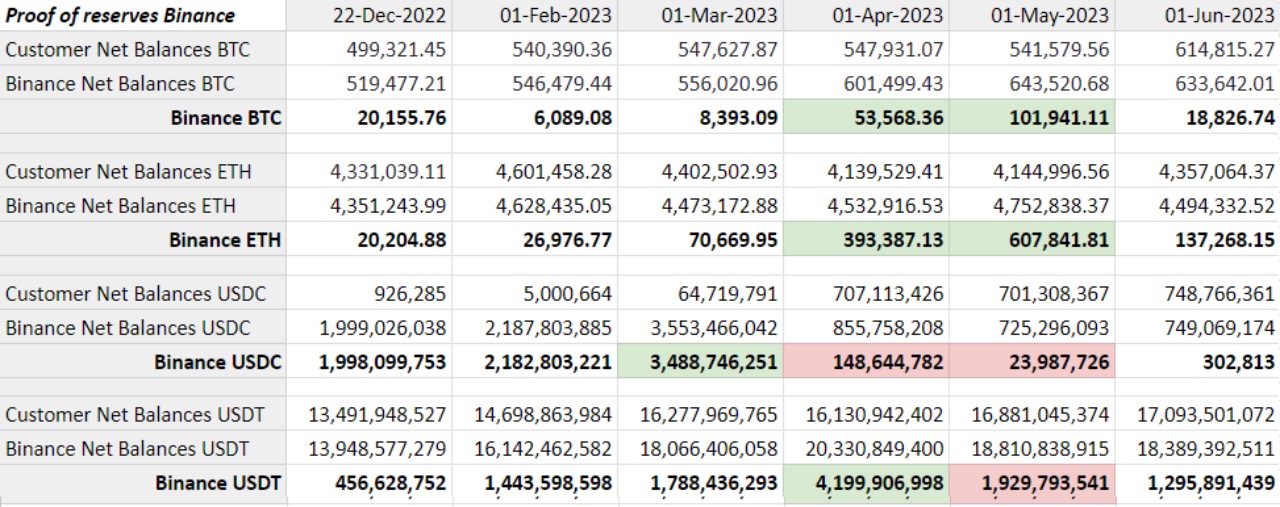

Due to safety concerns stemming from the USDC de-pegging, major USDC holders led by Binance and MakerDAO have reduced or even completely sold off their reserves of USDC. Recently, it was reported that Binance had sold a large amount of USDC in exchange for BTC and ETH as reserve assets. Binance's latest proof of reserves (PoR) shows that its USDC balance decreased from $3.4 billion on March 1 to $23.9 million on May 1. On-chain analyst Aleksandar Djakovic pointed out that after the collapse of Silvergate and Signature banks, Binance purchased approximately 100,000 BTC and 550,000 ETH between March 12 and May 1, totaling about $3.5 billion, which corresponds to the surplus amount of USDC they held, suggesting that Binance sold USDC to acquire BTC and ETH.

Binance reserve balance from December 2022 to June 2023, source: Binance

Binance reserve balance from December 2022 to June 2023, source: Binance

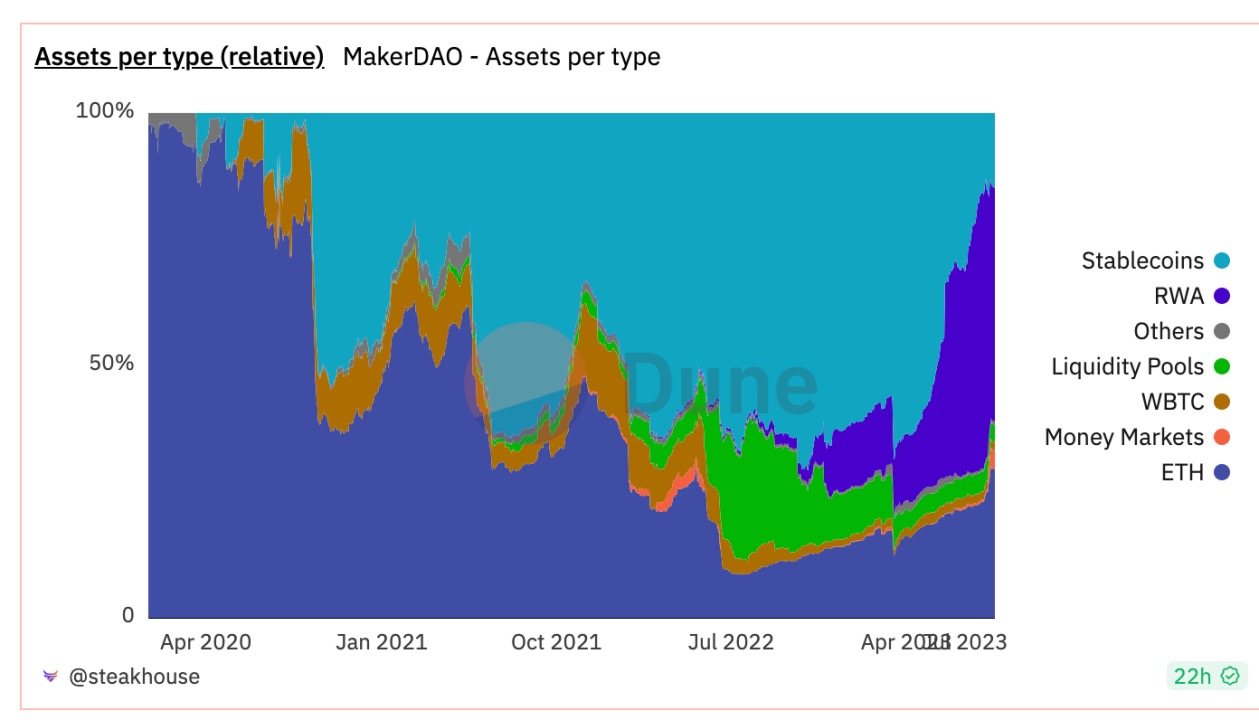

Meanwhile, MakerDAO has converted a large amount of USDC into USD to purchase U.S. Treasury bonds. Between 2021 and May 2023, the PSM stablecoin (over 70% is USDC) in MakerDAO's balance sheet accounted for more than half of MakerDAO's assets in most cases. However, after mid-May this year, the proportion of MakerDAO's RWA assets surged to about half, while its stablecoin assets fell below 15%. As of now, MakerDAO's stablecoin assets are approximately $700 million, while RWA assets are about $2.5 billion. In March, before the USDC de-pegging, MakerDAO's stablecoin assets were as high as nearly $4 billion. This means that at least over $2 billion of USDC in MakerDAO's asset reserves may have been converted into U.S. Treasury bonds and other RWA assets.

Source: Dune Dashboard @SebVentures

Source: Dune Dashboard @SebVentures

Not only decentralized stablecoin protocols like MakerDAO have significantly reduced their USDC assets, but algorithmic stablecoin Frax has also been exploring the introduction of RWA to reduce its dependence on USDC after the USDC de-pegging. The upcoming Frax Finance V3 upgrade will focus on changing this situation. Frax Finance founder Sam Kazemian mentioned the idea behind this upgrade during community interactions: FRAX has operated under the assumption that USDC would not de-peg since its inception. However, when USDC de-pegged, the redemption value of 0.95 USDC + 0.05 USD FXS was insufficient to reach $1.00. Therefore, FRAX v3 will change this situation through many new AMOs and features pegged to "sovereign dollars."

As Binance, MakerDAO, and others have sold off large amounts of USDC, the market cap of USDC has continued to decline. According to CMC data, USDC's market cap has dropped from $45 billion at the beginning of the year to about $26 billion, a decline of 42%, and it has been on a downward trend for six consecutive months.

With the recent announcement by traditional payment giant PayPal to launch PYUSD, the competitive pressure on USDC has further intensified. USDC and PYUSD are in direct competition, as both are stablecoins subject to U.S. regulation and share similar customer bases, while PYUSD, as a Web3 payment giant, benefits from a user base of 400 million and brand advantages.

Amid this competitive anxiety between old and new forces, Circle and CEO Jeremy Allaire have been vocal recently. On one hand, Circle CEO Jeremy Allaire disclosed Circle's revenue strength in an interview with Bloomberg, stating that despite the decline in market cap, Circle is still performing well operationally. Jeremy Allaire mentioned that Circle's revenue for the first half of this year was $779 million, surpassing the total revenue of $772 million for all of 2022; the adjusted EBITDA for the first half was $219 million, also exceeding the total revenue of $150 million for 2022. However, the portion of revenue related to USDC has not been disclosed.

In facing competition from PYUSD, Jeremy Allaire stated that Circle has $1 billion in assets and sufficient funds to respond to competition. Additionally, Jeremy Allaire also mentioned that despite ongoing speculation in the U.S., the adoption rate of USDC outside the U.S. has reached 70%, with some of the fastest-growing regions being emerging and developing markets. Jeremy Allaire seems to imply that PYUSD's main customer base is in the U.S., while USDC primarily serves regions outside the U.S., suggesting that the competition between the two may not be as fierce.

Beyond anxiety, USDC is also taking measures to address the decline in its market cap and the pressure from new competitors. On one hand, Circle is focusing on expanding into emerging markets outside the U.S., such as obtaining a crypto payment license in Singapore and considering issuing stablecoins in Japan according to new regulations.

On the other hand, Circle is also strengthening its partnerships within the ecosystem. According to an official announcement from Coinbase yesterday, Circle will welcome Coinbase's investment, and with Coinbase's support, USDC plans to launch on six new blockchains. It is worth mentioning that collaborations between stablecoins and exchanges have had successful precedents, such as the partnerships between USDT and Bitfinex, and BUSD and Binance, which have indeed resulted in a win-win situation.

Previously, Circle also reached an agreement with OKX to use USDC for paying gas fees, launched USDC on Arbitrum, and introduced a "Wallet as a Service" platform for developers. In the future, Circle will also launch cross-chain payments for stablecoins and a simplified smart contract development platform. Recently, Circle announced a $100,000 ecosystem funding program supported by USDC to attract more ecosystem partners to use USDC. Additionally, Circle is also cutting costs by restarting the purchase of U.S. Treasury bonds as USDC reserve assets to achieve higher returns and reducing operational costs through layoffs.

New Battle for Stablecoins: Regulation, RWA, Yield, Web2 Giants

As USDC's market cap continues to decline, the landscape of the stablecoin market is also being reshaped.

First, according to the "Stablecoin and CBDC Report" released by cryptocurrency analytics platform CCData, the total market cap of stablecoins has continued to decline to the range of $124 billion, marking the lowest record for stablecoin market cap since August 2021, and it has been falling for 17 consecutive months.

During this period of overall weakness in stablecoin market cap, the stablecoin market has seen significant fluctuations since the beginning of the year, with the major stablecoins experiencing varying degrees of impact, and the rankings of stablecoin market caps have changed considerably compared to the beginning of the year.

First, in February of this year, BUSD faced regulatory crackdowns. The New York Department of Financial Services (NYDFS) announced an investigation into BUSD issuer Paxos, and shortly after, the U.S. Securities and Exchange Commission (SEC) announced a lawsuit against Paxos regarding BUSD-related issues. BUSD, which was continuously strangled by regulation, saw its market cap drop from $16 billion in February to $3.3 billion, a decline of nearly 80%, and its position as the third-largest stablecoin after USDT and USDC was ceded to DAI.

Then, due to the Silicon Valley Bank run, USDC, which held reserves in that bank, also experienced a run and de-pegging risk. This led to the aforementioned large holders like Binance and MakerDAO selling off USDC to reduce their dependence on it. Currently, USDC has dropped from $45 billion at the beginning of the year to about $26 billion, nearly halving, setting a nearly two-year low.

Originally ranked behind BUSD, DAI saw a significant drop in market cap after the USDC de-pegging crisis, but rebounded due to its strategy of converting reserve assets from USDC to U.S. Treasury bonds. Its market cap has increased by over 20% in the past two months, making it the third-largest stablecoin.

USDT, which has consistently held the top position, although it has faced criticism for lack of asset transparency, has benefited from the turmoil of BUSD and USDC, with its market cap continuing to rise. Compared to the beginning of the year when its market cap was $66 billion, USDT's market cap has increased by 25.7% to $83 billion.

Currently, the fifth-largest stablecoin TUSD (TrueUSD) has quietly risen rapidly amid the disputes among the top four stablecoins, with its market cap more than doubling since March to about $3 billion, making it one of the fastest-growing stablecoins.

Data provider Kaiko shows that TUSD's share of stablecoin trading volume on centralized cryptocurrency exchanges has risen from less than 1% at the beginning of the year to 20%.

The rapid rise of the relatively unknown TUSD has also sparked many speculations. The Wall Street Journal recently published an article titled “Cryptocurrency Conundrum: Who Controls the Rapidly Growing Stablecoin TrueUSD?” questioning the behind-the-scenes operators of TrueUSD. The article mentions that TrueUSD was created in 2018 but later renamed Archblock and received funding from Peter Thiel's Founders Fund, Stanford University's StartX, Andreessen Horowitz, and Jump Trading.

Currently, TrueUSD's co-founder is embroiled in intense legal disputes regarding An's departure from the company. In a recent lawsuit, An stated that Justin Sun had discussed acquiring TrueUSD in 2020, but before the deal was finalized, An was ousted from the parent company of the stablecoin. His remarks have fueled market speculation that Justin Sun is the mastermind behind TrueUSD's sudden growth. Earlier in July, a partner at crypto investment firm Cinneamhain Ventures revealed that TUSD is related to Justin Sun's family and partners at Huobi.

Another rapidly growing stablecoin besides TUSD is FDUSD from First Digital Labs, which saw its market cap surge by 1410% after launching on Binance last month, reaching $305 million, currently ranking 11th among stablecoins, just behind Frax. It is reported that FDUSD is issued by FD121 Limited, a subsidiary of Hong Kong-based custodian First Digital Limited (brand name: First Digital Labs). On June 1 of this year, Zhao Changpeng announced that First Digital would issue stablecoins on the BNB Smart Chain. Due to the connection between FDUSD and "Hong Kong" and Binance, it is speculated to be a potential alternative to BUSD chosen by Binance.

We see that among the top five stablecoins, DAI has achieved a "turnaround" by converting its original stablecoin reserve assets into U.S. Treasury bonds and other RWA assets to generate yields, and distributing some of the profits to users. This year, like DAI, other projects are also launching interest-bearing stablecoins to gain more market share. For example, established DeFi projects like Curve and Aave, as well as new DeFi projects like Lybra Finance and OpenEden, are leveraging LSD, RWA, and other yield-bearing assets to promote the development of their interest-bearing stablecoins.

In May of this year, Curve's native stablecoin crvUSD was officially launched, currently supporting ETH and three liquid staking products: wbtc, wsteth, and sfrxETH as collateral, allowing for over-collateralized minting of crvUSD. According to Curve's website data, the minting of crvUSD has surpassed 120 million. Aave quickly followed suit, launching its native stablecoin GHO in July, which operates similarly to DAI, using Aave's aTokens as collateral for minting, with the distinction that aTokens are yield-bearing assets. Aave's minting volume has exceeded 20 million.

Similar to Curve's native stablecoin crvUSD, new forces like Lybra Finance and Prisma Finance are also supporting LSD assets for minting interest-bearing stablecoins. Currently, Lybra Finance's stablecoin eUSD has surpassed a market cap of $180 million, ranking 15th among stablecoins. Additionally, on-chain U.S. Treasury protocols represented by OpenEden allow users to invest in U.S. Treasury bonds through their native stablecoin TBILL to earn annualized returns, with OpenEden's TVL exceeding $12 million.

In addition to the changes in the landscape of mainstream stablecoins, the competition among interest-bearing stablecoins is intensifying, and this lucrative business of stablecoins is also attracting Web2 payment giants like PayPal, which has already issued over 30 million PYUSD. With PayPal entering the stablecoin market, Circle's CEO and other crypto figures predict that more non-crypto practitioners will flood into the stablecoin market.

Regulatory Framework Gradually Materializing: Will Compliant Stablecoins Lead Crypto into the Mainstream?

Although the total market cap of stablecoins is declining, the entry of Web2 giants like PayPal may force the implementation of compliant stablecoins, and the regulatory frameworks for stablecoins in key crypto regions such as the U.S., Singapore, and Hong Kong are gradually becoming clearer.

At the beginning of the year, the SEC's regulatory crackdown on BUSD temporarily shook confidence in the stablecoin market; however, the launch of PYUSD after a six-month wait is seen as accelerating the implementation of U.S. stablecoin legislation.

As PayPal announced the launch of PYUSD, Patrick McHenry, chairman of the U.S. House Financial Services Committee, supported the move, stating, "Stablecoins issued under a clear regulatory framework are expected to become a pillar of our 21st-century payment system. PayPal's stablecoin makes it more important than ever to push for legislation."

Earlier in late July, the U.S. House Financial Services Committee announced the passage of the "Payment Stablecoin Transparency Act (Draft)," which establishes a regulatory path for approving and regulating stablecoin issuers while creating unified federal minimum standards for payment stablecoins.

In addition to the U.S., the Monetary Authority of Singapore has taken the lead in releasing the "MAS Finalized Stablecoin Regulatory Framework." This legal framework outlines the scope of regulation and key requirements that issuers must meet regarding reserve assets, information disclosure, and other dimensions before issuing stablecoins.

Regarding stablecoin regulation in Hong Kong, in July, the Secretary for Financial Services and the Treasury, Christopher Hui, revealed in a public interview that the Hong Kong Monetary Authority is drafting a regulatory framework for stablecoins and plans to conduct a second round of public consultation within this year, aiming to implement regulatory arrangements in the 2023/2024 fiscal year.

Many crypto figures believe that as regulation gradually materializes, compliant stablecoins may be one of the keys for crypto applications to integrate into the mainstream economic cycle.