The king of cryptocurrency trading, Su Zhu, returns, and OLAS has risen over 10 times in half a month

Original authors: czgsws, Kaori, Bob, 0x711, BlockBeats

In the more than half a month since the cryptocurrency market has been sluggish and the Bitcoin volatility index has hit a new low, the cryptocurrency project Autonolas, which has seen its token rise more than 10 times in half a month and is not a meme coin, has sparked community discussions.

A large whale has shifted from never holding to purchasing large amounts of Autonolas tokens (OLAS) in multiple transactions since yesterday, and has now become the 9th largest holder of this token on the chain. Among the associated addresses that frequently transfer funds with this on-chain address, although there are no clear ownership markers in Nansen and other platforms, the large holdings overlap with the altcoin watchlist previously shared by Three Arrows Capital founder Su Zhu, leading the community to speculate that it may belong to Su Zhu.

By examining the holdings and operations of the address suspected to belong to Su Zhu, we can see which targets this on-chain whale has recently focused on.

Address 1: Holding assets valued at approximately $2.46 million

Address 1: 0x51eb4521ac4c354447a699ffcfb827dd941da04b

Address 1: 0x51eb4521ac4c354447a699ffcfb827dd941da04b

Autonolas (OLAS)

Autonolas, also known as Olas Network, aims to coordinate ecological contributors (code developers) and capital investors through a DAO organizational form, making Autonolas a unified network that includes off-chain services such as AI, oracles, and cross-chain communication.

According to official information, the Autonolas DAO was established in the summer of 2022, and its token OLAS was launched in July 2023 through a liquidity bootstrapping pool. After being listed, the token experienced nearly a month of silence before starting to rise on August 9, increasing from $0.1 to today's $1.5, a rise of over 15 times. The FDV is also approaching $800 million.

The address suspected to belong to Su Zhu began purchasing in batches starting from 3:35 AM on August 23, and as of the time of writing, has accumulated over 1.4 million OLAS, becoming the 9th largest holder of this token on the chain.

Pear Swap (PEAR)

PEAR is the governance token of the DeFi protocol Pear Swap. According to official information, PEAR holders can publish trading information for any token on the platform, with Pear Swap acting as an intermediary to facilitate OTC and P2P transactions between buyers and sellers without the need for intermediaries.

PEAR was launched in May this year, and after a lackluster three months of trading sideways, the token price surged following the announcement of the public beta launch of PearSwap v1 on August 11, rising from $0.009 to $0.062 within half a month, an increase of about 7 times.

The address suspected to belong to Su Zhu began buying on August 21 and currently holds 437,000 PEAR, valued at approximately $22,000. As of the time of writing, PEAR is priced at $0.05166, with a current FDV of $5.1 million.

PEAR 30-day price trend (Source: CoinGecko)

PEAR 30-day price trend (Source: CoinGecko)

Address 2: Holding assets valued at approximately $1.8 million

Address 2: 0xc49a3e19c90f86035dfba5a6d7e326b857bddbab

Address 2: 0xc49a3e19c90f86035dfba5a6d7e326b857bddbab

Hilo Dapp

Address 2 holds 2,451,514 HILO, valued at approximately $435,000. From the price trend, it can be seen that HILO has experienced a slight increase over the past month, with a significant price surge after August 19, peaking at $0.2347 on August 23. Coincidentally, Address 2 received HILO for the first time on August 20, demonstrating its timely market grasp. As of the time of writing, HILO is priced at $0.1783.

HILO 30-day price trend (Source: CoinGecko)

HILO 30-day price trend (Source: CoinGecko)

Hilo Dapp introduces a simple and user-friendly token binary options prediction market. Supported by HILO tokens, users can predict whether the price of a specific cryptocurrency will rise or fall within a selected time frame. Users vote (higher or lower) and lock $HILO tokens in the vote for a chance to win a share of the prediction pool prize based on their stake.

HILO stands for High + Low, focusing on predicting whether the price will go up or down, essentially choosing between option A or B.

Dubbz (DUBBZ)

Address 2 holds 178,638 DUBBZ, valued at approximately $419,000, which were purchased by Address 1 starting from August 15. As seen in the chart below, the price of BUDDZ took off around August 17, and Address 2 made its first DUBBZ purchase on August 18. Subsequently, DUBBZ maintained a high growth rate for several days before slightly declining recently. As of the time of writing, DUBBZ is priced at $2.2, with a 24-hour decline of 17.3%.

DUBBZ 30-day price trend (Source: CoinGecko)

DUBBZ 30-day price trend (Source: CoinGecko)

Dubbz is a platform that connects traditional gaming and Web3 through innovative monetization and seamless entry into Web3, primarily building SaaS and esports platforms that integrate the excitement of esports with the transformative power of blockchain, offering a new method of game monetization. Holding a certain number of DUBBZ tokens and becoming a professional member will grant a 50% fee discount in platform competitions, exclusive tournaments, early access features, games, and more.

The Dubbz team collaborates with game developers to integrate dAPPs into games and provide monetization and exposure for their products. Players will be able to use their existing Dubbz balance within games, eliminating the need for players to hold separate tokens for each game.

Unibot (UNIBOT)

Address 2 holds 8,010 UNIBOT, valued at approximately $960,000. From the price trend, UNIBOT has experienced significant fluctuations over the past month, bouncing between doubling and halving. Looking at the price trend of UNIBOT over the past month, there was a small price peak at the end of July, which is also when Address 2 first held UNIBOT.

UNIBOT 30-day price trend (Source: CoinGecko)

UNIBOT 30-day price trend (Source: CoinGecko)

Uni bot is a type of trading tool bot for Tel that helps users execute trades faster than DEX, with some users achieving good returns through Uni bot, which operates at six times the speed of Uniswap.

The total supply of UNIBOT is only 1 million, which is one of the reasons its price can be pushed up to $200 each. Currently, all are in circulation, with a 2-hour trading volume of $13,180,156.

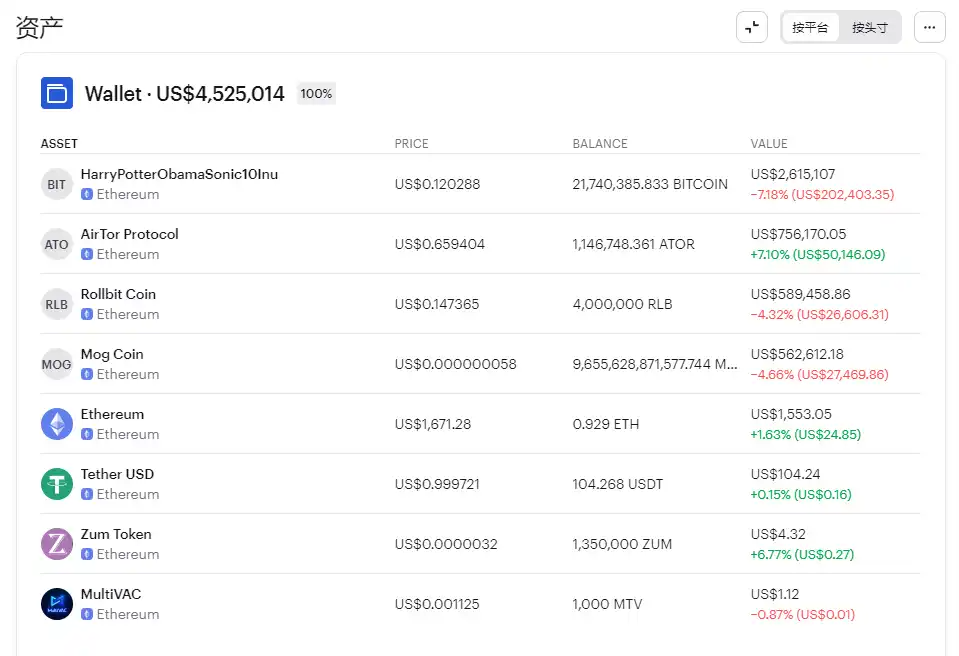

Address 3: Holding assets valued at approximately $4.5 million

Address 3: 0xa54d176707d72e22163630ffb82342559e00b547

Address 3: 0xa54d176707d72e22163630ffb82342559e00b547

HarryPotterObamaSonic10 Inu (BITCOIN)

As the second meme coin in this bull market after PEPE, Address 3 holds 21,740,385 BITCOIN (HarryPotterObamaSonic10 Inu), valued at approximately $2.61 million. Although BITCOIN has performed well throughout the year, its performance over the past month has not been impressive.

BITCOIN yearly price trend (Source: CMC)

BITCOIN yearly price trend (Source: CMC)

It is worth mentioning that Su Zhu previously published his private token "watchlist" in mid-July, with HarryPotterObamaSonic10 Inu prominently listed. After more than a month, Su Zhu's recommendations, including MKR, COMP, RLB, and OX, have all seen considerable increases.

AirTor Protocol (ATOR)

Address 3 holds 1,146,748 ATOR, valued at approximately $756,000. From the price trend, ATOR has maintained an upward trend over the past month, experiencing a slight pullback after achieving a doubling milestone.

ATOR 30-day price trend (Source: CoinGecko)

ATOR 30-day price trend (Source: CoinGecko)

Air Tor Protocol is an innovative system that supports relay operators on the decentralized internet and enhances online user privacy. The Air Tor Protocol is responsible for distributing ATOR tokens to reward operators for their contributions and to provide incentives for keeping the Tor network safer and more efficient.

The total supply of ATOR is 100 million, and all are currently in circulation. However, its daily trading volume across the network is only $374,555, indicating that it remains a token with low attention and participation.

Rollbit Coin (RLB)

Address 3 holds 4,000,000 RLB, valued at approximately $587,000. From the price trend, its current price has doubled compared to when Su Zhu made his call, but the recent downward trend in the cryptocurrency market has also impacted it.

RLB 30-day price trend (Source: CMC)

RLB 30-day price trend (Source: CMC)

The Rollbit gambling platform on the Solana chain has experienced rapid growth in 2023. Although specific operational data has not been obtained, as of the time of writing, its token RLB has increased more than 50 times this year. The project team announced on August 9 that they would change the token economics, with 10% of casino revenue, 20% of sportsbook revenue, and 30% of 1000x contract revenue being used for daily buybacks and burns of RLB, aiming to drive further highs.

The total supply of RLB is 5 billion, with a current circulation of 3.29 billion. The 24-hour trading volume across the network is $5,896,093, which is relatively decent compared to other tokens, with nearly $5.9 million in daily trading volume.

MOG Coin (MOG)

Address 3 holds 9,655,628,871,577 MOG, valued at approximately $570,000. From its 30-day price trend, a rise of more than 7 times can be considered somewhat insane.

MOG 30-day price trend (Source: CMC)

MOG 30-day price trend (Source: CMC)

With a total supply of 420 trillion, this is another meme coin, with a daily trading volume of $3,999,279. Earlier today, Su Zhu's OPNX just opened a 1000 MOG contract, making it hard to say that this coin's surge is unrelated to Su Zhu.