Detailed Explanation of Lybra's Business Model, Token Design, and Latest Developments

Written by: ETHAN, E2M Research

1. Business Design of Lybra

1.1 Business Model

Lybra's main business is the interest-bearing stablecoin eUSD, which allows users to mint eUSD by over-collateralizing ETH (automatically converted to stETH through the protocol) and stETH as collateral. Users who collateralize to obtain eUSD forfeit the interest earnings from LSD assets, while the project team uses the interest earnings from stETH to purchase eUSD in the market and distribute it according to users' eUSD holdings. The protocol charges a 1.5% annual management fee on minted eUSD as business income.

LSD (Liquid Staking Derivatives) is one of the industry solutions derived from the pain points of the minimum 32 ETH staking requirement and high operational thresholds for nodes after ETH transitions to a POS mechanism, specifically referring to the 1:1 staking certificates obtained through joint staking that allows small amounts of ETH to enter on-chain protocols.

The stETH mentioned in this article is the ETH staking certificate issued by Lido, the leading project in joint staking, which occupies 32% of the total POS staking share. Its business model involves selecting qualified node operators and allowing users to stake small amounts of ETH in its protocol to obtain stETH, charging users a 10% fee on staking earnings.

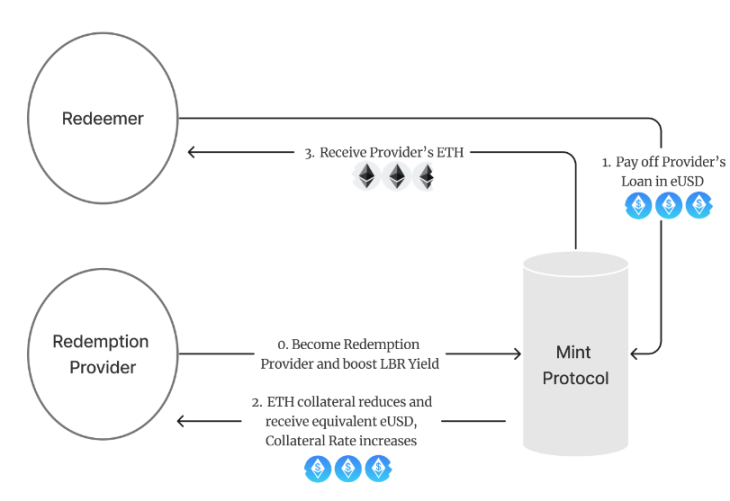

1.2 Rigid Redemption

The value of eUSD fluctuates due to market trading. When the price of eUSD is low and falls below 0.995, the protocol offers a rigid redemption service with a 0.5% deduction, allowing users to choose rigid redemption to exchange eUSD at a rate of 1:0.995 for ETH, thereby preventing the price of eUSD from further decoupling.

The exit liquidity for this part is provided by the collateral assets of users who choose the rigid exchange function within the protocol. When rigid redemption occurs, users providing exit liquidity receive 0.5% of the redemption fee and an additional 20% annualized LBR reward.

1.3 Liquidation Mechanism

The healthy collateralization ratio for the protocol's collateral is above 160%, while the liquidation line is at 150%. When a user is liquidated, up to 50% of the collateral will be liquidated from the liquidator's balance to repay the debt. In return, the liquidator receives collateral assets worth 109% of the repaid eUSD, and 0.5% of the collateral assets belong to the Keeper (a third-party monitoring project). If the liquidation is initiated by the Keeper, they can earn 1%. When the global collateralization ratio falls below 150%, users below 125% will be fully liquidated.

1.4 Minor Innovations in Design

The mechanism of eUSD references the codebase of the Liquity protocol and introduces some minor innovations based on Liquity's liquidity pool:

Liquity charges a one-time minting fee but has no other fees afterward, which initially allowed Liquity to gain significant protocol income, but later led to growth stagnation. In contrast, eUSD does not charge a minting fee but collects a 1.5% management fee on eUSD, which will provide more sustainable protocol income compared to Liquity.

Liquity incentivizes users to provide redemption funds into the liquidity pool while continuously rewarding LQTY tokens. Lybra removes the liquidity pool function and instead relies on Liquidators for liquidation, adding an additional 20% annualized LBR reward.

Liquity's collateral is singular, consisting only of ETH, which is also a reason for its slowing growth. In contrast, Lybra supports stETH as collateral and will support more LSD assets after v2, expanding the range of assets and gaining more incremental growth.

1.5 Potential Issues in Current Business of the Protocol:

The price of eUSD has consistently been at a premium due to the following reasons: the interest-bearing nature of eUSD leads users to hold it long-term and view it as a premium, reducing potential selling pressure and making it difficult to decouple downwards; the business logic involves purchasing eUSD with stETH earnings, creating a cyclical buying pressure.

The eternal issue for all stablecoins is the application scenarios. At the current stage, eUSD has no other application scenarios apart from the two trading pairs on Curve and Uni, severely limiting the long-term development of the stablecoin.

2. LBR Token Economic Model

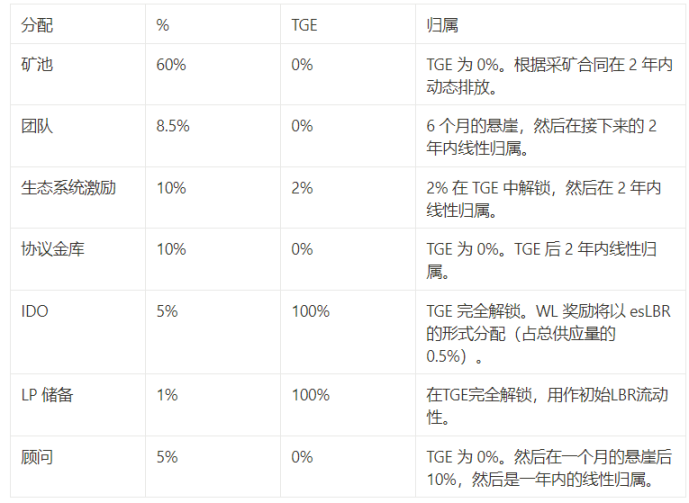

The current token distribution mechanism for the protocol's token LBR is shown in the table below, where the IDO portion sells 5M LBR at a price of 0.3U, valued at 1.5M.

The Lybra protocol also adopts a ve economic model, where ve tokens within the protocol are converted back to LBR through a linear release mechanism rather than a one-time release upon expiration. The current ve token in the protocol is esLBR, which cannot be traded or transferred but carries voting rights and can share protocol earnings. Mining rewards are the main source of esLBR, which linearly converts to LBR over 30 days.

According to its esLBR release model from May, the total daily emission of esLBR will range from 54,618 to 126,277, with the release proportions as follows: eUSD reward pool: 78%, LBR/ETH Uniswap V2 LP pool: 15%, eUSD/USDC Curve LP pool: 7%.

3. Current Protocol-Related Data (August 25)

3.1 Stablecoin Market Landscape

Looking at the overall landscape of the stablecoin market, data from defilama shows that it ranks 12th among stablecoins.

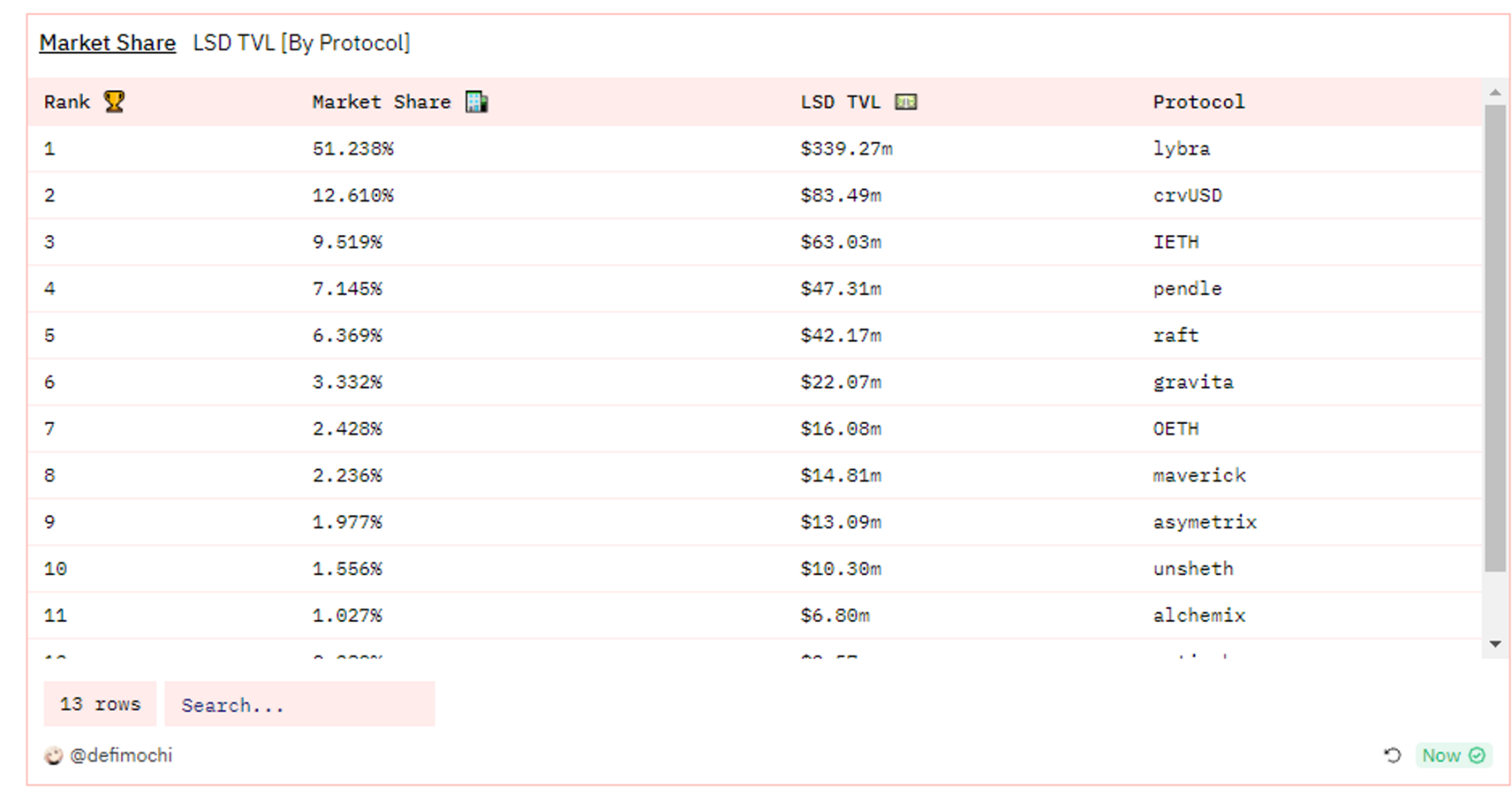

3.2 LSDFI Market Landscape

According to Dune data from Defimochi, the current LSDFI sector is not very large, approximately around 660 million, while Lybra occupies 51.2% of the LSDFI market, making it the absolute leading project.

3.3 Lybra's Internal Interest Rate Calculation

eUSD is an interest-bearing stablecoin. Based on the data in the above image, the official eUSD interest rate is 8.40%. I attempted to estimate the earnings for users participating in minting: the current global collateralization rate is 198%, and the stETH interest rate from Lido is approximately 4%. After deducting the 1.5% annual protocol fee (calculated based on the eUSD scale, so the previous total is directly reduced by 1.5%), users who stake according to the global collateralization rate earn approximately 6.42%, which differs somewhat from the official data.

The actual on-chain eUSD earnings can be understood through Loki's breakdown of the Lybra mechanism.

https://mirror.xyz/gundam0079.eth/RFkeOG9UCUDC57ggdy7xMVX7jGOPt9Mt8-y0E-30vfw

3.4 Official Website Interface

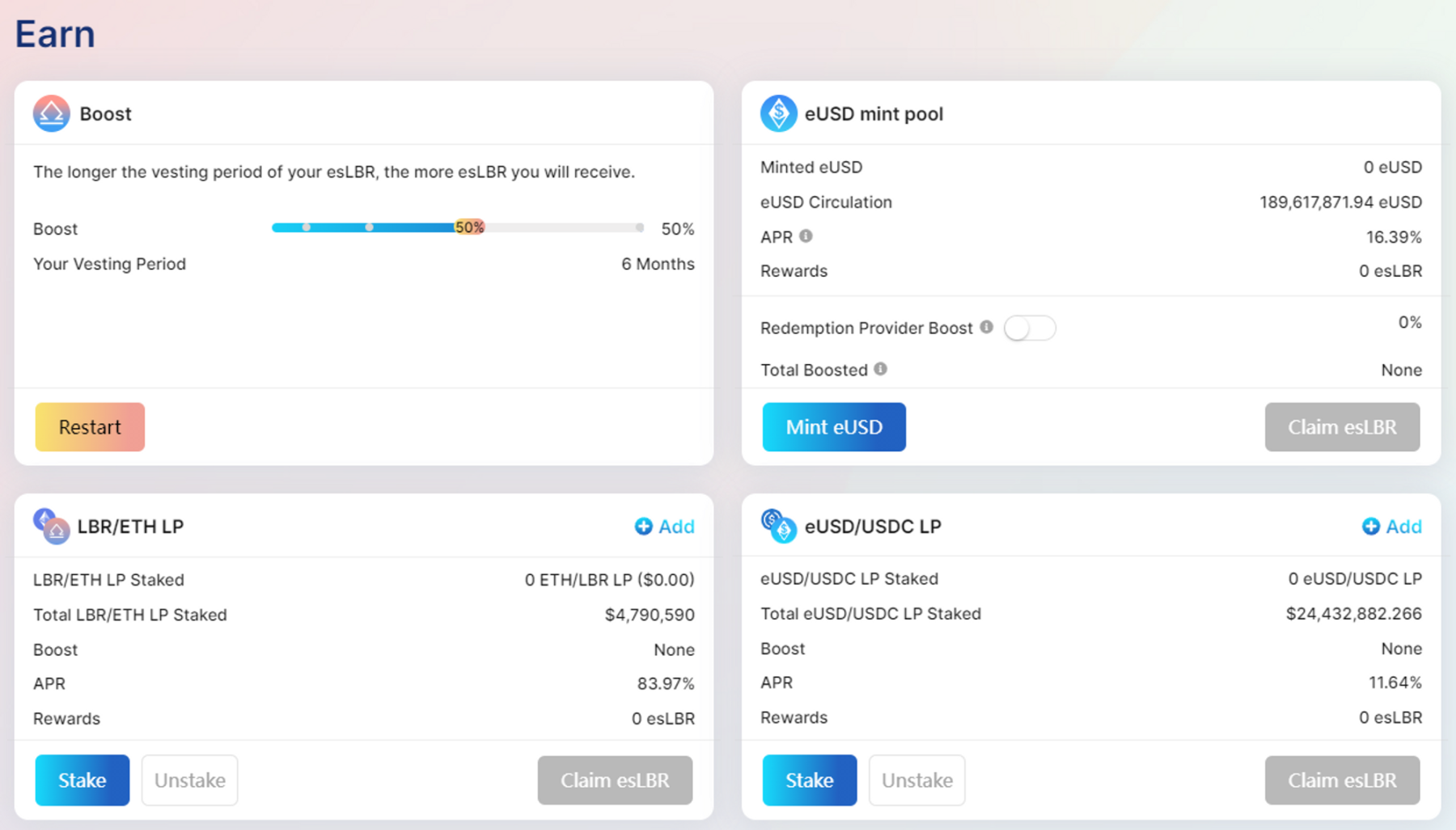

The following image shows the yield operation interface on Lybra's official website. First, let's look at the Mint pool section for eUSD, where the APR of 16.39% represents the annualized yield of subsidized esLBR. This additional yield is key to the protocol's flywheel logic.

After users participate in the eUSD minting mechanism, although the protocol will deduct an annual management fee of 1.5%, which means users will lose approximately (1.5%/198%) ≈ 0.76% of total earnings compared to stETH, they will receive a 16.39% annualized reward released linearly in esLBR monthly. The additional yield and the expected earnings from esLBR are more attractive compared to holding stETH.

In other words, although the protocol will take a portion of stETH's income, it will provide users holding eUSD with additional subsidies in the form of more linearly released esLBR, increasing the protocol's funds with future earnings expectations and potential selling pressure.

Another piece of information in the image is the optional Boost mechanism in the upper left corner. Users who enable the Boost mechanism will delay receiving esLBR's annualized rewards (up to one year for a 100% Boost). For example, if a user chooses a 6-month Boost, the protocol will pause the issuance of esLBR for half a year and will issue esLBR at a 50% bonus, i.e., 1.5 times the amount after six months.

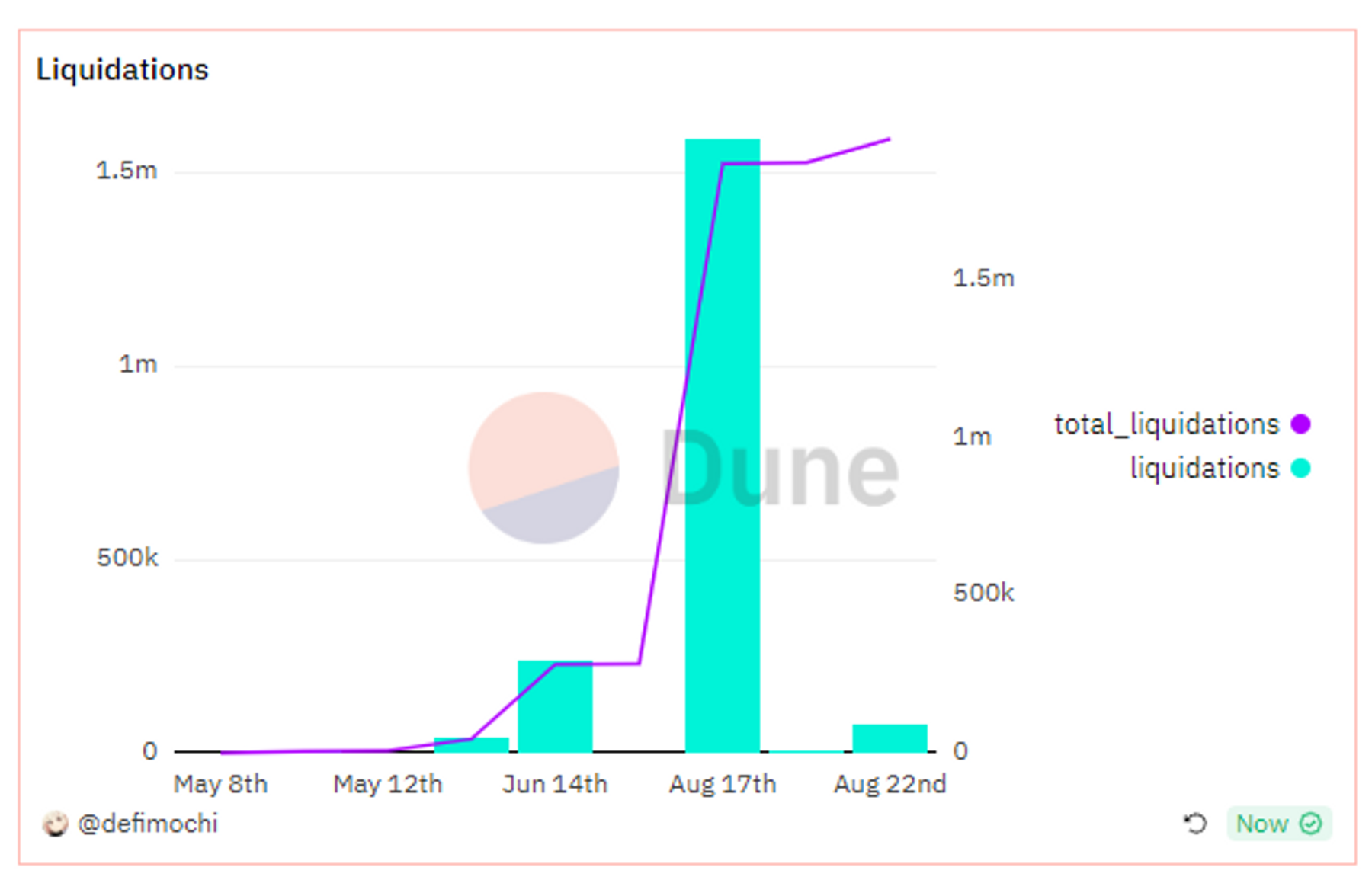

3.5 Historical Liquidation Data

Data from Dune shows that the protocol experienced significant liquidations from early August to August 17, liquidating 1.58M, with a total historical liquidation scale of 1.87M.

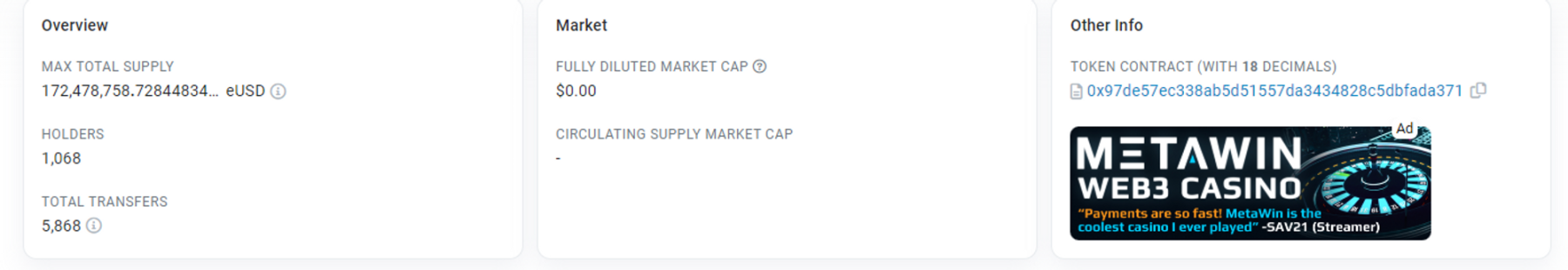

3.6 Number of eUSD Holders

The total number of users holding eUSD in the protocol is 1,068. From this data, it appears the protocol is still in its early stages. I attempted to participate in minting eUSD by collateralizing ETH, which has a minimum threshold of 1 ETH for the minting process. Considering the high gas fees on the ETH chain, this is unfriendly to retail investors. Retail investors with less than 1 ETH cannot participate, and those with several ETH need to consider gas costs before participating. I believe that only after the launch of Layer 2 and cross-chain staking to lower the thresholds will it be possible to attract retail participants' funds.

3.7 LBR Valuation

On August 25, I conducted a valuation. Based on data from Defilama, the coin price is $1.4, with a circulating market cap of 19.72M and FDV of 140M. Lybra's Fee and Revenue are 2.64M (estimated by multiplying the income from the past month by 12).

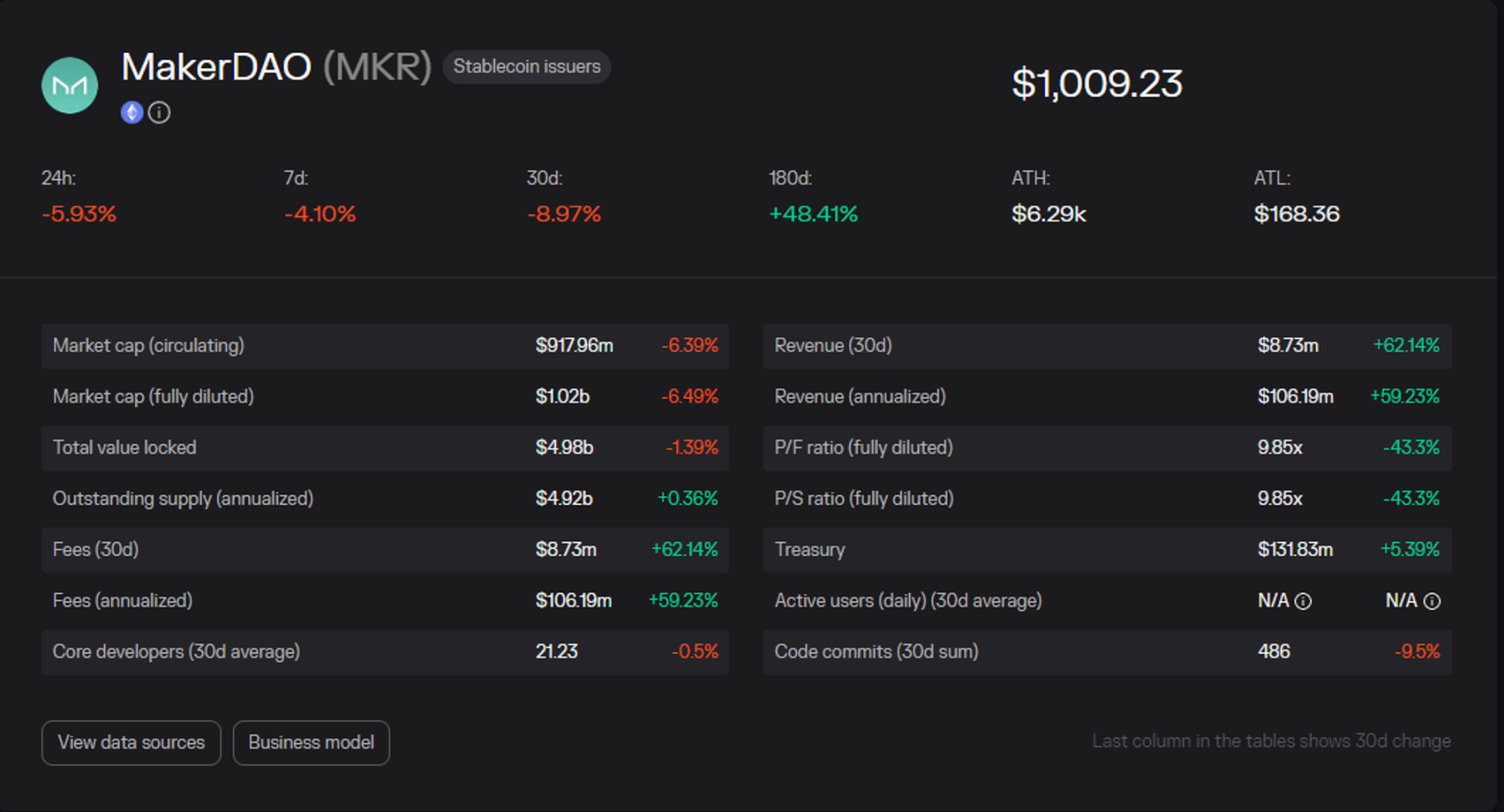

In the decentralized stablecoin sector, MakerDAO is the absolute leader. Comparing with MakerDAO's TokenTerminal data, MakerDAO currently has a circulating market cap of 917.96M and FDV of 1.02B; Fee and Revenue data are 106M (estimated by multiplying the income from the past month by 12).

The current valuation of LBR is shown in the table below:

From the valuation comparison, it is evident that Lybra's FDV valuation is significantly higher than MakerDAO's, while in terms of circulating market cap, LBR is currently lower compared to MakerDAO.

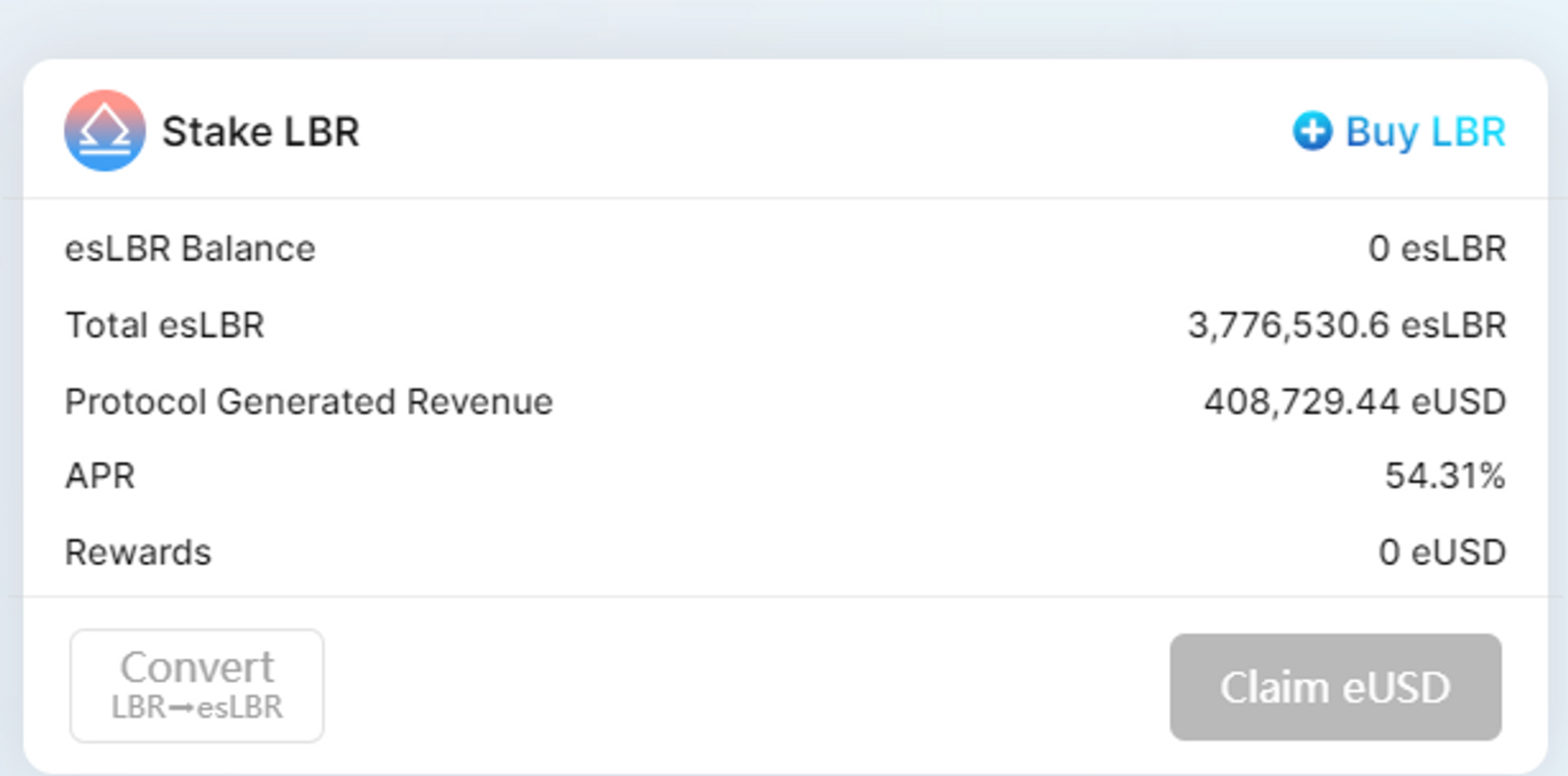

In Lybra's single-token mining project, the profit is eUSD. Here, the protocol buys all of its 1.5% income in eUSD, effectively empowering the staking of LBR tokens. Considering this, the protocol's valuation may still be somewhat underestimated.

4. V2 and SWOT Analysis

4.1 Lybra V2

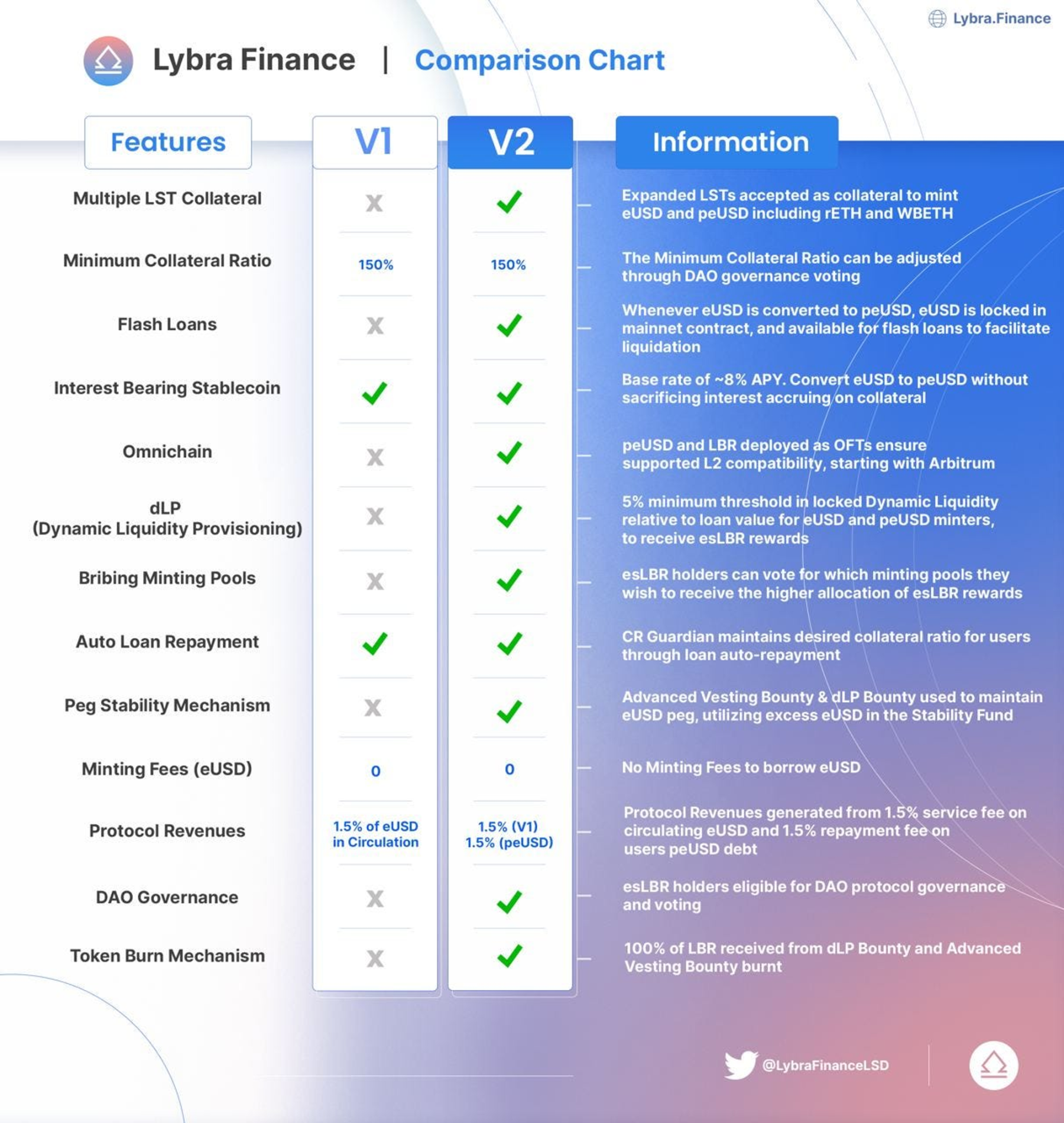

According to the information released by the official team, the V2 version is expected to be upgraded at the end of August and will be audited by Consensys and Halboun. The migration guide for Lybra's V2 has also been published, allowing users to update LBR and eUSD to the V2 version after the update.

The update plan for V2 includes: issuance of peUSD, collaboration with LayerZero, more trading pairs for eUSD, reducing the positive premium of eUSD, and updates to the economic model (dLP and Lybra War).

Issuance of Non-rebase Stablecoin peUSD and Support for More LSD Assets as Collateral

Issuing peUSD pegged to Non-Rebase LSD (initially including WBETH, rETH, swETH) while allowing the exchange of eUSD for Non-rebase peUSD. PeUSD does not carry interest-bearing properties, making it more conducive to circulation and trading.

Collateralized eUSD Can Be Used for Flash Loans

eUSD collateralized by peUSD can be used for flash loans, charging a 5% fee. The design intent is for liquidation purposes.

Collaboration with LayerZero to Develop Cross-Chain Tokens

PeUSD and LBR will become cross-chain versions through LayerZero, allowing for cross-chain circulation.

Increase Stablecoin Trading Pairs

In terms of application scenarios for eUSD, a new eUSD/3CRV pool will be issued on Curve to increase stablecoin trading pairs.

Value Stabilization Mechanism

To reduce the positive premium of eUSD, Lybra has proposed a price stabilization mechanism. When the premium of eUSD exceeds 5%, the protocol will convert the funds used to purchase eUSD into USDC for distribution, while issuing peUSD when the premium is below 0.05.

dLP Mechanism:

Users holding eUSD need to stake 5% of the total value of LBR/ETH trading pairs into the Curve pool to receive rewards; otherwise, the issuance will be paused, increasing the trading depth of LBR. If LP is not staked, the release of esLBR will be paused, and the penalized LBR will be given to users at a discounted price (50%).

Extend esLBR Linear Release Time

The maximum limit for the 30-day linear unlocking mechanism will be changed to 90 days, extending the linear release period and increasing the complexity of internal price competition. Users can also withdraw directly but will incur penalties on LBR rewards based on the timing, with penalized LBR also given to users at a discounted price (50%).

Lybra War

As Lybra supports more LSD assets, a bribery mechanism will be designed, hoping to create a Lybra War similar to Curve War.

4.2 SWOT Analysis:

Strengths:

1. First-Mover Advantage:

Lybra is currently the leading LSDFI project by market cap, and the number of users holding assets within the protocol is still relatively small.

2. Positive Flywheel Logic:

In an upward market for ETH, the rising value of collateral ETH will lead to higher collateralization ratios and higher returns, indicating significant development potential.

Weaknesses:

1. Credibility Risk:

The protocol is run by an anonymous team, and the team's background is unknown.

2. Reliance on Token Subsidies May Accumulate Selling Pressure:

Essentially, it is a borrowing of collateral, relying on the release of tokens for subsidies to maintain the positive flywheel operation. However, the protocol's development always incurs substantial subsidy costs, which can accumulate into potential selling pressure risks during slow growth.

3. Still in Early Stages with Unclear Moat:

The protocol currently has over 300 million in TVL and 160 million in eUSD, which is not substantial. The FDV market cap is significantly overvalued compared to Maker. If competitors emerge with large supply sources of LSD receipts, such as Lido, or deep collaborations with major trading scenarios like Curve or Uni, Lybra's future growth will face challenges.

4. Need to Expand Application Scenarios:

Currently, the application scenarios for eUSD are limited, with only Curve and Uni pools and low liquidity. The design of peUSD and LayerZero's full-chain support may address this to some extent, which is something to keep an eye on.

References:

https://docs.lybra.finance/lybra-finance-docs/background/stablecoins-on-the-market

https://mirror.xyz/gundam0079.eth/RFkeOG9UCUDC57ggdy7xMVX7jGOPt9Mt8-y0E-30vfw

https://dune.com/defimochi/lybra-finance

https://blocmates.com/blogmates/lybra-v2-fireside-qa-with-the-lybra-team/