The income gap between different Rollup operators

Original author: @poopmandefi

Original compilation: Luccy, BlockBeats

This article summarizes the views of crypto KOL @poopmandefi on social media platforms, organized by BlockBeats as follows:

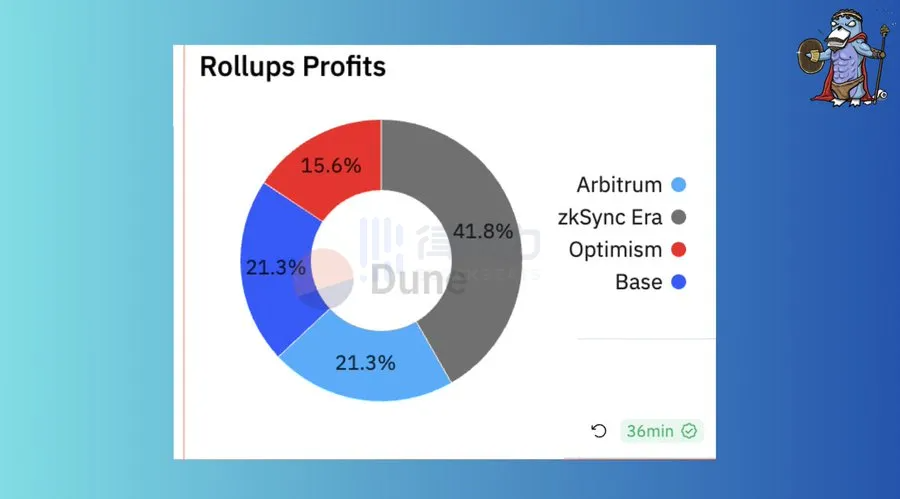

A Successful Rollup Can Be Highly Profitable

zksync has accumulated revenue of $20 million through Rollup (excluding costs)

Arbitrum's revenue is approximately $11.87 million

Optimism's revenue is approximately $8.9 million

Base's revenue is approximately $5.14 million

How Does Rollup Generate Revenue?

We will discuss how Rollup generates revenue from five aspects:

What is Rollup

Three Participants in Rollup Economics

Rollup Costs

Rollup Revenue

Summary of Rollup Economics

Let’s dive deeper into the blockchain scaling solution Rollup.

What is Rollup?

First, Rollup is a scaling solution whose basic idea is to move some transaction data off the main chain (such as Ethereum) and process it on a sidechain or Layer 2, only submitting the final results to the main chain when necessary. This approach can reduce the transaction load on the main chain. There are currently two popular types of Rollup: Optimistic Rollup and ZK Rollup.

Although they differ in their proof methods, they share a common goal: to achieve a balance between Rollup costs and revenue. To understand how they do this, we first need a basic understanding of Rollup economics.

Three Participants in Rollup Economics

First, there are three main participants in Rollups: users, operators, and Ethereum/base layer. Each of these participants represents a part of the value flow within Rollup.

The survival of Rollup depends on users, who pay gas fees on Rollup/Layer 2 to execute transactions. These fees are one of the main sources of Layer 2 revenue. Detailed information about revenue will be discussed later.

The fees paid by users flow to the Rollup operators, who are responsible for ordering, bundling, batching, or computing those transactions that require validity proofs.

Finally, the compressed transactions or messages from Rollup need to be settled on the base layer, which is the most expensive part of all steps. At the same time, running a system inevitably incurs costs and generates revenue, which incentivizes each participant to work.

In just three months, zksync has paid over $13 million in data availability (DA) and verification costs, followed by $8.3 million for Arbitrum and $6.5 million for Optimism. But what are the sources of these costs? The three main factors leading to these costs include:

· Operator costs

· Data availability costs (DA)

· Proving costs

Rollup Costs

Operator Costs: Involves expenses related to sorting, transaction validation, block generation, and other aspects of batch transaction processing. Since most Rollup operators are currently centralized, these costs are borne by the protocol itself or its partners.

Data Availability Costs: DA costs are the fees for batch submissions. Once operators accumulate enough data, they publish the data to the base layer in the form of "CALLDATA." The fees for publishing data are borne by the base layer, and the market price of data is governed by EIP-1559.

Proving Costs: In zkrollup, nodes on L2 need to submit validity proofs to demonstrate the correctness of changes. This process incurs proving costs whenever a state change is required.

Rollup Revenue

Now that we understand the main costs of Rollup, there must be corresponding revenue to offset these costs. Rollup's revenue relies on two main areas:

· Transaction fees

· Token issuance

Transaction Fees: Whenever a user transacts on Rollup, a fee is charged for that transaction. Additionally, Rollup can generate revenue through congestion fees (in the sequencer) and from MEV (Maximum Extractable Value) extracted from transactions.

Token Issuance: Launching a native Layer 2 token can be an important source of revenue for the team. Tokens help cover infrastructure costs while incentivizing both operators and investors, also promoting decentralization in shared services (the future of Layer 2).

Excluding token issuance and financing revenue, zkSync still managed to accumulate approximately $20 million in revenue from transaction fees, with a profit of $6.87 million after costs, ranking first. Meanwhile, both Base and Arb made a profit of $3.5 million, tying for second place.

Summary of Rollup Economics

Rollup involves three main participants: users, operators, and the base layer (L1).

The costs of running this system include operator costs, data availability costs, and proving costs (which dominate in zkRollup). To offset these costs, Rollup's revenue depends on transaction fees and token issuance.

A deeper understanding of the value flow between users and operators can be summarized in the following equations:

User Fees Paid = L1 Data Availability Costs + Operator Costs + L2 Congestion Fees

Operator Costs = L1 Data Availability Costs + Costs of Maintaining Operators

Operator Revenue = L2 User Fees + MEV in the Sequencer

Operator Profit = Operator Revenue - Operator Costs

Through these basic mathematical calculations, we can estimate the profitability of operators in different Rollups.

Given this, maintaining budget balance or surplus remains a primary goal for every L2. Therefore, many L2s are experimenting with different economic designs, including:

• Strategically reducing sending costs to L1

• Optimizing L2 congestion fees

Conclusion

Currently, we have only scratched the surface of Rollup. There is much more to discuss regarding Rollup economics. For a deeper understanding, it is recommended to read “Understanding rollup economics from first principles”.