Beyond the Indonesian Rupiah: Indonesia's Thriving Web3 Landscape

Author: Eujin, Jsquare

Indonesia, spanning over 17,000 islands, is home to the world's largest archipelago. It is the fourth most populous country globally, with a population of 277.7 million, making it a historically vibrant nation. Indonesia's 0.74% population growth rate further marks its rise, as it is currently classified as an emerging industrialized country. Thanks to its geographical location, Indonesia possesses abundant natural resources, ranging from thermal coal and palm oil to nickel steel (with a production of 1.6 million tons in 2022, making it the largest nickel producer in the world). Additionally, beyond these tangible assets, Indonesia has a significant intangible asset: a young workforce with a median age of 29.9 years. This demographic structure brings unique advantages.

In recent years, Indonesia has been committed to improving its education system and digital infrastructure. As a result of efforts in these foundational areas, outcomes are beginning to show: Indonesia now ranks sixth globally in the number of startups (approximately 2,500), becoming the only Southeast Asian country to enter the top ten. In comparison, its neighbor Singapore has 1,142 startups, while Malaysia has 320. The rise of Indonesian startups is attributed to a young, tech-savvy population and solid investor interest. With outstanding companies like GoTo, Indonesia has firmly established its place on the global startup stage.

Source: worldatlas

Ethnicities and Languages

Indonesia showcases a rich diversity of ethnic groups due to its archipelagic nature. The Javanese make up 40.1%, followed by the Sundanese at 15.5%. Other significant ethnic groups include Malays, Bataks, Madurese, Banjarese, Balinese, and Acehnese. This vibrant mix of ethnicities naturally gives rise to a tapestry of languages. While Indonesian is the language used by over 94% of the population (i.e., the national language), interestingly, it is the primary language for only 20% of the population. In contrast, Javanese is the dominant native language, spoken by over 30% of the population.

Source: Xinhua

Economic Landscape

Indonesia's economic engine is becoming increasingly robust. With a GDP of $1.32 trillion, it ranks 16th globally and proudly stands as the strongest economic engine among ASEAN countries. However, a closer look reveals a per capita GDP of $4,788, indicating significant economic development potential.

As the global economy faces challenges brought by the COVID-19 pandemic, Indonesia has demonstrated remarkable resilience. A deeper dive into the data shows that the archipelago experienced a challenging decline in GDP growth rate in 2020, recording a contraction of -2.07%. However, the following years showcased a strong economic recovery. By 2021, the growth rate rebounded to 3.70%, further accelerating to 5.31% in 2022. To put this in comparative context, India, another major Asian economy, experienced a surge in 2021, with a GDP growth rate of 9.05%, but it fell to 7.00% in 2022. Indonesia's sustained upward trajectory since 2020 indicates its solid economic foundation and adaptability.

Moreover, Indonesia's decade-long journey in employment presents an encouraging story. Starting from a peak unemployment rate of 8.06% in 2007, systematic policies aimed at reducing poverty and economic strategies have pushed this figure downward, reaching 4.05% in 2014. Since then, the rate has fluctuated between 3.6% and 4.5%. Impressively, 2022 saw a historic low, with the unemployment rate dropping to 3.55%. This continuous downward trend not only reflects Indonesia's robust economic management but also indicates its ability to create and maintain job opportunities in a changing global environment. Through ongoing economic progress and a strong social safety net, Indonesia has significantly reduced the extreme poverty rate from 19% in 2002 to 1.5% in 2022.

Indonesia's Digital Economy and Transformation

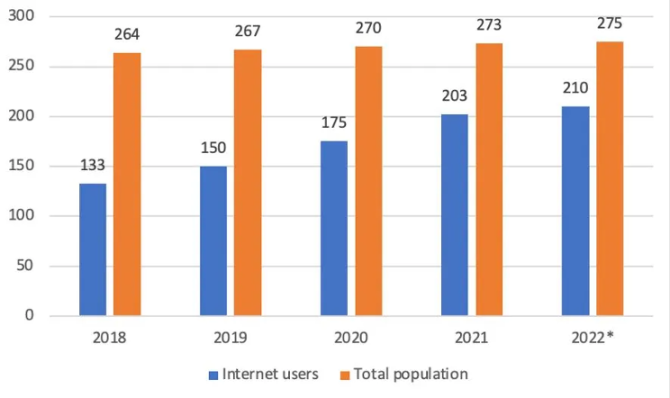

Indonesia's digital transformation is remarkable. Over the past five years, the country's internet penetration rate has significantly increased. In 2018, there were 133 million internet users out of a total population of 264 million. By April 2022, this number had risen to 210 million out of a total population of 275 million, marking a 58% growth in just five years. The annual growth rate of internet users has remained positive, with the most significant increase occurring between 2020 and 2021, when the number of users grew by 16%. This rapid adoption can be attributed to several factors, including the proliferation of affordable smartphones, improvements in digital infrastructure, and behavioral shifts triggered by the COVID-19 pandemic, which forced people to adopt online communication, work, and business models.

Note: () As of April 2022. Source: Katadata [2] and BPS*

Additionally, Indonesia's average internet speed is 43.35 Mbps, ranking 113th globally, with a median speed of 24.32 Mbps, ranking 122nd globally. While these figures may seem moderate on a global scale, the continuous growth of internet users and the thriving digital economy indicate that this is a country rapidly bridging the digital divide.

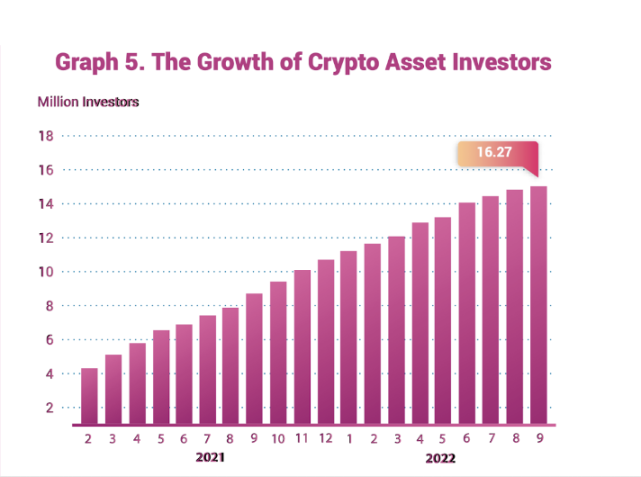

Growth of crypto asset investors, Source: CoFTRA

In September 2022, the number of crypto asset investors in Indonesia surged by 81.6% year-on-year, reaching 16.3 million. According to data from the Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI), this number further increased to 17.4 million by May 2023. In March 2022, according to data from Bank Indonesia, the country's largest crypto asset traders (i.e., Indodax, Tokocrypto, Luno, and Zipmex) recorded a trading value of 38.3 trillion Indonesian Rupiah (approximately $2.68 billion at the time).

The backbone of Indonesia's digital economy is its fintech sector, particularly electronic wallet platforms. Indonesian consumers show a strong inclination towards digital financial products. As of May 27, 2020, according to Bank Indonesia, there were 48 government-approved electronic wallet platforms. Leading among them are GoPay, OVO, and DANA. GoPay, an extension of ride-hailing giant Gojek, has long dominated mobile payments. Launched in 2017, OVO has benefited immensely from strategic partnerships with companies like Grab and Tokopedia. DANA is a product of Ant Financial and PT Elang Mahkota Teknologi (Emtek), quickly gaining market share, especially through its collaborations with online merchants.

Electronic wallet platforms like OVO, DANA, and GoPay lead Indonesia's digital payment landscape. However, the emergence of services like QRIS and BI-FAST has enabled traditional banks to join the digital payment revolution. QRIS is the QR code standard from Bank Indonesia, compatible with various e-wallets and banking applications. Meanwhile, BI-FAST enables seamless fund transfers between banks using details like account numbers, mobile numbers, or email addresses. As most mobile banking applications now integrate QRIS and BI-FAST, people are increasingly inclined to use these integrated services rather than standalone e-wallet applications. However, the deep integration of e-wallets in digital services, such as GoPay's association with Gojek and Tokopedia, remains a significant advantage.

BI-FAST

Launched by Bank Indonesia in December 2021, BI-FAST is a testament to the country's commitment to establishing a real-time, economical, convenient, and secure payment system. This initiative aligns with the Indonesian Payment System Blueprint (BSPI) 2025, aiming to achieve an integrated, interoperable, and interconnected digital ecosystem.

BI-FAST is not just a fast payment system; it symbolizes inclusivity and broad accessibility in the financial sector. Open to banks, non-banks, and other qualified entities, BI-FAST aims to be comprehensive. A report by ACI Worldwide further emphasizes the transformative potential of real-time payment systems in Indonesia. It is projected that by 2026, there will be 1.6 billion transactions, and the integration of platforms like BI-FAST could save businesses and consumers a net of $222 million, potentially adding $747 million to economic output.

The Path to Crypto Regulation Recognition - Indonesia

Indonesia's dance with cryptocurrency has been a cautious performance. Like many countries, the rapid rise of cryptocurrencies and their potential impact on traditional financial systems has raised alarms, necessitating careful assessment.

Historical Perspective: When and how did Indonesia begin to recognize cryptocurrency?

Indonesia's first interaction with cryptocurrency was cautious. The central bank of Indonesia, Bank Indonesia, initially warned against using Bitcoin and other cryptocurrencies in 2014, citing concerns that they could be used for money laundering and financing terrorism. By December 2017, Bank Indonesia issued a regulation prohibiting the use of cryptocurrencies like Bitcoin as payment tools, aiming to protect the Indonesian Rupiah's status as the sole legal medium of exchange domestically.

However, as times changed, so did perceptions. Recognizing the immense potential of blockchain technology and the cryptocurrency market, in early 2019, the Indonesian Commodity Futures Trading Regulatory Agency (known as BAPPEBTI) declared cryptocurrencies as tradable commodities. This effectively allowed cryptocurrency trading in a regulated environment. In December 2022, the Indonesian parliament passed a comprehensive bill known as P2SK, consolidating 17 existing financial laws into one. This new law covers all aspects of financial services, from fintech to digital banking. Notably, P2SK expands the regulatory scope to include crypto assets with risk characteristics. Thus, regulation and oversight of the crypto industry will transition from BAPPEBTI to the Financial Services Authority (known as OJK). This transition is expected to be completed within 24 to 30 months after the enactment of P2SK.

Regulatory Position in 2023

Cryptocurrency as a commodity: Indonesia prohibits the use of cryptocurrencies as a means of payment, emphasizing that the Indonesian Rupiah remains the only recognized currency in most financial transactions in the country. However, it allows cryptocurrencies to be traded as commodities, and the central bank has reiterated that cryptocurrencies are not valid payment methods.

Crypto exchanges: Indonesia's recognition of the potential of the crypto market is reflected in its establishment of the world's first state-backed cryptocurrency exchange in July 2023. Regulated by BAPPEBTI, the exchange will list licensed cryptocurrency companies, including Binance, Ripple, Ethereum, Tether, and Bitcoin. PT Kliring Berjangka Indonesia and PT Tennet Depository Indonesia have been appointed as the futures delivery house and crypto asset custodian, respectively.

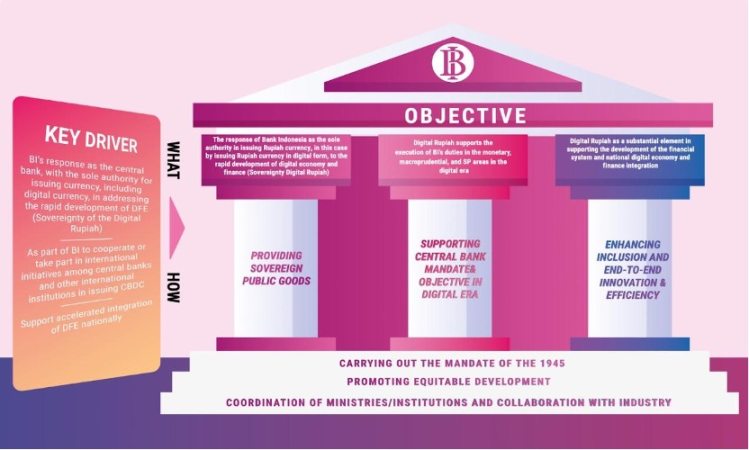

Central Bank Digital Currency (Digital Rupiah): As stated in the white paper released by Bank Indonesia on November 30, 2022, "Currency is the blood of the economy." However, for the government, the invention and widespread adoption of cryptocurrencies have the potential to surpass the Rupiah in terms of payment and settlement (i.e., "shadow currency"). Therefore, the government has significant concerns about losing monetary sovereignty, which could undermine the stability of the entire financial system.

In this context, Bank Indonesia, the institution with the lowest credit risk, has consistently taken a proactive stance on digital currency. The Garuda project aims to explore the optimal design for Indonesia's central bank digital currency (CBDC), namely the Digital Rupiah. The CBDC has already demonstrated its ability to meet three core principles while paving the way for the future digital era.

"First, to meet the public's demand for a risk-free medium of exchange in digital form; second, to maintain monetary sovereignty; and third, to ensure the effectiveness of the central bank's mission in maintaining monetary stability, financial system stability, and the efficiency and security of the payment system."

Framework for Digital Rupiah, Source: Bank Indonesia White Paper

This project demonstrates the country's commitment to exploring the potential of digital currency. The CBDC will undergo three development phases, each involving public consultations, technical experiments, and policy reviews.

Like many countries, Indonesia is seeking a balance between innovation and regulation. While recognizing the potential of cryptocurrencies and blockchain technology, it remains cautious to protect the integrity of its citizens and financial system. It will be interesting to see how Indonesia's relationship with cryptocurrency evolves, especially as more countries globally begin to embrace this new digital frontier.

Notable Web3 Projects in Indonesia

Indodax

Source: Indodax

Indodax is Indonesia's premier cryptocurrency exchange, known for its robust platform and extensive selection of crypto assets. Founded in 2014, Indodax has achieved tremendous growth, boasting over 5 million members who can easily trade popular cryptocurrencies like Bitcoin, Ethereum, and Ripple. The platform's convenience, speed, and security make it a trusted choice for traders in Indonesia and globally.

Indodax's credibility is further bolstered by certifications and licenses from the Commodity Futures Trading Supervisory Agency (BAPPEBTI) and the Ministry of Communication and Information of the Republic of Indonesia. Not only is Indodax recognized by local authorities; global cryptocurrency data aggregator CoinMarketCap ranks Indodax among the top 50 spot exchanges, praising its trading volume, traffic, liquidity, and the authenticity of reported trading volumes.

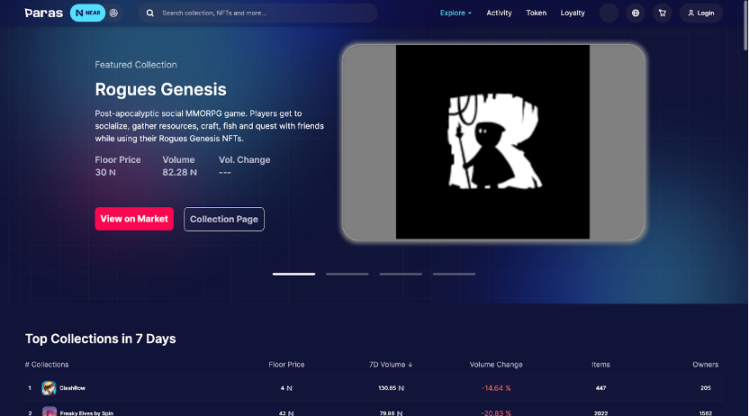

Paras - NFT Marketplace

Source: Paras

Paras is an NFT marketplace based in Indonesia that successfully raised $5 million in seed funding through private rounds and initial decentralized fundraising (2021), with contributions from investors such as Black Dragon Capital and Dragonfly Capital. Founded in 2020 by Rahmat Alariqi and Afiq Shofy Ramadhan, the company plans to use this funding to create crypto-native intellectual property focused on gaming and comics. Additionally, Paras launched Paras Comic, a platform for reading, borrowing, and selling digital comics, as well as purchasing NFT collectibles designed by comic artists.

Ghozali Everyday

Source: OpenSea

The last Indonesian project to mention is an NFT project called "Ghozali Everyday." Ghozali Ghozalo, also known as Sultan Gustaf Al Ghozali, is a 22-year-old Indonesian computer science student who successfully transformed a school project into an NFT collection called "Ghozali Everyday." This collection showcases 933 selfies taken by Ghozalo between the ages of 18 and 22, from 2017 to 2021.

Ghozalo describes the collection on OpenSea as: "These are really just photos of me standing in front of my computer every day." However, the Indonesian NFT and crypto community resonates with the value embodied by "Ghozali Everyday," as the digital world often requires mindfulness and authenticity. The collection was listed on January 9, 2022, at a price of $3 per photo. Within days, the floor price soared to 0.9 ETH (approximately $3,000) before slightly declining. The total transaction volume of the collection on OpenSea reached 314 ETH, or over $1 million, within five days (January 14, 2022).

Conclusion

Since the advent of Bitcoin around 14 years ago, we have witnessed a wave of developments in the field of distributed ledger technology (DLT). This includes revolutionary Layer 1 solutions like Ethereum, Cardano, Solana, and Aptos, which have reshaped the landscape of the cryptocurrency space. An increasing number of governments are beginning to seriously consider adopting cryptocurrencies, and we can expect a paradigm shift in society over the next few years or decades. Indonesia has already become a pioneer in CBDC experiments in Asia, demonstrating its commitment to staying ahead in the digital realm. While the ultimate impact of CBDC and cryptocurrency recognition remains uncertain, it is clear that Web3 and cryptocurrencies are moving in the right direction. As Indonesia's cryptocurrency industry develops, it may create more job opportunities and attract more developers, especially if the country's tax policies are favorable, potentially providing significant support for Indonesia's economy. However, there may be conflicting interests on different fronts. The core feature of DeFi is decentralization, which may undermine the power of central authorities, making it challenging for DeFi to adapt within a regulatory framework of cryptocurrency recognition.

Areas for Future Investment

Security: As the complexity of the cryptocurrency space continues to increase, security has become an indispensable component of the industry. We view it as the backbone of the future cryptocurrency industry. For instance, the mechanism design and system of Digital Rupiah must be impeccable and financially unassailable. Any minor flaw in the CBDC system could lead to catastrophic consequences for the entire digital currency system, potentially damaging Bank Indonesia's reputation for a lifetime. In this context, auditing services represented by companies like Trail of Bits, Quantstamp, Certik, and BlockSec are crucial for building trust and credibility in projects. Additionally, infrastructure projects, such as Zero-Knowledge Proof protocols, which provide privacy and scalability, are vital for the ongoing development of Web3 and DeFi platforms. As Indonesia increasingly focuses on CBDC, protecting these digital assets becomes even more critical. Investing in companies or projects dedicated to improving the security of the cryptocurrency ecosystem may yield success in the long term, especially as more transactions and interactions shift to blockchain platforms.

Data Analytics + Artificial Intelligence: The widespread use of privacy-centric projects like Tornado Cash, which shuffle assets, presents challenges as it disconnects the link between senders and receivers. Private transactions make it more difficult for governments and regulators to conduct investigations. AI and data analytics tools can serve as a first line of defense against malicious activities, acting like "digital police" to identify and combat cyber threats. When paired with AI, data analytics platforms can provide real-time tracking and combat cybercrime. In this context, an ideal platform that combines AI with robust data analytics remains lacking, presenting high-potential investment opportunities, particularly in countries like Indonesia that are actively adopting digital currencies.

Regulatory-compliant Layer 1 (L1): Prioritizing distributed ledger technology (DLT) solutions that meet regulatory standards is akin to a "digital court," providing a mechanism for tracing and taking action in the cryptocurrency space. These regulatory-compliant Layer 1 solutions are crucial for bridging the gap between traditional finance and the crypto world. As more countries and central banks, including Indonesia, explore the use of CBDC, regulatory-compliant Layer 1 can provide the necessary infrastructure for these projects, ensuring that all transactions occur within established regulations. Given their role in maintaining and enforcing the rules of the digital financial ecosystem, investing in these projects may prove profitable, as the demand for regulatory-compliant Layer 1 solutions may rise in the coming years.

Insurance: The insurance sector in the crypto world holds immense potential as it addresses the urgent need for risk mitigation in the volatile crypto space. While it is important, current insurance products in the crypto space are underperforming and failing to meet users' diverse needs, leaving a significant gap in the market. The development of crypto infrastructure, such as oracles, can provide the necessary foundation for the growth of customized insurance solutions in the crypto world. Indonesia's proactive crypto policies and focus on CBDC may favorably promote the development of crypto insurance, providing users with additional security.

SocialFi and GameFi: Both represent the integration of finance with social and gaming platforms, and while not as urgent as security or AI, they hold tremendous growth potential among younger users. Indonesia provides an ideal environment for these innovations with its strong Web3 community and tech-savvy population. The country's active online community and growing interest in cryptocurrencies create fertile ground for the rise of SocialFi and GameFi. Projects serving the Indonesian market in these areas may yield profits, as the country's rapidly evolving Web3 could significantly drive their success.

In the next decade, Indonesia's cryptocurrency landscape is expected to grow significantly. In a potentially more receptive regulatory environment, we can anticipate broader acceptance of crypto assets, driving domestic blockchain innovation. Progress in central bank digital currency experiments may lead to the actual implementation of a digital Rupiah, promoting financial inclusion and enhancing digital infrastructure. Government incentives for blockchain startups and private investments in areas like security, AI, and regulatory-compliant L1 solutions will further drive growth. As fintech companies adopt blockchain and DeFi, cryptocurrencies will increasingly become mainstream in Indonesia. The combination of these factors positions the country as a regional leader in the future development and adoption of blockchain, driving economic growth and digital innovation.

References: https://www.startupranking.com/countries https://www.worlddata.info/asia/indonesia/economy.php https://data.worldbank.org/country/indonesia https://www.worldbank.org/en/news/press-release/2023/05/09/world-bank-s-new-assessment-emphasizes-the-creation-of-better-opportunities-and-protection-against-poverty-in-indonesia https://www.iseas.edu.sg/articles-commentaries/iseas-perspective/2022-109-the-state-of-indonesias-digital-economy-in-2022-by-siwage-dharma-negara-and-astrid-meilasari-sugiana/ https://economysea.withgoogle.com/report/ https://iopscience.iop.org/article/10.1088/1757-899X/1077/1/012028/pdf https://wisevoter.com/country-rankings/internet-speed-by-country/#indonesia https://bitcoinmagazine.com/guides/bitcoin-price-history https://www.coindesk.com/markets/2014/01/16/indonesia-central-bank-warns-against-bitcoin-use/ https://www.aseanbriefing.com/news/indonesia-launches-worlds-first-state-backed-cryptocurrency-bourse/ https://relinconsultants.com/indonesia-crypto-law-regulations/ https://www.bi.go.id/en/rupiah/digital-rupiah/Documents/White-Paper-CBDC-2022_en.pdf https://indodax.com/ https://paras.id/ https://opensea.io/collection/ghozali-everyday