Arthur Hayes Blog: The Worst Woman in the World, Janet Yellen

Original Title: Bad Gurl

Author: Arthur Hayes

Compilation: Kate, Mars Finance

Wu Says Blockchain Note: This article is an excerpt and compilation based on the aforementioned Chinese version, and some details or information may have been omitted. We recommend that readers refer to the original text for a more comprehensive understanding while reading this article.

Arthur Hayes, co-founder and former CEO of BitMEX, published a new article titled "Bad Gurl," introducing U.S. Treasury Secretary Janet Yellen and how her plans will drive the BTC bull market. Janet Yellen is described as a "Bad Gurl," a slang term in English typically used to describe a woman who is misbehaving, rebellious, or adventurous, and in this context, it carries a more derogatory connotation.

The world's worst woman might be Janet Yellen, the U.S. Treasury Secretary, who, if she wishes, can unilaterally exclude individuals, companies, or entire countries from the dollar-based global financial system. Given that for most people, having dollars to purchase primary energy (oil and gas) and food is essential, being removed from the U.S. financial system is tantamount to a death sentence. She calls it sanctions; some call it a death sentence.

From a financial perspective, she is responsible for managing the regulations governing how the dirty fiat financial system operates. Since credit drives the world, and this credit comes from banks and other financial companies, her will has a significant impact on the global economic structure.

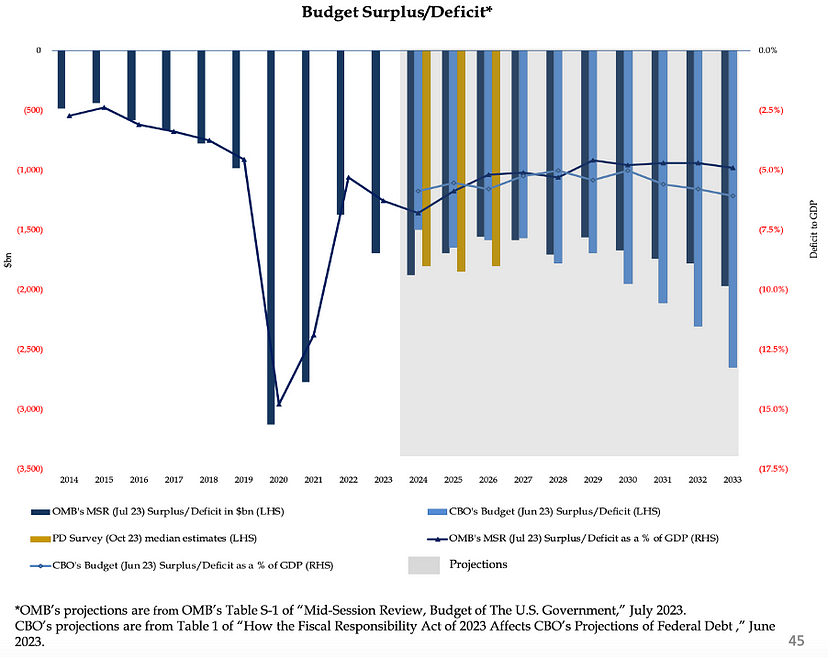

Her most important duty is to ensure that the U.S. government is funded. When U.S. government spending exceeds tax revenue, she is required to issue debt wisely. Given the recent massive scale of the U.S. government deficit, her role becomes even more critical.

But in Yellen's world, not everything is rosy. President Biden is addicted to spending, blowing up distant countries in pursuit of… who knows what. He seems to always support various conflicts conducted by the empire.

Yellen publicly supports her boss, but privately, she is busy ensuring that this empire can issue bonds at an affordable price for national expenditures. The baby boomers are aging, getting sick, and requiring more and more healthcare products and other benefits. The military-industrial complex needs an ever-expanding defense budget to produce more bullets and bombs. Interest must be paid to wealthy savers to fulfill commitments to debt holders.

But the market is not buying it; the yield on long-term U.S. Treasuries (maturity > 10 years) is rising faster than that of short-term Treasuries (maturity < 2 years). This poses a fatal problem for the financial system, known as "bear steepening."

What can she do to ensure Biden is re-elected in November 2024? She needs to devise a solution to buy time for the economy. So, here is Yellen's task list:

- Inject liquidity into the system to drive stock prices up. When the stock market rises, capital gains taxes increase, which helps pay some bills.

- Deceive the market into believing the Federal Reserve will cut interest rates, thereby alleviating the selling pressure on the stocks of non-"too big to fail" (TBTF) banks, which are all insolvent.

- Create the illusion that the Federal Reserve will cut interest rates, thus generating demand for long-term debt.

- Ensure that the injected liquidity is not too large to avoid causing oil prices to spike due to a weaker dollar.

The Federal Reserve recently kept interest rates unchanged and indicated it would further pause rate hikes as it continues to assess the impact of the rate hikes so far. Meanwhile, Yellen stated that the U.S. Treasury would increase the issuance of short-term Treasuries, which is precisely what money market funds (MMF) desire. MMFs will continue to draw funds from the Fed's reverse repurchase agreement (RRP) program and purchase Treasuries, injecting net liquidity into the market.

The remainder of this article will focus on my views, explaining why I believe the above policies will lead to the following outcomes:

- Injecting $1 trillion of net liquidity into the global financial markets, equivalent to the current size of the RRP.

(A) This liquidity injection will drive up U.S. stock markets, cryptocurrencies, gold, and other fixed-supply financial assets.

(B) All other major central banks, such as the People's Bank of China (PBOC), Bank of Japan (BOJ), and European Central Bank (ECB), will also print money, as the U.S. monetary environment is loosening, allowing them to print without weakening their own currencies.

- The market believes that the U.S. Treasury yield curve will steepen in a bull market.

(A) It will prevent the market from selling off all non-TBTF bank stocks.

- Once the RPP is exhausted by the end of 2024, the doomsday for the U.S. Treasury market will play out again.

Powell's Predicament

This is one of the most important images for understanding the power dynamics at the top of the empire. Biden and Yellen are instructing "Duck Powell" to fight inflation at all costs.

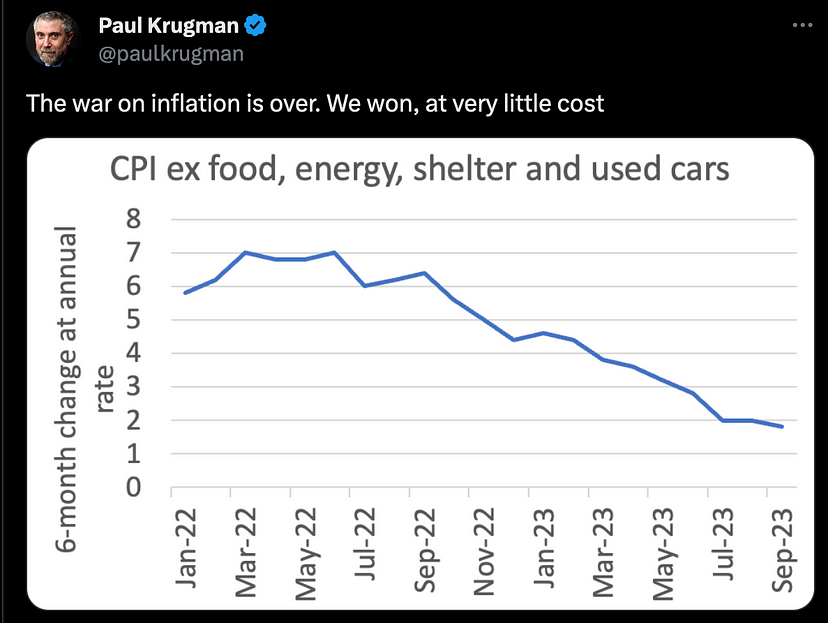

The problem with raising interest rates to levels that restrict the economy is that it will destroy the banking system. Thus, the Federal Reserve is playing a game where it pretends to combat inflation while always looking for a way to justify pausing its monetary tightening plan. The simplest (and least honest) way to achieve this is to fabricate misleading statistics about inflation levels.

The government-reported inflation data is all nonsense. Downplaying inflation convinces the public that their eyes are deceiving them at the checkout counter, which serves the government's interests. When you buy a loaf of bread, the price shock you feel is deemed unreliable because the government tells you that inflation doesn't exist at all. To accomplish this, bureaucrats create these representative baskets of goods to lessen the impact of rising food and energy prices. Misleading inflation statistics are calculated based on the price changes of this basket of goods.

The Federal Reserve dislikes a high Consumer Price Index (CPI), which includes food that fills bellies and gasoline that drives cars, prompting them to perform some fancy calculations. Miraculously, this leads to the creation of core CPI, or what they like to call "core inflation." Core CPI excludes food and energy. But core CPI is too high, so the Fed asks its staff to remove non-transitory factors from core CPI to obtain a better (i.e., lower) measure of inflation. After more magical math, they create a multi-core trend indicator.

The problem is that all these manipulated inflation indicators are above the Fed's 2% target. Worse yet, these indicators seem to have bottomed out. If the Fed were genuinely fighting inflation, they should continue raising rates until their vague inflation indicators reach 2%. But suddenly, Powell stated at the September press conference that the Fed would pause rate hikes to observe the effects of its rate hike actions.

My suspicion is that Powell was given a little nudge from Yellen and was told to hope he could pause again and signal to the market that the Fed would pause rate hikes until further notice. This is a clever policy response, in my opinion.

The market is willing to believe that a recession will arrive next year. A recession means the Fed must cut rates to ensure that terrible deflation does not occur. Deflation is the result of declining economic activity leading to falling prices. Deflation is harmful to the dirty fiat system because it reduces the value of the assets (collateral) that support the debt. This causes losses for creditors (i.e., banks and the wealthy). Therefore, the Fed cuts rates.

As I explained in my previous article, due to weakening economic forecasts, the market will buy a large amount of long-term U.S. Treasuries. This, combined with the general decline in interest rates caused by Fed policy, means that holders of long-term debt will profit. The result is that the yield curve will ultimately steepen.

The market will act first, buying more long-term bonds rather than short-term ones. This is because when interest rates fall, long-term bonds are more profitable than short-term bonds. What happens next? Bear steepening stops, the curve becomes more inverted, and then when the recession hits in 2024, the bull curve steepens. The Fed achieved all this simply by pausing twice in September and November and providing a forward-looking negative outlook on the economic outlook. This is a victory for Powell and Yellen, as positive market reactions can be achieved without needing to cut rates.

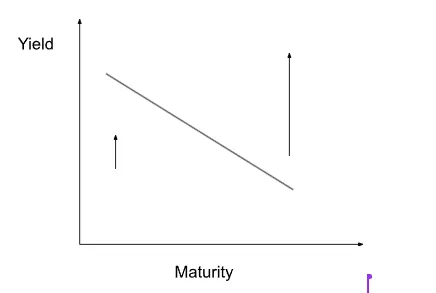

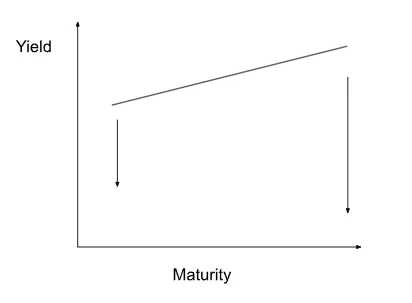

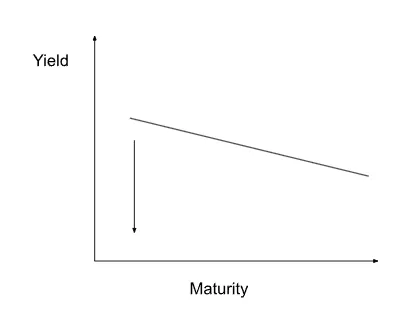

I will illustrate this process with a few simple charts. The longer the arrows, the greater the magnitude.

Figure 1: This is the curve of bear steepening. The curve begins to invert, with the yields across the curve rising, and long-term rates rising faster than short-term rates.

Figure 2: This is the final yield curve. As bear steepening intensifies, at higher rates, you get a positively sloped yield curve. This could be the worst outcome for bondholders and the banking system. Yellen must do everything she can to prevent this from happening.

Figure 3: If Yellen's strategy succeeds, and the market buys more long-term bonds than short-term ones, the curve will invert again.

Figure 4: This is the final yield curve. The curve inverts again, which is unnatural. The market expects a recession, which is why long-end yields are lower than short-end yields.

Figure 5: A recession occurs, or some TradFi companies go bankrupt, the Fed cuts rates, leading to a decline in short-term rates while long-term rates remain unchanged. This will steepen the curve.

Figure 6: This is the final yield curve. After all these shifts, the curve becomes steeper. The curve is positively sloped, which is natural, and the overall level of interest rates has declined. This is the best-case scenario for bondholders and the banking system.

Bank Rescue

The direct impact of the yield curve inverting again and ultimately steepening in a bull market is that the unrealized losses on U.S. Treasuries held to maturity on bank balance sheets decrease.

Bank of America (BAC) reported an unrealized loss of $132 billion in the HTM asset category for Q3 2023. BAC's Tier 1 common equity capital is $194 billion, with total risk-weighted assets (RWA) of $1.632 trillion. When you recalculate BAC's capital adequacy ratio (equity / RWA) by subtracting the unrealized losses from equity, it drops to 3.8%, far below the regulatory minimum requirement. If these losses are confirmed, BAC would enter bankruptcy proceedings like Silicon Valley Bank, Signature Bank, and First Republic. The higher the long-term Treasury yields, the larger the gap. Clearly, this is not possible. There is one rule for them and another for us.

The banking system is being suffocated by all the government debt it accumulated at record high prices and low yields from 2020 to 2022. Designated as TBTF, BAC is effectively a state-owned bank. However, the rest of the non-TBTF U.S. banking system is insolvent due to unrealized losses on Treasuries and commercial real estate loans.

If Yellen can devise a policy that leads to rising bond prices and falling yields, then holders of bank stocks have no reason to sell. This foreshadows an inevitable future: the entire balance sheet of the U.S. banking system will end up on the U.S. Treasury's books. This would be extremely bad news for the U.S. government's credibility, as the government would have to print money to ensure banks can honor deposit withdrawals. In this scenario, no one would want to buy long-term U.S. Treasuries.

Are There Consequences?

The challenge is that if the Fed cuts rates, the dollar may depreciate significantly. This would put tremendous upward pressure on oil prices since oil is priced in dollars. While mainstream financial media and intellectually bankrupt cheerleaders like Paul Krugman try to deceive the public into believing inflation does not exist, any seasoned politician knows that if gas prices rise on election day, you're finished. This is why, at this critical moment—when the Middle East is on the brink of war—cutting rates is tantamount to political suicide. By next election day, oil prices are likely to be close to $200.

Of course, if you exclude everything people need to live and make a living, inflation does not exist.

But what if inflation has already bottomed out, and the Fed pauses rate hikes while inflation accelerates? This is a possible outcome, but I believe any discontent arising from rising inflation will be drowned out by a strong U.S. economy.

Robust Economy

I believe there will be no recession in 2024. To understand why, let's return to the primary principles driving GDP growth.

GDP Growth = Private Sector Spending (net exports, investment also included) + Government Net Spending

Government Net Spending = Government Spending - Tax Revenue

When the government engages in deficit net spending, it drives net growth in GDP. This conceptually makes sense—government spends money to buy things and pays employees. However, the government extracts resources from the economy through taxation. Therefore, if government spending exceeds tax revenue, it provides a net stimulus to the economy.

If the government runs a massive deficit, it means nominal GDP will grow unless the private sector contracts by an equal amount. Government spending—or any spending for that matter—has a multiplier effect. Let's illustrate this with an example Biden gave to the American public in his recent speech about various conflicts involving the empire.

The U.S. government will increase defense spending. Many Americans will manufacture bullets and bombs to kill all the terrorists and more civilians surrounding the empire. As long as each terrorist does not kill more than 10 civilians, I have no issue with this. This is a "fair" ratio. Those Americans will spend their hard-earned money in their communities. There will be office buildings, restaurants, bars, etc., all built for the workers of the defense industry. This is the multiplier effect of government spending as it encourages private sector activity.

Given this, it is hard to imagine the private sector contracting enough to offset the net gains in GDP growth contributed by the government. In the latest Q3 2023 data dump, U.S. nominal GDP grew by 6.3%, with an annual deficit approaching 8%. If the CPI inflation rate is below 6.3%, then everyone is a winner because real GDP growth is positive. Why would voters be uneasy about this? Given that the CPI inflation rate is at the 3 level, it will take several quarters for inflation to exceed the level of the U.S. economy in the minds of voters.

The deficit for 2024 is expected to be between 7% and 10%. Driven by a spendthrift government, the U.S. economy will perform well. Therefore, moderate voters will be quite satisfied with rising stock markets, a strong economy, and subdued inflation.

Short-Term Treasuries

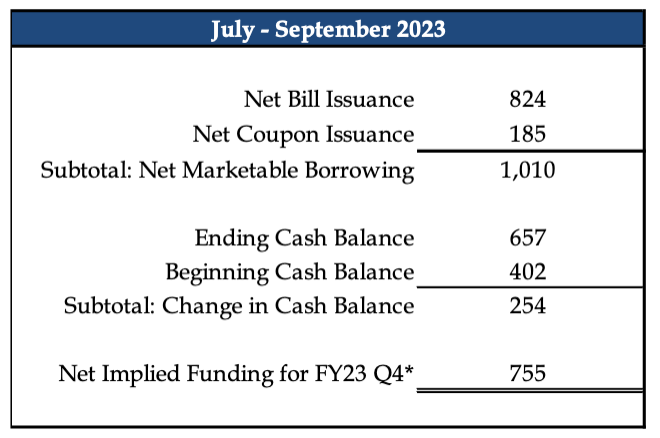

Yellen is not all-powerful. If she force-feeds the market with trillions of dollars of debt, bond prices will fall, and yields will rise. This will destroy any benefits the financial system gained from the Fed pausing rate hikes. Yellen needs to find a pool of funds that is very willing to buy a large amount of debt without demanding higher yields.

MMFs currently hold about $1 trillion in the Fed's RRP. This means MMF yields are close to the lower limit of the federal funds rate at 5.25%. The yields on 3-month and 6-month Treasury bills are around 5.6%. MMFs deposit funds with the Fed because of the lower credit risk and the ability to access funds overnight. MMFs will not sacrifice too much yield to lower risk. However, if Yellen can offer more Treasuries at slightly higher yields, money market funds will shift funds from low-yield fixed deposit rates (RRP) to higher-yield Treasuries.

In the latest quarterly financing report, Yellen pledged to increase the issuance of Treasuries. Some might argue that without the $2 trillion RRP, the sell-off of long-term Treasuries would be worse. Remember, back in early June, after U.S. politicians "shockingly" agreed to raise the U.S. debt ceiling, allowing them to spend more money, Yellen restarted borrowing. At that time, the RRP was $2.1 trillion. Since then, Yellen has sold a record amount of Treasuries, and the RRP balance has halved since then.

Yellen issued $824 billion in Treasuries, and the RRP decreased by $1 trillion. Success!

Please refer to my article on dollar liquidity, "Teach Me Daddy," to fully understand why dollar liquidity increases when the RRP balance decreases. It is important to note that if Yellen increases the Treasury General Account (TGA), it will offset the positive liquidity deficit caused by the decrease in RRP balance. The TGA is currently about $820 billion, above the target of $750 billion. Therefore, I do not believe the TGA will rise from now on—instead, I think it may remain flat or decline.

As the RRP is exhausted, $1 trillion of liquidity will be released into the global financial markets. It may take six months to fully deplete. This estimate is based on the speed at which the RRP has decreased from $2 trillion to $1 trillion and predictions for the pace of bond issuance.

Before I continue discussing how this liquidity will flow into cryptocurrencies, let me briefly outline how other central banks might respond.

Weak Dollar

As more dollars flow through the system, the price of the dollar relative to other currencies should decline. This is good news for Japan, China, and Europe. These countries all face fiscal issues. They take different forms, but ultimately require printing money to support certain parts of the financial system and the government bond market. However, not all central banks are created equal. Because the PBOC, BOJ, and ECB do not issue a global reserve currency, there are limits to how much they can print before their currencies depreciate against the dollar. All these central banks have been hoping and praying for the Fed to loosen monetary policy so they can do the same.

These central banks can also loosen monetary policy because the Fed's actions will have the most significant impact due to the incredible amounts involved. This means that any money printing actions by the PBOC, BOJ, and ECB will have relatively smaller effects. When converted into currency, the renminbi (China), yen (Japan), and euro (Europe) will strengthen against the dollar. They can print money to save their banking systems and support their government bond markets. Ultimately, energy imports priced in dollars become cheaper. This stands in stark contrast to recent situations where printing money led to their currencies depreciating against the dollar, which in turn increased the costs of energy imports priced in dollars.

The result is that while a large amount of dollar liquidity is injected, there will also be corresponding injections of renminbi, yen, and euros. From now until the first half of 2024, the total amount of fiat currency credit globally will accelerate.

Stupid and Smart Trades

Given all the liquidity of fiat currencies in the global market, what should one buy to outpace currency depreciation?

First, the dumbest thing one can do is to buy long-term bonds with a buy-and-hold mentality. As long as RRP > 0, this positive liquidity condition will persist. When RRP = 0, all the issues with long-term bonds will resurface. The last thing you want to do is to be unable to profit from any form of illiquid long-term debt when liquidity conditions change. Therefore, the dumbest manifestation of this trade is to buy long-term bonds, especially government bonds, and be mentally prepared to hold them. Today, you will experience a market-to-market gain, but at some point, the market will start to digest the impact of the further decline in RRP balance, and long-term bond yields will slowly rise, meaning prices will fall. If you are not a skilled trader, you will smash your golden egg with your diamond hands.

A moderately smart trade is to leverage long on short-term debt. Macro trading god Stan Druckenmiller recently told the world in an interview with Robinhood about fellow god Paul Tudor Jones that he bought ultra-long 2-year Treasuries. Great trade, brother! Not everyone is interested in the best expression of this trade (hint: it’s cryptocurrency). Therefore, if all you can trade are manipulated TradFi assets like government bonds and stocks, then this is a decent choice.

A slightly better trade than moderately smart (but still not the smartest trade) is to go long on large tech companies, especially those related to artificial intelligence (AI). Everyone knows AI is the future. This means anything related to AI will thrive as everyone is buying it. Tech stocks are long-term assets that will benefit as cash becomes trash again.

As I mentioned above, the smartest trade is to go long on cryptocurrencies. Nothing outpaces the growth of central bank balance sheets like cryptocurrencies.

This is a chart of Bitcoin (white), the Nasdaq 100 index (red), the S&P 500 index (green), and gold (yellow) divided by the Fed's balance sheet indexed to 100 since March 2020. As you can see, Bitcoin has outperformed all other assets (+258%) under the influence of the Fed's balance sheet expansion.

The first stop is always Bitcoin. Bitcoin is money, and just money.

The next stop is Ethereum. Ethereum is the commodity that powers the Ethereum network, the best internet computer.

Bitcoin and Ether are the reserve assets of cryptocurrencies. Everything else is junk.

Then we look at other so-called improved L1s. Solana is one example. These have been beaten down badly during the bear market. Therefore, they will rise from extremely low prices, providing huge returns for brave investors. However, they are still overhyped and cannot surpass Ethereum in terms of active developers, dApp activity, or total value locked.

Finally, various dApps and their respective tokens will launch. This is the most interesting part because this is where you get 10,000x returns. Of course, you are also more likely to get wrecked, but there are no rewards without risks.

I love junk coins, so don’t call me a Bitcoin maximalist!

Follow-Up Focus

I am monitoring the net amount of [RRP --- TGA] to determine whether dollars are flooding into the market. This will dictate whether I increase the pace of Treasury sales and Bitcoin purchases, as my confidence rises with expectations of increased dollar liquidity. But I will remain agile and flexible; after all, even the best-laid plans can easily go awry or fail.

Since Yellen was allowed to borrow again in June 2023, the Fed has net injected $300 billion. This is a combination of the decrease in RRP and the increase in TGA.

The ultimate uncertainty lies in oil prices and the war between Hamas and Israel. If Iran gets drawn into the war, we should consider that oil supplies flowing to over-leveraged Western countries will be disrupted. This would make it politically difficult for the Fed to adopt a non-interventionist monetary policy. They may have to raise rates to combat higher oil prices. On the other hand, some might argue that due to the war and rising energy prices, the economy will enter a recession, which would give the Fed a license to cut rates. In either case, uncertainty will rise, and the initial reaction may be a sell-off in Bitcoin. As we have seen, Bitcoin has proven to perform better than bonds during wartime. Even with a weak initial phase, I would buy the dip.

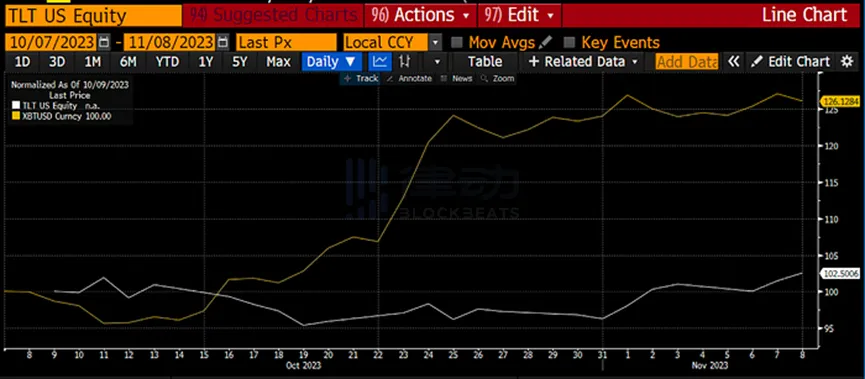

Since the outbreak of the Ukraine/Russia war, the U.S. long-term Treasury ETF (TLT) has fallen by 12%, while Bitcoin has risen by 52%.

Since the outbreak of the Hamas/Israel war, TLT has risen by 3%, while Bitcoin has risen by 26%.

If lowering the RRP is Yellen's goal, it will only last so long. All the concerns surrounding the U.S. Treasury market will resurface, which previously caused U.S. Treasury yields to spike in a bearish manner in 2010 and 2030, putting pressure on the financial system. Yellen has yet to convince Biden to stop the chaos, so after the calm, Bitcoin will once again become a real-time scoreboard of the health of the wartime fiat financial system.

Of course, if those managing the U.S. could choose peace, but do you think that’s possible? These bastards have been at war since 1776, with no signs of stopping.