BRCFi applications are highly favored by capital. How to seize the new opportunities in the Bitcoin ecosystem?

Author: Xiyou, ChainCatcher

With the continuous rise of BRC20 tokens such as ORDI, SATS, and RATS, the Bitcoin ecosystem has also gained momentum, leading to a surge of applications and infrastructure around Ordinals inscriptions and BRC20 emerging like mushrooms after rain.

According to data from the crypto platform Rootdata, multiple applications within the Bitcoin ecosystem have announced financing since entering December.

On December 20, the one-stop DeFi service platform ALEX Lab, based on Bitcoin Stack, received strategic investment from LK Venture, a subsidiary of Blue Harbor Interactive.

On December 18, the Bitcoin BRC ecosystem aggregation tool Biis announced it received strategic investment from crypto investment firm CGV; the DID market aggregator GoDID completed a new round of financing led by NGC at a valuation of $30 million, and a few days earlier, GODID's sub-platform bdid.io, focusing on the BTC ecosystem, issued the token BDID.

On December 16, the Bitcoin infrastructure project Tap Protocol, used for building OrdFi applications, completed a $4.2 million financing round led by Sora Ventures; on December 14, the Bitcoin stablecoin lending protocol bitSmiley completed a round of financing led by ABCDE and OKX Venture; on December 11, the Bitcoin Ordinals lending solution Liquidium completed a $1.25 million Pre-Seed round, with participation from Bitcoin Frontier Fund, Sora Ventures, and others.

On December 7, the cross-chain protocol MAP Protocol announced it received strategic investment from DWF Labs and Waterdrip Capital, achieving BRC20 cross-chain; the Bitcoin staking project Babylon announced it completed $18 million in Series A financing, led by Polychain Capital and Hack VC, among others.

In less than two weeks, a total of eight Bitcoin ecosystem-related projects have consecutively received funding support from crypto capital, covering cross-chain, lending, staking, and other products, all built around new assets such as Ordinals and BRC20.

With the influx of funds, the wealth effect of the Bitcoin ecosystem continues to ferment, evolving from the speculation of BRC20 inscriptions into the infrastructure and application products built around these assets. For example, the IDO platform Bounce Finance's token AUCTION, the cross-chain bridge Multibit’s token MUBI, and the stablecoin BitStable's governance token BSSB have all seen increases of over 100% in the past week. With strong capital support and the explosive growth of Bitcoin ecosystem application assets, a new track called BRCFi has emerged.

BRCFi refers to the DeFi ecosystem driven by BRC20 tokens, consisting of DeFi application products built around BRC20 and Ordinals assets. Currently, the BRCFi track has launched multiple cross-chain bridges, stablecoins, IDO platforms, lending, and other suite products. So, what are the representative products of BRCFi applications? How are they operating?

Bounce Finance's BRCFi Suite: Cross-chain Bridges, Stablecoins, IDO Platforms, etc.

Bounce Finance (AUCTION) Centralized Auction Platform Takes Off with Bitcoin Trend

Bounce Finance (AUCTION) was originally a multi-chain decentralized auction platform that provided token issuance and NFT auction services, simplifying the IDO process for new projects. The platform was founded in September 2020 by Jack Lu and Ryan Fang, with Jack Lu also being a partner at NGC Ventures. Born during the explosive growth of DeFi applications, Bounce Finance did not stand out, and as the crypto market turned bearish, the platform gradually faded from the crypto users' view.

However, in November, Bounce Finance gained rapid popularity due to the issuance of the Bitcoin ecosystem's cross-chain bridge Multibit token MUBI and stablecoin BitStable token BSSB. After the IDO on Bounce Finance, MUBI and BSSB surged by dozens of times, and the wealth effect brought by these IDO assets made Bounce Finance, which was hidden behind the scenes, the biggest winner, regarded by users as "the next source of tenfold coins."

In the past month, Bounce Finance has successfully issued tokens for three Bitcoin ecosystem projects. On November 12, it issued the Bitcoin cross-chain bridge MultiBit asset MUBI, with an IDO price of $0.00047, now quoted at $0.39, a cumulative increase of over 1000 times; on November 29, it launched the public sale of the Bitcoin-based cross-chain stablecoin protocol Bitstable project token BSSB, with an IDO cost of about $0.27, now quoted at $9.5, a cumulative increase of about 40 times; on December 15, it launched the DID service platform GoDID token BDID within the Bitcoin ecosystem, with a public sale price of $0.0029, now quoted at $0.06, a return of over 20 times.

Due to the successive stories of wealth creation from IDO projects, Bounce Finance has become the IDO benefactor platform within the Bitcoin ecosystem. After successfully issuing the Bitcoin ecosystem asset MUBI, Bounce Finance officially announced a series of actions to enter the Bitcoin ecosystem.

On November 25, Bounce Finance posted on social media that it was preparing to extensively cultivate the BTC ecosystem, announcing a focus on incubating BTC projects and providing auction support.

On December 1, it announced the launch of the Bitcoin DeFi application chain Bounce Bit, based on Binance's BTCB. BTCB is a wrapped asset issued by Binance that is 1:1 pegged to real BTC assets, allowing users to obtain BTCB by locking BTC, enabling BTC holders to participate in on-chain DeFi activities without giving up their Bitcoin positions, thus earning more returns. The Bounce Bit network will build a series of DeFi applications around BTCB and the native token AUCTION.

On December 6, Bounce Finance announced a brand upgrade to Bounce Brand, with products including the Bitcoin-based application chain Bounce Bit, a one-stop entry for exploring Bitcoin DeFi applications called Bounce Box, and the Bitcoin ecosystem asset auction platform Bounce Auction.

On December 19, Bounce Brand stated that the IDO would adopt a "two birds with one stone" strategy for token issuance, with two independent teams jointly issuing one token, the project identity kept confidential, using AUCTION and BitStable's stablecoin DAII for participation, with two auction pools set up.

Riding the wave of the Bitcoin ecosystem, Bounce Finance has successfully transformed from a forgotten auction platform into a leading IDO application deeply rooted in the Bitcoin ecosystem. The native token AUCTION has seen an increase of about 108% in the past week, with a rise of over 40% yesterday, currently quoted at $40.78, with a market cap of $260 million.

Bitcoin Cross-chain Bridge Protocol Multibit

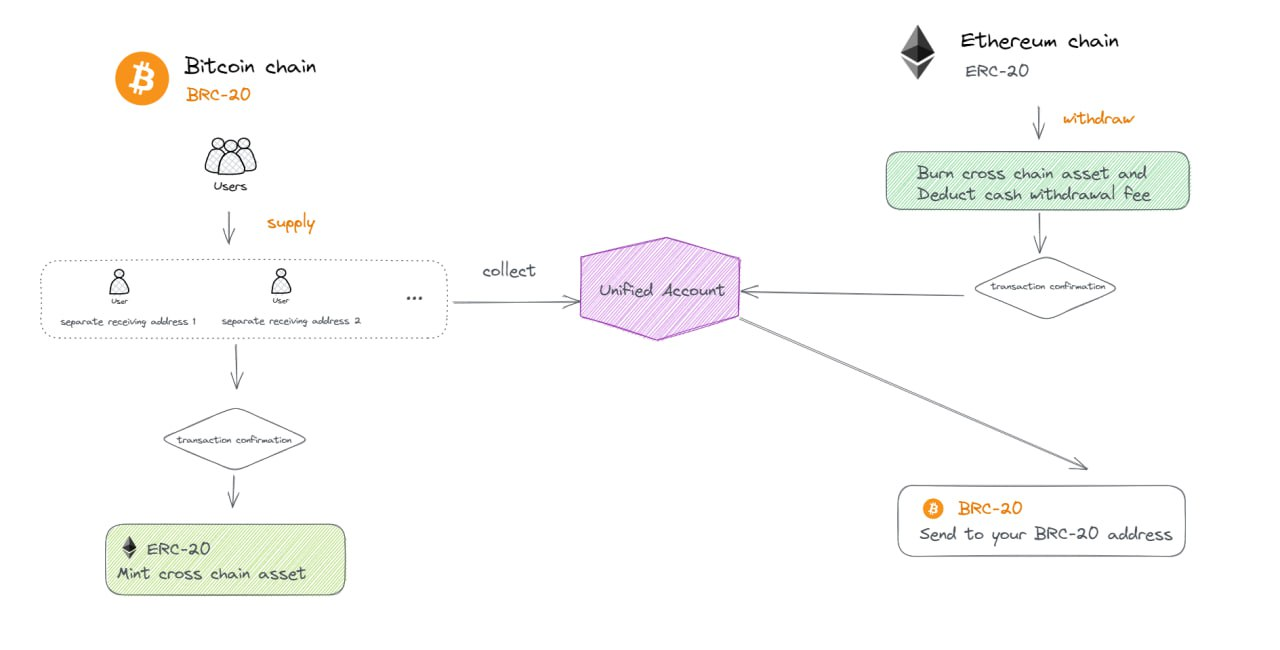

Multibit Bridge (MUBI) is a cross-chain protocol within the Bitcoin ecosystem that supports easy cross-chain transfers of BRC20 and ERC20 assets, allowing asset transfers between Ethereum, BNB Chain, and other EVM networks and the Bitcoin network.

MultiBit simplifies the token cross-chain transfer process between Bitcoin BRC20 and EVM networks. The specific cross-chain implementation process is as follows: first, users deposit the cross-chain BRC20 tokens into the BRC20 address provided by Multibit. After the Multibit protocol confirms, tokens will be minted and released to users on the corresponding EVM target chain. When users want to cross back BRC20 tokens, Multibit will destroy the corresponding number of tokens from the EVM chain and release the corresponding BRC20 tokens on the Bitcoin chain.

However, Multibit’s goal is not just a cross-chain bridge; it will also integrate OAMM trading, yield aggregators, stablecoin issuance, and other multi-faceted BRCFi application ecosystems in the future.

Among them, OAMM trading refers to the decentralized trading protocol (OAMM) launched by Multibit based on Ordinals assets, specifically designed for trading Ordinals (ORDI) tokens, where all liquidity pools are paired with ORDI tokens for price discovery; yield aggregators optimize the yield of ORDI tokens in BRCFi applications; stablecoins are also minted using ORDI as collateral.

The Multibit platform was initially born in May, but it did not attract attention until November, when the launch of the MUBI token made it successful. On November 12, MUBI completed its IDO auction on Bounce Finance, opening with a surge of 1140%.

The wealth effect brought by the IDO quickly made Multibit a star project in the Bitcoin ecosystem, with the MUBI token seeing an increase of about 131% in the past week, currently quoted at about $0.3, with a total issuance of 1 billion and a circulating supply of 950 million, giving it a circulating market cap of $290 million.

Bitcoin Ecosystem Stablecoin BitStable

BitStable (BSSB&DAII) is a stablecoin protocol within the Bitcoin ecosystem, utilizing a dual-token system of BSSB&DAII, where BSSB is the governance token and DAII is the stablecoin.

Currently, platform users can use assets approved by "BSSB Governance" as collateral to generate DAII, with only ORDI, MUBI, and BTCB assets supported as collateral. Additionally, BitStable has cross-chained some DAII to Ethereum, allowing DAII holders to exchange with USDT.

As of December 19, the BitStable platform has minted 30.75 million DAII, of which 30.54 million are in ERC20 format, and only 210,000 are in BRC20.

BitStable first appeared when it issued the BSSB token on the IDO platform Bounce Finance, with an increase of about 176% in the past week, currently quoted at $7.5, with a total issuance of 21 million and a market cap of $180 million.

However, it is worth noting that the BitStable protocol has been controversial since its launch. First, during the public sale of the BSSB token, the official website was inaccessible, leading users to suspect it might be a rug pull. The official response claimed they encountered a coordinated attack orchestrated by miners and high-tech developers, resulting in uneven token distribution, with unauthorized wallets receiving most of the available supply, leading the team to destroy 75% of the auctioned tokens. The BitStable X social media account was only online for two days during the auction, with its first post timestamped November 27.

Additionally, some users have stated that Bounce Finance, Multibit, and BitStable are all from the same team, aiming to create a Bitcoin ecosystem that integrates IDO, cross-chain, and stablecoins. This speculation is not baseless; both Multibit and BitStable's IDOs were executed on the Bounce Finance platform, and future IDO projects on Bounce Finance can use BitStable's stablecoin DAII as a participation ticket, while BitStable also supports MUBI assets as collateral for minting DAII, indicating a complex relationship among the three.

DID Market Aggregator GoDID Launches Bitcoin Ecosystem DID Management Tool Bdid.io

Like Multibit and BitStable, the DID aggregation tool GoDID also issued the BDID token on Bounce Finance and announced a new round of financing led by NGC Ventures at a valuation of $30 million on December 18.

Interestingly, Bounce Finance founder Jack Lu is also a partner at NGC Ventures. This has led some users to speculate, could it be that all products launched on the Bounce Finance platform are related to NGC Ventures, which might be the true operator behind a series of Bitcoin ecosystem projects like Multibit?

GoDID is a market aggregator for decentralized identity (DID), with core functions including bulk searching, querying, registering, trading, and managing DIDs, currently providing services for ENS, Space ID, and Bitcoin Ordinals DID.

On December 15, GODID's sub-platform Bdid.io issued the BDID token on Bounce Finance. Bdid.io is incubated by GODID and supports mainstream DID registration, trading, and management for various suffixes created by the Ordinals protocol, such as .sats, .bitmap, .btc, .unisat, .bitter, etc.

The total issuance of BDID is 500 million, with an IDO price of about $0.00297 on Bounce Finance, currently quoted at $0.04, yielding an investment return of about 20 times.

Lending Representative Products: BitSmiley, Liquidium, Liquidium

Stablecoin Lending Protocol BitSmiley

BitSmiley is a stablecoin lending protocol in the Bitcoin ecosystem, akin to "MakerDAO+Compound." This product mainly consists of a decentralized over-collateralized stablecoin protocol, lending protocol, and derivatives protocol. On December 14, bitSmiley announced it completed a round of financing led by ABCDE and OKX Venture.

Among them, bitUSD is a stablecoin generated with BTC as over-collateralized assets, soft-pegged to the US dollar. The collateral mechanism is similar to MakerDAO, except that bitUSD's issuance is backed by BTC as collateral. Any BTC holder can generate bitUSD by depositing Bitcoin into the "bitSmiley Treasury" smart contract, with each circulating bitUSD supported by over-collateral.

In the bitSmiley protocol, bitUSD can be used to settle debts, such as paying stability fees or loan interest. Users deposit a specific amount of BTC into the bitSmiley Treasury to generate bitUSD. To retrieve the deposited BTC, users need to repay the generated bitUSD and pay a certain stability minting fee.

With the stablecoin bitUSD at its core, BitSmiley has launched a peer-to-peer lending protocol called bitLending based on BRC20.

Currently, BitSmiley's products have not yet been launched, and the official Twitter account was only established on December 4.

NFT and BRC20 Lending Protocol Liquidium

Liquidium is a P2P lending protocol built on the Ordinals protocol, allowing users to borrow and lend Bitcoin using ordinal inscriptions and BRC20 as collateral. On December 11, it announced the completion of a $1.25 million Pre-Seed round, with participation from Sora Ventures and others.

Currently, the Liquidium platform only supports Ordinals ordinal inscriptions NFTs as collateral for lending, and BRC20 lending products have not yet been officially opened to the public, remaining in the whitelist application stage.

The Liquidium platform does not adopt a liquidation mechanism based on the loan collateral value LTV; the loan status depends on repayment within the set period. If not repaid by the due date, the loan defaults, and the collateral belongs to the lender.

BRC20 Ecosystem Stablecoin Lending Protocol Uplink Finance

Uplink Finance (UPFI) is a stablecoin lending protocol designed for investors in BRC-20 assets such as ORDI and SATS, claiming to be the MakerDAO of the BRC-20 ecosystem, allowing BRC20 asset holders to unlock the liquidity value of their holdings without selling.

On the Uplink Finance platform, users deposit BTC, ORDI, SATS, and other BRC-20 assets as collateral for over-collateralized lending of the platform's stablecoin UPSD.

On December 12, Uplink Finance announced that SATS and ORDI would become the first collateral for stablecoin minting on the platform, while airdropping the platform governance token UPFI to its asset holders.

Currently, the Uplink Finance platform's collateral lending page has not yet officially launched.

Ordinals Ecosystem Infrastructure Tools: Donation Platform TurtSat and Tap Protocol for Building OrdFi Applications

TurtSat: The Gitcoin of the Bitcoin Ecosystem

TurtSat (TURT) is a community-led Ordinals donation platform, aiming to become the Gitcoin of the Ordinals world. The platform features a donation protocol designed to allow more open-source developers and communities to participate in the ecological development of Ordinals and enjoy the benefits. Anyone can build and donate to Ordinals ecological protocols through TurtSat.

In short, project parties can obtain funding through TurtSat, and users can earn returns by supporting donation projects. Currently, the TurtSat platform has supported the issuance of tokens for multiple Bitcoin ecosystem projects in a Launchpad format, functioning similarly to Bounce Finance.

As of December 20, the TurtSat platform has issued BRC 20 asset protocol Chamcha token CHAX, BRC 20 cross-chain bridge Multibit token MUBI, Ordinals aggregation platform NXHUB token NHUB, Ordinals lending platform Dova Protocol token DOVA, Bitcoin ecosystem gaming platform Rabbit token RAIT, and Bitcoin ecosystem metaverse game Svarga token SVGR, all of which are infrastructure construction platforms related to BRC 20 and Ordinals within the Bitcoin ecosystem. Yesterday, the TurtSat platform also announced the launch of the Bitcoin staking platform Zooopia token ZOOA.

On December 7, TurtSat announced the launch of a staking fund pool for its native token TURT, supporting TURT holders to participate in projects issuing tokens on the platform for more returns. Additionally, TurtSat will issue a new asset called EGGS, which needs to be obtained by staking TURT tokens. EGGS can be exchanged for whitelists of launch projects, and in the future, EGGS will be applied in more scenarios such as project launch voting and direct exchanges for cooperative token packages.

The total issuance of TurtSat's native token TURT is 1 billion, currently quoted at $0.078, with a market cap of $78.73 million. The issuance volume of EGGS has not been disclosed.

Tap Protocol for Building OrdFi Applications

Tap Protocol is a platform launched by the Ordinals indexing protocol Trac for building OrdFi applications. On December 16, it announced the completion of a $4.2 million financing round led by Sora Ventures.

Trac is an infrastructure project within the Ordinals ecosystem, aiming to provide a decentralized system to track and access Ordinals-related protocols, such as BRC20, sats domain names, etc., offering a standardized interface for creating, managing, and trading digital assets on the Ordinals platform.

Tap Protocol is designed to build OrdFi applications, providing a series of tools to assist developers in creating DeFi products based on Ordinals, even without complex Bitcoin Layer 2 networks, such as enabling inscriptions to be split and activating DeFi applications on inscriptions.

In the future, Tap Protocol will launch products such as Ordinals fragmentation products, exchange pools, lending, and staking.