Gryphsis Cryptocurrency Weekly: Current Status and Expectations of Bitcoin Spot and Futures Markets in 2024

Author: Gryphsis Academy

Market and Industry Snapshot:

Layer 2 Overview:

Last week, Layer 2 saw an upward trend except for Base, which decreased by 3.33%, while Starknet showed the most significant growth at 2.96%. Protocols like Arcanum, Matrix Farm, Mountain Protocol, eZKalibur, and StarkDeFi demonstrated notable TVL growth ratios.

LSD Sector Overview:

In the LSD sector, Ethereum deposits decreased by 7.53%, while total withdrawals increased. In terms of market share, all blue-chip LSDs declined except for rETH, which rose by 29.28%, with swETH showing the most significant drop this week at 25.22%.

RWA Sector Overview:

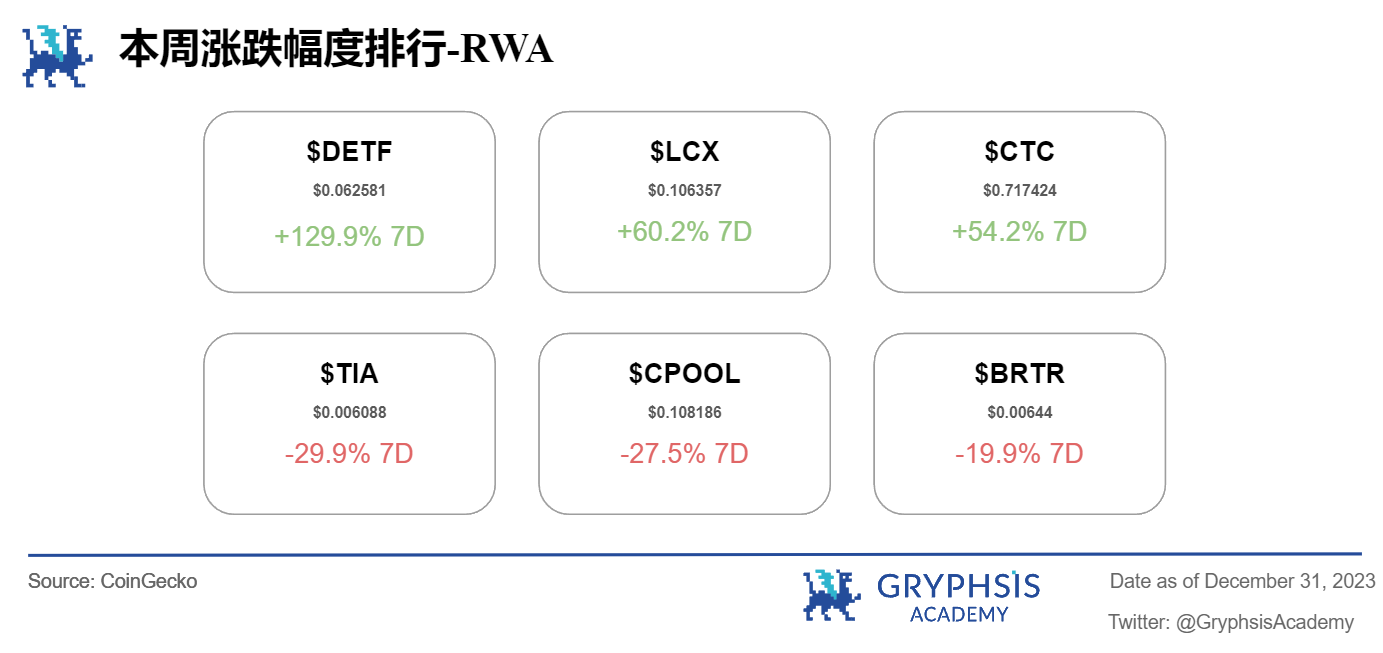

Last week, the market capitalization of real-world assets (RWA) increased by 7.69%, with an overall industry share of 0.14%, and a 24-hour trading volume decrease of 6.48%. The tokenized treasury saw a slight decline, but the value of tokenized U.S. Treasury bonds grew by 3.25%. Notable growth tokens include $DETF, $LCX, and $CTC, while tokens like $TIA, $CPOOL, and $BRTR experienced significant losses.

Main Topics

Macroeconomic Overview:

- US Stock V.S. Crypto

Major Events This Week:

- The expectations of the Bitcoin spot and futures markets in 2024

Weekly Protocol Recommendation:

- Clearpool

Weekly VC Investment Focus

Eclipse Fi ($1.9M)

Tonka Finance ($2.5M)

BRC20.com ($1.5M)

Twitter Alpha:

@TheDeFISaint on MUX Protocol

@0xelonmoney on Metis

@milesdeutscher on Cosmos

@0xAndrewMoh on RWA

@KingWilliamDefi on Solana Meme-coin

Macroeconomic Overview

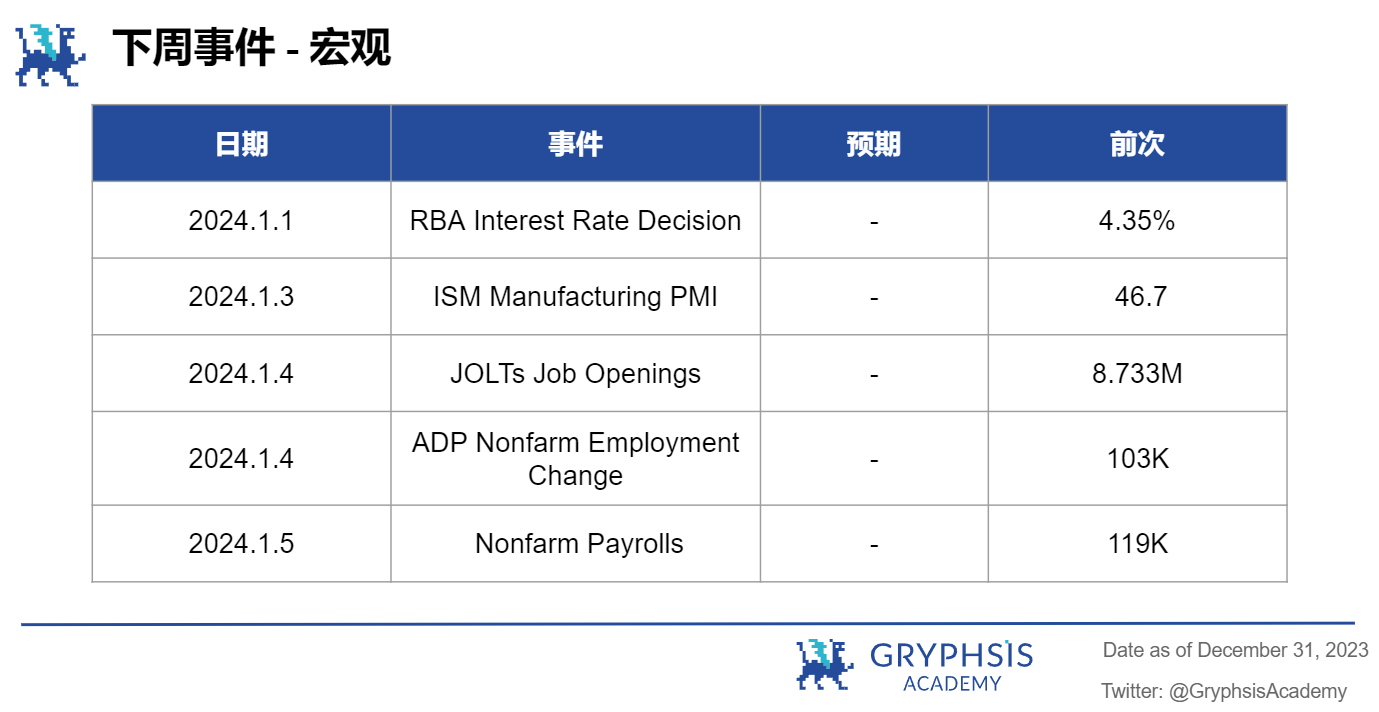

This week, the stock market showed weaker fluctuations compared to the crypto industry, with SPX and NASDAQ increasing by 0.32% and 0.29%, respectively. In the coming week, attention should be paid to significant events such as the ISM Manufacturing Purchasing Managers' Index, JOLTs job openings, ADP non-farm employment changes, and non-farm payrolls.

Major Events This Week

Current Status and Expectations of Bitcoin Spot and Futures Markets in 2024

It is estimated that U.S. regulators will approve a spot Bitcoin ETF in 2024, and the approval will trigger a nearly 49% increase in Bitcoin prices since October.

Currently, spot Bitcoin trading is concentrated on a few exchanges: Coinbase, Binance, Bybit, and OKX, which account for about 65% of spot Bitcoin trading. Among them, Binance accounts for 35.5%, while Bybit, OKX, and Coinbase account for 11.3%, 9.2%, and 8.9%, respectively.

Since the beginning of 2021, the average order size for Bitcoin has been gradually decreasing, currently around $1,652. While smaller order sizes are associated with retail investors, there are also institutions that split orders into many smaller ones to minimize slippage.

It is unwise to assume that retail investors are the main force in recent spot Bitcoin trading based solely on order size.

According to Coinbase's Q3 2023 trading summary, trading volume has declined in three of the past four quarters. Over the past year, the decline in trading volume has been similar for both retail and institutional traders.

David Liang from Path Crypto stated that history suggests we may see a price slowdown before the halving in April 2024.

In terms of the Bitcoin futures market, CME Group's Bitcoin futures open interest reached $4.55 billion, accounting for about 25% of total open interest, the highest level since Q2 2022.

Most CME Bitcoin futures positions are held by asset managers and leveraged funds, with the former showing a bullish bias and the latter showing a bearish bias, as asset managers tend to invest over a longer time frame compared to other buying clients. In contrast, hedge funds and commodity trading advisors (CTAs) tend to trade over shorter time frames and engage in basis trading and hedging.

CME Group noted: "Institutional investors are becoming increasingly active in the crypto space, with large Bitcoin holders holding at least 25 contracts reaching an all-time high in the week of November 7, 2023."

Funding rates align perpetual futures prices with spot prices. When the funding rate is positive, long contract holders pay funding fees to short contract holders, and vice versa. Funding rates increase as Bitcoin spot prices rise, indicating bullish sentiment and bias.

https://www.coindesk.com/markets/2023/12/27/what-to-expect-from-bitcoin-in-2024/

Weekly Protocol Recommendation

Welcome to our weekly protocol segment—here, we focus on protocols making waves in the crypto space. This week, we chose Clearpool, a permissionless decentralized lending protocol that allows institutions to raise funds directly without collateral.

Clearpool was launched in March 2022 and has issued over $440 million in loans, with a growing user base that includes both crypto and traditional financial institutions such as Wintermute, Jane Street, Fasanara Digital, and CoinShares. The protocol launched on the Ethereum mainnet in March 2022, expanded to Polygon PoS in July 2022, to Polygon zkEVM in July 2023, and to Optimism in October 2023.

Clearpool is mainly divided into the following business types: Permissionless, Prime, Stake

- Permissionless

Borrowers must go through Global KYC & AML to ensure that digital asset lending activities comply with local financial regulations and compliance standards. The initiated Pool will be governed by Clearpool's multi-signature, currently only supporting USDC/USDT funding.

- Prime

Prime serves as Clearpool's entry into RWA private credit and is already in use on the Optimism mainnet. On Prime, all counterparties, including Borrowers and Suppliers, must undergo strict KYC and anti-money laundering (AML) due diligence. Borrowers can initiate funding pools with customized terms, while Suppliers can earn yield opportunities with high-quality institutional counterparties in a secure and compliant environment.

Borrowing through Prime does not require collateral; Borrowers create funding pools with specific conditions within the core smart contract. After creating a funding pool, Borrowers can invite any other whitelisted institutions to fund the pool. The borrowed assets are automatically transferred directly to the Borrower's wallet address, and the Clearpool protocol itself does not hold the assets.

- CPOOL Oracles and Staking

Clearpool has its own oracle network, the Clearpool Oracle Network, where various institutions vote to determine the interest rates of the pools. Staking $CPOOL tokens into the Oracle pool not only earns $CPOOL token incentives but also helps maintain the interest rate pricing mechanism.

The weight of the oracles is determined by the amount of $CPOOL staked/held by each oracle, with their voting power being 15% of the $CPOOL they hold. Holders can delegate oracles to vote and earn $CPOOL rewards based on their staking ratio, and oracles can also charge a certain percentage as a commission.

Economic Token Model: The native token $CPOOL has an initial supply cap of 1 billion, with primary value capture in two areas:

1) Delegated Staking: Holders can delegate their tokens to oracles, with 15% of the total staked amount of oracles as their Voting Power, earning staking rewards based on the percentage of their individual stake.

2) LP Rewards: Providing liquidity by supplying their funds to earn CPOOL mining incentives.

The protocol's business model is as follows:

- Origination Fee

When Borrowers make repayment transactions (including principal), the origination fee is sent directly to the Clearpool treasury and charged to the Borrowers. The origination fee is calculated annually based on a 360-day standard year and a 30-day standard month for the loan amount.

- Protocol Fee

The protocol fee is a certain percentage of the pool interest approved by governance, which will be transferred to the protocol treasury upon maturity/repayment. This fee only applies when Borrowers initiate a "repayment" transaction. Penalty interest will begin to accrue immediately after overdue repayment.

The revenue generated by the protocol will be used to repurchase $CPOOL, either deposited into the reward pool for later redistribution as LP/staking rewards or burned.

Our Insights

Currently, Clearpool ranks third among permissionless lending protocols, with a monthly growth rate of 25.12%, and ranks first on Optimism. Meanwhile, its token $CPOOL has seen a monthly price increase of 111.29% since the announcement of the Prime business launch on Optimism on December 12.

If considered purely as a lending protocol, Clearpool's TVL ($55.28M) lacks competitive advantage in this space. However, in addition to basic lending services, it has introduced the RWA private credit Prime business, and its first Clearpool Prime loan was initiated by Portofino Technologies, a crypto-native HFT market-making firm that uses advanced technology to reduce friction in trading digital assets on exchanges and OTC markets. The first transaction of Clearpool Prime was funded by Azure Tide, a digital asset lending institution whose clients include many traditional family offices and institutions.

Once institutions are certified, they can apply for loan amounts without collateral, while users can also act as Suppliers to provide funds and earn APY. Clearpool further meets the compliance needs of institutional market participants for digital asset lending, while liquidity providers can earn attractive mining ($CPOOL) rewards.

Additionally, Clearpool has received a grant of 150,000 $OP from the Optimism Foundation, which will be used for liquidity mining rewards on the OP mainnet.

The oracle voting of $CPOOL serves as a governance mechanism, participating in the core competitive factors of the Curve War, and the governance rights of $CPOOL also have bribery value, further enhancing the demand for the token.

In summary, we see Clearpool making strides in compliance and application in RWA lending, becoming an important milestone in bridging the gap between traditional private credit and DeFi; it ranks in the top 3 among permissionless lending protocols and has secured a substantial grant from Optimism, with rich liquidity pool incentives; finally, its governance rights, mining incentives, and token buyback economic model all strongly favor Clearpool's future development.

Gryphsis Research Focus

Welcome to this week's "Gryphsis Research Focus," where we share the latest insights from our team. Our dedicated research team continuously explores the forefront trends, developments, and breakthroughs in the crypto space. This week, we are excited to share our newly released report, so let's dive in!

TL;DR:

Analysoor is the first Meta Protocol on the Solana chain, adopting a unique approach to create and distribute NFTs and tokens. It provides users with a Fair Launch minting mechanism by using block hash values as random number generators and selecting winners on each block. This mechanism has proven successful, effectively eliminating the impact of bots in the minting of $ZERO and Index ONE NFTs.

Fairness and liquidity guidance are the core value supports of Fair Launch. Under this mechanism, there are no pre-sales or whitelists, no team allocations, and no gas fee front-running transactions; everyone starts on the same starting line, and the disparity in capital volume does not create a competitive advantage in the minting process. The fees generated from minting do not flow to the project team or miners' wallets but are entirely used to create liquidity, benefiting the ecosystem and community, forming a positive feedback loop.

Analysoor is forming a strong community consensus, and its value and potential are being recognized and acknowledged by an increasing number of people. Meanwhile, its developers are continuously innovating more ways to combat potential bot behavior to ensure that fairness can be maintained and guaranteed in the long term. Among them, the application of AI algorithms and machine learning is what we are most likely to see next.

Compared to the market capitalizations of other mainstream launchpad projects on public chains like Auction, Turt, and Bake, Analysoor's current market cap may be severely undervalued. Considering that there is currently no leading launchpad protocol in the Solana ecosystem, Analysoor is very likely to take on this role, with significant potential for value growth in the future.

The market's demand for fairness and transparency is growing, and the Fair Launch mechanism will become an inevitable trend. Therefore, 2024 may be a year of explosion for Meta Protocols (especially on high-performance public chains like Solana), and Analysoor, as a pioneer of Fair Launch on the Solana chain, possesses enormous potential and a strong vision. We may see it expand into more diverse tracks in the future, becoming a multifunctional launchpad, not just for MEME coins and NFTs.

Full report: https://link.medium.com/kqHC6S6bXFb

Weekly VC Investment Focus

Welcome to our weekly investment focus, where we reveal the most significant venture capital dynamics in the crypto space. Each week, we will highlight the protocols that have received the most funding.

Eclipse Fi

Eclipse Fi is a modular issuance and liquidity solution that supports innovations on Cosmos and other blockchains. Eclipse Fi provides a comprehensive modular solution to meet token and liquidity needs, allowing project teams to control the entire token issuance process from the start and customize their issuance methods and processes based on their allocation and liquidity needs.

https://finance.yahoo.com/news/eclipse-fi-raises-1-9-162000033.html?guccounter=1

Tonka Finance

Tonka Finance is a lending platform focused on enhancing the functionality and liquidity of inscription track assets. By leveraging advanced lending mechanisms, diversified collateral options, and seamless cross-chain interactions, it aims to enhance the functionality, feasibility, liquidity, and accessibility of Bitcoin inscriptions and other digital assets, providing a better user experience than traditional lending protocols like AAVE and Compound. In the future, Tonka Finance will continue to provide effective solutions for new digital assets in terms of liquidity and financial utility.

https://www.chaincatcher.com/article/2110006

BRC20.com

BRC20.com is a Bitcoin-based DeFi protocol designed to provide key infrastructure for the BRC20 ecosystem. BRC20.com integrates advanced BRC20 features: mobile wallets, cross-chain bridges, multi-minting, markets, staking, and more. The BRC20.com API provides built-in discovery tools for discovering popular minting and hot token alpha.

https://x.com/BRC20com/status/1740396107962671237?s=20

Protocol Events

Thunder Terminal hacked for 86.5 ETH: ZachXBT

PancakeSwap community approves removing 300 million tokens from supply

zkSync outpaces Ethereum in monthly transaction volume, propelled by inscription activity

Levana Protocol exploited for over $1 million on Osmosis blockchain

Worldcoin launches in Singapore after pausing in India

Industry Updates

South Korea to disclose top public officials' crypto holdings next year

Bitcoin faces risk of protocol-level censorship as miners under increasing regulatory pressure

Canadian crypto exchange Catalyx ceases all trading following security breach

India's Financial Intelligence Unit issues compliance notices to offshore crypto exchanges including Binance, Kraken

Hong Kong proposes licenses should be required for stablecoin issuers

Twitter Alpha

There is a lot of Alpha in crypto Twitter, but navigating through thousands of Twitter threads can be challenging. Each week, we spend hours researching to curate insightful threads and compile a weekly selection for you. Let's dive in!

https://x.com/TheDeFISaint/status/1740677681635586388?s=20

https://x.com/0xelonmoney/status/1740406788204515630?s=20

https://x.com/milesdeutscher/status/1740403535030989041?s=20

https://x.com/0xAndrewMoh/status/1740455735832768517?s=20

https://x.com/KingWilliamDefi/status/1740408717546520596?s=20

Upcoming Events