An Analysis of Ethena Labs: Valued at $300 Million, the Stablecoin Disruptor in Arthur Hayes' Eyes

Written by: Azuma, Odaily Planet Daily

On February 16, the stablecoin project Ethena Labs announced the completion of a $140 million strategic funding round, raising $300 million, co-led by Dragonfly, Brevan Howard Digital, and the family office Maelstrom of BitMEX founder Arthur Hayes.

In July last year, Ethena Labs also completed a $6.5 million seed funding round, led by Dragonfly, with participation from Deribit, Bybit, OKX, Gemini, Huobi, Arthur Hayes, and his family office.

Inspiration: Arthur Hayes

Ethena Labs' current main product is the "Delta Neutral" stablecoin USDe, which was inspired by Arthur Hayes, the founder of BitMEX.

In March 2023, Arthur wrote an article titled "Dust on Crust," in which he discussed his vision for a new generation of stablecoins called "Satoshi Dollars," aimed at creating a stablecoin backed by equal amounts of long spot BTC and short futures.

Ethena Labs subsequently turned Arthur's vision into reality but chose ETH as the primary asset for spot and futures positions. In other words, the collateral for USDe consists of equal amounts of long spot ETH and short futures ETH.

Perhaps because Ethena Labs is advancing Arthur's vision on his behalf, the project received strong support from Arthur in both funding rounds, and Arthur himself minted a large amount of USDe, even publicly stating on X platform: "USDe will surpass USDT to become the largest dollar stablecoin."

What is "Delta Neutral"?

The biggest label for USDe is "Delta Neutral."

In finance, Delta is a measure of how much the price of an underlying asset affects the change in the value of a portfolio, with a range of "-1 to 1." The definition of "Delta Neutral" is that if a portfolio consists of related financial products and its value is not affected by small price changes in the underlying asset, then the portfolio has "Delta Neutral" properties.

Considering the product nature of USDe, since the collateral for this stablecoin consists of equal amounts of long spot ETH and short futures ETH, the Delta value of the spot position is "1," and the Delta value of the short futures position is "-1." After hedging, the Delta value becomes "0," achieving "Delta Neutral."

The fundamental nature of "Delta Neutral" ensures that the collateral minting position of USDe is largely unaffected by small price fluctuations in ETH, thereby (under normal circumstances) ensuring that USDe can maintain a robust collateral status.

Yield is Key

Having introduced the collateral structure of USDe, why does Ethena Labs adopt such a complex design? How can USDe capture market share from established stablecoins like USDT and USDC?

The answer lies in yield; USDe staking users can share dual returns from the collateral assets.

First is the stable income from the long spot staking. Ethena Labs supports staking spot ETH through liquid staking derivative protocols like Lido, earning an annual yield of 3% - 5%.

Second is the unstable income from the funding rates of short futures. Users familiar with contracts understand the concept of funding rates; although funding rates are a variable factor, for short positions, the majority of the time, funding rates are positive in the long run, which also means overall returns will be positive.

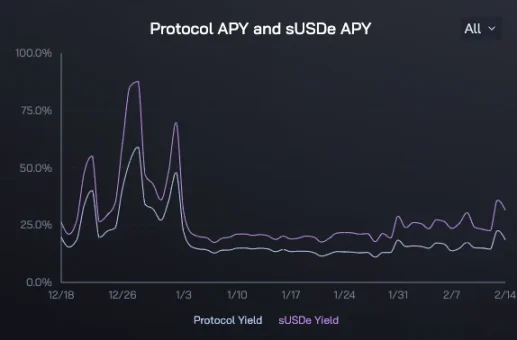

The combination of these two returns provides USDe with a considerable yield. Official data shows that the protocol yield of Ethena Labs and the yield of sUSDe (the staking token for USDe) have performed remarkably over the past two months, with the protocol yield peaking at 58.9% and a minimum of 10.99%; sUSDe peaked at 87.55% and a minimum of 17.43%.

Currently, the real-time yield of sUSDe is 27.6%. Considering the frenzy when MakerDAO previously achieved an 8% yield using RWA, it is easy to understand why Arthur has such confidence in USDe.

Four Layers of Potential Risks

In October last year, Austin Campbell, a professor at Columbia Business School and founder and managing partner of Zero Knowledge Consulting, published an article dissecting the design structure of USDe.

Austin pointed out in the article that he prefers to refer to USDe as a "structured note" rather than a stablecoin and analyzed four layers of potential risks associated with USDe:

- First is the security risk at the staking level, whether the security and sustainability of the staking nodes can be guaranteed;

- Second is the security risk of the futures contract platform, whether DEX or CEX, both are susceptible to hacking risks;

- Third is the risk of contract availability, as there may not always be sufficient liquidity to short;

- Fourth is the funding rate risk; although funding rates for short positions are mostly positive, there is a possibility of turning negative, which would be quite fatal for a "stablecoin" if the overall yield after weighted staking returns is negative.

Current Data and Future Outlook

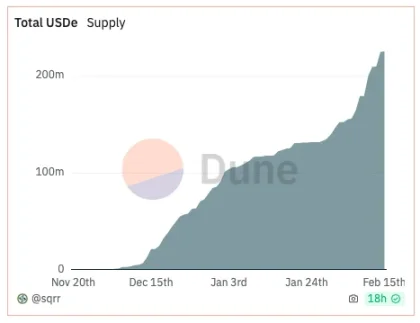

Currently, the real-time total minted amount of USDe is $234 million, maintaining a strong growth trend over the past few months.

It is worth mentioning that Ethena Labs has not publicly released its product, and access to USDe is still by private invitation, making this data performance even more remarkable.

Looking ahead, besides the recently completed $140 million funding, there are several other key matters surrounding Ethena Labs that need attention.

First is the public release of the product and the disclosure of the related token economic model.

Second, Seraphim, the former external "face" and expansion head of Lido, has joined Ethena Labs as the head of growth, which may help drive product integration for Ethena Labs.

Third, Binance Labs has included Ethena Labs in the first batch of incubation projects for Incubation Season 6, which may also become a significant boost for Ethena Labs' accelerated growth.

Challengers in the stablecoin space have come and gone; hopefully, this time, Ethena Labs and USDe will bring a different story.