RootData November Cryptocurrency Market Data Summary: BTC Enters Bull Mode, Investment and Financing Market Still in Bear Market

整理:饼干 \& Elvin,RootData

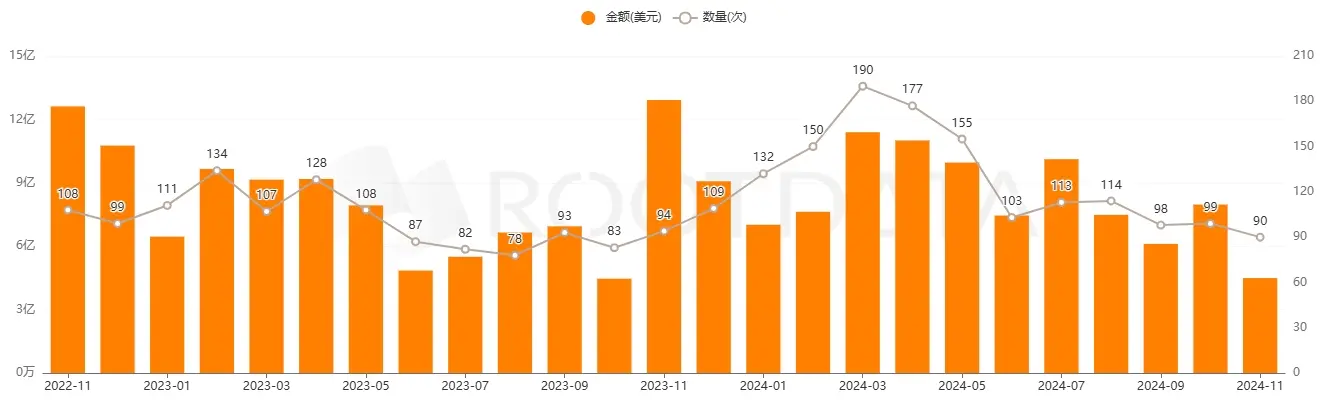

In November 2024, the crypto market showed a bull market trend, with BTC rising from $66,700 to around $99,800. However, investment and financing data decreased instead of increasing, with total financing amount reaching $450 million, a month-on-month decline of 20.5%. The number of financing events was 90. According to Fortune magazine, MicroStrategy plans to raise $42 billion in new capital over the next three years to purchase Bitcoin. The new financing plan is called the 21/21 Plan, aiming to raise $21 billion through stock issuance and another $21 billion through fixed-income securities, scheduled between 2025 and 2027.

Financing Trends in the Crypto Field Over the Past Two Years

In this article, we will focus on specific financing data, active investors, trending projects, and other aspects to present the changing trends in the crypto market.

I. Financing Data

In November, the total financing amount in the cryptocurrency sector was $450 million, a month-on-month decrease of 43.7% and a year-on-year decrease of 64.4%. This month's financing events totaled 90, similar to the data from the previous two months. The largest financing event this month was the synthetic stablecoin USDX, which completed a $45 million financing at a valuation of $275 million. Other popular projects that completed financing include the modular AI blockchain 0G, online gambling platform Monkey Tilt, hardware manufacturer Canaan, ETH staking yield protocol StakeStone, and settlement blockchain platform Partior.

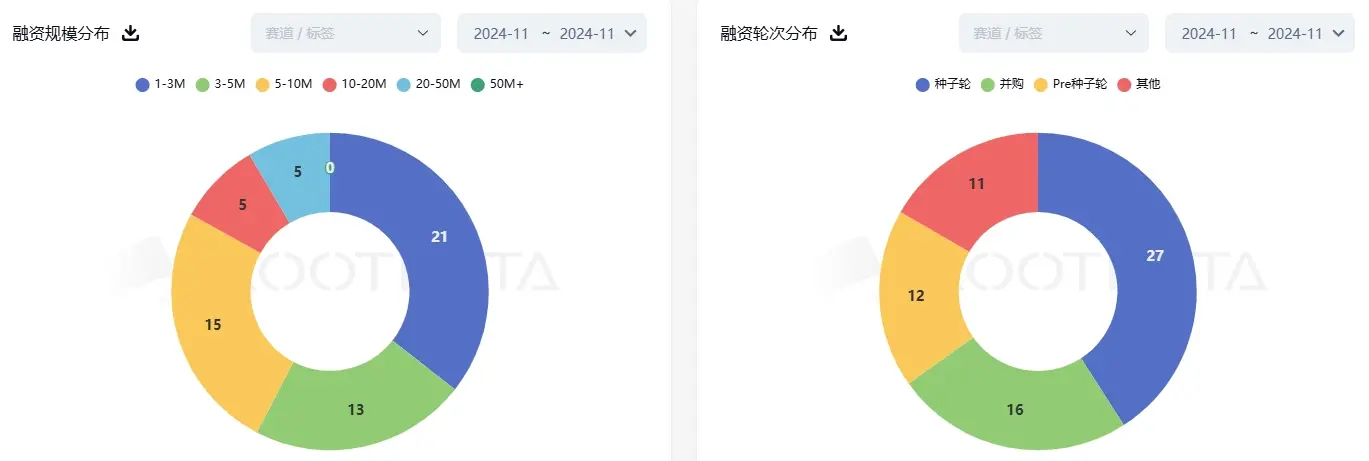

In terms of financing amount and rounds, the $1-3 million range accounted for the highest number of financing events, with seed rounds remaining the most popular financing stage, with 27 projects completing seed round financing. Notable projects include the modular AI blockchain 0G ($40 million), non-custodial wallet account Deblock ($16.8 million), L1 blockchain Cytonic ($8.3 million), internet-level blockchain Pharos ($8 million), ZK full-chain data proof platform Brevis ($7.5 million), and cryptocurrency AI model Pond ($7.5 million).

Additionally, there were 16 M&A events in November. Ethereum Rollup deployment platform Caldera acquired the NFT-native options protocol Hook Protocol, and DeFi derivatives protocol Cega announced its acquisition and will shut down the platform by the end of the year. Stablecoin payment processor Utopia was acquired by Coinbase, and blockchain analytics company smlXL was acquired by Dune. Additionally, Synthetix initiated a proposal to acquire Kwenta and restart derivatives trading functions through a merger.

II. Active Investors

Animoca Brands, Polychain, and Hack VC were the top three venture capital firms in November, each making 5 investments, with the following records:

- Animoca Brands: 0G, Qooverse, Balance, Talus, BLIFE Protocol

- Polychain: Brevis *, StakeStone *, Noble, Monkey Tilt, Talus *

- Hack VC: Pharos *, TAC *, 0G, Dango *, Monkey Tilt

Following closely were Binance Labs, Foresight Ventures, PAKA, Bankless Ventures, a16z CSX, and Waterdrip Capital, each making more than 4 investments.

Additionally, Stepan Simkin, Anatoly Yakovenko, and Sandeep Nailwal were the most active Web3 angel investors in November, each investing in at least 3 projects.

In terms of new fundraisings in the crypto sector, November showed more positive signals, with specific events including:

Theory Venture completed $450 million fundraising for its second fund, which will focus on three areas: data analytics, AI as a new platform, and decentralized infrastructure as a database. Since launching its first fund, Theory has led investments in companies like Context.ai, Initia, Superlinked, and Tobiko Data, and opened a new office in San Francisco.

Accolade Partners raised $202 million for its latest "fund of funds," focusing on blockchain and cryptocurrency investments. This fund is named Accolade Partners Blockchain III. Accolade's portfolio includes 1kx, Archetype, Framework Ventures, Parafi, Portal, Reverie, and Varrock.

A new fund under Altos Ventures completed $500 million in fundraising, focusing on areas such as AI, cybersecurity, cloud computing, and blockchain.

Coatue Management plans to raise $1 billion. This hedge fund previously led OpenSea's $300 million Series C funding, and its investment portfolio in the crypto sector includes CertiK, Hut 8, MoonPay, Dune Analytics, and more.

III. Trending Projects

The RootData heat value is calculated based on normalized data from platform search volume, click volume, user votes, and Twitter heat index. The projects with the highest heat value in November include:

Grass is the flagship product of Wynd Network, allowing users to profit from internet connections by selling unused network resources. For individuals, it will appear as a network extension that is downloaded, retained, and forgotten. It will work in the background, helping others access public network data in exchange for payments in the protocol's native tokens.

Aleo is a developer platform for building fully private, scalable, and cost-effective applications. Using zero-knowledge cryptography, Aleo moves smart contract execution off-chain to enable various decentralized applications that are both fully private and scalable to thousands of transactions per second.

DAWN is a decentralized wireless network for providing internet services, developed by the Andrena team, allowing owners or residents to buy and sell internet capacity in their surrounding areas—enabling users to operate as their own internet service providers. DAWN facilitates a trustless exchange system that employs backhaul, location, and frequency proofs.

Gradient Network is an open layer for edge computing on Solana, designed to make computing inclusive, accessible, and affordable for everyone.

Nodepay is a network infrastructure providing decentralized bandwidth for AI training. By connecting to the Nodepay network, users will be able to sell unused internet to AI companies, enabling efficient transfer of public training data, labels, model sharing, and remote distributed training.

DeAgentAI is a decentralized AI agent network that builds an AI feedback mechanism incentive protocol in Web3, achieving "insight proof" by tightly coupling feedback with the training process, dedicated to creating a decentralized network platform. This platform allows users to create and deploy their own AI agents, driving innovation and development in the AI field through token-based economic incentives for high-quality agents.

Story Protocol is building web3 technology to fundamentally change the way narratives are created. Its mission is to unleash a new way to create, manage, and license on-chain IP, ultimately forming a "story Lego block" ecosystem that can be remixed and recombined. Story Protocol provides a simplified framework to manage the entire lifecycle of IP development, supporting features like source tracking, frictionless licensing, and revenue sharing. Applications built on Story Protocol are designed for creators of all media (prose, images, games, audio, etc.), allowing writers and artists to track the provenance of their work, enabling anyone to contribute and remix while capturing the value of their contributions.

Usual is a stablecoin protocol that launches USD, a permissionless and fully compliant stablecoin backed 1:1 by real-world assets (RWA). USUAL is a governance token that allows the community to guide the future development of the network. Usual addresses current issues in the stablecoin market by redistributing profits to the community and rewarding token holders with actual earnings generated from RWAs.

9. Bless

Bless is a shared computing protocol powered by everyday devices that automatically connects unused devices with computational tasks that need to be executed. Users can now automatically run the applications and websites they use and earn rewards for doing so.

Pnut (Peanut the Squirrel) is a meme coin based on a squirrel pet, whose prototype was euthanized by the New York Department of Environmental Conservation (DEC) due to rabies concerns.

11. Act I

Act I is a meme coin aimed at exploring urgent behaviors in multi-AI and multi-user interactions.

Morpho is a lending protocol that combines the current liquidity pool model used in Compound or AAVE with the capital efficiency of a P2P matching engine used in order books. Morpho-Compound improves upon Compound by providing the same user experience, liquidity, and liquidation parameters, while increasing APY through peer-to-peer matching.

Pipe Network is a decentralized content delivery network (CDN) based on Solana. This secure, scalable, and highly localized solution allows permissionless contributors to deploy points of presence (PoP) in target areas, ensuring lightning-fast access to high-quality media and real-time applications.

Side Protocol is a fully Bitcoin-compatible Layer 1 blockchain with a self-custodied Bitcoin-native lending system.

Open Loot is an end-to-end solution for launching games with a Web3 economy. Open Loot handles all NFT and token management for partners and provides players with a super convenient experience.

IV. Project Updates

In November, RootData also recorded numerous events such as mainnet launches and new token issuances, helping users stay informed about important project dynamics in the market and grasp earlier alpha opportunities.

Projects that launched on the mainnet in November (sorted by date, not exhaustive):

Supra is a Layer 1 blockchain compatible with MultiVM, allowing developers to run smart contracts from any ecosystem. Supra Containers provide dedicated DappSpace, enabling developers to freely create their ecosystems around their token economics, customized governance, and local fee markets.

Dexodus is a decentralized perpetual contract exchange with fully integrated copy trading features. Dexodus functionalities include copy trading, gasless trading, one-click trading, and Chainlink data streams.

Jade is a decentralized stablecoin platform that allows users to mint $JSD, a yield-bearing stablecoin backed 1:1 by $USDC. By depositing USDC into Jade, users can earn yields while maintaining the stable value of their assets.

Hyperfluid is a fully on-chain mixed order book AMM DEX built for Aptos.

Endur.Fi is a platform introducing xSTRK, a tradable liquid staking token (LST) on Starknet. Endur is developed in collaboration with STRKFarm and Karnot, allowing STRK token holders to stake their assets while maintaining liquidity.

Fluid Protocol is a Fuel stablecoin protocol that allows users to withdraw interest-free loans against a single collateral type, with loans paid in Fluid's native stablecoin USDF, which must maintain a fixed minimum collateral ratio. Users will be able to redeem USDF at face value as collateral at any time.

Elara Finance is a next-generation DeFi platform that unifies dispersed ETH liquidity, creating a more accessible, secure, and higher-yielding financial ecosystem. ElaraLend is a decentralized lending protocol specifically tailored for scalable support of liquid staking tokens (LST) and liquidity re-staking tokens (LRT). Unified ETH (uETH) is a decentralized, over-collateralized cryptocurrency that maintains a stable 1:1 value with ETH.

Vana is an AI identity generation application that allows users to create a digital persona that can be used across different applications, while this digital persona remains private and can only be controlled by the creating user and their authorized accounts.

Projects that launched testnets in November (sorted by date, not exhaustive):

Linera is a blockchain protocol designed for low-latency applications. The project draws on academic research initiated by Facebook/Novi, such as the FastPay protocol and Zef protocol (slides).

Fhenix is the first blockchain driven by fully homomorphic encryption. By using fhEVM, Fhenix enables Ethereum developers to seamlessly build encrypted smart contracts and perform encrypted data computations while using Solidity and other familiar, easy-to-use tools.

Bless is a shared computing protocol powered by everyday devices that automatically connects unused devices with computational tasks that need to be executed. Users can now automatically run the applications and websites they use and earn rewards for doing so.

Projects that launched tokens in November (sorted by date):

Source: RootData Market

Dogc (DogeChaser) community, as a faithful inheritor of the Doge spirit, embodies the concept of "inheritance and innovation," injecting new vitality into MEME culture.

Midnight is a Web3 gaming company with a mission to create games with "eternal stories" and endless experiences. Midnight's games will feature a Web3-based "forging" system.

Hyperliquid is a high-performance L1 platform. Its vision is a fully on-chain open financial system where user-built applications connect with high-performance native components, all without compromising the end-user experience. Hyperliquid L1's performance is sufficient to run an entire permissionless financial application ecosystem—every order, cancellation, transaction, and settlement occurs transparently on-chain with block delays of <1 second. The flagship native application is a fully on-chain order book perpetual exchange, Hyperliquid DEX.

Posemesh is a decentralized machine perception and spatial computing network that provides low-latency networks for collaborative spatial computing and XR.

PinGo is an AI and DePin solution on the TON network, addressing the fragmentation and idleness of idle computing resources, providing a strong computational foundation for building AI models.

Rewardable is a Task-to-Earn platform that connects Web3 projects with verified user communities (known as Task Ninjas), ensuring genuine, high-quality participation through diverse, incentivized tasks.

Tomo Cat is a cat meme coin. It all started in Japan. Centuries ago, a stray cat waved at the samurai Ii Naotaka at the temple gate. This person came in, saved from a thunderstorm, and decided to build a temple to commemorate his savior.

Moongate is building an attention asset protocol for real-world activation. Moongate transforms consumers' real-world assets and experiences into on-chain achievements for exclusive rewards, access, and community. Moongate was previously an NFT ticketing and membership platform.

Shieldeum is an AI-driven decentralized physical infrastructure network (DePIN) that provides Web3 network security for cryptocurrency users. The Shieldeum ecosystem integrates data center servers to provide services such as application hosting infrastructure, data encryption, threat detection, and high-performance computing tasks, aimed at protecting the interests of cryptocurrency holders and Web3 enterprises.

Zenrock is a cryptocurrency custody platform built on part of Qredo's technology, aimed at solving this issue by managing private keys through decentralized multi-party computation (MPC) wallets.

Due to space limitations, the above is a partial overview of mainnet and token information. For more complete and timely data, please visit the RootData official website (https://www.rootdata.com/zh/) for more information.