TRON Industry Weekly Report: BTC Consolidation May Benefit Altcoin Sector, ZKP Integrated into AI Training Models

# I. Outlook

## 1. Macroeconomic Summary and Future Predictions

Last week, Trump posted on social media, suggesting a 50% tariff on EU goods starting June 1, claiming that the EU's trade barriers have led to an annual trade deficit of over $25 billion for the U.S. This move has raised concerns in the market about a substantial decoupling of U.S.-EU trade. Although Trump agreed to extend the negotiation deadline to July 9 on May 25, the threat of high tariffs has already impacted global supply chains and financial markets.

## 2. Market Movements and Warnings in the Crypto Industry

After Bitcoin broke through $111,000 to reach a historic high, the market entered a high-level consolidation phase, with the total market capitalization increasing from $3.1 trillion to $3.24 trillion, indicating that funds are gradually flowing into non-Bitcoin assets, showing early signs of a "altcoin season." Meme coins, AI, and DePIN sectors are showing localized activity, but the market remains dominated by institutions, with altcoins continuing to oscillate in a consolidation pattern. A full "altcoin season" may need to wait for Bitcoin to enter a sideways phase.

## 3. Industry and Track Hotspots

The Disney-like 3D metaverse platform Puffverse is breaking down the barriers between Web3 and Web2, allowing users to step into an extraordinary virtual world; the Web3 social ecosystem UXLINK is promoting deeper user engagement in the Web3 world by integrating various modular Dapps.

# II. Market Hotspot Tracks and Potential Projects of the Week

## 1. Potential Track Performance

1.1. Analyzing How the Disney-like 3D Metaverse Platform Puffverse Breaks Down Web3 & Web2 Barriers

PuffWorld is a metaverse designed to create an immersive 3D experience for users, allowing them to step into an extraordinary virtual world. In PuffWorld, users can explore this infinitely wonderful universe, significantly enhancing their gaming experience and establishing meaningful connections with others.

Currently, PuffWorld can accommodate up to 40 adventurers per channel, providing a high-quality and convenient interactive experience. Puffverse is continuously being developed, with plans to enable a single channel to host over 10,000 players in the future.

Architecture Overview

$PFVS & vePUFF

PFVS and vePUFF are two important tokens in the Puffverse ecosystem, closely related to each other.

$PFVS is the circulating token used in major payment scenarios within Puffverse. Users can use $PFVS for various purchases, such as buying the PuffGo Pass to participate in PuffGo leagues, purchasing game items, editing UGC content, and buying cloud gaming computing power. This token not only incentivizes users to actively participate in ecosystem development but also rewards developers who contribute to game development.

vePUFF is the governance token in Puffverse, primarily obtained by staking $PFVS, and can also be earned by participating in specific PuffGo games. Most importantly, vePUFF holders have the right to vote in Puffverse's decentralized governance (Puff DAO).

PFVS and vePUFF can be converted at a fixed ratio, with an exchange rate of 100:1, meaning 100 PFVS can be locked to obtain 1 vePUFF, allowing holders to enjoy ecosystem rewards and governance voting rights. Additionally, the length of time and quantity of vePUFF held will affect the final reward distribution.

Puffs NFT

The core asset in Puffverse is the main NFT called Puff.

Each NFT has a unique character and its corresponding appearance combination. Users can purchase these NFTs through the secondary market or participate in upcoming Puff events and promotions to obtain them.

Puffverse has built a rich and diverse NFT universe, with each NFT having different but practical functions within the ecosystem, including but not limited to:

- Puff Genesis: The most privileged version, allowing participation in all Puff NFT products in Puffverse.

- Puff Limited Edition NFT: Including Puff football series, New Year series, astronaut series, etc.

- Puff Classic: Can be used in the simulation-style idle game PuffSim to enhance the star rating of Puff NFTs.

- Puff General: A Puff NFT without special outfits, obtained through PuffGo Easter egg hatching, usable in PuffGo games.

- Puff Ticket: Can be used in the future to redeem game items.

These NFTs not only have collectible value but also play a key role in various products within Puffverse, creating strong interaction and deep engagement for users.

Product Overview

PuffGo - Party Battle Royale Blockchain Game

PuffGo is a blockchain-based multiplayer online party battle royale game, allowing players to enjoy the fun of the game while also enabling play-to-earn. The game includes multiple levels and gameplay modes, supporting various forms of competition from single-player to multiplayer. Players can collect game characters with different appearances, personalities, skills, and outfits, and compete in different levels and modes based on their characters' strengths. Diverse skill combinations and strategic choices will play a crucial role in competing for high rankings and generous rewards.

The game aims to let players experience a fun and differentiated gaming process by controlling various game characters, bringing an immersive entertainment experience through diverse themes, rich levels, and personalized outfits. PuffGo features several main characters, each with distinct personalities and unique appearances, accompanied by exclusive backstories and customized skills or attributes, showcasing their strengths in different scenarios.

The development team's vision is to create an NFT game universe (Gameverse) that integrates entertainment and reward mechanisms, allowing players to gain both enjoyment and returns.

PuffTown

PuffTown is the control panel for managing all Puff-related assets. It can display your in-game data and on-chain data, support wallet creation or import, manage various assets, track game records, enhance gaming experience, and allow you to enjoy simulation-style idle games, among other functions.

In short, PuffTown is a comprehensive management platform for Puffverse users, connecting on-chain and off-chain worlds, providing players with one-stop services and a more convenient operational experience.

PuffSim

PuffSim is a simulation idle game that allows players to easily earn passive income. Players can enhance their characters' combat power by upgrading them and use them to participate in adventures. After selecting a certain number of characters to join the adventure, players do not need to operate manually; they only need to wait for the characters to fight automatically, with rewards after the battle determined by total combat power and time.

In short, players send characters to participate in adventures, and based on the adventure results, they will receive character experience and corresponding gold/diamond rewards after a period of time, with a certain probability of obtaining treasure chests. Opening treasure chests may yield a random amount of gold or diamonds, with different probabilities for the two types of rewards.

In PuffSim, rewards are not directly generated as game tokens but are distributed in the form of in-game "Coins" and "Diamonds." Among them, "Diamonds" serve as a voucher for redeeming points, and before the TGE (Token Generation Event), the diamonds held in your address will automatically convert into IGO points (Initial Game Offering Points).

PuffWorld

PuffWorld is a metaverse designed to gather users in an exciting 3D virtual world, allowing users to step into an extraordinary immersive space. Users can explore this boundless virtual universe, enhancing their gaming experience while establishing deep connections with others.

Currently, PuffWorld can accommodate up to 40 adventurers per channel, providing a convenient and high-quality social interaction experience. Puffverse is continuously upgrading its system, and in the future, the capacity of a single channel will expand to over 10,000 players. Additionally, more captivating areas, innovative gameplay, and rich interactive features will be unlocked, continuously expanding the boundaries of the metaverse.

Review

As a Disney-like 3D metaverse, Puffverse integrates Web3 and Web2, boasting a rich gaming ecosystem (such as PuffGo, PuffSim, PuffWorld) and a tradable NFT system, supporting immersive entertainment and asset appreciation for users, which is its main advantage. Furthermore, the dual-token mechanism of PFVS and vePUFF constructs a relatively complete economic closed loop, incentivizing users and developers to participate. However, the downside lies in the current limited user capacity (e.g., PuffWorld only supports 40 people on screen), the ecosystem's construction is not yet fully realized, and subsequent functionalities and user growth need time to validate, while the competitive GameFi market presents a significant challenge.

1.2. Interpreting How the Web3 Social Ecosystem UXLINK Promotes Deeper User Engagement in the Web3 World Through Integration of Various Modular Dapps

The Social Growth Layer of UXLINK is a social growth infrastructure layer that includes core components such as chain abstraction, account abstraction, a universal gas mechanism, and social protocols. It provides modular services for developers and various applications, helping third-party projects quickly achieve user growth and social function integration, accelerating the construction and expansion of the Web3 application ecosystem.

Architecture Overview

- One Account (Account Abstraction)

The UXLINK Account is an account abstraction protocol that integrates social account abstraction and on-chain account abstraction. This protocol aims to bridge the identity boundaries between users in Web2 and Web3, allowing users to seamlessly access various applications and services through a unified account, achieving integration and management of social identity and on-chain assets, significantly enhancing user experience and system compatibility.

UXLINK Auth

UXLINK Auth is a secure, fast, and convenient Dapp login solution for Web2 and Web3 users. It provides users with a seamless cross-platform login experience, allowing users from both traditional internet and blockchain ecosystems to easily and securely access various Dapps. This solution effectively simplifies the login process, enabling users to connect to applications more quickly and enjoy a smoother interactive experience.

UXLINK Account

The UXLINK Account is a fundamental component of the One Account abstraction protocol, integrating social account abstraction and on-chain account abstraction:

Social Account Abstraction (Off-Chain Account Abstraction)

Social account abstraction refers to the ability of UXLINK accounts to integrate multiple social media accounts (such as Telegram, X (formerly Twitter), Line, Kakao Talk, WhatsApp, Facebook, TikTok, etc.) into a single virtual account for unified management and authentication. Users can log in, verify identity, and interact through social accounts, easily switching identities across different platforms and enjoying cross-platform interactive experiences.

On-Chain Account Abstraction

On-chain account abstraction refers to the UXLINK account's support for unified abstraction of multi-chain blockchain accounts, allowing users to manage their accounts on different blockchain networks (such as Ethereum, Arbitrum, Mantle, TON, KAIA, BTC L2, Solana, etc.) without dealing with complex on-chain operations. Through UXLINK accounts, users can simplify on-chain transactions, asset management, and other operations.

- One Gas (Unified Gas: $UXLINK)

The One Gas mechanism of UXLINK aims to address issues such as gas token fragmentation, inability to use tokens across chains, and high costs of cross-chain transactions in a multi-chain ecosystem. With the One Gas feature, users only need to hold $UXLINK in their accounts to pay for various transaction fees.

Traditionally, users need to hold native tokens (such as ETH, BNB, MATIC, etc.) on each blockchain to pay for gas, which not only increases the complexity of fund management but also leads to asset fragmentation. The One Gas mechanism achieves a "one token across multiple chains" experience: users only need to hold $UXLINK to perform operations across multiple blockchains.

Additionally, One Gas supports real-time dynamic calculation of cross-chain transaction fees, making multi-chain interactions more convenient and efficient, significantly lowering the barriers for users to use Web3 applications.

Using One Gas When executing transactions through One Gas, UXLINK's payment hub (Payment Hub) adopts an embedded Dapp model (implemented through UXLINK's transaction SDK and API), allowing users to directly use $UXLINK tokens to pay gas fees. Users do not need to switch between multiple tokens, and gas fees will be automatically handled by UXLINK's native Paymaster.

All gas fees will be settled seamlessly between the source chain and target chain, with no additional costs. Therefore, when users conduct cross-chain transactions, they do not need to bridge across chains, manage cross-chain balances, or maintain native token pools for each chain, resulting in a simplified and smooth one-stop cross-chain payment experience.

- Social Growth Protocols

UXLINK has launched a social growth protocol system, which includes the following three major protocols:

- X2EARN Protocol Based on the "behavior equals rewards" mechanism, various interactive behaviors of users on the platform (such as inviting, sharing, participating in tasks, etc.) can earn rewards, incentivizing users to continue participating.

- Social Group Protocol Supports the construction and management of on-chain social groups, recording group activities, member relationships, and interactive behaviors, providing on-chain credible evidence for social data.

- Social Graph Protocol Centers around user relationships, establishing a portable and composable on-chain social relationship graph to support various application scenarios such as recommendation systems, identity verification, and user profiling.

X2EARN Protocol

When users complete interactions in various Dapps within the UXLINK ecosystem, these behaviors will be securely and effectively verified and recorded in the UXLINK account system, and users will receive universal points (Universal Points, abbreviated as UXUY) as rewards provided by UXLINK.

What are Universal Points (UXUY)?

UXLINK has introduced a unique incentive mechanism—Universal Points (UXUY). UXUY is a points system designed to encourage users to complete interactive tasks in Dapps that integrate the One Account protocol. Through UXUY points, project parties can enhance user activity, thus forming an efficient user incentive closed loop.

Combining the universal points incentive mechanism with the X2Earn protocol, UXLINK can provide Dapp project parties with real and effective social data and on-chain behavioral data. The X2Earn protocol can record every interaction of users in Dapps and convert it into verifiable social data and on-chain interaction data.

Summary

The advantage of UXLINK lies in its construction of a Web3 social infrastructure aimed at the general public, combining account abstraction (One Account), unified gas payment (One Gas), social growth protocols (Social Growth Protocols), and other modular capabilities, bridging the login, interaction, transaction, and growth paths for Web2 and Web3 users, significantly lowering the barriers to using Web3; at the same time, the UXUY points mechanism incentivizes real user behavior, providing verifiable social and on-chain data for Dapp projects, facilitating rapid ecosystem growth.

The downside is that its ecosystem is still in the early stages, and its attractiveness to external Dapps, user data privacy protection mechanisms, and the security of the unified account system still need to be validated by the market and time. Additionally, unified payment and cross-chain operations are highly dependent on the stability and execution efficiency of the underlying architecture, posing certain technical challenges and scalability risks.

## 2. Detailed Explanation of Projects to Focus on This Week

2.1. Detailed Explanation of Base's Investment in Giza, a Trustless Protocol Enabling AI Developers to Generate Zero-Knowledge Proofs

Introduction

Giza is developing a trustless protocol for decentralized machine learning inference computation, providing security for the open economy of open-source AI. This protocol enables AI developers to generate zero-knowledge proofs (ZKPs), achieving transparency and credibility when deploying verifiable machine learning models.

Giza has built infrastructure that supports truly autonomous DeFi agents. It provides key components for agents to execute tasks in a decentralized manner, respond to user intentions in a non-custodial way, and operate freely across multiple protocols while maintaining strong trust assurances.

By popularizing access to advanced market intelligence, Giza breaks down barriers, allowing all participants to enjoy algorithm-level precision capabilities that were previously only available to top players, thus achieving fair competition.

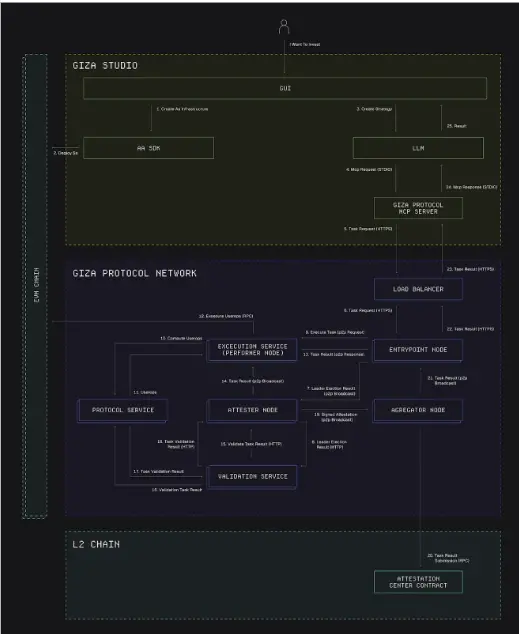

Technical Architecture Analysis

There is an infrastructure gap between the potential of agents and their actual deployment, which requires a specifically built solution to address the unique challenges in automated financial operations. Existing blockchain infrastructure, while strong in transaction execution, lacks the specialized capabilities needed to support secure, non-custodial agent operations and faces inherent scalability limitations. Meanwhile, centralized automation solutions, while attempting to address performance bottlenecks, compromise on security and user sovereignty, introducing unacceptable trust assumptions.

The Giza protocol bridges this gap with a comprehensive architecture designed specifically for autonomous DeFi agents. The protocol establishes secure operational boundaries for agents while supporting seamless interaction with various financial protocols. By combining smart account infrastructure, a cryptoeconomic security execution mechanism based on EigenLayer, and standardized, semantically rich protocol interfaces, Giza creates a secure and flexible operating environment. This scalable execution model supports millions of agent operations without sacrificing the security guarantees required for decentralized finance.

The underlying Giza protocol operates through three key architectural components, ensuring that agents can operate securely and autonomously:

- Semantic Abstraction Layer: Transforms complex protocol interactions into standardized operations, enabling agents to understand and execute financial strategies across multiple protocols.

- Decentralized Execution Layer: Provides distributed computing with cryptoeconomic security guarantees through the EigenLayer AVS framework, requiring operators to stake GIZA tokens to participate in protocol operations.

- Agent Authorization Layer: Provides a non-custodial security mechanism through smart accounts and session keys, allowing users to grant agents specific permissions without relinquishing control over their assets.

This system provides DeFi agents with an infrastructure that balances security, flexibility, and scalability, making decentralized automated financial systems truly possible.

- Semantic Abstraction Layer: The Bridge Connecting AI and Blockchain

The semantic abstraction layer of the Giza protocol provides a bidirectional communication framework between AI systems and blockchain protocols. This layer implements the "Model Context Protocol (MCP)" specification, enabling AI agents to interact with decentralized finance protocols using natural financial concepts while retaining the security guarantees of the underlying blockchain infrastructure.

The semantic abstraction layer consists of three interrelated technical components that together create a comprehensive framework for AI and blockchain interaction:

- MCP Server Implementation

The foundation of the semantic abstraction layer is the dedicated implementation of the Model Context Protocol (MCP), which presents protocol services in an AI-native construct:

- Resources: Exposes protocol states, market conditions, and historical data in a resource format compliant with MCP standards, accompanied by rich semantic context;

- Tools: Represents protocol operations as tools with clearly defined input/output interfaces and semantic descriptions;

- Execution Flow: The request processing flow is validated based on service definitions and converted into a protocol-compatible format.

The MCP server operates as a client component via STDIO, integrated into the MCP host, ensuring the separation between core protocol functionality and client-facing interfaces. This technical design allows for the development of more adapters without altering the protocol itself.

- Protocol Abstraction Framework

The middle layer implements adapters tailored to specific protocols, unifying interaction patterns among different DeFi protocols:

- Operation Mapping: Converts specific protocol interfaces into structurally unified standardized operations;

- State Transformation: Transforms raw protocol states into semantically meaningful, context-rich data formats;

- Safety Constraints: Sets protocol-aware boundary conditions based on protocol usage rates, liquidity depth, and volatility metrics;

- Execution Planning: Develops optimal execution paths based on gas costs, slippage predictions, and protocol-specific factors.

- Protocol Service Registry

The protocol service registry maintains the authoritative source of protocol service definitions, supporting secure service discovery and execution:

- Service Definition Storage: Implements versioned storage of service descriptions compliant with MCP standards, accompanied by semantic context for AI interpretation;

- Version Management: Tracks multiple versions of each service and maintains a clear dependency graph and compatibility matrix.

The semantic abstraction layer establishes a bidirectional data processing pipeline that transforms data and operations between the agent system and blockchain protocols:

Operation Execution Flow

- Request Processing: The AI system submits requests through the MCP server, which validates based on service definitions and converts requests into protocol-compatible formats.

- Protocol Interaction: Validated operations interact with corresponding protocol adapters through the Decentralized Execution Layer, including service calls, transaction execution, task execution validation, and session key permission validation.

- Result Transformation: Execution results are converted back into semantically rich formats for AI systems to understand and reason.

This bidirectional processing pipeline creates a secure feedback loop, allowing AI systems to understand protocol states using natural financial concepts and execute precise operations within strict security boundaries.

- Decentralized Execution Layer

While agent authorization provides a secure boundary for autonomous operations, agents need robust infrastructure support to execute their strategies at scale and stability. The decentralized execution layer is designed to address this core challenge, meeting three key design requirements:

- Decentralized Computing: Eliminates single points of failure through a distributed node architecture;

- Cryptoeconomic Security: Establishes quantifiable costs for malicious behavior through token staking mechanisms;

- Scalability Performance Assurance: Maintains efficient execution performance even as the number of protocols and on-chain applications increases.

If these requirements are not met, agents will face irreconcilable trade-offs between security, performance, and censorship resistance. The execution layer successfully overcomes these limitations through a network architecture built specifically for this purpose.

Core Architecture

The execution layer forms the operational core of the Giza protocol, creating a decentralized node network to coordinate the execution of protocol services. This architecture utilizes the Othentic technology stack to implement EigenLayer's Active Verification Service (AVS) framework, achieving secure and minimal trust computing off-chain while maintaining trustworthiness through strict security boundaries and cryptoeconomic guarantees.

Through this design, Giza overcomes the inherent scalability limitations of on-chain execution while retaining the security attributes required for financial operations.

The network consists of four main types of nodes that work together in coordination:

- Entrypoint Nodes are responsible for coordinating task assignments, executing leader elections for incoming operations, and managing network communication through a secure peer-to-peer protocol layer to ensure tamper-proof message propagation.

- Performer Nodes execute service calls to the corresponding registered services under the direct instruction of entrypoint nodes, executing operations when they are selected as leaders for the task. After executing service calls, the resulting user operations are submitted on-chain. Subsequently, task proofs are generated and broadcasted to attester nodes for verification.

- Attester Nodes are responsible for verifying execution results, ensuring that tasks meet protocol requirements through strict checks using predefined verification algorithms for each service type.

Aggregator Nodes are responsible for establishing consensus, processing verification results from multiple attester nodes, and achieving efficient final result verification using BLS signatures.

This division of responsibilities creates natural security boundaries, and combined with session key strategies, makes malicious behavior by operators unprofitable and subject to penalties. The architecture employs task routing and verification mechanisms, with each node maintaining a local view of the current state while participating in a global consensus mechanism.

The entire system is based on EigenLayer's Active Verification Service (AVS) framework, integrating the Othentic technology stack that provides production-grade customizable AVS contracts as well as implementations for aggregator and attester nodes for network guidance. This integration bridges the gap between off-chain execution efficiency and on-chain security guarantees, eliminating single points of failure while maintaining the performance required for complex financial operations.

Security and Economic Mechanism The security of the Giza execution layer relies on a cryptoeconomic model that creates direct economic incentives for correct operations while imposing substantial penalties for malicious behavior. Through EigenLayer's re-staking mechanism and native staking, the protocol achieves quantifiable security guarantees that scale with network adoption.

Network operators must stake GIZA tokens as collateral for participation in verification, establishing the basic utility of the tokens while setting actual costs for attack behavior. The system imposes slashing penalties for misconduct while distributing protocol fees to reliable operators, forming an economic cycle: the more usage, the more rewards participants maintaining the infrastructure receive. This approach leverages EigenLayer's unique staking model to provide isolation guarantees, protecting the execution layer from external risks.

This economic framework, combined with protective measures defined in session keys, ensures that rational operators always act in the best interest of the network, as the rewards for correct operations far outweigh the potential gains from malicious behavior. The result is a self-reinforcing security model that becomes increasingly resilient as protocol adoption grows.

Execution Flow

Agent operations flow through the network in a streamlined, efficient, and secure process:

- Tasks first enter through a protected load balancer to prevent potential attack vectors

- A leader election mechanism determines the node responsible for executing the task

- Service calls execute the corresponding protocol services

- Attester nodes verify the results according to protocol requirements

- Aggregator nodes establish consensus from multiple verification results

- Final results are confirmed on-chain through the "Attestation Center"

For operations across multiple chains, dedicated message processors maintain state consistency between execution environments, enabling seamless cross-chain strategies without sacrificing security guarantees.

Thus, the Decentralized Execution Layer constitutes the core infrastructure supporting the Giza permissionless agent ecosystem, creating a secure and efficient environment for autonomous strategies to operate freely.

- Agent Authorization Layer

The foundation of the Giza architecture is its agent authorization system, built on smart account infrastructure, allowing agents to execute operations without custody through fine-grained permission management:

- Users retain full control over their assets while granting agents specific operational permissions through session keys.

- Programmable authorization policies create verifiable security boundaries for automated operations.

- Modular smart accounts form the basis of this system, separating asset custody from transaction authorization.

This implementation uses an ERC-7579 compatible smart contract wallet, supporting modular expansion. This standard allows for the deployment of dedicated modules to define programmable operational boundaries and verification mechanisms, thereby extending the functionality of smart accounts.

This approach creates verifiable security boundaries for automated operations without sacrificing user sovereignty. Users always retain control over their assets but can delegate specific execution permissions to agents through a carefully designed authorization framework.

Summary

Giza's advantage lies in its successful bridging of the semantic gap between AI and blockchain through the semantic abstraction layer and decentralized execution architecture, allowing AI to operate DeFi protocols in a "financial concept understanding" manner securely. Its modular design (such as ERC-7579-based smart accounts), EigenLayer-based execution network, and fine-grained authorization mechanisms collectively build a foundation for agent operations that is highly secure, scalable, and performant. However, Giza's disadvantages include high system complexity and reliance on multiple tech stacks (such as AVS, Othentic, MCP, etc.), which may increase deployment and maintenance barriers, as well as higher learning costs for developers and users.

# III. Industry Data Analysis

1. Overall Market Performance

1.1 Spot BTC & ETH ETF

ETF Market Dynamics:

- Bitcoin ETF Continues to Attract Capital: BlackRock's iShares Bitcoin Trust has attracted $6.5 billion in inflows over the past month, becoming the fifth-largest ETF of the year.

- VanEck Launches Onchain Economy ETF: VanEck launched the Onchain Economy ETF (ticker: $NODE) on May 14, investing in 30 to 60 companies related to the blockchain economy, including exchanges, miners, and businesses holding crypto assets.

- Asia's First Ethereum Staking ETF Set to Launch: Huaxia Fund plans to launch Asia's first Ethereum staking ETF in Hong Kong on May 15, allowing investors to earn rewards without directly participating in staking.

ETF Application Progress:

- XRP Spot ETF Applications Enter Review Stage: XRP spot ETF applications submitted by institutions such as Bitwise, Grayscale, 21Shares, WisdomTree, and Canary Capital have entered the SEC's review stage, with preliminary responses expected around May 19.

- Solana Spot ETF Applications Progressing Smoothly: Solana spot ETF applications submitted by institutions such as VanEck, Grayscale, and Bitwise have entered the public comment period, with the SEC expected to provide preliminary responses in mid-May.

- Optimistic Outlook for Litecoin ETF Approval: The Litecoin ETF application submitted by Canary Funds is expected to receive a ruling from the SEC on May 5, with analysts estimating a 90% approval probability.

As of November 1 (Eastern Time), the total net outflow for Ethereum spot ETFs was $10.9256 million.

1.2. Spot BTC vs ETH Price Trends

Analysis

BTC is currently maintaining an upward trend on the 4H level, meaning the upward pattern has not been broken. As shown in the chart, the three phases of adjustment are very orderly and healthy (after breaking through the upper boundary of the consolidation zone, a new high was established and stabilized above the previous high). Therefore, as long as it does not fall below $106,800, the bullish outlook continues, but the current market should be considered as a three-phase consolidation after breaking through to $111,900.

For users, only a valid drop below $106,800 would warrant a temporary bearish outlook, with the first bearish point of focus being around the support near $100,600.

Analysis

ETH is strictly speaking just entering the second phase of a wide consolidation trend, oscillating around the $2,320 to $2,730 range. Therefore, the current trend can be viewed as a mid-term continuation of the upward movement, remaining bullish until it falls below $2,320. The upper resistance can be directly focused on the $2,730 line, as well as the second and third resistance lines at $2,850 and even $3,040, respectively, which correspond to the upper and lower boundaries of the consolidation zone during the decline at the beginning of the year, providing effective resistance.

2. Public Chain Data

2.1. BTC Layer 2 Summary

Analysis

Major Technical Developments

- Stacks (STX)

- sBTC Deposit Cap Increased: Stacks announced the completion of the Cap-2 expansion for sBTC, raising the deposit cap by 2,000 BTC, bringing the total capacity to 3,000 BTC (approximately $250 million) to enhance liquidity and support the growing demand for Bitcoin-backed DeFi applications.

- Nakamoto Upgrade: Introduced sBTC, a decentralized Bitcoin-pegged asset that allows users to seamlessly transfer BTC to the Stacks network for DeFi interactions.

- Bitlayer

- BitVM Integration: Bitlayer launched a BitVM-based bridging feature, allowing users to transfer assets trustlessly between multiple networks, enhancing Bitcoin's flexibility in DeFi applications.

- Mezo

- HODL Consensus Mechanism: Mezo introduced the Proof of HODL consensus mechanism, rewarding users for locking BTC to secure the network and earn returns. Its TVL reached $230 million by early 2025.

- Merlin Chain

- ZK-Rollup Technology: Merlin Chain utilizes ZK-Rollup technology to improve Bitcoin's scalability and efficiency, with the mainnet expected to launch soon.

2.2. EVM & Non-EVM Layer 1 Summary

Analysis

Key Points for EVM-Compatible Layer 1

- Ethereum Scalability Plans

- RISC-V Architecture Proposal: Vitalik Buterin proposed replacing the Ethereum Virtual Machine (EVM) with the RISC-V architecture to enhance scalability and operational efficiency. This move aims to simplify the execution layer while improving zero-knowledge proof performance.

- EIP-9698 Proposal: Plans to increase Ethereum's gas limit by 100 times over the next four years, aiming for a processing capacity of approximately 2,000 transactions per second by 2029.

- Injective Native EVM Integration

- Injective announced that it will integrate native EVM support into its Layer 1 blockchain, allowing Ethereum ecosystem DApps to run seamlessly on the Injective network.

- Kadena Launches Chainweb EVM

- Kadena launched "Chainweb EVM," adding 20 EVM-compatible chains to its multi-chain architecture, providing a low-fee and highly scalable alternative to address Ethereum's scalability challenges.

Non-EVM Layer 1 Dynamics

- Sui Emphasizes User Experience Growth

- Sui is a user-centric Layer 1 public chain that continues to expand in low latency, stable fees, and an "object-centric" data model. Its parallel execution architecture supports high throughput, representing rapid technical growth.

- TON Ecosystem Expansion

- The Open Network (TON) continues to expand its ecosystem, with daily on-chain transaction counts reaching 1.2 million and total locked value exceeding $350 million. Toncoin has also been integrated into Telegram's peer-to-peer transfer system, seamlessly bringing blockchain functionality into the social platform.

2.3. EVM Layer 2 Summary

Analysis

Technical Progress and Network Upgrades

- Pectra Upgrade Drives Ethereum Expansion

On May 7, 2025, Ethereum successfully implemented the Pectra hard fork, one of the most significant upgrades since the merge in 2022. Pectra introduced higher gas limits and more flexible staking mechanisms, significantly enhancing the network's scalability and interoperability with L2 chains. Following the upgrade, ETH price surged by 25% within 24 hours, reaching $2,400, marking the largest single-day gain in four years.

- Superchain Expands Its Market Share

The Superchain alliance, led by Optimism, currently accounts for 60% of Ethereum L2 transaction volume, expected to reach 80% by the end of the year. This alliance includes major participants such as Coinbase, Kraken, Sony, Uniswap, and Sam Altman's World. Superchain's daily transaction volume has reached 11.5 million, with total locked value exceeding $4 billion.

# IV. Macroeconomic Data Review and Key Data Release Nodes for Next Week

As the U.S. Treasury's 20-year bond auction subscription ratio hit a year-to-date low, the secondary market quickly sparked a wave of dollar asset sell-offs. This phenomenon reflects deep concerns in the market regarding the health of U.S. finances. According to a recent report from Goldman Sachs, the sustainability of U.S. debt is facing severe challenges due to the dual pressures of rigid growth in fiscal spending and declining tax revenue expectations. Meanwhile, frequent adjustments to tariff policies and strategic adjustments in the asset allocation structure of global institutional investors will continue to weaken the attractiveness of dollar assets.

Important macroeconomic data nodes for this week (May 26 - May 30) include:

May 29: Initial jobless claims in the U.S. for the week ending May 24

May 30: U.S. April Core PCE Price Index Year-on-Year; U.S. May Michigan Consumer Sentiment Index Final Value

# V. Regulatory Policies

U.S.: Promoting Stablecoin Legislation and Cryptocurrency Reserves

Progress of the GENIUS Act: The U.S. Senate has passed the GENIUS Act aimed at regulating stablecoins, marking an important step in U.S. cryptocurrency legislation. The act aims to provide a clear regulatory framework for the stablecoin market, enhancing financial stability and consumer protection.

Bitcoin Price Volatility: Influenced by President Trump's proposed new tariff policies, Bitcoin prices fell back after a brief surge. Previously, the market had optimistic expectations for improvements in cryptocurrency regulation, driving Bitcoin prices up.

Brazil: Concerns Over Capital Flow Volatility Triggered by Stablecoins

- Central Bank Warning: Renato Gomes, Deputy Governor of the Central Bank of Brazil, pointed out that the widespread use of dollar-backed stablecoins in international remittances has led to increased volatility in capital flows. Approximately 90% of crypto asset flows are related to stablecoins, bypassing traditional regulatory channels and posing challenges for financial regulation.

EU: Plans to Ban Anonymous Cryptocurrencies and Accounts

- New Anti-Money Laundering Regulations: The EU has approved a new anti-money laundering regulation that plans to ban the use of anonymous cryptocurrencies (such as Monero and Zcash) and unverified crypto accounts starting in 2027. This measure aims to enhance the transparency of financial transactions and combat illegal activities.

India: Calls for Leadership in Global Cryptocurrency Regulation

- Policy Initiatives: As major jurisdictions such as the U.S., EU, Singapore, and Dubai advance the integration of crypto assets, India is being urged to take proactive measures to play a leadership role in global cryptocurrency regulation to ensure a significant position in the digital economy.

Nigeria: Classifying Bitcoin as Securities

- New Investment Bill: Nigerian President Bola Ahmed Tinubu has signed the 2025 Investment and Securities Bill, officially classifying Bitcoin and other digital assets as securities. This bill provides Nigeria with a formal regulatory framework for cryptocurrencies, aiming to enhance investor protection, promote transparency, and align with international standards.