DappRadar: Why Can NFTs Avoid the Cryptocurrency Crash?

Original Title: Why are NFTs Sidestepping the Crypto Crash?

Original Author: Pedro Herrera

Translation: Deep Tide TechFlow

In recent weeks, a series of macroeconomic events have shaken the market, reminding everyone of the potential risks and pervasive volatility in the industry. The issues surrounding BTC mining in Kazakhstan have caused a stir. With new COVID outbreaks, unease over potential interest rate hikes by the Federal Reserve, and the latest political issues in Ukraine, a hostile environment has dragged down capital markets.

The correlation between cryptocurrencies and traditional markets has widely felt this impact, with BTC and Ethereum's ETH losing half their value since hitting all-time highs in November. The same goes for BNB, ADA, SOL, AVAX, SAND, MANA, GALA, and several other historically well-performing cryptocurrencies. During this period, the total market capitalization of cryptocurrencies shrank from $2.9 trillion to $1.6 trillion.

There is no doubt that the crypto market is currently in a challenging period. Market sentiment indicates fear. However, indicators related to the performance of specific blockchain verticals, such as NFTs, may suggest otherwise.

Understanding NFT Macroeconomics

While a series of events have hindered the crypto market, several factors have positively impacted the outlook for NFTs at the macroeconomic level.

First, the involvement of celebrities and major brands in the NFT space seems to be increasing. Stars with extensive social influence, like Neymar (with over 200 million followers on Twitter and Instagram) and Kevin Hart (with over 192 million followers on Twitter and Instagram), have publicly announced their recent joinings of the Bored Ape Yacht Club (BAYC), one of the premier NFT projects.

To amplify the impact, Twitter, perhaps the most popular social media platform among cryptocurrency and NFT enthusiasts, enabled its first web3 feature within the social platform just days ago. Social media platforms Instagram and Facebook are expected to follow suit. Meanwhile, retail giant Walmart has applied for several trademarks related to NFTs.

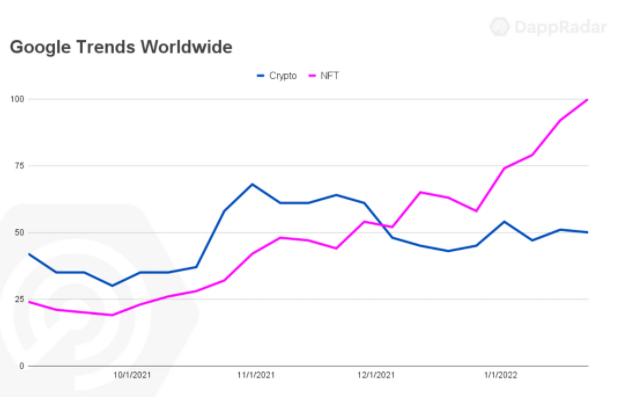

The popularity of these assets is higher than ever. The search volume for "NFT" has surpassed that of "crypto" for the first time. Additionally, the growing interest from Asia is promising. The market, previously dominated by North American and European users, is now welcoming Asian NFT audiences.

On-chain NFT Metrics Tell a Bullish Story

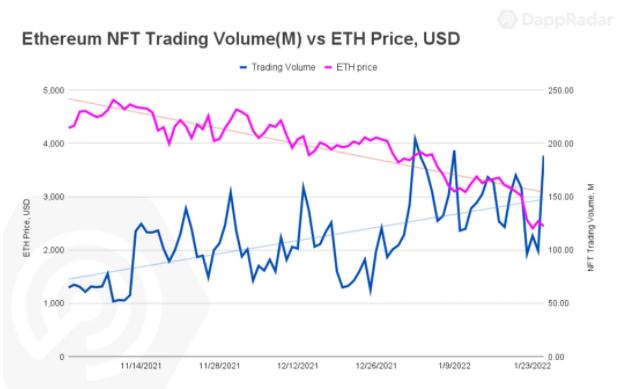

NFTs have single-handedly generated some of the most impressive metrics we saw in the blockchain industry last year. In 2021 alone, these assets generated a total of $25 billion, which is 18,414% higher than the total of the previous four years.

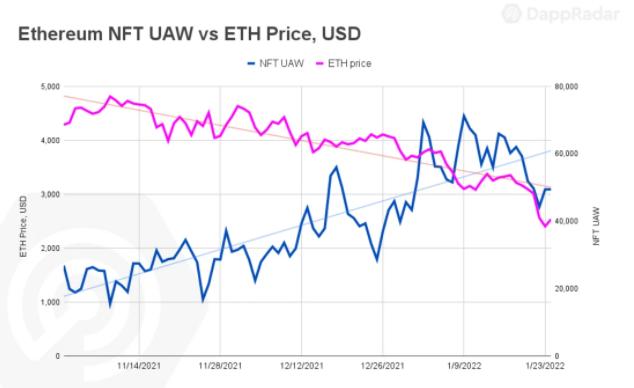

While cryptocurrencies are struggling, NFTs seem to be thriving. Narrowing the analysis to Ethereum, which accounted for 75% of last year's trading volume, we see positive trends. The number of NFT sales and users on this blockchain has increased, leading to a rise in unique active wallets (UAW) connecting to NFT Dapps (collectibles and marketplaces).

Since December 2021, an average of over 53,300 UAW have connected to Ethereum NFT Dapps daily, which is 43% higher than the numbers from the third quarter of last year.

In addition to positive macroeconomic events, the core role of NFTs in profitability and the metaverse narrative also contributes to the bullish on-chain metrics, as the search for decentralized and interoperable metaverses benefits NFTs.

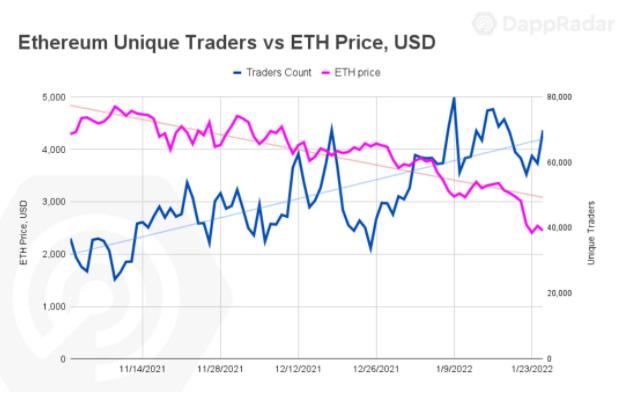

Moreover, as the value of underlying assets supporting NFTs declines, individuals may view negative cryptocurrency trends as buying opportunities. Although January has not yet ended, the number of unique traders is higher than ever.

A record of 1.6 million independent traders has driven Ethereum NFTs to generate over $3.7 billion in sales, excluding sales on LooksRare, and is expected to break the record of $4.5 billion set in August 2021.

This set of on-chain metrics tells the story of the adoption of a new asset class and positive market sentiment. Nevertheless, another metric makes the appreciation of NFTs even more apparent: floor price.

Floor Price Analysis

The floor price is one of the most important indicators for assessing NFT collections, especially from an investor's perspective. The floor price of an NFT collection is the lowest asking price, representing the minimum entry threshold.

Recent analyses of the floor prices of some significant Ethereum collectibles indicate that NFTs behave similarly to assets that store value. One class of assets has outperformed major cryptocurrencies and even traditional assets like gold or the S&P 500 index.

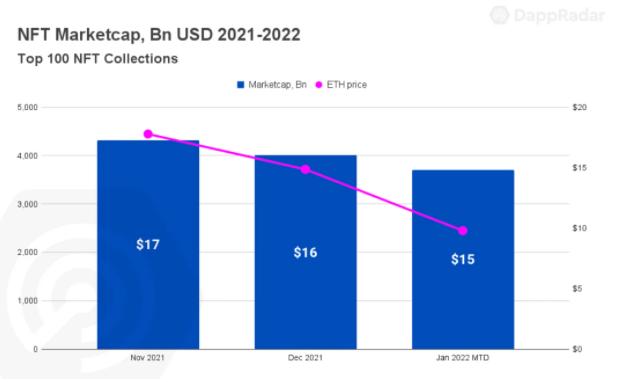

The overall value of the NFT space is increasing, with the floor prices (prices) of the top 100 NFT collections indicating that the value of NFTs has decreased by $2.4 billion since November, currently estimated at $14.8 billion. Despite ETH being hit by 50%, the value of the most traded collectibles has been affected by only 15%, indicating that this category has resisted the crash.

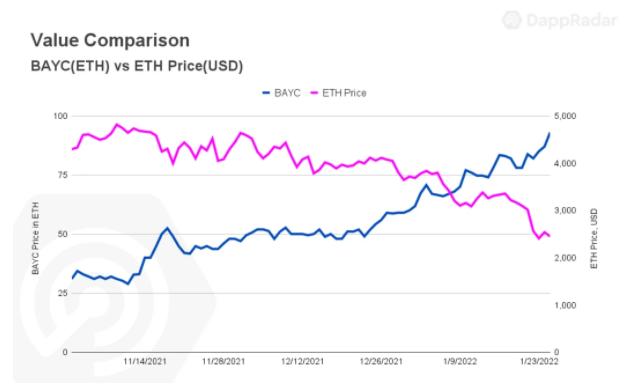

One of the NFT collections that has had a direct positive impact on the trend of NFTs is BAYC. In early November, when BTC and ETH peaked, the floor price of this collection fluctuated around 30 ETH. A week later, despite a 15% drop in ETH's price, BAYC's floor price surged by over 60%, exceeding 50 ETH.

By the end of the year, the cheapest BAYC could be bought for 60 ETH, now exceeding 90 ETH, meaning that to purchase the most affordable bored ape, one would need to spend over $225,000 at the current ETH price.

While the most important cryptocurrencies have lost about half their value over the past two months, since November 10, BAYC has increased by 207% in ETH terms. But most importantly, in terms of actual measured value, the floor price of this collection has risen by 14% in USD. Holding BAYC from November 10 to February 2 would represent a 14% capital gain, while holding any related cryptocurrency would result in a net loss of about 50%. It can be said that BAYC has become a value-preserving asset class.

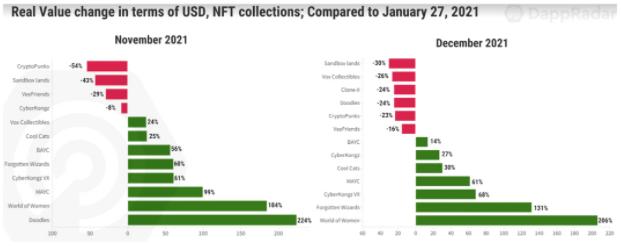

BAYC is not the only avatar series that has increased its value. Since November 10, another Ethereum avatar series, World of Women, has increased by 383% in ETH terms, with actual value rising by 185% during the same period. Since last December, Cyber Kongz and its voxel (VX) version have seen their floor prices' actual values increase by 27% and 68%, respectively. The same goes for Doodles, whose floor price has risen by 224% since November.

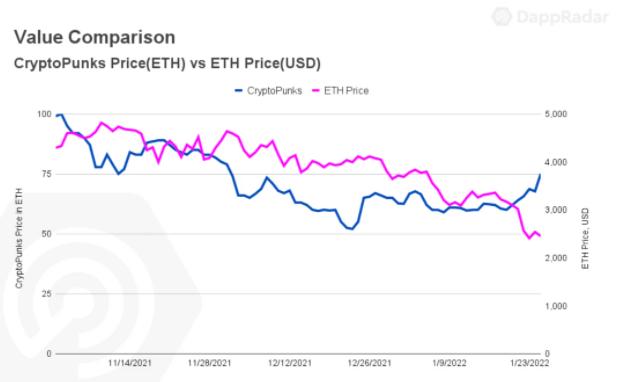

For CryptoPunks, a historically significant NFT collection, the analysis is more complicated. Although this collection has not performed as well as its peers, Punks still outperform several crypto-based assets. The floor price of Cryptopunks reached 100 ETH on November 2, dropping to 83 ETH a week later, on the same day BTC and ETH hit all-time highs.

Since that day, the floor price has decreased by 9.6% in ETH terms. The actual value has only shrunk from $254,000 to $229,000. Nevertheless, it can be confidently stated that CryptoPunks are assets that store value.

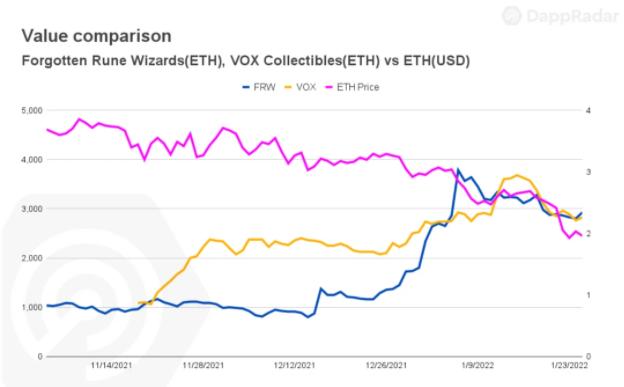

The value of avatars has significantly increased, but NFTs related to the virtual world and gaming have performed exceptionally well. Forgotten Rune Wizards is one such case, with its ETH floor price rising by 210% since November 10, and its actual value up by 132% compared to December. Similarly, since November, the floor price of Gala Games VOX NFTs has increased by 145% in ETH terms.

NFTs representing the virtual world have gained value from the metaverse hype cycle. For example, the floor prices of virtual land in The Sandbox and Decentraland have remained at levels consistent with Facebook's rebranding announcement, although their actual dollar values have decreased.

Meanwhile, despite the negative crypto trends, the floor price of virtual apartments within Worldwide Webb has increased by 242% in ETH terms since November, while the ETH price of Cryptovoxels plots is 17% higher than in November.

Analyzing the floor prices of collectibles can provide insights into the stability of the project from an investment perspective. Recent analyses confirm that some NFTs have resisted the negative trends of the overall market. But why does this happen? Why have NFTs proven capable of resisting fluctuations in cryptocurrency prices?

The answer to this question may not be straightforward. A combination of certain factors has made some NFTs attractive to rational investors.

Cultural Value and Adoption

There is a viewpoint that certain NFTs should be regarded as cultural works rather than digital assets. Like some artworks, certain NFTs may be seen as genuine investment opportunities by some individuals. Beeple's "Everydays: The First 5000 Days" introduced non-fungible tokens to new audiences through a $69 million auction at Christie's. Generative art collectibles like Fidenza, Ringers, or Autoglyphs are emerging as new forms of expression, valued at least in the thousands of dollars.

Similarly, BAYC and CryptoPunks have reached mainstream status. On August 23, VISA announced the acquisition of CryptoPunk #7610 for $150,000, solidifying Punks' status as a value-preserving asset. Additionally, 101 pieces from the BAYC collection were auctioned at Sotheby's for $24 million.

Currently, only a few collectibles have reached this status. Nevertheless, potential applications in music, ticketing, sports, and fashion are still pressing. In summary, NFTs encapsulate profound human emotions. Only time will tell whether certain NFTs will have a cultural impact that transcends generations.

Utility

One of the important aspects shared by successful NFT projects is the rewards granted to their community members: the additional value or utility inherited by holding any of these projects' NFTs.

For example, after CryptoPunks owners received free Meebits, Larva Labs promoted a utility blueprint that increased the actual capital gains of the initial investment. Projects like Cool Cats (with an Ethereum floor price increase of 150% since November 10), The Meta Key (370%), Doodles, or BAYC itself also follow this trend.

Utility can also be found in revenue-generating NFTs. Projects that distribute their native utility tokens daily, such as CyberKongz and its BANANA token. Holders of Genesis Kongz receive ten BANANA tokens daily, each valued at $24. Similar situations are found in SupDucks (35%) and VOLT token, as well as Cool Cats and their future MILK token.

Additionally, NFTs are merging with other categories like DeFi and gaming. A clear indication of the DeFi and NFT mix is platforms like NFTfi, which allow users to use NFTs as collateral. The fractionalization of NFTs, or projects like Pixel Vault, where its MetaHero Universe (57%) NFTs can be staked to farm POW tokens.

Of course, there are fully integrated gaming elements. Despite significant price drops in ETH, SOL, GALA, and AURY, Mirandus NFTs and Aurory Villagers have maintained their floor prices. We have previously observed the evaluation of Forgotten Rune Wizards, another NFT collection with gaming mechanics. While maintaining the floor prices of countless gaming alternatives is challenging, it can be confidently stated that the demand for blockchain gaming is rising, adding value to these types of NFTs.

Celebrity and Traditional Player Involvement

Another relevant trend positively impacting NFTs is the involvement of celebrities and well-known brands. With sports stars like NFL's Dez Bryant, NBA's Stephen Curry, Post Malone, Snoop Dogg, and Eminem joining the elite club, BAYC has begun to gain momentum.

After welcoming Jimmy Fallon, Paris Hilton, Neymar, and Kevin Hart, the BAYC community has become even more unique. The positive influence of celebrities is reflected in World of Women, where the floor price increased by 250% within hours of Eva Longoria announcing her purchase. Doodles is another project benefiting from well-known NFT figures like Pranksy, Loopify, and Steve Aoki.

Similarly, there is also the influence of large traditional players. Brands like Adidas, Coca-Cola, Pepsi, Budweiser, and several others have either launched their collectibles or collaborated with significant NFT teams to establish a presence in this space. Fashion giants like Gucci, Burberry, and others leveraging metaverse hype are also part of this trend.

Teams Becoming Brands

The teams behind NFT collections bear a high degree of responsibility for the fate of their projects. Some teams have discovered that surrounding themselves with talented artists and experienced developers is a key to success. Once a team succeeds, they can become a true brand in the field.

RTFKT is one such case, the team behind Clone-X, responsible for developing unique NFT works in collaboration with Jeff Staple and Fewocious. This digital design and fashion brand has consistently met expectations and adeptly handled any challenges. RTFKT has become one of the most influential brands in the Web3 space and was acquired by Nike last December, with the acquisition amount undisclosed.

Scarcity Factors

Finally, there is the factor of scarcity, as it directly relates to human psychology, the anxiety of missing out on something, also known as FOMO, which is associated with scarce assets and investment markets, and NFTs combine both.

Most collectibles launch limited quantities of NFTs that will remain unchanged forever. Whether it's 10,000 or 20,000, the limited supply of specific versions will always remain constant, which is the allure of blockchain.

The result is that NFTs are gradually becoming their own asset class. While there remains a correlation with cryptocurrencies due to the nature of this technology, NFTs are slowly creating an economy for themselves, with macro events and market factors having positive or negative impacts on the space.

The sum of previously adjusted factors such as cultural value, additional utility, celebrity involvement, brand recognition, and the scarcity of these assets drives the latest wave of NFT adoption.

The best part is that what we have seen is just the tip of the iceberg. Projects like Larva Labs, BAYC, Cool Cats, RTFKT, Cyber Kongz, and Doodles will continue to be highly involved in the metaverse narrative. With the launch of products that reduce customer friction, the friction and resistance for non-crypto users will decrease, such as the anticipated Coinbase marketplace that will integrate Mastercard payments. There are many potential use cases that will embed NFTs into traditional business models.

It remains unclear whether the current bearish trend in the cryptocurrency market will last for two weeks or two years. Nevertheless, NFTs continue to retain and increase their actual value under current conditions, proving themselves as digital assets capable of storing value.