NFT New Narrative: The Turning Point of Web3 Brand Economy

Source: Decentralise

Original Author: Joel

Translation: Katie, Odaily Planet Daily

Editor’s Note from Planet Daily: In the world of web2, we have already seen new models of brand economy: from increasing ad impressions by feeding users the content they are addicted to, to selling products through trust models recommended by KOLs. However, there are many issues: customer acquisition costs are rising, data is inaccurate, and it is difficult to effectively incentivize core consumers, etc. This article discusses the potential of NFTs to change the status quo. NFTs will not just be speculative products but will become tools for all brands to build real communities, effectively reach consumers through on-chain data, and enhance core consumer loyalty in the future, which is quite interesting.

With the advent of the internet, we have shifted from a transaction economy to an attention economy. The development of the attention economy firmly captures the public's psyche and massively alters cultural narratives.

NFTs represent the financial productization of attention. As more and more brands release NFTs, this could change business models in the next decade, potentially reducing brand costs to an infinite degree.

However, we are still in the experimental stage of NFTs, with brands actively conducting NFT experiments. Adidas is creating hoodies for members of the Bored Ape Yacht Club, FTX is helping Coachella design NFT lifetime festival tickets, and POAP is assisting event organizers in creating attendance certificates using NFTs. The possibilities of NFTs are endless.

To predict where NFTs will go in the future, we first need to understand how business has evolved to this point.

The Predecessor of NFTs

In the early days, human economies were resource-intensive, and ownership was not valued. Over time, it became a norm for people to claim ownership of the work they put in. Think about how companies evolved from paying salaries to distributing dividends, and now to employee stock options.

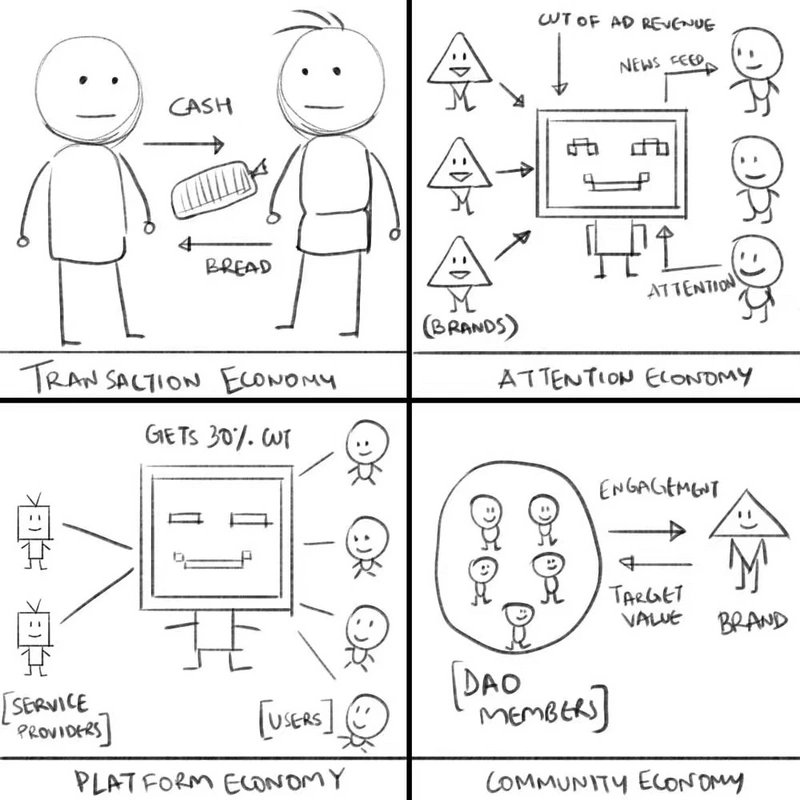

After analyzing resource expenditure and ownership, we summarize the four stages of economic model evolution:

Transaction Economy: Currency is exchanged for goods or services. Most of human history has been based on a transaction economy. Think of bartering, the Silk Road, or the ultimate form of colonization. The transaction economy is the pillar of all the above. Before technologies like ships and trade routes emerged, the focus was on local markets, continuing until the invention of the printing press.

Attention Economy: The printing press significantly reduced the cost of replicating information. However, it wasn't until the 18th century that the book market emerged and literacy rates soared. Newspapers were the pioneers of today's platforms. The attention economy refers to selling "attention" to third parties instead of goods. Just last year, YouTube earned $29 billion through advertising influence. They have almost no production costs, and customer stickiness is very high. You can scale the attention economy to a national level like Facebook without worrying about costs rising proportionally.

Platform Economy: The platform economy connects sellers and service providers with potential buyers. Amazon thus generated nearly $489 billion in revenue. Following the same model, Uber's revenue grew from $100 million in 2013 to $13 billion in 2020. The value of a platform lies in discovering and trusting suppliers on it. Most mobile applications we use daily are platforms. The cost lies in managing suppliers and trusting users with a sufficiently large user base.

Community Economy: The community economy is the evolution of cooperatives. The internet has exposed us to global markets (2010), and smart contracts allow us to trust each other without intermediaries (2020). We have been exploring alternative economic models. This is the significance of DAOs, which connect individual autonomy with previously non-existent economic opportunities.

The community economy is an instance of users managing what they use. These economic models leave evidence of economic interactions on-chain, allowing people to publicly access data about the participants in these economies. The difference between community economy and platform or attention economies is that participants' data is typically not stored on servers owned by corporations. Anyone can query and build upon this data. Examples include Gitcoin, ENS, Covalent, Biconomy, and NFT-based DAOs like LobsterDAO.

Do shareholder-driven companies count as community economies? GameStop might barely fit this definition, but let's return to the topic of NFTs.

The Present of NFTs

Let’s analyze the different quantifications of brand value under various economic models using a chart. The x-axis represents relationships, which refer to the connections between parties in a transaction. The closer the relationship, the harder it is to conduct highly quantifiable and fully negotiated transactions. On the y-axis, we break down economic interactions. It refers to the extent to which the seller determines value before the transaction and how quickly the customer accepts the transaction. Think about Amazon's delivery service; you know what you bought and when it will arrive at your doorstep.

Buyers usually know the value and price of Rolls-Royce or Gucci products; they rarely need to confirm repeatedly because brand trust has been established, and the value proposition is clear. Trust in attention economy platforms is often low. We rarely buy brand products directly from those platforms. Attention economy platforms have been optimized for KOLs because they strike the right balance between personal content and commerce.

Influential (and trusted) individuals sell products directly in a subscription format, with representative examples being Substack (a platform similar to the American version of WeChat public accounts, where messages are received in the form of paid subscription emails) and Patreon (a platform for content creators and artists to crowdfund their works and products). The problem is that the content from these KOLs may be biased, which is why communities are important in modern business.

Communities like Product Hunt (a platform for discovering new products where developers can submit their works, and the site generates daily rankings based on public voting, allowing users to learn about innovative services, interesting applications, and fun hardware) have changed the relationships between participants, transforming strangers who randomly meet on the internet into collaborators driven by a shared vision.

For token and NFT-based communities, price often serves as the adhesive that brings people together, reducing friction in transactions. With minimal information asymmetry, the final price usually appears in public auctions. Web3 project communities have taken this to the extreme. Most teams simply hold a governance committee instead of outsourcing. Individuals interested in tasks can complete and submit them according to community governance rules and receive token payments.

This breaks the typical employment model. Contributors collaborate with multiple teams, and teams can select talent from a larger talent pool. Since rewards are usually paid in the project's tokens, contributors can choose to exchange them for stablecoins or hold the tokens. Holding tokens also gives contributors a sense of belonging to the network, both spiritually and economically, thereby increasing user stickiness.

The Future of NFTs

NFTs take this model to the extreme. Due to the average cost of NFTs being higher than fungible tokens, ordinary retail participants do not have enough idle funds to purchase multiple NFTs and can only go all in or all out. Looking ahead, major brands may use NFTs as a way to stimulate high-end consumer groups.

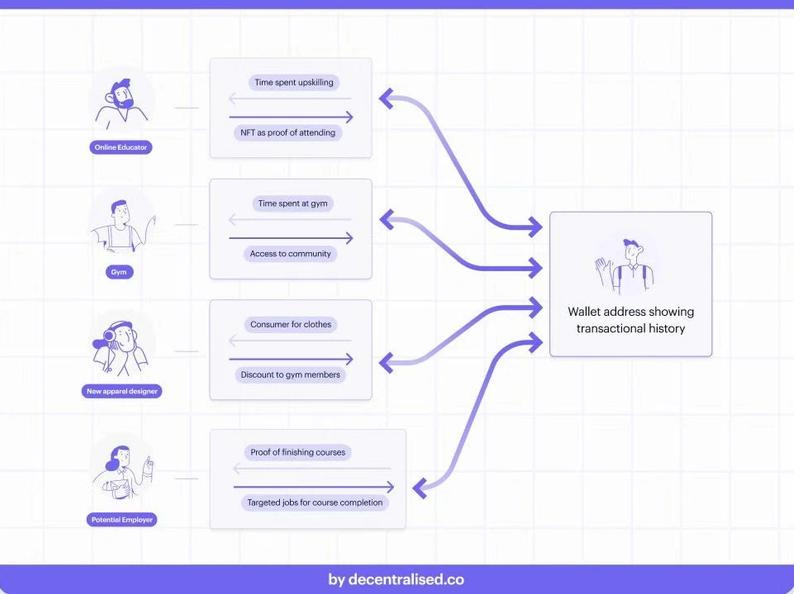

Airdropping NFTs to the 1,000 most active users? Using NFTs to encourage friendly behavior or signal to the most active product users. We can see NFTs as on-chain participation certifications. Because NFTs can unlock new customer privileges. Historically, brands have owned all data related to users, while independent third-party developers have been unable to directly incentivize these users; using NFTs can achieve this.

Multiple business entities can offer unique discounts based on wallet history.

Of course, NFTs are not just for unlocking customer privileges; current membership cards can do that too. What NFTs can achieve in the future is to reach unlicensed community goals in a value-added manner.

Charlie Munger has a famous saying: "Show me the incentive, and I will show you the result."

Web2 platforms keep us addicted to content on screens because their motivation is based on selling ads. The more time you spend staring at interesting videos, the more likely the platform is to show you ads, which is why they are built on variable rewards.

NFTs may become our way to change the dynamics of the internet. Brands can leverage on-chain data to target users, offer them special treatment, and enter communities where they might benefit, rather than slowly pushing users to buy things they may not need. Of course, there are privacy issues here. For example, can someone who attends a specific geographical location in real life be tracked on-chain? This is why solutions like zero-knowledge proofs are becoming increasingly important.

Growth Driven by NFTs

You might think it’s crazy to suggest that we will shift from running our economy based on ads to a user data-driven model. But several factors could contribute to this shift. Hardware or operating system changes since the release of iOS 14 can reduce advertising. In fact, several platforms have already experimented with NFTs.

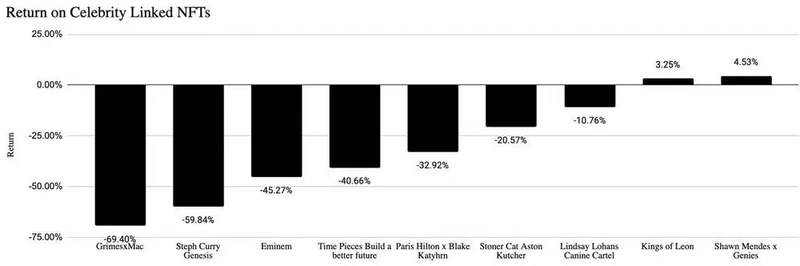

Time Magazine released a series containing over 4,600 NFT collectibles, granting holders access to the magazine. Famous WWE star John Cena posted 500 NFTs to his 16.2 million Instagram followers, but only about 37 people purchased them. Melania Trump attempted to issue NFTs but ended up buying them back herself. Ubisoft, one of my favorite game companies, conducted NFT issuance tests, with sales totaling only $400. Most NFTs related to celebrities have shown a downward trend since their issuance.

I believe that building communities based on NFTs requires a lot of thought about user positioning.

When LooksRare launched, there were 22,000 wallet addresses. Currently, about 18,000 wallets still hold these tokens, with approximately 80% holding LOOKS for over a month. This situation arises because LooksRare's target users are those active trading users on NFT platforms.

Another example is LobsterDAO, whose DAO launch benefited from "providing NFTs in proportion to user activity in community chats." The community has released about 7 original versions of DeFi, using NFTs to verify user identities and rewarding tokens in exchange for performing certain actions, such as staking or adding liquidity. For the team, the gifted tokens are the cost of acquiring users who have previously participated in DeFi-related discussions.

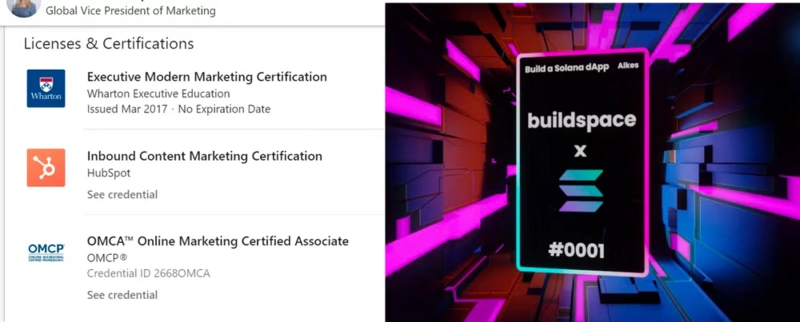

Startups should see that NFTs provide social capital for their key users. The latest update of Twitter Blue allows users to verify their ownership of NFTs. As user preferences evolve, the advertising model of newspapers may face a similar fate. Twitter allows users to display their owned NFTs as profile pictures, effectively turning everyone’s personal identity into a billboard and integrating it with existing social networks.

Startups can soon airdrop NFTs with predefined privileges, such as premium users, contributors, and product ambassadors, effectively sparking interest and curiosity among third-party users. Another approach is education. As learning models shift from universities to digital media, we will see certifications based on non-mandatory learning on-chain becoming increasingly common. If a platform is digital, it can simply access users by checking their on-chain assets. Bankless is another publishing platform that operates as a DAO using on-chain assets.

Here for NFTs, Staying for the Community

Do you remember how I defined NFTs at the beginning of this article as a representation of the economy of your attention? I believe this is the most overlooked aspect of today’s ecosystem. Most NFTs represent some subculture or meme, giving people a sense of belonging, such as mfers. This is the manifestation of brands equating to identity.

Deep down, we are all searching for the same thing: a tribe we belong to, an identity.

Sometimes, users go to great lengths to establish their dominance (social status) within the "tribe," which can require significant financial expenditure. Commercial tools like NFTs make it more efficient to find like-minded individuals and tribes and exchange signals with each other.