BitMEX Founder: What Should Be the Best Design for Stablecoins?

Author: Arthur Hayes, Founder of BitMEX

Compiled by: Biscuit, Chain Catcher

The views expressed herein are solely those of the author and should not be construed as investment advice or recommendations for engaging in investment trading.

We can hardly control why humanity exists in this universe. As a civilization, we expend too much energy trying to bring calm and stagnation to a turbulent Earth. Just adjusting the temperature in our homes and workplaces consumes a significant amount of energy.

Because we instinctively understand that humanity is just a reed swaying in the wind, granting immense power to individuals and institutions. Politicians tell us there is a plan, corporate leaders chart the path for the future, and we hope to achieve success continuously. But reality throws unexpected challenges time and again, and the plans set by leaders often fall short. Yet, what can we do but try again and again?

Just as civil society exhibits composure, the money that powers civilization must also remain stable. Fiat currencies are designed to slowly depreciate over time. When referencing the purchasing power of past fiat currencies, humanity struggles to comprehend the loss of purchasing power over decades or centuries. We are accustomed to believing that today’s dollars, euros, yen, etc., will buy the same amount of energy tomorrow.

The behavior of Bitcoin and the crypto movement it sparked is profoundly tragic. Satoshi Nakamoto is essentially a revolutionary, and the love and anger of crypto believers have led to price volatility for Bitcoin beyond fiat currencies and pure energy itself. While believers claim to accept this volatility with steadfast faith, we are merely human and sometimes abandon the gold standard. In difficult times, stablecoins show us their sweet melody, but many fail to realize that they are fundamentally incompatible with the financial world we hope to create.

Many people ask me about my views on stablecoins. Recent fluctuations surrounding Terra's dollar-pegged stablecoin UST prompted me to begin writing a series of articles on stablecoins and Central Bank Digital Currencies (CDBC). These two concepts are interconnected with the fundamental nature of the debt-based portion of the global financial system.

This article will explore the broad categories of blockchain stablecoins— including fiat-backed, over-collateralized crypto, algorithmic, and Bitcoin-backed stablecoins. While there is currently no effective solution, the final part of this article will address my current view: a Bitcoin-backed stablecoin pegged to the dollar, which is also an ERC-20 asset compatible with the Ethereum Virtual Machine (EVM), is the best way to combine these two incompatible systems.

In this market downturn, the only comfort is our breath. Our actions and thoughts are not entirely under rational control, so we must breathe in and out slowly, methodically, and consciously. Only then can we faithfully spread the good words of the Lord.

"The Freeman has a saying: 'God created Arrakis to train the faithful.' Man cannot contradict the word of God." ------ Paul Atreides, 'Dune'

Fiat-Backed Stablecoins

As explained in the previous article “I Still Can't Draw A Line,” banks are utilities that operate fiat value. They help individuals and organizations conduct business. Before the advent of the Bitcoin blockchain, banks were the only trusted intermediaries capable of performing these functions. Even after Bitcoin emerged, banks remained the most popular intermediaries, leading some banks to act recklessly, believing that the government could print money to bail them out.

Banks impose significant taxes on users regarding the time and cost of transferring value. Given that we can now use instant and nearly free crypto communication methods, we have no reason to continue paying so much in traditional banking fees and wasting so much time.

Bitcoin created a competitive peer-to-peer payment system with low time and money costs. For many, accustomed to using fiat currencies and energy (i.e., a barrel of oil) as benchmarks, Bitcoin is highly volatile. To address this issue, Tether created the first dollar-pegged stablecoin using the Omni smart contract protocol built on Bitcoin.

Tether created a new class of digital assets on public blockchains, backed 1:1 by fiat assets held by banking institutions, which we now refer to as fiat-backed stablecoins. Following Tether (also known as USDT) and USDC, various other fiat-backed stablecoins have emerged, each project’s fiat custodial assets (AUC) surging with the growth of tokens. Currently, USDT and USDC together hold over $100 billion in fiat AUC.

Because the Bitcoin economy lacks infrastructure, our means of payment still rely on dollars or other fiat currencies. Given that traditional fiat transfer methods are very expensive and complex, bypassing the banking payment system to send fiat instantly and at low cost is highly valuable. I would rather send someone USDT or USDC than use the expensive global fiat banking payment system.

The fundamental problem with this type of stablecoin is that it requires willing banks to accept the fiat assets backing the token. The transaction fees of stablecoins do not fall into the pockets of bankers, but the banks holding these massive fiat assets incur costs. It is well known that central banks have undermined the lending business model of commercial banks, making it impossible for them to agree to commercial banks holding billions of dollars in agreements to achieve decentralization.

Fiat-backed stablecoins want to utilize the storage facilities of banks without paying any fees for it. To me, this strategy is unsustainable. Billions may not be a problem, but expecting commercial banks to allow fiat-backed stablecoins' AUC to reach trillions of dollars is unrealistic.

Fiat-backed stablecoins will not become payment solutions supporting Web3 or a truly decentralized global economy. They cannot become fast, low-cost, and secure digital payment services connecting the physical world. When the Federal Reserve prohibited Silvergate Bank from partnering with Facebook's Diem stablecoin, we saw this dissonance. Given Facebook's massive user base, if Diem were launched, it would immediately become one of the largest circulating currencies globally. It would directly compete with traditional fiat currencies, which is not allowed to happen.

The next iteration of stablecoins is a series of projects that over-collateralize major cryptocurrencies to maintain a peg to fiat value.

Over-Collateralized Stablecoins

In short, this type of stablecoin allows participants to mint a pegged fiat token in exchange for crypto collateral, with MakerDAO being the most successful example.

MakerDAO has two tokens. Maker (MKR) is the governance token of the system. It is similar to bank shares, but banks aim for assets to exceed liabilities. These assets are mainstream cryptocurrencies like Bitcoin and Ether, and MakerDAO promises to create a token pegged to the dollar, DAI, upon receiving crypto assets.

1 DAI = 1 USD

Users can borrow DAI from MakerDAO by providing a certain amount of crypto collateral. Since the price of crypto collateral may drop in dollar value, Maker will programmatically liquidate the staked collateral to meet DAI loans. This is done on the Ethereum blockchain, and the process is very transparent. Therefore, the liquidation price level of Maker can be calculated.

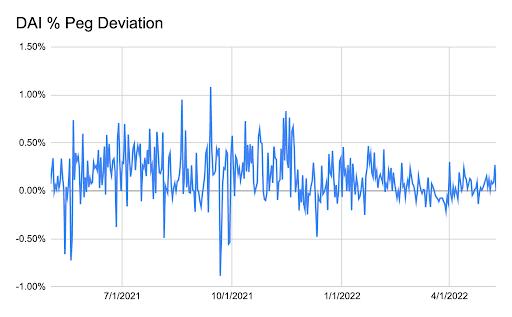

This is a chart showing the percentage deviation of DAI from its $1 peg, with a reading of 0% meaning DAI perfectly maintains its peg. Maker has done well in maintaining the dollar peg.

The system is very robust, as it has survived multiple price crashes of Bitcoin and Ether, with its DAI token still maintaining a value close to $1 in the open market. The downside of this system is that it is over-collateralized. It effectively eliminates liquidity in the crypto capital markets in exchange for the stability of pegged fiat assets. It is well known that stagnation is expensive, while volatility is free.

The f(x) of MakerDAO and other over-collateralized stablecoins: completely depletes the liquidity and collateral of the ecosystem. Maker token holders can choose to introduce risk into the business model by lending out idle collateral for greater income. However, this introduces credit risk into the system. Who is a reliable borrower paying positive interest on crypto, and what collateral do they promise? Is that collateral the original asset?

The benefit of the fiat portion of banking is that the system can grow exponentially without depleting all the collateral of the currency. These over-collateralized stablecoins fill a very important niche market, but for the reasons stated above, they will always remain a niche market.

The next iteration of stablecoins aims to completely eliminate any link to "hard" collateral and is solely supported by fancy algorithms for minting and burning. Theoretically, these algorithmic stablecoins could scale to meet the demands of a global decentralized economy.

Algorithmic Stablecoins

The established goal of these stablecoins is to create an anchored asset with less than 1:1 crypto or fiat collateral. Typically, the aim is to support the anchored stablecoin using assets beyond "hard" collateral. Given that Terra is the current topic, I will use LUNA and UST as examples to explain the mechanics of algorithmic stablecoins.

LUNA is the governance token of the Terra ecosystem.

UST is a stablecoin pegged to $1, with its "asset" being only the circulating LUNA tokens.

Here’s how UST works to maintain its $1 peg:

Inflation: If 1 UST = $1.01, then UST is overvalued relative to its pegged value. In this case, the protocol allows LUNA holders to exchange $1 worth of LUNA for 1 UST. LUNA is burned or removed from circulation, and UST is minted or put into circulation. Assuming 1 UST = $1.01, traders earn $0.01 in profit. This drives up the price of LUNA as its supply decreases.

Deflation (the current situation): If 1 UST = $0.99, then UST is undervalued relative to its pegged exchange rate. In this case, the protocol allows UST holders to exchange 1 UST for $1 worth of LUNA. Assuming you can buy 1 UST for $0.99 and exchange it for $1 worth of LUNA, you would profit $0.01. UST is burned, and LUNA is minted. This leads to downward pressure on the price of LUNA as its supply increases during the downturn. The biggest problem is that investors who now hold newly minted LUNA will decide to sell it immediately rather than hold it in hopes of a price increase. This is why LUNA faces persistent selling pressure when UST trades at a significantly de-pegged price.

The more UST is used in the business of the decentralized economy of Web3, the higher the value of LUNA. This minting and burning mechanism is very useful during upward trends. But if UST cannot reverse its downward trend, then a death spiral may begin with the indefinite minting of LUNA in an attempt to bring UST back to its peg.

All algorithmic stablecoins have some form of minting/burning interaction between governance tokens and pegged stablecoins. All these protocols share a common problem: how to restore confidence in the peg when the trading price of the anchored stablecoin falls below its fiat peg.

Due to the death spiral phenomenon, almost all algorithmic stablecoins have failed. If the price of the governance token falls, then the governance token assets supporting the anchored token are perceived by the market as untrustworthy. At that point, participants begin to sell their pegged tokens and governance tokens. Once the spiral begins, restoring confidence in the market becomes very costly and difficult.

The death spiral is no joke; it is a confidence game based on a debt banking system. However, this game has no government to force users to use the system.

Theoretically, profit-seekers should be willing to ignore the collateral's decline to preserve the algorithmic protocol in exchange for the massive profits from the newly created governance tokens. But this is merely hypothetical.

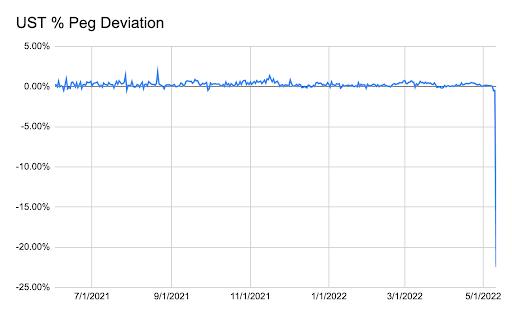

This is a chart showing the percentage deviation of UST from its $1 peg. Like MakerDAO, 0% means the peg is rock solid. As you can see, everything was fine until UST de-pegged.

Many similar projects have failed or are failing. This is not to say that this model cannot work; at least it has been effective for a time. I am researching a specific algorithmic stablecoin project and holding its governance token. Currently, the project is profitable at the protocol level, making it attractive. The protocol has a structure similar to Terra but accepts other mainstream collateral to support its anchored stablecoin in addition to its governance token.

Theoretically, this model resembles a part of banking that could scale to meet the needs of a decentralized Web3 economy, but it requires near-perfect design and execution.

Bitcoin-Backed Stablecoins

The only commendable goal of stablecoins is to allow the issuance of tokens pegged to fiat currencies on public blockchains. This has practical utility before the arrival of true Bitcoin economics. So, let’s try to make the most of a fundamentally flawed premise.

The most primitive crypto collateral is Bitcoin. How can we transform Bitcoin into an unbreakable dollar-pegged stablecoin at a 1:1 dollar value ratio?

Various top crypto derivatives exchanges offer inverse perpetual swaps and futures contracts. These derivative contracts are based on BTC/USD but are margined in BTC. This means that profits, losses, and margins are denominated in Bitcoin, while quotes are in dollars.

When we do some math, I will hold your hand— I know this is difficult for your TikTok-damaged brain.

Each derivative contract is worth $1 of Bitcoin at any price.

Contract value in Bitcoin = [$1 / BTC price] * number of contracts

If BTC/USD is $1, then the contract is worth 1 BTC. If BTC/USD is $10, then the contract is worth 0.1 BTC.

Now let’s use BTC and short derivative contracts to synthesize $100.

Assuming BTC/USD = $100.

At a BTC/USD price of $100, how much is 100 contracts or $100 worth of BTC?

[$1 / $100] * $100 = 1 Bitcoin

Intuitively, this should make sense.

100 synthetic dollars: 1 BTC + 100 short derivative contracts

If the price of Bitcoin tends toward infinity, the value of the short derivative contracts denominated in Bitcoin approaches 0. Let’s use a larger but finite BTC/USD price to demonstrate this.

Assuming the price of Bitcoin rises to $200.

What is the value of our derivative contracts?

[$1 / $200] * $100 = 0.5 Bitcoin

Thus, our unrealized loss is 0.5 BTC. If we subtract the unrealized loss of 0.5 BTC from our 1 BTC staked collateral, our net balance is now 0.5 BTC. But at the new BTC/USD price of $200, 0.5 BTC still equals $100. Therefore, even if the price of Bitcoin rises and causes our derivative position to incur an unrealized loss, we still have $100 in synthetic dollars. In fact, mathematically, this position cannot be liquidated upward.

The first fundamental flaw of the system occurs when the price of BTC/USD approaches 0. As the price nears zero, the contract value becomes greater than all the Bitcoin that would exist— making it impossible for the short side to repay you in Bitcoin.

This is math.

Assuming the price of Bitcoin drops to $1.

What is the value of our derivative contracts?

[$1 / $1] * $100 = 100 Bitcoin

Our unrealized gain is 99 BTC. If we add the unrealized gain to our initial 1 BTC collateral, our total balance is 100 BTC. At a price of $1100, Bitcoin is equivalent to $100. Therefore, our $100 synthetic peg remains intact. However, note how a 99% drop in Bitcoin's price increases the contract's Bitcoin value by 100 times. This is the definition of negative convexity and shows how this peg breaks when Bitcoin's price approaches 0.

The reason I ignore this scenario is that if Bitcoin goes to zero, the entire system will cease to exist. At that point, there will be no public blockchain capable of transferring value, as miners will not expend pure energy to maintain a system where the native token is worthless. If you are concerned that this is a real possibility, just continue using the fiat banking track— no need to try something that might be cheaper and faster.

Now, we must introduce some centralization, which brings a series of other issues to this design. The trading volume of these inverse contracts is sufficient for the only place where a Bitcoin-backed stablecoin serving the current ecosystem can occur is on centralized exchanges (CEX).

The first point of centralization is the creation and redemption process.

Creation Process:

Send BTC to the foundation.

The foundation stakes BTC on one or more CEX and sells inverse derivative contracts to create sUSD, i.e., synthetic dollars.

The foundation issues an sUSD token based on a public blockchain. For ease of use, I suggest creating an ERC-20 asset.

To trade these derivatives, the foundation must create an account on one or more CEX. The BTC collateral is not held by the foundation but remains with the CEX itself.

Redemption Process:

Send sUSD to the foundation.

The foundation buys back short inverse derivative contracts on one or more CEX and then burns sUSD.

The foundation withdraws net BTC collateral and returns it to the redeemer.

This process has two issues. First, the CEX may not be able to return all the BTC collateral entrusted to it for any reason. Second, the CEX must charge margin to the losers. In this project, when the price of BTC drops, the project's derivatives are profitable. If the price drops too far, too quickly, the CEX will not have enough long margin to pay out. This is where various socialized loss mechanisms come into play. TL;DR, we cannot assume that if the price of BTC drops, the project will receive all the BTC profits it deserves.

Setup

The foundation needs to raise funds for the project's development. The greatest need for funds is a general fund covering exchange counterparty risk. Governance tokens must initially be sold in exchange for Bitcoin. This Bitcoin is specifically for situations where the CEX does not pay as expected. Clearly, this fund is not infinite, but it will provide confidence that if the CEX's returns are below what they should be, the $1 peg can be maintained.

The next step is to determine how the protocol will earn revenue. There are two sources of income:

- The protocol will charge fees for each creation and redemption.

- The protocol will benefit from the natural positive basis between derivative contracts and the underlying spot value. Let me explain.

The established policy of the Federal Reserve (and most other major central banks) is to inflate its currency at a rate of 2% per year. In fact, since 1913 (the year the Federal Reserve was established), the dollar's purchasing power has lost over 90% when pegged to the CPI basket.

BTC has a fixed supply. As the denominator (USD) increases in value, the numerator (BTC) remains constant. This means we should always assign a higher value to the future value of the BTC/USD exchange rate compared to the spot value. Therefore, fundamentally, the futures premium (futures price > spot) or funding rate (perpetual swaps) should be positive— which means income for those shorting these inverse derivative contracts.

One might argue that the nominal yield on U.S. Treasuries is positive and that there are no nominal risk-free instruments priced in Bitcoin— thus assuming that the dollar will depreciate relative to Bitcoin in the long term is incorrect. While this is true, as I and many others have written, negative real interest rates (i.e., when the nominal risk-free Treasury yield is below GDP growth) are the only mathematical way for the U.S. to repay debt holders nominally.

Another option is to raise the population growth rate above 2% per year, which would require couples collectively avoiding contraception and other family planning methods. According to the U.S. Census Bureau, the population growth rate in 2021 was 0.1%. If you exclude immigration, the rate would be negative.

The final option is to discover some new amazing energy conversion technology that significantly reduces the energy cost per dollar of economic activity. Both of these alternative solutions seem unlikely to be realized quickly.

Long positions in Bitcoin and short inverse derivative contracts should earn positive returns year after year. Therefore, the larger the circulation of sUSD, the more Bitcoin is held in custody compared to short derivative contracts, generating a substantial stream of compound interest income. This provides a massive funding pool for governance token holders.

Perfection is Impossible

Creating a stablecoin pegged to fiat currency on a public blockchain cannot be done without many compromises. It is up to the users of the relevant solutions to determine whether the compromises are worth achieving the goal of making fiat currency faster and cheaper on a public blockchain than on a bank-controlled centralized payment network.

Among the four options proposed, I prefer Bitcoin and derivative-backed stablecoins, followed by over-collateralized crypto-backed stablecoins. However, each of these solutions ties cryptocurrencies to large pools of funds. As I mentioned in “The Doom Loop,” the problem is that these public networks require assets to move between parties to generate transaction fees that maintain the payment network. In the long run, holding is toxic. Therefore, let us not be complacent but continue to strive to create a Bitcoin economy from farm to table.

Will Terra / UST Survive?

Terra is currently in the deepest part of the death spiral. Please read this tweet thread from founder Do Kwon; what is happening now is entirely by design. The protocol is functioning normally, and the fact that people are surprised by what is happening means they did not read the white paper correctly. Luna-tics also did not seriously question where Anchor's 20% UST yield comes from.

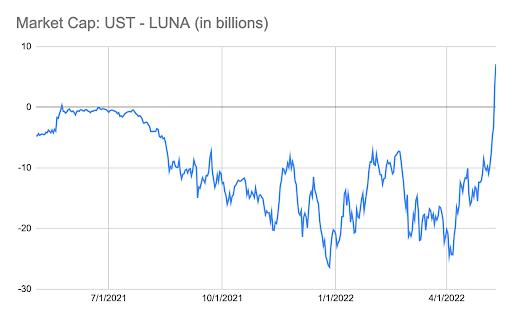

The spiral stops when the market cap of UST equals that of LUNA. If left to develop, the protocol will find a market cap balance. Then the question becomes what the final stationary market cap will be. Most importantly, when arbitrageurs buy cheap UST to create fresh LUNA, who will buy that LUNA? When you know there are billions of dollars of LUNA selling pressure, why would you buy LUNA from those selling it as long as UST is < $1?

Even if LUNA and UST survive this event, some genius protocol changes must be made to enhance market confidence that LUNA's market cap will always exceed the floating UST. I do not know how to do this. That is why I will only LARP. Many have highlighted this fundamental issue— see Dr. Clements' article for a more detailed discussion.

This is a chart of [UST market cap - LUNA market cap]. When this value < $0, the system is healthy. Upward peaks mean UST must be burned and LUNA issued to bring UST back to its peg.

Algorithmic stablecoins are not much different from fiat debt-backed currencies, except for one key factor: Terra and others like it cannot force anyone to use UST at any cost. They must convince the market through their fancy designs that the governance tokens supporting the protocol will have a non-zero value, which will grow faster over time than the number of issued fiat-pegged tokens. However, governments can always ultimately force their citizens to use their currency at gunpoint. Therefore, there is always an inherent demand for fiat currency, even if everyone knows that the "assets" supporting that currency are worth less than the circulating currency.

Another victim is a group of investors shouting "Hooray, Hooray, Long Live!" Because of their enthusiasm for Terra, they are now busy fixing their balance sheets instead of buying Bitcoin and Ether as they recover their downward trajectory.

Adjournment

This collapse is not over…

During a proper collapse, the market seeks out indiscriminate sellers and forces them to sell. This week’s crash was exacerbated by the forced sale of all Luna Foundation Bitcoin to defend the UST:USD peg. As usual, they still failed to defend the peg. This is the reason all pegs fail in the face of cosmic entropy.

I dutifully sold $30,000 worth of Bitcoin and $2,500 worth of June put options. I did not change my structural long crypto positions, even as they are losing "value" in fiat terms. If anything, I am evaluating the various altcoins I hold and increasing my exposure.

I did not expect the market to move through these levels so quickly. This collapse occurred less than a week after the Federal Reserve raised rates by the expected 50 basis points. This market cannot handle rising nominal rates. What shocks me is that anyone could believe that long-risk assets at historical all-time high multiples would not yield to rising nominal rates.

The U.S. CPI rose 8.3% year-on-year in April, down from a previous year-on-year 8.5%. 8.3% is still too hot to handle, and the Fed in firefighting mode cannot abandon its unrealistic pursuit against inflation. A 50 basis point rate hike is expected in June, which will continue to undermine long-risk assets.

The crypto capital markets must now determine who is overexposed to anything related to Terra. Any service offering above-average returns, if perceived to have any contact with this drama, will experience rapid outflows. Given that most people have never read how any of these protocols work in distress, it will be a practice of selling first and reading later. This will continue to put pressure on all crypto assets as all investors lose confidence and prefer to grab the safety blanket of holding fiat cash.

After the bloodletting ends, the crypto capital markets must have time to recover. Therefore, trying to understand reasonable price targets is foolish. But what I will say is that given my macro view on the inevitability of eventual money printing, I will close my eyes and trust the Lord.

Thus, I am a buyer of Bitcoin at $20,000 and Ethereum at $1,300. These levels roughly correspond to the historical peaks of each asset during the 2017/18 bull market.

We do not know who among us is colluding with the devil while swearing allegiance to God. Therefore, keep yourself away from the "buy" and "sell" buttons until the dust settles. Everything will be revealed to the faithful in due time.