Cryptocurrency Trader Ansem: The Next Phase Trend and Core Narrative of the Crypto Market After a Soft Landing

Original Title: 《A Soft-ish Landing》

Original Author: Ansem

Original Compilation: Amber, Foresight News

In the past week, traditional financial markets have shown some positive signals against the backdrop of easing inflation pressures in the U.S., while the cryptocurrency market has also "followed" suit with a phase of recovery.

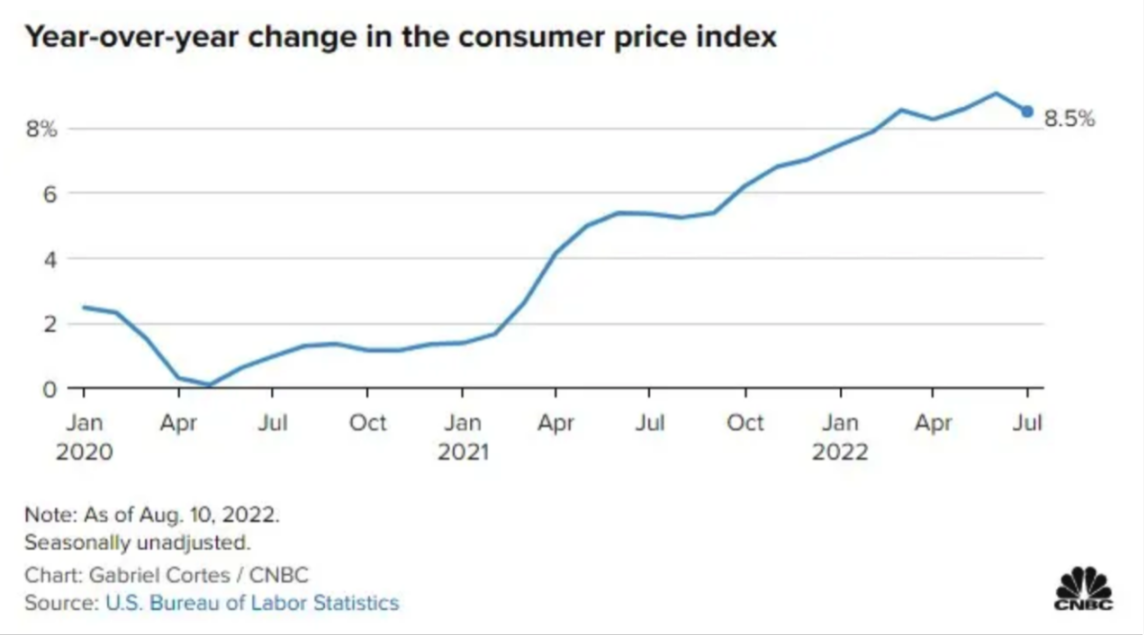

The U.S. CPI data for July recorded a level of 8.5%, lower than market expectations.

A month ago, the previous value hit a record high of 9.6%. Most market participants were surprised by the fierce rebound in financial markets following such poor data releases, but in reality, this was due to the market's forward pricing of "data won't get worse." From the outcome, this seemingly divergent judgment from the current data was accurate. However, whether the CPI can truly mark a turning point remains to be seen.

From the perspective of "wealth destruction," this year's bear market is more severe than any previous cycle in cryptocurrency history. The collapse of Luna in May directly wiped out $60 billion in total market value from the cryptocurrency market, causing a series of chain reactions throughout the ecosystem. The rapid plunge in Bitcoin and Ethereum prices led to a crisis for the hedge fund Three Arrows Capital, and in June, the total market value of the crypto market dropped another $10 billion, with several large CeFi institutions in the crypto space going bankrupt, resulting in a stormy round of deleveraging in the market.

On the bright side, it is almost impossible to see such a large-scale sell-off in the short term again. Moreover, the bottoms formed after such events often become strong support in the future. This article is not trading guidance but seeks to find the most probable outcomes for the market's next steps through clues in the market.

Macroeconomic Financial Markets and BTC500

For most of this year, the correlation between cryptocurrencies and traditional financial markets has reached an unprecedented level. Traditional financial markets have been under pressure amid the Federal Reserve tightening monetary policy and worsening inflation conditions, while the cryptocurrency market has been hit hard again due to a series of black swan events just as the downtrend seemed to be nearing its end. However, as the market gradually stabilizes, risk appetite is slowly returning, and there are also signs of warming in the crypto market. I believe that in the coming period, the market will experience a phase of sideways fluctuations, especially for Bitcoin, where the rebound may come later than those altcoins with clearer narratives.

From a technical analysis perspective, the S&P 500, Nasdaq, and Nasdaq 100 have recently restored a bullish structure on their weekly charts, with prices breaking above the recent high before the last round of accelerated declines. Compared to the rebound in April, the strength of the current rise and the "harvest" on the chart are clearer.

Although the daily chart shows that the price is near a strong resistance area, the first touch near the second-quarter highs may lead to a new round of corrections. However, this correction could provide an excellent buying opportunity. Whether this is the last deep squat before a jump depends on the strength of this correction. If the S&P 500 index can hold above 4080, the upward momentum will continue; however, if this level is lost, the current rebound is expected to end.

The market has been hoping that Powell can manage the elusive "soft landing." The Federal Reserve is currently walking a tightrope amid high interest rates, high debt, and high inflation, and any mismanagement of monetary policy could have severe negative impacts. The recent rebound has been attributed to strong employment data and a declining CPI figure; only if these data maintain a positive momentum can the Fed gain greater flexibility in adjusting monetary policy. However, risks such as the worsening energy crisis in the Eurozone, escalating conflicts in Ukraine, and issues in the Taiwan Strait are difficult to price in advance, adding uncertainty to the market. Nevertheless, most people remain relatively optimistic about the changing economic situation and do not believe that a global financial crisis like that of 2008 will reoccur.

It is worth mentioning that the U.S. employment data for July performed impressively. Although the market's pricing efficiency regarding employment conditions is not high, as most believe that an improvement in employment will lead to more aggressive rate hikes by the Fed. However, I believe that once the market begins to price in changes in employment indicators normally, inflation is likely to experience a turning point influenced by healthy employment conditions.

Important Events:

August 25: Jackson Hole Annual Meeting

September 2: August Non-Farm Employment Data

September 13: August CPI

September 15-16: ETH Merge

September 22: Federal Reserve Interest Rate Meeting

Before the next Federal Reserve interest rate meeting, we have about a 4-5 week time window during which the market is likely to show a pattern of falling first and then rebounding, thereby preemptively digesting the impacts of significant risk events such as the Ethereum merge and the Fed's rate decision. If next month's non-farm and CPI data continue to perform well, the expected correction will not be strong. However, given the highly emotional state of the financial market this year, it is essential to ensure liquidity during this period of high uncertainty. In the coming time, the market is expected to provide clearer directional signals, and what we need to do is trust our judgment and execute firmly.

Charts, Narratives, and Other Interesting Things

Ethereum

Since the CPI decline a month ago, ETH has been leading the entire cryptocurrency market, outperforming Bitcoin and showing significantly better performance than other major public chains and large-cap cryptocurrencies. Recently, only tokens related to the merge, such as OP, Lido, and GMX, have been able to keep pace with Ethereum.

I believe that layer-two related tokens are more worthy of attention during the merge cycle because Rollups require higher activity to help Ethereum achieve better market pricing, and OP has already validated this judgment well; Arbitrum is expected to follow the same path in the future.

Moreover, Ethereum is currently the only liquid asset that major players in the cryptocurrency market can use to bet on the merge, giving it a much better narrative than Bitcoin at this stage. Another point is that the independence of the crypto market is rising; after this recent rebound, there is a very noticeable divergence in the market. Many altcoins have not even recovered the highs from the first rebound after the Luna collapse, while Bitcoin and Ethereum are in much better shape. This scenario, where Bitcoin and Ethereum lead the decline but only altcoins suffer devastating blows, has been relatively rare before.

From a market perspective, I believe that Ethereum below $1800 is worth buying. However, if the price experiences a rapid drop again and breaks below the $1650 level, we need to be more cautious in choosing the bottom-fishing timing. If that happens, the market may drop again to the $1000 round number. However, as long as the $1650 support holds, it is almost certain that Ethereum will recover to $2000 when the merge lands in mid-September.

DOGE & SHIBA INU

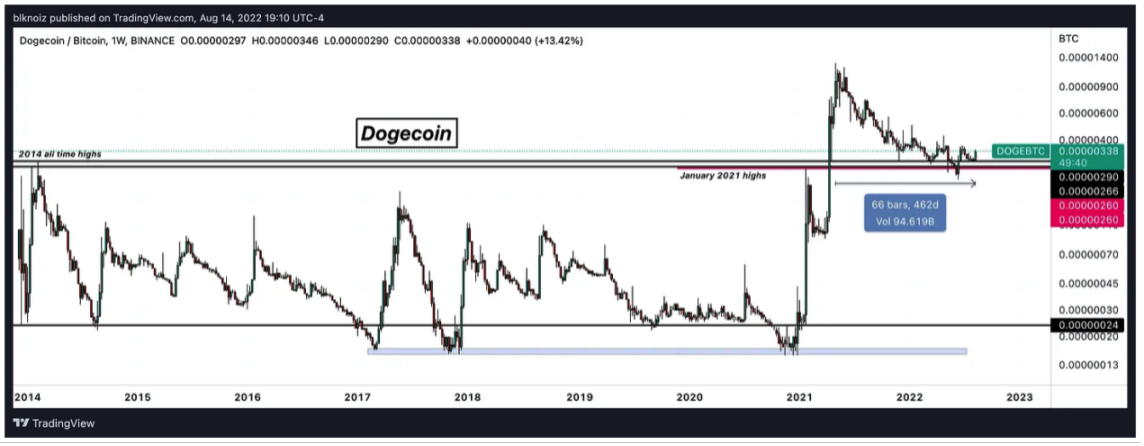

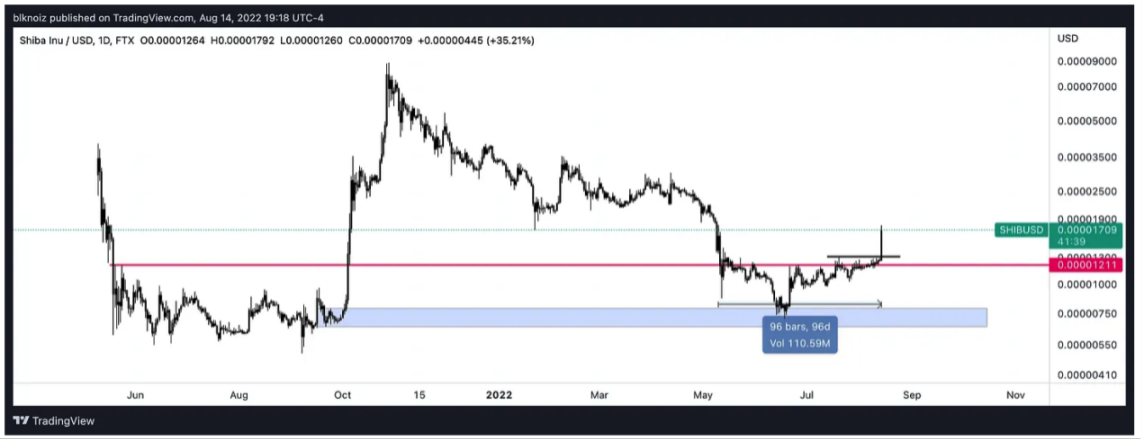

Last Saturday, I received alerts about SHIB breaking resistance levels, and the DOGE/BTC pair starting to flatten indicates that we are about to see a new round of choices in the market—either the last wave of rotation among altcoins during the bear market rebound or a new explosive market will arrive soon. Considering the current market situation, I believe the latter is more likely.

If you look back at the relatively short history of the cryptocurrency market, you will find that DOGE/BTC is a magical indicator for judging retail investor entry. In the past week or so, due to the rising discussion around several retail stocks, including AMC, the WallStreetBets Reddit community, which surged to fame during the market rally in early 2021, has become active again. If you experienced the market in early 2021, you would be familiar with the stories of GameStop and Dogecoin. Currently, the Dogecoin ecosystem has even introduced a Dogecoin chain, adding another layer to the narrative around Dogecoin. Shiba and Dogecoin have almost no underlying support in terms of crypto technology innovation, DeFi, or metaverse gaming; their price increases are driven almost entirely by memes, community FOMO, and the inherent capital attributes of crypto. However, Dogecoin has always managed to jump the gun before every round of crypto market rallies. Yet history does not always repeat perfectly, and this rise may simply be a rotation among altcoins during the bear market rebound.

From a technical chart perspective, the market has rebounded after approaching last summer's lows and has broken above the upper boundary of the range it has been oscillating in for the past few months. However, if the market falls back into this range shortly, it would be a bad signal. Therefore, the performance of this newly broken level, which has turned from resistance to support, during the retest is crucial.

The changes in Google Trends are highly correlated with price movements; each price peak is accompanied by a peak in Google search trends. From this perspective, Dogecoin has not yet reached a point where it needs to reverse its upward trend, and market attention towards it remains relatively low.

Solana

Solana was my favorite cryptocurrency in 2021. As another winner in the previous public chain competition besides BNB, it once led the last market cycle. With Ethereum transitioning to a modular network architecture and moving most of its execution to Rollups, Solana will become the representative public chain that directly handles all transactions on layer one. Solana has faced many challenges in its development, but its very low network usage costs remain very attractive to ordinary users, and the flourishing of NFTs in the Solana ecosystem confirms this. However, this has also led to the network being abused by bots, resulting in multiple outages. For Solana to advance further, it must develop DeFi applications; currently, Drift and Friktion on Solana have achieved some success. Additionally, there are currently no high TPS gaming applications on Solana, and whether this network can handle high-frequency small transactions like Avalanche's subnet is crucial.

The recent network upgrade on Solana implemented Quic/Qos/localized fee markets, which will help prevent congestion during peak network traffic, providing users with a better experience. I am willing to call this upgrade Solana 2.0, with the official patch version number being 1.10.32. Quic is the protocol used by validators that allows block producers to rate bots and handle congestion that UDP cannot achieve. The localized fee market will operate similarly to the fee market on Ethereum, but the fees will not be globally affected across the entire network; instead, they will be specific to the portion being restricted. This specification is made possible because Solana's runtime allows for parallel transaction processing. For example, on ETH, whenever a popular NFT mint occurs, it pushes the entire network's gas fees up, while on Solana, the fees will only spike for users interacting with that specific mint, allowing the rest of the network to continue operating without interruption. Staking-weighted quality of service ensures that nodes are entitled to a percentage of the data packets delivered to leaders equivalent to what they have staked, preventing bots with high percentages or no stakes from surpassing others. These changes are now broadcasted on the mainnet, so we will see in the coming months whether these changes significantly impact network performance.

From a technical analysis perspective, once the $48.5 level is effectively broken, it will quickly open up space above. The ideal buying opportunity will be if the price pulls back to the $40-42 support area without breaking. However, if last week's low of $39.15 is broken, we need to be cautious of the risk of a new round of rapid declines.

Chilliz

Chilliz has been one of the most successful crypto teams in realizing consumer markets in the real world. They are a fintech provider targeting sports and entertainment companies, with some notable partnerships including FC Barcelona, Juventus, UFC, and 13 NFL teams. Many sports clubs now have their own CHZ-related tokens through their Socios.com app, which allows fans to interact with their favorite teams. The app has not yet launched in the U.S. but is expected to do so soon. Recently, they announced a partnership with FC Barcelona detailing their $100 million investment to support their NFT and metaverse plans. Since early August, CHZ has performed very strongly, outperforming most ERC20 tokens.

Currently, CHZ exists as an ERC-20 token, which fans use to purchase fan tokens for associated teams operating on its sidechain, Socios. Later this year, they will launch their own public chain, Chilliz 2.0, which will be a one-stop platform for teams to interact with fans through various decentralized applications. If they can effectively replicate their success in the U.S. market, they could almost monopolize the NFT x fan x sports market.

Recently, CHZ has seen a strong rebound, breaking above the downtrend resistance line it has faced for nearly a year. Strong resistance above needs to be seen around $0.30. As long as the price holds above the $0.15-0.17 support area, the upward momentum is temporarily secure.

XMON

Sudoswap, aptly referred to by Sisyphus as the Uniswap of NFT markets, is an AMM that attempts to make your JPEGs more liquid. Over the past year, NFTs have arguably been the best entry point for newcomers to the crypto market, but unless you have a keen eye, it can be challenging to succeed consistently in the NFT market.

Sudoswap allows users to trade NFTs more efficiently, enabling them to creatively build different pools and have their own dedicated curves. sudoSwap is not a centralized market that charges fees on every trade; instead, it is a completely decentralized platform that does not charge any fees, providing users with a simpler way to buy and sell. The main obstacle will be whether liquidity transfers; the data growth trend of this platform looks promising over the past month. Given that it reached about one-tenth of OpenSea's sales just 30 days after launch, once market enthusiasm returns, especially if more gaming item NFTs are introduced to the platform, Sudoswap's future growth potential remains considerable.

Some Thoughts

I believe the worst of the market is behind us, and we are unlikely to see new lows before the Ethereum merge. However, we still need to hedge risks; Bitcoin currently lacks new narratives and its poor market performance makes it the most suitable asset for hedging short positions. Although Bitcoin has a loyal following, these individuals often focus on very long cycles and do not care about short-term fluctuations. The current state of the macro financial market is still not good, but once the anxiety over economic recession begins to ease, liquidity in the market will quickly return. If the market shows signs of improvement, the best follow-up options are actually Dogecoin, on-chain options, and some MEME altcoins. Of course, I also like Chilliz because it provides the best opportunity for people to connect with their favorite teams, and I would be very willing to pay for on-chain assets launched by teams I like. Regardless of the economic situation, people always love competitive sports. I previously paid attention to StepN but did not do much research and have not figured out whether its model is sustainable. So far, I have not used this app. I believe the metaverse track is still full of alpha because it has not been deeply explored, but I do not intend to elaborate too much here; readers can pay more attention to new projects in this track.

In the past two months, Lido Finance, OP, GMX, FOLD, and other merge-related tokens have performed well, but these tokens will face tests ahead. If the Ethereum merge is successfully completed and leads to a large-scale reduction in supply, it could cause a collective correction in these assets. The upcoming restart of the Arbitrum Odyssey in September is worth noting, and assets like LINK and SNX, which have performed well in this recent bull market, seem to have gradually begun to recover after weathering the toughest phases of the bear market. However, currently, buying Ethereum in the spot market may be the lowest-risk option. If you want a safer choice, then interact more on layer two and wait for new projects to announce their token plans in the future.

The upcoming Jackson Hole Annual Meeting is expected to clarify the market's interpretation of future U.S. economic data and provide some forward-looking signals regarding adjustments to the Fed's monetary policy, which are key points to watch in the near future.

Key mainstream assets to focus on: ETH, SOL

Key MEME assets to focus on: SHIB, DOGE

Assets with high ceilings: CHZ

Medium ceiling assets to watch: XMON

Options for risk hedging: BTC, APE

Watchlist: SNX, LINK, LDO, FOLD, GMX, SYN, SCRT, UNI, AAVE, IMX, OSMO, DPX, MATIC, BTRFLY

Looking Ahead

The current focus of the market is on the upcoming Ethereum merge in the fourth quarter, but we should further broaden our thinking. Given the significant uncertainty in the macro financial market, I do not believe we can predict how the U.S. stock market will develop next. We do not need to guess the specific CPI figures, but we can analyze the potential responses and decisions the Fed may make based on some details. If we can indeed welcome a bull market again or at least a larger-scale bear market rebound, the sector rotations we need to deal with will be completely different from the market conditions of 2021. Once the trend changes, we need to quickly identify new hot tracks with real long-term potential.

Future narratives worth paying attention to in the market:

Sol 2.0 and localized account fee markets

Optimistic Rollups v2: Arbitrum Nitro and Optimism Bedrock

privDeFi: Aztec Connect, Secret Network, Penumbra, Mina + zkApps

sudoSwap & Doge

Cross-chain security

Interoperability of accounts between application chains

The rise of on-chain options

zkEVMs: Scroll vs. zkSync vs. Starknet vs. Polygon Hermez

New public chains: Aptos & Sui

xApps & cross-chain communication: CCIP vs. Stargate vs. Synapse Chain vs. Connext vs. Wormhole vs. IBC

Celestia & Sovereign Rollups

dyMension and RollApps vs. Rollups

Modular execution rollups / FuelVM

Chain games: Aurory, Illuvium, Treeverse, Strange Clans

EIP 4844

Overall, I believe we are in a good window, and the market is expected to remain in a relatively good state for the next month or so. Once the macro financial market environment improves further, we must seize these new narratives in a timely manner.