Arthur Hayes: Bitcoin in Times of War

Original Title: 《For the War》

Author: Arthur Hayes

Compiled by: Wu Says Blockchain

What will you do for the war?

Zoltan Pozar previously wrote in his article "War and Interest Rates":

War leads to escalating inflation.

War takes many different forms. There are cold wars, hot wars, and as Pippa Malmgren puts it, "hot wars in cold places" such as cyberspace, outer space, and the deep sea. Great powers are waging hot wars involving technology, goods, and commodity flows—economic hot wars—these wars have recently been a major cause of inflation.

His articles succinctly describe the global wars that the current centers of political power are engaged in. While the standoff between Ukraine and Russia may be the only direct and highly publicized dynamic conflict currently taking place, there is no doubt: a comprehensive economic war is quietly being waged between the world's major flags.

On the Brink of Extinction

To emphasize the seriousness of the current conflict, the following painful chart records significant conflicts between past old hegemons and challengers.

Of the 16 instances listed, 75% led to war. If we hope to avoid a major kinetic conflict, history is not on the side of humanity.

In Dale Copeland's masterpiece "Economic Interdependence and War," it is written:

Hitler acknowledged that, in the long run, the economic stimulus provided by rearmament could never constitute a foundation for a sound economy, further elaborating on the supply dilemma:

"Countries that rely on foreign trade for survival have obvious military weaknesses. Since our foreign trade is conducted through British-dominated maritime routes, this is a transportation security issue rather than a foreign exchange issue, which reveals our food situation's comprehensive weakness during wartime. The only remedy that seems visionary to us is to acquire vast living space."

National Power

When war occurs, the state takes priority. Regardless of what the laws and regulations are before the war, during wartime, whatever the state needs, it will take. Since the state must possess what is necessary to wage war, the private sector is often excluded from a wide range of goods and services.

"But that's illegal!" you might say. "My country can't just do that because it's a wartime expedient." I would like to remind these readers that the pandemic was also a war—who among us did not have our personal freedoms restricted in the righteous fight against an invisible virus? Wearing masks, getting hurriedly approved "vaccines," staying home, and going out as little as possible. While everyone complained and groaned, they ultimately—in most cases—did what the state told them to do.

When the domestic economy cannot produce enough goods and services to support the state and the private sector, the state resorts to making the people pay the costs and increasing the supply of legal tender. As the war progresses and goods become harder to obtain, the value of this currency decreases. During previous world wars, shortages of milk, bread, butter, sugar, and labor were rampant, with nowhere to hide. In the current iteration of global economic warfare, we still face shortages—they just look a bit different. We are already short on semiconductor chips, face masks, baby formula, and weapons.

In wartime, you either have a loaf of bread, or you don't. In wartime, banks are either open, or they are not. In wartime, when you want to travel, your passport either has the right stamps, or it doesn't. In wartime, channels are key, and prices are secondary. Therefore, the price curves of all necessities and services lack elasticity.

So, as we enter World War III and fight in unconventional corridors, how do we, as ordinary citizens, protect ourselves and our families from the prevailing wartime "all or nothing" dichotomy? In the absence of traditional legal protections, how do we shield ourselves from the state that needs our resources because of… war?

Previously, many believed the best way to save was to hold hard currencies like gold. However, this mindset is common, and states will prohibit private ownership of precious metals, forcing gold owners to sell their bullion to the government at low prices.

Some more industrious civilians began to exchange their money for more "hard currency" fiat and store it abroad. But the government has an answer to this too: capital controls (i.e., laws that impose restrictions on the outflow of funds from the domestic economy).

So, if the government uses all these levers to prevent its citizens from protecting themselves and their wealth, what options do we have left to shield ourselves from the destruction that may follow World War III?

Many people understand the shift in how markets operate in peacetime versus wartime and may leverage this understanding to create, accelerate, and/or consolidate their wealth and power. Striving to become participants in this tragic thing we call global total war.

This is not dramatic; no matter how wealthy or powerful you are, any asset with legitimate ownership is fair game for wartime confiscation. Your bank account, your stock portfolio, your house, your car—your ownership of these things depends on the state maintaining and protecting your proprietary rights to use them.

Let us return to World War II and observe how different nations treated their citizens' property. In this article, I will explore how the United States, the United Kingdom, Germany, and Japan handled wartime rationing and what this meant for capital controls, food, and its pricing, as well as the ownership of "hard currencies" like gold—then I will argue that under these difficult conditions (which we may see again if World War III escalates into a larger conflict), Bitcoin will be the best means for civilians to protect their wealth.

Before I begin, let me insert a public service announcement—now is the time to buy Bitcoin. Because once your fiat assets are frozen or legal capital controls are established, your wealth cannot be converted into harder currencies. At that point, your wealth depends on the whims of the state, and you better hope that the flag printed on your passport wins. This is how states gain public support—they deprive people of their escape routes. The only way out is through!

Capital Controls

The flag that can mobilize most of its citizens' resources and commit them to war is the winning flag. The government must control these private resources in physical form (i.e., food, machinery, labor) or abstract form (i.e., circulating currency, stocks, bonds, and other financial assets). The physical route is more obvious and psychologically more destructive. Imagine a government thug knocking on your door, demanding all the food in your kitchen to feed hungry soldiers, or you working 8 hours a day in a repurposed factory making ammunition for less than market wages. This makes war very real for ordinary citizens.

Therefore, conversely, we can expect the state to take the abstract route, targeting citizens' funds and assets. The state always has very clever ways to impose monetary patriotism on the people.

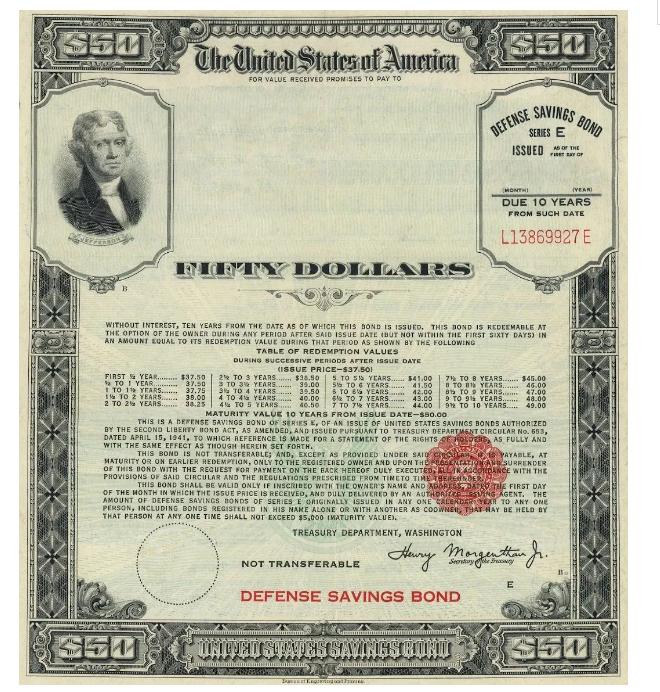

Its most benign strategy is to sell low-yield government bonds to its citizens, igniting their patriotism and persuading them to patriotically invest idle capital in the government. A common example of this is war bonds. War bonds turn citizens into "investors" in the war effort. Now, everyone's interests are aligned. We win the war, and you get your money back.

The yields on these war bonds will not exceed the domestic inflation rate because if they did, the government would slowly go bankrupt. But the government will not emphasize the fact that their yields are below inflation—they will count on their citizens' ignorance of how bond numbers work.

No matter how hard the government tries to sell the righteousness of these bonds to the public, ordinary people may understand that war means inflation (or at least come to realize this as the war drags on). As long as human civilization exists, there will be war. The state always "pays" for the costs of war with inflation. Ultimately, this may leave citizens scrambling to find ways to escape this harmful habit.

From the state's perspective, this is why capital controls must be established—laws that prohibit or restrict the transfer of money and assets outside the domestic economy. Without them, treasonous citizens would convert their capital into hard currencies and make it difficult for the flames of war to burn. Capital controls make it nearly impossible to escape the state's financial system, as all options to convert the national currency into harder equivalents or purchase financial assets yielding higher than government bonds are essentially prohibited. Once citizens of the state find themselves in economic distress, they are likely to succumb to this situation—earning negligible yields that cannot outpace inflation is better than having no yield at all. This is how you begin to transform the people of this land into financial patriots.

Let’s take a look at how various countries implemented capital controls during World War II.

Open Capital Controls

Open capital controls directly restrict the flow of currency across borders and between currencies. The end result is a fragile pool of capital that can easily be directed toward "patriotic" purposes.

Americas

During World War II, the flow of capital outside the United States was largely unrestricted. The U.S. had the strongest economy and no actual fighting on its soil; there was little reason for domestic capital to flee.

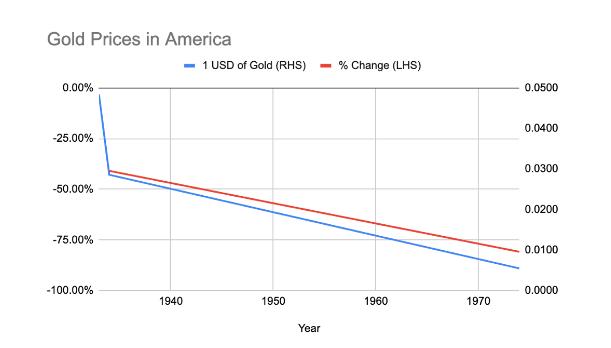

However, the only asset that the U.S. did strictly control was gold.

For decades, the Federal Reserve was required to hold 40% of its issued currency in gold and redeem gold held by American citizens at a price of $20.67 per ounce. But the Emergency Banking Act of 1933 gave the president greater control over banks, international transfers, and gold, paving the way for Executive Order 6102—issued by President Franklin D. Roosevelt (FDR) during World War II, requiring Americans to immediately exchange their gold with the government or face penalties.

Roosevelt's gold confiscation policy meant that private owners were obligated to bring their coins, bars, or gold certificates to banks and exchange them for dollars at the current rate of $20.67 per ounce. In the following year, the president subsequently raised the official gold price to $35 per ounce, effectively devaluing the dollar by 40% to stimulate inflation and boost the economy. This was part of Roosevelt's larger effort to free the U.S. from the gold standard. The ban on personal gold lasted until December 1974 when President Ford legalized private ownership.

Let this chart sink in: gold capital controls lasted for 41 years, during which time the dollar lost 80% of its gold purchasing power. Trapped capital is dead capital.

United Kingdom

The UK implemented extensive capital controls—covering most imports and exports as well as private portfolios and retail investments. These policies were enacted as part of the Emergency Powers Act of 1939, later updated by the Exchange Control Act of 1947.

The sale of securities, the exchange of pounds for any other currency, and the flow of funds abroad were strictly controlled. Your capital is simply not yours. You can only sell securities, conduct foreign exchange, or remit funds out of the country if the government deems your reasons for doing so legitimate according to their rules.

Professor Daisuke Ikemoto wrote: "Exchange controls were initially introduced in 1939 for wartime purposes but have remained in place since the end of the conflict. This has allowed successive British governments to coordinate the maintenance of a fixed exchange rate with their commitment to demand management policies."

Germany

During the war, Germany implemented capital controls so that funds could be used to "invest" in government bonds. These measures will be discussed in more detail in the next section, particularly regarding the yields on German government bonds.

After the war, in the early years of the Federal Republic of Germany, frequent current account deficits and a lack of foreign exchange reserves led to strict prohibitions on any capital exports by residents. The legal basis for these controls was found in the foreign exchange regulations of the Allied occupation zones. However, by the early 1950s, West Germany's current account turned to surplus, and the country's war-related foreign debts were eventually resolved. Restrictions on overseas foreign direct investment were relaxed starting in 1952, and from 1956, residents were allowed to purchase foreign securities.

Japan

I do not have a good document detailing the capital controls faced by Japanese citizens. However, I found this enlightening paper discussing the various ways Japan funded its occupation of Southeast Asian countries during the war. Here is the abstract of the paper:

This paper analyzes how Japan financed its occupation of Southeast Asia during World War II, the transfer of resources to Japan, and the monetary and inflationary consequences of Japanese policies. In Malaya, Myanmar, Indonesia, and the Philippines, military pricing for resources and occupation troops significantly increased the money supply. Despite high inflation rates, due to the continued demand for currency transactions, Japan's hard enforcement of its currency monopoly, and the declining military capacity to transport resources back to the homeland, hyperinflation was almost nonexistent.

In Thailand and Indochina, the costs of occupation and bilateral clearing arrangements created near-unlimited Japanese purchasing power, allowing one-third of Indochina's annual GDP to be transferred to Japan. While the Thai and Indochinese governments primarily funded Japan's demands by printing large amounts of currency, inflation rates only rose as currency expansion continued due to the continued use of currency as a store of value in rice surplus areas.

If Japan "transferred" one-third of Indochina's annual GDP to fuel its war efforts due to a lack of basic goods, do you think the state would allow ordinary citizens to escape their patriotic financial responsibilities by permitting capital to flee abroad? If you believe they would allow Japanese civilians to escape, are you bodoh or what?

After the war, the focus on economic reconstruction meant that capital inflows and outflows were strictly controlled. This policy was implemented early in the Allied occupation of the country and was ultimately derived from the Foreign Exchange and Foreign Trade Control Act of 1949. In principle, all cross-border flows were prohibited unless specially authorized by an administrative order. It wasn't until the early 1960s that these restrictions began to ease, and even then, only for certain flows closely related to foreign trade transactions.

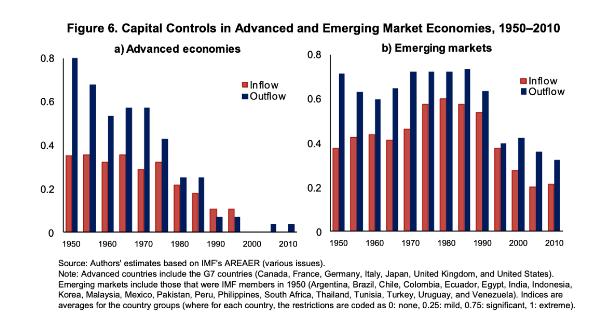

Post-War Global Situation

The following chart shows the universality and durability of post-war capital controls after the Bretton Woods Agreement came into effect.

Today's Conflicts

Let’s fast forward to see what open capital controls look like in today’s world. With the ravages of the Ukraine conflict, Russia has taken several measures to support the ruble. Most notably, Russia imposed a $10,000 withdrawal limit on consumers and required companies to convert their foreign exchange reserves into rubles. The expected result of strengthening the ruble has been achieved, with the government believing these restrictions are necessary to avoid financial pain, and that these restrictions will be lifted once the risks subside.

Financial Repression

Returning to World War II, these countries have now implemented capital controls, and their domestic capital is trapped within their borders, with limited investment options available to their citizens. What did the state do next to seize its citizens' inland capital and redirect it toward the war effort? They happily offered debt obligations to patriots to help fund the fight. Where possible, I have attempted to compile a figure representing the actual yields of various "war bonds" or other government bonds issued during and after the war.

U.S. War Bonds

Fortunately, the U.S. Treasury wrote an excellent report on the history of financing during World War II. While I do not have a similar report for other countries, note how the funds were raised and the rationale provided. Here is an excerpt from that report, with comments adding real color.

By early 1941, public debt was rapidly expanding. As defense spending injected funds into the economy and removed consumer goods from the market, the danger of price inflation was increasing. There was an obvious need to extract surplus funds from the spending stream and store them for future use, thereby helping to alleviate inflationary pressures during this critical period.

This is Economics 101—government spending crowds out the private market. If the government needs a water tank, you cannot have a washing machine.

The government created new bureaucracies to promote the newly issued war bonds. Art created by famous artists helped persuade ordinary citizens to part with their scarce capital.

America's entry into the war brought many new problems to the government that could only be solved with public help. Rationing—protection—human resources—allocation of scarce materials—these are just some key programs that required public cooperation (in addition to purchasing war bonds).

It was clear—I couldn't have said it better myself.

Even when selling small bonds to small investors went very smoothly, people realized this raised a tricky question: could a voluntary bond program really work, or did it have to be designed as a system of forced loans to the government (i.e., forced savings)?

…

Only Treasury Secretary Morgenthau, with President Roosevelt's support, opposed the plan (to force ordinary citizens to hand over their savings to the state). His point was that a voluntary approach was the "democratic way"—but even he was forced to admit that if the upcoming war loan campaign failed to produce the expected results, some form of mandatory savings might indeed have to be considered.

If the public does not voluntarily provide the state with what it needs, the state must accept it. While the "mandatory" option was never taken, the U.S. Treasury was always prepared to do whatever it took to fund the war, even if it meant depriving its citizens of their property rights.

The following chart shows that the U.S. issued $186 billion in war bonds between 1941 and 1945.

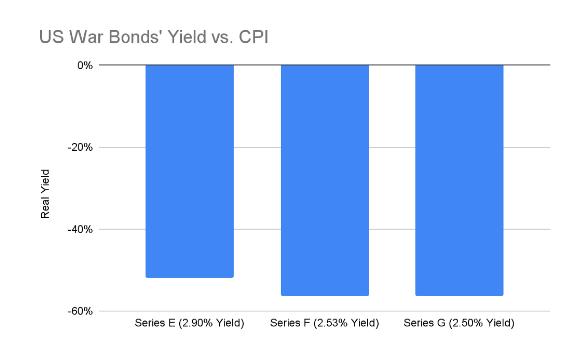

Were war bonds a good investment? That depends on how you define "good." If by "good" you mean that bondholders' income exceeded inflation, then the following chart can refute any notion that these were "good" investments.

These bonds had maturities of 10 to 12 years. Assuming you bought the bonds at issuance and held them to maturity, the chart above shows the actual amount you lost. This is indeed shocking.

But from the government's perspective, the war bond campaign was a tremendous success. During the war, the public voluntarily surrendered hundreds of billions of scarce capital. This capital was used to arm and feed the military rather than compete for limited consumer goods and fuel domestic inflation.

United Kingdom

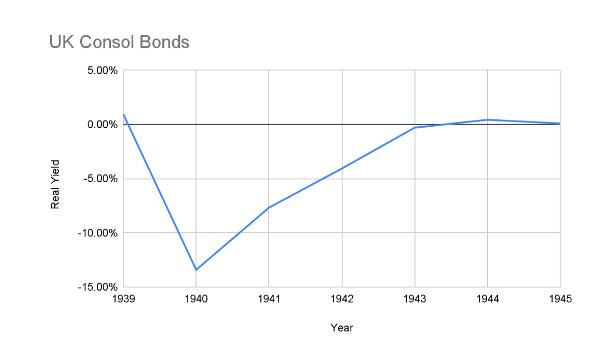

The UK's Consol bonds are the longest-issued bonds of any modern nation, running from 1756 to 2015/16. But here, we will focus on the real yields of these bonds during and shortly after the war.

During the wartime period from 1939 to 1945, holders of Consol bonds actually lost 24%. Thank you for your participation!

Germany

In an insightful paper titled "Financing the German Economy During World War II," author Zdenka Johnson made the following points about confiscated capital and measures to fund the war effort:

Then, merchants trading with the Reich had to accept that up to 40% of payments for goods and services were made in the form of interest-free tax notes (Steuergutscheine). These vouchers could be used to pay future tax obligations to the state and also provided tax benefits. This debt instrument simultaneously solved several problems—the government obtained very favorable loans, reduced cash expenditures, and did not have to issue as many government bonds. After a six-month regulatory period, private companies "lent" the government nearly 5 billion marks.

Opportunities to invest in private securities were severely limited. For banks and private investors, in fact, there was no choice but to invest in [government securities]. In 1940, primarily savings banks provided 8 billion RM to the state, nearly 13 billion the following year. By the end of 1944, two-thirds of savings were in securities, of which 95% were state bonds.

Both during and after the war, Germany followed the standard prescription for how to fund a war. Lock up capital, then force it to lend to the state at negligible rates.

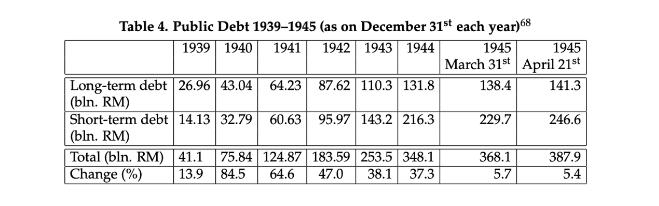

As mentioned above, the confiscated capital of individuals and businesses was forcibly lent to the state. While I could not find reliable datasets on bond yields and consumer price indices, below is a chart detailing how public debt ballooned during the war. I did find one data point on yields indicating that the yield in 1939 averaged 3.9%, dropping to 3.5% in 1942. Yields fell, but public debt grew 4.5 times. Typically, when supply increases dramatically without a surge in demand, prices must fall. When bond prices fall, yields rise. Thus, even with limited data, we can observe how the government saved money by forcing the public to "invest" idle capital in the state, as yields were lower.

Japan

We do not have wartime bond or inflation data.

While no government bond yields exceeded inflation, winners at least got back their principal plus interest. German bondholders faced outright default and severe legal challenges in collecting their debts after the war. It shows—being a winner is worth it.

Today's Conflicts

So far, no major power has begun selling "war bonds," primarily because, technically, the U.S./NATO and Russia/China are not at war. However, in today's era of increased capital mobility, keep a close eye on the rules and regulations regarding how public and private pension/retirement accounts must invest. The global baby boomer generation holds trillions of dollars in "savings" in these managed pools. Governments deliberately craft rules so that this capital can only flow into "approved" investments. Watch for more restrictions on how retirement savings can be invested, prioritizing the state over everything else.

Food Rationing

Now we will introduce the last major form of economic control exercised by governments during wartime—food rationing—and its impact on prices and citizens' wages during World War II. Before I begin, I should note that in the case of World War III, food rationing may not look the same as what occurred during World War II. I think we are more likely to see food shortages rather than direct food rationing. However, I expect the impact of food shortages on prices and cultural effects to be similar—therefore, it is still useful to review what happened during the rationing period.

Japan

The official rationing system was first implemented in 1938 and gradually expanded by 1942 to include "almost all basic necessities." As Junko Baba pointed out, rationing was conducted under the slogans "luxuries are the enemy" and "do not crave before victory." Rations were systematically controlled, monitored, and distributed in limited amounts to each household through neighborhood associations (tonari-gumi) across the country.

In 1939, rice supplies were controlled by the government, and rationing of consumer goods began in 1940. By 1942, rice, wheat, barley, and rye were monopolized by the government. Despite police efforts, the black market—or rather, the free market—thrived, facilitating the exchange and sale of various consumer foods.

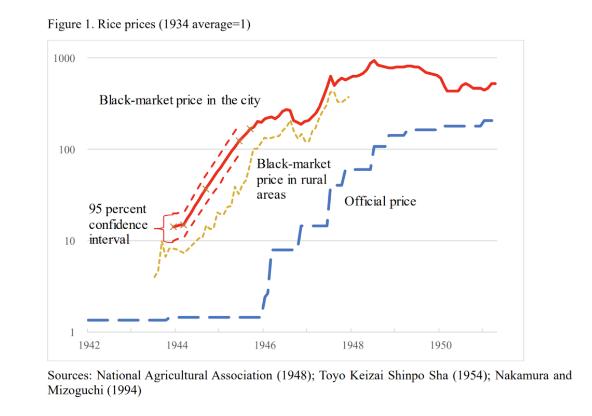

Here is an example of how much price disparity there can be for a basic commodity.

Rice Prices During World War II

If you have been to Japan (or anywhere in Asia), you know how important rice is to the general diet. In the samurai era, the samurai class was paid in rice (called koku).

As you can see in this log chart, the "real" price of rice was sometimes ten times higher than the official price. Given the large rationing of basic foods, if you wanted to consume freely, or even at all, you had to pay exorbitant prices for rice.

Unless your income increased tenfold after the war broke out, the fiat currency you hid in your mattress would have lost 90% of its purchasing power for rice. I ask you, what is the value of fiat currency when you cannot even afford a bowl of rice?

I do not have such charts to illustrate the free market prices of basic foods in the U.S., U.K., and Germany, but I will briefly describe the food rationing systems of other wartime countries.

United States

The U.S. implemented widespread rationing to assist the war effort. Tires, sugar, meat, milk, coffee, and more could only be purchased using government-issued ration points. As Laura Schumm pointed out, "On January 30, 1942, the Emergency Price Control Act authorized the Office of Price Administration (OPA) to set price limits and ration food and other goods to prevent hoarding and ensure fair distribution of scarce resources. Managing rationing was a complex bureaucracy with over 8,000 local offices reassessing point allocations monthly. Different population groups received different benefits, and everyone received a non-transferable coupon booklet. Families were encouraged to plant 'victory gardens' to provide as much of their own food as possible.

If you think going to the DMV is bad (for non-Americans, imagine your frustrating visit to a government bureaucratic office), imagine wading through the swamp of bureaucracy to feed your hungry children.

United Kingdom

The U.K. began wartime rationing in 1939, managed by the Ministry of Food. Basic goods (meat, sugar, cheese, etc.) and most products (grains, biscuits, rice) were distributed via coupons. While fruits and vegetables were never rationed, long lines and shortages made it a daunting task for most housewives to supply their households. Distribution varied among different populations, with workers receiving larger shares, children receiving more fats, and mothers receiving more milk, and so on. The government also encouraged growing crops at home, which they called "victory gardens."

Germany

Rationing in Germany began in 1939, shortly after hostilities commenced. Individuals received cards (updated every four weeks) and were allocated food points. Although a strict rationing system did not come into effect until 1942, shortages of meat, eggs, milk, bread, and other items were evident throughout grocery store aisles for the previous three years. Germany also differentiated rations by individual (more for laborers, mothers, Jews, etc.). Unsurprisingly, the country also experienced a thriving free exchange market.

Today's Conflicts

The U.S., Europe, Russia, and China have not begun rationing food. But remember, history is an imperfect guide to the future. While food rationing previously helped feed the hungry in pursuit of glory, today's food rationing—for all countries ultimately involved in World War III, or all countries relying on these great powers for food exports—may look different.

Think about it, most of us can afford to stare at computer screens for a living because of modern agriculture. We use fossil fuels to power mechanized agricultural equipment and leverage our industrial chemical knowledge to mass-produce fertilizers. This means very few people are employed as farmers without negatively impacting our massive modern agricultural output. In short, industrialization and urbanization have shifted humanity from farms to cities.

Imagine a world where countries producing disproportionate amounts of global fertilizers restrict exports to hostile nations. Imagine a world where countries acting as the "world's workshop" refuse to export the critical components needed to build and operate industrial mechanized agricultural equipment. Imagine a world where energy flows are disrupted to the extent that fossil fuels needed to power agricultural machinery simply do not exist. The result would be a sharp decline in agricultural output, followed by famine in certain countries.

Given that millions are not fighting on battlefields, they must be fed, I expect shortages caused by restricted exports and low agricultural output to replace the more direct shortages caused by providing food for soldiers during World War II. At this point, as Logan Roy eloquently asked, "What’s the price of a pint of milk?"

Your domestic fiat currency will not keep up with this food inflation. If you are experiencing food inflation, it means your country structurally lacks the necessary components of modern agriculture, and no amount of money printing can solve this deficit. Governments always resort to quotas and subsidies to relieve pressure—but they never work and only exacerbate the problem. Why would a business risk trying to solve this issue when the government will ultimately seize their property to feed the people?

At this point, the free market will emerge like mushrooms after rain. The past free market was physical, but if physical cash is banned and only electronic forms of currency are accepted, then free market goods will be priced in electronic currencies that the state cannot seize. I predict that the currency of the free market will be Bitcoin.

Exit Strategy

If you take away anything from the previous section, it should be that governments have a variety of tools to strengthen financial loyalty and limit your investment capabilities—history shows that this control (along with other wartime impacts) often causes significant harm to civilians' personal finances.

With this in mind, the best time to escape wartime capital controls is before they are enacted. Remember, currently, your fiat net worth is zero, and you can decide for yourself when to access your bank accounts, stock portfolios, and real estate. However, when the state says Nyet to capital freedom, the game is over.

In this digital age, we must be very thoughtful about what constitutes fiat digital financial assets and what constitutes true decentralized cryptocurrencies. If you think you are escaping EU capital controls by transferring your euro bank balance to a CHF bank balance, you are missing the point. Any digital asset held within the banking system, regardless of currency, is fair game for confiscation. You must completely exit the system.

The value and transmission network of Bitcoin do not rely on government-chartered banking institutions. Therefore, it exists outside the system, "beyond money." Of course, the government can shut down the internet and the power grid. But by then, your country has already lost the war. Rather than worrying about your financial assets, you better hope you have a passport from another country to escape to greener pastures.

The government can also easily prohibit converting fiat currency into Bitcoin, which may prevent capital from escaping its control. However, it may not be able to confiscate Bitcoin from those who already hold it—that's the point.

The Intrinsic Value of Bitcoin

At any time, there is no mathematical method to prove that a specific public Bitcoin address belongs to me or that I can access the Bitcoin contained in that address. It can only be reasonably determined that I can access that address at a specific date and time if I sign a message spending Bitcoin outputs. This is revolutionary and not fully understood by most.

For all other currency assets, I can easily determine who owns it without assuming the owner has taken discrete actions. If you say you have a gold bar, I can see the gold. If you say your bank balance is $1 million, I can ask the bank to confirm. If you say you own that house, I can ask the government whose name is on the deed. But for Bitcoin, just because I suspect a public address might belong to you does not mean you can actually access the funds in that address.

Moreover, Bitcoin has no physical manifestation; I can submit my Bitcoin private key to memory and spend funds at any time without anyone knowing. There are no external visible clues about how much Bitcoin I own.

The key is that you can discreetly convert fiat assets into Bitcoin. Bitcoin has no mass. Converting $1,000,000,000 into Bitcoin weighs the same as converting $1 into Bitcoin, while converting $1,000,000,000 into gold weighs several tons. Protecting several tons of gold from the greedy eyes of the state is extremely difficult. A gold bar in the bank, fiat currency in the bank, or your house can also be stolen without your consent.

For those who want to take "your" Bitcoin, they either need to know your private key (i.e., your password), or they need you to sign a transaction transferring Bitcoin to the state. But what if you "forget" the password to your Bitcoin wallet? Well, then the funds will be completely inaccessible. Thus, while the state can enact laws to grant itself ownership of specific public addresses, enforcing these laws will be quite difficult—because the state cannot control the Bitcoin contained in those wallets without your consent.

Of course, they have a very simple way to obtain your consent. State agents equipped with blunt instruments or firearms can access your residence and demand that you sign a transaction transferring Bitcoin to the state. You might protest that you "forgot the password," leading to agents "enhanced interrogation," like breaking your knees or shooting you non-lethally. At that point, you might remember your private key—but you might also not. If not, you could become a permanent cripple, or your life could be extinguished, depending on your decision, but they still cannot obtain your Bitcoin.

How Bitcoin Will Survive

Assuming:

A total world war

Capital Controls

With these two assumptions, how can Bitcoin be mined? Remember, mining is necessary to keep the network running, as mining is essentially the act of verifying and confirming transactions.

Clearly, any country that enacts modern capital controls may prohibit Bitcoin mining on its territory. So how will the network operate if major economies are fighting each other?

One side may decide to use Bitcoin as a financial weapon. If a group of flags believes that the operation of the Bitcoin network will economically weaken their opponents, game theory suggests they may allow miners to exist. However, this is naturally a fragile relationship, and if the state decides at any time that mining Bitcoin has achieved its purpose, it may prohibit and confiscate any related machines.

Alternatively, there are always neutral countries in any conflict—these neutral countries gain significant economic returns by allowing both sides of the war to coexist within their borders. Switzerland did not participate in either World War, despite being quite noisy in Central Europe. Switzerland does not inherently have abundant natural energy, but imagine another country with rich natural energy (like hydro or geothermal) deciding to take a neutral stance like Switzerland. This would be an ideal location for Bitcoin miners to operate. Miners would be heavily taxed, but at least they would be allowed to exist. Bitcoin could continue, and neutral countries would become the birthplaces of crypto capital havens.

Finally, remember that before 2013—when ASICs were first commercialized—Bitcoin mining could be profitably conducted by hobbyists using personal computers. It goes without saying that the network's hash rate was much lower at that time, but the beauty of Bitcoin's self-correcting nature of difficulty is that it creates the possibility of recovery for Bitcoin mining, allowing it to return to an activity that can be profitably conducted by ordinary computer users, rather than just capital-rich mining enterprises. If commercial mining is explicitly or implicitly banned, if enterprising individuals still find value in supporting the network that underpins digital people's currency, the network can still operate.

Price Conversion

Readers may also be frustrated that I have not provided price predictions if economic warfare escalates. The moment war becomes "total" for both sides is the moment you lose all options to protect yourself economically. The fiat price of Bitcoin is no longer a thing. Who cares how many dollars/euros/yens/renminbis/rubles, etc., it takes to buy one Bitcoin when you are prohibited from converting fiat currency into anything other than domestic government bonds?

At this point, I expect the price of Bitcoin to shift from fiat exchange rates to oil exchange rates. Oil is the energy that drives modern civilization. The ownership goal of Bitcoin is to maintain sustained purchasing power over oil. "Bitcoin per barrel of oil" will become the new exchange rate.

The goal is to maintain financial flexibility in the face of unpredictable wars. 100% of your financial capital should never be parked in just one currency instrument, whether it be Bitcoin, domestic fiat currency, bonds, stocks, real estate, commodities, or gold. However, the opportunity to transfer fiat assets into Bitcoin and other "real" assets only exists today, and may not exist tomorrow. Keep this in mind.