Miles Deutscher outlines the FTX and SBF crisis

Original author: milesdeutscher

Original source: Twitter

Compiled by: Qianwen, ChainCatcher

SBF was once revered as the king of crypto, but now rumors are rampant that Alameda and FTX are on the brink of bankruptcy.

I will briefly discuss how SBF and FTX got into trouble:

SBF was long seen as an idol in the field—his arbitrage trading, founding FTX and Alameda, and successful large investments, such as $SOL.

He amassed a huge net worth at his peak, estimated to be between $10 billion and $14.5 billion.

Recently, FTX has been busy leading the financing of new projects, with Aptos and Sui being two examples.

He has always been adept at manipulating the market—despite the chaos caused by Luna, he leveraged the situation to continue implementing aggressive expansion plans:

- Helping BlockFi through a $400 million lifeline

- Bidding for Voyager's assets

- Considering funding Celsius

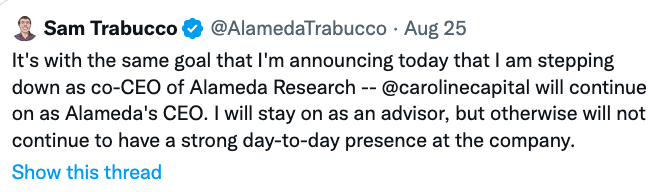

However, beneath the thriving facade, cracks began to appear. Alameda CEO Sam Trabucco suddenly resigned, raising alarms.

A month later, FTX President Brett Harrison announced his resignation.

After that, reports emerged that FTX was facing investigations from securities regulators over some legal issues.

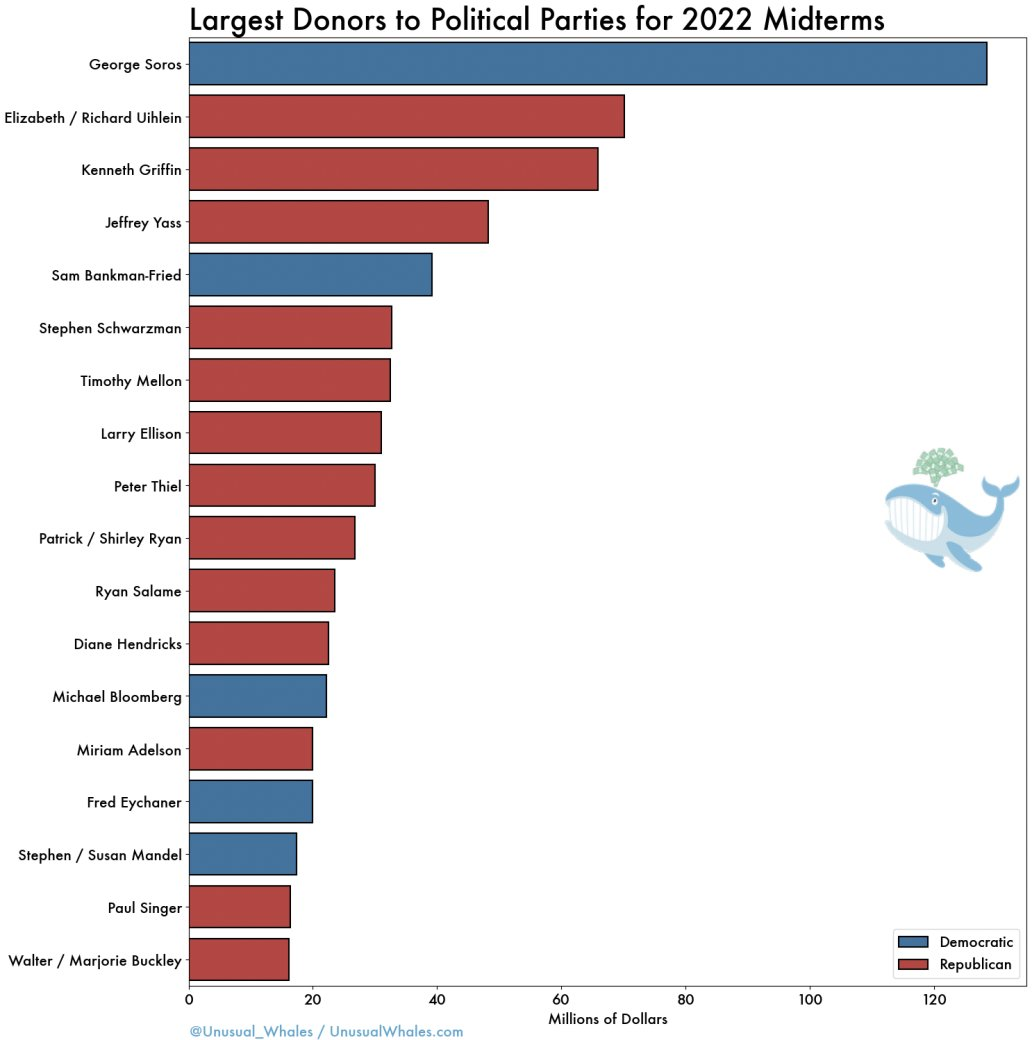

SBF intended to enter politics, having donated nearly $50 million for the upcoming midterm elections. Previously, he announced plans to donate $1 billion for the 2024 U.S. presidential election (which he later backtracked on). Clearly, political interests were on his mind.

Public sentiment towards Sam grew increasingly negative, peaking after the DCCPA bill draft was leaked.

Sam seemed to have been supporting the bill. Despite trying to play the "good guy" on Twitter, the entire bill had clear signals indicating it could pose a significant threat to DeFi.

Key figures from multiple industries expressed opposition to the bill, most notably Bitboy, who was also making some efforts.

Erik Voorhees famously questioned SBF's stance during an interview with Bankless, a clip of which circulated online, leading to heightened skepticism within the cryptocurrency community.

The damage Sam inflicted on the public was immense. People realized that his intentions might differ from what was initially perceived, leading to a shift in public sentiment. This change in sentiment foreshadowed a series of events that further fueled market anxiety.

On Wednesday, Alameda's balance sheet was leaked, raising concerns as it showed that "the net assets of Alameda's business are actually thin tokens centrally controlled and printed by FTX." ------ Cory Klippsten.

Dylan LeClair also analyzed some concerns surrounding the balance sheet in a tweet.

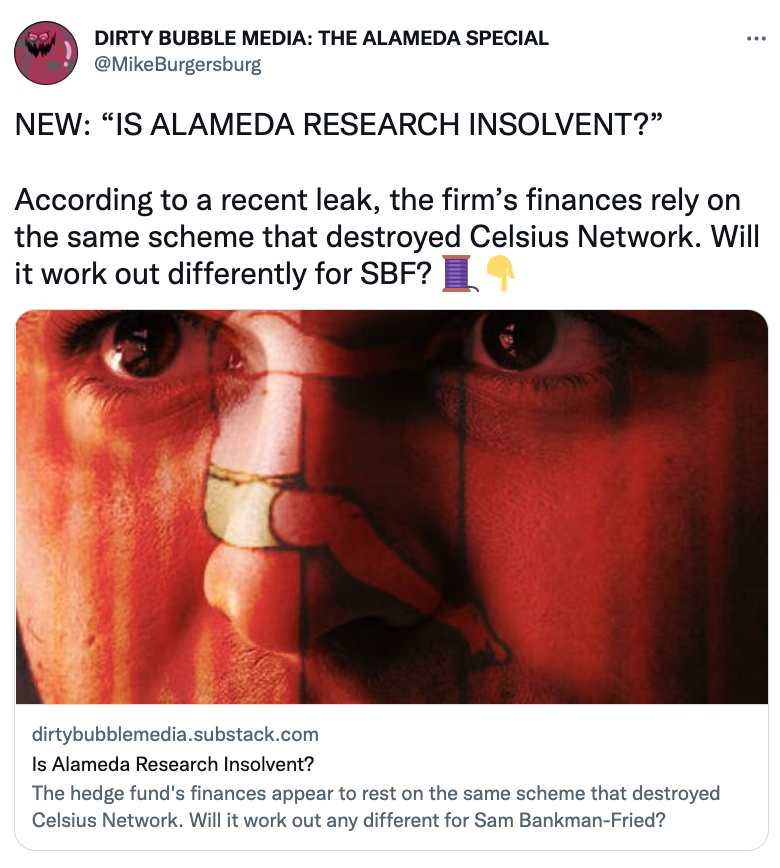

An account initially called Celsius' collapse published a report titled "Is Alameda bankrupt?" suggesting that it was "at least unstable."

More rumors began to spread, and the market entered a full-blown FUD. News of FTX's bankruptcy intensified.

Then, we saw a massive transfer of $584 million worth of FTT to Binance. CZ confirmed that it was indeed Binance that executed the transfer.

CZ announced his decision to "liquidate any remaining FTT on our books," indicating that Binance was exiting its holdings of $FTT.

CZ fired shots at Sam, stating that their sale of FTT was "a lesson learned from $LUNA." CZ also mentioned SBF's lobbying activities, indicating he "would not support covert lobbying against other industry players."

As a result, FTX's main token $FTT was sold off, dropping 15% from its weekly high, but found strong support around the $22 range.

Alameda's CEO Caroline was forced to respond to CZ's token sale. In my view, this response was desperate, more like a warning. We all know what happened the last time someone tried to "stabilize everything."

More importantly, $FTT was not the only concern; Alameda held other tokens that could face downward pressure if the situation worsened.

Doubts surrounding FTX intensified, with people eager to withdraw assets, leading to significant capital outflows. The threat of a "bank run" loomed, with some forced to wait four hours to process withdrawals.

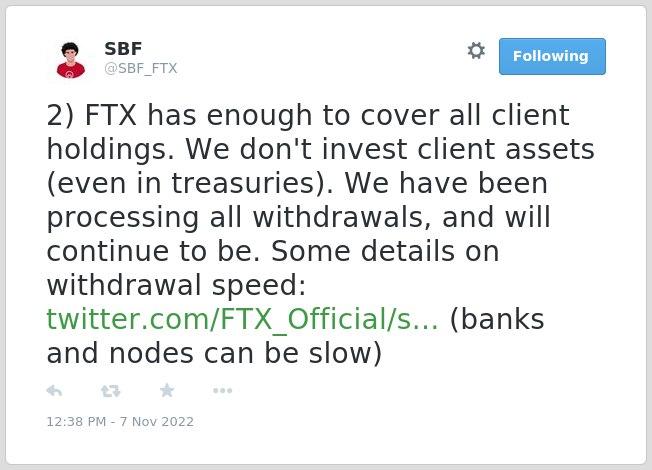

Sam had previously responded, claiming that FTX had no issues and that assets were fine. However, that tweet has since been deleted, with media speculating that it was likely to address upcoming legal challenges.

However, I remain cautious about this situation; after all, where there’s smoke, there’s fire.