What exactly happened with Alameda Research?

Original Title: 《What happened at Alameda Research》

Written by: milkyeggs

Compiled by: Katie Gu, Odaily Planet Daily

The New York Times published a "whitewashing" article about SBF yesterday, prompting rebuttals from various insiders. This article will provide a glimpse into the FTX incident from the perspective of Alameda Research, and how SBF, Sam Trabucco (former co-CEO of Alameda Research), and Caroline Ellison (current co-CEO of Alameda Research) burned through over $20 billion in fund profits and FTX user deposits.

It is important to clarify that we do not fully understand what exactly happened at Alameda Research and FTX. However, we have enough information to grasp the bigger picture. Through investigations by Twitter users, forum anecdotes, and official news, the history of these two closely linked companies begins to become clear.

Without witness testimonies and a comprehensive financial investigation, our accusations are merely provisional. Any given piece of information may be flawed or even fabricated. However, by connecting the currently available data, we can outline a credible timeline:

- SBF, Trabucco, and Caroline (possibly) started with good intentions but were not particularly suited to run a trading company;

- During the bull market of 2020-2021, Alameda Research gained substantial paper profits through leveraged long trades and illiquid stock trading;

- Although Alameda was initially profitable as a market maker, their advantages eventually diminished and became unprofitable;

- Despite achieving success in some discretionary positions, overall, due to excessive discretionary spending, illiquid venture investments, uncompetitive market-making strategies, reckless lending practices, rigid internal finances, and a general lack of organizational capability, Alameda and FTX continued to lose substantial amounts of money and liquidity during 2021-2022;

- In early 2022, when recalling loans, an emergency decision was made to use FTX user deposits to repay creditors;

- This method of debt repayment stimulated increasingly unstable trading operations and gambling, ultimately leading to complete bankruptcy.

Alameda Research May Have Lost Over $15 Billion

Most news reports seem to depict the scale of the bankruptcy as relatively small. For example, The New York Times suggests that user deposits were used to cover venture capital funding.

Similarly, Matt Levine's column seems to imply that the decline in the value of FTT, which was used as collateral, led to a massive imbalance between assets and liabilities.

Both of these claims overlook a key part of the story. First, FTX lost approximately $8 billion in user collateral. Even considering the total venture capital amounts of FTX and Alameda, as well as the marginal decline in collateral value due to the drop in FTT prices, it is entirely unreasonable to claim that FTX has $8 billion in liabilities. These losses are significant, but they alone do not fully explain FTX's bankruptcy.

In addition, it is widely believed that FTX and Alameda profited handsomely together because:

- FTX had high trading fees, coupled with a large user trading volume;

- Significant risk trading was conducted with tokens like SOL, MAPS, OXY, SRM;

- There was likely "collusion" between Alameda and FTX, allowing Alameda to have an advantage over other market makers on FTX.

While it is difficult to calculate their estimated profits in exact dollar values, these channels, especially the lucrative risk trading, brought at least $10 billion in profits to Alameda and FTX.

Thus, a larger mystery remains. It seems that Alameda and FTX successfully squandered profits worth $15 billion (possibly more). Notably, there has yet to be a comprehensive account of the situation. We may never know where all that money went. However, we provide some individual hypotheses that, when combined, can reasonably explain the losses of $15 billion or more.

Alameda's Market-Making Advantage Diminished, They Started Going Long

Alameda was considered a highly capable and profitable market maker. But is this view really accurate?

Despite the backgrounds of Alameda's core circle (SBF and Caroline from Jane Street, Trabucco from SIG), having a few years of experience in a trading company does not make you a business genius. While this may have been considered highly competitive in the cryptocurrency market of 2019, it is far from the precision of price trend predictions in traditional finance. As larger, more capable, and well-capitalized market makers like Tower and XTX began trading in the cryptocurrency market, Alameda gradually lost its edge.

"When you lose your advantage, you start to neglect your market-making situation and become a speculator." Several statements from Alameda executives support this theory. For example, Trabucco described a news-based trading strategy in April 2021:

It should be noted that he was essentially describing leveraged cryptocurrency market testing, as an emerging narrative adopted by institutions, which is entirely similar to the reasons many retail traders invested in cryptocurrency in 2021.

He also described his bullish stance on DOGE for months, as Elon Musk frequently discussed DOGE on Twitter.

There is no doubt that their long positions in BTC and DOGE made money. Some might say this was quite a savvy trade. Perhaps this was not "quantitative trading" at all, and Alameda was clearly expanding into areas outside their expertise, making their advantages difficult to quantify and seemingly unrelated to their professional domain. They may have made money in public trades, but how did they fare in winning trades?

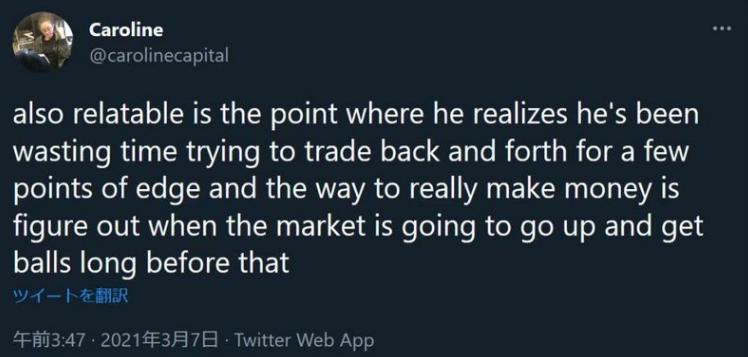

Caroline strongly hinted a month ago that she preferred to bet on long positions rather than pick up pennies in the algorithm jungle:

These strategies performed well in a bull market, as almost all long positions were rising. Notably, Trabucco attributed their success to trading skills rather than simple market testing.

We can speculate that their trading strategy was a combination of (1) negative-margin market making and (2) free long positions. In fact, the less profitable their algorithmic trading became, the more likely people were to assume they would compensate for all losses by going long on BTC and DOGE. In terms of net worth, they likely made substantial profits in most trades during 2020-2021, but once the market began to reverse at the end of 2021, their overall economic gains and losses may have declined significantly.

Alameda did indeed make many correct free trades. Buying Solana at low prices, accumulating a large amount of low-float Solana ecosystem tokens, boosting the overall Solana ecosystem, purchasing oversold liquidations, etc. But there is a sense that perhaps they became overconfident from their bull market experience, ultimately overestimating their trading abilities, leading to subsequent losses. They used illiquid ecosystem tokens as collateral for loans instead of selling them in a consistent manner. They believed market-making behavior was justified because it generated inflated trading volumes on FTX, which in turn justified a higher risk valuation for the exchange.

Alameda Is a Disorganized and Mismanaged Trading Company

Working for a top trading firm for a few years clearly does not mean you are a top trader, nor does it mean you excel at organizing business practices.

A former Alameda employee shared a description of internal practices on an "effective altruism" forum. This comment is merely a narrative based on the commenter’s personal memory; however, certain details mentioned above have been corroborated by personal accounts shared with me privately, leading me to believe that Alameda's internal operations experienced incredible financial losses—poor bookkeeping, arbitrary free trading under SBF's guidance, mismanagement, and astonishingly poor organization.

These descriptions align with many stories I have heard from reliable sources (both firsthand and secondhand), pointing to SBF's poor capital management. For instance, a friend of mine, whose company received venture capital from FTX, mentioned that although Alameda fell far behind in its commitment to provide monthly status updates, no one ever bothered to follow up. Other accounts are similarly consistent, describing the company culture as "intuitive."

When you have only a vague understanding of a company's books, especially considering the astonishing amounts of money FTX spent on advertising, brand deals, and other discretionary expenditures, it is likely they did not realize the severity of their situation until their loans began to be recalled after the LUNA crash. When you really need to raise funds and find yourself short on cash, you are forced to confront massive losses, which may have tempted SBF and others to use FTX's customer deposits to cover their hoped-for temporary deficits. This, in turn, spawned more depraved and riskier forms of gambling trading.

SBF Is Unstable, Reckless, and Possibly Incompetent

Isn't it strange that a group of former traders would engage in such reckless behavior? While we know very little about Caroline and Trabucco personally, fortunately, we have many stories about SBF as a manager.

It is clear that SBF has a "huge risk appetite," as confirmed by a former employee of FTX. SBF has also publicly denied the applicability of the Kelly criterion (a formula used to determine the optimal size of bets in gambling and investing) to the size of his bets.

Why would SBF be so insistent on deliberately exaggerating his stakes? Is it purely due to a muddled thinking about the optimal strategy for long-term growth? Another hypothesis is that, aside from a natural inclination for risk, he may have been taking dopaminergic drugs (prescription medications for Parkinson's disease) as a sedative. It is well known that these drugs can lead to dangerous behaviors such as compulsive gambling or shopping sprees.

Autism Capital recently shared a description from a former FTX employee detailing how SBF encouraged extreme stimulant use. This aligns with SBF's self-admission of using stimulants as "performance enhancers."

FTX's massive spending on advertising and brand partnerships was likely a strategy to attract deposits, but part of the reason may be due to SBF's ongoing abuse of these drugs. FTX acquired naming rights to the esports organization TSM for an astonishing $210 million, far exceeding similar deals in the esports industry. Even his real estate acquisitions are shocking, with reports indicating he owns a $200 million real estate portfolio in the Bahamas. These do not seem like high-risk bets with positive expected value. Either the executive management is incompetent, or as we said, he was actually on drugs and making crazy acquisitions. SBF exhibits clear deficiencies in overall capability and cognitive ability.

In the past 24 hours, SBF has been posting the riddle "What happened" on Twitter word by word, with some tweets spaced hours apart.

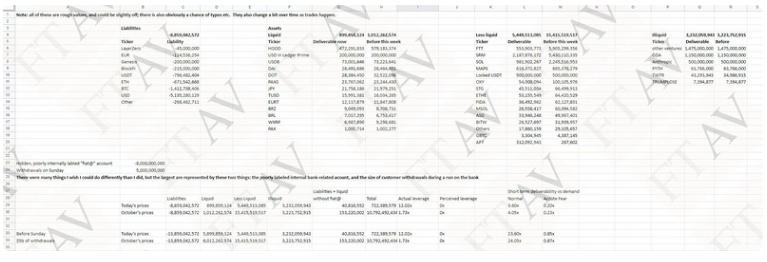

Is this widespread lack of capability the reason why FTX's balance sheet (provided by SBF earlier last week) is so absurdly oversimplified?

If the observations about SBF's character and abilities are half true, they would largely explain Alameda's losses. (Although he officially resigned as CEO, he certainly maintains close ties with Caroline and Trabucco.) In particular, once customer deposits were scrutinized, he likely attempted to become even more reckless in increasingly desperate attempts.

Collusion Between Alameda and FTX Led to Huge Algorithmic Trading Losses

For a long time, there have been suspicions that FTX and Alameda were essentially colluding, with Alameda jumping the gun before tokens were launched and possibly having special privileges to bypass risk checks, which has been corroborated by multiple reports. (API traders on FTX are notoriously known for experiencing high latency, which may essentially be a deliberately designed obstacle that only Alameda can bypass.)

Doug Colkitt speculated that this could have led to an "algorithmic trading collapse," similar to the infamous Knight Capital Group incident in traditional markets.

Reports from private communications suggest that the losses incurred could exceed $1 billion. Of course, there may be other factors I am unaware of. Without access to FTX's records, it is difficult to truly confirm or deny these claims, although the sources are credible, and I tend to believe them. If true, the scale of these losses could be a major reason for the overall losses of FTX and Alameda.

Loans Collateralized by FTT/SRM Led to Reflexive Liquidations

A trusted friend (not an insider) anonymously shared a theory with Autism Capital. In summary, it revolves around SBF's series of increasingly desperate attempts to support a series of loans backed by illiquid junk coins (FTT/SRM) facing reflexive liquidations. Due to token emissions, even maintaining their price at a constant level requires continuous capital inflows, which continually increases Alameda's exposure to these tokens while depleting their cash reserves. Ultimately, they did not have enough funds to meet customer withdrawal demands while preventing a series of liquidations of collateral.

I am not sure if this theory fully explains the losses suffered by FTX and Alameda. However, it does explain part of the reason.

This theory aligns well with Caroline's admission that FTX transferred customer deposits to repay recalled loans after the LUNA crash. In particular, it explains why FTX assisted insolvent companies like Voyager and BlockFi. Aside from loans recalled by other entities like Genesis, this means that the short-term demand for cash would be enormous and unpredictable. If Alameda had already been operating with poor bookkeeping, especially if they had significant exposure to the risks of the LUNA crash itself, it is conceivable that SBF and others felt they had no choice but to tap into customer deposits.

Conclusion

We do not actually know how Alameda and FTX squandered billions of dollars. But we can attempt to roughly estimate their potential losses (in dollars):

- Acquisition of Voyager/BlockFi: $1.5 billion

- LUNA exposure: $1 billion

- "Knight Capital-style" algorithmic collapse: $1 billion

- Maintenance of FTT/SRM collateral: $2 billion

- Venture capital: $2 billion

- Real estate, branding, and other unnecessary expenditures: $2 billion

- FTT drop from $22 billion to $4.4 billion: $4 billion

- Poor outcomes from free long positions: $2 billion

- Total: $15.5 billion

This is a very rough estimate. I do not know how much they lost on LUNA, nor do I know how much they spent on long positions in junk coins. I have not calculated their total venture capital amounts, nor have I added up the amounts for each of their brand partners. However, the overall situation is clear. With enough potential sources of loss, even if some numbers are off, it is now at least conceivable how they could have incurred such astonishing losses. There are many reasons that could lead to losses far exceeding $15 billion.

I make no claims about the ultimate truth of the above information. My aim is to compile this content into a coherent narrative, leaving readers to draw their own conclusions.