How will the Ethereum merge affect stakers' income and taxes?

Author: Seun Gbri

Compiled by: 0x11, Foresight News

Stephen Covey once said that there are three things that are eternal in life: change, choice, and principles. However, we should add a fourth: taxes. Almost everyone in the crypto world is talking about the merge; how does the merge affect ETH holders? What does it mean for the environment? Another key question is whether more taxes will need to be paid after the merge. We will explore the tax implications of ETH after the merge and its impact on stakers.

How Does the Merge Affect Your Income and Taxes?

We will examine this issue under different scenarios: what happens to the ETH in your wallet that was not staked before the merge? What happens when you stake ETH?

No country or region has established specific tax regulations or guidelines on how to handle your ETH after the merge. For tax purposes, the merge may be classified as a soft fork. U.S. tax law has rules regarding the definition of a soft fork; according to IRS FAQ 30, a soft fork occurs when there is a protocol update (like the merge) but does not result in the creation of new cryptocurrency.

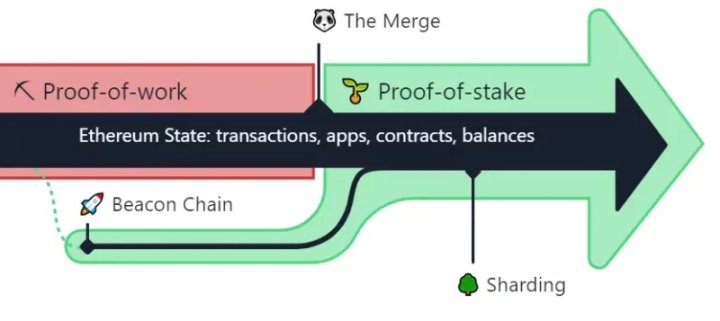

According to IRS guidelines, a "soft fork" occurs when a distributed ledger is updated through a protocol change that does not result in a transfer of the ledger or the establishment of new tokens. You do not receive any new cryptocurrency from a soft fork; instead, you remain in the same position as before the fork, meaning you do not receive any rewards. In fact, a soft fork leaves you in the same situation as before and does not generate additional income, which means it is not a taxable event. This aligns perfectly with what happens during the Ethereum merge; the merge does not create a new Ethereum chain. It makes Ethereum faster, more scalable, and less harmful to the environment. The old chain will merge with the Beacon chain; no new income is created; all transaction histories are preserved.

Assuming you have 5 ETH in your wallet, with no new income generated; instead, the Ethereum ecosystem converts your PoW ETH to PoS ETH after the merge.

What Happens if You Staked ETH Before the Merge?

You might wonder how you could stake ETH before the merge. Wasn't the purpose of the merge to introduce a staking mechanism? Before the merge, some exchanges offered staking services; however, the merge completely eliminated the PoW mechanism and converted all ETH to PoS ETH, requiring you to lock your ETH to earn rewards, thus necessitating the staking of your PoW ETH (the ETH before the merge). To lock your ETH, you must convert it to "ETH 2" or "ETH 2.S," which represent the staked ETH.

Note that different exchanges use different names for staked ETH. Coinbase, Binance, and many other exchanges refer to it as "ETH 2," while Kraken calls it "ETH 2.S." Since "ETH 2" is merely used as a "label," this staking before the merge is also a soft fork, and the tokens are essentially the same, just distinguished by a new name, without creating new cryptocurrency. For example, suppose you spent $200 in 2019 to purchase 5 ETH, and then a year later, you staked them by converting to ETH 2 on Binance. The converted ETH is now worth $5000. Regardless of the price, this transaction does not incur taxes because it does not generate new income.

How Do Different Types of Staking and Jurisdictions Affect Taxes?

Before the Ethereum 2.0 network is supported, stakers will not have access to the original ETH deposited or the staking rewards. This means that ETH 2 rewards are illiquid.

Should These Illiquid Rewards Be Taxed?

There are no clear rules defining the nature of PoS ETH staking income, so we will use the closest guidelines to determine how staking taxes are applied. We will reference several jurisdictions, but countries have different tax laws and guidelines.

The closest guideline in the U.S. is the mining tax guideline: Notice 2014 - 21. Although receiving staking rewards on ETH 2 is a taxable event, you do not need to file an income tax return until you can use, manage, and exchange the rewards. If you stake 5 ETH on Binance this year and receive 0.5 ETH as a staking reward a month later, you do not need to report the income because it cannot be spent yet. However, suppose Binance allows you to access the 0.5 ETH staking reward in 2025, and the price of 0.5 ETH is now $350; you now have the right to handle that $350, so you can report it as income (you can spend it). Most stakers typically cannot access rewards before such functionality is enabled for PoS ETH.

The closest guideline in Canada is the mining tax guideline: Guide for Cryptocurrency Users. Generally, in Canada, you do not need to pay taxes unless you are mining on a commercial scale. What does this mean for Canadians' illiquid staking rewards? Like in the U.S., you do not need to pay taxes until you have full control over the funds; as mentioned, you do not need to file an income tax return until you can use, manage, and exchange the rewards. The main difference is that if this staking is done as a "hobby" or "for fun," you do not need to report any income tax even if you can spend the staking rewards.

Note: Both "amateur miners" and "commercial miners" pay capital gains tax, but income tax differs.

Suppose you staked 5 ETH on Binance this year and received 0.5 ETH the following month, which cannot be spent yet, but it is in your wallet. Now it is 2025, and Binance allows you to withdraw the 0.5 ETH, which is now priced at $350; you do not need to pay income tax on that $350 because you cannot be classified as a "commercial staker."

Now consider Almorok ventures staking 300 ETH and receiving 30 ETH in rewards. It is now 2025, and Binance has allowed Almorok ventures to access their staking rewards; they must pay taxes on the staking rewards because they are staking for "commercial purposes."

Note: The terms "commercial purpose" and "for pleasure" are typically determined by various factors.

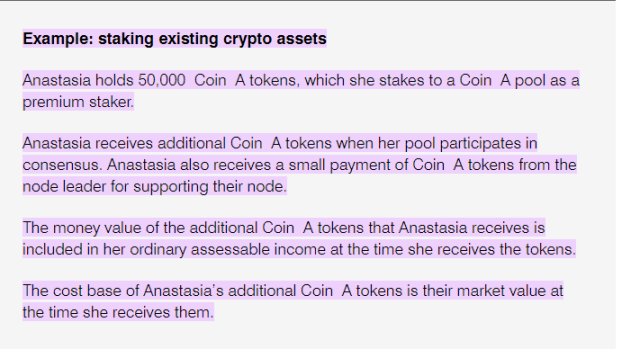

Australia has established guidelines for staking rewards, with the ATO specifying how to report staking rewards: Staking Rewards and the Roles of Forgers In Australia, you do not need to report taxes to fully receive staking rewards. Once you can use those funds, you must report the rewards you can dispose of and capital gains tax (after sale).

In the UK, there are also HMRC regulations regarding staking rewards: Crypto Assets Manual. The specific facts will depend on whether such staking constitutes a taxable transaction (cryptocurrency as trading income), considering various variables including:

Scale of activity

Organization

Risk

Commerciality

You do not need to pay taxes until you fully receive the staking rewards. After receiving staking rewards, you must report income tax on the staking rewards, CGT, or corporation tax on chargeable gains (CGTC).

Liquid Staking

Staking protocols like Lido, RPL, and Marinade Finance also offer liquid staking derivative tokens. Liquid staking not only provides the ability to earn rewards through staked cryptocurrency but also allows stakers to continue using their locked assets for investment and yield in other activities. Therefore, both the staked ETH and the staking rewards you receive can be controlled and invested in other activities. Rewards obtained from liquid staking are taxable income.

This means you do not have to wait for a period before you can fully access your staking rewards. Thus, once you receive staking rewards, you can dispose of (sell, exchange, etc.) them.

Converting ETH to stETH is a taxable event because it differs from the ETH you own; it allows you to receive staking rewards that you can use and control, and the price of stETH is not entirely pegged to ETH, so stETH should be taxed upon receipt. You should report immediately after receiving reward income. Additionally, when you sell stETH, it triggers another taxable event.

For example, you exchange your 5 ETH (costing $5000) for 5 stETH worth $5500. In the following year, you will receive 0.5 stETH worth $500. Your tax will be $500 (5500 - 5000) in capital gains and $500 in ordinary income (subsequent rewards from stETH).

How Does This Differ from Non-Liquid Staking Taxes in Each Jurisdiction Mentioned?

In the jurisdictions mentioned above regarding non-liquid staking rewards, you must wait to gain access before filing taxes, but in liquid staking, you report staking rewards as income when you receive (you receive rewards immediately) and sell rewards, triggering another taxable event, and file in the U.S.

In Canada, you must be a "commercial" stakeholder to report income tax, while everyone reports capital gains tax (CGT) upon disposal.

In Australia, each (commercial and recreational) stakeholder reports other income upon receipt and CGT upon disposal.

An Example from Australia Illustrating How Your Taxes Work After Receiving Liquid Staking Rewards

In the UK, the situation depends on factors such as commerciality, risk, scale of activity, and organization. Any cryptocurrency rewards given for mining and staking (upon receipt) are generally taxed as income; if mining activities do not constitute trading, any necessary expenses will reduce the taxable amount.

If the activity meets the trading criteria, income must be determined according to applicable tax laws. If a "staker" retains the rewards, they will pay CGT or CGTC upon disposal of the rewards.

Conclusion

The proof-of-stake mechanism has significantly changed the Ethereum ecosystem. However, from a tax perspective, there is no reason to feel afraid. While this article does not discuss how staking rewards after the merge will constitute taxable income, it answers questions about how to value them.