From near bankruptcy to an 800-fold turnaround in a bear market, how did Fantom become a model that embodies the long-term value of blockchain?

Written by: Dust Technology

"On the brink of bankruptcy, turning around 800 times in a bear market, sitting on 1.5 billion."

Once these keywords come out, you can understand why I want to specifically talk about it.

Fantom once secured funding during the bull market, but shortly after, it entered a trough. According to the worst-case scenario, the money on the books at that time was insufficient for it to survive for another 4 years. No one expected that transitioning from a bull market to a bear market, in the blink of an eye, its current assets are sufficient to last for another 30 years without any issues.

From a company "on the brink of bankruptcy" to "resurrected," it has become a company that continuously generates revenue and has particularly strong growth, with its value rising strongly and the token value also increasing. So today, we will look at how Fantom has become a model for long-term value in blockchain by examining its operational mechanism and token status.

The birth of Bitcoin in 2009 represented a significant technological advancement and further moved society towards greater efficiency. However, Bitcoin was not built for scale, and the consensus mechanism that powers the blockchain is inherently limited in design.

Currently, the solutions we commonly see make trade-offs among three aspects: scalability, security, and decentralization. This is known as the blockchain trilemma.

For example, Bitcoin focuses on decentralization and security, which makes it less suitable for any transactions that require speed and quick confirmations, such as daily payments, data transfers, asset trading, or other transactions that consumers and businesses rely on in daily life.

Especially in traditional financial systems, from backend processes to consumer-facing solutions, high throughput and quick finality are required. Providing bank-level security while also decentralizing these services on a large scale is a challenge for the entire blockchain industry.

Today, we present a scalable, decentralized smart contract platform, Fantom, which utilizes a PoS model to secure the network. The protocol was established by the Fantom Foundation in 2018 and uses its proprietary Lachesis consensus mechanism, which can support multiple blockchain layers on top of it. Fantom is a high-performance, scalable, EVM-compatible, and secure smart contract platform that provides ledger services for enterprises and applications. The mainnet deployment, Fantom Opera, is built on Fantom's Lachesis consensus mechanism. Fantom is a leaderless, asynchronous consensus and Byzantine fault-tolerant first-layer blockchain protocol.

Lachesis enables Fantom to provide fast transaction speeds, low transaction costs, and deterministic finality. This is achieved while maintaining permissionless, decentralized, and open-source characteristics.

Its high-speed consensus mechanism, Lachesis, allows digital assets to operate at unprecedented speeds and offers more improvements than current systems. It is characterized by speed, security, and high scalability. These features enable organizations, businesses, and individuals to develop decentralized applications that can be used in the real world across a wide range of industries.

For example, distributed ledgers like Bitcoin can be said to have strong security through their consensus protocols and decentralization, but they sacrifice speed as a result. Fantom addresses this challenge by implementing asynchronous Byzantine fault tolerance ("aBFT"). Fantom's aBFT consensus allows transactions to be processed asynchronously, improving transaction speed and throughput compared to synchronous BFT ledgers like Ethereum and Bitcoin. Fantom achieves decentralization and security through a permissionless and leaderless consensus protocol, allowing anyone to join and leave the network at any time, with all nodes being equal.

For example, distributed ledgers like Bitcoin can be said to have strong security through their consensus protocols and decentralization, but they sacrifice speed as a result. Fantom addresses this challenge by implementing asynchronous Byzantine fault tolerance ("aBFT"). Fantom's aBFT consensus allows transactions to be processed asynchronously, improving transaction speed and throughput compared to synchronous BFT ledgers like Ethereum and Bitcoin. Fantom achieves decentralization and security through a permissionless and leaderless consensus protocol, allowing anyone to join and leave the network at any time, with all nodes being equal.

Fantom's aBFT consensus, Lachesis, can scale to many nodes around the world in a permissionless open environment, providing a good level of decentralization. It does not use delegated proof of stake and has no concept of "master nodes."

FTM token

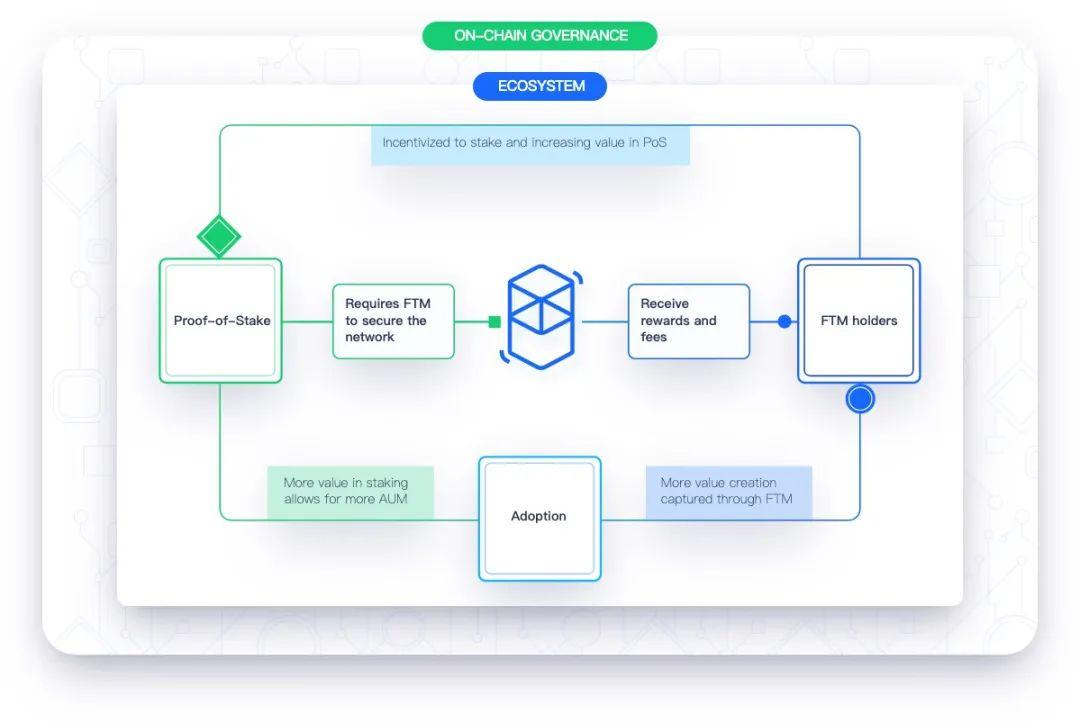

FTM is the primary token on the Fantom network. FTM is used to secure the network through staking, governance, payments, and fees. The total supply is 3.175 billion FTM. Currently, 2.1 billion are in circulation, while the remainder is reserved for staking rewards. If rewards remain at current levels (depending on governance decisions), it will take more than two years to distribute all rewards and achieve full circulation of the total supply.

The supply is distributed across different token standards to ensure easier trading. The total number of tokens will never exceed the cap of 3.175 billion FTM.

Currently, FTM can be purchased on all major cryptocurrency exchanges. The exchange with the highest trading volume and lowest slippage is Binance. FTM can be used as a native mainnet token, ERC-20 token, and BEP-2 token. Below is the classification of the different FTM tokens currently in circulation:

Opera FTM: Used on Fantom's mainnet Opera Chain

ERC20: Exists on the Ethereum network

BEP2: Exists on the Binance chain

Opera is a fully decentralized blockchain network that integrates smart contracts for applications. It is compatible with the Ethereum Virtual Machine and powered by Fantom's aBFT consensus. Therefore, smart contracts developed on Ethereum can run on Opera, with improved scalability and security.

Opera is a fully decentralized blockchain network that integrates smart contracts for applications. It is compatible with the Ethereum Virtual Machine and powered by Fantom's aBFT consensus. Therefore, smart contracts developed on Ethereum can run on Opera, with improved scalability and security.

Fantom's Opera network is fully compatible with the Ethereum Virtual Machine (EVM). It also features Web3JS API and RPC support. All smart contracts written in Solidity or Vyper, compiled and deployed on Ethereum, are fully compatible with the Opera network. Fantom's Opera network supports all smart contract languages that are EVM-compatible, including Solidity and Vyper.

The FTM token has many use cases within the Fantom ecosystem.

The FTM token has many use cases within the Fantom ecosystem.

1. Ensuring Network Security

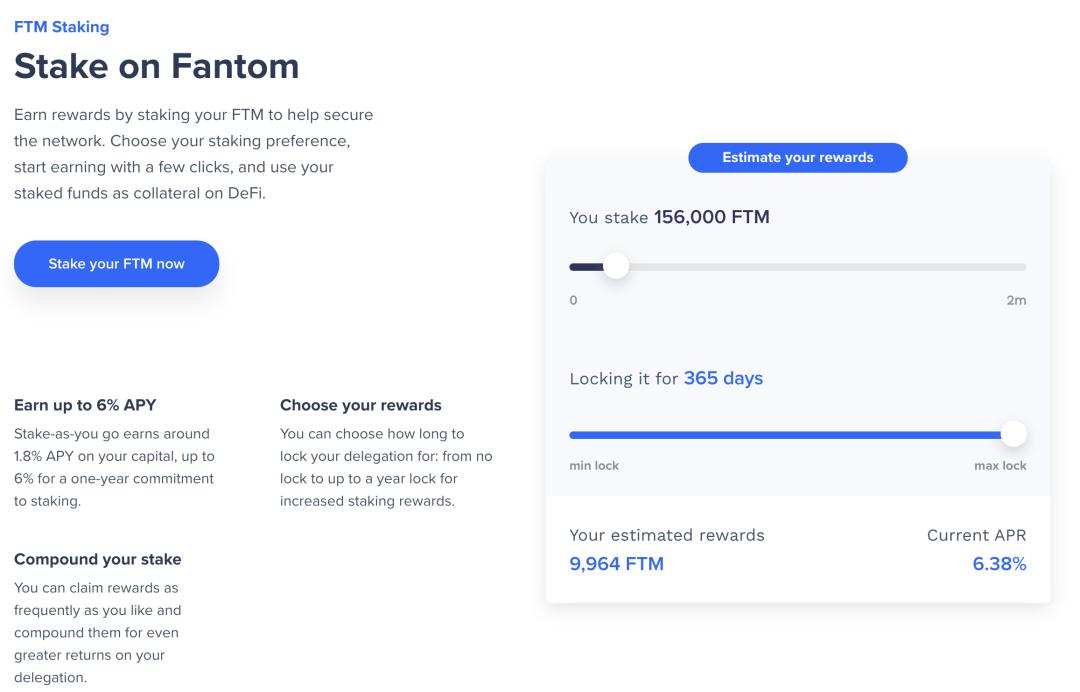

Fantom uses a Proof-of-Stake system that requires validators to hold FTM. Anyone with at least 1,000,000 FTM can run their own validator node to earn rewards and transaction fees. Each FTM holder can choose to delegate their tokens to a validator (while fully retaining custody of their funds) to earn staking rewards. Validators then charge a small fee for their services. By locking their FTM, validators help the network achieve decentralization and security.

2. Paying Network Fees

To compensate validators for their services and prevent transaction spam, every action taken on the Fantom network requires a small fee. This fee is paid in FTM.

3. Voting in On-Chain Governance

Decisions regarding the Fantom ecosystem are made through transparent on-chain voting. Votes are weighted based on the amount of FTM held by an entity. Essentially, 1 FTM equals 1 vote, with FTM serving as the governance token, allowing validators and delegators to vote on network parameters such as block rewards and technical committees.

4. Other Use Cases

FTM will be used as collateral for the upcoming Fantom DeFi suite. Staking on Fantom is intended to ensure the security of the Fantom network. The Opera network uses Proof-of-Stake: validators and delegators contribute to network security by staking their tokens and will be rewarded for it.

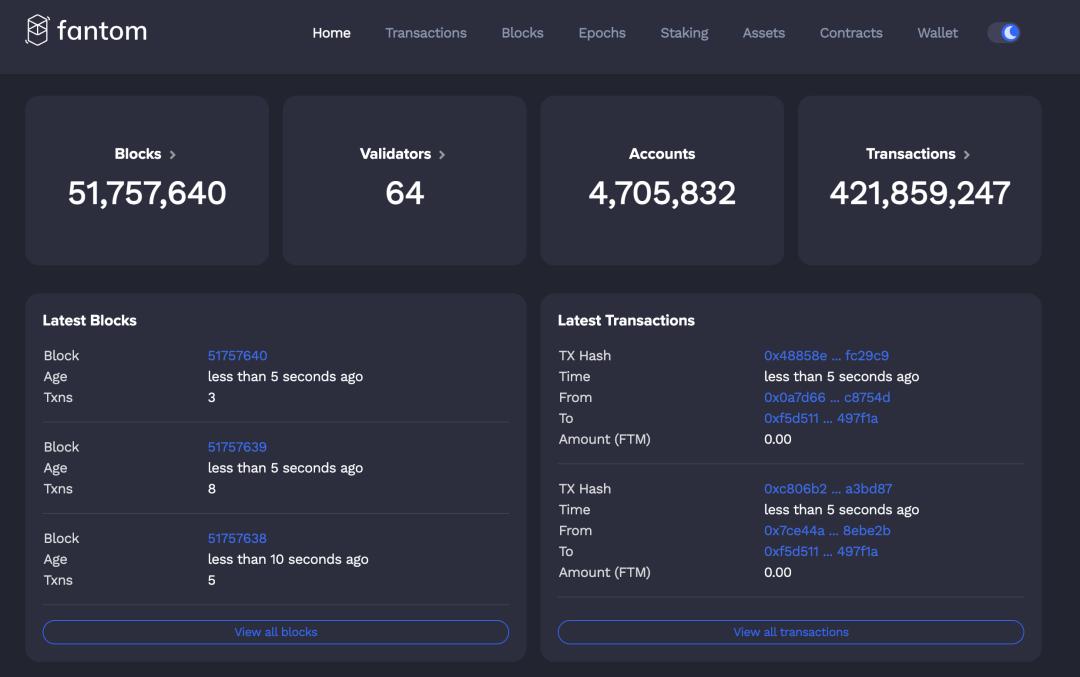

Looking at the Data

Based on publicly available information, I have compiled data on important milestones for Fantom: On June 16, 2018, Fantom raised $40,000,000, most of which was in ETH.

In December, Fantom converted ETH to USD, significantly lower than the price at which it was raised, leaving less than five million dollars. Major expenses included over $3,000,000 for exchange listing fees and over $500,000 for KOL sponsorship fees. Subsequently, the project team decided to stop paying for exchanges and KOLs, completely cutting off marketing for Fantom. They only hired essential staff, and C-level employees reduced their salaries, with some working for free.

By February 2020, Fantom's non-FTM funds were down to just over $3 million, while 45,000,000 FTM was worth approximately $400,000. Fantom began actively participating in decentralized finance, using profits to buy FTM, with a target of growing to $8 million by the end of 2020.

In March 2020, expenses reached $600,000/year, and the project team earned a 20% annual interest rate on $3 million, resulting in a profit of $600,000/year. Fantom then began considering scaling up.

By February 2021, profits exceeded $1 million/week. By May, liquid assets reached $300,000,000, with over $1.5 billion in the treasury.

As of November 2022, which is now, it holds over 450 million FTM, $100 million in stablecoins, $100 million in crypto assets, and $50 million in non-crypto assets, with annual expenses of about $700,000.

Looking at it now, it can still last for another 30 years without touching the FTM.

Revenue/Earnings

Validators: Fantom operates 9 validators, holding a total of 60,708,615 FTM. They earn approximately 4,182,823.5735 FTM/year.

Delegators: Fantom has delegated about 60,000,000 FTM to Fantom validators. They earn approximately 4,100,000 FTM/year.

Network Revenue: The Fantom ecosystem earns 10% of all transaction fees. The average daily transaction fee is 30,000 FTM, generating over $1,000,000/year. The average fee per transaction is less than $0.005.

DeFi Revenue: Fantom earns approximately $5.98 million from various DeFi strategies across the entire Fantom and Ethereum ecosystems.

Fantom's current revenue exceeds $10,000,000/year, excluding any capital gains.

Talking About Experience

Fantom's value journey has also been volatile, and it has learned lessons along the way. For instance, when it initially spent money on advertising and influence, it could only foresee a remaining "lifespan" of about 4 years.

Fantom quickly realized that it no longer needed to compete with rivals over integrations, listings, and partnerships.

The Fantom Foundation holds relatively few FTM, with most common L1s holding 50%-80% of the token supply. At launch, Fantom held less than 3%, which has now increased to 14%. The most direct way to acquire FTM is through purchase, and there are very few ways to obtain it through partnerships.

The project team believes that validators are not part of the foundation, and this is done to support the network we believe in and earn fees for it.

However, this is not Fantom's core business (the core business is to build the most scalable and powerful L1 chain). Apart from ETH, Fantom's non-forked L1 has been operating for over 4 years and hopes to continue for at least another 30 years. Therefore, it aims to promote development in a sustainable manner.

Another point from Fantom that I think is very valid is that if the revenue model is solely selling tokens, then this cannot sustain long-term survival. If DeFi did not exist, many companies would likely not be able to operate today.