SBF Lawsuit 12 Key Points Summary

Author: @Compound 248

Compiled by: Moni, Odaily Planet Daily

On December 22, former FTX CEO Sam Bankman-Fried (SBF) was extradited from the Bahamas to New York, USA, and detained by the FBI. Last week, federal prosecutors in New York announced an indictment involving eight charges, and if convicted on all counts, he could face decades in prison.

Former Alameda Research CEO Caroline Ellison has admitted to conspiring to commit wire fraud against FTX customers, wire fraud against Alameda Research lenders, commodity fraud, securities fraud, and money laundering, among seven charges, which could result in a maximum sentence of 110 years; FTX co-founder Gary Wang has admitted to conspiring to commit wire fraud against FTX customers, commodity fraud, and securities fraud, among four charges, and could face up to 50 years in prison.

Based on leaked legal documents submitted by the U.S. Securities and Exchange Commission in the Southern District of New York, we have outlined 12 key points of the case:

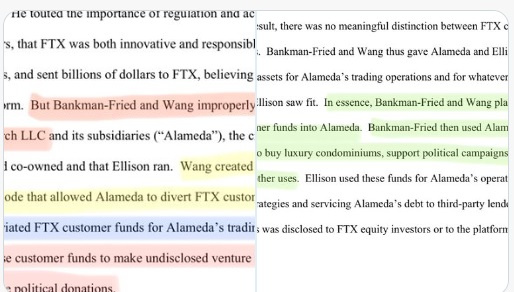

- SBF told colossal lies; Gary Wang created a "backdoor" for Alameda Research to facilitate money laundering, while Caroline Ellison turned Alameda Research into SBF's personal fund, allowing SBF to wildly purchase real estate, venture capital, and donate to American politicians.

- Caroline has admitted that SBF instructed her to do many things, including directing her to take customer funds from FTX in exchange for FTT tokens, which contradicts SBF's repeated claims that he was unaware of FTX taking customer funds. Clearly, Caroline no longer wants to collude with SBF and is now trying to bring him down.

- In May 2022, Alameda Research realized that things were going wrong. At that time, the fund had already "borrowed" billions of dollars in FTX customer assets, but the severe volatility in the crypto market made it impossible for Alameda Research (including SBF) to fulfill its borrowing obligations, resulting in SBF becoming increasingly frantic, instructing Caroline to take more money from FTX customers.

- SBF had been plotting for a long time. In fact, a large number of shameless violations had been secretly executed for a long time, peaking in 2022. SBF had started this behavior years ago, so the problems with FTX are not a recent "incident," but rather a "premeditated fraud" that has been years in the making.

- SBF and Gary Wang owned 100% of Alameda Research shares. When mentioning Alameda Research, one can almost substitute "SBF" because SBF owned 90% of the fund's shares, while Gary Wang owned the remaining 10%—Alameda Research had no customers; all the money was stolen from customers by SBF and Gary Wang.

- SBF has always had absolute control over Alameda Research. Even when Caroline and Sam Trabucco were appointed as co-CEOs of Alameda Research in 2021, SBF still maintained control over the fund, frequently communicating with fund employees and having complete access to the fund's books and trading records—"Alameda belongs to SBF alone" is absolutely true.

- Alameda (SBF) was "excluded" from FTX's risk management processes. As many know, FTX, as a cryptocurrency exchange, indeed had a decent risk engine, but SBF and Alameda Research were not included because SBF could easily issue FTT, a "junk coin," as collateral.

- SBF is the culprit behind the loss of up to $8 billion in FTX customer funds. SBF directed Alameda Research to execute a series of violations, transferring $8 billion of FTX customer funds directly into Alameda's accounts, which essentially constituted "loans," and SBF could even make Alameda (which is actually SBF himself) not pay any interest.

- SBF has committed securities fraud. Among the many fraudulent acts committed by SBF and others, one is securities fraud. The U.S. Securities and Exchange Commission has already filed a lawsuit against SBF; just imagine how SBF lied to potential investors to raise new funds, undoubtedly making the situation "worse."

- FTT is a "security." SamCoins, ShitCoins, Web3 "Tokens," or even "magic beans," no matter what you call it, the FTT token is definitely not what you imagine a cryptocurrency to be. SBF lied to every investor and manipulated the price of FTT. Now, the U.S. Securities and Exchange Commission has also clearly stated: FTT is a "security."

- SBF was not engaged in cryptocurrency lending; what he was doing was "money laundering." If your fund "borrows" customer assets and then "lends" that money to yourself, and all transactions are not even recorded, is that "lending business"? Isn't that just blatant money laundering?!

- FTX customers withdrew $5 billion in a single day, with a funding gap of $8 billion.

Summary: The above are the 12 key points of the SBF lawsuit. More lawsuits against him and his accomplices are expected to emerge, pushing SBF towards his ultimate fate.