CGV Research: Where will Web3 applications with 1 billion users emerge?

Author: Shigeru

Original Source: https://medium.com/@CGVFoF/the-road-to-one-billion-users-of-web3-applications-f616682e1b17

Today, Web3 is no longer just a theoretical concept or a buzzword; many people have high hopes for it as a technological revolution that could disrupt the internet.

However, looking globally, there are still very few Web3 applications with a massive user base, and Bitcoin may be the only one that can barely be considered the most well-known and widely used Web3 application.

- Former Web3 advocate and Twitter founder Jack Dorsey, who converted the first tweet into an NFT, stated that you do not own Web 3.0; venture capitalists and their limited partners do, and Web 3.0 will never escape their (financial) incentives;

- Moxie Marlinspike, founder of the encrypted communication app Signal, candidly remarked after developing two DApps: Web3 may be a false proposition;

- PandaDAO, which raised 1900 ETH, initiated a dissolution process less than a year after its establishment, simply because "the core work of the community is voting, leaving no time for actual work"…

Many people wonder: from today's perspective, the world of Web2 is certainly better than Web1, but will the world of Web3 be better than Web2 in the future?

Without users, what is there to discuss? The natural selection of users determines the prosperity of the Web3 world.

In the world of Web2, Facebook has over 3 billion global users, YouTube and WhatsApp have over 2 billion users, and WeChat and TikTok have over 1 billion users.

In contrast, in the Web3 world, data from cryptocurrency payment company TripleA shows that in 2022, there were over 320 million cryptocurrency and Web3 users globally, approximately 4.2% of the world's population. If we compare the current user base of Web3 to the internet, the conclusion is that Web3's development stage is roughly equivalent to the late 1990s of the internet. Andreessen Horowitz (a16z) predicts that Web3 may soon reach 1 billion users. So, what fields might give birth to applications that truly scale Web3 users to the billion level?

Steering Clear of "Pseudo-Web3 Applications" Dressed in Web3 Garb

Separating the false from the true. Not all applications claiming to be Web3 are truly Web3 applications.

First and foremost, GameFi is a major hotspot for "pseudo-Web3 applications."

GameFi, by definition, consists of two parts: Game + Finance, simply referring to players earning cryptocurrency by playing games. Market-leading GameFi games, such as Axie Infinity and DeFi Kingdoms, have not made a significant impression on the 3 billion global gamers and have gradually entered a death spiral with the downturn of the cryptocurrency market.

Take Axie Infinity as an example. Since 2021, it has been market-favored by promoting the idea that "blockchain games can make the global economy fairer and provide more opportunities for people around the world" by allowing players to "play to earn." However, 14 months later, most people no longer play this game; they generally feel angry and anxious, with some even losing thousands of dollars.

A healthy GameFi project will have a complete internal and external ecological mechanism, such as obtaining real external revenue through brand collaborations and other commercial partnerships. In contrast, GameFi projects relying on Ponzi models for user growth see early users' earnings coming from the principal invested by later users. If the project's income cannot keep pace with the growth of liabilities, a collapse is only a matter of time.

The NFT sector, primarily focused on profile pictures (PFP), also faces similar issues.

In the past, PFP almost became synonymous with NFTs. When NFTs are mentioned, one immediately thinks of the Bored Ape Yacht Club, which can sell for hundreds of thousands of dollars. However, without functional support, effective incentives for creators, and a healthy cycle, the vast majority of PFP projects hold very little value, merely seeking recognition from a community to support their worth. Compared to the market peak in early 2022, the overall trading volume of the NFT market has declined by over 90%, and the prices of mainstream PFP projects have generally dropped by 60-70%, with other projects faring even worse.

Additionally, the once-booming metaverse projects show stark contrasts; compared to Roblox's 202 million monthly active users and Minecraft's 141 million monthly active users, Web3 projects like Sandbox have only 200k monthly active users, and Decentraland has only 56k. This raises the question: are the valuations of Decentraland and Sandbox inflated?

It can be said that, aside from the aforementioned fields, there are numerous "pseudo-Web3 applications" in areas like DeFi, DID, DAO, and Sociafi. Their existence may be a product of capital bubbles or a historical legacy of technological growth cycles, overshadowing many truly valuable Web3 applications.

It's Time to Return to the Essential Value of Web3

Starting from first principles, let us return to the essence of Web3 and gain insight into its next development direction.

Web3 is widely regarded as the industry form closest to the "value internet." In fact, Web3 is not a simple upgrade based on Web1 and Web2; its core is to build a new type of network that is decentralized, co-creates value, and distributes it according to contribution, granting users true data autonomy.

So, how should we define "Web3 applications"? Based on industry perspectives, the CGV Research team believes that Web3 applications are those based on blockchain technology, using tokens as tools or mediums, starting from solving users' actual needs, and supporting users in interactive operations to achieve value creation, distribution, and circulation. Clearly, Web3 applications are not a panacea for all problems, nor are they suitable for every scenario. If one creates Web3 applications merely to align with the Web3 trend, it will ultimately lead to failure. What exactly are Web3 applications suitable for, and what are they not suitable for?

This question deserves continuous contemplation from all those involved in entrepreneurship and investment in Web3. I strongly agree with Alex Xu of Mint Ventures that the underlying value of Web3 lies in its permissionless and global nature, providing an unprecedentedly vast free market in terms of scale and boundaries, while open-source code and verifiable data lower the trust costs, leading to prosperity.

Thus, "freedom" and "trust" are the core advantages of Web3 and its essential value.

In terms of freedom, this includes: the free combination and migration of assets, protocols, identities, product matrices, intellectual property, and more; in terms of trust, the characteristics of immutability and transparency based on blockchain technology enable Web3 to establish a new type of trust relationship distinct from traditional trust built on justice, violent authority, customs, and culture.

For a Web3 application suitable for a business scenario, if it is not well-designed in terms of "freedom" and "trust," and lacks thoughtful business planning, it will face significant challenges in future operations.

For instance, projects that aim to put real-world assets on-chain (such as synthetic assets, STOs, etc.) do not escape the original credit system (based on legal and governmental asset rights), and simply grafting onto Web3 is unlikely to succeed; whereas projects that are natively Web3, with assets and business flows entirely on-chain, naturally possess the dual attributes of freedom and trust, giving them an inherent advantage.

In addition to leveraging the advantages of "freedom" and "trust" in Web3, having a basic commercial logic is also fundamental to ensuring the sustainable operation of Web3 projects.

Looking back at the phenomenon of the Web3 application StepN in 2022, while it attempted to address multiple issues such as product growth, fundraising, and corporate governance with an X-to-earn economic model, which is commendable, it later faced a Waterloo-like decline. The biggest issue with StepN is similar to the aforementioned GameFi problem: the project's business model is not sound, failing to create much external ecological value, and instead converting long-term debts (NFT sales revenue) into cash income, weakening the project's value creation capability.

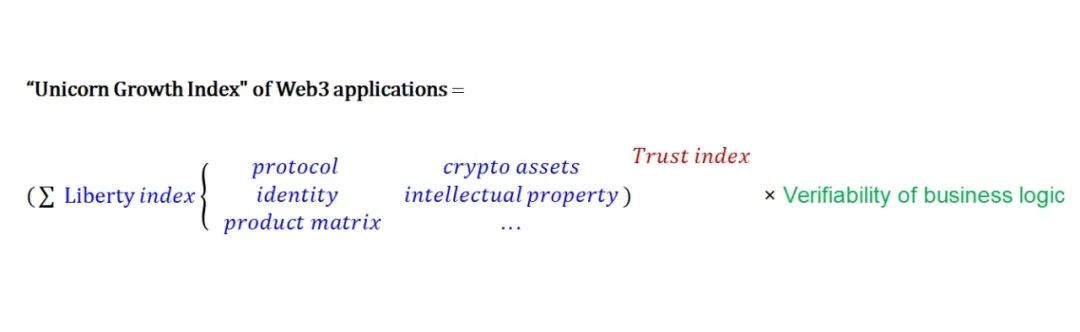

Therefore, the CGV Research team believes that the success of Web3 applications relies on the foundational digital elements of "freedom" and "trust," along with verifiable commercial logic; all three are indispensable. Based on this, we propose the "Unicorn Growth Index" of Web3 applications:

6 Types of Web3 Projects with "Unicorn" Growth Potential

1. Mobile Crypto Wallets

Freedom Index: ☆☆☆☆

Trust Index: ☆☆☆☆

Commercial Model Verifiability Index: ☆☆☆☆☆

Web3 Unicorn Growth Index: ☆☆☆☆☆

Crypto wallets possess dual attributes, serving as both asset accounts and symbols of identity. The first step for users to engage with the Web3 world is to open a crypto wallet, whether by creating an account on a centralized exchange, registering a decentralized wallet, or purchasing a hardware wallet; users need a wallet to enter Web3.

In 2009, Bitcoin enabled the existing asymmetric key pair technology to be used for writing into public databases, thus creating the first "crypto wallet"; in 2016, MetaMask was officially launched, opening the door to dApps, unlike previous wallets and platforms that focused solely on interacting with cryptocurrencies like Bitcoin.

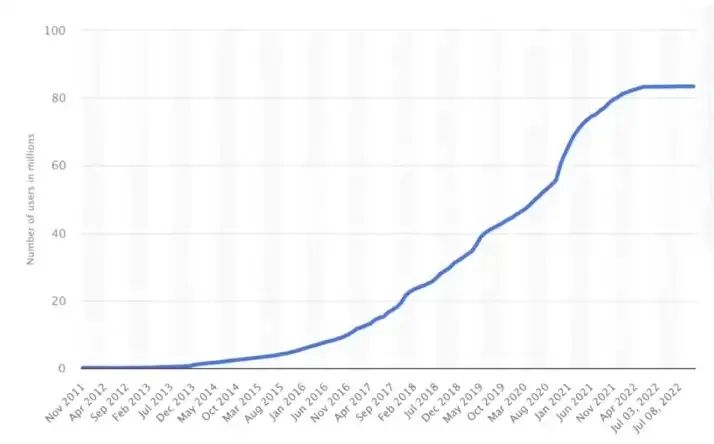

Global Wallet Users from November 2011 to July 11, 2022 (in millions)

Data Source: https://www.statista.com

With the development of crypto assets, wallets have evolved through different stages: from single-asset wallets and single-chain wallets to multi-chain, multi-asset wallets, evolving from simple transfer and receipt functions to blockchain ecosystem aggregation service platforms, giving rise to mobile wallets, public chain ecosystem wallets, trading platform wallets, asset custody wallets, hardware wallets, identity wallets, and other segmented tracks.

In addition to the traditional business model of user and fund deposit functions, crypto wallets also include providing value-added services (financial products, PoS mining, trading, asset aggregation, market information, etc.) and monetizing traffic through advertising.

We are particularly optimistic about the development of mobile crypto wallets, which have the potential to become traffic and distribution platforms for Web3 applications, ultimately facilitating a paradigm shift in the entire Web3 track from "wealth creation effect" to "everyday applications." Notable mobile crypto wallets include:

- Metamask: (@MetaMask) with over 30 million monthly active users. A lightweight Ethereum open-source wallet, also an app wallet; it supports the most comprehensive Dapps and has testing functionalities for Ethereum smart contracts, compatible with hardware wallets like Ledger and Trezor.

- TrustWallet: (@TrustWallet) a non-custodial mobile multi-chain crypto wallet with over 58 million total users, supporting over 8 million tokens and serving as a gateway to thousands of Web3 dApps.

- BitKeep: (@BitKeepOS) with 8 million global users, the largest Web3 multi-chain wallet in the Asian market, employing various security mechanisms such as cold-hot separation and offline signing, supporting over 80 main chains, and offering one-click cross-chain trading.

2. "Play-and-Earn" Games

Freedom Index: ☆☆☆☆

Trust Index: ☆☆☆☆

Commercial Model Verifiability Index: ☆☆☆☆☆

Web3 Unicorn Growth Index: ☆☆☆☆☆

Just as games are crucial to the internet economy, crypto games have long been viewed as the best driving force for user growth in the Web3 ecosystem.

Although the potential market for crypto games is enormous, they are not very engaging for most players. Today's crypto games are most commonly found in GameFi or P2E (Play-to-Earn), where the biggest highlight is providing players with opportunities to earn income, but the simple incentive of making money through gaming may not be a sustainable model. If we extend the timeline to six months or longer, we have yet to see any truly successful projects.

Creating Web3 games still needs to return to the essence of gaming, emphasizing that fun itself is the true value.

With the decline in market enthusiasm and shifts in user interest, Web3 games have seen a new trend emerge: Play-and-Earn. On one hand, this draws from the traditional Free-to-Earn model, allowing everyone to participate for free while selectively enabling some players to earn; on the other hand, it creates fully on-chain games and autonomous worlds, where the core logic of the game resides on-chain, with future open architectures, self-sustainability, and composability.

Unfortunately, we currently do not see a typical representative of "Play-and-Earn" games; who will be the next Axie Infinity or StepN remains to be seen.

Of course, while various games are still exploring how to balance entertainment experience and economic incentives, the capital market is already betting on the market. In May 2022, a16z established a $600 million fund specifically to invest in Web3 gaming startups, focusing on three areas: game studios, consumer applications supporting player communities (like Discord), and game infrastructure providers. Although these three areas seem disparate, they share a single goal: to create truly meaningful Web3 games.

Currently, notable projects in the Web3 gaming industry chain that may collaborate to create the next generation of "Play-and-Earn" games include:

- TreasureDAO: (@Treasure_DAO) a decentralized gaming and publishing platform that meets the needs of independent developers through a comprehensive infrastructure and ecosystem, forming an economy by accumulating player-generated content. It is currently the top gaming and NFT ecosystem on Arbitrum, boasting a community of over 100,000 players.

- SkyArk Studio: (@SkyarkS) an AAA-level blockchain game studio, launching series of fully on-chain and asset-only chain games like SkyArk Chronicles, along with a proprietary NFT game engine that allows NFTs to be interoperable, editable, and evolvable, helping players use NFTs across different games with various gameplay.

- Bedlam: an esports gaming hub that creates and hosts individual gaming identities (performance statistics and content) for Web3 games. Users can participate in leagues or tournaments and follow their favorite teams.

3. Phygital Applications

Freedom Index: ☆☆☆

Trust Index: ☆☆☆☆

Commercial Model Verifiability Index: ☆☆☆☆

Web3 Unicorn Growth Index: ☆☆☆☆

For crypto-native and Web2 brands in the fashion and entertainment sectors, Web3 offers an opportunity to bring digital and real-world items and experiences to their audiences. This new popular pairing of the physical and digital worlds has coined its own term: phygital.

"Phygital" combines "Physical" and "Digital," representing the integration of physical environments or tangible objects with digital or online technology-driven experiences, a term first proposed by the Australian marketing agency Momentum in 2013.

We believe that, more broadly, physical projects with digital representations and digital projects that can influence physical environments or tangible objects can all be classified as Phygital applications. They represent a broad category of Web3, enabling blockchain developers to create new methods that combine the physical and digital worlds.

In 2022, luxury jewelry company Tiffany collaborated with CryptoPunks holders to launch "NFTiffs," offering a physical diamond pendant as a bonus. The 250 NFTiffs sold out within 20 minutes of their debut, netting the company $12.5 million. The creation of such "phygital" projects represents an innovative business attempt by luxury goods in Web3.

In December 2021, NIKE announced the acquisition of virtual streetwear brand RTFKT, making it its fourth independent brand alongside Nike, Jordan, and Converse. This indicates that Nike has elevated NFT development to a brand strategy level. RTFKT is creating a physical sneaker using Nike's electronic shoelace Adapt technology, allowing consumers to purchase virtual shoes and subsequently redeem corresponding physical pairs.

NBA Top Shot is a blockchain collectible game co-created by the NBA, NBPA, and Dapper Labs, aimed at turning highlight moments of NBA stars into tradable digital game cards. In other words, what fans used to do offline with physical card exchanges can now happen online anytime and anywhere.

In addition to fast-moving consumer goods and luxury items, financial entities are also attempting to connect with Web3 through physical card businesses. Visa and Mastercard are collaborating with various Web3 companies to develop cryptocurrency debit cards. For example, Blockchain.com will partner with Visa to launch a debit card linked to customers' crypto accounts, with no transaction fees, allowing users to earn 1% cryptocurrency cashback.

By combining the physical and digital worlds, phygital drops are no longer just about purchasing items for display; they create more by integrating various aspects of the real and virtual worlds to produce unique experiences.

Although the current combination of physical and virtual products is still in the early stages of Phygital products, we can glimpse the immense potential generated by the combination of Phygital and Web3 through the convenience of social sharing and DIY derived from virtual products.

Currently, notable Phygital application solution providers include:

- RTFKT Studios: (@RTFKT) creating unique sneakers and digital artifacts using the latest gaming engines, NFTs, blockchain authentication, and augmented reality, combined with manufacturing expertise.

- Dapper Labs: (@dapperlabs) the company behind well-known projects like CryptoKitties, NBA Top Shot, NFL All Day, UFC Strike, and the Flow blockchain, using blockchain technology to bring NFTs and new forms of digital engagement to fans worldwide, paving the way for a more open and inclusive digital world starting from gaming and entertainment.

4. Web3 Growth Stack Applications

Freedom Index: ☆☆☆

Trust Index: ☆☆☆☆

Commercial Model Verifiability Index: ☆☆☆☆☆

Web3 Unicorn Growth Index: ☆☆☆☆☆

Web2 companies embracing Web3 will drive the breakout of Web3, bringing in a massive influx of users. Data shows that among the top 100 global brands, 43 brands, including Starbucks, are experimenting with Web3 and NFT alternative use cases.

Major Brand Flagship NFT Collection Launches Source: Messari

Major Brand Flagship NFT Collection Launches Source: Messari

Shayon Sengupta of Multicoin Capital first proposed the concept of the "Web3 Growth Stack," which refers to product managers and marketers using Web3 technology to build tools for acquiring, attracting, and retaining customers. The significant advantage of the Web3 Growth Stack is its ability to tightly couple in-app events with on-chain payments.

Web2 products cannot send value to users in real-time, but Web3 products can, potentially expanding the design space for growth tools and advertising models fundamentally.

Previously, Starbucks announced the launch of its NFT membership program, Starbucks Odyssey, where consumers can participate in Odyssey series journey activities, primarily involving interactive games and fun challenges, and upon completion, they receive collectible digital journey badges (i.e., NFTs) as rewards.

Digital journey badges as NFTs can be traded, further upgrading participate-to-earn to collect-to-earn, enhancing user stickiness and repurchase rates; owning NFTs as Starbucks members means data is on-chain, allowing other brands (partner or competing brands) to airdrop various rewards to this group of members, evolving into airdrop-to-earn: the more active the members are, the more NFTs they hold, the more airdrops they receive, further enhancing user stickiness and repurchase.

The essence behind Starbucks' NFT membership program is a true return to a user-centric approach, where users regain ownership of their data while reaping more value that rightfully belongs to them.

Now, more commercial brands are closely watching how Starbucks develops and the effectiveness of its practices; if successful, we will see significant enthusiasm from major brands to release NFT reward points models.

Starbucks has 27.4 million members, Nike has over 300 million members, and Pizza Hut has over 80 million members… These brands utilizing the "Web3 Growth Stack" tools to transition to Web3 may be the fastest path to unlocking billion-level Web3 applications.

Notable Web3 Growth Stack applications include:

- Blackbird: (@blackbird_xyz) a Web3 platform designed for the travel and hospitality industry, aiming to establish direct connections between restaurants and guests through loyalty and membership services. It integrates loyalty and membership-related products, providing rewards based on dining frequency, spending, and various behaviors.

- Layer Infinity: (@RensOriginal) a Web3 platform established by e-commerce brands. It helps traditional consumer brands easily transition to Web3 by issuing NFTs compatible with the metaverse, which can be linked to physical products. In addition to tracking product authenticity and redeeming physical items, each NFT can link to various different utility NFTs.

5. Web3 Social Applications

Freedom Index: ☆☆☆

Trust Index: ☆☆☆☆

Commercial Model Verifiability Index: ☆☆☆☆☆

Web3 Unicorn Growth Index: ☆☆☆☆☆

Social platforms hold vast user traffic, profiles, and behavioral data, containing immense commercial value, and have always been the most valuable form of internet products in the Web2 world, as evidenced by the valuations of giants like Facebook, Twitter, and TikTok.

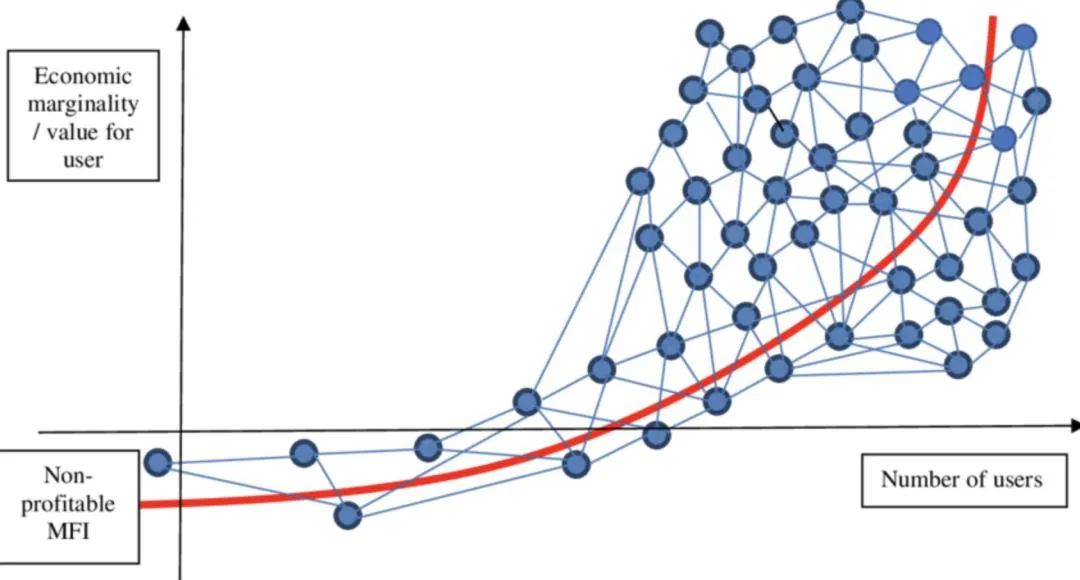

According to Metcalfe's Law, the value of a social network is proportional to the square of the number of users. The more users there are, the greater the value of the social platform, and then the user growth curve can suddenly explode at a certain point.

Metcalfe's Law

Metcalfe's Law

Image Source: "MICROFINTECH: Expanding Financial Inclusion through Cost-Cutting Innovations"

Therefore, the challenge in innovating social projects lies in the difficulty of "easy to defend but hard to attack"; once a user network is established through a certain paradigm, later entrants can only look up to it.

For social platforms in the Web3 era, decentralized technologies based on blockchain allow for decentralization and composability of user-generated content, social relationship data, identity reputation, etc., giving people absolute control over their social data, representing a new user-centric social network.

However, the current development of Web3 social applications is still in its very early stages; Web3 products cannot yet accommodate the daily user volumes of billions seen on Facebook and WeChat; the entry barrier for Web 3.0 products is higher, and the user experience still lags behind Web2 products.

Moreover, most current Web3 social products only meet the pure on-chain social + financial needs of crypto-native users; in the future, products that simultaneously meet on-chain and real-world social + financial needs may stand out, as social interaction is not just about online data exchange but should connect more aspects of our lives, including video entertainment, gaming, music, fitness, and more.

CGV Research believes that if we look ahead to the next generation of Web3 social applications, the key characteristics for success include:

1) Acceptable user costs;

2) Product experiences that are close to or exceed Web 2.0, with a low entry barrier;

3) Timely and comprehensive synchronization of user data (integrating on-chain and off-chain);

4) Continuous incentive mechanisms designed through tokens or NFTs;

5) Mature community vitality, with high user activity and stickiness.

Overall, social applications are the most promising yet challenging battlefield in the Web3 application domain. How to expand infrastructure and implement sustainable economic models is the current focus and difficulty. For the Web3 social application track, perhaps we need to take a longer-term view.

Notable Web3 social applications include:

- Lens Protocol: (@LensProtocol) an open, composable Web3 social media protocol that allows anyone to create non-custodial social media profiles and build new social media applications. Users can freely develop and own their created content through holding corresponding NFTs.

- Mask Network: (@realMaskNetwork) a portal helping users transition from Web 2.0 to Web 3.0, integrating privacy social, borderless payment networks, decentralized file storage and sharing, decentralized finance, and governance (DAO). It allows users to encrypt their messages on Twitter and Facebook while also facilitating cryptocurrency red envelope transactions, ITOs, and decentralized file uploads and storage.

- Galxe: (@Galxe) a collaborative credential infrastructure aimed at creating user profiles based on people's blockchain behavior. Brands and projects can use these Web3 digital credentials for better promotion, such as gamifying their loyalty systems, conducting marketing campaigns, and acquiring users.

6. Creator Economy Applications

Freedom Index: ☆☆☆☆☆

Trust Index: ☆☆☆☆☆

Commercial Model Verifiability Index: ☆☆☆☆

Web3 Unicorn Growth Index: ☆☆☆☆☆

For many, the creator economy is a vast concept, encompassing various forms of content, including text, images, music, and video, each with its own growth logic.

Based on industry perspectives, CGV Research defines the creator economy as an economic form where independent content creators (such as bloggers, social media KOLs, videographers, etc.) publish their original content through platforms or communities via digital carriers like text, video, and audio, and earn revenue.

The creator economy has two key characteristics: first, creators can exchange unique personal content for fans and followers, monetizing traffic; second, tools and infrastructure are built to create or manage content.

According to a report by Influencer Marketing Hub, there are currently 50 million people participating in the creator economy globally. By the end of 2022, the market size of the global creator economy is expected to reach $104.2 billion.

However, the current creator economy system faces severe income inequality issues, with a significant portion of creators' earnings going to third-party service fees. On Spotify, each play of a song by a paid account generates only $0.004 in royalties; only 0.33% of YouTube creators earn a full-time income; and only the top 1% of authors on Amazon can earn $1,000 in a month. Additionally, issues such as lack of content management rights and cutthroat competition are widespread in the current creator economy system.

Web3, based on blockchain infrastructure, represents a new generation of the internet, distinguishing itself from previous iterations by allowing users to truly own and freely use the data content they create, beyond mere consumption and creation.

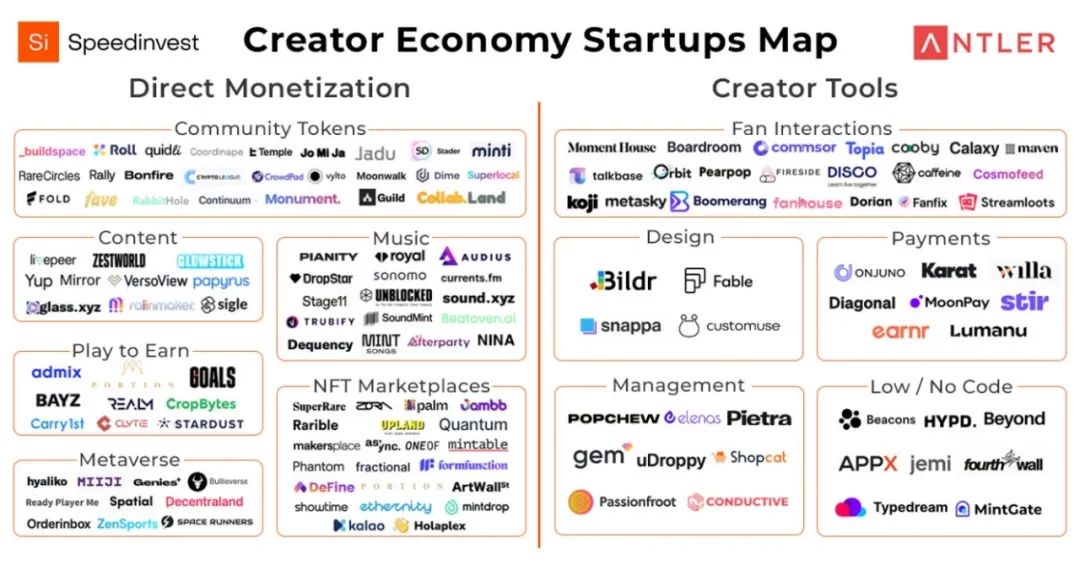

Global Creator Economy Startups

List Source: Speedinvest

Following this logic, Web3 brings three paradigm shifts to the "creator economy":

1) Redistributing the value and rights of the platform back to creators through independent mechanisms like tokenization and smart contracts;

2) Providing a composable and trustworthy new perspective for those looking to start creating;

3) Giving users the first opportunity to earn rewards and own a part of internet value.

Web3 creator economy projects encompass application scenarios such as content creation, NFT issuance and trading, community building, fan incentives, and asset management, forming a complete value chain that helps creators closely connect with fans through content, NFTs, and social tokens.

Of course, it is important to note that the starting point of the Web3 creator economy is not about competing for traffic, but rather abandoning the struggle for user attention and focusing on productivity; only by providing better content can better earnings be achieved. Notable Web3 applications in the creator economy include:

- Mirror: (@viamirror) combines content publishing with Web3 technology, storing content on Arweave through wallet connections and publishing it to fans. Additionally, all posts on Mirror are mintable, turning fans into collectors;

- Rally: (@rally_io) a Web3 alternative to YouTube, is a platform for creators to build their own independent digital economies around social tokens. It prioritizes creators, allowing them to drive interaction with their communities.

Bill Gates once said: "We always overestimate what we can do in one or two years and underestimate what we can do in five or ten years."

Looking at it now, the market for 1 billion Web3 users seems far away, but nothing is impossible; it is just a matter of time.

As practitioners of Web3, the only thing we can do is to keep building, bringing Web3 services to every corner of the globe and every aspect of people's lives, making this time come sooner.