The ecological heat of Curve is rising again, and this DAO-developed project is definitely worth paying attention to

Written by: Jack, BlockBeats

Recently, discussions about Curve have been very heated. With the continuous expansion and development of the ecosystem, the "Lego gameplay" of Curve and Convex is becoming increasingly diverse. Driven by the crypto market trends, many tokens in the Curve ecosystem have seen significant price increases recently, among which the most outstanding projects are Concentrator, CLever, and Conic Finance, rising nearly 500%, 300%, and 100% respectively. Interestingly, the two projects with the largest increases, Concentrator and CLever, are both developed by the DeFi community AladdinDAO.

This article will introduce the structure and main goals of AladdinDAO, as well as the Lego mechanisms of Concentrator and CLever.

AladdinDAO

AladdinDAO is a collective value discovery community aimed at shifting the main body of investment in the crypto field from venture capital to the development community by providing one-stop liquidity mining services. The economic model of AladdinDAO adopts the controversial DeFi 2.0 game theory mechanism (Note from BlockBeats: for more on DeFi 2.0, please read “APY 70,000%, Dominated by OHM Forks DeFi 2.0”). The team hopes to incentivize the community to continuously launch new quality projects through this mechanism. Currently, the rebase interval for ALD is two weeks, with an APY maintained at around 10%, executing nearly 360 DeFi yield strategies.

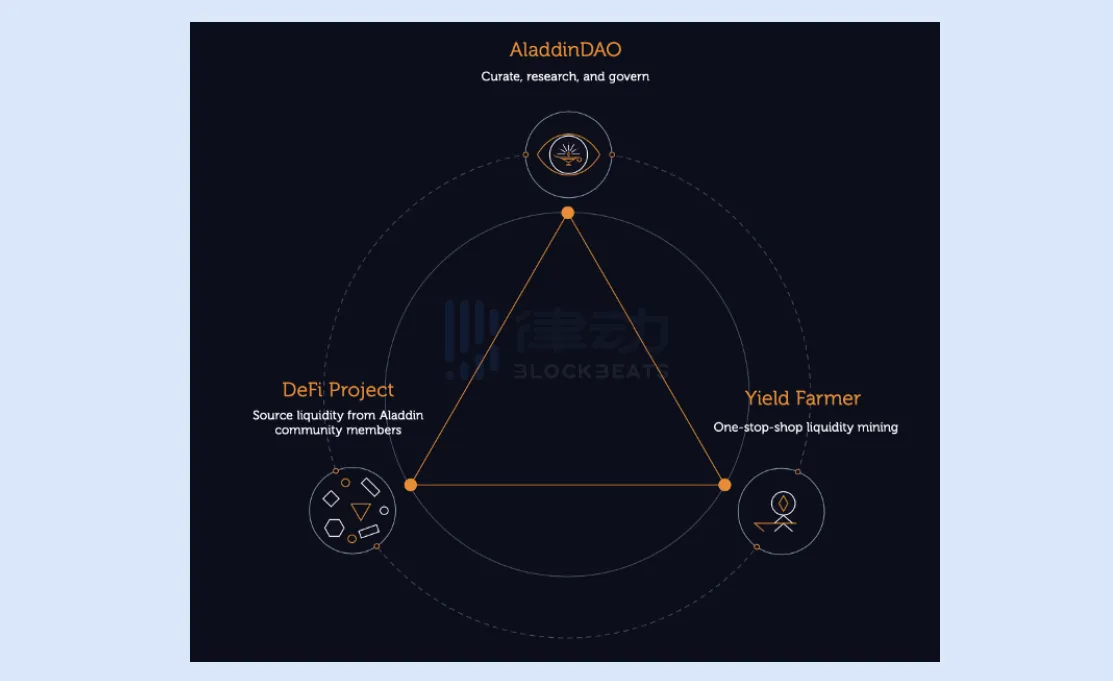

AladdinDAO aims to build a "three-sided market" in the DeFi field, consisting of AladdinDAO itself, DeFi projects, and DeFi yield farmers. Community members or users enjoy one-stop liquidity mining services while providing liquidity for selected DeFi projects; the DAO is responsible for providing the best yield strategy projects for DeFi users; the "Boule" member group, composed of experienced DeFi developers and players, shares the profits of the DAO community by discovering and developing DeFi projects, while Boule members also receive additional incentives in the form of AladdinDAO governance token ALD.

Boule members are the absolute core of AladdinDAO. They are responsible for discovering and developing new DeFi projects and act as headhunters to continuously recruit new DeFi talent for the community. Additionally, a reward and punishment mechanism is established within the DAO for Boule members. Members who develop quality projects or attract top talent can receive corresponding token incentives and promotion paths from the DAO community, while underperforming Boule members will have their rankings lowered and may lose their Boule status in subsequent cycles.

Concentrator

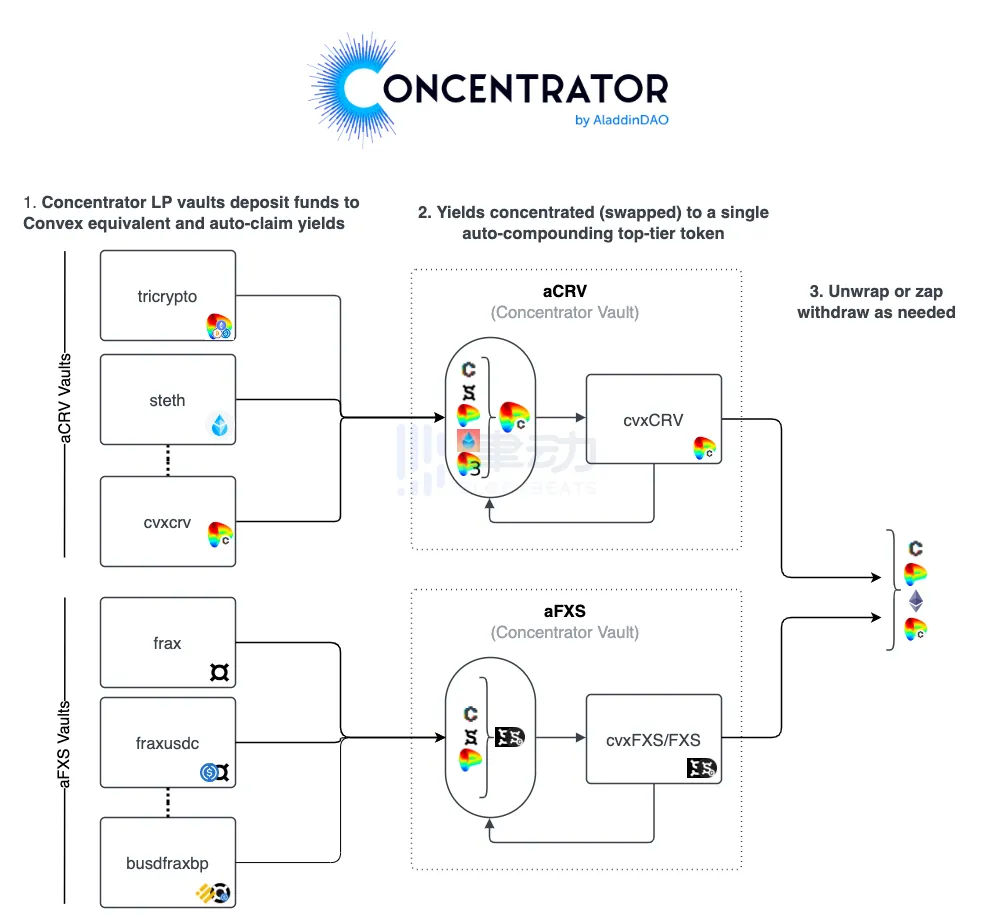

Concentrator is a Curve yield enhancer developed by AladdinDAO. It improves user yields on the Convex protocol by concentrating and converting all Curve ecosystem yield assets into interest-bearing assets that can automatically compound. The Curve ecosystem applications and protocols have a strong "nested doll" property, which often leads to users' yields being scattered across various small assets, failing to effectively realize marginal utility.

The role of Concentrator is to repackage various Curve pool yield assets into universal interest-bearing assets and reinvest them into new DeFi yield farming strategies, aiming to save users' gas fees and improve capital efficiency. Currently, Concentrator mainly repackages aCRV and aFXS assets, with the packaging certificates based on Convex's cvxCRV and cvxFXS.

Users deposit LP tokens from Curve into their chosen strategies, and Concentrator automatically deposits them into various yield vaults on Convex. The rewards harvested are packaged as aCRV or aFXS, and users can unlock their earned interest-bearing assets at any time and exit in the form of blue-chip assets like CVX, CRV, or ETH. According to official documentation, users can enhance their yield by over 20% through the repackaging.

Throughout the yield process, Concentrator charges users a standard fee of 10%. Each yield strategy will set different withdrawal fees based on the standard fee, and these fee revenues will be distributed to CTR token stakers and the Concentrator treasury. CTR is the native token of Concentrator, and its mechanism is similar to Curve's veToken, but without inflation. CTR holders will be able to lock their tokens to obtain veCTR. Like veCRV, in addition to governance functions, veCTR holders have voting rights on the allocation of 50% of Concentrator's revenue, with voting weight determined by the amount and duration of the lock-up, with a maximum lock-up period of 4 years.

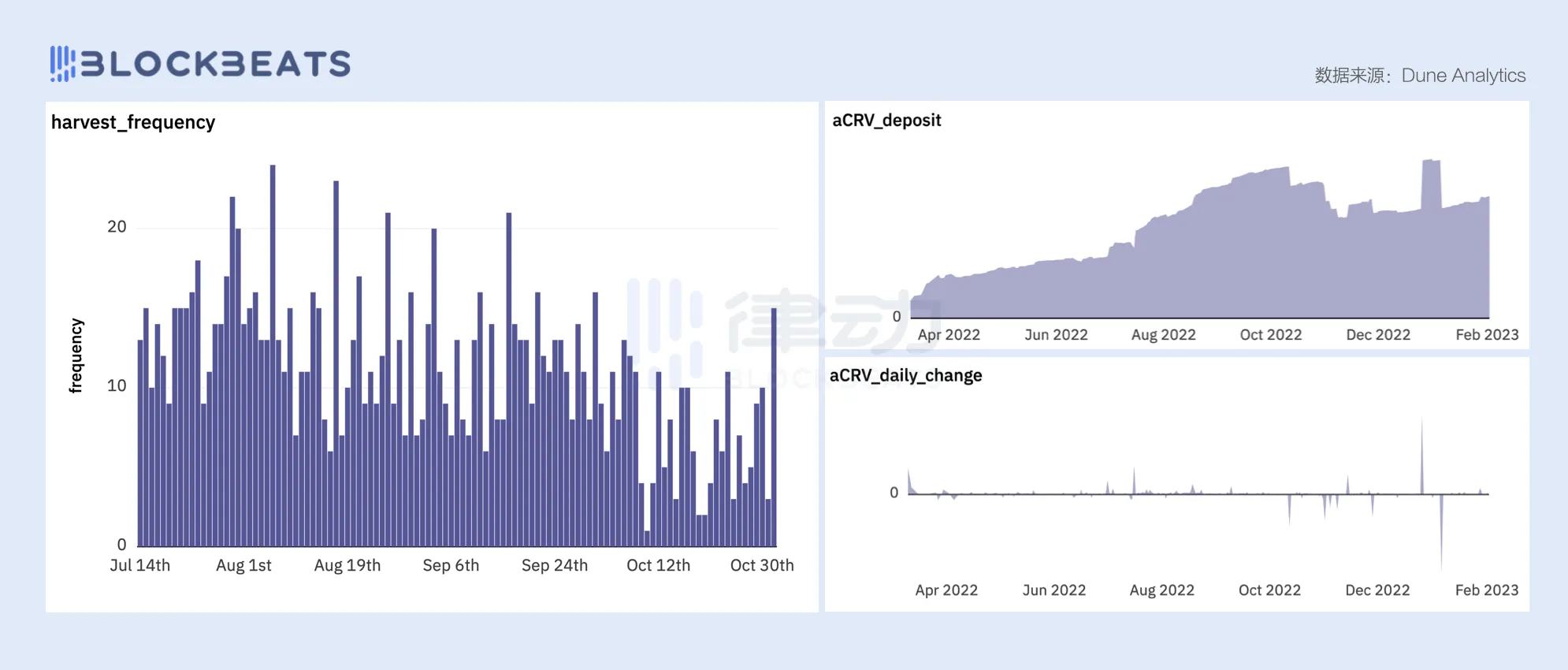

In terms of protocol performance, Concentrator's yields are relatively stable, but as shown in the chart below, its yields exhibit a certain downward trend, aligning with the current yield level trends in the DeFi ecosystem. As of now, Concentrator has repackaged over 3.75 million aCRV, with the staking amount of aCRV showing a stable growth trend and very low daily fluctuations.

CLever

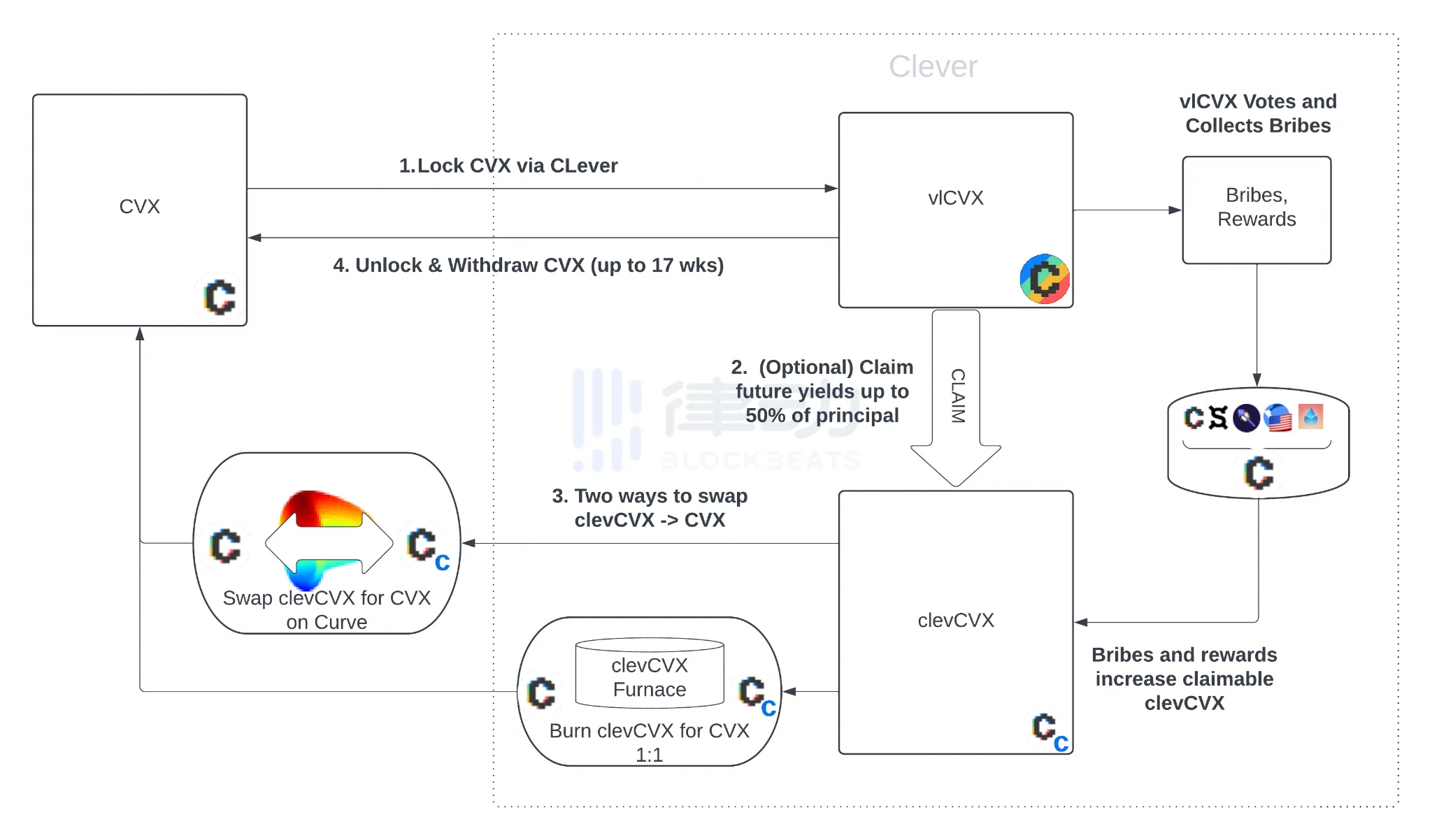

CLever is a Convex yield leverage protocol developed by AladdinDAO, capable of providing CVX holders with continuous, automated bribery and yield leverage. In simple terms, it pre-pays users their future fixed yields and creates leveraged returns based on that. Users only need to lock their CVX to immediately receive 50% of their future yields in the form of clevCVX at no cost, which can then be exchanged back to CVX through Curve liquidity pools or the CLever furnace, and this portion of CVX can be re-staked to achieve up to 2 times CVX yield leverage.

All locked CVX will be used for Convex voting to maximize bribery yields, and all these bribery yields will be exchanged back to CVX and placed in the CLever furnace to synthesize more clevCVX. The unpaid yield debt for users who pre-paid their yields will decrease with the amount harvested, achieving automatic repayment for users, while users without unpaid yield debt can earn additional clevCVX rewards.

The CLever furnace is the minting/destroying and exchange contract for clevCVX and CVX. When new CVX yields enter the protocol treasury, clevCVX will be minted based on a 1:1 ratio, while CVX will be placed in the furnace. Any user can destroy clevCVX to exchange for CVX in the furnace. When there is not enough CVX supply in the furnace, the protocol will proportionally distribute the remaining CVX to all users with active requests. Users can arbitrage through CLever's furnace mechanism when the value of clevCVX is lower than that of CVX, helping to maintain the peg between clevCVX and CVX.

Users need to lock at least 2 times their claimed future yields in the system until they receive those future yields. When users are ready to exit, they simply need to issue an unlock request. The requested CVX will be extracted during the next unlock from Convex (which may take up to 17 weeks), and users who wish to continue earning do not need to take any action, as their underlying CVX will be automatically re-locked after each unlock. Any early unlock operations will incur a repayment fee.

The yield leverage mechanism of CLever essentially involves users borrowing based on CVX while using yields for automatic loan repayment. However, unlike ordinary lending protocols, CLever's lending model has almost no liquidation risk because the value of the borrowed asset (clevCVX) and the collateral (CVX) do not change independently. While clevCVX may decouple, it can be balanced through the arbitrage market. Of course, since the stETH decoupling incident, users still need to be aware of related risks.

Additionally, in most lending protocols, interest rates often fluctuate due to changes in liquidity within the system. However, since CLever's fee model charges 20% of future yields, users can know their borrowing costs in advance and have a fixed interest rate. At the same time, CLever's mechanism also eliminates the oracle risk of conventional lending mechanisms, as the collateral and borrowed assets are the same and are paired in a single liquidity pool, preventing liquidation due to oracle failures or attacks.

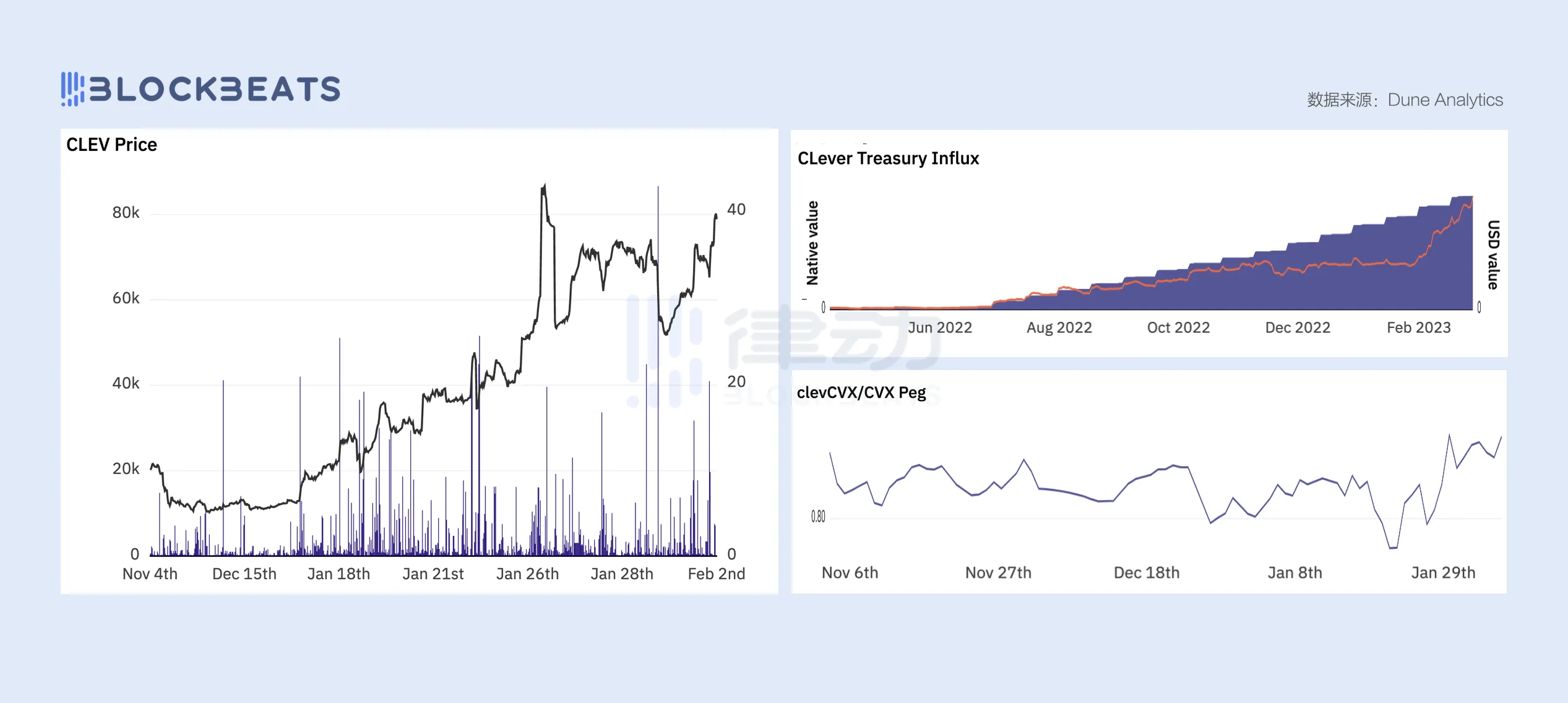

Currently, the CLever protocol has locked over 1.74 million CVX, minted over 800,000 clevCVX, and generated over 160,000 CVX yields. As shown in the chart below, the price of CLever's native token CLEV has been steadily rising, with both CVX yields and protocol treasury income showing steady growth. The exchange rate between clevCVX and CVX has a certain discrepancy, maintaining a peg around 0.8. Despite some fluctuations, the peg remains relatively stable, and the furnace mechanism has shown relatively significant effects.

In the past week, the debate over the advantages and disadvantages of Curve V2 and Uniswap v3 has been particularly intense. However, BlockBeats believes that although both protocols have their strengths and weaknesses in market-making algorithms and technology stacks, they have completely different market positions. In the short term, Curve cannot replace Uniswap's position in the ERC-20 token trading market, and conversely, Uniswap cannot replace Curve's share in the stablecoin and pegged asset trading market. The development of both will jointly promote the growth of the DeFi market. Instead of focusing on the well-known "King of DeFi," it is better to dive deep into understanding the potential projects within their respective ecosystems, as the returns will be more substantial.