2023 Q1 Cryptocurrency Investment and Financing Report: Market Overview, Hot Trends, and Performance of Investment Institutions | RootData

Authors: Xiangxiang Xi, Yu Gu, RootData

The first quarter of 2023 has just passed, and most cryptocurrency practitioners are experiencing mixed feelings. On one hand, several banks in the U.S. faced a crisis of bank runs, and regulatory agencies continued to crack down on centralized exchanges, impacting market confidence; on the other hand, cryptocurrency assets represented by BTC and ETH performed quite well in the secondary market. Besides price factors, we also believe that multiple signals within the cryptocurrency field are showing strong signs of recovery and growth.

So, how did the cryptocurrency investment and financing market perform in the first quarter of 2023? What are the hottest trends in the current market? How frequently are investment institutions making moves, and what are their preferences? Rootdata has conducted a comprehensive analysis based on platform statistics. This report consists of three parts: Overview of the cryptocurrency investment and financing market in 2023Q1, analysis of investment and financing market trends, and performance of investment institutions.

1. Overview of the Cryptocurrency Investment and Financing Market in 2023Q1

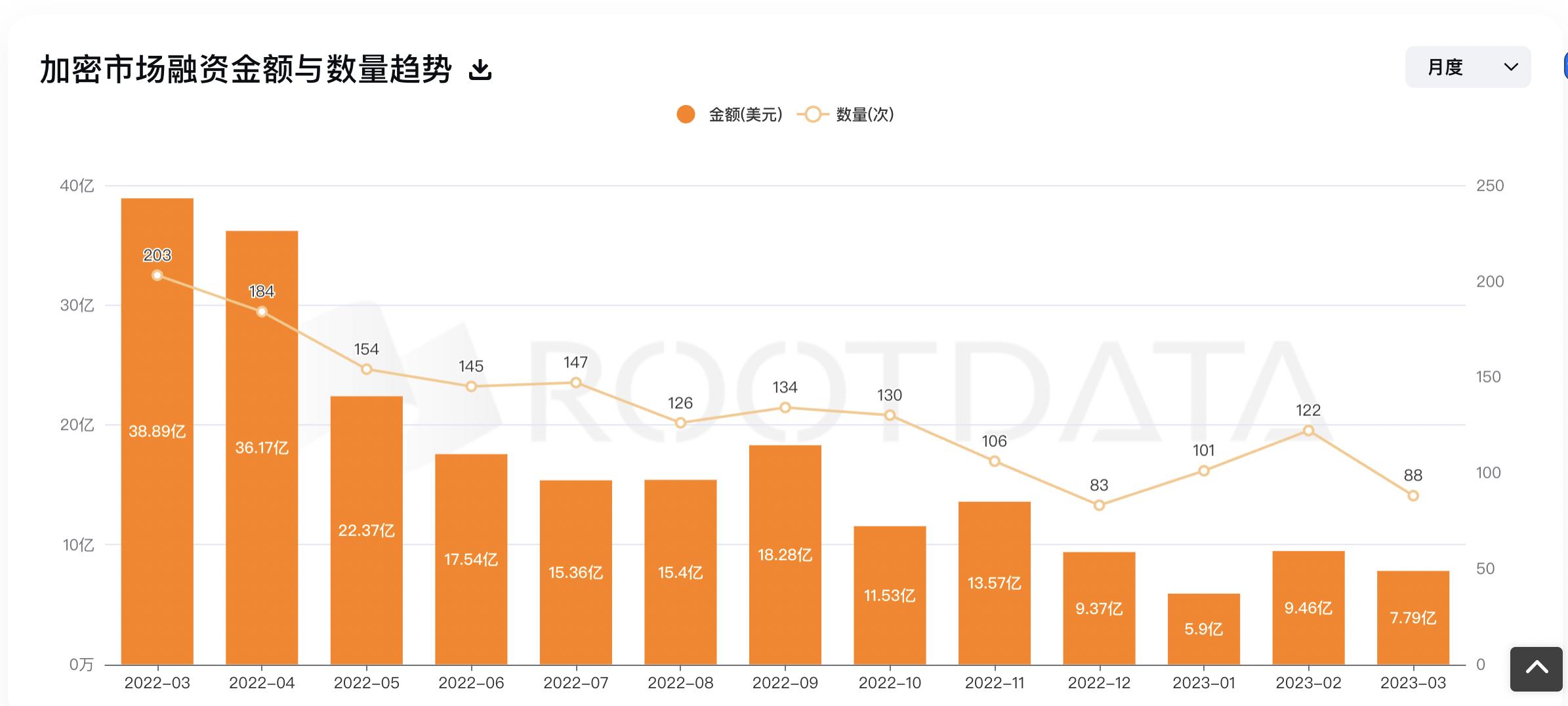

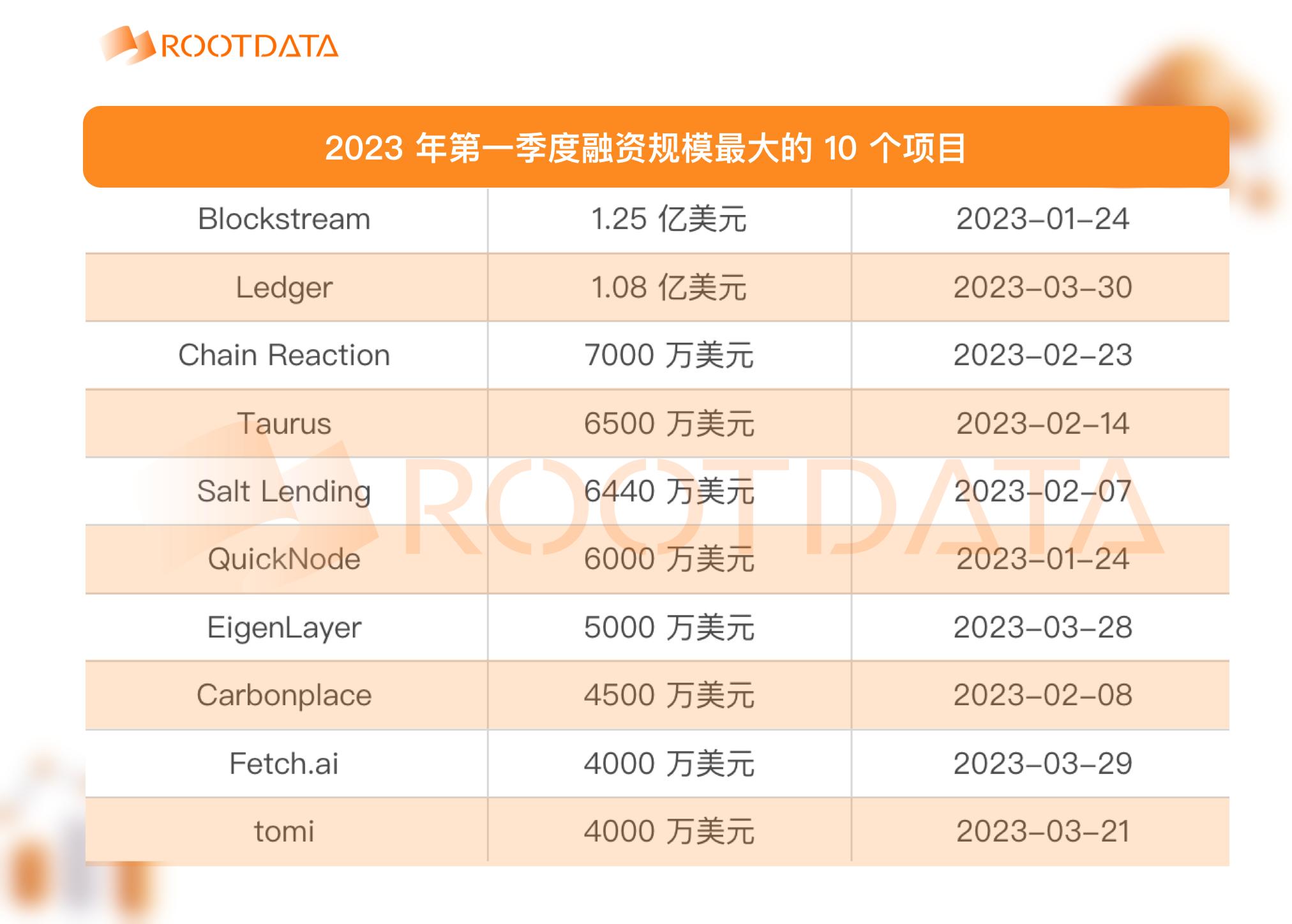

RootData data shows that from January to March 2023, the cryptocurrency industry disclosed a total of 309 project financing events, with a total financing amount reaching $2.317 billion, far lower than the $12.48 billion in the first quarter of 2022, a year-on-year decrease of about 81%. Compared to the $3.463 billion in the fourth quarter of 2022, there was also a significant decline, with a quarter-on-quarter decrease of 33%. In summary, both the number of financing events and the amount of financing in this quarter hit a new low since 2021.

It can be seen that after entering the bear market cycle, the financing rhythm in the primary market of the cryptocurrency industry has experienced a cliff-like drop, and investment institutions are relatively cautious and have not actively made moves. On the other hand, many projects have seen valuation inversions between the primary and secondary markets, making the secondary market more favored by investors.

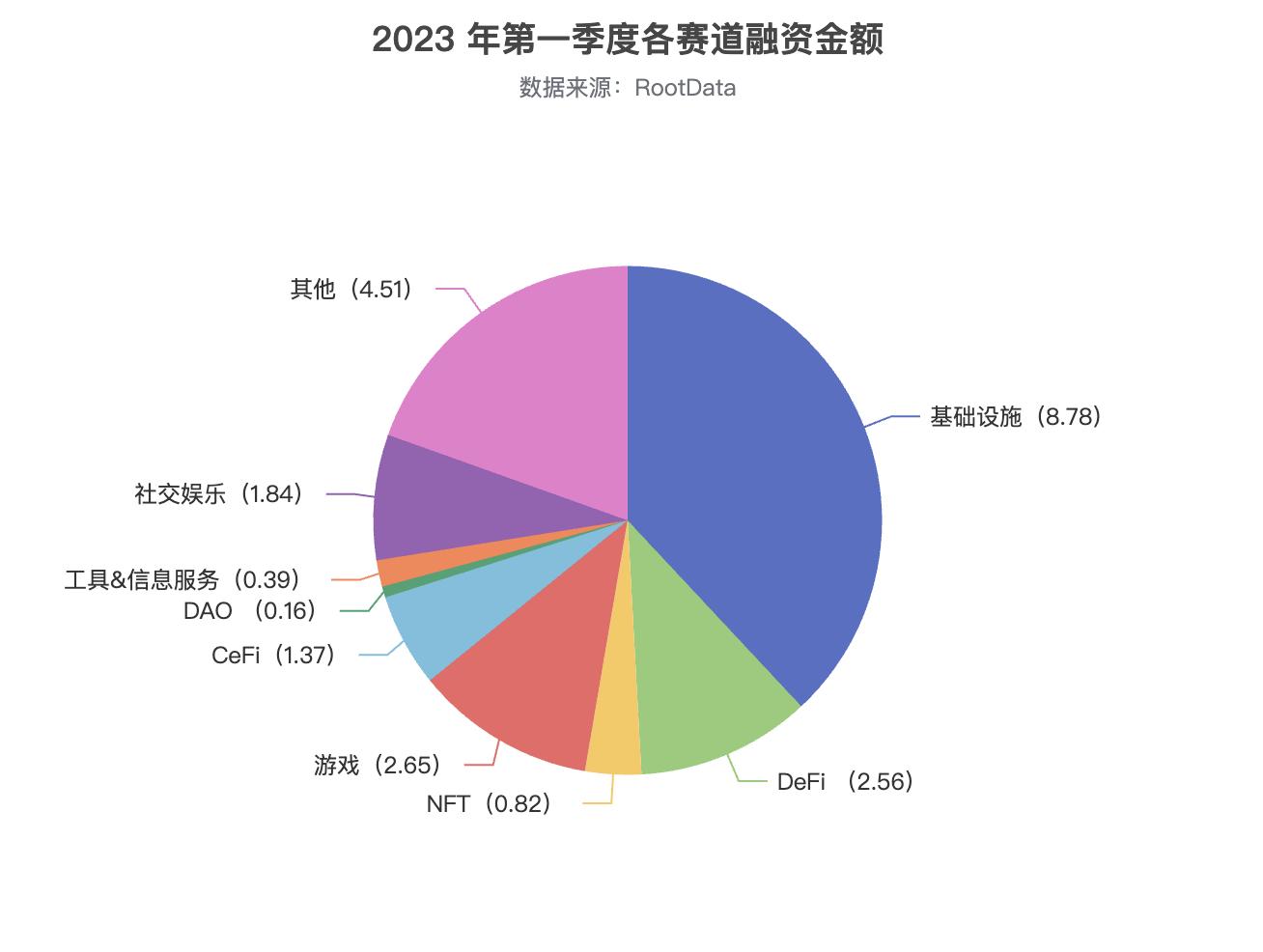

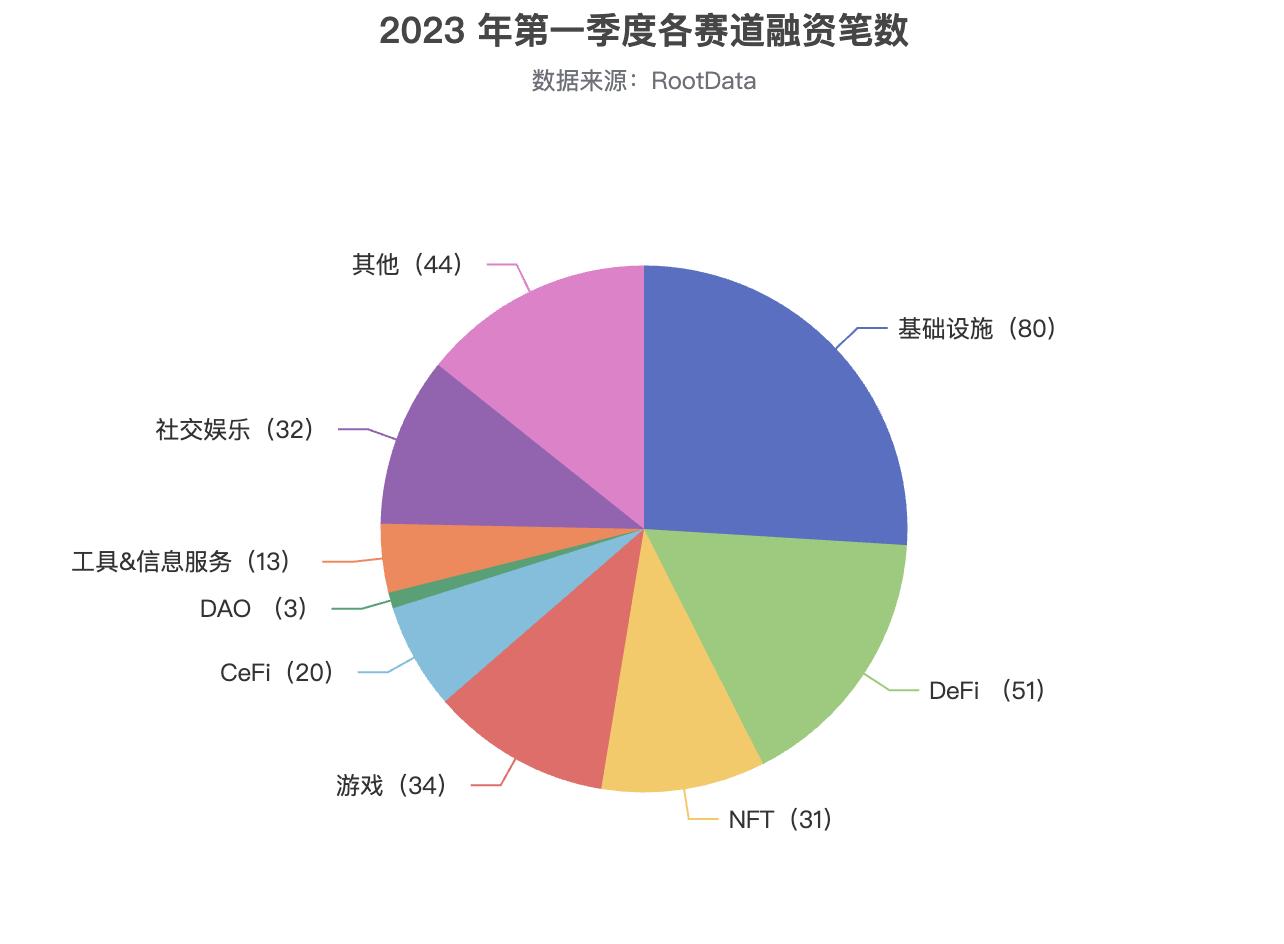

From the distribution of financing across various sectors, the following chart shows the number of financing events and financing amounts (in hundreds of millions of dollars) for each sector from January to March 2023:

Among them, the infrastructure sector had the highest number and amount of financing among the nine major sectors, with an average single financing amount exceeding $10 million. Popular financing projects in this sector include modular blockchains, zk concepts, etc.;

The DeFi sector ranked second in the number of financing events and fourth in financing amount, with popular subfields being DEX, derivatives, etc.;

The gaming and social entertainment sectors ranked third and fourth in terms of financing events, with subfields such as gaming platforms and creator economy being favored by capital in the first quarter of 2023.

2. Analysis of Cryptocurrency Investment and Financing Market Trends in 2023Q1

1) Ethereum Staking Protocols and Services

Ethereum liquid staking allows users to lock ETH in the blockchain network to earn rewards while maintaining the liquidity of the locked funds. According to DefiLlama data, as of the end of March 2023, the total value of crypto assets deposited in liquid staking protocols was close to $15 billion. The upcoming Ethereum Shanghai upgrade will enable staking unlocks, which is expected to bring higher staking participation and make competition among liquid staking protocols more intense.

For users, liquid staking is attractive for several reasons: first, it is user-friendly, allowing participation in network validation and benefits without needing 32 ETH, making it a relatively stable and secure fixed-income product; second, staking tokens can be withdrawn at any time, with no thresholds; third, it releases liquidity, thereby improving capital utilization efficiency; fourth, users can not only receive validation rewards but also participate in governance of those rewards.

In addition, liquid staking is expected to grow further, as the ETH staking ratio is significantly lower than that of other L1 tokens. Currently, only 14% of ETH is staked, while the average for L1 staking is 58%. The current market consensus is that once the Shanghai upgrade is successful, the disappearance of liquidity risks and uncertainties in lock-up periods will lead to more funds flowing into staking protocols.

Current liquid staking protocols in the market face fierce competition, and newly emerging similar products are primarily focusing on three directions: first, collaborating with other Dapps to provide more application scenarios for generated derivative tokens; second, striving to deploy on more L1 chains to maximize TVL; third, focusing on improving the security level of the protocols.

During 2023Q1, staking protocols and services such as Unamano, Rocket Pool, Obol Network, Diva, and Ether.Fi have successively secured financing. Additionally, institutional cryptocurrency custody and staking solution Finoa and MoodMiner, which has a low asset threshold of 1 Euro and supports staking of over 100 digital assets, also received funding.

It can be said that the future of liquid staking protocols depends on the overall long-term development of public chains, with security being of utmost importance. Additionally, factors such as value capture ability and on-chain DeFi ecosystem construction also have a significant impact on the protocols.

2) AI

Over the past decade, artificial intelligence has steadily entered the commercial field and gradually improved the user experience of internet products, but this did not attract much interest from outsiders. ChatGPT changed this. Suddenly, everyone is talking about how AI will disrupt their work, learning, and lives.

How AI will transform the cryptocurrency field has become one of the most focused topics in the cryptocurrency industry this year. Many believe that the maturity of AI concepts will bring significant benefits to the Web3 world, with typical use cases including DeFi, GameFi, NFTs, DAOs, smart contracts, etc.

During 2023Q1, blockchain platforms based on artificial intelligence and machine learning received significant financing, such as Fetch.ai, decentralized collaboration platform FedML, identity system-focused Aspecta, social-oriented PLAI Labs, digital asset research platform Kaito, and AI creation platform Botto. We can expect to see further integration of artificial intelligence and blockchain, leading to more secure, transparent, and efficient systems.

3) DeFi Derivatives

Just as the traditional financial derivatives market is supported by the hedging needs of the real industry, DeFi derivatives are also evolving from a single trading demand to more diversified areas such as risk hedging.

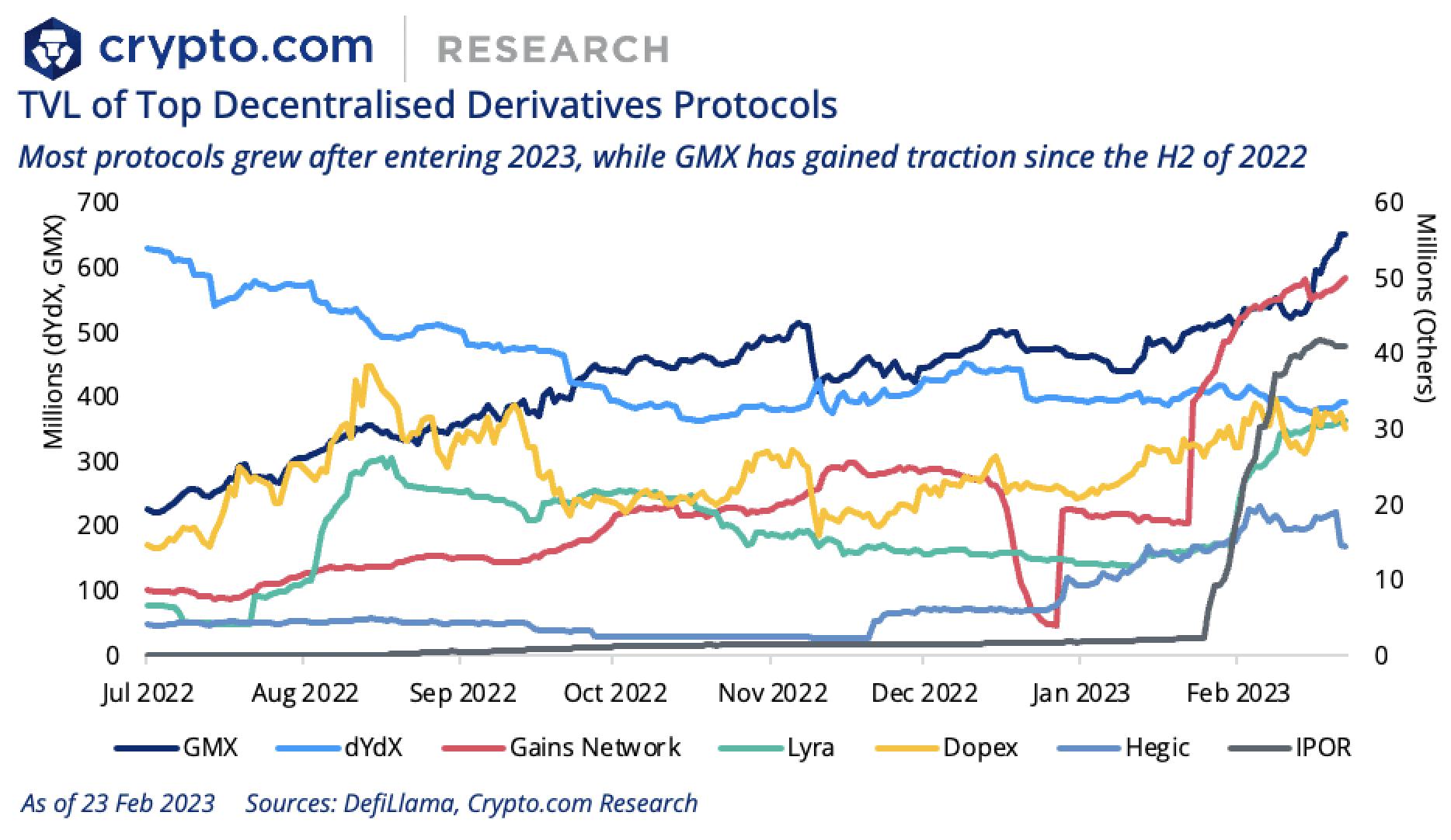

On the other hand, although CEX leads significantly in derivatives trading volume, decentralized derivatives protocols like GMX and Gains Network have also shown significant growth during the bear market of 2022, thanks to higher transparency and innovative system designs.

Currently, emerging decentralized derivatives protocols centered around traders, liquidity providers, and token holders are continuously appearing. Fundamentally, they aim to solve the following problems: first, attracting liquidity and improving asset utilization; second, building composability and cross-margining, such as using various forms of crypto collateral to secure leveraged positions; third, providing a user-friendly experience for traders and liquidity providers.

According to Rootdata statistics, in the last quarter, projects in the DeFi derivatives direction that received financing include the perpetual contract trading platform Narwhal Finance that enables leveraged trading across all asset classes through synthetic assets, the decentralized perpetual contract exchange Vest Exchange in the Arbitrum ecosystem, the options trading platform Optix Protocol that supports 10x leverage, and the alternative derivatives protocol Cega that builds exotic options structured products for retail investors, as well as the strategy aggregation protocol Blueberry Protocol that aggregates various leverage strategies into one account.

4) NFTFi

The NFT sector is undergoing significant changes. This emerging asset class is expected to establish a dedicated financial ecosystem.

With the widespread adoption of NFTs, various DeFi protocols and technologies are expected to be applied to NFTs, which is NFTFi. It is like "LEGO blocks," which can enhance capital efficiency by inserting different protocols.

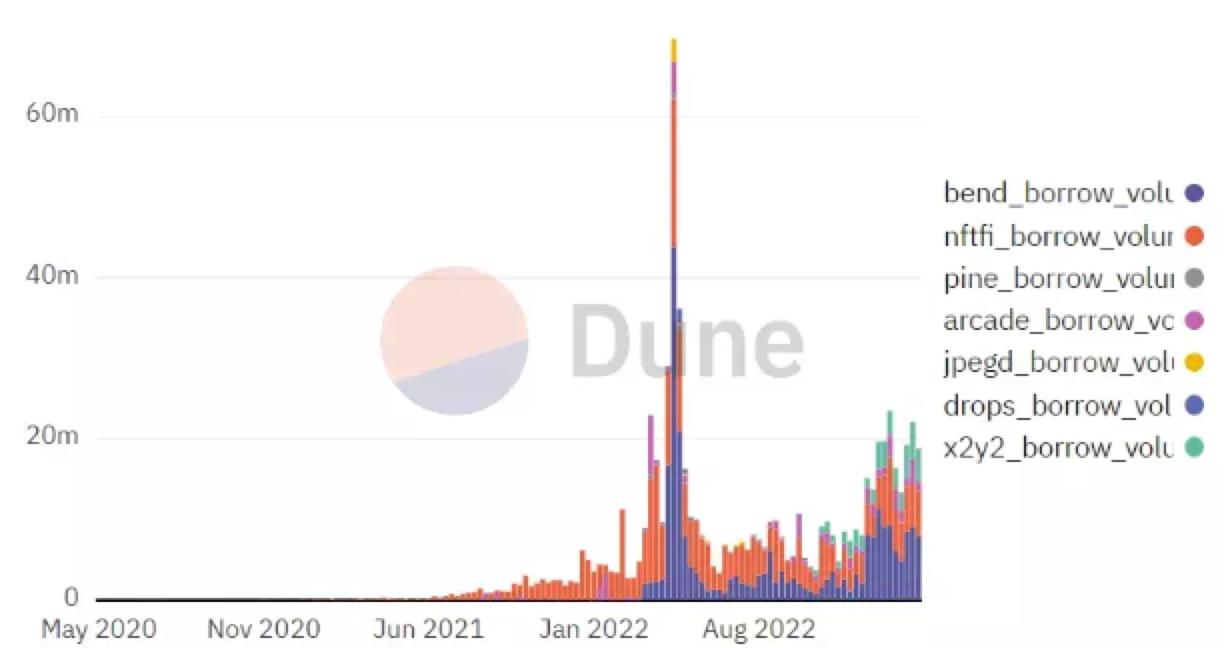

DeFi platforms like Aave and Compound have been around for several years, and now similar products in the NFTFi space, such as BendDAO, ParaSpace, JPEG'd, and NFTfi, have also emerged. User data and transaction volume data from platforms like Bend, NFTfi, Pine, Arcade, JPEG'd, Drops, and x2y2 indicate that this market is steadily expanding.

(Data on transaction scale of NFT lending platforms)

Similar to the summer of DeFi in 2020, a summer of NFTFi is expected to emerge at some point. This may attract DeFi players who, even if they have no direct interest in NFTs, are likely to be drawn in by potential returns.

Over the past two years, NFTs have experienced a turbulent cycle without leveraged participation in trading, and with the launch of NFT derivatives, more people are expected to participate in larger-scale trading. The emergence of NFTFi is expected to bring greater liquidity and higher market efficiency to the entire ecosystem.

During 2023Q1, NFT automatic market maker protocol Midaswap based on Liquidity Book, NFT yield-generating protocol insrt finance, NFT lending protocol paprMEME powered by Uniswap V3, NFT derivatives exchange NFEX providing leveraged trading, and community-centered NFT exchange EZswap have all secured financing.

5) Data Analysis Products

Most companies in Web3 are striving to make data-driven decisions to drive growth. The cryptocurrency field needs more data analysis products to provide users with more comprehensive, diverse, and in-depth insights. On the other hand, pioneering crypto data tools will also effectively enhance the scientific nature of investor decision-making while making the data flow in the cryptocurrency industry more transparent.

Currently, how to integrate off-chain, on-chain, and social media data, how to leverage data to drive new user acquisition and activity retention, and how to analyze user behavior through data to guide business decisions are important issues that many gaming companies, NFT companies, and even asset management platforms are focusing on.

During 2023Q1, such products that announced financing news include the data analysis platform Helika for game studios and NFTs, multi-chain insights focused on NFTs and digital assets bitsCrunch, data intelligence platform focused on Web3 EdgeIn, and Web3 security infrastructure Trusta Labs providing witch attack prevention analysis.

6) Creator Economy

Although the creator economy in the Web3 industry is still in its infancy, with a small audience and a lack of content production, on the other hand, there are few strong competitors in the industry, making it a very blue ocean with great potential.

Token incentives, as an important innovative tool in the creator economy, allow creators to attract fans using new monetization and value capture mechanisms and co-create new content with them. Its larger-scale application is expected to help strengthen and energize the creator ecosystem.

During 2023Q1, many subfields in the creator sector secured financing. In music, the Web3 interactive music platform Muverse and music collectibles platform VAULT; in content, the Web3 content creation platform RepubliK and novel reading platform Read2N; in branding, fashion, and artists, cultural brand ManesLAB, artist platform Wild, Web3 fashion platform Syky; and also the platform GigaStar that builds better mutual benefit mechanisms for YouTube creators and fans have all received financing.

7) Modular Blockchain

Modular blockchain refers to a blockchain that completely outsources at least one of the four components: "execution layer, settlement layer, consensus layer, and data availability layer" to external chains. Due to the complexity of providing services to millions or more users on a single chain and the limited capacity to solve problems, shard and Layer 2 solutions were proposed, which gradually evolved into modular blockchains. The initial solution for modular implementation was rollups, a concept that later expanded into modular blockchains.

The main advantages of modular blockchains currently are twofold: first, they possess sovereignty; although they use other layers, new modular blockchains can have sovereignty like L1. This allows blockchains to respond to hacker attacks and push upgrades without any underlying permission; second, it effectively improves scalability, allowing for expansion without sacrificing security or decentralization.

During 2023Q1, projects focusing on building high-performance, customizable second-layer blockchains like Caldera, modular settlement layers like dYmension, and ecosystems of interoperable and scalable rollups like Sovereign have all secured significant new rounds of financing.

8) zk Concepts

The zk ecosystem is becoming increasingly prosperous. Zk-Rollup uses validity proofs to verify and package all transactions off-chain, and when the verified transactions are submitted to the main chain, they are accompanied by zero-knowledge proofs to prove the validity of the transactions. In the words of StarkWare CEO Uri, "It provides trustless computational integrity, ensuring that the computation is executed correctly even without supervision." This sounds very similar to the early ideals of Bitcoin.

In comparison, Optimistic Rollup can be compatible with EVM, has a mature and early technical solution, and has lower migration costs for developers. Representative projects like Arbitrum and Optimism currently hold the highest market share among rollups. However, zk-Rollups, due to their incompatibility with EVM, have higher technical difficulty and slower development progress, and their applications are not as widespread as OP series rollups that can target smart contracts.

However, zk-Rollup has many advantages over Optimistic Rollup: first, better scalability, as zk-Rollups require uploading less data to the mainnet than Optimistic Rollups. In practical applications, zk-Rollup's performance enhancement capability is about ten times that of Optimistic Rollup; second, shorter transaction finality times; third, higher security.

Vitalik once said in 2021, "In the short term, Optimistic rollup will win due to its EVM compatibility. But in the medium to long term, as zk-SNARK technology improves, zk-rollups will win all use cases."

During 2023Q1, zk concept projects that announced completed financing include the trust layer based on zero-knowledge proofs Proven, Ethereum native zkEVM second-layer solution Scroll, zk-rollup protocol Polybase, Web3 interoperability infrastructure PolyHedra, zk dark pool protocol Renegade, ZK hardware acceleration project Cysic, ecosystem of interoperable and scalable rollups Sovereign, ultimate Web3 middleware based on ZKP Hyper Oracle, and zero-knowledge proof market =nil;.

9) Security Solutions

Web3 security technology is rapidly developing, but the transparency and openness of blockchain code still lead to frequent hacking incidents. Since 2021, losses in Web3 due to security issues have exceeded $10 billion. Therefore, how to provide asset protection-related products for enterprises, infrastructure providers, and ordinary users to avoid losses from hacking or human errors has always been an important theme in the cryptocurrency industry.

How to analyze smart contracts to prevent vulnerabilities? How to monitor malicious activities in on-chain transactions? How to establish a better and more mature digital asset ecosystem? These are also the problems that companies in this sector are trying to solve.

During 2023Q1, relevant projects can be divided into two categories based on their client types: the first category targets B-end clients, such as the crypto security service provider Ironblocks that automatically conducts threat detection and helps teams take preventive measures quickly, the crypto security company Hypernative that uses proprietary machine learning models to monitor on-chain and off-chain data sources, and MetaTrust that automates the generation of security scanning solutions using a security scanning engine; the second category targets C-end users, such as the crypto security company Staging Labs that actively scans transactions around the clock and can timely transfer risk assets, and the crypto security solution Coincover that can identify unauthorized access to suspicious transactions.

3. Performance of Cryptocurrency Investment Institutions

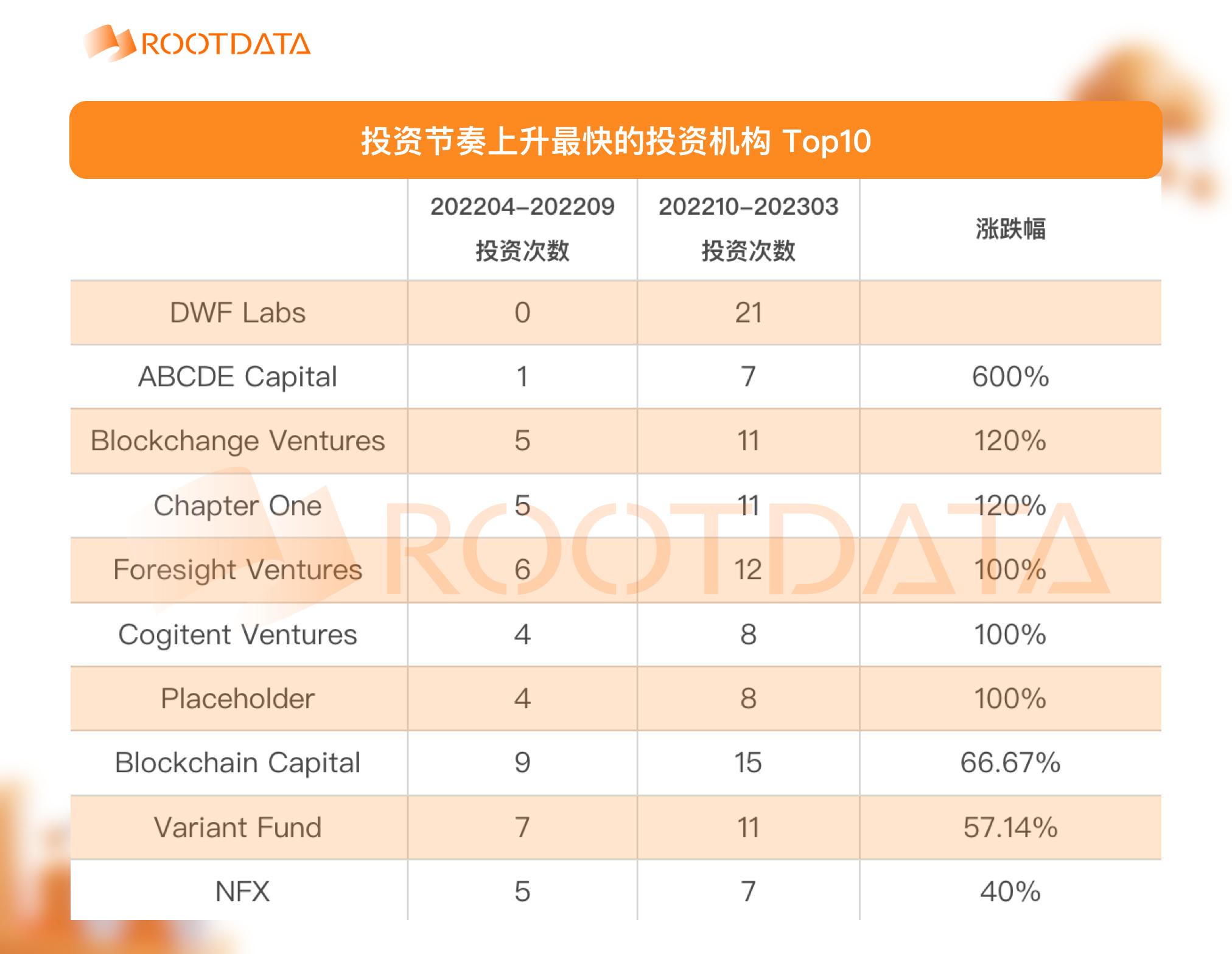

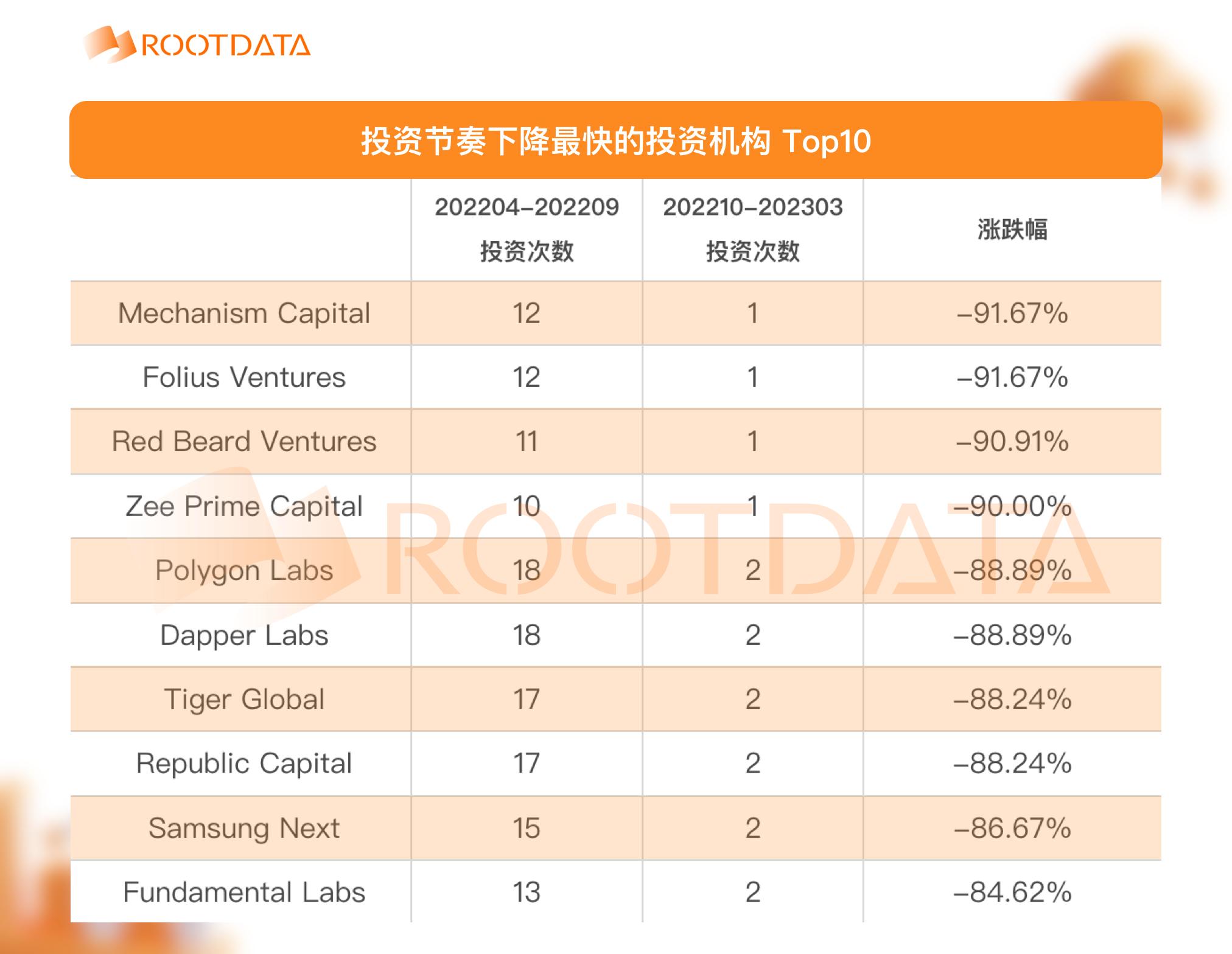

After experiencing a series of upheavals such as the FTX incident, the cryptocurrency investment institution market is also undergoing a reshuffle, with many venture capital firms falling silent while several institutions are accelerating their investment frequency.

Considering the representativeness of the data interval (the data volume in the first quarter is insufficient), Rootdata has counted the number of moves made by cryptocurrency investment institutions in the past six months (from October 2022 to March 2023) and compared it with the data from the previous six months (from April to September 2022). Based on a minimum investment of 8 times, we filtered out the 10 cryptocurrency venture capital institutions with the highest growth rates and the largest declines in investment frequency.

In terms of the fastest growth rate, DWF Labs is a well-known dark horse in the industry, with at least 21 publicly disclosed investments in the past six months, whereas this institution had no prior records of making moves. Additionally, ABCDE Capital, Blockchange Ventures, Chapter One, Foresight Ventures, Cogitent Ventures, and Placeholder have all seen their publicly disclosed investment counts double or more.

In terms of the largest declines, well-known institutions such as Mechanism Capital, Folius Ventures, Zee Prime Capital, Polygon Labs, Dapper Labs, Tiger Global, and Republic Capital have all seen declines exceeding 85%, with publicly disclosed investment counts not exceeding 2.

Additionally, in terms of overall investment counts, the top ten investors in the past six months are Coinbase Ventures, Shima Capital, Big Brain Holdings, Polygon Ventures, DWF Labs, Polychain, Circle Ventures, HashKey Capital, Solana Ventures, and a16z.