What problems does Uniswap v4 solve that current DEXs are facing?

Source: Foresight News

Author: Sleeping in the Rain

The release of the Uni v4 draft is an exciting event, although it is unrelated to its token empowerment and does not have a specific release date announced yet. However, it introduces two core innovations: Hook and The Singleton. Before breaking down these two core upgrades, let's discuss the current bottlenecks faced by DEXs ⬇️

The industry's attitude towards DEXs remains optimistic, as they decentralize trading and custody, allowing traders to avoid concerns about fees, price, and settlement transparency, all of which can be verified on-chain. Uniswap sparked the wave of DEXs, enabling permissionless trading for everyone and providing liquidity participation for market making.

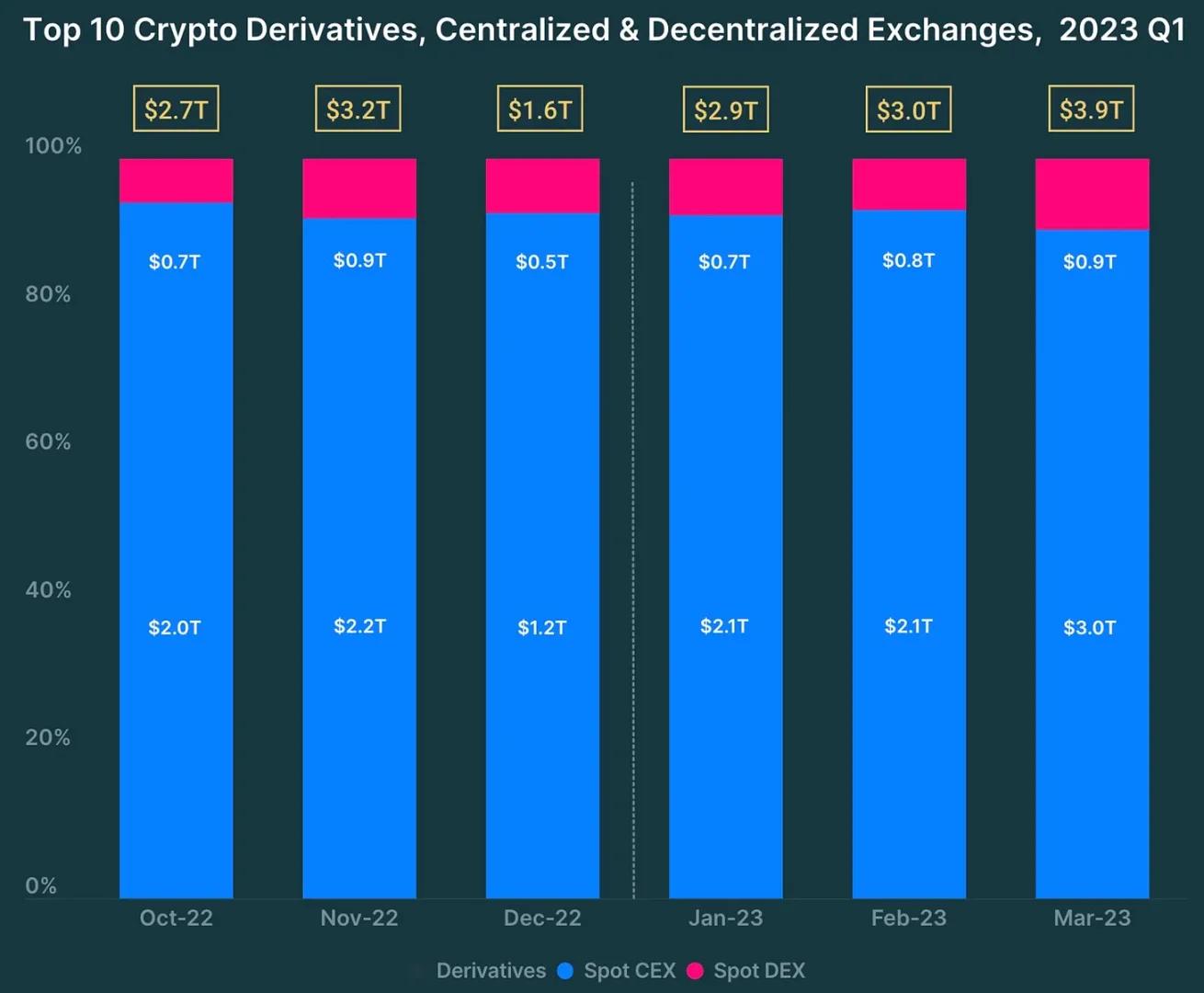

However, despite the promising vision, DEXs still cannot compete directly with CEXs. The reasons are well-known: MEV, lack of price advantages, GAS fees, and LPs not making money, among others. As seen in the chart produced by Coingecko, CEXs still hold a crushing advantage. (The DEX data for Q2 might be better due to a surge in trading volume driven by a wave of meme coins.)

1. So, what story does Uni v4 tell?

Customizability (Hook) and extreme cost reduction (The Singleton and accounting).

Extreme customizability: The Hook feature allows anyone to deploy liquidity pools using custom contracts. This statement might seem a bit abstract, but based on the examples mentioned by the official team (executing TWAMM orders, limit orders, dynamic fees, internal MEV allocation mechanisms, custom oracles), I will expand on a few examples—how Hook supports the custom execution logic needed by different developers:

Features implemented by Camelot: variable fees for liquidity pools and additional rewards for LPs. After v4 is launched, deployers can directly deploy such pools on Uniswap. This includes the ability to set various trading taxes for future meme coins directly through Uniswap v4. A previous example to reference is $AIDOGE, which includes trading taxes and using $ARB to incentivize $AIDOGE liquidity. However, the advantage of Hook is that it meets these needs while also allowing for other structural possibilities.

More protocols can implement features based on Uniswap v4's Hook functionality, such as order book trading, which would be more favorable for traders. So, can Perp DEX also build products based on v4 LP? I think it's a great vision, and I believe a large Uniswap ecosystem will emerge in the future, which will form Uniswap's moat. In short, Hook greatly increases the composability and scalability of Uniswap's liquidity.

However, as @WinterSoldierxz mentioned, Hook, being a simple JavaScript function, comes with its own shortcomings (i.e., dependency array). Hook still has some limitations, but in terms of programming difficulty, JavaScript has a lower threshold, allowing developers to quickly build liquidity pools and products based on it.

Extreme cost reduction: The Singleton sets all LP contracts to a single contract, thereby reducing the Gas fees for creating LPs and multi-hop trades (cross-pool routing trades).

Additionally, it's worth mentioning the accounting feature of v4, which not only reduces the cost of frequent trading but also introduces market makers into the DEX space.

2. So, returning to the initial challenges faced by DEXs, what problems does v4 solve?

MEV: The internal MEV allocation mechanism for liquidity providers in v4 has the potential to alleviate the current MEV issues.

Price: Introducing market makers and limit trading will help mitigate this problem.

Gas fees: This is a problem that v4 aims to solve; if calculated on Layer 2, these fees will be even lower.

LP income: LP income is insufficient due to three factors: (1) insufficient trading volume; (2) Gas fees; (3) impermanent loss. The fundamental reason for insufficient trading volume is that DEXs are not as competitive as CEXs in terms of product strength, and v4 is working to address this issue, with Gas fee reduction being a primary focus. Impermanent loss needs to be addressed through order book market making—developers may build a limit order exchange based on Uniswap v4 in the future.

3. What else should we pay attention to?

In a section of the blog, Uniswap mentioned, "Depositing out-of-range liquidity into lending protocols," which means that Uniswap's idle liquidity will have the capability to provide liquidity for lending protocols.

I believe Uniswap has grand ambitions; while allowing developers to build on v4, the official team may also construct new products through Hooks, such as lending protocols and stablecoin protocols. Nowadays, former DeFi giants have begun to expand in related areas, such as MakerDAO launching lending protocols and Curve and AAVE introducing stablecoins. v4 may become an opportunity for Uniswap to move forward.

Additionally, Uniswap v4 has brought native ETH back into trading pairs. This is also an effort to reduce user Gas fees.

For other DEXs, future DEX forks will likely lack competitiveness, while innovative DEXs, like iZumi, will have more competitive products. They wrote an article titled "iZUMi: How to Leverage Uni V4's Limit Order Functionality to Achieve the Next Generation 'On-Chain Binance'," which I personally think is well-written.

Furthermore, it's worth mentioning suzhu's new CEX OPNX. OPNX is strictly speaking a CEX, but its product also adopts an accounting model similar to Uniswap v4 (just in terms of model), separating trading collateral from the matching engine. Traders deposit money into OPNX for collateral and then trade within the product.

My view is that Uniswap has now redirected the market's focus back to the DEX track, which is a good thing and provides some valuable insights for newcomers. However, we must not overlook existing competitors in the DEX space, such as Curve, TraderJoe, and iZumi.