How to use sentiment analysis to gain insights into trends and opportunities in the crypto world

Author: veDAO

Market sentiment is an assessment of traders' attitudes and emotions, which can influence their investment decisions. Especially in the highly volatile cryptocurrency market, market sentiment can experience sharp fluctuations in a short period. The ups and downs of market sentiment often signify new opportunities or new pressures and risks. If you are not familiar with sentiment analysis in cryptocurrencies, this article is for you.

This article will introduce you to sentiment analysis methods and classic sentiment analysis indicators in the crypto world, as well as share several related practical tools to help you understand cryptocurrency market sentiment more scientifically and grasp token price fluctuations more accurately.

What is Sentiment Analysis?

The term "sentiment" in the financial environment refers to perceptions and feedback about market conditions. Cryptocurrency market sentiment describes investors' reactions and attitudes toward macro market prices and reflects the psychology of those involved in cryptocurrency trading and development.

In a general sense, sentiment analysis is the process of detecting positive or negative sentiments in text. It was initially used to detect sentiment in social data, measure brand reputation, and understand customers, scoring a piece of text based on corresponding sentiments. For example, "can't wait" corresponds to +0.5 points, while "run away" corresponds to -0.4 points, etc. It assigns a score to each word based on its negative or positive degree and then sums all scores to assess the overall sentiment of a sentence. Typically, this score ranges from -1 to +1, where -1 indicates very negative sentiment and +1 indicates very positive sentiment.

This analysis method can be widely applied in the crypto world. Sentiment data in cryptocurrencies comes from text information on social media platforms such as Twitter, Discord, and Telegram. A sentiment analysis tool can aggregate real-time dynamic information from various platforms and community protocols, analyze and summarize current market sentiment based on a scoring system and corresponding weights, thereby assisting investors in their market behavior. Otherwise, investors would need to manually and time-consumingly browse different social networks to discover the perceived psychology of specific tokens.

Sentiment Analysis Methods in the Crypto World

Just last month, on the 23rd, four researchers from Pennsylvania State University published a research paper on "Cryptocurrency Sentiment Analysis." The study found that social media sentiment can significantly predict cryptocurrency returns, with fundamental events playing a role in shaping sentiment. Additionally, the research found that market booms are positively correlated with momentum returns but do not predict volatility, indicating that sentiment affects returns through price perception and demand shocks rather than risk premium channels. Overall, the paper emphasizes the importance of sentiment in understanding and predicting cryptocurrency market dynamics.

Cryptocurrency Fear and Greed Index

The Cryptocurrency Fear and Greed Index is an analytical tool used to measure market sentiment in the cryptocurrency space, particularly in Bitcoin. The index ranges from 0 to 100, where values close to 0 indicate extreme fear and values close to 100 indicate extreme greed.

The Cryptocurrency Fear and Greed Index is calculated using six main factors, each weighted according to perceived importance. These factors include:

- Market Momentum and Trading Volume (25%): The index calculation compares current daily trading volume and momentum with the 30-day and 90-day averages. Larger sales volumes and negative daily market trends indicate significant selling pressure, thus increasing panic. In contrast, large buying volumes and repeated positive market trends indicate heightened greed.

- Volatility (25%): The higher the volatility of crypto assets, the more fearful investors may be, leading to a lower score for the index. Like market momentum and trading volume, volatility and value decline (maximum drawdown) are compared to the 30-day and 90-day averages.

- Trends (10%): Higher search volumes typically lead to greater potential greed, resulting in a higher index score. However, not all searches carry the same weight; for example, negative searches like "Bitcoin market manipulation" and "Bitcoin crash" indicate greater market fear.

- Dominance (10%): Dominance looks at Bitcoin's market capitalization as a percentage of the total cryptocurrency market capitalization. Generally, an increase in Bitcoin's dominance (increased market share) represents a more fearful market, as investors may view Bitcoin as a "safe haven" in cryptocurrencies. In contrast, the index views increased altcoin investments as a more greedy market, with more speculators willing to invest in lesser-known assets for potentially high returns.

- Social Media (15%): The algorithm collects and calculates posts with cryptocurrency-related hashtags and measures the posting speed of cryptocurrency-related posts and the interaction volume within a specific time frame. A higher interaction rate typically reflects more market greed, while a lower interaction rate may indicate more fearful market behavior.

- Surveys (15%): Surveys can be used to gauge investor sentiment toward cryptocurrencies. Bullish responses may indicate greed, while bearish responses may indicate fear.

This index comprehensively reflects market sentiment and serves as a sentiment indicator and risk management tool, helping investors make informed decisions and avoid excessive emotional reactions. When the market is driven by extreme fear or greed, it often leads to overcorrections. Specifically, investors can use it to:

- Measure market sentiment: High values indicate the market may be overbought (extreme greed), while low values indicate the market may be oversold (extreme fear).

- Inform investment decisions: High values may suggest caution or selling, while low values may indicate a good buying opportunity. However, other market factors should always be considered, and due diligence should be conducted.

- Risk management: The index can help manage the risk level of a portfolio, aiding in balancing between potentially high-return, high-risk investments and safer, lower-return investment options.

Bull and Bear Index

The GMI Bull and Bear Index is an index based on the rate of price change and the status of perpetual contract funding rates. This index has a strong identification ability for bull and bear transitions over medium to long periods (six months to a year) in historical backtesting and can also provide important reference directions for public trading psychology, market frenzy states, and short-term breakout intentions.

The GMI index is directly proportional to the speed of BTC price increases and inversely proportional to the size of perpetual contract funding rates. It is calculated based on Bitcoin's historical price trends and funding rates, i.e., GMI = Bitcoin price increase rate / Bitcoin perpetual contract funding rate level.

Using the GMI Bull and Bear Index, one should first know that when GMI >= 0.4, it indicates a bull market; when GMI < 0.4, it indicates a bear market. Secondly, we know that GMI has the following four states:

- GMI declines while price rises: This is a negative signal, indicating that the increase rate of bullish energy is less than that of bearish energy, suggesting market panic and potential price correction space.

- GMI rises while price declines: This is a positive signal, indicating that the decline rate of bullish energy is less than that of bearish energy.

- GMI rises alongside price: This is a positive signal, indicating that the increase rate of bullish energy is greater than that of bearish energy.

- GMI declines alongside price: This is a negative signal, indicating that the decline rate of bullish energy is greater than that of bearish energy. Since its launch, the GMI Bull and Bear Index has had a very high accuracy rate, successfully helping some users avoid significant drops and bravely increase their positions. It can be used in conjunction with the Fear and Greed Index to assist in investment decisions.

Practical Analysis Tools

1. Cryptocurrency Fear and Greed Index Dashboard created by Investment Analysis Website Alternative.me

The Fear and Greed Index created by this website is updated daily, quantifying and categorizing sentiment while using visual color gradients to quickly and intuitively inform users of the current market fear and greed index level, as well as summarizing index information from yesterday, last week, and last month.

The current Cryptocurrency Fear and Greed Index serves as an excellent benchmark for crypto traders, investors, and market analysts, as previously mentioned. However, it also has its limitations, such as its focus on Bitcoin, which may lead to discrepancies in sentiment responses for other crypto assets. Its calculations are not entirely transparent; while the weights for major categories are publicly explained, the composition of smaller categories has not disclosed calculation percentages.

Related link:

https://alternative.me/crypto/fear-and-greed-index/

2. On-chain and Cryptocurrency Social Media Analysis Tool Santiment

Santiment is a comprehensive data analysis tool designed to guide cryptocurrency traders in making optimal trading decisions based on real-time data rather than sentiment. It predicts potential market cycle tops (the best time to exit the market) or potential market cycle bottoms (the best time to enter the market) by combining token social media activity, movements of idle or significant wallets, and many other indicators.

Within the social media analysis page, users can input keywords they want to query, such as buy the dip, sell, bottom, etc., and it presents users with streaming data from social platforms like Telegram, Reddit, and Twitter, followed by a time-based statistical summary.

Santiment's user interface is very friendly, making it an easy-to-use platform. It has a vast amount of data sources, including on-chain, social media, and financial reports, with the longest data history dating back to 2009. It analyzes over 7 million social media posts daily, with available indicators expanded to 731, and wallet tags reaching 22, providing real-time and up-to-date data. However, it requires a higher fee compared to other cryptocurrency analysis platforms.

Related link:

3. Social Media Monitoring and Analysis Tool LunarCrush

LunarCrush uses AI-managed algorithms to gather information and return it to users in an easy-to-understand manner, enabling users to search, track, and actively engage in discussions on trending topics across all social media.

On LunarCrush, over 2,000 different cryptocurrencies are listed and categorized based on market sentiment identified from data extracted from various sites considered by the application. Social networks like Twitter, Reddit forums, YouTube video hosts, and Medium blog platforms are checked through AI-managed algorithms, providing users with a set of metrics summarizing cryptocurrency market attitudes.

For example:

- Social Volume: The number of times a cryptocurrency is mentioned within a given time period. If someone uses the term Bitcoin on Twitter, the social volume for Bitcoin will increase by 1 during the analyzed period.

- Social Engagement: The level of community engagement around a cryptocurrency. This metric considers responses to publications, reviews, and shares to exclude any form of manipulation and spam.

- Social Contributors: Similar to collecting unique mention counts for "social volume," this statistic determines the number of unique individuals discussing a particular cryptocurrency within a given time period.

- Shared Links: The number of times URLs related to cryptocurrencies are shared, which can include articles, block explorers, or candlestick charts.

On July 12, it was reported that LunarCrush completed a $5 million Series A funding round, co-led by Draper Round Table and INCE Capital. LunarCrush subsequently released a beta version of its social search tool, allowing users to search for any topic on the platform, not just financial products. The new tool enables users to search across all social media platforms to extract the most relevant content around established interests.

The project is accessible without registration and is free, providing diverse and selectable metrics that allow users to intuitively understand the current popularity of all crypto assets, which can aid investors in their investment decisions and move away from solely relying on candlestick charts to judge market trends.

Related link:

4. veDAO: Web3 Investment Compass

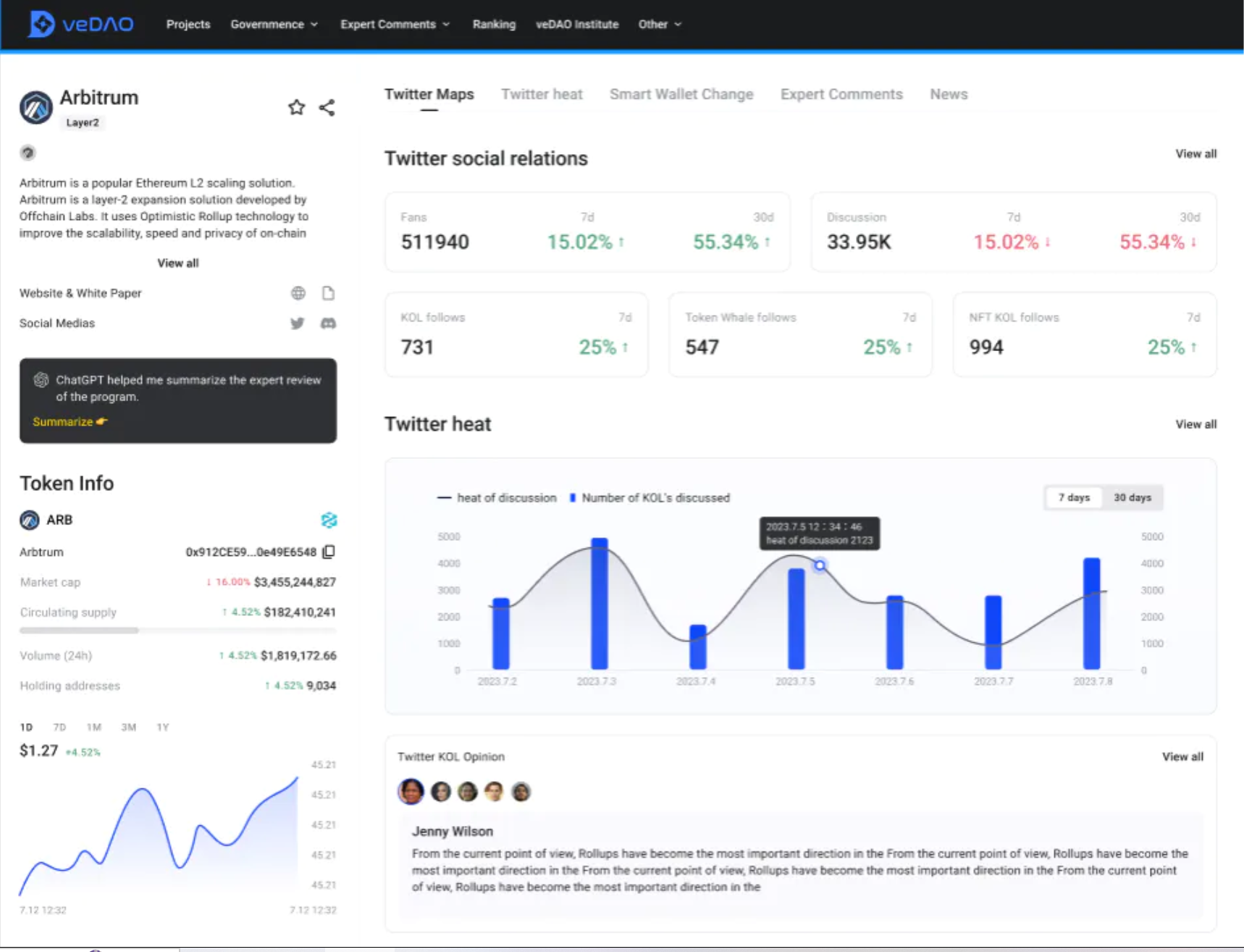

As a DAO-led decentralized investment and financing platform, veDAO aims to help investors accurately capture Alpha and achieve hundredfold returns. It has a massive TB-level project database covering nearly 70 mainnet ecosystems and 40 Web3 tracks, including over 22,000 Twitter KOLs, 3,700 investment institutions, 20,000 whale addresses, and 6,000 related news articles. In addition to a comprehensive project evaluation system and an expert committee composed of well-known Web3 institutions, veDAO will launch two tracking modules in August—Twitter sentiment tracking and smart money signal tracking.

veDAO new version design draft

By leveraging the advantages of a massive database, veDAO analyzes and tracks Twitter sentiment, visually displaying the current project's popularity through intelligent sorting. The analyzed metrics include the number of mentions by KOLs and changes, how many KOLs mentioned it, token price changes, etc. This allows users to quickly and accurately understand where Twitter sentiment is most concentrated, thus grasping the latest token trends and information, aiding in investment strategy adjustments, enabling faster tracking of Alpha, and allowing for earlier risk avoidance.

veDAO new version design draft

The upcoming new features of veDAO will also utilize AI interaction methods, combining large language models to easily use information. The Twitter sentiment analysis for specific projects/tokens will be more refined and diversified in observation dimensions, including changes in Twitter followers, discussion counts and changes, how many KOLs are following, how many whales are following, and how many NFT KOLs are following. Data visualization will quickly and intuitively display the counts and changes, efficiently assisting investors in analyzing token community sentiment and allowing for evidence-based adjustments to investment strategies while tracking Alpha projects to minimize risks.

Related link:

Conclusion

Cryptocurrency sentiment surrounds us every moment. Learning to analyze the fluctuations in sentiment allows us to seize market opportunities and risks more swiftly. Finding an efficient analysis tool suitable for oneself can also enable investors to conduct more precise analyses. As cryptocurrency data analysis tools continue to proliferate, this text shares more practical and user-friendly tools, hoping readers can flexibly utilize such analysis tools to better predict and judge the market, making optimal investment decisions.