Web3 Game July Report: Strong rebound secures $297 million in funding, virtual land hits a one-year low

Original Title: \$297M Investment Surge: What's Ahead for Web3 Gaming & Metaverse?

Written by: Sara Gherghelas

Translated by: Zen, PANews

Key Points Overview

- Blockchain games account for 41% of on-chain dapp activity, reaching 712,611 dUAW, with WAX leading at 300,325 dUAW;

- Genkai NFT's trading volume exceeded \$491,000, with the floor price dropping to 0.19 ETH, a decrease of 24% from the minting value;

- With Mighty Bear Games migrating from Polygon and TreasureDAO, Arbitrum's ecosystem games gained momentum, achieving 73,580 transactions in a single month and revenue exceeding \$842,000;

- Sweat Economy became the most played game dapp in July, with monthly UAW exceeding 739,000;

- Metaverse land sales totaled 10,796 parcels, with a transaction volume of \$5.6 million, marking a new low for the year;

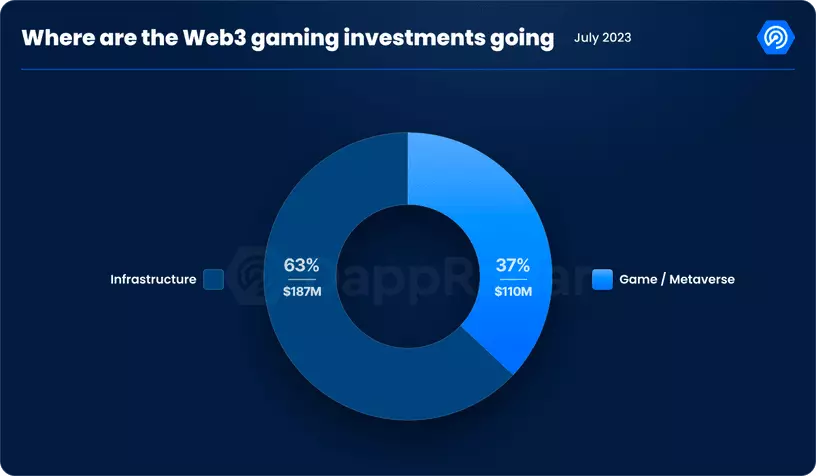

- Web3 gaming investment rebounded to \$297 million, with 63% flowing into infrastructure;

Overview of Blockchain Games

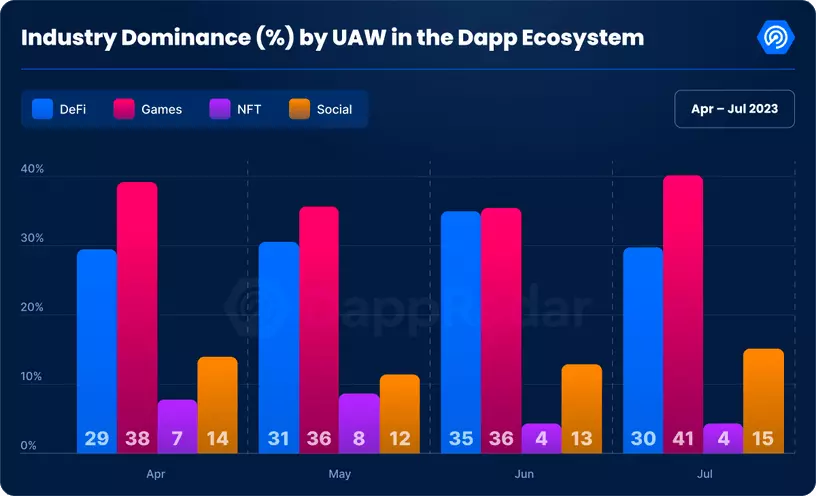

After witnessing a decline in market dominance in June, blockchain gaming quickly reestablished itself as a key player in the dapp space. Current data shows that the industry has a daily unique active wallet (dUAW) count of 712,611, which, despite a slight month-over-month decrease of 0.5%, accounts for 41% of the entire industry.

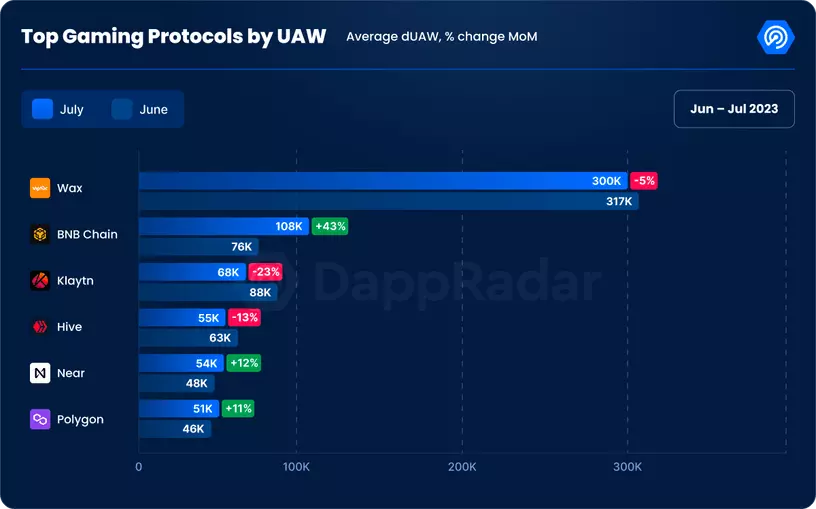

In terms of performance across various blockchains, WAX has emerged as the reigning champion in the gaming sector based on UAW metrics. WAX registered 300,325 dUAW this month, thanks not only to the well-known Web3 game Alien Worlds but also contributions from other popular games like Wombat Dungeon Master and Taco.

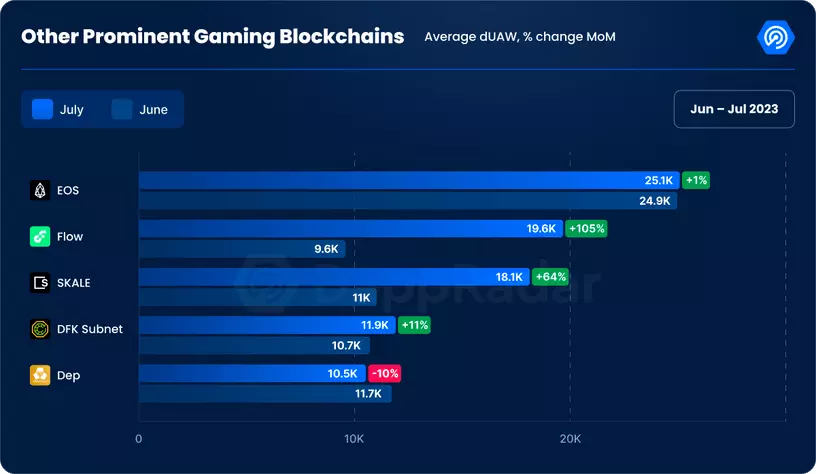

Meanwhile, BNB Chain has rebounded to second place, with its UAW surging by 43% to reach 108,311 dUAW, primarily driven by gaming platforms such as Xterio and Gaimin. Although some top blockchains experienced slight declines this month, newcomers are emerging, with platforms behind games like CryptoBlades and 5TARS seeing a 64% growth to 18,133 dUAW. Flow also made headlines with an impressive 105% growth, reaching 19,621 dUAW.

Ronin Partners with CyberKongz to Launch Genkai NFT

The Ronin blockchain, developed specifically for Axie Infinity, saw 97% of its gaming UAW activity in July coming from Axie.

However, this dominance may weaken in the future. The well-known Ethereum-based NFT series CyberKongz is set to launch its anime-inspired Genkai NFT on Ronin. To further strengthen ties with Ronin, CyberKongz plans to migrate its "Play & Kollect" on-chain community (a hub for fans to discover, mint, and collect NFTs) from Polygon to Ronin. This collaboration will also involve Sky Mavis in creating a Genkai-themed game based on Ronin.

The Genkai NFT series has a total supply of 20,000, with 4,000 NFTs based on Ronin and the remaining 16,000 created on Ethereum. Notably, Ethereum-based assets will seamlessly transition to benefit from Ronin, and importantly for the Axie Mystic community, around 1,000 holders will be able to mint 4,000 Genkai for free on Ronin.

The Genkai NFT minting event began at 4 PM UTC on July 27 for pre-registered wallets, followed by a public sale starting at 8 PM UTC, with a minting fee of 0.25 ETH each. Additionally, existing CyberKongz enthusiasts can enjoy a Genkai airdrop, although this will have a 180-day redemption period. Recent data shows that Genkai NFT's trading volume exceeded \$491,000, with a base price of 0.19 ETH, depreciating by 24% compared to the initial minting price.

The Gaming Pivot of Ethereum L2: The Rise of Arbitrum

In recent months, Ethereum's L2 solution Arbitrum has increasingly established itself as a key gaming platform. Singapore gaming giant Mighty Bear Games announced the direct migration of its battle royale game Mighty Action Heroes from Polygon to Arbitrum, drawing attention as the game entered public testing on July 14. Mighty Bear also partnered with TreasureDAO and integrated the MAGIC token. This has been a significant boost for TreasureDAO, which recently reported a trading volume exceeding \$842,000, with a total of 73,580 transactions, averaging \$11.4 per transaction.

Arbitrum Nova, a streamlined version tailored for gaming, further enriches the Arbitrum ecosystem. The gaming sector on Arbitrum is expanding beyond the core projects under TreasureDAO. For instance, the highly anticipated "BattlePlan!" game from Pixel Vault and its reboot protocol are expected to debut on Arbitrum Nova. This shift brings interesting technical considerations: Arbitrum employs Optimistic rollups, while allies like Polygon and Immutable are staunch supporters of the zk-rollups route.

Nonetheless, these Ethereum-centric scaling strategies, after rapid adoption, are undoubtedly a boon for the Ethereum gaming sector. This momentum positions Ethereum favorably against non-EVM competitors like Solana and Sui, as well as relatively strict chains like BNB.

July Chain Game Rankings: The Revival of "Move to Earn"

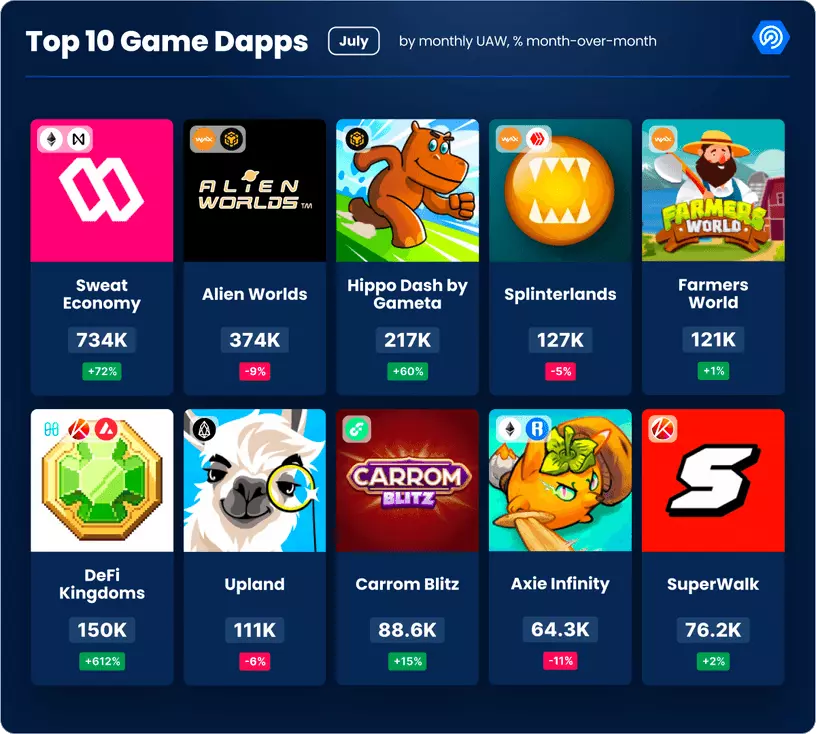

In July, the Web3 gaming world saw some interesting changes, most notably the resurgence of "move to earn" games. The standout was Sweat Economy, with monthly UAW exceeding 730,000, indicating a potential revival of the "move to earn" trend. Super Walk further solidified this sentiment, being a fitness social dapp based on Klaytn that attracted over 68,000 users this month, placing it in the top 10.

While new entrants brought disruptive changes, we also saw consistent performances from familiar names. For example, Alien Worlds has reached second place on the leaderboard, while major games like Splinterlands, Upland, Farmers World, and Axie Infinity remain strong. These games have not only established their strength but also cultivated robust communities, securing their positions in the rankings. Joyride Games' Carrom Blitz has also regained attention. In terms of development, Upland has maintained transparency regarding its vision, releasing a roadmap for Q3 2023 that emphasizes scalable growth and enhanced player customization, aspiring to become a global virtual universe brand.

Notably, the correlation between transactions and UAW for games like Hippo Dash, Alien Worlds, and Farmers World is close to 1:1. Their game structures may be key, suggesting that each transaction could lead to the birth of a new wallet.

Has the Hype Around Virtual Realms Ended?

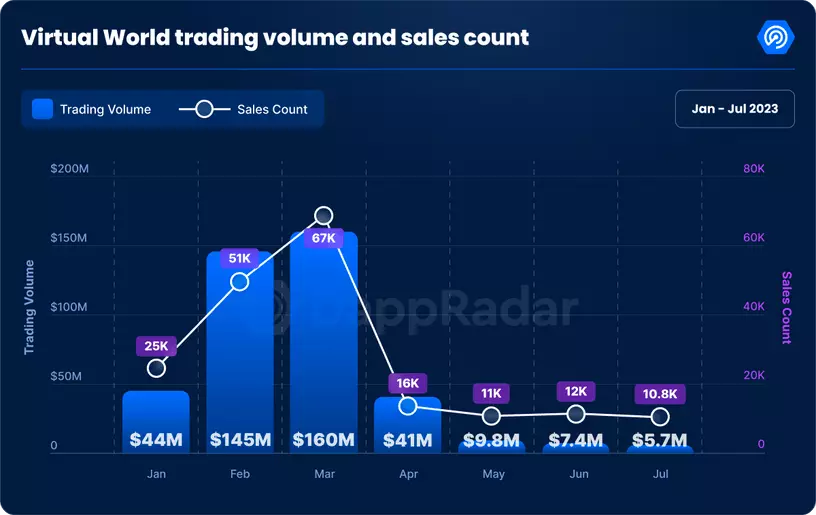

In June of this year, the performance of virtual worlds saw a staggering decline, with transaction volumes dropping to just \$7.4 million. The 12,466 land sales also reflected this downward trend, with an average transaction price of \$594. Fast forward to July, and the situation did not become more optimistic. Transaction volumes hit a new low of \$5.6 million, with 10,796 land sales, averaging \$523 per parcel.

Clearly, while enthusiasm for trading metaverse assets seems to be waning, the second-quarter metaverse report indicated that user engagement and interest in the technology remain resilient. To delve deeper into the sources of this trading activity, our analysis focused on the top 5 virtual world NFT collections. As expected, Otherdeed for Otherside and Otherdeed Expanded undisputedly captured the largest share, with combined sales reaching \$4 million, accounting for 72.5% of total transaction volume.

The Sandbox leads in the number of traders, with over 1,100 traders and 252 UAW in July alone. To enhance product quality, the Sandbox team launched a series of innovative features on July 19, enabling users to create personalized gamified experiences. This evolution marks a significant step for The Sandbox towards strengthening decentralization and expanding the role of user-generated content.

However, this downward trend has prompted some metaverse projects to come to an end. Perhaps this reflects the inherent nature of bear market cycles, where only elite projects thrive. Neopets is a prime example. The Neopets team recently announced the termination of the Neopets Metaverse project, which was initially envisioned as a Web3-integrated game, and will now cease further development. Despite launching series like Genesis, Pizzaroo, and Masterpiece, Neopets' strategic direction remains vague, particularly regarding their NFT and blockchain aspirations. Their vague assurances of "supporting the community," coupled with mentions of potential benefits like physical goods or in-game items, only exacerbate this ambiguity. Neopets is reportedly planning to return to the Web2 space.

Driving the Future: \$297 Million in Web3 Gaming Investment

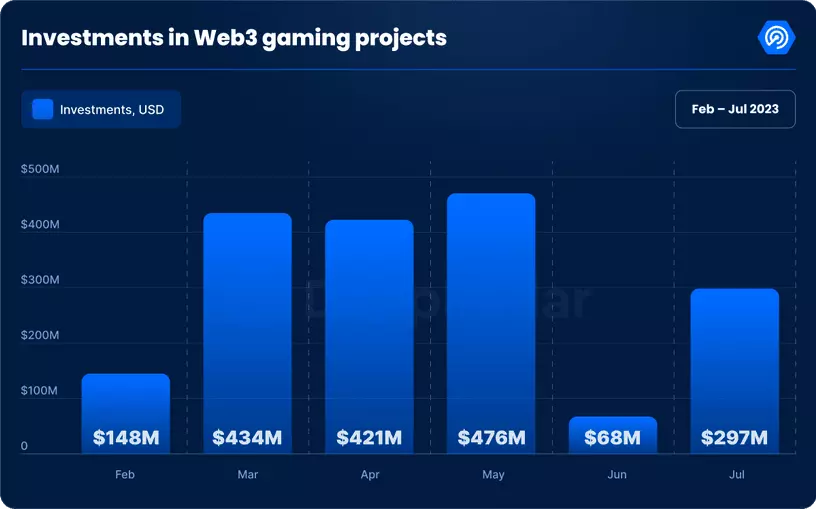

In June 2023, Web3 gaming investment plummeted to an annual low of \$68 million. Notably, the turmoil in the entire crypto market in June posed significant obstacles, with several flagship Web3 gaming projects facing adversity, primarily triggered by legal entanglements involving Binance and Coinbase with the SEC.

Nevertheless, Web3 gaming saw a strong rebound in July, securing \$297 million in funding. A closer examination reveals that infrastructure projects absorbed the largest share of investment, totaling \$187 million, accounting for 63% of the total funding. Meanwhile, investments in games and the metaverse amounted to \$110 million, making up the remaining 37%.

Certain investments stood out due to their innovation and prospects. A prime example is Animoca Brands' \$30 million investment in hi, which gained attention for launching the world's first NFT avatar-customized debit card in 2022. Furthermore, Animoca announced a collaboration with nWay to launch a new game (related reading: Bored Apes Meet Mech Battles: What to Expect from Animoca's Highlighted Chain Game Wreck League), making headlines again, as the game collaborates with Yuga Labs for its first season. Inworld AI also secured up to \$50 million in funding from Lightspeed Venture Partners, boosting the valuation of this AI-driven game character engine creator to an impressive \$500 million.

Additionally, two key investments have drawn industry attention: Valhalla Ventures launched a \$66 million venture capital fund focused on deep tech and gaming startups; meanwhile, Futureverse, which merges AI and metaverse technology, raised \$54 million in its latest funding round. To bridge AI and the virtual universe, Futureverse seeks to merge 11 virtual universe infrastructure and content companies, creating a broad virtual universe ecosystem driven by digital collectibles. Their ambitions extend beyond this; to explore new horizons in AI gaming, they recently partnered with FIFA to launch an AI-centered consumer game, AI League, available on iOS and Android platforms.

This influx of investment underscores a steadfast belief in the potential of virtual worlds and the metaverse, even amid observed industry downturns.

Welcome Web3: New Script Unveiled for Google Play Store

Google is preparing to introduce Web3 games to its Play Store later this year, marking a groundbreaking initiative.

(Related reading: Interpreting Google Store's Digital Asset Policy: Allowing NFTs in Apps and Games, Prohibiting Mining on Devices)

While this is exciting news, the announcement on their blog also comes with certain stipulations. First, developers must be transparent about incorporating NFTs into their games. Additionally, game studios have been warned against hyping potential earnings through gameplay or trading, indicating a clear opposition to the "play to earn" model. Google has also drawn boundaries against mixing NFTs with gacha mechanics, a move many consider prudent, with these policy revisions set to take effect on December 7.

Given the unparalleled influence of the mobile space, the barriers to merging Web3 with mobile applications have undoubtedly hindered the industry's growth. Google's adjusted stance is expected to reignite mobile game studios' interest in exploring NFTs, injecting new enthusiasm and confidence into the broader ecosystem to create outstanding mobile games and applications. As mentioned in our previous gaming reports, a noticeable shift has emerged, with dominant Web2 game studios transitioning into the Web3 space.

Apple and Google remain on our watchlist, and we eagerly await their next steps in addressing the core challenges faced by Web3 developers. Most concerning is the directive requiring all game-related transactions, NFT acquisitions, and other content to utilize Apple/Google's fiat-centric in-app purchase systems. This poses obstacles for cryptocurrency-based value exchanges or the deployment of non-custodial wallets.